The global defibrillator market size was valued at $13,168 million in 2020, and is projected to reach $24,608.3 million by 2030, registering a CAGR of 6.6% from 2021 to 2030.

Defibrillator is defined as a medical devices used to deliver therapeutic shock to a patient’s heart in life-threatening conditions, such as ventricular fibrillation, cardiac arrhythmia, and pulseless ventricular tachycardia. The defibrillation procedure encompasses delivery of an electric shock to the heart, which depolarizes heart muscles and restores its normal electric impulse. External defibrillators are life-saving medical devices used to deliver defibrillating shock through paddles or electrode pads to diagnose and restore life-threatening abnormal heart rhythms in the conditions of unexpected cardiac arrest.

The COVID-19 outbreak is anticipated to have a negative impact on growth of the global defibrillators market. The outbreak of COVID-19 has disrupted workflows in the healthcare sector globally. The pandemic affected the buying capacities of hospitals, particularly in small-scale hospitals, resulting in canceled or postponed supply deals and procedure, which has impacted the overall revenue of all the major players in the defibrillators market.

Growing focus towards public access defibrillator (PAD) by the public and private organizations has fueled the market growth. Moreover, increase in number of key players to develop advanced defibrillator devices, rapidly growing geriatric population with elevated risk of cardiac arrest and increase in incidence of cardiac diseases further drive the market growth. Defibrillators are capable of performing cardioversion, defibrillation, and pacing of the heart. External defibrillators are of three major types, namely manual external defibrillator, automated external defibrillator (AEDs), and wearable cardioverter defibrillator (WCDs). AEDs are used for the treatment of sudden cardiac arrest (SCA) due to its high efficiency and ease in use, thereby bagging a large market share in the global defibrillator market. However, increase in pricing pressure on players is restraining the growth of the defibrillators market.

The increase in adoption of technologically advanced defibrillators devices, growing demand for quality medical care, and rise in prevalence of SCA are key factors for the growth of the defibrillator market.

The increase in focus and availability of defibrillators in offices, schools, shopping malls, grocery stores, and airports propel the market growth. Furthermore, increase in focus of key market players on public access defibrillators and increase in number of training & awareness programs across the globe are a few more factors driving the growth of the defibrillator.,

Advancement in the innovation of the next-generation external defibrillators to improve safety and effectiveness, are anticipated to create lucrative opportunities. Defibrillators aim to enhance the ability of the industry, identifying and addressing problems associated with devices. SCA is the leading cause of death globally, which is a life-threatening condition. It can be treated successfully by early intervention of the disease with defibrillation at the right time. The global external defibrillator market is dominated by automated external defibrillators (AEDs) and expected to grow with highest rate in future due to increase in adoption by heart failure patients across the globe. The increasing installations of public access AEDs have fueled the market growth. The second-largest market of external defibrillators is covered by manual external defibrillators followed by wearable external defibrillators.

The defibrillator market in this report is studied on the basis of product, end user, and region. On the basis of product, the market is divided into implantable defibrillators and external defibrillators. Implantable defibrillators are classified into transvenous implantable cardioverter defibrillator (T-ICDs), subcutaneous implantable cardioverter defibrillator (S-ICDs), and cardiac resynchronization therapy- defibrillator (CRT-D). External defibrillators are further classified as manual external defibrillator, automated external defibrillator (AEDs), and wearable cardioverter defibrillator (WCDs). On the basis of end user, the market is segregated into hospitals, pre-hospital, public access market, alternative care, and home. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

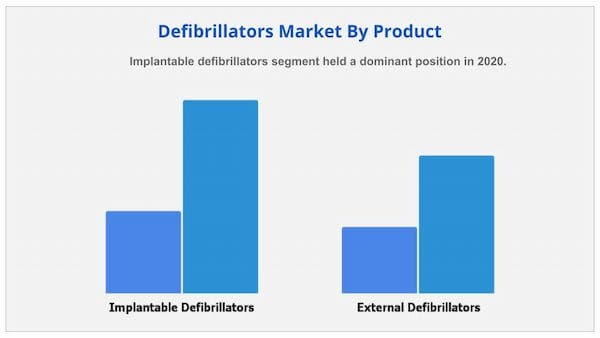

By product, the implantable defibrillators segment currently dominates the global defibrillator market and is expected to continue during the forecast period owing to rapid increase in geriatric population, emergence of new technologies, increase in adoption of S-ICDs, and rise in incidence of sudden cardiac arrest (SCA). However, the external defibrillators segment is expected to witness considerable growth during the forecast period, owing to advancements in technology in the healthcare sector and rise in adoption of external defibrillators installations.

By end users, the hospitals segment dominated the global defibrillator market in 2020 and is anticipated to be dominant in the market owing to higher number of cardiac patients received in hospitals and surgeries performed in hospital settings. Both, ICDs and external defibrillators are increasingly used in hospitals to deliver treatment to patients of sudden cardiac arrest and for other indications. However, the alternative care segment is expected to witness considerable growth during the forecast period, owing to increase in demand for early diagnosis and initiative taken by government or private organizations for development of alternative care system.

Region Segment Review

North America garnered a major share in the defibrillator market in 2020, and is expected to continue to dominate during the forecast period, owing to initiatives by key players, favorable regulations, and technologically advanced healthcare facilities in the U.S. and Canada. However, Asia-Pacific is expected to register highest CAGR of 8.2% from 2021 to 2030, owing to developing healthcare infrastructure, high patient population, and prevalence of cardiac diseases.

The major companies profiled in this report include Asahi Kasei Corporation, Stryker Corporation, Biotronik SE & Co. KG, Boston Scientific Corporation, Philips Healthcare, LivaNova PLC, Medtronic plc, Cardiac Science Corporation, Nihon Kohden Corporation, and St. Jude Medical, Inc.

Key Benefits For Stakeholders

| By Product |

|

| Segment by Enduser |

|

| By Region |

|

| Forecast units | USD Billion in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Ans. The global defibrillator market size was valued at $13,168 million in 2020, and is projected to reach $24,608.3 million by 2030, registering a CAGR of 6.6% from 2021 to 2030.

Ans. Implantable defibrillators segment held a dominant position in 2020.

Ans. Asia- Pacific region would exhibit the fastest CAGR of 8.2% during the forecast period.

Ans. Hospital segment held a dominant position in 2020.

$5540

$6654

$9280

HAVE A QUERY?

OUR CUSTOMER