The global micromobility market was valued at USD 40.19 Billion in 2020, and is projected to reach USD 195.42 Billion by 2030, registering a CAGR of 17.4% from 2021 to 2030.

The growing popularity of on-demand transport services, government efforts for smart cities, and an increase in venture capital and strategic investments are some of the key factors driving the micromobility market's growth. In order to commute within a 10 km radius, micromobility refers to a variety of small, lightweight vehicles that operate at a maximum speed of 15 mph (25 km/h).

An increase in pollution levels, increased urbanization, a cost-effective means of transportation, and growing environmental awareness are other reasons propelling the micromobility market's expansion. Additionally, the industry is anticipated to grow over the long run as more individuals switch to micromobility forms of transit as a result of worries about their health, cleanliness, and social isolation following an initial delay brought on by covid-induced lockdowns.

Get Chapterwise Report with Affordable Price

Other factors driving the growth of the micromobilty market are an increase in pollution levels, rapid urbanization, a cost-efficient mode of transportation, and growing concern for environmental impact. Moreover, after an initial slowdown due to covid induced lockdowns the market is expected to rise further in the long term as health, hygiene, and social distancing concerns encourage more people to shift to micromobility modes of transportation.

Due to rising pollution levels, growing environmental consciousness, and escalating traffic in major centers, the demand for micromobility will only rise as urbanization does. Bicycles, scooters, mopeds, skateboards, and other micromobility forms of transportation offer much-needed simple access to public infrastructure, lessen the total environmental impact, and are significantly less expensive than conventional modes of transportation. Thus, rising environmental concerns will fuel the micromobility market's expansion throughout the course of the projected period.

E-bikes and e-kick scooters are two examples of on-demand micromobility services that offer flexibility, fare comparison, and other features like real-time feedback, review ratings, etc. Furthermore, location, pricing, and demand-supply determination have all gotten much simpler with the introduction of numerous mobile applications. As a result, the micromobility market is expanding and will keep expanding over the course of the projected period due to the growing demand for transport services related to micromobility.

The expansion of the industry is also being fueled by increased government efforts and assistance for the construction of smart cities with the requisite bike infrastructure, etc. The micromobility market is expanding and will keep expanding over the course of the projection period as a result of initiatives including constructing temporary bike lanes, expanding public open spaces, and prohibiting motorized cars from some routes. Major governments all over the world are radically altering the transport infrastructure in major cities to provide room for bicyclists and pedestrians, which is further fostering the market for micromobility.

The industry has been given a significant boost by the rise in demand for carpooling and bike sharing among office commuters as well as the existence of major market participants like Uber and Ola. The demand for micromobility transport services has expanded as a result of several offerings, including pick-up and drop-off services, co-passenger information, more convenience, and inexpensive pricing, which is further boosting the micromobility market's expansion. Increased investments are also helping the market expand.

Although covid-induced lockdowns initially caused a decline in the micromobility business, the recovery has been fruitful. As e-bikes, scooters, mopeds, and other types of micromobility offer minimal touch points and improved social distance management, Covid 19 has resulted in an increase in customers in the micromobility industry. Consequently, the market for micromobility is anticipated to grow more as customer preferences change over the course of the projected period.

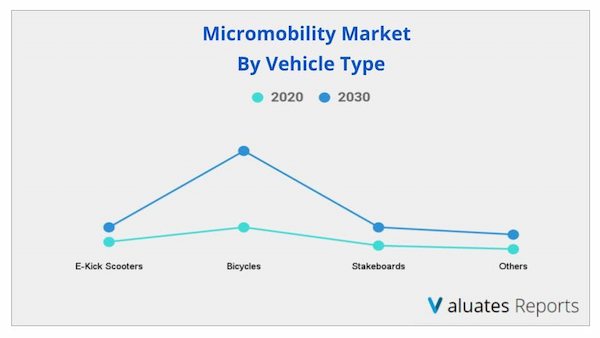

The electric bicycle category, which is based on vehicle type, is anticipated to provide attractive growth prospects during the forecast period since e-bikes are the least expensive means of transportation, resulting in faster acceptance among end users.

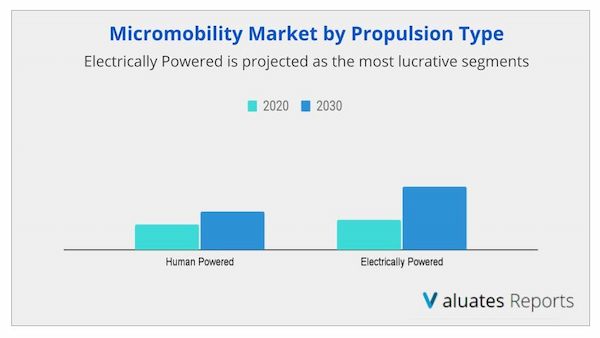

Due to the growing demand for electric-powered micromobility transportation modes, the electrically powered category is anticipated to have the biggest micromobility market share over the projection period.

