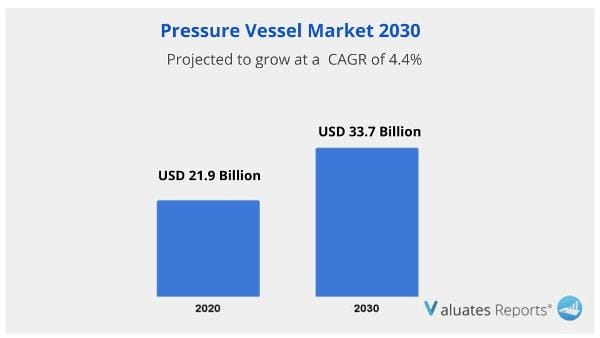

The global pressure vessel market size for alternative fuels was valued at USD 21.9 billion in 2020 and is projected to reach USD 33.7 billion by 2030, growing at a CAGR of 4.4% from 2020 to 2030.

Due to the rising demand for non-conventional fuels and the quick growth of midstream and downstream industries globally, opportunities are expected to exist in the pressure vessel market for alternative fuels.

The key factors driving the rise of pressure vessels are the demand from numerous end-user industries and advancements in the technology of industrial equipment in emerging nations.

These containers are mostly used in the refining of petroleum products, pharmaceuticals, chemicals, food, and beverage industries. The design, construction, and testing of pressure vessels are meticulously carried out by qualified experts and are governed by standards since the unintentional release and leaking of their contents pose a risk to the environment. Two of the more well-known standards are the American Petroleum Industry (API) 510 Pressure Vessel Inspection Code and the American Society of Mechanical Engineers Boiler and Pressure Vessel Code (ASME BPVC) Part VIII. The pressure vessel market is anticipated to develop as a result of this factor.

The oil and gas midstream industry is booming. Particularly in the USA's Permian Basin and Bakken, production has grown quickly, creating a production bottleneck. Because there aren't enough pipelines to move production to process, export, or storage, oil and gas companies are keen to discover ways to market their goods. Midstream companies have to regularly compress and move hundreds of miles of gas upstream. Once it gets downstream, petrochemical industries extract the impurities and byproducts from it. NGLs in the gas are converted by industries into components like plastic that are utilized in everyday things even further downstream (like your desk, car, and computer). This aspect is anticipated to fuel the pressure vessel market expansion.

The main driving force behind thermal power plants worldwide is the demand for electricity from various sectors. The industry is attempting to enhance plant operations and make them more environmentally and economically friendly, despite the fact that conventional coal-fired power plants are subject to tight regulations regarding climate change. Supercritical and ultra-supercritical technologies are being applied in this situation. This is driving the market for pressure vessels. The APAC area has one of the most advanced pressure vessel markets. China, India, and Japan are the three largest pressure vessel markets in the Asia-Pacific region. This in turn is expected to drive the growth of the pressure vessel market.

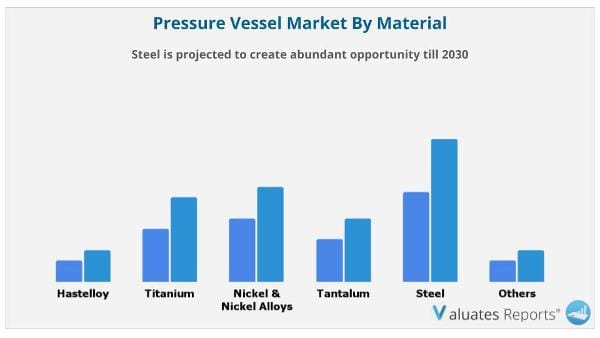

In terms of material, the steel market surpassed all others in 2020 and is anticipated to rise during the anticipated time period. The rise in midstream and downstream activities in the global oil and gas industry provides an explanation for this.

The boiler segment dominated the alternative fuel pressure vessel market globally in terms of product in 2020, and it is projected that it will continue to grow at the fastest rate in the years to come. This is a result of the oil and gas industry's increased R&D efforts and the rapid growth of applications, such as heat- and electricity-generating systems.

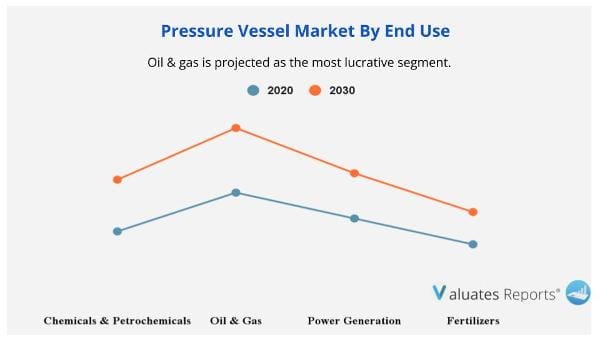

According to end use, the oil & gas segment dominated the worldwide pressure vessel market for alternative fuels in 2020. It is projected that this trend would hold during the forecast period. This is due to the rise in the demand for liquefied natural gas (LNG) and compressed natural gas (CNG) in the transportation sector.

