The globally connected car market size was valued at USD 63.03 billion in 2019 and is projected to reach USD 225.16 billion by 2027, registering a CAGR of 17.1% during the forecast period. Growing customer demand for communication solutions, increasing need for continuous connectivity, increasing technology dependency, and growing tech-savvy population are key factors leading to the growth of the connected car market size

The main objective of connected cars is to keep the consumer connected to the outside world by providing continuous access to the Internet even when they are traveling.

Connect cars have an integrated wireless LAN and can communicate inside and outside the vehicle with entities. Connected cars are designed to receive remote over-the-air ( OTA) software updates, and relay diagnostic and operational data of onboard systems and components. By leveraging vehicle connectivity in this way, automakers can dramatically reduce recall expenses, enhance infotainment, offer location-conscious services, enhance response time for safety, and deliver post-sale vehicle performance and functionality improvements.

Due to these advantages, the connected car market size is expected to proliferate during the forecast period.

Another main development that raises the demand for innovative connected car technologies is the advent of autonomous vehicle technology in the connected car industry.

Automakers are developing AI interfaces that function as virtual personal assistants with the ability to respond to voice commands in conjunction with their navigation system and proactively direct drivers. With the growing use of sensors and other data-gathering technologies, AI will be essential to making sense of it all. Some cars now use AI for Level 3 autonomous driving, but there is a need for significant changes to the vehicle as well as the infrastructure for the industry to achieve Level 5. This incorporation of AI technology in vehicles is expected to increase the connected car market size.

The increasing collaborations between network & service providers with automotive companies are also expected to stimulate the growth of connected car market size.

The advanced diagnostic system is another feature that is expected to fuel the growth of the connected car market size. For advanced diagnostics, the car's device can provide both the automotive supplier and the consumer with vehicle data, which can help detect possible automotive problems before they occur.

Increasing passenger car sales among developing nations like India, China, and Japan will help the automotive-connected car market expand over the forecast period.

Security and safety concerns such as unauthorized access to multiple automotive apps or breaking into the vehicle communication network will serve as a constraint for the connected car market. Besides, the lack of seamless Internet connectivity across regions can hamper the growth of the connected car industry.

Within the connected car industry, embedded type connectivity is expected to display the fastest growth. The growth of embedded connected solutions is due to factors such as policy mandates, service plan cost management, and cloud-based technology development.

Connectivity solution is categorized into integrated, embedded, and tethered. The category of embedded communication holds the largest market share and will sustain its market position over the forecast period. Thanks to more secure & faster data transmission with the use of antennas without interference from external sources such as SIM, efficient network, and protection solutions. The embedded interface is designed to connect to the built-in modem and a subscriber identity module (SIM), and drivers can use devices such as Apple's CarPlay or Android Auto to navigate it to nearby gas stations.

Asia Pacific region is expected to witness the highest growth rate in the connected car market. Countries like China and India are expected to drive the connected car market growth over the forecast period. Automotive manufacturers in this region are also working on the budget car segment to include innovative vehicle control and protection technologies. This extension into the budget car is expected to further fuel the market growth.

During the forecast period, the North American market is expected to experience the fastest growth, particularly in the US. US market growth is driven mainly by the rising automobile safety requirements, demand for vehicle-to-vehicle (V2V) communication technology, and the introduction of IoT into the automotive industry.

The connected car market has the potential to boost automobile manufacturers' revenues significantly over the forecast period. Car manufacturers are expected to deliver the right mix of application and product packages to the right customers and must systematically invest in R&D if they are willing to maintain their technological leadership.

In addition, manufacturers rely on mergers, acquisitions, and strategic partnerships with technology and network service providers to make their presence known in the industry.

Some of the top companies in the connected car market are Airbiquity Inc., CloudMade, Continental AG, Intellias Ltd., LUXOFT, Qualcomm Technologies, Inc., Robert Bosch GmbH, Sierra Wireless, Tesla, and ZUBIE, INC., AT&T, Audi AG, BMW Group, Daimler AG, Ford Motor Company, Samsung Electronics, Telefonica SA, TomTom International, Verizon Communications and Vodafone Group Plc.

Ans. North America is expected to hold the largest connected car market share during the forecast period.

Ans. The key market players profiled in the connected car market include Continental AG, Robert Bosch GmbH, Tesla, Audi AG, BMW Group, and others which holds a major market share in the global connected car market.

Ans. The globally connected car market size was valued at USD 63.03 billion in 2019 and is projected to reach USD 225.16 billion by 2027, registering a CAGR of 17.1% during the forecast period.

Ans. Factors such as the rise in trend of connectivity solutions and ease of vehicle diagnosis are the factors that are expected to drive the connected car market.

Ans. The forecast period for the connected car market is 2020 to 2027.

CHAPTER 1:INTRODUCTION

1.1.Report description

1.2.Key benefits for stakeholders

1.3.Key market segments

1.4.Research methodology

1.4.1.Primary research

1.4.2.Secondary research

1.4.3.Analyst tools and models

CHAPTER 2:EXECUTIVE SUMMARY

2.1.CXO perspective

CHAPTER 3:MARKET OVERVIEW

3.1.Market definition and scope

3.2.Key findings

3.2.1.Top impacting factors

3.2.2.Top investment pockets

3.2.3.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Moderate-to-high bargaining power of suppliers

3.3.2.Low-to-moderate threat of new entrants

3.3.3.Low-to-high threat of substitutes

3.3.4.Moderate-to-high intensity of rivalry

3.3.5.Moderate bargaining power of buyers

3.4.Market share analysis, 2019 (%)