Based on vehicle type, the electric bicycle segment is expected to provide lucrative opportunities for growth during the forecast period as e-bikes are the cheapest modes of transportation leading to faster adoption among end consumers.

Based on propulsion type, the electrically powered segment is expected to hold the largest micromobility market share during the forecast period due to the rising demand for electric-powered micromobility transportation modes.

| Report Metric | Details |

| Report Name | Micromobility Market |

| The market size in 2021 | USD 40.19 Billion |

| The revenue forecast in 2031 | USD 195.42 Billion |

| Growth Rate | CAGR 6.4% |

| Market size available for years | 2022-2031 |

| Forecast units | Value (USD) |

| Segments covered | Type, Application, Industry, Regions |

| Report coverage | Revenue & volume forecast, company share, competitive landscape, growth factors, and trends |

| Geographic regions covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Ans. Yes, we do provide the option to buy chapters in a report. We also can customize the report based on your specific requirements.

Ans: The global micromobility market was valued at USD 40.19 Billion in 2020, and is projected to reach USD 195.42 Billion by 2030, registering a CAGR of 17.4% from 2021 to 2030.

Ans: Latin America and Middle East holds the largest market share. LAMEA would exhibit the highest CAGR of 25.9% during 2021-2030.

The key players profiled in the report include Beam Mobility Holdings, Bird, Electricfeel, Dott, Lime, Neuron Mobility, VOI, Yulu, Zagster, and Floatility GmbH as the service providers, which are operating efficiently in the micromobility market.

Ans: Major trends such as rise in trend of on-demand transportation services, government initiatives for smart cities, and rise in venture capital and strategic investments, supplement the growth of the global micromobility market.

CHAPTER 1:INTRODUCTION

1.1.Report description

1.2.Key benefits for stakeholders

1.3.Key market segments

1.4.Research methodology

1.4.1.Primary research

1.4.2.Secondary research

1.4.3.Analyst tools and models

CHAPTER 2:EXECUTIVE SUMMARY

2.1.CXO perspective

CHAPTER 3:MARKET OVERVIEW

3.1.Market definition and scope

3.2.Key findings

3.2.1.Top impacting factors

3.2.2.Top investment pockets

3.2.3.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Low-to-high bargaining power of suppliers

3.3.2.Low-to-high threat of new entrants

3.3.3.Low-to-high threat of substitutes

3.3.4.Moderate-to-high intensity of rivalry

3.3.5.Moderate-to-high bargaining power of buyers

3.4.Key player positioning, 2020 (%)

3.5.Market dynamics

3.5.1.Drivers

3.5.1.1.Rise in trend of on-demand transportation services

3.5.1.2.Government initiatives for smart cities

3.5.1.3.Rise in venture capital and strategic investments

3.5.2.Restraints

3.5.2.1.Low rate of internet penetration in developing regions

3.5.2.2.Rise in bike vandalism & theft

3.5.3.Opportunities

3.5.3.1.Intelligent transportation system

3.5.3.2.Increasing government initiatives for the development of bike-sharing infrastructure