In terms of geography, North America was the leader in the global pressure vessel market for alternative fuels in 2020, and it is predicted that this region would hold this position during the projected period. There are numerous factors to blame for this, including significant proved reserves and onshore and heavy industries in the region.

Bharat Heavy Electricals Limited (BHEL), Doosan Heavy Industries & Construction Co., Ltd., General Electric Company, Halvorsen Company, IHI Corporation, Larsen & Toubro Limited, Mitsubishi Heavy Industries, Ltd., Pressure vessels (India), Samuel Pressure Vessel Group, and Westinghouse Electric Company LLC.

| Report Metric | Details |

| Report Name | Pressure Vessel Market |

| The market size in 2020 | USD 21.9 Billion |

| The revenue forecast in 2030 | USD 33.7 Billion |

| Growth Rate | Compound Annual Growth Rate (CAGR) of 9.3% from 2021 to 2030 |

| Market size available for years | 2021-2030 |

| Forecast units | Value (USD) |

| Segments covered | By Material, Product, End Use & Regions |

| Report coverage | Revenue & volume forecast, company share, competitive landscape, growth factors, and trends |

| Geographic regions covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Ans. The global Pressure Vessel Market size for alternative fuels was valued at $21.9 billion in 2020, and is projected to reach $33.7 billion by 2030, growing at a CAGR of 4.4% from 2020 to 2030.

Ans. The key factors driving the rise of pressure vessels are the demand from numerous end-user industries and advancements in the technology of industrial equipment in emerging nations.

Ans. The global Pressure Vessel Market size is estimated to grow with a Compound Annual Growth Rate (CAGR) of 4.4% during the forecast period.

Ans. By End USe, Oil & gas is projected as the most lucrative segment.

Ans. North America is projected to create abundant $ opportunity till 2030.

Ans. Bharat Heavy Electricals Limited (BHEL), Doosan Heavy Industries & Construction Co., Ltd., General Electric Company, Halvorsen Company, IHI Corporation, Larsen & Toubro Limited, Mitsubishi Heavy Industries, Ltd., Pressure vessels (India), Samuel Pressure Vessel Group, and Westinghouse Electric Company LLC.

CHAPTER 1:INTRODUCTION

1.1.Report description

1.2.Key market segments

1.3.Key benefits for stakeholders

1.4.Research methodology

1.4.1.Primary research

1.4.2.Secondary research

1.4.3.Analyst tools and models

CHAPTER 2:EXECUTIVE SUMMARY

2.1.Key findings

2.2.CXO perspective

CHAPTER 3:MARKET OVERVIEW

3.1.Market definition and scope

3.2.Key findings

3.2.1.Top investment pockets

3.3.Key forces shaping the market

3.4.Market dynamics

3.4.1.Drivers

3.4.1.1.Rise in demand for hydrogen & compressed natural gas (CNG) vehicle

3.4.1.2.Upsurge in global energy demand

3.4.1.3.Rise in focus on biogas and bio-diesel

3.4.2.Restraint

3.4.2.1.High cost associated with pressure vessel

3.4.3.Opportunities

3.4.3.1.Government regulation with respect to alternative fuel

3.5.Value Chain Analysis

3.6.Impact of key regulations on the global Pressure Vessel market for Alternative Fuels market

3.7.Impact of CORONA (COVID-19) outbreak on the market

CHAPTER 4:GLOBAL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL

4.1.Overview

4.1.1.Market size and forecast, by Material

4.2.Hastelloy

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast, 2020-2030

4.3.Titanium

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Market size and forecast, 2020-2030

4.4.Nickel & Nickel Alloys

4.4.1.Key market trends, growth factors, and opportunities

4.4.2.Market size and forecast, 2020-2030

4.5.Tantalum

4.5.1.Key market trends, growth factors, and opportunities

4.5.2.Market size and forecast, 2020-2030

4.6.Steel

4.6.1.Key market trends, growth factors, and opportunities

4.6.2.Market size and forecast, 2020-2030

4.7.Others

4.7.1.Key market trends, growth factors, and opportunities

4.7.2.Market size and forecast, 2020-2030

CHAPTER 5:GLOBAL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT

5.1.Overview

5.1.1.Market size and forecast, By product

5.2.Boiler

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, 2020-2030

5.3.Nuclear Reactor

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, 2020-2030

5.4.Separator

5.4.1.Key market trends, growth factors, and opportunities

5.4.2.Market size and forecast, 2020-2030

5.5.Others

5.5.1.Key market trends, growth factors, and opportunities

5.5.2.Market size and forecast, 2020-2030

CHAPTER 6:GLOBAL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE

6.1.Overview

6.1.1.Market size and forecast, By End-use

6.2.Chemicals & Petrochemicals

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, 2020-2030

6.3.Oil & Gas

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, 2020-2030

6.4.Power Generation

6.4.1.Key market trends, growth factors, and opportunities

6.4.2.Market size and forecast, 2020-2030

6.5.Fertilizers

6.5.1.Key market trends, growth factors, and opportunities

6.5.2.Market size and forecast, 2020-2030

CHAPTER 7:GLOBAL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET, BY REGION

7.1.Overview

7.1.1.Market size and forecast, by region

7.2.North America

7.2.1.Key market trends, growth factors, and opportunities

7.2.2.Market size and forecast, by Material

7.2.3.Market size and forecast, By product

7.2.4.Market size and forecast, by End-use

7.2.5.Market size and forecast, by country

7.2.5.1.U.S.

