Italy Travel Insurance Market

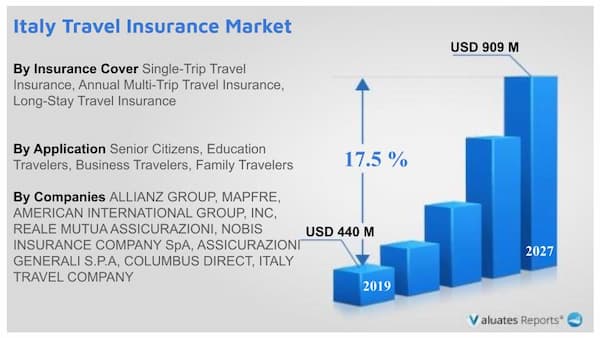

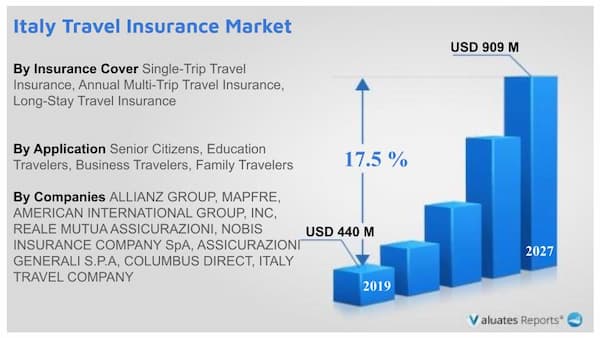

The Italy travel insurance market size was valued at $440 million in 2019 and is projected to reach $909 million by 2027, growing at a CAGR of 17.5% from 2020 to 2027. Travel insurance is a type of insurance that provides protection for those traveling domestically or abroad. Primarily, it covers the costs & losses such as loss of baggage, evacuation due to medical condition or hijack, trip cancellation due to medical emergency, loss of travel documents, and other such losses associated with traveling. Key players in the country offer different plans by covering costs and losses depending on coverages in the policy.

Increase in tourism result in several incidences such as health issues, cancelled flights, accidents, theft or loss of baggage, natural calamities, and other such occurrences of uncertainties during travel. Therefore, to mitigate the risks associated with such incidences, consumers are opting for travel insurance, which is acting as a prime driver for the Italy travel insurance market. However, relaxed norms & low fluctuation in rates due to large number of competitors and lack of awareness regarding various insurance schemes and benefits of travel insurance have resulted in decline of gross written premium in the Italy travel insurance market.

On the contrary, expansion of existing products by including specific coverages such as pre-existing medical condition, COVID-19 related coverages and others, is providing an immense potential to the travel insurance providers in the country. Moreover, technological developments such as global positioning system (GPS), artificial intelligence (AI), geo-location, application program interface (API), data analytics, among others are providing innovative opportunities for insurers in the market. Thus, these factors are expected to provide lucrative opportunities during the forecast period.

The single-trip travel insurance dominated the Italy travel insurance market industry in 2019 and is projected to maintain its dominance during the forecast period. Due to increased demand for customized coverage offerings under this policy and are available at an extra premium cost depending on customers need and demands. In addition, rise in number of multi-generation travelers such as grandparents, parents, and grandchildren availing single-trip travel personalized coverages with an extra premium are becoming major factors driving the Italy travel insurance market growth.

Segment Review

The Italy travel insurance market is segmented on the basis of insurance cover, distribution channel, distribution mode, and end user. In terms of insurance cover, it is segmented into single-trip travel insurance, annual multi-trip travel insurance, and long-stay travel insurance.

Based on distribution channel, it is classified into insurance intermediaries, insurance companies, banks, insurance brokers, and insurance aggregators. On the basis of distribution mode, it is segmented into business-to-business (B2B), business-to-consumer (B2C), and business-to-business-to-consumer (B2B2C). Based on end user, it is segmented into senior citizens, education travelers, business travelers, family travelers, and others.

