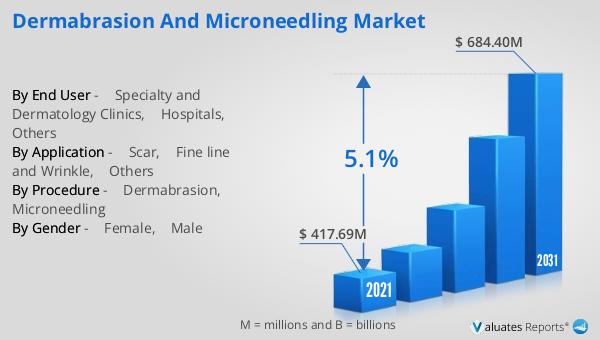

Ans: The Dermabrasion and Microneedling Market witnessing a CAGR of 5.1% during the forecast period 2024-2031.

According to a new report published by , titled, “Dermabrasion and Microneedling Market," The dermabrasion and microneedling market size was valued at $417.69 million in 2021 and is estimated to reach $684.40 million by 2031, exhibiting a CAGR of 5.1% from 2022 to 2031. Dermabrasion and microneedling are used to improve the appearance of scars, wrinkles, and other skin blemishes. Dermabrasion is a procedure used to treat scars, wrinkles, and other skin blemishes. It involves the use of a device to remove the top layers of skin, revealing the smoother and healthier skin underneath. It is a safe and effective way to treat scars, reducing their appearance and improving the texture of the skin. Dermabrasion can also be used to treat wrinkles, age spots, and other skin imperfections. Microneedling is a procedure used to procedure can help reduce the appearance of scars, improve skin texture, and reduce wrinkles. It involves the use of a device with fine needles that creates tiny punctures in the skin, which stimulates the body's natural healing process

Growth of the global dermabrasion and microneedling market is majorly driven by rise in prevalence of skin care treatment, and increase in number of minimal invasive aesthetic procedures. For instance, in 2020, according to the America Society of Plastic Surgeons, nearly 10.4 million minimally invasive procedures were performed among females in the U.S. Further, less complication of minimal-invasive procedures in comparison with invasive aesthetic surgical procedures is anticipated to fuel the growth of the dermabrasion and microneedling market.

According to the International Society of Aesthetic Plastic Surgeon, in 2021, around 13.5% of plastic surgeon were reported to have performed dermabrasion, globally. As per the same source, in 2021, around 23.9% of plastic surgeons in India were reported to have conducted dermabrasion procedure. India provides the highest percentage of plastic surgeon who conduct dermabrasion. Thus, rise in number of plastic surgeons to conduct dermabrasion procedure is attributed to drive the growth of the market.

Increase in number of development strategies such as collaboration, and agreement, by different key players is anticipated to propel the market growth. For instance, in March 2022, R2 Technologies Inc, one of the leading providers of cryoaesthetic medical devices, announced the Food and Drug Administration (FDA) clearance for general dermabrasion procedure through Glacial Rx device, in U.S. This device is also used in various clinics in U.S such as DermaTouch RN Laser & Skin Care and Elias Dermatology. For instance, in January 2020, Candela corporation announced the collaboration agreement with MT.DERM GmbH, for the commercialization of MT.DERM's medical microneedling products. This product is CE registered in Europe. Thus, increase in product approval of dermabrasion and microneedling device for different procedures propel the growth of the market.

Moreover, increase in prevalence of skin disorders such as scar, hyperpigmentation, acne, fine line and wrinkle is attributed to rise in number of major surgical procedures. According to American Academy of Dermatology Association, around 50 million Americans were affected with acne, each year. This surges the need for facial rejuvenation procedure such as dermabrasion and microneedling treatment and drives the growth of the market. Moreover, according to one of the articles of Lumenis, more than 80% of UK population were reported to have been affected with acne vulgaris at some point in their life. Thus, increase in prevalence of skin disorder, and increase in demand for aesthetic appearance surge the adoption of dermabrasion and microneedling treatment, and anticipated to boost the growth of market.

Furthermore, increase in adoption of minimal invasive procedure such as dermabrasion and microneedling in various aesthetic service providers such as clinics, hospital, dermatology centers, boost the dermabrasion and microneedling market growth. In addition, aesthetic service providers also use the advanced and newly developed technology in microneedling and dermabrasion procedure. AsAestheticshape (Germany), Eden Skin Clinic (UK), Essi Clinic (UK), Yorkville Institute of Plastic Surgery (Canada), SpaSurgica (Canada), and Fortis Healthcare(India) and kincare and Beauty Clinic (Spain) are some of the aesthetic service providers offering dermabrasion and microneedling treatment.

On the other hand, high cost of dermabrasion procedure and availability of alternative treatment hinder the growth of the market. For instance, according to the Aedit, the minimum price of dermabrasion procedure is around $500 and the maximum price of dermabrasion procedure is around $4,000. Moreover, as per the same source, the average cost of microneedling along with platelet-rich plasma (PRP) is $725, per session. Furthermore, dermabrasion procedures are rarely practiced in hospitals, clinics, aesthetic centers, and beauty salons. This procedure is replaced with new and simpler technology such as Erbium: YAG laser or lasers CO2.

The COVID-19 outbreak is anticipated to have a negative impact on the growth of the global dermabrasion and microneedling market. The COVID-19 pandemic has stressed healthcare systems globally. A huge number of clinics and hospitals across the globe were restructured to increase the hospital capacity for the patients diagnosed with COVID-19. Non-essential surgical procedures were cancelled due to the pandemic. Decrease in the number of elective surgeries during COVID-19 pandemic due to lockdown is anticipated to decrease the demand for facial aesthetic procedure and have negative impact on the market growth.

According to American Society of Plastic Surgeons, in 2020, it was reported that around 15% of cosmetic procedures were decreased from 2019 to 2020 due to COVID-19 pandemic in the U.S. In addition, decrease in number of visits for aesthetic appearance to dermatology clinics, during pandemic hamper the growth of the market. Furthermore, facial rejuvenation procedure such as dermabrasion and microneedling are non-emergency aesthetic procedures significantly hampered revenue of aesthetic companies. In addition, sudden sharp cut in monthly income of population is anticipated to have negative impact on the market.

Segmental Overview

The dermabrasion and microneedling market share is segmented into Procedure, Gender, Application, End User, and Region. On the basis of procedure, the market is classified into dermabrasion, and microneedling. On the basis of gender, the market is classified into male, and female. On the basis of application, the market is classified into fine line and wrinkle, scar, and others. The others segment includes sun damage, and pigmentation. On the basis of end user, the market is divided into specialty and dermatology clinics, hospitals, and others. The others segment include beauty salon, and aesthetic clinics.

Region wise, the dermabrasion and microneedling market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, UK, France, Spain, Italy, and rest of Europe), Asia-Pacific (India, China, Australia, Japan, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, Colombia, and rest of LAMEA).

By Procedure

Based on procedure, the dermabrasion and microneedling market is bifurcated into dermabrasion, and microneedling. The dermabrasion segment dominated the market in 2021, due to prevalence of skin disease such as acne scar, and advancement in technology for development of advanced dermabrasion treatment. The microneedling segment is expected to exhibit fastest growth during the forecast period, owing to rise in demand for anti-aging procedures, increase in R&D activities in medical aesthetic centers, and clinical trials on microneedling treatment.

By Gender

Based on gender, the dermabrasion and microneedling market size is classified into male, and female. The female segment was the highest revenue contributor to the market in 2021 and is projected to be the fastest growing segment during the forecast period, owing to increase in demand for aesthetic appearance in female population, and rise in disposable income.

By Application

Based on application, the dermabrasion and microneedling market is classified into scar, fine line & wrinkle, and others. The scar was the largest growing segment in 2021 and is projected to be the fastest growing segment during the forecast period owing to rise in prevalence of scar caused due to acne, accident, and previous surgery, and increase in demand for minimal invasive aesthetic procedure.

By End User

Based on end user, the dermabrasion and microneedling market is classified into specialty and dermatology clinics, hospitals, and others. The hospital segment was the largest growing segment in 2021 and is projected to be the fastest growing segment during the forecast period owing to increase in adoption of aesthetic procedure in hospitals and rise in expenditure by government to develop healthcare sector.

By Region

Region wise, North America has the highest market share in 2021, and is expected to maintain its lead during the forecast period, owing to increase in prevalence of skin disease, rise in number of aesthetic centers, surge in product approval for dermabrasion and microneedling device, availability of well-developed healthcare infrastructure, and strong presence of dermabrasion and microneedling industry in this region. However, Asia-Pacific is expected to exhibit fastest growth during the dermabrasion and microneedling market forecast, owing to high prevalence of aging population with an increasing need of aesthetic procedure, improvement in healthcare awareness, rise in prevalence of premature aging, and surge in healthcare expenditure.

Competition Analysis

Some of the major companies that operate in the dermabrasion and microneedling market include Apollo Hospitals Enterprise Ltd., Essi Clinic, JNU Hospital, SpaSurgica, LuxeSkin Med Spa, Cutis Skin Clinic & Cosmetology Center, Bingham Memorial Hospital, Fortis Healthcare, Azura Skin Care Center, and Yorkville Institute of Plastic Surgery

Recent product approvals in the Dermabrasion and Microneedling Market

Recent Collaboration in the Dermabrasion and Microneedling Market

| Report Metric | Details |

| Report Name | Dermabrasion and Microneedling Market |

| Accounted market size in 2021 | $ 417.69 million |

| Forecasted market size in 2031 | $ 684.40 million |

| CAGR | 5.1% |

| Base Year | 2021 |

| Forecasted years | 2024 - 2031 |

| By Procedure | ● Dermabrasion ● Microneedling |

| By Gender | ● Female ● Male |

| By Application | ● Scar ● Fine line and Wrinkle ● Others |

| By End User | ● Specialty and Dermatology Clinics ● Hospitals ● Others |

| By Region |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Ans: The Dermabrasion and Microneedling Market witnessing a CAGR of 5.1% during the forecast period 2024-2031.

Ans: The Dermabrasion and Microneedling Market size in 2031 will be $ 684.40 million.

Ans: The Applications covered in the Dermabrasion and Microneedling Market report are ● Scar, ● Fine line and Wrinkle, ● Others

Ans: The End users covered in the Dermabrasion and Microneedling Market report are ● Specialty and Dermatology Clinics, ● Hospitals, ● Others

$5730

$6450

$9600

$3840

HAVE A QUERY?

OUR CUSTOMER