3.5.Market dynamics

3.5.1.Drivers

3.5.1.1.Rise in trend of connectivity solutions

3.5.1.2.Ease of vehicle diagnosis

3.5.1.3.Increase in need of safety & security

3.5.2.Restraints

3.5.2.1.Threat of data hacking

3.5.2.2.High installation cost

3.5.2.3.Lack of uninterrupted & seamless internet connectivity

3.5.3.Opportunities

3.5.3.1.Intelligent transportation system

3.5.3.2.Improved performance of autonomous vehicles

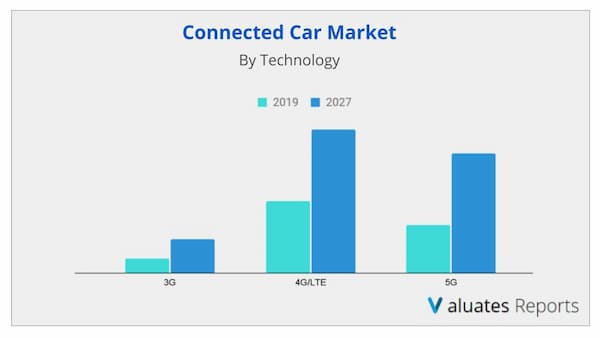

CHAPTER 4:CONNECTED CAR MARKET, BY TECHNOLOGY

4.1.Overview

4.2 Integrated

4.3.3G

4.3.1.Key market trends, growth factors and opportunities

4.3.2.Market size and forecast, by region

4.3.3.Market analysis by country

4.4.4G/LTE

4.4.1.Key market trends, growth factors and opportunities

4.4.2.Market size and forecast, by region

4.4.3.Market analysis by country

4.5.5G

4.5.1.Key market trends, growth factors and opportunities

4.5.2.Market size and forecast, by region

4.5.3.Market analysis by country

CHAPTER 5:CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS

5.1.Overview

5.2.Integrated

5.2.1.Key market trends, growth factors and opportunities

5.2.2.Market size and forecast, by region

5.2.3.Market analysis by country

5.3.Embedded

5.3.1.Key market trends, growth factors and opportunities

5.3.2.Market size and forecast, by region

5.3.3.Market analysis by country

5.4.Tethered

5.4.1.Key market trends, growth factors and opportunities

5.4.2.Market size and forecast, by region

5.4.3.Market analysis by country

CHAPTER 6:CONNECTED CAR MARKET, BY SERVICE

6.1.Overview

6.2.Driver assistance

6.2.1.Key market trends, growth factors and opportunities

6.2.2.Market size and forecast, by region

6.2.3.Market analysis by country

6.3.Safety

6.3.1.Key market trends, growth factors and opportunities

6.3.2.Market size and forecast, by region

6.3.3.Market analysis by country

6.4.Entertainment

6.4.1.Key market trends, growth factors and opportunities

6.4.2.Market size and forecast, by region

6.4.3.Market analysis by country

6.5.Well-being

6.5.1.Key market trends, growth factors and opportunities

6.5.2.Market size and forecast, by region

6.5.3.Market analysis by country

6.6.Vehicle management

6.6.1.Key market trends, growth factors and opportunities

6.6.2.Market size and forecast, by region

6.6.3.Market analysis by country

6.7.Mobility management

6.7.1.Key market trends, growth factors and opportunities

6.7.2.Market size and forecast, by region

6.7.3.Market analysis by country

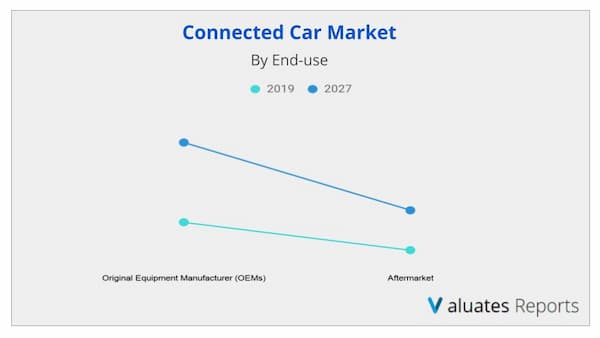

CHAPTER 7:CONNECTED CAR MARKET, BY END-MARKET

7.1.Overview

7.2.Original equipment manufacturer (OEM)

7.2.1.Key market trends, growth factors and opportunities

7.2.2.Market size and forecast, by region

7.2.3.Market analysis by country

7.3.Aftermarket

7.3.1.Key market trends, growth factors and opportunities

7.3.2.Market size and forecast, by region

7.3.3.Market analysis by country

CHAPTER 8:CONNECTED CAR MARKET, BY REGION

8.1.Overview

8.2.North America

8.2.1.Key market trends, growth factors, and opportunities

8.2.2.Market size and forecast, by technology

8.2.3.Market size and forecast, by connectivity solutions

8.2.4.Market size and forecast, by services

8.2.5.Market size and forecast, by end-market

8.2.6.Market analysis by country

8.2.6.1.U.S.