3.6.COVID-19 impact analysis

3.6.1.Evolution of outbreaks

3.6.1.1.SARS

3.6.1.2.COVID-19

3.6.2.Micro-economic impact analysis

3.6.2.1.Consumer trend

3.6.2.2.Technology trend

3.6.2.3.Regulatory trend

3.6.3.Macro-economic impact analysis

3.6.3.1.GDP

3.6.3.2.Import/export analysis

3.6.3.3.Employment index

3.6.4.Impact on the micromobility industry analysis

3.7.Competitive landscape

3.7.1.Competitive dashboard

3.7.2.SWOT analysis

CHAPTER 4:MICROMOBILITY MARKET, BY PROPULSION TYPE

4.1.Overview

4.2.Human powered

4.2.1.Key market trends, growth factors and opportunities

4.2.2.Market size and forecast, by region

4.2.3.Market analysis by country

4.3.Electrically powered

4.3.1.Key market trends, growth factors and opportunities

4.3.2.Market size and forecast, by region

4.3.3.Market analysis by country

CHAPTER 5:MICROMOBILITY MARKET, BY VEHICLE TYPE

5.1.Overview

5.2.E-kick scooters

5.2.1.Key market trends, growth factors and opportunities

5.2.2.Market size and forecast, by region

5.2.3.E-kick scooter market size and forecast, by propulsion type

5.2.4.Market analysis by country

5.3.Bicycles

5.3.1.Key market trends, growth factors and opportunities

5.3.2.Market size and forecast, by region

5.3.3.Bicycle market size and forecast, by propulsion type

5.3.4.Market analysis by country

5.4.Skateboards

5.4.1.Key market trends, growth factors and opportunities

5.4.2.Market size and forecast, by region

5.4.3.Skateboards market size and forecast, by propulsion type

5.4.4.Market analysis by country

5.5.Others

5.5.1.Key market trends, growth factors and opportunities

5.5.2.Market size and forecast, by region

5.5.3.Others market size and forecast, by propulsion type

5.5.4.Market analysis by country

CHAPTER 6:MICROMOBILITY MARKET, BY SHARING TYPE

6.1.Overview

6.2.Docked

6.2.1.Key market trends, growth factors and opportunities

6.2.2.Market size and forecast, by region

6.2.3.Docked Micromobility Market, by age group

6.2.4.Market analysis by country

6.3.Dock-less

6.3.1.Key market trends, growth factors and opportunities

6.3.2.Market size and forecast, by region

6.3.3.Dock-less Micromobility Market, by age group

6.3.4.Market analysis by country

CHAPTER 7:MICROMOBILITY MARKET, BY AGE GROUP

7.1.Overview

7.2.15-34

7.2.1.Key market trends, growth factors and opportunities

7.2.2.Market size and forecast, by region

7.2.3.Market analysis by country

7.3.35-54

7.3.1.Key market trends, growth factors and opportunities

7.3.2.Market size and forecast, by region

7.3.3.Market analysis by country

7.4.55 and above

7.4.1.Key market trends, growth factors and opportunities

7.4.2.Market size and forecast, by region

7.4.3.Market analysis by country

CHAPTER 8:MICROMOBILITY MARKET, BY REGION

8.1.Overview

8.2.North America

8.2.1.Key market trends, growth factors, and opportunities

8.2.2.Market size and forecast, by propulsion type

8.2.3.Market size and forecast, by vehicle type

8.2.4.North America E-kick scooter micromobility market, by propulsion type

8.2.5.North America bicycle micromobility market, by propulsion type

8.2.6.North America skateboard micromobility market, by propulsion type

8.2.7.North America others micromobility market, by propulsion type

8.2.8.Market size and forecast, by sharing type

8.2.9.North America Docked Micromobility Market, by Age Group

8.2.10.North America Dock-less Micromobility Market, by Age Group

8.2.11.Market size and forecast, by sharing type

8.2.12.Market analysis by country

8.2.12.1.U.S.