7.2.5.1.1.Market size and forecast, by Material

7.2.5.1.2.Market size and forecast, By product

7.2.5.1.3.Market size and forecast, by End-use

7.2.5.2.Canada

7.2.5.2.1.Market size and forecast, by Material

7.2.5.2.2.Market size and forecast, By product

7.2.5.2.3.Market size and forecast, by End-use

7.2.5.3.Mexico

7.2.5.3.1.Market size and forecast, by Material

7.2.5.3.2.Market size and forecast, By product

7.2.5.3.3.Market size and forecast, by End-use

7.3.Europe

7.3.1.Key market trends, growth factors, and opportunities

7.3.2.Market size and forecast, by Material

7.3.3.Market size and forecast, By product

7.3.4.Market size and forecast, by End-use

7.3.5.Market size and forecast, by country

7.3.5.1.Germany

7.3.5.1.1.Market size and forecast, by Material

7.3.5.1.2.Market size and forecast, By product

7.3.5.1.3.Market size and forecast, by End-use

7.3.5.2.France

7.3.5.2.1.Market size and forecast, by Material

7.3.5.2.2.Market size and forecast, By product

7.3.5.2.3.Market size and forecast, by End-use

7.3.5.3.UK

7.3.5.3.1.Market size and forecast, by Material

7.3.5.3.2.Market size and forecast, By product

7.3.5.3.3.Market size and forecast, by End-use

7.3.5.4.Spain

7.3.5.4.1.Market size and forecast, by Material

7.3.5.4.2.Market size and forecast, By product

7.3.5.4.3.Market size and forecast, by End-use

7.3.5.5.Italy

7.3.5.5.1.Market size and forecast, by Material

7.3.5.5.2.Market size and forecast, By product

7.3.5.5.3.Market size and forecast, by End-use

7.3.5.6.Rest of Europe

7.3.5.6.1.Market size and forecast, by Material

7.3.5.6.2.Market size and forecast, By product

7.3.5.6.3.Market size and forecast, by End-use

7.4.Asia-Pacific

7.4.1.Key market trends, growth factors, and opportunities

7.4.2.Market size and forecast, by Material

7.4.3.Market size and forecast, By product

7.4.4.Market size and forecast, by End-use

7.4.5.Market size and forecast, by country

7.4.5.1.China

7.4.5.1.1.Market size and forecast, by Material

7.4.5.1.2.Market size and forecast, By product

7.4.5.1.3.Market size and forecast, by End-use

7.4.5.2.Japan

7.4.5.2.1.Market size and forecast, by Material

7.4.5.2.2.Market size and forecast, By product

7.4.5.2.3.Market size and forecast, by End-use

7.4.5.3.India

7.4.5.3.1.Market size and forecast, by Material

7.4.5.3.2.Market size and forecast, By product

7.4.5.3.3.Market size and forecast, by End-use

7.4.5.4.South Korea

7.4.5.4.1.Market size and forecast, by Material

7.4.5.4.2.Market size and forecast, By product

7.4.5.4.3.Market size and forecast, by End-use

7.4.5.5.Australia

7.4.5.5.1.Market size and forecast, by Material

7.4.5.5.2.Market size and forecast, By product

7.4.5.5.3.Market size and forecast, by End-use

7.4.5.6.Rest of Asia-Pacific

7.4.5.6.1.Market size and forecast, by Material

7.4.5.6.2.Market size and forecast, By product

7.4.5.6.3.Market size and forecast, by End-use

7.5.LAMEA

7.5.1.Key market trends, growth factors, and opportunities

7.5.2.Market size and forecast, by Material

7.5.3.Market size and forecast, By product

7.5.4.Market size and forecast, by End-use

7.5.5.Market size and forecast, by country

7.5.5.1.Brazil

7.5.5.1.1.Market size and forecast, by Material

7.5.5.1.2.Market size and forecast, By product

7.5.5.1.3.Market size and forecast, by End-use

7.5.5.2.Saudi Arabia

7.5.5.2.1.Market size and forecast, by Material

7.5.5.2.2.Market size and forecast, By product

7.5.5.2.3.Market size and forecast, by End-use

7.5.5.3.South Africa

7.5.5.3.1.Market size and forecast, by Material

7.5.5.3.2.Market size and forecast, By product

7.5.5.3.3.Market size and forecast, by End-use

7.5.5.4.U.A.E.