8.2.6.1.1.Market size and forecast, by technology

8.2.6.1.2.Market size and forecast, by connectivity solutions

8.2.6.1.3.Market size and forecast, by services

8.2.6.1.4.Market size and forecast, by end-market

8.2.6.2.Canada

8.2.6.2.1.Market size and forecast, by technology

8.2.6.2.2.Market size and forecast, by connectivity solutions

8.2.6.2.3.Market size and forecast, by services

8.2.6.2.4.Market size and forecast, by end-market

8.2.6.3.Mexico

8.2.6.3.1.Market size and forecast, by technology

8.2.6.3.2.Market size and forecast, by connectivity solutions

8.2.6.3.3.Market size and forecast, by services

8.2.6.3.4.Market size and forecast, by end-market

8.3.Europe

8.3.1.Key market trends, growth factors, and opportunities

8.3.2.Market size and forecast, by technology

8.3.3.Market size and forecast, by connectivity solutions

8.3.4.Market size and forecast, by services

8.3.5.Market size and forecast, by end-market

8.3.6.Market analysis by country

8.3.6.1.UK

8.3.6.1.1.Market size and forecast, by technology

8.3.6.1.2.Market size and forecast, by connectivity solutions

8.3.6.1.3.Market size and forecast, by services

8.3.6.1.4.Market size and forecast, by end-market

8.3.6.2.Germany

8.3.6.2.1.Market size and forecast, by technology

8.3.6.2.2.Market size and forecast, by connectivity solutions

8.3.6.2.3.Market size and forecast, by services

8.3.6.2.4.Market size and forecast, by end-market

8.3.6.3.France

8.3.6.3.1.Market size and forecast, by technology

8.3.6.3.2.Market size and forecast, by connectivity solutions

8.3.6.3.3.Market size and forecast, by services

8.3.6.3.4.Market size and forecast, by end-market

8.3.6.4.Russia

8.3.6.4.1.Market size and forecast, by technology

8.3.6.4.2.Market size and forecast, by connectivity solutions

8.3.6.4.3.Market size and forecast, by services

8.3.6.4.4.Market size and forecast, by end-market

8.3.6.5.Italy

8.3.6.5.1.Market size and forecast, by technology

8.3.6.5.2.Market size and forecast, by connectivity solutions

8.3.6.5.3.Market size and forecast, by services

8.3.6.5.4.Market size and forecast, by end-market

8.3.6.6.Rest of Europe

8.3.6.6.1.Market size and forecast, by technology

8.3.6.6.2.Market size and forecast, by connectivity solutions

8.3.6.6.3.Market size and forecast, by services

8.3.6.6.4.Market size and forecast, by end-market

8.4.Asia-Pacific

8.4.1.Key market trends, growth factors, and opportunities

8.4.2.Market size and forecast, by technology

8.4.3.Market size and forecast, by connectivity solutions

8.4.4.Market size and forecast, by services

8.4.5.Market size and forecast, by end-market

8.4.6.Market analysis by country

8.4.6.1.China

8.4.6.1.1.Market size and forecast, by technology

8.4.6.1.2.Market size and forecast, by connectivity solutions

8.4.6.1.3.Market size and forecast, by services

8.4.6.1.4.Market size and forecast, by end-market

8.4.6.2.India

8.4.6.2.1.Market size and forecast, by technology

8.4.6.2.2.Market size and forecast, by connectivity solutions

8.4.6.2.3.Market size and forecast, by services

8.4.6.2.4.Market size and forecast, by end-market

8.4.6.3.Japan

8.4.6.3.1.Market size and forecast, by technology

8.4.6.3.2.Market size and forecast, by connectivity solutions

8.4.6.3.3.Market size and forecast, by services

8.4.6.3.4.Market size and forecast, by end-market

8.4.6.4.South Korea

8.4.6.4.1.Market size and forecast, by technology

8.4.6.4.2.Market size and forecast, by connectivity solutions

8.4.6.4.3.Market size and forecast, by services

8.4.6.4.4.Market size and forecast, by end-market

8.4.6.5.Rest of Asia-Pacific

8.4.6.5.1.Market size and forecast, by technology

8.4.6.5.2.Market size and forecast, by connectivity solutions

8.4.6.5.3.Market size and forecast, by services

8.4.6.5.4.Market size and forecast, by end-market

8.5.LAMEA

8.5.1.Key market trends, growth factors, and opportunities

8.5.2.Market size and forecast, by technology

8.5.3.Market size and forecast, by connectivity solutions

8.5.4.Market size and forecast, by services

8.5.5.Market size and forecast, by end-market

8.5.6.Market analysis by country

8.5.6.1.Latin America

8.5.6.1.1.Market size and forecast, by technology

8.5.6.1.2.Market size and forecast, by connectivity solutions

8.5.6.1.3.Market size and forecast, by services

8.5.6.1.4.Market size and forecast, by end-market

8.5.6.2.Middle East

8.5.6.2.1.Market size and forecast, by technology

8.5.6.2.2.Market size and forecast, by connectivity solutions

8.5.6.2.3.Market size and forecast, by services

8.5.6.2.4.Market size and forecast, by end-market

8.5.6.3.Africa

8.5.6.3.1.Market size and forecast, by technology

8.5.6.3.2.Market size and forecast, by connectivity solutions

8.5.6.3.3.Market size and forecast, by services

8.5.6.3.4.Market size and forecast, by end-market

CHAPTER 9:COMPANY PROFILES

9.1.Airbiquity Inc.

9.1.1.Company overview

9.1.2.Company snapshot

9.1.3.Product portfolio

9.1.4.Key strategic moves and developments

9.2.CloudMade

9.2.1.Company overview

9.2.2.Company snapshot

9.2.3.Product portfolio

9.2.4.Key strategic moves and developments

9.3.Continental AG

9.3.1.Company overview

9.3.2.Company snapshot

9.3.3.Operating business segments

9.3.4.Business performance

9.3.5.Key strategic moves and developments

9.4.Intellias Ltd.

9.4.1.Company overview

9.4.2.Company snapshot

9.4.3.Product portfolio

9.4.4.Key strategic moves and developments

9.5.LUXOFT

9.5.1.Company overview

9.5.2.Company snapshot

9.5.3.Operating business segments

9.5.4.Business performance

9.5.5.Key strategic moves and developments

9.6.Qualcomm Technologies, Inc.

9.6.1.Company overview

9.6.2.Company snapshot

9.6.3.Operating business segments

9.6.4.Business performance

9.6.5.Key strategic moves and developments

9.7.Robert Bosch GmbH

9.7.1.Company overview

9.7.2.Company snapshot

9.7.3.Operating business segments

9.7.4.Business performance

9.7.5.Key strategic moves and developments

9.8.Sierra Wireless

9.8.1.Company overview

9.8.2.Company snapshot

9.8.3.Operating business segments

9.8.4.Business performance

9.8.5.Key strategic moves and developments

9.9.Tesla

9.9.1.Company overview

9.9.2.Company snapshot

9.9.3.Operating business segments

9.9.4.Product portfolio

9.9.5.Business performance

9.9.6.Key strategic moves and developments

9.10.ZUBIE, INC.