8.2.12.1.1.Market size and forecast, by propulsion type

8.2.12.1.2.Market size and forecast, by vehicle type

8.2.12.1.3.Market size and forecast, by sharing type

8.2.12.1.4.Market size and forecast, by age group

8.2.12.2.Canada

8.2.12.2.1.Market size and forecast, by propulsion type

8.2.12.2.2.Market size and forecast, by vehicle type

8.2.12.2.3.Market size and forecast, by sharing type

8.2.12.2.4.Market size and forecast, by age group

8.2.12.3.Mexico

8.2.12.3.1.Market size and forecast, by propulsion type

8.2.12.3.2.Market size and forecast, by vehicle type

8.2.12.3.3.Market size and forecast, by sharing type

8.2.12.3.4.Market size and forecast, by age group

8.3.Europe

8.3.1.Key market trends, growth factors, and opportunities

8.3.2.Market size and forecast, by propulsion type

8.3.3.Market size and forecast, by vehicle type

8.3.4.Europe E-kick scooter micromobility market, by propulsion type

8.3.5.Europe bicycle micromobility market, by propulsion type

8.3.6.Europe skateboard micromobility market, by propulsion type

8.3.7.Europe others micromobility market, by propulsion type

8.3.8.Market size and forecast, by sharing type

8.3.9.Europe Docked Micromobility Market, by Age Group

8.3.10.Europe Dock-less Micromobility Market, by Age Group

8.3.11.Market size and forecast, by sharing type

8.3.12.Market analysis by country

8.3.12.1.UK

8.3.12.1.1.Market size and forecast, by propulsion type

8.3.12.1.2.Market size and forecast, by vehicle type

8.3.12.1.3.Market size and forecast, by sharing type

8.3.12.1.4.Market size and forecast, by age group

8.3.12.2.Germany

8.3.12.2.1.Market size and forecast, by propulsion type

8.3.12.2.2.Market size and forecast, by vehicle type

8.3.12.2.3.Market size and forecast, by sharing type

8.3.12.2.4.Market size and forecast, by age group

8.3.12.3.France

8.3.12.3.1.Market size and forecast, by propulsion type

8.3.12.3.2.Market size and forecast, by vehicle type

8.3.12.3.3.Market size and forecast, by sharing type

8.3.12.3.4.Market size and forecast, by age group

8.3.12.4.Italy

8.3.12.4.1.Market size and forecast, by propulsion type

8.3.12.4.2.Market size and forecast, by vehicle type

8.3.12.4.3.Market size and forecast, by sharing type

8.3.12.4.4.Market size and forecast, by age group

8.3.12.5.Rest of Europe

8.3.12.5.1.Market size and forecast, by propulsion type

8.3.12.5.2.Market size and forecast, by vehicle type

8.3.12.5.3.Market size and forecast, by sharing type

8.3.12.5.4.Market size and forecast, by age group

8.4.Asia-Pacific

8.4.1.Key market trends, growth factors, and opportunities

8.4.2.Market size and forecast, by propulsion type

8.4.3.Market size and forecast, by vehicle type

8.4.4.Asia-Pacific E-kick scooter micromobility market, by propulsion type

8.4.5.Asia-Pacific bicycle micromobility market, by propulsion type

8.4.6.Asia-Pacific skateboard micromobility market, by propulsion type

8.4.7.Asia-Pacific others micromobility market, by propulsion type

8.4.8.Market size and forecast, by sharing type

8.4.9.Asia-Pacific Docked Micromobility Market, by Age Group

8.4.10.Asia-Pacific Dock-less Micromobility Market, by Age Group

8.4.11.Market size and forecast, by sharing type

8.4.12.Market analysis by country

8.4.12.1.China

8.4.12.1.1.Market size and forecast, by propulsion type

8.4.12.1.2.Market size and forecast, by vehicle type

8.4.12.1.3.Market size and forecast, by sharing type

8.4.12.1.4.Market size and forecast, by age group

8.4.12.2.Japan

8.4.12.2.1.Market size and forecast, by propulsion type

8.4.12.2.2.Market size and forecast, by vehicle type

8.4.12.2.3.Market size and forecast, by sharing type

8.4.12.2.4.Market size and forecast, by age group

8.4.12.3.India

8.4.12.3.1.Market size and forecast, by propulsion type

8.4.12.3.2.Market size and forecast, by vehicle type

8.4.12.3.3.Market size and forecast, by sharing type

8.4.12.3.4.Market size and forecast, by age group

8.4.12.4.South Korea

8.4.12.4.1.Market size and forecast, by propulsion type

8.4.12.4.2.Market size and forecast, by vehicle type

8.4.12.4.3.Market size and forecast, by sharing type

8.4.12.4.4.Market size and forecast, by age group

8.4.12.5.Rest of Asia-Pacific

8.4.12.5.1.Market size and forecast, by propulsion type

8.4.12.5.2.Market size and forecast, by vehicle type

8.4.12.5.3.Market size and forecast, by sharing type

8.4.12.5.4.Market size and forecast, by age group

8.5.LAMEA

8.5.1.Key market trends, growth factors, and opportunities

8.5.2.Market size and forecast, by propulsion type

8.5.3.Market size and forecast, by vehicle type

8.5.4.LAMEA E-kick scooter micromobility market, by propulsion type

8.5.5.LAMEA bicycle micromobility market, by propulsion type

8.5.6.LAMEA skateboard micromobility market, by propulsion type

8.5.7.LAMEA others micromobility market, by propulsion type

8.5.8.Market size and forecast, by sharing type

8.5.9.LAMEA Docked Micromobility Market, by Age Group

8.5.10.LAMEA Dock-less Micromobility Market, by Age Group

8.5.11.Market size and forecast, by sharing type

8.5.12.Market analysis by country

8.5.12.1.Latin America

8.5.12.1.1.Market size and forecast, by propulsion type

8.5.12.1.2.Market size and forecast, by vehicle type

8.5.12.1.3.Market size and forecast, by sharing type

8.5.12.1.4.Market size and forecast, by age group

8.5.12.2.Middle East

8.5.12.2.1.Market size and forecast, by propulsion type

8.5.12.2.2.Market size and forecast, by vehicle type

8.5.12.2.3.Market size and forecast, by sharing type

8.5.12.2.4.Market size and forecast, by age group

8.5.12.3.Africa

8.5.12.3.1.Market size and forecast, by propulsion type

8.5.12.3.2.Market size and forecast, by vehicle type

8.5.12.3.3.Market size and forecast, by sharing type

8.5.12.3.4.Market size and forecast, by age group

CHAPTER 9:COMPANY PROFILES

9.1.Beam Mobility Holdings Pte. Ltd.

9.1.1.Company overview

9.1.2.Company snapshot

9.1.3.Product portfolio

9.1.4.Key strategic moves and developments

9.2.Bird Rides

9.2.1.Company overview

9.2.2.Company snapshot

9.2.3.Product portfolio

9.2.4.Key strategic moves and developments

9.3.Electricfeel

9.3.1.Company overview

9.3.2.Company snapshot

9.3.3.Product portfolio

9.3.4.Key strategic moves and developments

9.4.Dott

9.4.1.Company overview

9.4.2.Company snapshot

9.4.3.Product portfolio

9.4.4.Key strategic moves and developments

9.5.Lime

9.5.1.Company overview

9.5.2.Company snapshot

9.5.3.Product portfolio

9.6.Neuron

9.6.1.Company overview

9.6.2.Company snapshot

9.6.3.Product portfolio

9.6.4.Key strategic moves and developments

9.7.VOI

9.7.1.Company overview

9.7.2.Company snapshot

9.7.3.Product portfolio

9.8.Yulu Bikes Pvt Ltd

9.8.1.Company overview

9.8.2.Company snapshot

9.8.3.Product portfolio

9.9.Zagster

9.9.1.Company overview

9.9.2.Company snapshot

9.9.3.Product portfolio

9.9.4.Key strategic moves and developments

9.10.Floatility GmbH

9.10.1.Company overview

9.10.2.Company snapshot

9.10.3.Product portfolio

LIST OF TABLES

TABLE 01.MACRO-ECONOMIC INDICATORS PROJECTIONS (1/2):

TABLE 02.MACRO-ECONOMIC INDICATORS PROJECTIONS (1/2):

TABLE 03.GLOBAL MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020-2030 ($MILLION)

TABLE 04.MICROMOBILITY MARKET REVENUE FOR HUMAN POWERED, BY REGION 2020–2030 ($MILLION)

TABLE 05.MICROMOBILITY MARKET REVENUE FOR ELECTRICALLY POWERED, BY REGION 2020–2030 ($MILLION)

TABLE 06.GLOBAL MICROMOBILITY MARKET, BY VEHICLE TYPE, 2020-2030 ($MILLION)

TABLE 07.MICROMOBILITY MARKET REVENUE FOR E-KICK SCOOTERS, BY REGION 2020–2030 ($MILLION)

TABLE 08.MICROMOBILITY MARKET REVENUE FOR E-KICK SCOOTERS, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 09.MICROMOBILITY MARKET REVENUE FOR BICYCLES, BY REGION 2020–2030 ($MILLION)

TABLE 10.MICROMOBILITY MARKET REVENUE FOR BICYCLE, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 11.MICROMOBILITY MARKET REVENUE FOR SKATEBOARDS, BY REGION 2020–2030 ($MILLION)

TABLE 12.MICROMOBILITY MARKET REVENUE FOR SKATEBOARDS, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 13.MICROMOBILITY MARKET REVENUE FOR OTHERS, BY REGION 2020–2030 ($MILLION)

TABLE 14.MICROMOBILITY MARKET REVENUE FOR OTHERS, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 15.GLOBAL MICROMOBILITY MARKET, BY SHARING TYPE, 2020-2030 ($MILLION)

TABLE 16.MICROMOBILITY MARKET REVENUE FOR DOCKED, BY REGION 2020–2030 ($MILLION)

TABLE 17.DOCKED MICROMOBILITY MARKET REVENUE, BY AGE GROUP 2020–2030 ($MILLION)

TABLE 18.MICROMOBILITY MARKET REVENUE FOR DOCK-LESS, BY REGION 2020–2030 ($MILLION)

TABLE 19.DOCK-LESS MICROMOBILITY MARKET REVENUE, BY AGE GROUP 2020–2030 ($MILLION)

TABLE 20.GLOBAL MICROMOBILITY MARKET, BY AGE GROUP, 2020-2030 ($MILLION)

TABLE 21.MICROMOBILITY MARKET REVENUE FOR 15-34, BY REGION 2020–2030 ($MILLION)

TABLE 22.MICROMOBILITY MARKET REVENUE FOR 35-54, BY REGION 2020–2030 ($MILLION)

TABLE 23.MICROMOBILITY MARKET REVENUE FOR 55 AND ABOVE, BY REGION 2020–2030 ($MILLION)

TABLE 24.NORTH AMERICA MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 25.NORTH AMERICA MICROMOBILITY MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 26.NORTH AMERICA E-KICK SCOOTER MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 27.NORTH AMERICA BICYCLE MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 28.NORTH AMERICA SKATEBOARD MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 29.NORTH AMERICA OTHERS MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 30.NORTH AMERICA MICROMOBILITY MARKET, BY SHARING TYPE, 2020–2030 ($MILLION)

TABLE 31.NORTH AMERICA DOCKED MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 32.NORTH AMERICA DOCK-LESS MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 33.NORTH AMERICA MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 34.U.S. MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 35.U.S. MICROMOBILITY MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 36.U.S. MICROMOBILITY MARKET, BY SHARING TYPE, 2020–2030 ($MILLION)

TABLE 37.U.S. MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 38.CANADA MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 39.CANADA MICROMOBILITY MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 40.CANADA MICROMOBILITY MARKET, BY SHARING TYPE, 2020–2030 ($MILLION)

TABLE 41.CANADA MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 42.MEXICO MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 43.MEXICO MICROMOBILITY MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 44.MEXICO MICROMOBILITY MARKET, BY SHARING TYPE, 2020–2030 ($MILLION)

TABLE 45.MEXICO MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 46.EUROPE MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 47.EUROPE MICROMOBILITY MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 48.EUROPE E-KICK SCOOTER MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 49.EUROPE BICYCLE MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 50.EUROPE SKATEBOARD MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 51.EUROPE OTHERS MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 52.EUROPE MICROMOBILITY MARKET, BY SHARING TYPE, 2020–2030 ($MILLION)

TABLE 53.EUROPE DOCKED MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 54.EUROPE DOCK-LESS MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 55.EUROPE MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 56.UK MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 57.UK MICROMOBILITY MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 58.UK MICROMOBILITY MARKET, BY SHARING TYPE, 2020–2030 ($MILLION)

TABLE 59.UK MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 60.GERMANY MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 61.GERMANY MICROMOBILITY MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 62.GERMANY MICROMOBILITY MARKET, BY SHARING TYPE, 2020–2030 ($MILLION)

TABLE 63.GERMANY MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 64.FRANCE MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 65.FRANCE MICROMOBILITY MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 66.FRANCE MICROMOBILITY MARKET, BY SHARING TYPE, 2020–2030 ($MILLION)

TABLE 67.FRANCE MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 68.ITALY MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 69.ITALY MICROMOBILITY MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 70.ITALY MICROMOBILITY MARKET, BY SHARING TYPE, 2020–2030 ($MILLION)

TABLE 71.ITALY MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 72.REST OF EUROPE MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 73.REST OF EUROPE MICROMOBILITY MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 74.REST OF EUROPE MICROMOBILITY MARKET, BY SHARING TYPE, 2020–2030 ($MILLION)

TABLE 75.REST OF EUROPE MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 76.ASIA-PACIFIC MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 77.ASIA-PACIFIC MICROMOBILITY MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 78.ASIA-PACIFIC E-KICK SCOOTER MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 79.ASIA-PACIFIC BICYCLE MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 80.ASIA-PACIFIC SKATEBOARD MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 81.ASIA-PACIFIC OTHERS MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 82.ASIA-PACIFIC MICROMOBILITY MARKET, BY SHARING TYPE, 2020–2030 ($MILLION)

TABLE 83.ASIA-PACIFIC DOCKED MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 84.ASIA-PACIFIC DOCK-LESS MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 85.ASIA-PACIFIC MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 86.CHINA MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 87.CHINA MICROMOBILITY MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 88.CHINA MICROMOBILITY MARKET, BY SHARING TYPE, 2020–2030 ($MILLION)

TABLE 89.CHINA MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 90.JAPAN MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 91.JAPAN MICROMOBILITY MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 92.JAPAN MICROMOBILITY MARKET, BY SHARING TYPE, 2020–2030 ($MILLION)

TABLE 93.JAPAN MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 94.INDIA MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 95.INDIA MICROMOBILITY MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 96.INDIA MICROMOBILITY MARKET, BY SHARING TYPE, 2020–2030 ($MILLION)

TABLE 97.INDIA MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 98.SOUTH KOREA MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 99.SOUTH KOREA MICROMOBILITY MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 100.SOUTH KOREA MICROMOBILITY MARKET, BY SHARING TYPE, 2020–2030 ($MILLION)

TABLE 101.SOUTH KOREA MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 102.REST OF ASIA-PACIFIC MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 103.REST OF ASIA-PACIFIC MICROMOBILITY MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 104.REST OF ASIA-PACIFIC MICROMOBILITY MARKET, BY SHARING TYPE, 2020–2030 ($MILLION)

TABLE 105.REST OF ASIA-PACIFIC MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 106.LAMEA MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 107.LAMEA MICROMOBILITY MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 108.LAMEA E-KICK SCOOTER MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 109.LAMEA BICYCLE MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 110.LAMEA SKATEBOARD MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 111.LAMEA OTHERS MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 112.LAMEA MICROMOBILITY MARKET, BY SHARING TYPE, 2020–2030 ($MILLION)

TABLE 113.LAMEA DOCKED MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 114.LAMEA DOCK-LESS MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 115.LAMEA MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 116.LATIN AMERICA MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 117.LATIN AMERICA MICROMOBILITY MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 118.LATIN AMERICA MICROMOBILITY MARKET, BY SHARING TYPE, 2020–2030 ($MILLION)

TABLE 119.LATIN AMERICA MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 120.MIDDLE EAST MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 121.MIDDLE EAST MICROMOBILITY MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 122.MIDDLE EAST MICROMOBILITY MARKET, BY SHARING TYPE, 2020–2030 ($MILLION)

TABLE 123.MIDDLE EAST MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 124.AFRICA MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020–2030 ($MILLION)

TABLE 125.AFRICA MICROMOBILITY MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 126.AFRICA MICROMOBILITY MARKET, BY SHARING TYPE, 2020–2030 ($MILLION)

TABLE 127.AFRICA MICROMOBILITY MARKET, BY AGE GROUP, 2020–2030 ($MILLION)

TABLE 128.BEAM MOBILITY HOLDINGS PTE. LTD.: COMPANY SNAPSHOT

TABLE 129.BEAM MOBILITY HOLDINGS PTE. LTD.: PRODUCT PORTFOLIO

TABLE 130.BEAM MOBILITY HOLDINGS PTE. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 131.BIRD RIDES: COMPANY SNAPSHOT

TABLE 132.BIRD RIDES: PRODUCT PORTFOLIO

TABLE 133.BIRD RIDES: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 134.ELECTRICFEEL: COMPANY SNAPSHOT

TABLE 135.ELECTRICFEEL: PRODUCT PORTFOLIO

TABLE 136.ELECTRICFEEL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 137.DOTT: COMPANY SNAPSHOT

TABLE 138.DOTT: PRODUCT PORTFOLIO

TABLE 139.DOTT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 140.LIME: COMPANY SNAPSHOT

TABLE 141.LIME: PRODUCT PORTFOLIO

TABLE 142.NEURON: COMPANY SNAPSHOT

TABLE 143.NEURON: PRODUCT PORTFOLIO

TABLE 144.NEURON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 145.VOI TECHNOLOGIES LTD: COMPANY SNAPSHOT

TABLE 146.VOI TECHNOLOGIES LTD: PRODUCT PORTFOLIO

TABLE 147.YULU BIKES: COMPANY SNAPSHOT

TABLE 148.YULU BIKES: PRODUCT PORTFOLIO

TABLE 149.ZAGSTER CORPORATION: COMPANY SNAPSHOT

TABLE 150.ZAGSTER CORPORATION: PRODUCT PORTFOLIO

TABLE 151.ZAGSTER CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 152.FLOATILITY GMBH: COMPANY SNAPSHOT

TABLE 153.FLOATILITY GMBH: PRODUCT PORTFOLIO

LIST OF FIGURES

FIGURE 01.KEY MARKET SEGMENTS

FIGURE 02.EXECUTIVE SUMMARY

FIGURE 03.EXECUTIVE SUMMARY

FIGURE 04.TOP IMPACTING FACTORS

FIGURE 05.TOP INVESTMENT POCKETS

FIGURE 06.TOP WINNING STRATEGIES, BY YEAR, 2018-2021*

FIGURE 07.TOP WINNING STRATEGIES, BY DEVELOPMENT, 2018-2021*

FIGURE 08.TOP WINNING STRATEGIES, BY COMPANY, 2018-2021*

FIGURE 09.KEY PLAYER POSITIONING, 2020 (%)

FIGURE 10.COMPETITIVE DASHBOARD OF TOP 10 KEY PLAYERS (1/2)

FIGURE 11.COMPETITIVE DASHBOARD OF TOP 10 KEY PLAYERS (2/2)

FIGURE 12.SWOT ANALYSIS

FIGURE 13.GLOBAL MICROMOBILITY MARKET, BY PROPULSION TYPE, 2020-2030

FIGURE 14.COMPARATIVE SHARE ANALYSIS OF MICROMOBILITY MARKET FOR HUMAN POWERED, BY COUNTRY, 2020 & 2030 ($MILLON)

FIGURE 15.COMPARATIVE SHARE ANALYSIS OF MICROMOBILITY MARKET FOR ELECTRICALLY POWERED, BY COUNTRY, 2020 & 2030 ($MILLON)

FIGURE 16.GLOBAL MICROMOBILITY MARKET, BY VEHICLE TYPE, 2020-2030

FIGURE 17.COMPARATIVE SHARE ANALYSIS OF MICROMOBILITY MARKET FOR E-KICK SCOOTERS, BY COUNTRY, 2020 & 2030 ($MILLON)

FIGURE 18.COMPARATIVE SHARE ANALYSIS OF MICROMOBILITY MARKET FOR BICYCLES, BY COUNTRY, 2020 & 2030 ($MILLON)

FIGURE 19.COMPARATIVE SHARE ANALYSIS OF MICROMOBILITY MARKET FOR SKATEBOARDS, BY COUNTRY, 2020 & 2030 ($MILLON)

FIGURE 20.COMPARATIVE SHARE ANALYSIS OF MICROMOBILITY MARKET FOR OTHERS, BY COUNTRY, 2020 & 2030 ($MILLON)

FIGURE 21.GLOBAL MICROMOBILITY MARKET, BY SHARING TYPE, 2020-2030

FIGURE 22.COMPARATIVE SHARE ANALYSIS OF MICROMOBILITY MARKET FOR DOCKED, BY COUNTRY, 2020 & 2030 ($MILLON)

FIGURE 23.COMPARATIVE SHARE ANALYSIS OF MICROMOBILITY MARKET FOR DOCK-LESS, BY COUNTRY, 2020 & 2030 ($MILLON)

FIGURE 24.GLOBAL MICROMOBILITY MARKET, BY AGE GROUP, 2020-2030

FIGURE 25.COMPARATIVE SHARE ANALYSIS OF MICROMOBILITY MARKET FOR 15-34, BY COUNTRY, 2020 & 2030 ($MILLON)

FIGURE 26.COMPARATIVE SHARE ANALYSIS OF MICROMOBILITY MARKET FOR 35-54, BY COUNTRY, 2020 & 2030 ($MILLON)

FIGURE 27.COMPARATIVE SHARE ANALYSIS OF MICROMOBILITY MARKET FOR 55 AND ABOVE, BY COUNTRY, 2020 & 2030 ($MILLON)

FIGURE 28.MICROMOBILITY MARKET, BY REGION, 2020-2030 (%)

FIGURE 29.COMPARATIVE SHARE ANALYSIS OF MICROMOBILITY MARKET, BY COUNTRY, 2020–2030 (%)

FIGURE 30.U.S. MICROMOBILITY MARKET, 2020–2030 ($MILLION)

FIGURE 31.CANADA MICROMOBILITY MARKET, 2020–2030 ($MILLION)

FIGURE 32.MEXICO MICROMOBILITY MARKET, 2020–2030 ($MILLION)

FIGURE 33.COMPARATIVE SHARE ANALYSIS OF MICROMOBILITY MARKET, BY COUNTRY, 2020–2030 (%)

FIGURE 34.UK MICROMOBILITY MARKET, 2020–2030 ($MILLION)

FIGURE 35.GERMANY MICROMOBILITY MARKET, 2020–2030 ($MILLION)

FIGURE 36.FRANCE MICROMOBILITY MARKET, 2020–2030 ($MILLION)

FIGURE 37.ITALY MICROMOBILITY MARKET, 2020–2030 ($MILLION)

FIGURE 38.REST OF EUROPE MICROMOBILITY MARKET, 2020–2030 ($MILLION)

FIGURE 39.COMPARATIVE SHARE ANALYSIS OF MICROMOBILITY MARKET, BY COUNTRY, 2020–2030 (%)

FIGURE 40.CHINA MICROMOBILITY MARKET, 2020–2030 ($MILLION)

FIGURE 41.JAPAN MICROMOBILITY MARKET, 2020–2030 ($MILLION)

FIGURE 42.INDIA MICROMOBILITY MARKET, 2020–2030 ($MILLION)

FIGURE 43.SOUTH KOREA MICROMOBILITY MARKET, 2020–2030 ($MILLION)

FIGURE 44.REST OF ASIA-PACIFIC MICROMOBILITY MARKET, 2020–2030 ($MILLION)

FIGURE 45.COMPARATIVE SHARE ANALYSIS OF MICROMOBILITY MARKET, BY COUNTRY, 2020–2030 (%)

FIGURE 46.LATIN AMERICA MICROMOBILITY MARKET, 2020–2030 ($MILLION)

FIGURE 47.MIDDLE EAST MICROMOBILITY MARKET, 2020–2030 ($MILLION)

FIGURE 48.AFRICA MICROMOBILITY MARKET, 2020–2030 ($MILLION)

$5769

$9995

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS