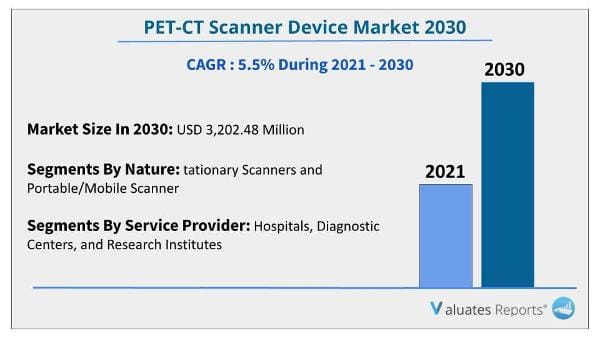

The global PET-CT scanner device market was valued at $1,876.14 million in 2020, and is projected to reach $3,202.48 million by 2030, registering a CAGR of 5.5% from 2021 to 2030.

Positron emission tomography is also called as PET imaging or a PET scan, which is a type of nuclear medicine imaging. It uses small amounts of radioactive materials called radiotracers or radiopharmaceuticals, a special camera and a computer to evaluate organ and tissue functions. It can detect the early onset of disease before other imaging test by identifying changes at the cellular level. It can diagnose heart diseases, cancer, gastrointestinal, endocrine, and neurological disorders. Radiotracers that are used in it usually accumulate in tumors or regions of inflammation and bind to the specific proteins in the body. For instance, F-18 fluorodeoxyglucose (FDG) is a common radiotracer that gets absorbed in cancer cells. Further, it can be detected in the area of examination at the time of imaging. It has various advantages to use like it gives greater detail with higher level of accuracy. Moreover, it provides greater convenience for the patient who undergoes PET-CT scan.

The growth of the PET-CT scanner device market is driven by rise in prevalence of chronic illnesses throughout the world, growth in demand for effective diagnostic systems, and increased coverage for PET-CT scanning under Medicare. Moreover, surge in use of PET-CT for cancer diagnosis, development of newer products, and increase in investments in R&D by companies are other factors that contribute toward the growth of the market. However, limited shelf life and inadequate availability of radiopharmaceuticals are expected to hinder the market growth. Conversely, improvement in healthcare infrastructure in emerging nations offers the lucrative growth of the market.

The application of PET imaging makes it possible to monitor vital pathophysiological alternations of COVID-19 at the molecular level, and thus provides essential guidance for the subsequent diagnosis, evaluation, and treatment of COVID-19. F-labeled fluorodeoxyglucose (18F-FDG), a radiolabeled glucose analogue, is still the most commonly-used PET imaging agent in COVID-19 cases, and the integrated PET/CT system can be utilized to characterize the functional and structural changes of COVID-19 simultaneously. This use of devices in the diagnosis and evaluation of the COVID-19 helped the PET-CT scanner devices market to gain its position.

The impact of COVID-19 on the PET-CT scanner device market was recorded to be fairly positive. This was attributed to increasing use of PET-CT scan device in the diagnosis, evaluation, and treatment of COVID-19. Moreover, the cancer patients undergoing radiation therapy are at an elevated risk for the development of more severe disease. The demand for PET CT scanner devices is anticipated to rise as individuals with cancer are worried about the COVID-19 effects on them which also impacted the growth of the market.

