LIST OF TABLES

TABLE 01. GLOBAL FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 02. FROZEN YOGURT MARKET FOR ORGANIC, BY REGION, 2021-2031 (REVENUE, $MILLION)

TABLE 03. FROZEN YOGURT MARKET FOR CONVENTIONAL, BY REGION, 2021-2031 (REVENUE, $MILLION)

TABLE 04. GLOBAL FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 05. FROZEN YOGURT MARKET FOR CHOCOLATE, BY REGION, 2021-2031 (REVENUE, $MILLION)

TABLE 06. FROZEN YOGURT MARKET FOR MANGO, BY REGION, 2021-2031 (REVENUE, $MILLION)

TABLE 07. FROZEN YOGURT MARKET FOR PINEAPPLE, BY REGION, 2021-2031 (REVENUE, $MILLION)

TABLE 08. FROZEN YOGURT MARKET FOR STRAWBERRY, BY REGION, 2021-2031 (REVENUE, $MILLION)

TABLE 09. FROZEN YOGURT MARKET FOR OTHERS, BY REGION, 2021-2031 (REVENUE, $MILLION)

TABLE 10. GLOBAL FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 11. FROZEN YOGURT MARKET FOR SUPERMARKET AND HYPERMARKET, BY REGION, 2021-2031 (REVENUE, $MILLION)

TABLE 12. FROZEN YOGURT MARKET FOR CONVENIENCE STORES, BY REGION, 2021-2031 (REVENUE, $MILLION)

TABLE 13. FROZEN YOGURT MARKET FOR SPECIALIST RETAILERS, BY REGION, 2021-2031 (REVENUE, $MILLION)

TABLE 14. FROZEN YOGURT MARKET FOR ONLINE STORES, BY REGION, 2021-2031 (REVENUE, $MILLION)

TABLE 15. FROZEN YOGURT MARKET FOR OTHERS, BY REGION, 2021-2031 (REVENUE, $MILLION)

TABLE 16. FROZEN YOGURT MARKET, BY REGION, 2021-2031 (REVENUE, $MILLION)

TABLE 17. NORTH AMERICA FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 18. NORTH AMERICA FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 19. NORTH AMERICA FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 20. NORTH AMERICA FROZEN YOGURT MARKET, BY COUNTRY, 2021-2031 (REVENUE, $MILLION)

TABLE 21. U.S. FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 22. U.S. FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 23. U.S. FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 24. CANADA FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 25. CANADA FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 26. CANADA FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 27. MEXICO FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 28. MEXICO FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 29. MEXICO FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 30. EUROPE FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 31. EUROPE FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 32. EUROPE FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 33. EUROPE FROZEN YOGURT MARKET, BY COUNTRY, 2021-2031 (REVENUE, $MILLION)

TABLE 34. GERMANY FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 35. GERMANY FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 36. GERMANY FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 37. UK FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 38. UK FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 39. UK FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 40. FRANCE FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 41. FRANCE FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 42. FRANCE FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 43. ITALY FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 44. ITALY FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 45. ITALY FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 46. BELGIUM FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 47. BELGIUM FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 48. BELGIUM FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 49. RUSSIA FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 50. RUSSIA FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 51. RUSSIA FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 52. NETHERLANDS FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 53. NETHERLANDS FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 54. NETHERLANDS FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 55. SPAIN FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 56. SPAIN FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 57. SPAIN FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 58. REST OF EUROPE FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 59. REST OF EUROPE FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 60. REST OF EUROPE FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 61. ASIA-PACIFIC FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 62. ASIA-PACIFIC FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 63. ASIA-PACIFIC FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 64. ASIA-PACIFIC FROZEN YOGURT MARKET, BY COUNTRY, 2021-2031 (REVENUE, $MILLION)