9.10.1.Company overview

9.10.2.Company snapshot

9.10.3.Product portfolio

9.10.4.Key strategic moves and developments

9.11.AT&T INC

9.11.1.Company overview

9.11.2.Company snapshot

9.11.3.Operating business segments

9.11.4.Product portfolio

9.11.5.Business performance

9.11.6.Key strategic moves and developments

9.12.AUDI AG

9.12.1.Company overview

9.12.2.Company snapshot

9.12.3.Operating business segments

9.12.4.Product portfolio

9.12.5.Business performance

9.12.6.Key strategic moves and developments

9.13.BMW GROUP

9.13.1.Company overview

9.13.2.Company snapshot

9.13.3.Operating business segments

9.13.4.Product portfolio

9.13.5.Business performance

9.13.6.Key strategic moves and developments

9.14.DAIMLER AG (MERCEDES-BENZ)

9.14.1.Company overview

9.14.2.Company snapshot

9.14.3.Operating business segments

9.14.4.Product portfolio

9.14.5.Business performance

9.14.6.Key strategic moves and developments

9.15.FORD MOTOR COMPANY

9.15.1.Company overview

9.15.2.Company snapshot

9.15.3.Operating business segments

9.15.4.Product portfolio

9.15.5.Business performance

9.15.6.Key strategic moves and developments

9.16.SAMSUNG ELECTRONICS CO. LTD. (HARMAN INTERNATIONAL INDUSTRIES, INC.)

9.16.1.Company overview

9.16.2.Company snapshot

9.16.3.Operating business segments

9.16.4.Business performance

9.16.5.Key strategic moves and developments

9.17.TELEFONICA, S.A.

9.17.1.Company overview

9.17.2.Company snapshot

9.17.3.Operating business segments

9.17.4.Product portfolio

9.17.5.Business performance

9.17.6.Key strategic moves and developments

9.18.TOMTOM INTERNATIONAL N.V.

9.18.1.Company overview

9.18.2.Company snapshot

9.18.3.Operating business segments

9.18.4.Product portfolio

9.18.5.Business performance

9.18.6.Key strategic moves and developments

9.19.VERIZON COMMUNICATIONS INC.

9.19.1.Company overview

9.19.2.Company snapshot

9.19.3.Operating business segments

9.19.4.Product portfolio

9.19.5.Business performance

9.19.6.Key strategic moves and developments

9.20.VODAFONE GROUP PLC

9.20.1.Company overview

9.20.2.Company snapshot

9.20.3.Operating business segments

9.20.4.Product portfolio

9.20.5.Business performance

9.20.6.Key strategic moves and developments

TABLE 01.GLOBAL CONNECTED CAR MARKET, BY SYSTEM, 2019-2027 ($MILLION)

TABLE 02.CONNECTED CAR MARKET REVENUE FOR 3G, BY REGION 2019–2027 ($MILLION)

TABLE 03.CONNECTED CAR MARKET REVENUE FOR 4G/LTE, BY REGION 2019–2027 ($MILLION)

TABLE 04.CONNECTED CAR MARKET REVENUE FOR 5G, BY REGION 2019–2027 ($MILLION)

TABLE 05.GLOBAL CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS, 2019-2027 ($MILLION)

TABLE 06.CONNECTED CAR MARKET REVENUE FOR INTEGRATED, BY REGION 2019–2027 ($MILLION)

TABLE 07.CONNECTED CAR MARKET REVENUE FOR EMBEDDED, BY REGION 2019–2027 ($MILLION)

TABLE 08.CONNECTED CAR MARKET REVENUE FOR TETHERED, BY REGION 2019–2027 ($MILLION)

TABLE 09.GLOBAL CONNECTED CAR MARKET, BY SERVICE, 2019-2027 ($MILLION)

TABLE 10.CONNECTED CAR MARKET REVENUE FOR DRIVER ASSISTANCE, BY REGION 2019–2027 ($MILLION)

TABLE 11.CONNECTED CAR MARKET REVENUE FOR SAFETY, BY REGION 2019–2027 ($MILLION)

TABLE 12.CONNECTED CAR MARKET REVENUE FOR ENTERTAINMENT, BY REGION 2019–2027 ($MILLION)

TABLE 13.CONNECTED CAR MARKET REVENUE FOR WELL-BEING, BY REGION 2019–2027 ($MILLION)

TABLE 14.CONNECTED CAR MARKET REVENUE FOR VEHICLE MANAGEMENT, BY REGION 2019–2027 ($MILLION)

TABLE 15.CONNECTED CAR MARKET REVENUE FOR MOBILITY MANAGEMENT, BY REGION 2019–2027 ($MILLION)

TABLE 16.GLOBAL CONNECTED CAR MARKET, BY END-MARKET, 2019-2027 ($MILLION)

TABLE 17.CONNECTED CAR MARKET REVENUE FOR ORIGINAL EQUIPMENT MANUFACTURER (OEMS), BY REGION 2019–2027 ($MILLION)

TABLE 18.CONNECTED CAR MARKET REVENUE FOR AFTERMARKET, BY REGION 2019–2027 ($MILLION)

TABLE 19.NORTH AMERICA CONNECTED CAR MARKET, BY TECHNOLOGY, 2019–2027 ($MILLION)

TABLE 20.NORTH AMERICA CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS, 2019–2027 ($MILLION)

TABLE 21.NORTH AMERICA CONNECTED CAR MARKET, BY SERVICES, 2019–2027 ($MILLION)

TABLE 22.NORTH AMERICA CONNECTED CAR MARKET, BY END-MARKET, 2019–2027 ($MILLION)

TABLE 23.U.S. CONNECTED CAR MARKET, BY TECHNOLOGY, 2019–2027 ($MILLION)