The report analyses the profiles of key players operating in the Italy travel insurance industry including Allianz, American International Group Inc., AXA, ASSICURAZIONI GENERALI S.P.A., Cattolica Assicurazioni, Columbus Direct, ERGO Group AG, IMA Italia Assistance S.p.A., Insure & Go Insurance Services Limited, Italy Travel Company, MAPFRE, Nobis Insurance Company SpA, and Reale Mutua Assicurazioni. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Top Impacting Factors

Rapid Growth in Tourism

Rise in tourist population owing to increase in disposable income, extensive coverage for holidays, easy online travel booking options, among others has attributed to the growth of the tourism industry in the country. With an increase in tourism, several incidences such as cancelled flights, accidents, health issues, theft or loss of baggage, natural calamities, and other such occurrences of uncertainties during travel. To mitigate the risks associated with such incidences, consumers are opting for travel insurance. Therefore, the growth of the tourism industry is acting as a prime driver for the Italy travel insurance market.

New Technological Developments in the Italy Travel Insurance Industry

Increase in technologies such as geo-location, application program interface (API), artificial intelligence (AI), data analytics, blockchain, and big data are providing innovative opportunities for insurers in the country. With these technological developments, travel insurance distribution platforms are expected to enhance productivity for providing coverages seamlessly at the point-of-purchase. Moreover, digital transformation enables travel insurance companies to create highly personalized user experiences to their customers.

Further, in order to maintain the market position, insurers are considering use of big data analytics that offer possibilities of generating large premiums. In addition, technologies help in data collection, cater to customer specific needs, calculate risk, and detect fraud. Therefore, easy accessibility and convenient travel insurance offerings by technological advancements are expected to provide lucrative opportunities for insures in the country.

Market Share

Business Travelers segment would exhibit the highest CAGR of 20.2% during 2020-2027. Business-to-Consumer (B2C) segment would grow at a highest CAGR of 18.6% during the forecast period. Insurance Intermediaries segment holds a dominant position in 2019 and would maintain the lead during 2020-2027. Single-Trip Travel Insurance segment will dominate the market throughout the forecast period.

By Insurance Cover

- Single-Trip Travel Insurance

- Annual Multi-Trip Travel Insurance

- Long-Stay Travel Insurance

By Distribution Channel

- INSURANCE INTERMEDIARIES

- INSURANCE COMPANIES

- BANKS

- INSURANCE BROKERS

- INSURANCE AGGREGATORS

By Distribution Mode

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

- Business-to-Business-to-Consumer (B2B2C)

By End User

- Senior Citizens

- Education Travelers

- Business Travelers

- Family Travelers

Key Market Players

ALLIANZ GROUP, MAPFRE, AMERICAN INTERNATIONAL GROUP, INC, REALE MUTUA ASSICURAZIONI, NOBIS INSURANCE COMPANY SpA, ASSICURAZIONI GENERALI S.P.A, COLUMBUS DIRECT, ITALY TRAVEL COMPANY, INSURE & GO INSURANCE SERVICES LIMITED, CATTOLICA ASSICURAZIONI, AXA, IMA ITALIA ASSISTANCE S.p.A, ERGO GROUP AG

Chapter 1 : INTRODUCTION

1.1. Report description

1.2. Key benefits for stakeholders

1.3. Key market segments

1.4. Research methodology

1.4.1. Secondary research

1.4.2. Primary research

1.4.3. Analyst tools & models

Chapter 2 : EXECUTIVE SUMMARY

2.1. Key findings

2.1.1. Top impacting factors

2.1.2. Top investment pockets

2.2. CXO perspective

Chapter 3 : MARKET OVERVIEW

3.1. Market definition and scope

3.2. Key forces shaping the Italy travel insurance market

3.3. Market dynamics

3.3.1. Drivers

3.3.1.1. Rapid growth in tourism

3.3.1.2. Convenient shopping due to online comparison sites

3.3.1.3. Travel rule and regulations

3.3.2. Restraint

3.3.2.1. Lack of awareness regarding travel insurance policy

3.3.3. Opportunities

3.3.3.1. Expansion of products and services

3.3.3.2. New technological developments in the Italy travel insurance industry

3.4. COVID-19 impact analysis on Italy travel insurance market

3.4.1. Impact on travel & tourism industry

3.4.2. Impact on Italy travel insurance market size

3.4.3. Change in travelers’ trends, preferences, and budget impact due to COVID-19

3.4.4. Framework for solving market challenges faced by travel insurance providers and policy adopters in the country

3.4.5. Economic impact on travel insurers

3.4.6. Key player strategies to tackle negative impact in the industry

3.4.7. Opportunity analysis for travel insurance policy providers

Chapter 4 : ITALY TRAVEL INSURANCE MARKET, BY INSURANCE COVER

4.1. Overview

4.2. Single-trip travel insurance

4.2.1. Key market trends, growth factors, and opportunities

4.2.2. Market size and forecast

4.3. Annual multi-trip travel insurance

4.3.1. Key market trends, growth factors, and opportunities

4.3.2. Market size and forecast

4.4. Long-stay travel insurance

4.4.1. Key market trends, growth factors, and opportunities

4.4.2. Market size and forecast

Chapter 5 : ITALY TRAVEL INSURANCE MARKET, BY DISTRIBUTION CHANNEL

5.1. Overview

5.2. Insurance intermediaries

5.2.1. Key market trends, growth factors, and opportunities

5.2.2. Market size and forecast

5.3. Insurance companies

5.3.1. Key market trends, growth factors, and opportunities

5.3.2. Market size and forecast

5.4. Banks

5.4.1. Key market trends, growth factors, and opportunities

5.4.2. Market size and forecast

5.5. Insurance brokers

5.5.1. Key market trends, growth factors, and opportunities

5.5.2. Market size and forecast

5.6. Insurance aggregators

5.6.1. Key market trends, growth factors, and opportunities

5.6.2. Market size and forecast

Chapter 6 : ITALY TRAVEL INSURANCE MARKET, BY DISTRIBUTION MODE

6.1. Overview

6.2. Business-to-business (B2B)

6.2.1. Key market trends, growth factors, and opportunities

6.2.2. Market size and forecast

6.3. Business-to-consumer (B2C)

6.3.1. Key market trends, growth factors, and opportunities

6.3.2. Market size and forecast

6.4. Business-to-business-to-consumer (B2B2C)

6.4.1. Key market trends, growth factors, and opportunities

6.4.2. Market size and forecast

Chapter 7 : ITALY TRAVEL INSURANCE MARKET, BY END USER

7.1. Overview

7.2. Senior citizens

7.2.1. Key market trends, growth factors, and opportunities

7.2.2. Market size and forecast

7.3. Education travelers

7.3.1. Key market trends, growth factors, and opportunities

7.3.2. Market size and forecast

7.4. Business travelers

7.4.1. Key market trends, growth factors, and opportunities

7.4.2. Market size and forecast

7.5. Family travelers

7.5.1. Key market trends, growth factors, and opportunities

7.5.2. Market size and forecast

7.6. Others

7.6.1. Key market trends, growth factors, and opportunities

7.6.2. Market size and forecast

Chapter 8 : COMPETITIVE LANDSCAPE

8.1. Introduction

8.1.1. Market player positioning, 2019

8.1.2. Top winning strategies

Chapter 9 : COMPANY PROFILES

9.1. ALLIANZ GROUP

9.1.1. Company overview

9.1.2. Key executive

9.1.3. Company snapshot

9.1.5. Operating business segments

9.1.6. Product portfolio

9.1.7. Business performance

9.1.8. Key strategic moves and developments

9.2. AMERICAN INTERNATIONAL GROUP, INC.

9.2.1. Company overview

9.2.2. Key executive

9.2.3. Company snapshot

9.2.4. Operating business segments

9.2.5. Product portfolio

9.2.6. Business performance

9.2.7. Key strategic moves and developments

9.3. AXA

9.3.1. Company overview

9.3.2. Key executive

9.3.3. Company snapshot

9.3.4. Operating business segments

9.3.5. Product portfolio

9.3.6. Business performance

9.3.7. Key strategic moves and developments

9.4. ASSICURAZIONI GENERALI S.P.A.

9.4.1. Company overview

9.4.2. Key executive

9.4.3. Company snapshot

9.4.4. Product portfolio

9.4.5. Business performance

9.4.6. Key strategic moves and developments

9.5. CATTOLICA ASSICURAZIONI

9.5.1. Company overview

9.5.2. Key executive

9.5.3. Company snapshot

9.5.4. Product portfolio

9.5.5. Business performance

9.6. COLUMBUS DIRECT

9.6.1. Company overview

9.6.2. Key executive

9.6.3. Company snapshot

9.6.4. Product portfolio

9.7. ERGO GROUP AG

9.7.1. Company overview

9.7.2. Key executive

9.7.3. Company snapshot

9.7.4. Product portfolio

9.8. IMA ITALIA ASSISTANCE S.p.A.

9.8.1. Company overview

9.8.2. Key executive

9.8.3. Company snapshot

9.8.4. Product portfolio

9.9. INSURE & GO INSURANCE SERVICES LIMITED

9.9.1. Company overview

9.9.2. Key executive

9.9.3. Company snapshot

9.9.4. Product portfolio

9.10. ITALY TRAVEL COMPANY

9.10.1. Company overview

9.10.2. Company snapshot

9.10.3. Product portfolio

9.11. MAPFRE

9.11.1. Company overview

9.11.2. Key executive

9.11.3. Company snapshot

9.11.4. Product portfolio

9.11.5. Business performance

9.12. NOBIS INSURANCE COMPANY SpA

9.12.1. Company overview

9.12.2. Key executive

9.12.3. Company snapshot

9.12.4. Product portfolio

9.12.5. Key strategic moves and developments

9.13. REALE MUTUA ASSICURAZIONI

9.13.1. Company overview

9.13.2. Key executive

9.13.3. Company snapshot

9.13.4. Product portfolio

List of Tables

TABLE 01. ITALY TRAVEL INSURANCE MARKET REVENUE, BY INSURANCE COVER, 2019–2027 ($MILLION)

TABLE 02. ITALY TRAVEL INSURANCE MARKET REVENUE FOR SINGLE-TRIP INSURANCE, 2019–2027 ($MILLION)

TABLE 03. ITALY TRAVEL INSURANCE MARKET REVENUE FOR ANNUAL MULTI-TRIP INSURANCE, 2019–2027 ($MILLION)

TABLE 04. ITALY TRAVEL INSURANCE MARKET REVENUE FOR LONG-STAY TRAVEL INSURANCE, 2019–2027 ($MILLION)

TABLE 05. ITALY TRAVEL INSURANCE MARKET REVENUE, BY DISTRIBUTION CHANNEL, 2019-2027 ($MILLION)

TABLE 06. ITALY TRAVEL INSURANCE MARKET REVENUE FOR INSURANCE INTERMEDIARIES, 2019–2027 ($MILLION)

TABLE 07. ITALY TRAVEL INSURANCE MARKET REVENUE FOR INSURANCE COMPANIES, 2019–2027 ($MILLION)

TABLE 08. ITALY TRAVEL INSURANCE MARKET REVENUE FOR BANKS, 2019–2027 ($MILLION)

TABLE 09. ITALY TRAVEL INSURANCE MARKET REVENUE FOR INSURANCE BROKERS, 2019–2027 ($MILLION)

TABLE 10. ITALY TRAVEL INSURANCE MARKET REVENUE FOR INSURANCE AGGREGATORS, 2019–2027 ($MILLION)

TABLE 11. ITALY TRAVEL INSURANCE MARKET REVENUE, BY DISTRIBUTION MODE, 2019-2027 ($MILLION)

TABLE 12. ITALY TRAVEL INSURANCE MARKET REVENUE FOR B2B DISTRIBUTION MODE, 2019–2027 ($MILLION)

TABLE 13. ITALY TRAVEL INSURANCE MARKET REVENUE FOR B2C DISTRIBUTION MODE, 2019–2027 ($MILLION)

TABLE 14. ITALY TRAVEL INSURANCE MARKET REVENUE FOR B2B2C DISTRIBUTION MODE, 2019–2027 ($MILLION)

TABLE 15. ITALY TRAVEL INSURANCE MARKET REVENUE, BY END USER, 2019-2027 ($MILLION)

TABLE 16. ITALY TRAVEL INSURANCE MARKET REVENUE FOR SENIOR CITIZENS, 2019–2027 ($MILLION)

TABLE 17. ITALY TRAVEL INSURANCE MARKET REVENUE FOR EDUCATION TRAVELERS, 2019–2027 ($MILLION)

TABLE 18. ITALY TRAVEL INSURANCE MARKET REVENUE FOR BUSINESS TRAVELERS, 2019–2027 ($MILLION)

TABLE 19. ITALY TRAVEL INSURANCE MARKET REVENUE FOR FAMILY TRAVELERS, 2019–2027 ($MILLION)

TABLE 20. ITALY TRAVEL INSURANCE MARKET REVENUE FOR OTHERS, 2019–2027 ($MILLION)

TABLE 21. ALLIANZ: KEY EXECUTIVE

TABLE 22. ALLIANZ: COMPANY SNAPSHOT

TABLE 23. ALLIANZ: OPERATING SEGMENTS

TABLE 24. ALLIANZ GROUP: PRODUCT PORTFOLIO

TABLE 25. AMERICAN INTERNATIONAL GROUP, INC.: KEY EXECUTIVE

TABLE 26. AMERICAN INTERNATIONAL GROUP, INC.: COMPANY SNAPSHOT

TABLE 27. AMERICAN INTERNATIONAL GROUP, INC. OPERATING SEGMENTS

TABLE 28. AMERICAN INTERNATIONAL GROUP, INC.: PRODUCT PORTFOLIO

TABLE 29. AXA: KEY EXECUTIVE

TABLE 30. AXA: COMPANY SNAPSHOT

TABLE 31. AXA: OPERATING CATEGORIES

TABLE 32. AXA: PRODUCT PORTFOLIO

TABLE 33. ASSICURAZIONI GENERALI S.P.A.: KEY EXECUTIVE

TABLE 34. ASSICURAZIONI GENERALI S.P.A.: COMPANY SNAPSHOT

TABLE 35. ASSICURAZIONI GENERALI S.P.A.: PRODUCT PORTFOLIO

TABLE 36. CATTOLICA ASSICURAZIONI: KEY EXECUTIVE

TABLE 37. CATTOLICA ASSICURAZIONI: COMPANY SNAPSHOT

TABLE 38. CATTOLICA ASSICURAZIONI: PRODUCT PORTFOLIO

TABLE 39. COLUMBUS DIRECT: KEY EXECUTIVE

TABLE 40. COLUMBUS DIRECT: COMPANY SNAPSHOT

TABLE 41. COLUMBUS DIRECT: PRODUCT PORTFOLIO

TABLE 42. ERGO GROUP AG: KEY EXECUTIVE

TABLE 43. ERGO GROUP AG: COMPANY SNAPSHOT

TABLE 44. ERGO GROUP AG: PRODUCT PORTFOLIO

TABLE 45. IMA ITALIA ASSISTANCE S.P.A.: KEY EXECUTIVE

TABLE 46. IMA ITALIA ASSISTANCE S.P.A.: COMPANY SNAPSHOT

TABLE 47. IMA ITALIA ASSISTANCE S.P.A.: PRODUCT PORTFOLIO

TABLE 48. INSURE & GO INSURANCE SERVICES LIMITED: KEY EXECUTIVE

TABLE 49. INSURE & GO INSURANCE SERVICES LIMITED: COMPANY SNAPSHOT

TABLE 50. INSURE & GO INSURANCE SERVICES LIMITED: PRODUCT PORTFOLIO

TABLE 51. ITALY TRAVEL COMPANY: COMPANY SNAPSHOT

TABLE 52. ITALY TRAVEL COMPANY: PRODUCT PORTFOLIO

TABLE 53. MAPFRE: KEY EXECUTIVE

TABLE 54. MAPFRE: COMPANY SNAPSHOT

TABLE 55. MAPFRE: PRODUCT PORTFOLIO

TABLE 56. NOBIS INSURANCE COMPANY SPA: KEY EXECUTIVE

TABLE 57. NOBIS INSURANCE COMPANY SPA: COMPANY SNAPSHOT

TABLE 58. NOBIS INSURANCE COMPANY SPA: PRODUCT PORTFOLIO

TABLE 59. REALE MUTUA ASSICURAZIONI: KEY EXECUTIVE

TABLE 60. REALE MUTUA ASSICURAZIONI: COMPANY SNAPSHOT

TABLE 61. REALE MUTUA ASSICURAZIONI: PRODUCT PORTFOLIO

List of Figures

FIGURE 01. KEY MARKET SEGMENTS

FIGURE 02. ITALY TRAVEL INSURANCE MARKET, 2019–2027

FIGURE 04. TOP IMPACTING FACTORS

FIGURE 05. TOP INVESTMENT POCKETS

FIGURE 06. LOW BARGAINING POWER OF SUPPLIERS

FIGURE 07. HIGH BARGAINING POWER OF BUYER

FIGURE 08. MODERATE THREAT OF SUBSTITUTES

FIGURE 09. MODERATE THREAT OF NEW ENTRANTS

FIGURE 10. HIGH COMPETITIVE RIVALRY

FIGURE 11. ITALY TRAVEL INSURANCE MARKET, BY INSURANCE COVER, 2019-2027

FIGURE 12. ITALY TRAVEL INSURANCE MARKET REVENUE, BY DISTRIBUTION CHANNEL, 2019-2027 ($MILLION)

FIGURE 13. ITALY TRAVEL INSURANCE MARKET REVENUE, BY DISTRIBUTION MODE, 2019-2027 ($MILLION)

FIGURE 14. ITALY TRAVEL INSURANCE MARKET REVENUE, BY END USER, 2019-2027 ($MILLION)

FIGURE 15. MARKET PLAYER POSITIONING, 2019

FIGURE 16. TOP WINNING STRATEGIES, BY YEAR, 2018-2020

FIGURE 17. TOP WINNING STRATEGIES, BY DEVELOPMENT, 2018-2020

FIGURE 18. TOP WINNING STRATEGIES, BY COMPANY, 2018-2020

FIGURE 19. ALLIANZ: NET SALES, 2017–2019 ($MILLION)

FIGURE 20. ALLIANZ: REVENUE SHARE BY SEGMENT (2019)

FIGURE 21. AMERICAN INTERNATIONAL GROUP, INC.: NET SALES, 2017–2019 ($MILLION)

FIGURE 22. AMERICAN INTERNATIONAL GROUP, INC.: REVENUE SHARE BY SEGMENT (2019)

FIGURE 23. AMERICAN INTERNATIONAL GROUP, INC.: REVENUE SHARE BY REGION (2019)

FIGURE 24. AXA:NET SALES, 2017–2019 ($MILLION)

FIGURE 25. AXA: REVENUE SHARE BY SEGMENT (2019)

FIGURE 26. ASSICURAZIONI GENERALI S.P.A.: NET PROFIT, 2017–2019 ($MILLION)

FIGURE 27. CATTOLICA ASSICURAZIONI: NET PROFIT, 2017–2019 ($MILLION)

FIGURE 28. MAPFRE: NET PROFIT, 2017–2019 ($MILLION)