Europe Application Modernization Services Market

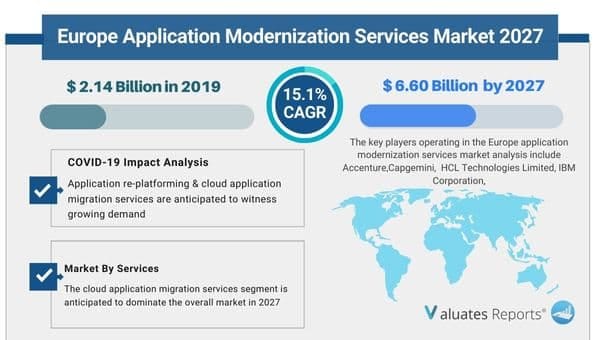

The Europe application modernization services market size was valued at $2.14 billion in 2019 and is projected to reach $6.60 billion by 2027, growing at a CAGR of 15.1% from 2020 to 2027.

Application modernization is the process of taking existing legacy applications and modernizing their platform infrastructure, internal architecture, and/or features. Application modernization aids in improving the velocity of new feature delivery, exposing the functionality of existing applications to be consumed via an application programming interface (API) by other services, and re-platforming applications from on-premises to cloud for the purpose of application scale and performance as well as long-term data center & IT strategy.

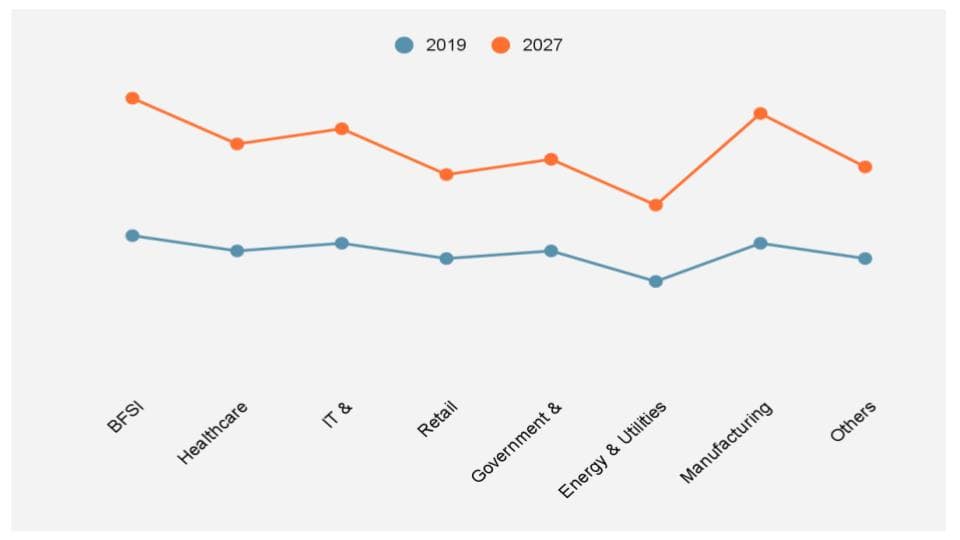

Europe Application Modernization Services Market by Service (Application Portfolio Assessment, Cloud Application Migration, Application Re-platforming, Application Integration, And UI Modernization, and Post Modernization Services), Deployment Mode (Private Cloud, Public Cloud, and Hybrid Cloud), Enterprise Size (Large Enterprises and Small & Medium-sized Enterprises), and Industry Vertical (BFSI, Healthcare, IT & telecommunications, Retail, Government & Public Sector, Energy & Utilities, Manufacturing, and Others)

Post COVID-19 emergence, application re-platforming & cloud application migration services are anticipated to witness growing demand, as companies are seeking for cloud-based solutions to ensure data availability, agility, and update business processes due to adoption of remote working culture.

Increase in demand for cloud computing, surge in adoption of Big Data analytics software for leveraging advantages of Big Data, and rise in need to replace legacy applications are some of the major factors that are driving the growth of the Europe application modernization services market. However, adopting and managing constant changes in industry trends and lack of skilled IT staff are anticipated to restrict the application modernization services market growth in Europe. On the contrary, need for modern infrastructure and digital transformation is anticipated to provide lucrative growth opportunities for the market in Europe during the analysis period.