TABLE 24.U.S. CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS, 2019–2027 ($MILLION)

TABLE 25.U.S. CONNECTED CAR MARKET, BY SERVICES, 2019–2027 ($MILLION)

TABLE 26.U.S. CONNECTED CAR MARKET, BY END MARKET, 2019–2027 ($MILLION)

TABLE 27.CANADA CONNECTED CAR MARKET, BY TECHNOLOGY, 2019–2027 ($MILLION)

TABLE 28.CANADA CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS, 2019–2027 ($MILLION)

TABLE 29.CANADA CONNECTED CAR MARKET, BY SERVICES, 2019–2027 ($MILLION)

TABLE 30.CANADA CONNECTED CAR MARKET, BY END MARKET, 2019–2027 ($MILLION)

TABLE 31.MEXICO CONNECTED CAR MARKET, BY TECHNOLOGY, 2019–2027 ($MILLION)

TABLE 32.MEXICO CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS, 2019–2027 ($MILLION)

TABLE 33.MEXICO CONNECTED CAR MARKET, BY SERVICES, 2019–2027 ($MILLION)

TABLE 34.MEXICO CONNECTED CAR MARKET, BY END MARKET, 2019–2027 ($MILLION)

TABLE 35.EUROPE CONNECTED CAR MARKET, BY TECHNOLOGY, 2019–2027 ($MILLION)

TABLE 36.EUROPE CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS, 2019–2027 ($MILLION)

TABLE 37.EUROPE CONNECTED CAR MARKET, BY SERVICES, 2019–2027 ($MILLION)

TABLE 38.EUROPE CONNECTED CAR MARKET, BY END-MARKET, 2019–2027 ($MILLION)

TABLE 39.UK CONNECTED CAR MARKET, BY TECHNOLOGY, 2019–2027 ($MILLION)

TABLE 40.UK CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS, 2019–2027 ($MILLION)

TABLE 41.UK CONNECTED CAR MARKET, BY SERVICES, 2019–2027 ($MILLION)

TABLE 42.UK CONNECTED CAR MARKET, BY END MARKET, 2019–2027 ($MILLION)

TABLE 43.GERMANY CONNECTED CAR MARKET, BY TECHNOLOGY, 2019–2027 ($MILLION)

TABLE 44.GERMANY CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS, 2019–2027 ($MILLION)

TABLE 45.GERMANY CONNECTED CAR MARKET, BY SERVICES, 2019–2027 ($MILLION)

TABLE 46.GERMANY CONNECTED CAR MARKET, BY END MARKET, 2019–2027 ($MILLION)

TABLE 47.FRANCE CONNECTED CAR MARKET, BY TECHNOLOGY, 2019–2027 ($MILLION)

TABLE 48.FRANCE CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS, 2019–2027 ($MILLION)

TABLE 49.FRANCE CONNECTED CAR MARKET, BY SERVICES, 2019–2027 ($MILLION)

TABLE 50.FRANCE CONNECTED CAR MARKET, BY END MARKET, 2019–2027 ($MILLION)

TABLE 51.RUSSIA CONNECTED CAR MARKET, BY TECHNOLOGY, 2019–2027 ($MILLION)

TABLE 52.RUSSIA CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS, 2019–2027 ($MILLION)

TABLE 53.RUSSIA CONNECTED CAR MARKET, BY SERVICES, 2019–2027 ($MILLION)

TABLE 54.RUSSIA CONNECTED CAR MARKET, BY END MARKET, 2019–2027 ($MILLION)

TABLE 55.ITALY CONNECTED CAR MARKET, BY TECHNOLOGY, 2019–2027 ($MILLION)

TABLE 56.ITALY CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS, 2019–2027 ($MILLION)

TABLE 57.ITALY CONNECTED CAR MARKET, BY SERVICES, 2019–2027 ($MILLION)

TABLE 58.ITALY CONNECTED CAR MARKET, BY END MARKET, 2019–2027 ($MILLION)

TABLE 59.REST OF EUROPE CONNECTED CAR MARKET, BY TECHNOLOGY, 2019–2027 ($MILLION)

TABLE 60.REST OF EUROPE CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS, 2019–2027 ($MILLION)

TABLE 61.REST OF EUROPE CONNECTED CAR MARKET, BY SERVICES, 2019–2027 ($MILLION)

TABLE 62.REST OF EUROPE CONNECTED CAR MARKET, BY END MARKET, 2019–2027 ($MILLION)

TABLE 63.ASIA-PACIFIC CONNECTED CAR MARKET, BY TECHNOLOGY, 2019–2027 ($MILLION)

TABLE 64.ASIA-PACIFIC CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS, 2019–2027 ($MILLION)

TABLE 65.ASIA-PACIFIC CONNECTED CAR MARKET, BY SERVICES, 2019–2027 ($MILLION)

TABLE 66.ASIA-PACIFIC CONNECTED CAR MARKET, BY END-MARKET, 2019–2027 ($MILLION)

TABLE 67.CHINA CONNECTED CAR MARKET, BY TECHNOLOGY, 2019–2027 ($MILLION)

TABLE 68.CHINA CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS, 2019–2027 ($MILLION)

TABLE 69.CHINA CONNECTED CAR MARKET, BY SERVICES, 2019–2027 ($MILLION)

TABLE 70.CHINA CONNECTED CAR MARKET, BY END MARKET, 2019–2027 ($MILLION)

TABLE 71.INDIA CONNECTED CAR MARKET, BY TECHNOLOGY, 2019–2027 ($MILLION)

TABLE 72.INDIA CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS, 2019–2027 ($MILLION)

TABLE 73.INDIA CONNECTED CAR MARKET, BY SERVICES, 2019–2027 ($MILLION)

TABLE 74.INDIA CONNECTED CAR MARKET, BY END MARKET, 2019–2027 ($MILLION)

TABLE 75.JAPAN CONNECTED CAR MARKET, BY TECHNOLOGY, 2019–2027 ($MILLION)

TABLE 76.JAPAN CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS, 2019–2027 ($MILLION)

TABLE 77.JAPAN CONNECTED CAR MARKET, BY SERVICES, 2019–2027 ($MILLION)

TABLE 78.JAPAN CONNECTED CAR MARKET, BY END MARKET, 2019–2027 ($MILLION)

TABLE 79.SOUTH KOREA CONNECTED CAR MARKET, BY TECHNOLOGY, 2019–2027 ($MILLION)

TABLE 80.SOUTH KOREA CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS, 2019–2027 ($MILLION)

TABLE 81.SOUTH KOREA CONNECTED CAR MARKET, BY SERVICES, 2019–2027 ($MILLION)

TABLE 82.SOUTH KOREA CONNECTED CAR MARKET, BY END MARKET, 2019–2027 ($MILLION)

TABLE 83.REST OF ASIA-PACIFIC CONNECTED CAR MARKET, BY TECHNOLOGY, 2019–2027 ($MILLION)

TABLE 84.REST OF ASIA-PACIFIC CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS, 2019–2027 ($MILLION)

TABLE 85.REST OF ASIA-PACIFIC CONNECTED CAR MARKET, BY SERVICES, 2019–2027 ($MILLION)

TABLE 86.REST OF ASIA-PACIFIC CONNECTED CAR MARKET, BY END MARKET, 2019–2027 ($MILLION)

TABLE 87.LAMEA CONNECTED CAR MARKET, BY TECHNOLOGY, 2019–2027 ($MILLION)

TABLE 88.LAMEA CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS, 2019–2027 ($MILLION)

TABLE 89.LAMEA CONNECTED CAR MARKET, BY SERVICES, 2019–2027 ($MILLION)

TABLE 90.LAMEA CONNECTED CAR MARKET, BY END-MARKET, 2019–2027 ($MILLION)

TABLE 91.LATIN AMERICA CONNECTED CAR MARKET, BY TECHNOLOGY, 2019–2027 ($MILLION)

TABLE 92.LATIN AMERICA CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS, 2019–2027 ($MILLION)

TABLE 93.LATIN AMERICA CONNECTED CAR MARKET, BY SERVICES, 2019–2027 ($MILLION)

TABLE 94.LATIN AMERICA CONNECTED CAR MARKET, BY END MARKET, 2019–2027 ($MILLION)

TABLE 95.MIDDLE EAST CONNECTED CAR MARKET, BY TECHNOLOGY, 2019–2027 ($MILLION)

TABLE 96.MIDDLE EAST CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS, 2019–2027 ($MILLION)

TABLE 97.MIDDLE EAST CONNECTED CAR MARKET, BY SERVICES, 2019–2027 ($MILLION)

TABLE 98.MIDDLE EAST CONNECTED CAR MARKET, BY END MARKET, 2019–2027 ($MILLION)

TABLE 99.AFRICA CONNECTED CAR MARKET, BY TECHNOLOGY, 2019–2027 ($MILLION)

TABLE 100.AFRICA CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS, 2019–2027 ($MILLION)

TABLE 101.AFRICA CONNECTED CAR MARKET, BY SERVICES, 2019–2027 ($MILLION)

TABLE 102.AFRICA CONNECTED CAR MARKET, BY END MARKET, 2019–2027 ($MILLION)

