LIST OF TABLES

TABLE 01. LIST OF SPORTS EQUIPMENT & APPAREL BRANDS (TOP 100) IN EUROPE

TABLE 02. EUROPE SPORTS EQUIPMENT AND APPAREL MARKET, BY PRODUCT TYPE, 2017–2025 ($MILLION)

TABLE 03. SPORTS EQUIPMENT IN EUROPE SPORTS EQUIPMENT AND APPAREL MARKET, BY COUNTRY, 2017–2025 ($MILLION)

TABLE 04. SPORTS APPAREL AND FOOTWEAR IN EUROPE SPORTS EQUIPMENT AND APPAREL MARKET, BY COUNTRY, 2017–2025 ($MILLION)

TABLE 05. EUROPE SPORTS EQUIPMENT AND APPAREL MARKET, BY RETAILERS, 2017–2025 ($MILLION)

TABLE 06. BRAND OUTLETS IN EUROPE SPORTS EQUIPMENT AND APPAREL MARKET, BY COUNTRY, 2017–2025 ($MILLION)

TABLE 07. INDEPENDENT STORES IN EUROPE SPORTS EQUIPMENT AND APPAREL MARKET, BY COUNTRY, 2017–2025 ($MILLION)

TABLE 08. EUROPE SPORTS EQUIPMENT AND APPAREL MARKET, BY COUNTRY, 2017–2025 ($MILLION)

TABLE 09. GERMANY SPORTS EQUIPMENT AND APPAREL MARKET, BY PRODUCT TYPE, 2017–2025 ($MILLION)

TABLE 10. GERMANY SPORTS EQUIPMENT AND APPAREL MARKET, BY RETAILERS, 2017–2025 ($MILLION)

TABLE 11. FRANCE SPORTS EQUIPMENT AND APPAREL MARKET, BY PRODUCT TYPE, 2017–2025 ($MILLION)

TABLE 12. FRANCE SPORTS EQUIPMENT AND APPAREL MARKET, BY RETAILERS, 2017–2025 ($MILLION)

TABLE 13. UK SPORTS EQUIPMENT AND APPAREL MARKET, BY PRODUCT TYPE, 2017–2025 ($MILLION)

TABLE 14. UK SPORTS EQUIPMENT AND APPAREL MARKET, BY RETAILERS, 2017–2025 ($MILLION)

TABLE 15. ITALY SPORTS EQUIPMENT AND APPAREL MARKET, BY PRODUCT TYPE, 2017–2025 ($MILLION)

TABLE 16. ITALY SPORTS EQUIPMENT AND APPAREL MARKET, BY RETAILERS, 2017–2025 ($MILLION)

TABLE 17. SPAIN SPORTS EQUIPMENT AND APPAREL MARKET, BY PRODUCT TYPE, 2017–2025 ($MILLION)

TABLE 18. SPAIN SPORTS EQUIPMENT AND APPAREL MARKET, BY RETAILERS, 2017–2025 ($MILLION)

TABLE 19. REST OF EUROPE SPORTS EQUIPMENT AND APPAREL MARKET, BY PRODUCT TYPE, 2017–2025 ($MILLION)

TABLE 20. REST OF EUROPE SPORTS EQUIPMENT AND APPAREL MARKET, BY RETAILERS, 2017–2025 ($MILLION)