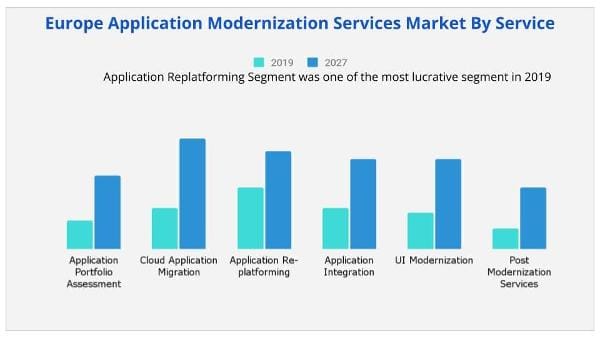

On the basis of service, the cloud application migration services segment is anticipated to dominate the overall market in 2027. This is attributed to the fact that cloud technology is gaining traction as an on-demand, self-service environment to move forward in helping businesses outmaneuver uncertainty by providing enhanced scalability and cost efficiencies. Post the outbreak of the COVID-19 pandemic, many companies are accelerating their move to the cloud, reinventing their offerings, and becoming more agile in their business operations, which significantly contribute to the growth of the overall market.

According to deployment mode, the public cloud segment accounted for the highest Europe application modernization services market share in 2019. However, the hybrid cloud segment is expected to witness highest growth rate during the forecast period, owing to the need for scalability, control of critical operations, and less investment cost.

In 2019, the large enterprises segment garnered the major Europe application modernization services market size, as large enterprises have legacy applications installed due to heavy investment capacity. Furthermore, to keep up with the dynamic market trends, large enterprises are realizing the need to transform and modernize their applications, thus driving the growth of this market.

The Europe application modernization services market is expected to recover till mid-2021, and will be struggling with a slow growth rate. However, it is likely to recover in the upcoming years, owing to rise in adoption of work-from-home culture across Europe. The application modernization services market has witnessed significant growth in past few years; however, due to the outbreak of the COVID-19 pandemic, some of the sectors are projected to witness a sudden downfall in 2020. This is attributed to implementation of lockdown by governments in majority of the countries and the shutdown of travel across the world to prevent the transmission of virus. The application modernization services market is projected to grow in the upcoming years after the recovery from the COVID-19 pandemic in Europe. Various organizations across the Europe have initiated work-from-home culture for their employees, which is further creating the demand for cloud-based technologies to manage critical information of organizations and ensure business continuity, thus creating lucrative opportunity for the Europe application modernization services market growth.

The report focuses on the growth prospects, restraints, and application modernization services market trends in Europe. Moreover, the study includes Porter’s five forces analysis of the industry to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, the threat of substitutes, and bargaining power of buyers on the growth of the Europe application modernization services market.

Europe Application Modernization Services Market Segment Review

The Europe application modernization services market is segmented into service, deployment mode, enterprise size, industry vertical, and country. By service, it is divided into application portfolio assessment, cloud application migration, application re-platforming, application integration, UI modernization, and post modernization services. Depending on deployment mode, it is categorized into private cloud, public cloud, and hybrid cloud. According to enterprise size, the application modernization services market is segregated into large enterprises and small & medium enterprises. As per industry vertical, it is fragmented into BFSI, healthcare, IT & telecommunications, retail, government & public sector, energy & utilities, manufacturing, and others. Country wise, the market is analyzed across Austria, Germany, Switzerland, the UK, France, and rest of Europe.

The key players operating in the Europe application modernization services market analysis include Accenture, Aspire Systems, Atos, Bell Integrator, Blu Age, Capgemini, DXC Technology Company, HCL Technologies Limited, IBM Corporation, and Micro Focus.

The majority of companies still use legacy systems, which form hurdles in the adoption of new technologies. The reluctance for modernizing the legacy systems and high dependency on existing systems can lead to higher overall costs in the long run. Considering the urgency of the need to modernize the legacy environment, enterprises are anticipated to adopt legacy modernization services increasingly during the forecast period, which notably contributes to the growth of the Europe application modernization services market.