TABLE 65. CHINA FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 66. CHINA FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 67. CHINA FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 68. JAPAN FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 69. JAPAN FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 70. JAPAN FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 71. INDIA FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 72. INDIA FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 73. INDIA FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 74. AUSTRALIA FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 75. AUSTRALIA FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 76. AUSTRALIA FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 77. SOUTH KOREA FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 78. SOUTH KOREA FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 79. SOUTH KOREA FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 80. THAILAND FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 81. THAILAND FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 82. THAILAND FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 83. INDONESIA FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 84. INDONESIA FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 85. INDONESIA FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 86. REST OF ASIA-PACIFIC FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 87. REST OF ASIA-PACIFIC FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 88. REST OF ASIA-PACIFIC FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 89. LAMEA FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 90. LAMEA FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 91. LAMEA FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 92. LAMEA FROZEN YOGURT MARKET, BY COUNTRY, 2021-2031 (REVENUE, $MILLION)

TABLE 93. BRAZIL FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 94. BRAZIL FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 95. BRAZIL FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 96. ARGENTINA FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 97. ARGENTINA FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 98. ARGENTINA FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 99. UAE FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 100. UAE FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 101. UAE FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 102. SAUDI ARABIA FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 103. SAUDI ARABIA FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 104. SAUDI ARABIA FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 105. CHILE FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 106. CHILE FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 107. CHILE FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 108. TURKEY FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 109. TURKEY FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 110. TURKEY FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 111. SOUTH AFRICA FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 112. SOUTH AFRICA FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 113. SOUTH AFRICA FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 114. REST OF LAMEA FROZEN YOGURT MARKET, BY NATURE, 2021-2031 (REVENUE, $MILLION)

TABLE 115. REST OF LAMEA FROZEN YOGURT MARKET, BY FLAVOR, 2021-2031 (REVENUE, $MILLION)

TABLE 116. REST OF LAMEA FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021-2031 (REVENUE, $MILLION)

TABLE 117. YAKULT HONSHA CO., LTD.: KEY EXECUTIVES

TABLE 118. YAKULT HONSHA CO., LTD.: COMPANY SNAPSHOT

TABLE 119. YAKULT HONSHA CO., LTD.: PRODUCT PORTFOLIO

TABLE 120. YAKULT HONSHA CO., LTD.: KEY STRATERGIES

TABLE 121. MENCHIE'S GROUP, INC.: KEY EXECUTIVES

TABLE 122. MENCHIE'S GROUP, INC.: COMPANY SNAPSHOT

TABLE 123. MENCHIE'S GROUP, INC.: PRODUCT SEGMENTS

TABLE 124. MENCHIE'S GROUP, INC.: PRODUCT PORTFOLIO

TABLE 125. NESTLE S.A.: KEY EXECUTIVES

TABLE 126. NESTLE S.A.: COMPANY SNAPSHOT

TABLE 127. NESTLE S.A.: PRODUCT SEGMENTS

TABLE 128. NESTLE S.A.: PRODUCT PORTFOLIO

TABLE 129. DUPONT: KEY EXECUTIVES

TABLE 130. DUPONT: COMPANY SNAPSHOT

TABLE 131. DUPONT: PRODUCT SEGMENTS

TABLE 132. DUPONT: PRODUCT PORTFOLIO

TABLE 133. MORINAGACO., LTD.: KEY EXECUTIVES

TABLE 134. MORINAGACO., LTD.: COMPANY SNAPSHOT

TABLE 135. MORINAGACO., LTD.: PRODUCT SEGMENTS

TABLE 136. MORINAGACO., LTD.: PRODUCT PORTFOLIO

TABLE 137. MORINAGACO., LTD.: KEY STRATERGIES

TABLE 138. YOGURTLAND FRANCHISING, INC.: KEY EXECUTIVES

TABLE 139. YOGURTLAND FRANCHISING, INC.: COMPANY SNAPSHOT

TABLE 140. YOGURTLAND FRANCHISING, INC.: PRODUCT SEGMENTS

TABLE 141. YOGURTLAND FRANCHISING, INC.: PRODUCT PORTFOLIO

TABLE 142. YOGEN FRUZ CANADA INC.: KEY EXECUTIVES

TABLE 143. YOGEN FRUZ CANADA INC.: COMPANY SNAPSHOT

TABLE 144. YOGEN FRUZ CANADA INC.: PRODUCT SEGMENTS

TABLE 145. YOGEN FRUZ CANADA INC.: PRODUCT PORTFOLIO

TABLE 146. ARLA FOODS AMBA: KEY EXECUTIVES

TABLE 147. ARLA FOODS AMBA: COMPANY SNAPSHOT

TABLE 148. ARLA FOODS AMBA: PRODUCT SEGMENTS

TABLE 149. ARLA FOODS AMBA: PRODUCT PORTFOLIO

TABLE 150. ARLA FOODS AMBA: KEY STRATERGIES

TABLE 151. BRITANNIA INDUSTRIES LIMITED: KEY EXECUTIVES

TABLE 152. BRITANNIA INDUSTRIES LIMITED: COMPANY SNAPSHOT

TABLE 153. BRITANNIA INDUSTRIES LIMITED: PRODUCT SEGMENTS

TABLE 154. BRITANNIA INDUSTRIES LIMITED: PRODUCT PORTFOLIO

TABLE 155. CHOBANI GLOBAL HOLDINGS, LLC: KEY EXECUTIVES

TABLE 156. CHOBANI GLOBAL HOLDINGS, LLC: COMPANY SNAPSHOT

TABLE 157. CHOBANI GLOBAL HOLDINGS, LLC: PRODUCT SEGMENTS

TABLE 158. CHOBANI GLOBAL HOLDINGS, LLC: PRODUCT PORTFOLIO

TABLE 159. DANONE INC.: KEY EXECUTIVES

TABLE 160. DANONE INC.: COMPANY SNAPSHOT

TABLE 161. DANONE INC.: PRODUCT SEGMENTS

TABLE 162. DANONE INC.: PRODUCT PORTFOLIO

TABLE 163. GENERAL MILLS, INC.: KEY EXECUTIVES

TABLE 164. GENERAL MILLS, INC.: COMPANY SNAPSHOT

TABLE 165. GENERAL MILLS, INC.: PRODUCT SEGMENTS

TABLE 166. GENERAL MILLS, INC.: PRODUCT PORTFOLIO

TABLE 167. GENERAL MILLS, INC.: KEY STRATERGIES

TABLE 168. LACTALIS GROUP: KEY EXECUTIVES

TABLE 169. LACTALIS GROUP: COMPANY SNAPSHOT

TABLE 170. LACTALIS GROUP: PRODUCT SEGMENTS

TABLE 171. LACTALIS GROUP: PRODUCT PORTFOLIO

TABLE 172. SAPUTO INC.: KEY EXECUTIVES

TABLE 173. SAPUTO INC.: COMPANY SNAPSHOT

TABLE 174. SAPUTO INC.: PRODUCT SEGMENTS

TABLE 175. SAPUTO INC.: PRODUCT PORTFOLIO

TABLE 176. SAPUTO INC.: KEY STRATERGIES

TABLE 177. GUJARAT COOPERATIVE MILK MARKETING FEDERATION LTD.: KEY EXECUTIVES

TABLE 178. GUJARAT COOPERATIVE MILK MARKETING FEDERATION LTD.: COMPANY SNAPSHOT

TABLE 179. GUJARAT COOPERATIVE MILK MARKETING FEDERATION LTD.: PRODUCT SEGMENTS

TABLE 180. GUJARAT COOPERATIVE MILK MARKETING FEDERATION LTD.: PRODUCT PORTFOLIO LIST OF FIGURES

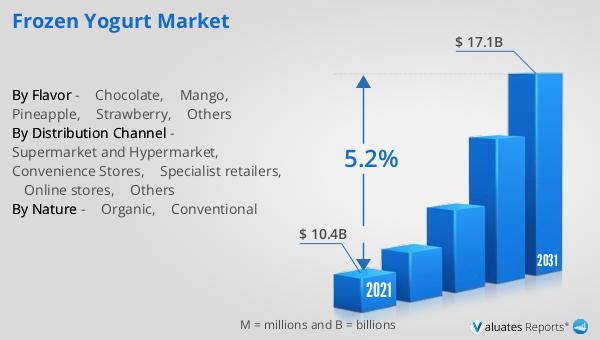

FIGURE 01. FROZEN YOGURT MARKET, 2021-2031

FIGURE 02. SEGMENTATION OF FROZEN YOGURT MARKET, 2021-2031

FIGURE 03. TOP INVESTMENT POCKETS IN FROZEN YOGURT MARKET (2022-2031)

FIGURE 04. LOW BARGAINING POWER OF SUPPLIERS

FIGURE 05. LOW BARGAINING POWER OF BUYERS

FIGURE 06. LOW THREAT OF SUBSTITUTES

FIGURE 07. LOW THREAT OF NEW ENTRANTS

FIGURE 08. LOW INTENSITY OF RIVALRY

FIGURE 09. DRIVERS, RESTRAINTS AND OPPORTUNITIES: GLOBALFROZEN YOGURT MARKET

FIGURE 10. FROZEN YOGURT MARKET, BY NATURE, 2021(%)

FIGURE 11. COMPARATIVE SHARE ANALYSIS OF FROZEN YOGURT MARKET FOR ORGANIC, BY COUNTRY 2021-2031(%)

FIGURE 12. COMPARATIVE SHARE ANALYSIS OF FROZEN YOGURT MARKET FOR CONVENTIONAL, BY COUNTRY 2021-2031(%)

FIGURE 13. FROZEN YOGURT MARKET, BY FLAVOR, 2021(%)

FIGURE 14. COMPARATIVE SHARE ANALYSIS OF FROZEN YOGURT MARKET FOR CHOCOLATE, BY COUNTRY 2021-2031(%)

FIGURE 15. COMPARATIVE SHARE ANALYSIS OF FROZEN YOGURT MARKET FOR MANGO, BY COUNTRY 2021-2031(%)

FIGURE 16. COMPARATIVE SHARE ANALYSIS OF FROZEN YOGURT MARKET FOR PINEAPPLE, BY COUNTRY 2021-2031(%)

FIGURE 17. COMPARATIVE SHARE ANALYSIS OF FROZEN YOGURT MARKET FOR STRAWBERRY, BY COUNTRY 2021-2031(%)

FIGURE 18. COMPARATIVE SHARE ANALYSIS OF FROZEN YOGURT MARKET FOR OTHERS, BY COUNTRY 2021-2031(%)

FIGURE 19. FROZEN YOGURT MARKET, BY DISTRIBUTION CHANNEL, 2021(%)

FIGURE 20. COMPARATIVE SHARE ANALYSIS OF FROZEN YOGURT MARKET FOR SUPERMARKET AND HYPERMARKET, BY COUNTRY 2021-2031(%)

FIGURE 21. COMPARATIVE SHARE ANALYSIS OF FROZEN YOGURT MARKET FOR CONVENIENCE STORES, BY COUNTRY 2021-2031(%)

FIGURE 22. COMPARATIVE SHARE ANALYSIS OF FROZEN YOGURT MARKET FOR SPECIALIST RETAILERS, BY COUNTRY 2021-2031(%)

FIGURE 23. COMPARATIVE SHARE ANALYSIS OF FROZEN YOGURT MARKET FOR ONLINE STORES, BY COUNTRY 2021-2031(%)

FIGURE 24. COMPARATIVE SHARE ANALYSIS OF FROZEN YOGURT MARKET FOR OTHERS, BY COUNTRY 2021-2031(%)