TABLE 21. ADIDAS: COMPANY SNAPSHOT

TABLE 22. ADIDAS: OPERATING SEGMENTS

TABLE 23. ADIDAS: PRODUCT PORTFOLIO

TABLE 24. AMER SPORTS CORPORATION: COMPANY SNAPSHOT

TABLE 25. BOSTON SCIENTIFIC: OPERATING SEGMENTS

TABLE 26. AMER SPORTS CORPORATION: PRODUCT PORTFOLIO

TABLE 27. ASICS CORPORATION: COMPANY SNAPSHOT

TABLE 28. ASICS CORPORATION: OPERATING SEGMENTS

TABLE 29. ASICS CORPORATION: PRODUCT PORTFOLIO

TABLE 30. FILA KOREA LTD.: COMPANY SNAPSHOT

TABLE 31. FILA KOREA LTD.: PRODUCT PORTFOLIO

TABLE 32. NEW BALANCE: COMPANY SNAPSHOT

TABLE 33. NEW BALANCE: PRODUCT PORTFOLIO

TABLE 34. NIKE, INC.: COMPANY SNAPSHOT

TABLE 35. NIKE, INC.: OPERATING SEGMENTS

TABLE 36. NIKE, INC.: PRODUCT PORTFOLIO

TABLE 37. PUMA: COMPANY SNAPSHOT

TABLE 38. PUMA: OPERATING SEGMENTS

TABLE 39. PUMA: PRODUCT PORTFOLIO

TABLE 40. SPORTS DIRECT INTERNATIONAL PLC: COMPANY SNAPSHOT

TABLE 41. SPORTS DIRECT INTERNATIONAL PLC: OPERATING SEGMENTS

TABLE 42. SPORTS DIRECT INTERNATIONAL PLC: PRODUCT PORTFOLIO

TABLE 43. UNDER ARMOUR: COMPANY SNAPSHOT

TABLE 44. UNDER ARMOUR: PRODUCT PORTFOLIO

TABLE 45. VFC: COMPANY SNAPSHOT

TABLE 46. VFC: OPERATING SEGMENTS

TABLE 47. VFC: PRODUCT PORTFOLIO LIST OF FIGURES

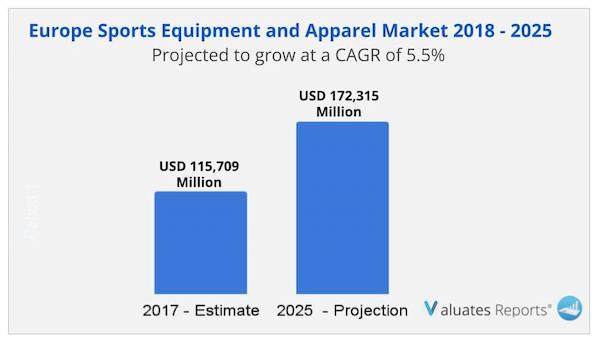

FIGURE 01. SNAPSHOT: EUROPE SPORTS EQUIPMENT AND APPAREL MARKET

FIGURE 02. EUROPE SPORTS EQUIPMENT AND APPAREL MARKET SEGMENTATION

FIGURE 03. TOP INVESTMENT POCKETS, 2017–2025

FIGURE 04. TOP WINNING STRATEGIES, BY YEAR, 2016–2019*

FIGURE 05. TOP WINNING STRATEGIES, BY DEVELOPMENT, 2016–2019* (%)

FIGURE 06. TOP WINNING STRATEGIES, BY COMPANY, 2016–2019*

FIGURE 07. MODERATE BARGAINING POWER OF SUPPLIERS

FIGURE 08. HIGH BARGAINING POWER OF BUYERS

FIGURE 09. MODERATE THREAT OF NEW ENTRANTS

FIGURE 10. LOW THREAT OF SUBSTITUTION

FIGURE 11. HIGH INTENSITY OF COMPETITIVE RIVALRY

FIGURE 12. EUROPE SPORTS EQUIPMENT AND APPAREL MARKET: DRIVERS, RESTRAINTS, AND OPPORTUNITIES

FIGURE 13. MARKET PLAYER POSITIONING, 2017

FIGURE 14. EUROPE SPORTS EQUIPMENT AND APPAREL MARKET, BY PRODUCT TYPE, 2017 (%)

FIGURE 15. COMPARATIVE SHARE ANALYSIS OF SPORTS EQUIPMENT IN EUROPE SPORTS EQUIPMENT AND APPAREL MARKET, BY COUNTRY, 2017 & 2025 (%)