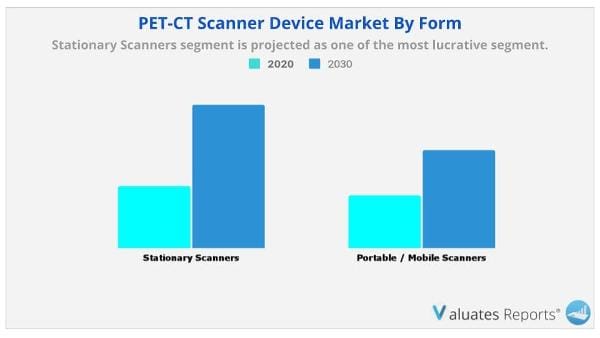

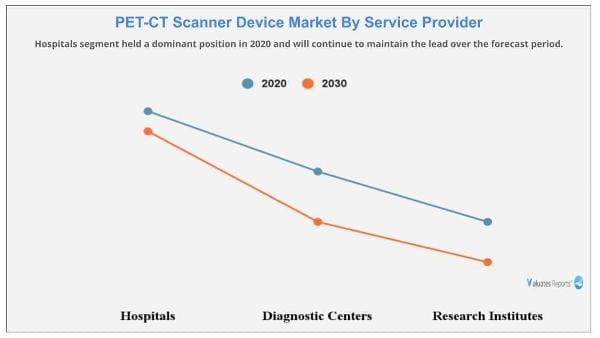

The global PET-CT scanner device market is segmented into type, service provider, slice count, isotope/detector type, application, and region. On basis of type, the market is bifurcated into stationary scanners and portable/mobile scanners. Depending on service provider, it is classified into hospitals, diagnostic centers, and research institutes. By slice count, it is categorized into low slice scanner (<64 slices), medium slice scanner (64 slices), and high slice scanner (>64 slices). As per isotope/detector type, it is fragmented into flurodeoxyglucose (FDG), 62Cu ATSM, 18 F sodium fluoride, FMISO, gallium, thallium, and others. The applications covered in the study include oncology, neurology, cardiology, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the stationary scanners segment dominated the global PET-CT scanner device market in 2020, and is anticipated to continue this trend during the forecast period, owing to rise in demand for stationary scanner, surge in patient awareness toward stationary scanners, advancements in the PET-CT scan devices, rise in number of cases of cancer, cardiology diseases, and the launch of effective products.

Depending on service provider, the hospitals segment was the major contributor to the global PET-CT scanner device market in 2020, and is anticipated to lead during the forecast period, due to increase in number of hospitals, surge in patient awareness toward treatment in hospitals, rise in the healthcare infrastructure, and increase in adoption of PET-CT scanner device.

As per slice count, the medium slice scanner (64 slices) segment led the global market in 2020, and is anticipated to continue this trend during the forecast period, owing to rise in demand for medium slice scanner, surge in applications of medium slice scanners, advancements in the PET-CT scan devices, and increase in the rate of imaging with medium slice scanners.

According to isotope/detector type, the flurodeoxyglucose (FDG) was the prominent segment in 2020, and is anticipated to continue this trend during the forecast period, owing to rise in applications of FDG, decline in the number of side effects of FDG, and surge in prevalence of chronic diseases.

By application, the oncology segment exhibited the highest growth in 2020, and is anticipated to continue this trend during the forecast period, owing to rise in prevalence of cancer disease, surge in patient awareness towards early diagnosis & treatment of cancer, changes in lifestyle of population, and increase in consumption of tobacco among the population.

North America accounted for major share of the global PET-CT scanner device market share in 2020, and is expected to remain dominant throughout the forecast period. This is attributed to increase in number of chronic disease patients, surge in demand for PET-CT scan devices, availability of advanced healthcare facilities with trained medical professionals, rise in number of R&D activities coupled with large presence of key players, and surge in investment made by governments in the healthcare system. However, Asia-Pacific is expected to experience the highest growth rate during the forecast period majorly due to improvement in healthcare infrastructure, rise in number of hospitals equipped with advanced scanner devices, development of the R&D sector, rise in healthcare reforms, and technological advancements in the field of PET-CT.

|

Report Metric |

Details |

|

Report Name |

PET-CT Scanner Device Market |

|

Market size value in 2020 |

$1,876.14 million |

|

Revenue forecast in 2030 |

$3,202.48 million |

|

Growth Rate |

CAGR of 5.5% |

|

Base year considered |

2020 |

|

Forecast Period |

2021-2030 |

|

By Type |

Stationary Scanners and Portable/Mobile Scanner |

|

By Application |

Hospitals, Diagnostic Centers, and Research Institutes |

|

Report Coverage |

Revenue & volume forecast, company share, competitive landscape, growth factors, and trends |

|

Segments Covered |

By Type, Application, and Region |

|

Geographic Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Ans. Yes, we do provide the option to buy chapters in a report. We also can customize the report based on your specific requirements.

Ans. The global PET-CT scanner device market was valued at $1,876.14 million in 2020, and is projected to reach $3,202.48 million by 2030, registering a CAGR of 5.5% from 2021 to 2030.

Ans. Yes, the report includes a COVID-19 impact analysis. Also, it is further extended into every individual segment of the report.

$5769

$10663

HAVE A QUERY?

OUR CUSTOMER