7.5.5.4.1.Market size and forecast, by Material

7.5.5.4.2.Market size and forecast, By product

7.5.5.4.3.Market size and forecast, by End-use

7.5.5.5.Rest of LAMEA

7.5.5.5.1.Market size and forecast, by Material

7.5.5.5.2.Market size and forecast, By product

7.5.5.5.3.Market size and forecast, by End-use

CHAPTER 8:COMPETITIVE LANDSCAPE

8.1.Introduction

8.1.1.Market player positioning, 2020

8.2.Top winning strategies

8.2.1.Top winning strategies, by year

8.2.2.Top winning strategies, by development

8.2.3.Top winning strategies, by company

8.3.Product mapping of top 10 players

8.4.Competitive heatmap

8.5.Key developments

8.5.1.New product launches

8.5.2.Expansions

8.5.3.Acquisition

8.5.4.Partnership

CHAPTER 9:COMPANY PROFILES:

9.1.Bharat Heavy Electricals Limited (BHEL)

9.1.1.Company overview

9.1.2.Company snapshot

9.1.1.Key executives

9.1.2.Operating business segments

9.1.3.Product portfolio

9.1.4.Business performance

9.2.Doosan Heavy Industries & Construction

9.2.1.Company overview

9.2.2.Company snapshot

9.2.3.Key executives

9.2.4.Operating business segments

9.2.5.Product portfolio

9.2.6.Business performance

9.2.7.Key strategic moves and developments

9.3.General Electric

9.3.1.Company overview

9.3.2.Key executives

9.3.3.Company snapshot

9.3.4.Operating business segments

9.3.5.Product portfolio

9.3.6.Business performance

9.3.7.Key strategic moves and developments

9.4.Halvorsen Company

9.4.1.Company overview

9.4.2.Company snapshot

9.4.3.Key executives

9.4.4.Product portfolio

9.4.5.Key strategic moves and developments

9.5.IHI Corporation

9.5.1.Company overview

9.5.2.Company snapshot

9.5.3.Key executives

9.5.4.Operating business segments

9.5.5.Product portfolio

9.5.6.Business performance

9.5.7.Key strategic moves and developments

9.6.Larsen & Toubro

9.6.1.Company overview

9.6.2.Company snapshot

9.6.3.Key executives

9.6.4.Operating business segments

9.6.5.Product portfolio

9.6.6.Business performance

9.6.7.Key strategic moves and developments

9.7.Mitsubishi Heavy Industries

9.7.1.Company overview

9.7.2.Company snapshot

9.7.3.Key executives

9.7.4.Operating business segments

9.7.5.Product portfolio

9.7.6.Business performance

9.7.7.Key strategic moves and developments

9.8.Pressure Vessels (India)

9.8.1.Company overview

9.8.2.Company snapshot

9.8.3.Key executives

9.8.4.Product portfolio

9.9.Samuel, Son & Co.

9.9.1.Company overview

9.9.2.Company snapshot

9.9.3.Key executives

9.9.4.Product portfolio

9.10.Westinghouse Electric Company

9.10.1.Company overview

9.10.2.Company snapshot

9.10.3.Key executives

9.10.4.Product portfolio

LIST OF TABLES

TABLE 01.GLOBAL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 02.GLOBAL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 03.GLOBAL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 04.GLOBAL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 (THOUSAND UNIT)

TABLE 05.GLOBAL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 06.GLOBAL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 (THOUSAND UNIT)

TABLE 07.NORTH AMERICA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET, BY REGION 2020–2030 ($MILLION)

TABLE 08.NORTH AMERICA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET, BY REGION 2020–2030 (THOUSAND UNIT)

TABLE 09.NORTH AMERICA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 10.NORTH AMERICA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 11.NORTH AMERICA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 12.NORTH AMERICA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 13.NORTH AMERICA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 14.NORTH AMERICA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 15.NORTH AMERICA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET, BY COUNTRY 2020–2030 ($MILLION)

TABLE 16.NORTH AMERICA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 17.U.S. PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 18.U.S. PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 19.U.S. PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 20.U.S. PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 21.U.S. PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 22.U.S. PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 23.CANADA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 24.CANADA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 25.CANADA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 26.CANADA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 27.CANADA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 28.CANADA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 29.MEXICO PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 30.MEXICO PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 31.MEXICO PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 32.MEXICO PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT, 2020–2030 (THOUSAND UNIT)

TABLE 33.MEXICO PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 34.MEXICO PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE, 2020–2030 (THOUSAND UNIT)

TABLE 35.EUROPE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 36.EUROPE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 37.EUROPE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 38.EUROPE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 (THOUSAND UNIT)

TABLE 39.EUROPE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 40.EUROPE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 (THOUSAND UNIT)

TABLE 41.EUROPE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET, BY COUNTRY 2020–2030 ($MILLION)

TABLE 42.EUROPE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY COUNTRY 2020–2030 (THOUSAND UNIT)

TABLE 43.GERMANY PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 44.GERMANY PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 45.GERMANY PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 46.GERMANY PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT, 2020–2030 (THOUSAND UNIT)

TABLE 47.GERMANY PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 48.GERMANY PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE, 2020–2030 (THOUSAND UNIT)

TABLE 49.FRANCE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 50.FRANCE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 51.FRANCE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 52.FRANCE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT, 2020–2030 (THOUSAND UNIT)