FIGURE 16. COMPARATIVE SHARE ANALYSIS OF SPORTS APPAREL AND FOOTWEAR IN EUROPE SPORTS EQUIPMENT AND APPAREL MARKET, BY COUNTRY, 2017 & 2025 (%)

FIGURE 17. EUROPE SPORTS EQUIPMENT AND APPAREL MARKET, BY RETAILERS, 2017 (%)

FIGURE 18. COMPARATIVE SHARE ANALYSIS OF BRAND OUTLETS IN EUROPE SPORTS EQUIPMENT AND APPAREL MARKET, BY COUNTRY, 2017 & 2025 (%)

FIGURE 19. COMPARATIVE SHARE ANALYSIS OF INDEPENDENT STORES IN EUROPE SPORTS EQUIPMENT AND APPAREL MARKET, BY COUNTRY, 2017 & 2025 (%)

FIGURE 20. EUROPE SPORTS EQUIPMENT AND APPAREL MARKET, BY COUNTRY, 2017 (%)

FIGURE 21. GERMANY SPORTS EQUIPMENT AND APPAREL MARKET, 2017–2025 ($MILLION)

FIGURE 22. FRANCE SPORTS EQUIPMENT AND APPAREL MARKET, 2017–2025 ($MILLION)

FIGURE 23. UK SPORTS EQUIPMENT AND APPAREL MARKET, 2017–2025 ($MILLION)

FIGURE 24. ITALY SPORTS EQUIPMENT AND APPAREL MARKET, 2017–2025 ($MILLION)

FIGURE 25. SPAIN SPORTS EQUIPMENT AND APPAREL MARKET, 2017–2025 ($MILLION)

FIGURE 26. REST OF EUROPE SPORTS EQUIPMENT AND APPAREL MARKET, 2017–2025 ($MILLION)

FIGURE 27. ADIDAS: NET SALES, 2016–2018 ($MILLION)

FIGURE 28. ADIDAS: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 29. ADIDAS: REVENUE SHARE BY PRODUCT CATEGORY, 2018 (%)

FIGURE 30. ADIDAS: REVENUE SHARE BY REGION, 2018 (%)

FIGURE 31. AMER SPORTS CORPORATION: NET SALES, 2016–2018 ($MILLION)

FIGURE 32. AMER SPORTS CORPORATION: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 33. AMER SPORTS CORPORATION: REVENUE SHARE BY REGION, 2018 (%)

FIGURE 34. ASICS CORPORATION: NET SALES, 2015–2017 ($MILLION)

FIGURE 35. ASICS CORPORATION: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 36. ASICS CORPORATION: REVENUE SHARE BY REGION, 2017 (%)

FIGURE 37. FILA KOREA LTD.: NET SALES, 2015–2017 ($MILLION)

FIGURE 38. NIKE, INC.: NET SALES, 2016–2018 ($MILLION)

FIGURE 39. NIKE, INC.: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 40. NIKE, INC.: REVENUE SHARE BY PRODUCT CATEGORY, 2018 (%)

FIGURE 41. PUMA: NET SALES, 2016–2018 ($MILLION)

FIGURE 42. PUMA: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 43. PUMA: REVENUE SHARE BY REGION, 2018 (%)

FIGURE 44. SPORTS DIRECT INTERNATIONAL PLC: NET SALES, 2016–2018 ($MILLION)

FIGURE 45. SPORTS DIRECT INTERNATIONAL PLC: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 46. SPORTS DIRECT INTERNATIONAL PLC: REVENUE SHARE BY REGION, 2018 (%)

FIGURE 47. UNDER ARMOUR: NET SALES, 2016–2018 ($MILLION)

FIGURE 48. UNDER ARMOUR: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 49. VFC: NET SALES, 2015–2017 ($MILLION)

FIGURE 50. VFC: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 51. VFC: REVENUE SHARE BY REGION, 2017 (%