TABLE 103.AIRBIQUITY INC.., LTD.: COMPANY SNAPSHOT

TABLE 104.CLOUDMADE.: COMPANY SNAPSHOT

TABLE 105.CONTINENTAL AG: COMPANY SNAPSHOT

TABLE 106.CONTINENTAL AG: OPERATING SEGMENTS

TABLE 107.INTELLIAS LTD.: COMPANY SNAPSHOT

TABLE 108.LUXOFT: COMPANY SNAPSHOT

TABLE 109.LUXOFT: OPERATING SEGMENTS

TABLE 110.QUALCOMM TECHNOLOGIES, INC.: COMPANY SNAPSHOT

TABLE 111.QUALCOMM TECHNOLOGIES, INC.: OPERATING SEGMENTS

TABLE 112.ROBERT BOSCH GMBH: COMPANY SNAPSHOT

TABLE 113.ROBERT BOSCH GMBH: OPERATING SEGMENTS

TABLE 114.SIERRA WIRELESS: COMPANY SNAPSHOT

TABLE 115.SIERRA WIRELESS: OPERATING SEGMENTS

TABLE 116.TESLA: COMPANY SNAPSHOT

TABLE 117.ZUBIE, INC.: COMPANY SNAPSHOT

TABLE 118.AT&T INC: COMPANY SNAPSHOT

TABLE 119.AT&T INC: OPERATING SEGMENTS

TABLE 120.AT&T INC: PRODUCT PORTFOLIO

TABLE 121.AUDI AG: COMPANY SNAPSHOT

TABLE 122.AUDI AG: OPERATING SEGMENTS

TABLE 123.AUDI AG: PRODUCT PORTFOLIO

TABLE 124.BMW GROUP: COMPANY SNAPSHOT

TABLE 125.BMW GROUP: OPERATING SEGMENTS

TABLE 126.FORD MOTOR COMPANY: PRODUCT PORTFOLIO

TABLE 127.DAIMLER AG: COMPANY SNAPSHOT

TABLE 128.DAIMLER AG: OPERATING SEGMENTS

TABLE 129.DAIMLER AG: PRODUCT PORTFOLIO

TABLE 130.FORD MOTOR COMPANY: COMPANY SNAPSHOT

TABLE 131.FORD MOTOR COMPANY: OPERATING SEGMENTS

TABLE 132.FORD MOTOR COMPANY: PRODUCT PORTFOLIO

TABLE 133.SAMSUNG: COMPANY SNAPSHOT

TABLE 134.SAMSUNG: OPERATING SEGMENTS

TABLE 135.SAMSUNG: PRODUCT PORTFOLIO

TABLE 136.TELEFONICA, S.A.: COMPANY SNAPSHOT

TABLE 137.TELEFONICA, S.A.: OPERATING SEGMENTS

TABLE 138.TELEFONICA, S.A.: PRODUCT PORTFOLIO

TABLE 139.TOMTOM INTERNATIONAL N.V.: COMPANY SNAPSHOT

TABLE 140.TOMTOM INTERNATIONAL N.V.: OPERATING SEGMENTS

TABLE 141.TOMTOM INTERNATIONAL N.V.: PRODUCT PORTFOLIO

TABLE 142.VERIZON COMMUNICATIONS INC.: COMPANY SNAPSHOT

TABLE 143.VERIZON COMMUNICATIONS INC.: OPERATING SEGMENTS

TABLE 144.VERIZON COMMUNICATIONS INC.: PRODUCT PORTFOLIO

TABLE 145.VODAFONE GROUP PLC: COMPANY SNAPSHOT

TABLE 146.VODAFONE GROUP PLC: PRODUCT PORTFOLIO

LIST OF FIGURES

FIGURE 01.KEY MARKET SEGMENTS

FIGURE 02.EXECUTIVE SUMMARY

FIGURE 03.EXECUTIVE SUMMARY

FIGURE 04.TOP IMPACTING FACTORS

FIGURE 05.TOP INVESTMENT POCKETS

FIGURE 06.TOP WINNING STRATEGIES, BY YEAR, 2017-2020*

FIGURE 07.TOP WINNING STRATEGIES, BY DEVELOPMENT, 2017-2020*

FIGURE 08.TOP WINNING STRATEGIES, BY COMPANY, 2017-2020*

FIGURE 09.MARKET SHARE ANALYSIS, 2019 (%)

FIGURE 10.GLOBAL CONNECTED CAR MARKET, BY SYSTEM, 2019-2027

FIGURE 11.COMPARATIVE SHARE ANALYSIS OF CONNECTED CAR MARKET FOR 3G, BY COUNTRY, 2019 & 2027 ($MILLON)

FIGURE 12.COMPARATIVE SHARE ANALYSIS OF CONNECTED CAR MARKET FOR 4G/LTE, BY COUNTRY, 2019 & 2027 ($MILLON)

FIGURE 13.COMPARATIVE SHARE ANALYSIS OF CONNECTED CAR MARKET FOR 5G, BY COUNTRY, 2019 & 2027 ($MILLON)

FIGURE 14.GLOBAL CONNECTED CAR MARKET, BY CONNECTIVITY SOLUTIONS, 2019-2027

FIGURE 15.COMPARATIVE SHARE ANALYSIS OF CONNECTED CAR MARKET FOR INTEGRATED, BY COUNTRY, 2019 & 2027 ($MILLON)

FIGURE 16.COMPARATIVE SHARE ANALYSIS OF CONNECTED CAR MARKET FOR EMBEDDED, BY COUNTRY, 2019 & 2027 ($MILLON)

FIGURE 17.COMPARATIVE SHARE ANALYSIS OF CONNECTED CAR MARKET FOR TETHERED, BY COUNTRY, 2019 & 2027 ($MILLON)

FIGURE 18.GLOBAL CONNECTED CAR MARKET, BY SERVICE, 2019-2027

FIGURE 19.COMPARATIVE SHARE ANALYSIS OF CONNECTED CAR MARKET FOR DRIVER ASSISTANCE, BY COUNTRY, 2019 & 2027 ($MILLON)

FIGURE 20.COMPARATIVE SHARE ANALYSIS OF CONNECTED CAR MARKET FOR SAFETY, BY COUNTRY, 2019 & 2027 ($MILLON)

FIGURE 21.COMPARATIVE SHARE ANALYSIS OF CONNECTED CAR MARKET FOR ENTERTAINMENT, BY COUNTRY, 2019 & 2027 ($MILLON)

FIGURE 22.COMPARATIVE SHARE ANALYSIS OF CONNECTED CAR MARKET FOR WELL-BEING, BY COUNTRY, 2019 & 2027 ($MILLON)

FIGURE 23.COMPARATIVE SHARE ANALYSIS OF CONNECTED CAR MARKET FOR VEHICLE MANAGEMENT, BY COUNTRY, 2019 & 2027 ($MILLON)

FIGURE 24.COMPARATIVE SHARE ANALYSIS OF CONNECTED CAR MARKET FOR MOBILITY MANAGEMENT , BY COUNTRY, 2019 & 2027 ($MILLON)

FIGURE 25.GLOBAL CONNECTED CAR MARKET, BY END-MARKET, 2019-2027

FIGURE 26.COMPARATIVE SHARE ANALYSIS OF CONNECTED CAR MARKET FOR ORIGINAL EQUIPMENT MANUFACTURERS (OEMS), BY COUNTRY, 2019 & 2027 ($MILLON)

FIGURE 27.COMPARATIVE SHARE ANALYSIS OF CONNECTED CAR MARKET FOR AFTERMARKET, BY COUNTRY, 2019 & 2027 ($MILLON)

FIGURE 28.CONNECTED CAR MARKET, BY REGION, 2019-2027 (%)

FIGURE 29.COMPARATIVE SHARE ANALYSIS OF CONNECTED CAR MARKET, BY COUNTRY, 2019–2027 (%)

FIGURE 30.U.S. CONNECTED CAR MARKET, 2019–2027 ($MILLION)

FIGURE 31.CANADA CONNECTED CAR MARKET, 2019–2027 ($MILLION)

FIGURE 32.MEXICO CONNECTED CAR MARKET, 2019–2027 ($MILLION)