FIGURE 25. FROZEN YOGURT MARKET BY REGION, 2021

FIGURE 26. U.S. FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 27. CANADA FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 28. MEXICO FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 29. GERMANY FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 30. UK FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 31. FRANCE FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 32. ITALY FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 33. BELGIUM FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 34. RUSSIA FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 35. NETHERLANDS FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 36. SPAIN FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 37. REST OF EUROPE FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 38. CHINA FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 39. JAPAN FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 40. INDIA FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 41. AUSTRALIA FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 42. SOUTH KOREA FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 43. THAILAND FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 44. INDONESIA FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 45. REST OF ASIA-PACIFIC FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 46. BRAZIL FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 47. ARGENTINA FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 48. UAE FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 49. SAUDI ARABIA FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 50. CHILE FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 51. TURKEY FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 52. SOUTH AFRICA FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 53. REST OF LAMEA FROZEN YOGURT MARKET, 2021-2031 ($MILLION)

FIGURE 54. TOP WINNING STRATEGIES, BY YEAR

FIGURE 55. TOP WINNING STRATEGIES, BY DEVELOPMENT

FIGURE 56. TOP WINNING STRATEGIES, BY COMPANY

FIGURE 57. PRODUCT MAPPING OF TOP 10 PLAYERS

FIGURE 58. COMPETITIVE DASHBOARD

FIGURE 59. COMPETITIVE HEATMAP: FROZEN YOGURT MARKET

FIGURE 60. TOP PLAYER POSITIONING, 2021

FIGURE 61. YAKULT HONSHA CO., LTD.: NET SALES, 2019-2021 ($MILLION)

FIGURE 62. YAKULT HONSHA CO., LTD.: RESEARCH & DEVELOPMENT EXPENDITURE, 2019-2021

FIGURE 63. YAKULT HONSHA CO., LTD.: REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 64. YAKULT HONSHA CO., LTD.: REVENUE SHARE BY REGION, 2021 (%)

FIGURE 65. NESTLE S.A.: RESEARCH & DEVELOPMENT EXPENDITURE, 2019-2021

FIGURE 66. NESTLE S.A.: NET SALES, 2019-2021 ($MILLION)

FIGURE 67. NESTLE S.A.: REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 68. NESTLE S.A.: REVENUE SHARE BY REGION, 2021 (%)

FIGURE 69. DUPONT: NET REVENUE, 2019-2021 ($MILLION)

FIGURE 70. DUPONT: REVENUE SHARE BY REGION, 2021 (%)

FIGURE 71. DUPONT: REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 72. MORINAGACO., LTD.: NET SALES, 2019-2021 ($MILLION)

FIGURE 73. MORINAGACO., LTD.: RESEARCH & DEVELOPMENT EXPENDITURE, 2019-2021

FIGURE 74. MORINAGACO., LTD.: REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 75. ARLA FOODS AMBA: NET REVENUE, 2019-2021 ($MILLION)

FIGURE 76. ARLA FOODS AMBA: RESEARCH & DEVELOPMENT EXPENDITURE, 2019-2021

FIGURE 77. ARLA FOODS AMBA: REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 78. ARLA FOODS AMBA: REVENUE SHARE BY REGION, 2021 (%)

FIGURE 79. BRITANNIA INDUSTRIES LIMITED: NET REVENUE, 2019-2021 ($MILLION)

FIGURE 80. BRITANNIA INDUSTRIES LIMITED: RESEARCH & DEVELOPMENT EXPENDITURE, 2019-2021

FIGURE 81. BRITANNIA INDUSTRIES LIMITED: REVENUE SHARE BY REGION, 2021 (%)

FIGURE 82. DANONE INC.: NET SALES, 2019-2021 ($MILLION)

FIGURE 83. DANONE INC.: REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 84. GENERAL MILLS, INC.: NET SALES, 2019-2021 ($MILLION)

FIGURE 85. GENERAL MILLS, INC.: RESEARCH & DEVELOPMENT EXPENDITURE, 2019-2021

FIGURE 86. GENERAL MILLS, INC.: REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 87. SAPUTO INC.: NET REVENUE, 2019-2021 ($MILLION)

FIGURE 88. SAPUTO INC.: REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 89. GUJARAT COOPERATIVE MILK MARKETING FEDERATION LTD.: NET SALES, 2019-2021 ($MILLION