TABLE 53.FRANCE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 54.FRANCE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE, 2020–2030 (THOUSAND UNIT)

TABLE 55.UK PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 56.UK PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 57.UK PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 58.UK PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT, 2020–2030 (THOUSAND UNIT)

TABLE 59.UK PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 60.UK PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE, 2020–2030 (THOUSAND UNIT)

TABLE 61.SPAIN PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 62.SPAIN PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 63.SPAIN PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 64.SPAIN PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT, 2020–2030 (THOUSAND UNIT)

TABLE 65.SPAIN PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 66.SPAIN PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE, 2020–2030 (THOUSAND UNIT)

TABLE 67.ITALY PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 68.ITALY PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 69.ITALY PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 70.ITALY PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCY, 2020–2030 (THOUSAND UNIT)

TABLE 71.ITALY PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 72.ITALY PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE, 2020–2030 (THOUSAND UNIT)

TABLE 73.REST OF EUROPE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 74.REST OF EUROPE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 75.REST OF EUROPE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 76.REST OF EUROPE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT, 2020–2030 (THOUSAND UNIT)

TABLE 77.REST OF EUROPE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 78.REST OF EUROPE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE, 2020–2030 (THOUSAND UNIT)

TABLE 79.ASIA-PACIFIC PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 80.ASIA-PACIFIC PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 81.ASIA-PACIFIC PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 82.ASIA-PACIFIC PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT, 2020–2030 (THOUSAND UNIT)

TABLE 83.ASIA-PACIFIC PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 84.ASIA-PACIFIC PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE, 2020–2030 (THOUSAND UNIT)

TABLE 85.ASIA-PACIFIC PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET, BY COUNTRY 2020–2030 ($MILLION)

TABLE 86.ASIA-PACIFIC PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY COUNTRY, 2020–2030 (THOUSAND UNIT)

TABLE 87.CHINA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 88.CHINA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 89.CHINA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 90.CHINA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT, 2020–2030 (THOUSAND UNIT)

TABLE 91.CHINA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 92.CHINA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE, 2020–2030 (THOUSAND UNIT)

TABLE 93.JAPAN PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 94.JAPAN PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 95.JAPAN PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 96.JAPAN PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT, 2020–2030 (THOUSAND UNIT)

TABLE 97.JAPAN PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 98.JAPAN PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE, 2020–2030 (THOUSAND UNIT)

TABLE 99.INDIAN PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 100.INDIA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 101.INDIAN PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 102.INDIA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT, 2020–2030 (THOUSAND UNIT)

TABLE 103.INDIAN PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 104.INDIA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE, 2020–2030 (THOUSAND UNIT)

TABLE 105.SOUTH KOREA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 106.SOUTH KOREA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 107.SOUTH KOREA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 108.SOUTH KOREA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT, 2020–2030 (THOUSAND UNIT)

TABLE 109.SOUTH KOREA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 110.SOUTH KOREA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE, 2020–2030 (THOUSAND UNIT)

TABLE 111.AUSTRALIA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 112.AUSTRALIA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 113.AUSTRALIA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 114.AUSTRALIA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT, 2020–2030 (THOUSAND UNIT)

TABLE 115.AUSTRALIA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 116.AUSTRALIA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE, 2020–2030 (THOUSAND UNIT)

TABLE 117.REST OF ASIA-PACIFIC PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 118.REST OF ASIA-PACIFIC PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 119.REST OF ASIA-PACIFIC PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 120.REST OF ASIA-PACIFIC PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT, 2020–2030 (THOUSAND UNIT)

TABLE 121.REST OF ASIA-PACIFIC PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 122.REST OF ASIA-PACIFIC PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE, 2020–2030 (THOUSAND UNIT)

TABLE 123.LAMEA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 124.LAMEA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 125.LAMEA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 126.LAMEA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT, 2020–2030 (THOUSAND UNIT)

TABLE 127.LAMEA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 128.LAMEA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE, 2020–2030 (THOUSAND UNIT)

TABLE 129.LAMEA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET, BY COUNTRY 2020–2030 ($MILLION)

TABLE 130.LAMEA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY COUNTRY, 2020–2030 (THOUSAND UNIT)

TABLE 131.BRAZIL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 132.BRAZIL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 133.BRAZIL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 134.BRAZIL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT, 2020–2030 (THOUSAND UNIT)

TABLE 135.BRAZIL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 136.BRAZIL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE, 2020–2030 (THOUSAND UNIT)

TABLE 137.SAUDI ARABIA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 138.SAUDI ARABIA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 139.SAUDI ARABIA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 140.SAUDI ARABIA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT, 2020–2030 (THOUSAND UNIT)

TABLE 141.SAUDI ARABIA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 142.SAUDI ARABIA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE, 2020–2030 (THOUSAND UNIT)

TABLE 143.SOUTH AFRICA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 144.SOUTH AFRICA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 145.SOUTH AFRICA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 146.SOUTH AFRICA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT, 2020–2030 (THOUSAND UNIT)

TABLE 147.SOUTH AFRICA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 148.SOUTH AFRICA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE, 2020–2030 (THOUSAND UNIT)

TABLE 149.U.A.E. PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 150.U.A.E. PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 151.U.A.E. PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 152.U.A.E. PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT, 2020–2030 (THOUSAND UNIT)

TABLE 153.U.A.E. PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 154.U.A.E. PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE, 2020–2030 (THOUSAND UNIT)

TABLE 155.REST OF LAMEA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 ($MILLION)

TABLE 156.REST OF LAMEA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY MATERIAL, 2020–2030 (THOUSAND UNIT)

TABLE 157.REST OF LAMEA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT 2020–2030 ($MILLION)

TABLE 158.REST OF LAMEA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY PRODUCT, 2020–2030 (THOUSAND UNIT)

TABLE 159.REST OF LAMEA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE 2020–2030 ($MILLION)

TABLE 160.REST OF LAMEA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS, BY END-USE, 2020–2030 (THOUSAND UNIT)

TABLE 161.KEY NEW PRODUCT LAUNCHES (2017–2021)

TABLE 162.KEY EXPANSIONS (2017–2021)

TABLE 163.KEY ACQUISITION (2017–2021)

TABLE 164.KEY PARTNERSHIP (2017–2021)

TABLE 165.BHARAT HEAVY ELECTRICALS LIMITED: COMPANY SNAPSHOT

TABLE 166.BHARAT HEAVY ELECTRICALS LIMITED: KEY EXECUTIVES

TABLE 167.BHARAT HEAVY ELECTRICALS LIMITED.: OPERATING SEGMENTS

TABLE 168.BHARAT HEAVY ELECTRICALS LIMITED: PRODUCT PORTFOLIO

TABLE 169.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 170.DOOSAN HEAVY INDUSTRIES & CONSTRUCTION.: COMPANY SNAPSHOT

TABLE 171.DOOSAN HEAVY INDUSTRIES & CONSTRUCTION.: KEY EXECUTIVES

TABLE 172.DOOSAN HEAVY INDUSTRIES & CONSTRUCTION.: OPERATING SEGMENTS

TABLE 173.DOOSAN HEAVY INDUSTRIES & CONSTRUCTION.: PRODUCT PORTFOLIO

TABLE 174.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 175.DOOSAN HEAVY INDUSTRIES & CONSTRUCTION.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 176.GENERAL ELECTRIC.: KEY EXECUTIVES

TABLE 177.GENERAL ELECTRIC.: COMPANY SNAPSHOT

TABLE 178.GENERAL ELECTRIC.: OPERATING SEGMENTS

TABLE 179.GENERAL ELECTRIC.

TABLE 180.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 181.GENERAL ELECTRIC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 182.HALVORSEN COMPANY: COMPANY SNAPSHOT

TABLE 183.HALVORSEN COMPANY: KEY EXECUTIVES

TABLE 184.HALVORSEN COMPANY: PRODUCT PORTFOLIO

TABLE 185.HALVORSEN COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 186.IHI CORPORATION.: COMPANY SNAPSHOT

TABLE 187.IHI CORPORATION: KEY EXECUTIVES

TABLE 188.IHI CORPORATION.: OPERATING SEGMENTS

TABLE 189.IHI CORPORATION.: PRODUCT PORTFOLIO

TABLE 190.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 191.IHI CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 192.LARSEN & TOUBRO.: COMPANY SNAPSHOT

TABLE 193.LARSEN & TOUBRO: KEY EXECUTIVES

TABLE 194.LARSEN & TOUBRO.: OPERATING SEGMENTS

TABLE 195.LARSEN & TOUBRO.: PRODUCT PORTFOLIO

TABLE 196.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 197.LARSEN & TOUBRO: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 198.MITSUBISHI HEAVY INDUSTRIES: COMPANY SNAPSHOT

TABLE 199.MITSUBISHI HEAVY INDUSTRIES: KEY EXECUTIVES

TABLE 200.MITSUBISHI HEAVY INDUSTRIES.: OPERATING SEGMENTS

TABLE 201.MITSUBISHI HEAVY INDUSTRIES: PRODUCT PORTFOLIO

TABLE 202.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 203.MITSUBISHI HEAVY INDUSTRIES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 204.PRESSURE VESSELS.: COMPANY SNAPSHOT

TABLE 205.PRESSURE VESSELS.: KEY EXECUTIVES

TABLE 206.PRESSURE VESSELS.: PRODUCT PORTFOLIO

TABLE 207.SAMUEL, SON & CO.: COMPANY SNAPSHOT

TABLE 208.SAMUEL, SON & CO.: KEY EXECUTIVES

TABLE 209.SAMUEL, SON & CO.: PRODUCT PORTFOLIO

TABLE 210.WESTINGHOUSE ELECTRIC COMPANY: COMPANY SNAPSHOT

TABLE 211.WESTINGHOUSE ELECTRIC COMPANY: KEY EXECUTIVES

TABLE 212.WESTINGHOUSE ELECTRIC COMPANY: PRODUCT PORTFOLIO

LIST OF FIGURES

FIGURE 01.GLOBAL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET SNAPSHOT, BY SEGMENTATION, 2021–2030

FIGURE 02.GLOBAL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET SNAPSHOT, BY REGION, 2021–2030