FIGURE 33.COMPARATIVE SHARE ANALYSIS OF CONNECTED CAR MARKET, BY COUNTRY, 2019–2027 (%)

FIGURE 34.UK CONNECTED CAR MARKET, 2019–2027 ($MILLION)

FIGURE 35.GERMANY CONNECTED CAR MARKET, 2019–2027 ($MILLION)

FIGURE 36.FRANCE CONNECTED CAR MARKET, 2019–2027 ($MILLION)

FIGURE 37.RUSSIA CONNECTED CAR MARKET, 2019–2027 ($MILLION)

FIGURE 38.ITALY CONNECTED CAR MARKET, 2019–2027 ($MILLION)

FIGURE 39.REST OF EUROPE CONNECTED CAR MARKET, 2019–2027 ($MILLION)

FIGURE 40.COMPARATIVE SHARE ANALYSIS OF CONNECTED CAR MARKET, BY COUNTRY, 2019–2027 (%)

FIGURE 41.CHINA CONNECTED CAR MARKET, 2019–2027 ($MILLION)

FIGURE 42.INDIA CONNECTED CAR MARKET, 2019–2027 ($MILLION)

FIGURE 43.JAPAN CONNECTED CAR MARKET, 2019–2027 ($MILLION)

FIGURE 44.SOUTH KOREA CONNECTED CAR MARKET, 2019–2027 ($MILLION)

FIGURE 45.REST OF ASIA-PACIFIC CONNECTED CAR MARKET, 2019–2027 ($MILLION)

FIGURE 46.COMPARATIVE SHARE ANALYSIS OF CONNECTED CAR MARKET, BY COUNTRY, 2019–2027 (%)

FIGURE 47.LATIN AMERICA CONNECTED CAR MARKET, 2019–2027 ($MILLION)

FIGURE 48.MIDDLE EAST CONNECTED CAR MARKET, 2019–2027 ($MILLION)

FIGURE 49.AFRICA CONNECTED CAR MARKET, 2019–2027 ($MILLION)

FIGURE 50.CONTINENTAL AG: REVENUE, 2016–2018 ($MILLION)

FIGURE 51.CONTINENTAL AG: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 52.CONTINENTAL AG: REVENUE SHARE BY REGION, 2018 (%)

FIGURE 53.LUXOFT: REVENUE, 2016–2018 ($MILLION)

FIGURE 54.LUXOFT: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 55.LUXOFT: REVENUE SHARE BY REGION, 2018 (%)

FIGURE 56.QUALCOMM TECHNOLOGIES, INC.: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 57.QUALCOMM TECHNOLOGIES, INC.: REVENUE SHARE BY REGION, 2018 (%)

FIGURE 58.ROBERT BOSCH GMBH: REVENUE, 2016–2018 ($MILLION)

FIGURE 59.ROBERT BOSCH GMBH: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 60.ROBERT BOSCH GMBH: REVENUE SHARE BY REGION , 2018 (%)

FIGURE 61.SIERRA WIRELESS: REVENUE, 2016–2018 ($MILLION)

FIGURE 62.SIERRA WIRELESS: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 63.SIERRA WIRELESS: REVENUE SHARE BY REGION , 2018 (%)

FIGURE 64.TESLA: REVENUE, 2016–2018 ($MILLION)

FIGURE 65.TESLA: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 66.TESLA: REVENUE SHARE BY REGION, 2018 (%)

FIGURE 67.AT&T INC: REVENUE, 2016–2018 ($MILLION)

FIGURE 68.AT&T INC: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 69.AT&T INC.: REVENUE SHARE BY GEOGRAPHY, 2018 (%)

FIGURE 70.AUDI AG: REVENUE, 2016–2018 ($MILLION)

FIGURE 71.AUDI AG: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 72.AUDI AG: REVENUE SHARE BY GEOGRAPHY, 2018 (%)

FIGURE 73.BMW GROUP: REVENUE, 2016–2018 ($MILLION)

FIGURE 74.BMW GROUP: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 75.BMW GROUP: REVENUE SHARE BY GEOGRAPHY, 2018 (%)

FIGURE 76.DAIMLER AG: NET SALES, 2016–2018 ($MILLION)

FIGURE 77.DAIMLER AG: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 78.DAIMLER AG: REVENUE SHARE BY GEOGRAPHY, 2018 (%)

FIGURE 79.FORD MOTOR COMPANY: REVENUE, 2016–2018 ($MILLION)

FIGURE 80.FORD MOTOR COMPANY: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 81.FORD MOTOR COMPANY: REVENUE SHARE BY GEOGRAPHY, 2018 (%)

FIGURE 82.SAMSUNG: NET SALES, 2016–2018 ($MILLION)

FIGURE 83.SAMSUNG: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 84.SAMSUNG: REVENUE SHARE BY GEOGRAPHY, 2018 (%)

FIGURE 85.TELEFONICA, S.A.: REVENUE, 2016–2018 ($MILLION)

FIGURE 86.TELEFONICA, S.A.: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 87.TELEFONICA, S.A.: REVENUE SHARE BY GEOGRAPHY, 2018 (%)

FIGURE 88.TOMTOM INTERNATIONAL N.V.: REVENUE, 2016–2018 ($MILLION)

FIGURE 89.TOMTOM INTERNATIONAL N.V.: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 90.TOMTOM INTERNATIONAL N.V.: REVENUE SHARE BY GEOGRAPHY, 2018 (%)

FIGURE 91.VERIZON COMMUNICATIONS INC.: REVENUE, 2016–2018 ($MILLION)

FIGURE 92.VERIZON COMMUNICATIONS INC.: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 93.VODAFONE GROUP PLC: REVENUE, 2016–2018 ($MILLION)

FIGURE 94.VODAFONE GROUP PLC: REVENUE SHARE BY GEOGRAPHY, 2018 (%)

$5769

$8995

HAVE A QUERY?

OUR CUSTOMER