Developers need additional time to modernize large and complex legacy apps. In addition, they need to ensure that the app is being modernized without disrupting business processes and operations. Hence, there are high chance that the business requirements and industry trends may keep changing during the modernization process. Enterprises can easily manage frequent changes in business needs and industry trends by switching from waterfall to agile methodology.

However, the agile methodology requires them to revamp the existing work environment and deploy cross-functional teams. The challenges in legacy app modernization still differ according to the type and complexity of the legacy application, business needs & goals, and specific modernization scenarios. Thus, such changes in industry trends and business requirements are anticipated to hinder the Europe application modernization services market growth.

Varying business rules and use cases demand innovative functionalities to aid business processes efficiently. Organizations need to continuously develop their business processes due to changing customer needs, rapid technological advancements, and increasing competition. Many organizations need business agility to survive and expand in competitive business environments. This is realized by adopting the latest technologies, and developing and delivering modern applications technology, thus driving the growth of the application modernization services market. As per consultancy.eu, 75% of European organizations will be completely digitally transformed by 2029 and will become digitally native enterprises.

Thus, these factors collectively are expected to offer remunerative opportunities for the expansion of the Europe application modernization services market during the forecast period.

|

Report Metric |

Details |

|

Report Name |

Europe application modernization services Market |

|

Market size value in 2019 |

USD 2.14 Billion |

|

Revenue forecast in 2027 |

USD 6.60 Billion |

|

Growth Rate |

15.1% |

|

Base year considered |

2019 |

|

Forecast Period |

2020-2027 |

|

By Service |

Application Portfolio Assessment, Cloud Application Migration, Application Re-platforming, ApplicationIntegration, UI Modernization, Post Modernization Services. |

|

By Deployment |

Private Cloud, Public Cloud, Hybrid Cloud |

|

Report Coverage |

Revenue & volume forecast, company share, competitive landscape, growth factors, and trends |

|

Segments Covered |

By Service, Deployment, and Region |

|

Geographic Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Ans. Due to the COVID-19 pandemic, The Europe application modernization services market size was valued at $2.14 billion in 2019 and is projected to reach $6.60 billion by 2027, growing at a CAGR of 15.1% from 2020 to 2027.

Ans. Some of the Major companies are Accenture, Aspire Systems, Atos, Bell Integrator, Blu Age, Capgemini, and DXC Technology Company.

Ans. Yes, the report includes a COVID-19 impact analysis. Also, it is further extended into every individual segment of the report.

TABLE OF CONTENT

CHAPTER 1:INTRODUCTION

1.1.Report description

1.2.Key benefits for stakeholders

1.3.Key market segments

1.4.Research methodology

1.4.1.Secondary research

1.4.2.Primary research

1.4.3.Analyst tools & models

CHAPTER 2:EXECUTIVE SUMMARY

2.1.CXO perspective

CHAPTER 3:MARKET OVERVIEW

3.1.Market definition and scope

3.2.Key findings

3.2.1.Top impacting factors

3.2.2.Top investment pockets

3.3.Porter's five forces analysis

3.4.Market dynamics

3.4.1.Drivers

3.4.1.1.Increase in demand for cloud computing

3.4.1.2.Increase in adoption of Big Data analytics software for leveraging advantages of Big Data

3.4.1.3.Rise in need to replace legacy applications

3.4.2.Restraint

3.4.2.1.Adopting and managing constant changes

3.4.3.Opportunity

3.4.3.1.Need for modern infrastructure and digital transformation

3.5.COVID-19 impact analysis on application modernization services market

3.5.1.Impact on market size

3.5.2.Consumer trends, preferences, and budget impact

3.5.3.Regulatory framework

3.5.4.Economic impact

3.5.5.Strategies to tackle negative impact

3.5.6.Opportunity window

CHAPTER 4:APPLICATION MODERNIZATION SERVICESS MARKET, BY SERVICE

4.1.Overview

4.2.Application portfolio assessment

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast

4.3.Cloud application migration

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Market size and forecast

4.4.Application re-platforming

4.4.1.Key market trends, growth factors, and opportunities

4.4.2.Market size and forecast

4.5.Application integration

4.5.1.Key market trends, growth factors, and opportunities

4.5.2.Market size and forecast

4.6.UI modernization

4.6.1.Key market trends, growth factors, and opportunities

4.6.2.Market size and forecast

4.7.Post modernization services

4.7.1.Key market trends, growth factors, and opportunities

4.7.2.Market size and forecast

CHAPTER 5:EUROPE APPLICATION MODERNIZATION SERVICES MARKET, BY DEPLOYMENT MODE

5.1.Overview

5.2.Private cloud

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region

5.3.Public cloud

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region

5.4.Hybrid cloud

5.4.1.Key market trends, growth factors, and opportunities

5.4.2.Market size and forecast

CHAPTER 6:APPLICATION MODERNIZATION SERVICESS MARKET, BY ENTERPRISE SIZE

6.1.Overview

6.2.Large enterprises

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast

6.3.SMEs

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast

CHAPTER 7:APPLICATION MODERNIZATION SERVICESS MARKET, BY INDUSTRY VERTICAL

7.1.Overview

7.2.BFSI

7.2.1.Key market trends, growth factors, and opportunities

7.2.2.Market size and forecast

7.3.Healthcare

7.3.1.Key market trends, growth factors, and opportunities

7.3.2.Market size and forecast

7.4.IT & telecommunications

7.4.1.Key market trends, growth factors, and opportunities

7.4.2.Market size and forecast

7.5.Retail

7.5.1.Key market trends, growth factors, and opportunities

7.5.2.Market size and forecast

7.6.Government & public sector

7.6.1.Key market trends, growth factors, and opportunities

7.6.2.Market size and forecast

7.7.Energy & utilities

7.7.1.Key market trends, growth factors, and opportunities

7.7.2.Market size and forecast

7.8.Manufacturing

7.8.1.Key market trends, growth factors, and opportunities

7.8.2.Market size and forecast

7.9.Others

7.9.1.Key market trends, growth factors, and opportunities

7.9.2.Market size and forecast

CHAPTER 8:APPLICATION MODERNIZATION SERVICESS MARKET, BY COUNTRY

8.1.Overview

8.2.Austria

8.2.1.Market size and forecast, by Service

8.2.2.Market size and forecast, by deployment mode

8.2.3.Market size and forecast, by enterprise size

8.2.4.Market size and forecast, By Industry Vertical

8.3.Germany

8.3.1.Market size and forecast, by Service

8.3.2.Market size and forecast, by deployment mode

8.3.3.Market size and forecast, by enterprise size

8.3.4.Market size and forecast, By Industry Vertical

8.4.Switzerland

8.4.1.Market size and forecast, by Service

8.4.2.Market size and forecast, by deployment mode

8.4.3.Market size and forecast, by enterprise size

8.4.4.Market size and forecast, By Industry Vertical

8.5.UK

8.5.1.Market size and forecast, by Service

8.5.2.Market size and forecast, by deployment mode

8.5.3.Market size and forecast, by enterprise size

8.5.4.Market size and forecast, By Industry Vertical

8.6.France

8.6.1.Market size and forecast, by Service

8.6.2.Market size and forecast, by deployment mode

8.6.3.Market size and forecast, by enterprise size

8.6.4.Market size and forecast, By Industry Vertical

8.7.Rest of Europe

8.7.1.Market size and forecast, by Service

8.7.2.Market size and forecast, by deployment mode

8.7.3.Market size and forecast, by enterprise size

8.7.4.Market size and forecast, By Industry Vertical

CHAPTER 9:COMPETITIVE LANDSCAPE

9.1.Key player positioning

9.2.Top winning strategies

9.3.Competitive dashboard

9.4.Key developments

9.4.1.Product development

9.4.2.Partnership

9.4.3.Product Launch

9.4.4.Acquisition

9.4.5.Agreement

9.4.6.Collaboration

CHAPTER 10:COMPANY PROFILE

10.1.ACCENTURE PLC.

10.1.1.Company overview

10.1.2.Key executive

10.1.3.Company snapshot

10.1.4.Operating business segments

10.1.5.Product portfolio

10.1.6.R&D expenditure

10.1.7.Business performance

10.1.8.Key strategic moves and developments

10.2.ASPIRE SYSTEMS

10.2.1.Company overview

10.2.2.Key executive

10.2.3.Company snapshot

10.2.4.Product portfolio

10.2.5.Key strategic moves and developments

10.3.ATOS

10.3.1.Company overview

10.3.2.Key executive

10.3.3.Company snapshot

10.3.4.Operating business segments

10.3.5.Product portfolio

10.3.6.R&D expenditure

10.3.7.Business performance

10.3.8.Key strategic moves and developments

10.4.BELL INTEGRATOR

10.4.1.Company overview

10.4.2.Key executive

10.4.3.Company snapshot

10.4.4.Product portfolio

10.5.BLU AGE

10.5.1.Company overview

10.5.2.Key executive

10.5.3.Company snapshot

10.5.4.Product portfolio

10.5.5.Key strategic moves and developments

10.6.CAPGEMINI

10.6.1.Company overview

10.6.2.Key executive

10.6.3.Company snapshot

10.6.4.Product portfolio

10.6.5.Business performance

10.6.6.Key strategic moves and developments

10.7.DXC TECHNOLOGY COMPANY

10.7.1.Company overview

10.7.2.Key executive

10.7.3.Company snapshot

10.7.4.Operating business segments

10.7.5.Product portfolio

10.7.6.Business performance

10.7.7.Key strategic moves and developments

10.8.HCL TECHNOLOGIES

10.8.1.Company overview

10.8.2.Key executive

10.8.3.Company snapshot

10.8.4.Operating business segments

10.8.5.Product portfolio

10.8.6.Business performance

10.8.7.Key strategic moves and developments

10.9.INTERNATIONAL BUSINESS MACHINES CORPORATION

10.9.1.Company overview

10.9.2.Key executive

10.9.3.Company snapshot

10.9.4.Operating business segments

10.9.5.Product portfolio

10.9.6.R&D expenditure

10.9.7.Business performance

10.9.8.Key strategic moves and developments

10.10.MICRO FOCUS

10.10.1.Company overview

10.10.2.Key executive

10.10.3.Company snapshot

10.10.4.Product portfolio

10.10.5.R&D expenditure

10.10.6.Business performance

10.10.7.Key strategic moves and developments

LIST OF TABLES & FIGURES

TABLE 01.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE, BY SERVICE, 2019-2027 ($MILLION)

TABLE 02.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE FOR APPLICATION PORTFOLIO ASSESSMENT, 2019–2027 ($MILLION)

TABLE 03.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE FOR CLOUD APPLICATION MIGRATION, 2019-2027 ($MILLION)

TABLE 04.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE FOR APPLICATION RE-PLATFORMING, 2019-2027 ($MILLION)

TABLE 05.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE FOR APPLICATION INTEGRATION, 2019-2027 ($MILLION)

TABLE 06.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE FOR UI MODERNIZATION, 2019-2027 ($MILLION)

TABLE 07.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE FOR POST MODERNIZATION SERVICES, 2019-2027 ($MILLION)

TABLE 08.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE, BY DEPLOYMENT MODE, 2019-2027 ($MILLION)

TABLE 09.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE FOR PRIVATE CLOUD, 2019-2027 ($MILLION)

TABLE 10.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE FOR PUBLIC CLOUD, 2019-2027 ($MILLION)

TABLE 11.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE FOR HYBRID CLOUD, 2019–2027 ($MILLION)

TABLE 12.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE, BY ENTERPRISE SIZE, 2019-2027 ($MILLION)

TABLE 13.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE FOR LARGE ENTERPRISES, 2019-2027 ($MILLION)

TABLE 14.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE FOR SMES, 2019-2027 ($MILLION)

TABLE 15.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE, BY INDUSTRY VERTICAL, 2019-2027 ($MILLION)

TABLE 16.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE FOR BFSI, 2019-2027 ($MILLION)

TABLE 17.APPLICATION MODERNIZATION SERVICESS MARKET REVENUE FOR HEALTHCARE, 2019-2027 ($MILLION)

TABLE 18.APPLICATION MODERNIZATION SERVICESS MARKET REVENUE FOR IT & TELECOMMUNICATIONS, 2019-2027 ($MILLION)

TABLE 19.APPLICATION MODERNIZATION SERVICESS MARKET REVENUE FOR RETAIL, 2019-2027 ($MILLION)

TABLE 20.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE FOR GOVERNMENT AND PUBLIC SECTOR, 2019-2027 ($MILLION)

TABLE 21.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE FOR ENERGY & UTILITIES, 2019-2027 ($MILLION)

TABLE 22.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE FOR MANUFACTURING, 2019-2027 ($MILLION)

TABLE 23.APPLICATION MODERNIZATION SERVICESS MARKET REVENUE FOR OTHERS, 2019-2027 ($MILLION)

TABLE 24.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE, BY COUNTRY, 2019-2027 ($MILLION)

TABLE 25.AUSTRIA APPLICATION MODERNIZATION SERVICESS MARKET, BY SERVICE, 2019–2027 ($MILLION)

TABLE 26.AUSTRIA APPLICATION MODERNIZATION SERVICESS SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2027 ($MILLION)

TABLE 27.AUSTRIA APPLICATION MODERNIZATION SERVICESS MARKET, BY ENTERPRISE SIZE, 2019-2027 ($MILLION)

TABLE 28.AUSTRIA APPLICATION MODERNIZATION SERVICESS MARKET, BY INDUSTRY VERTICAL, 2019-2027 ($MILLION)

TABLE 29.GERMANY APPLICATION MODERNIZATION SERVICESS MARKET, BY SERVICE, 2019–2027 ($MILLION)

TABLE 30.GERMANY APPLICATION MODERNIZATION SERVICESS SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2027 ($MILLION)

TABLE 31.GERMANY APPLICATION MODERNIZATION SERVICESS MARKET, BY ENTERPRISE SIZE, 2019-2027 ($MILLION)

TABLE 32.GERMANY APPLICATION MODERNIZATION SERVICESS MARKET, BY INDUSTRY VERTICAL, 2019-2027 ($MILLION)

TABLE 33.SWITZERLAND APPLICATION MODERNIZATION SERVICESS MARKET, BY SERVICE, 2019–2027 ($MILLION)

TABLE 34.SWITZERLAND APPLICATION MODERNIZATION SERVICESS SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2027 ($MILLION)

TABLE 35.SWITZERLAND APPLICATION MODERNIZATION SERVICESS MARKET, BY ENTERPRISE SIZE, 2019-2027 ($MILLION)

TABLE 36.SWITZERLAND APPLICATION MODERNIZATION SERVICESS MARKET, BY INDUSTRY VERTICAL, 2019-2027 ($MILLION)

TABLE 37.UK APPLICATION MODERNIZATION SERVICESS MARKET, BY SERVICE, 2019–2027 ($MILLION)

TABLE 38.UK APPLICATION MODERNIZATION SERVICESS SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2027 ($MILLION)

TABLE 39.UK APPLICATION MODERNIZATION SERVICESS MARKET, BY ENTERPRISE SIZE, 2019-2027 ($MILLION)

TABLE 40.UK APPLICATION MODERNIZATION SERVICESS MARKET, BY INDUSTRY VERTICAL, 2019-2027 ($MILLION)

TABLE 41.FRANCE APPLICATION MODERNIZATION SERVICESS MARKET, BY SERVICE, 2019–2027 ($MILLION)

TABLE 42.FRANCE APPLICATION MODERNIZATION SERVICESS SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2027 ($MILLION)

TABLE 43.FRANCE APPLICATION MODERNIZATION SERVICESS MARKET, BY ENTERPRISE SIZE, 2019-2027 ($MILLION)

TABLE 44.FRANCE APPLICATION MODERNIZATION SERVICESS MARKET, BY INDUSTRY VERTICAL, 2019-2027 ($MILLION)

TABLE 45.REST OF EUROPE APPLICATION MODERNIZATION SERVICESS MARKET, BY SERVICE, 2019–2027 ($MILLION)

TABLE 46.REST OF EUROPE APPLICATION MODERNIZATION SERVICESS SOLUTIONS MARKET, BY DEPLOYMENT MODE, 2019-2027 ($MILLION)

TABLE 47.REST OF EUROPE APPLICATION MODERNIZATION SERVICESS MARKET, BY ENTERPRISE SIZE, 2019-2027 ($MILLION)

TABLE 48.REST OF EUROPE APPLICATION MODERNIZATION SERVICESS MARKET, BY INDUSTRY VERTICAL, 2019-2027 ($MILLION)

TABLE 49.PRODUCT DEVELOPMENT (2017-2020)

TABLE 50.PARTNERSHIP (2017-2020)

TABLE 51.PRODUCT LAUNCH (2017-2020)

TABLE 52.ACQUISITION (2017-2020)

TABLE 53.AGREEMENT (2017-2020)

TABLE 54.COLLABORATION (2017-2020)

TABLE 55.ACCENTURE: KEY EXECUTIVE

TABLE 56.ACCENTURE: COMPANY SNAPSHOT

TABLE 57.ACCENTURE: OPERATING SEGMENTS

TABLE 58.ACCENTURE.: PRODUCT PORTFOLIO

TABLE 59.ASPIRE SYSTEMS: KEY EXECUTIVE

TABLE 60.ASPIRE SYSTEMS: COMPANY SNAPSHOT

TABLE 61.ASPIRE SYSTEMS: PRODUCT PORTFOLIO

TABLE 62.ATOS: KEY EXECUTIVE

TABLE 63.ATOS: COMPANY SNAPSHOT

TABLE 64.ATOS: OPERATING SEGMENTS

TABLE 65.ATOS: PRODUCT PORTFOLIO

TABLE 66.ATOS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 67.BELL INTEGRATOR: KEY EXECUTIVE

TABLE 68.BELL INTEGRATOR: COMPANY SNAPSHOT

TABLE 69.BELL INTEGRATOR: PRODUCT PORTFOLIO

TABLE 70.BLU AGE.: KEY EXECUTIVE

TABLE 71.BLU AGE.: COMPANY SNAPSHOT

TABLE 72.BLU AGE: PRODUCT PORTFOLIO

TABLE 73.CAPGEMINI: KEY EXECUTIVE

TABLE 74.CAPGEMINI: COMPANY SNAPSHOT

TABLE 75.CAPGEMINI: PRODUCT PORTFOLIO

TABLE 76.DXC TECHNOLOGY: KEY EXECUTIVE

TABLE 77.DXC TECHNOLOGY: COMPANY SNAPSHOT

TABLE 78.DXC TECHNOLOGY: OPERATING SEGMENTS

TABLE 79.DXC TECHNOLOGY: PRODUCT PORTFOLIO

TABLE 80.HCL TECHNOLOGIES.: KEY EXECUTIVE

TABLE 81.HCL TECHNOLOGIES.: COMPANY SNAPSHOT

TABLE 82.HCL TECHNOLOGIES: OPERATING SEGMENTS

TABLE 83.HCL TECHNOLOGIES.: PRODUCT PORTFOLIO

TABLE 84.INTERNATIONAL BUSINESS MACHINES CORPORATION: KEY EXECUTIVE

TABLE 85.INTERNATIONAL BUSINESS MACHINES CORPORATION: COMPANY SNAPSHOT

TABLE 86.INTERNATIONAL BUSINESS MACHINES CORPORATION: OPERATING SEGMENTS

TABLE 87.INTERNATIONAL BUSINESS MACHINES CORPORATION: PRODUCT PORTFOLIO

TABLE 88.MICRO FOCUS: COMPANY SNAPSHOT

TABLE 89.MICRO FOCUS: PRODUCT PORTFOLIO

LIST OF FIGURES

FIGURE 01.KEY MARKET SEGMENTS

FIGURE 02.EUROPE APPLICATION MODERNIZATION SERVICES MARKET, 2019–2027

FIGURE 03.EUROPE APPLICATION MODERNIZATION SERVICES MARKET, BY COUNTRY, 2019-2027

FIGURE 04.TOP IMPACTING FACTORS

FIGURE 05.TOP INVESTMENT POCKETS

FIGURE 06.MODERATE-TO-HIGH BARGAINING POWER OF SUPPLIERS

FIGURE 07.MODERATE BARGAINING POWER OF BUYERS

FIGURE 08.MODERATE-TO-HIGH THREAT OF SUBSTITUTES

FIGURE 09.MODERATE-TO-HIGH THREAT OF NEW ENTRANTS

FIGURE 10.MODERATE-TO-HIGH COMPETITIVE RIVALRY

FIGURE 11.DRIVERS, RESTRAINTS, AND OPPORTUNITIES

FIGURE 12.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE, BY VISITOR DEMOGRAPHIC, 2019-2027($MILLION)

FIGURE 13.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE, BY DEPLOYMENT MODE, 2019-2027 ($MILLION)

FIGURE 14.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE, BY ENTERPRISE SIZE, 2019-2027 $MILLION)

FIGURE 15.EUROPE APPLICATION MODERNIZATION SERVICES MARKET REVENUE, BY INDUSTRY VERTICAL, 2019-2027 ($MILLION)

FIGURE 16.AUSTRIA APPLICATION MODERNIZATION SERVICESS MARKET, 2019–2027 ($MILLION)

FIGURE 17.GERMANY APPLICATION MODERNIZATION SERVICESS MARKET, 2019–2027 ($MILLION)

FIGURE 18.SWITZERLAND APPLICATION MODERNIZATION SERVICESS MARKET, 2019–2027 ($MILLION)

FIGURE 19.UK APPLICATION MODERNIZATION SERVICESS MARKET, 2019–2027 ($MILLION)

FIGURE 20.FRANCE APPLICATION MODERNIZATION SERVICESS MARKET, 2019–2027 ($MILLION)

FIGURE 21.REST OF EUROPE APPLICATION MODERNIZATION SERVICESS MARKET, 2019–2027 ($MILLION)

FIGURE 22.EUROPE APPLICATION MODERNIZATION SERVICES MARKET: KEY PLAYER POSITIONING, 2019

FIGURE 23.TOP WINNING STRATEGIES, BY YEAR, 2017-2020

FIGURE 24.TOP WINNING STRATEGIES, BY DEVELOPMENT, 2017-2020

FIGURE 25.TOP WINNING STRATEGIES, BY COMPANY, 2017-2020

FIGURE 26.COMPETITIVE DASHBOARD

FIGURE 27.COMPETITIVE DASHBOARD

FIGURE 28.COMPETITIVE HEATMAP OF KEY PLAYERS

FIGURE 29.R&D EXPENDITURE, 2017–2019 ($MILLION)

FIGURE 30.ACCENTURE: REVENUE, 2017–2019 ($MILLION)

FIGURE 31.ACCENTURE: REVENUE SHARE BY OPERATING SEGMENT, 2019 (%)

FIGURE 32.ACCENTURE: REVENUE SHARE BY REGION, 2019 (%)

FIGURE 33.R&D EXPENDITURE, 2017–2019 ($MILLION)

FIGURE 34.ATOS: REVENUE, 2017–2019 ($MILLION)

FIGURE 35.ATOS: REVENUE SHARE BY DIVISION, 2019 (%)

FIGURE 36.ATOS: REVENUE SHARE BY BUSINESS UNIT, 2019 (%)

FIGURE 37.CAPGEMINI: REVENUE, 2017–2019 ($MILLION)

FIGURE 38.CAPGEMINI: REVENUE SHARE BY REGION, 2019 (%)

FIGURE 39.DXC TECHNOLOGY: REVENUE, 2018–2020 ($MILLION)

FIGURE 40.DXC TECHNOLOGY: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 41.DXC TECHNOLOGY: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 42.HCL TECHNOLOGIES: REVENUE, 2018–2020 ($MILLION)

FIGURE 43.HCL TECHNOLOGIES: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 44.HCL TECHNOLOGIES: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 45.R&D EXPENDITURE, 2017–2019 ($MILLION)

FIGURE 46.INTERNATIONAL BUSINESS MACHINES CORPORATION: REVENUE, 2017–2019 ($MILLION)

FIGURE 47.INTERNATIONAL BUSINESS MACHINES CORPORATION: REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 48.INTERNATIONAL BUSINESS MACHINES CORPORATION: REVENUE SHARE BY REGION, 2019 (%)

FIGURE 49.MICRO FOCUS: KEY EXECUTIVE

FIGURE 50.R&D EXPENDITURE, 2017–2019 ($MILLION)

FIGURE 51.MICRO FOCUS: REVENUE, 2017–2019 ($MILLION)

FIGURE 52.MICRO FOCUS: REVENUE SHARE BY REGION, 2019 (%)

$4290

$8186

HAVE A QUERY?

OUR CUSTOMER