FIGURE 03.GLOBAL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET SEGMENTATION

FIGURE 04.TOP INVESTMENT POCKETS

FIGURE 05.MODERATE BARSGAINING POWER OF SUPPLIERS

FIGURE 06.MODERATE THREAT OF NEW ENTRANTS

FIGURE 07.MODERATE THREAT OF SUBSTITUTES

FIGURE 08.MODERATE INTENSITY OF COMPETITIVE RIVALRY

FIGURE 09.MODERATE BARSGAINING POWER OF BUYERS

FIGURE 10.GLOBAL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET DYNAMICS

FIGURE 11.VALUE CHAIN ANALYSIS

FIGURE 12.GLOBAL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS REVENUE, BY MATERIAL ($MILLION)

FIGURE 13.GLOBAL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS VOLUME, BY MATERIAL (THOUSAND UNIT)

FIGURE 14.MARKET SIZE AND FORECAST, 2020-2030

FIGURE 15.MARKET SIZE AND FORECAST, 2020-2030 (THOUSAND UNIT)

FIGURE 16.MARKET SIZE AND FORECAST, 2020-2030

FIGURE 17.MARKET SIZE AND FORECAST, 2020-2030 (THOUSAND UNIT)

FIGURE 18.MARKET SIZE AND FORECAST, 2020-2030

FIGURE 19.MARKET SIZE AND FORECAST, 2020-2030 (THOUSAND UNIT)

FIGURE 20.MARKET SIZE AND FORECAST, 2020-2030

FIGURE 21.MARKET SIZE AND FORECAST, 2020-2030 (THOUSAND UNIT)

FIGURE 22.MARKET SIZE AND FORECAST, 2020-2030

FIGURE 23.MARKET SIZE AND FORECAST, 2020-2030 (THOUSAND UNIT)

FIGURE 24.MARKET SIZE AND FORECAST, 2020-2030 ($MILLION)

FIGURE 25.MARKET SIZE AND FORECAST, 2020-2030 (THOUSAND UNIT)

FIGURE 26.GLOBAL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS REVENUE, BY PRODUCT ($MILLION)

FIGURE 27.GLOBAL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS VOLUME, BY PRODUCT (THOUSAND UNIT)

FIGURE 28.MARKET SIZE AND FORECAST, 2020-2030

FIGURE 29.MARKET SIZE AND FORECAST, 2020-2030

FIGURE 30.MARKET SIZE AND FORECAST, 2020-2030

FIGURE 31.MARKET SIZE AND FORECAST, 2020-2030

FIGURE 32.MARKET SIZE AND FORECAST, 2020-2030

FIGURE 33.MARKET SIZE AND FORECAST, 2020-2030

FIGURE 34.MARKET SIZE AND FORECAST, 2020-2030

FIGURE 35.MARKET SIZE AND FORECAST, 2020-2030

FIGURE 36.GLOBAL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS REVENUE, BY END-USE ($MILLION)

FIGURE 37.GLOBAL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS VOLUME, BY END-USE (THOUSAND UNIT)

FIGURE 38.MARKET SIZE AND FORECAST, 2020-2030

FIGURE 39.MARKET SIZE AND FORECAST, 2020-2030

FIGURE 40.MARKET SIZE AND FORECAST, 2020-2030

FIGURE 41.MARKET SIZE AND FORECAST, 2020-2030

FIGURE 42.MARKET SIZE AND FORECAST, 2020-2030

FIGURE 43.MARKET SIZE AND FORECAST, 2020-2030

FIGURE 44.MARKET SIZE AND FORECAST, 2020-2030

FIGURE 45.MARKET SIZE AND FORECAST, 2020-2030

FIGURE 46.GLOBAL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET REVENUE, BY REGION ($MILLION)

FIGURE 47.GLOBAL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET VOLUME, BY REGION (THOUSAND UNIT)

FIGURE 48.U.S. PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET REVENUE, 2020–2030, ($MILLION)

FIGURE 49.U.S. PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET REVENUE, 2020–2030, (THOUSAND UNIT)

FIGURE 50.CANADA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET REVENUE, 2020–2030, ($MILLION)

FIGURE 51.CANADA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET VOLUME, 2020–2030, (THOUSAND UNIT)

FIGURE 52.MEXICO PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET REVENUE, 2020–2030, ($MILLION)

FIGURE 53.MEXICO PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET VOLUME, 2020–2030, (THOUSAND UNIT)

FIGURE 54.GERMANY PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET REVENUE, 2020–2030, ($MILLION)

FIGURE 55.GERMANY PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET VOLUME, 2020–2030, (THOUSAND UNIT)

FIGURE 56.FRANCE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET REVENUE, 2020–2030, ($MILLION)

FIGURE 57.FRANCE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET VOLUME, 2020–2030, (THOUSAND UNIT)

FIGURE 58.UK PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET REVENUE, 2020–2030, ($MILLION)

FIGURE 59.UK PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET VOLUME, 2020–2030, (THOUSAND UNIT)

FIGURE 60.SPAIN PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET REVENUE, 2020–2030, ($MILLION)

FIGURE 61.SPAIN PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET VOLUME, 2020–2030, (THOUSAND UNIT)

FIGURE 62.ITALY PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET REVENUE, 2020–2030, ($MILLION)

FIGURE 63.ITALY PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET VOLUME, 2020–2030, (THOUSAND UNIT)

FIGURE 64.REST OF EUROPE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET REVENUE, 2020–2030, ($MILLION)

FIGURE 65.REST OF EUROPE PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET VOLUME, 2020–2030, (THOUSAND UNIT)

FIGURE 66.CHINA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET REVENUE, 2020–2030, ($MILLION)

FIGURE 67.CHINA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET VOLUME, 2020–2030, (THOUSAND UNIT)

FIGURE 68.JAPAN PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET REVENUE, 2020–2030, ($MILLION)

FIGURE 69.JAPAN PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET VOLUME, 2020–2030, (THOUSAND UNIT)

FIGURE 70.INDIA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET REVENUE, 2020–2030, ($MILLION)

FIGURE 71.INDIA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET VOLUME, 2020–2030, (THOUSAND UNIT)

FIGURE 72.SOUTH KOREA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET REVENUE, 2020–2030, ($MILLION)

FIGURE 73.SOUTH KOREA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET VOLUME, 2020–2030, (THOUSAND UNIT)

FIGURE 74.AUSTRALIA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET REVENUE, 2020–2030, ($MILLION)

FIGURE 75.AUSTRALIA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET VOLUME, 2020–2030, (THOUSAND UNIT)

FIGURE 76.REST OF ASIA-PACIFIC PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET REVENUE, 2020–2030, ($MILLION)

FIGURE 77.REST OF ASIA-PACIFIC PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET VOLUME, 2020–2030, (THOUSAND UNIT)

FIGURE 78.BRAZIL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET REVENUE, 2020–2030, ($MILLION)

FIGURE 79.BRAZIL PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET VOLUME, 2020–2030, (THOUSAND UNIT)

FIGURE 80.SAUDI ARABIA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET REVENUE, 2020–2030, ($MILLION)

FIGURE 81.SAUDI ARABIA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET VOLUME, 2020–2030, (THOUSAND UNIT)

FIGURE 82.SOUTH AFRICA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET REVENUE, 2020–2030, ($MILLION)

FIGURE 83.SOUTH AFRICA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET VOLUME, 2020–2030, (THOUSAND UNIT)

FIGURE 84.U.A.E. PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET REVENUE, 2020–2030, ($MILLION)

FIGURE 85.U.A.E. PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET VOLUME, 2020–2030, (THOUSAND UNIT)

FIGURE 86.REST OF LAMEA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET REVENUE, 2020–2030, ($MILLION)

FIGURE 87.REST OF LAMEA PRESSURE VESSEL MARKET FOR ALTERNATIVE FUELS MARKET VOLUME, 2020–2030, (THOUSAND UNIT)

FIGURE 88.MARKET PLAYER POSITIONING, 2020

FIGURE 89.TOP WINNING STRATEGIES, BY YEAR, 2018–2022

FIGURE 90.TOP WINNING STRATEGIES, BY DEVELOPMENT, 2018–2022 (%)

FIGURE 91.TOP WINNING STRATEGIES, BY COMPANY, 2018–2022

FIGURE 92.PRODUCT MAPPING OF TOP 10 PLAYERS

FIGURE 93.COMPETITIVEHEATMAP OF KEY PLAYERS

FIGURE 94.BHARAT HEAVY ELECTRICALS LIMITED: REVENUE, 2019-2021 ($MILLION)

FIGURE 95.BHARAT HEAVY ELECTRICALS LIMITED: REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 96.DOOSAN HEAVY INDUSTRIES & CONSTRUCTION.: REVENUE, 2018-2020 ($MILLION)

FIGURE 97.DOOSAN HEAVY INDUSTRIES & CONSTRUCTION.: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 98.DOOSAN HEAVY INDUSTRIES & CONSTRUCTION: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 99.GENERAL ELECTRIC.: REVENUE, 2019–2021 ($MILLION)

FIGURE 100.GENERAL ELECTRIC.: REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 101.GENERAL ELECTRIC.: REVENUE SHARE BY REGION, 2021 (%)

FIGURE 102.IHI CORPORATION: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 103.IHI CORPORATION: REVENUE SHARE BY REGION 2020 (%)

FIGURE 104.LARSEN & TOUBRO: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 105.LARSEN & TOUBRO: REVENUE SHARE BY REGION 2020 (%)

FIGURE 106.MITSUBISHI HEAVY INDUSTRIES: REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 107.MITSUBISHI HEAVY INDUSTRIES, REVENUE SHARE BY REGION 2021(%)

$5769

$6450

$10995

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS