The global lithium-ion battery market size was valued at USD 46.2 billion in 2022, and the lithium-ion battery industry is projected to reach USD 189.4 billion by 2032, growing at a CAGR of 15.2% from 2023 to 2032.

Costs associated with producing lithium-ion batteries have decreased when the batteries are produced in greater quantities due to economies of scale. In addition to consumer electronics and electric vehicles, lithium-ion batteries are now more reasonably priced and suited for a number of applications, including energy storage systems for homes and businesses.

The sector received a boost from government stimulus plans and programs that supported electric and renewable transportation. The demand for lithium-ion batteries was also spurred by the growing need for large-scale batteries and other power storage options.

The global trend toward cleaner, more sustainable forms of transportation has led to an increase in the popularity of electric cars. Since lithium-ion batteries have better energy densities, greater driving ranges, and faster charging rates, they are the preferred energy storage choice for EVs. Governments and customers are giving environmental sustainability a higher emphasis, which has increased demand for electric vehicles. As a result, the market for lithium-ion batteries has grown significantly. The growing usage of smartphones, tablets, laptops, and wearable technologies has greatly aided the expansion of the Lithium-ion battery business. Lithium-ion batteries are the ideal choice for these devices' demand for efficient and portable power sources due to their high energy density and rechargeability.

Lithium-ion batteries play a significant role in grid-level energy storage solutions. As the usage of renewable energy sources like solar and wind grows, reliable and efficient energy storage devices are increasingly needed to balance changes in supply and demand. Lithium-ion batteries' scalable and high-performance energy storage choices, which also improve system stability, enable the integration of renewable energy sources into power networks. Due to continual scientific advancements, lithium-ion batteries now offer significantly improved performance, safety, and cost-effectiveness. Improvements in electrode materials, electrolytes, and cell architecture have enabled higher energy densities, faster charging rates, and more safety features.

In addition to electric cars, a number of other industries are electrifying themselves more and more in order to reduce their carbon footprint and costs. In forklifts, material handling equipment, and marine boats, for instance, lithium-ion batteries perform better, endure longer, and need less maintenance than traditional lead-acid batteries. Many governments around the world have put incentives and enabling laws into place to encourage the use of lithium-ion batteries and the switch to more environmentally friendly energy sources. Subsidies, tax credits, and grants for electric vehicles and renewable energy storage systems have considerably benefited the growth of the lithium-ion battery industry.

Impact of Russia-Ukraine War on Global Lithium-Ion Battery Market

The lithium-ion battery industry may be significantly impacted by the conflict between Russia and Ukraine. Ukraine is a major supplier of lithium, cobalt, and nickel, three essential minerals and metals required for the manufacture of batteries. If mining operations or transport routes in Ukraine or neighboring countries are disrupted by the conflict, this could lead to higher prices and supply constraints for lithium-ion batteries. Additionally, the geopolitical effects of the conflict can make it more difficult for investors to make choices in the battery sector.

Impact of Global Recession on Global Lithium-Ion Battery Market

In 2023, a global recession is expected to have a significant negative influence on the lithium-ion battery industry. During a financial downturn, consumer spending frequently decreases, company investments fall, and overall financial activity slows down. The military, defense, maritime, and offshore industries, among others, are predicted to experience a direct impact from these factors on the demand for lithium-ion batteries.

The market expansion has actually slowed down, which is the first notable result. Due to rising costs for new ventures and declining consumer purchasing power, lithium-ion batteries are in demand. The slower rate of growth could have an effect on the global market expansion, which could lead to decreased earnings and sales.

Furthermore, projects that require lithium-ion batteries may be delayed or abandoned, which would hurt the market. Economic ambiguity during a recession can occasionally lead to enterprises delaying investments and giving priority to cost-cutting initiatives. Initiatives like electrifying security vehicles or integrating renewable energy into maritime and offshore usage may therefore experience delays or possibly be put on hold.

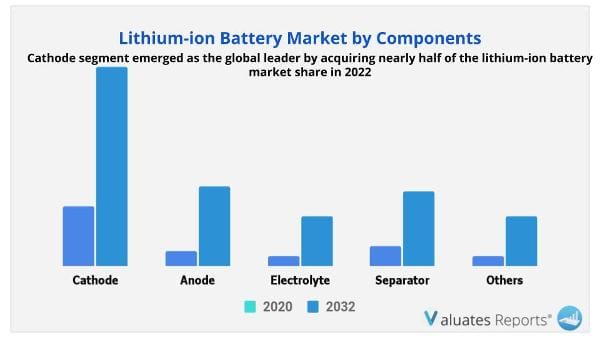

By dominating around half of the lithium-ion battery market in 2022, the cathode industry rose to the top of the global components division. The movement toward electric transportation has had a considerable impact on the cathode market. The demand for high-performance cathode materials with improved energy density and longer lifetimes is growing along with the popularity of EVs.

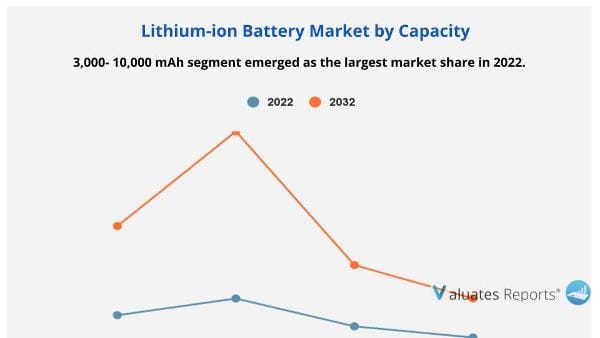

The market share leader in 2022 was the category with capacities between 3,000 and 10,000 mAh. As the market for portable devices, such as smartphones and wearables, expands, compact and lightweight batteries are in high demand. Due to the rising demand for energy storage solutions in the renewable energy industry, these batteries are perfect for storing and supplying clean energy.

Based on application, the automotive sector was found to hold the most market share in 2022. The market for lithium-ion batteries used in automotive applications is being propelled by the expansion of the electric vehicle market, technological advancements, and the establishment of a charging infrastructure. Government subsidies support the growth of the lithium-ion battery industry. Environmental concerns are the main factor driving demand for electric vehicles.

Lithium-ion battery production is largely centered in Asia Pacific, which currently holds the majority of the global market share. China, Japan, and South Korea are among the countries leading the development of lithium-ion batteries. The Asia Pacific lithium-ion battery market has grown as a result of the region's strong electronics manufacturing industry as well as the increasing demand for electric vehicles.

| Report Metric | Details |

| Report Name | Global Lithium Ion Battery Market |

| Base Year | 2022 |

| Forecasted years | 2023-2032 |

| By Company |

Panasonic Corporation, A123 Systems LLC, Hitachi, Ltd., GS Yuasa International Ltd., SAMSUNG SDI CO., LTD., Toshiba Corporation., Saft Groupe S.A., CATL, BYD Co., Ltd., LG Chem |

| Segment by Component |

|

| Segment by Capacity |

|

| Segment by Application |

|

| CAGR | 15.2% |

| Forecast units | USD billion in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Ans. The global lithium-ion battery market size was valued at $46.2 billion in 2022, and lithium-ion battery industry is projected to reach $189.4 billion by 2032, growing at a CAGR of 15.2% from 2023 to 2032.

Ans. The global lithium-ion battery market is expected to grow at a compound annual growth rate of 15.2% from 2023 to 2032.

Ans. Panasonic Corporation, A123 Systems LLC, Hitachi, Ltd., GS Yuasa International Ltd., SAMSUNG SDI CO., LTD., Toshiba Corporation., Saft Groupe S.A., CATL, BYD Co., Ltd., LG Chem.

Ans. The increase in future applications of lithium-ion batteries in a variety of industries, consisting of electric vehicles, consumer electronics, and renewable energy storage, has paved the way for tremendous advancements in energy storage technology.

Ans. On the basis of component, the cathode segment emerged as the global leader by acquiring nearly half of the lithium-ion battery market share in 2022.

Ans. On the basis of capacity, the 3,000- 10,000 mAh segment emerged as the largest market share in 2022.

Ans. On the basis of application, the automotive segment emerged as the largest market share in 2022.

CHAPTER 1: INTRODUCTION

1.1. Report description

1.2. Key market segments

1.3. Key benefits to the stakeholders

1.4. Research Methodology

1.4.1. Primary research

1.4.2. Secondary research

1.4.3. Analyst tools and models

CHAPTER 2: EXECUTIVE SUMMARY

2.1. CXO Perspective

CHAPTER 3: MARKET OVERVIEW

3.1. Market definition and scope

3.2. Key findings

3.2.1. Top impacting factors

3.2.2. Top investment pockets

3.3. Porter’s five forces analysis

3.3.1. Moderate bargaining power of suppliers

3.3.2. High threat of new entrants

3.3.3. Moderate threat of substitutes

3.3.4. High intensity of rivalry

3.3.5. Moderate bargaining power of buyers

3.4. Market dynamics

3.4.1. Drivers

3.4.1.1. Growth in demand for electric vehicles (EVs)

3.4.1.2. Consumer electronics proliferation

3.4.1.3. Increase in energy storage installations

3.4.1.4. Advancements in battery technology

3.4.1.5. Renewable energy integration

3.4.2. Restraints

3.4.2.1. High cost

3.4.2.2. Safety concerns

3.4.3. Opportunities

3.4.3.1. Renewable energy storage

3.4.3.2. Electric vehicle penetration in emerging markets

3.5. COVID-19 Impact Analysis on the market

3.6. Key Regulation Analysis

3.7. Value Chain Analysis

3.8. Components of a Lithium-ion Battery

3.9. Cost components of a Lithium-Ion Battery

CHAPTER 4: LITHIUM-ION BATTERY MARKET, BY COMPONENT

4.1. Overview

4.1.1. Market size and forecast

4.2. Cathode

4.2.1. Key market trends, growth factors and opportunities

4.2.2. Market size and forecast, by region

4.2.3. Market share analysis by country

4.2.4. Cathode Lithium-ion Battery Market by Type

4.2.4.1. Lithium-Iron Phosphate Market size and forecast, by region

4.2.4.2. Lithium-Iron Phosphate Market size and forecast, by country

4.2.4.3. Lithium-Manganese Oxide Market size and forecast, by region

4.2.4.4. Lithium-Manganese Oxide Market size and forecast, by country

4.2.4.5. Lithium-Nickel-Cobalt-Aluminum Oxide Market size and forecast, by region

4.2.4.6. Lithium-Nickel-Cobalt-Aluminum Oxide Market size and forecast, by country

4.2.4.7. Lithium-Nickel-Manganese Cobalt Market size and forecast, by region

4.2.4.8. Lithium-Nickel-Manganese Cobalt Market size and forecast, by country

4.2.4.9. Lithium-Titanate Oxide Market size and forecast, by region

4.2.4.10. Lithium-Titanate Oxide Market size and forecast, by country

4.3. Anode

4.3.1. Key market trends, growth factors and opportunities

4.3.2. Market size and forecast, by region

4.3.3. Market share analysis by country

4.4. Electrolyte

4.4.1. Key market trends, growth factors and opportunities

4.4.2. Market size and forecast, by region

4.4.3. Market share analysis by country

4.5. Separator

4.5.1. Key market trends, growth factors and opportunities

4.5.2. Market size and forecast, by region

4.5.3. Market share analysis by country

4.6. Others

4.6.1. Key market trends, growth factors and opportunities

4.6.2. Market size and forecast, by region

4.6.3. Market share analysis by country

CHAPTER 5: LITHIUM-ION BATTERY MARKET, BY CAPACITY

5.1. Overview

5.1.1. Market size and forecast

5.2. 0-3,000 mAh

5.2.1. Key market trends, growth factors and opportunities

5.2.2. Market size and forecast, by region

5.2.3. Market share analysis by country

5.3. 3,000- 10,000 mAh

5.3.1. Key market trends, growth factors and opportunities

5.3.2. Market size and forecast, by region

5.3.3. Market share analysis by country

5.4. 10,000- 60,000 mAh

5.4.1. Key market trends, growth factors and opportunities

5.4.2. Market size and forecast, by region

5.4.3. Market share analysis by country

5.5. 100,000 mAh and Above

5.5.1. Key market trends, growth factors and opportunities

5.5.2. Market size and forecast, by region

5.5.3. Market share analysis by country

CHAPTER 6: LITHIUM-ION BATTERY MARKET, BY APPLICATION

6.1. Overview

6.1.1. Market size and forecast

6.2. Electrical and Electronics

6.2.1. Key market trends, growth factors and opportunities

6.2.2. Market size and forecast, by region

6.2.3. Market share analysis by country

6.2.4. Electrical and Electronics Lithium-ion Battery Market by Application

6.2.4.1. Smartphones and Tablet/PC Market size and forecast, by region

6.2.4.2. Smartphones and Tablet/PC Market size and forecast, by country

6.2.4.3. UPS Market size and forecast, by region

6.2.4.4. UPS Market size and forecast, by country

6.2.4.5. Others Market size and forecast, by region

6.2.4.6. Others Market size and forecast, by country

6.3. Automotive

6.3.1. Key market trends, growth factors and opportunities

6.3.2. Market size and forecast, by region

6.3.3. Market share analysis by country

6.3.4. Automotive Lithium-ion Battery Market by Application

6.3.4.1. Cars, Buses and Trucks Market size and forecast, by region

6.3.4.2. Cars, Buses and Trucks Market size and forecast, by country

6.3.4.3. Scooters and Bikes Market size and forecast, by region

6.3.4.4. Scooters and Bikes Market size and forecast, by country

6.3.4.5. Trains and Aircraft Market size and forecast, by region

6.3.4.6. Trains and Aircraft Market size and forecast, by country

6.4. Industrial

6.4.1. Key market trends, growth factors and opportunities

6.4.2. Market size and forecast, by region

6.4.3. Market share analysis by country

6.4.4. Industrial Lithium-ion Battery Market by Application

6.4.4.1. Cranes and Forklift Market size and forecast, by region

6.4.4.2. Cranes and Forklift Market size and forecast, by country

6.4.4.3. Mining Equipment Market size and forecast, by region

6.4.4.4. Mining Equipment Market size and forecast, by country

6.4.4.5. Smart Grid and Renewable Energy Storage Market size and forecast, by region

6.4.4.6. Smart Grid and Renewable Energy Storage Market size and forecast, by country

6.5. Others

6.5.1. Key market trends, growth factors and opportunities

6.5.2. Market size and forecast, by region

6.5.3. Market share analysis by country

CHAPTER 7: LITHIUM-ION BATTERY MARKET, BY REGION

7.1. Overview

7.1.1. Market size and forecast By Region

7.2. North America

7.2.1. Key trends and opportunities

7.2.2. Market size and forecast, by Component

7.2.2.1. North America Cathode Lithium-ion Battery Market by Type

7.2.3. Market size and forecast, by Capacity

7.2.4. Market size and forecast, by Application

7.2.4.1. North America Electrical and Electronics Lithium-ion Battery Market by Application

7.2.4.2. North America Automotive Lithium-ion Battery Market by Application

7.2.4.3. North America Industrial Lithium-ion Battery Market by Application

7.2.5. Market size and forecast, by country

7.2.5.1. U.S.

7.2.5.1.1. Key market trends, growth factors and opportunities

7.2.5.1.2. Market size and forecast, by Component

7.2.5.1.2.1. U.S. Cathode Lithium-ion Battery Market by Type

7.2.5.1.3. Market size and forecast, by Capacity

7.2.5.1.4. Market size and forecast, by Application

7.2.5.1.4.1. U.S. Electrical and Electronics Lithium-ion Battery Market by Application

7.2.5.1.4.2. U.S. Automotive Lithium-ion Battery Market by Application

7.2.5.1.4.3. U.S. Industrial Lithium-ion Battery Market by Application

7.2.5.2. Canada

7.2.5.2.1. Key market trends, growth factors and opportunities

7.2.5.2.2. Market size and forecast, by Component

7.2.5.2.2.1. Canada Cathode Lithium-ion Battery Market by Type

7.2.5.2.3. Market size and forecast, by Capacity

7.2.5.2.4. Market size and forecast, by Application

7.2.5.2.4.1. Canada Electrical and Electronics Lithium-ion Battery Market by Application

7.2.5.2.4.2. Canada Automotive Lithium-ion Battery Market by Application

7.2.5.2.4.3. Canada Industrial Lithium-ion Battery Market by Application

7.2.5.3. Mexico

7.2.5.3.1. Key market trends, growth factors and opportunities

7.2.5.3.2. Market size and forecast, by Component

7.2.5.3.2.1. Mexico Cathode Lithium-ion Battery Market by Type

7.2.5.3.3. Market size and forecast, by Capacity

7.2.5.3.4. Market size and forecast, by Application

7.2.5.3.4.1. Mexico Electrical and Electronics Lithium-ion Battery Market by Application

7.2.5.3.4.2. Mexico Automotive Lithium-ion Battery Market by Application

7.2.5.3.4.3. Mexico Industrial Lithium-ion Battery Market by Application

7.3. Europe

7.3.1. Key trends and opportunities

7.3.2. Market size and forecast, by Component

7.3.2.1. Europe Cathode Lithium-ion Battery Market by Type

7.3.3. Market size and forecast, by Capacity

7.3.4. Market size and forecast, by Application

7.3.4.1. Europe Electrical and Electronics Lithium-ion Battery Market by Application

7.3.4.2. Europe Automotive Lithium-ion Battery Market by Application

7.3.4.3. Europe Industrial Lithium-ion Battery Market by Application

7.3.5. Market size and forecast, by country

7.3.5.1. Germany

7.3.5.1.1. Key market trends, growth factors and opportunities

7.3.5.1.2. Market size and forecast, by Component

7.3.5.1.2.1. Germany Cathode Lithium-ion Battery Market by Type

7.3.5.1.3. Market size and forecast, by Capacity

7.3.5.1.4. Market size and forecast, by Application

7.3.5.1.4.1. Germany Electrical and Electronics Lithium-ion Battery Market by Application

7.3.5.1.4.2. Germany Automotive Lithium-ion Battery Market by Application

7.3.5.1.4.3. Germany Industrial Lithium-ion Battery Market by Application

7.3.5.2. France

7.3.5.2.1. Key market trends, growth factors and opportunities

7.3.5.2.2. Market size and forecast, by Component

7.3.5.2.2.1. France Cathode Lithium-ion Battery Market by Type

7.3.5.2.3. Market size and forecast, by Capacity

7.3.5.2.4. Market size and forecast, by Application

7.3.5.2.4.1. France Electrical and Electronics Lithium-ion Battery Market by Application

7.3.5.2.4.2. France Automotive Lithium-ion Battery Market by Application

7.3.5.2.4.3. France Industrial Lithium-ion Battery Market by Application

7.3.5.3. Italy

7.3.5.3.1. Key market trends, growth factors and opportunities

7.3.5.3.2. Market size and forecast, by Component

7.3.5.3.2.1. Italy Cathode Lithium-ion Battery Market by Type

7.3.5.3.3. Market size and forecast, by Capacity

7.3.5.3.4. Market size and forecast, by Application

7.3.5.3.4.1. Italy Electrical and Electronics Lithium-ion Battery Market by Application

7.3.5.3.4.2. Italy Automotive Lithium-ion Battery Market by Application

7.3.5.3.4.3. Italy Industrial Lithium-ion Battery Market by Application

7.3.5.4. UK

7.3.5.4.1. Key market trends, growth factors and opportunities

7.3.5.4.2. Market size and forecast, by Component

7.3.5.4.2.1. UK Cathode Lithium-ion Battery Market by Type

7.3.5.4.3. Market size and forecast, by Capacity

7.3.5.4.4. Market size and forecast, by Application

7.3.5.4.4.1. UK Electrical and Electronics Lithium-ion Battery Market by Application

7.3.5.4.4.2. UK Automotive Lithium-ion Battery Market by Application

7.3.5.4.4.3. UK Industrial Lithium-ion Battery Market by Application

7.3.5.5. Spain

7.3.5.5.1. Key market trends, growth factors and opportunities

7.3.5.5.2. Market size and forecast, by Component

7.3.5.5.2.1. Spain Cathode Lithium-ion Battery Market by Type

7.3.5.5.3. Market size and forecast, by Capacity

7.3.5.5.4. Market size and forecast, by Application

7.3.5.5.4.1. Spain Electrical and Electronics Lithium-ion Battery Market by Application

7.3.5.5.4.2. Spain Automotive Lithium-ion Battery Market by Application

7.3.5.5.4.3. Spain Industrial Lithium-ion Battery Market by Application

7.3.5.6. Rest of Europe

7.3.5.6.1. Key market trends, growth factors and opportunities

7.3.5.6.2. Market size and forecast, by Component

7.3.5.6.2.1. Rest of Europe Cathode Lithium-ion Battery Market by Type

7.3.5.6.3. Market size and forecast, by Capacity

7.3.5.6.4. Market size and forecast, by Application

7.3.5.6.4.1. Rest of Europe Electrical and Electronics Lithium-ion Battery Market by Application

7.3.5.6.4.2. Rest of Europe Automotive Lithium-ion Battery Market by Application

7.3.5.6.4.3. Rest of Europe Industrial Lithium-ion Battery Market by Application

7.4. Asia-Pacific

7.4.1. Key trends and opportunities

7.4.2. Market size and forecast, by Component

7.4.2.1. Asia-Pacific Cathode Lithium-ion Battery Market by Type

7.4.3. Market size and forecast, by Capacity

7.4.4. Market size and forecast, by Application

7.4.4.1. Asia-Pacific Electrical and Electronics Lithium-ion Battery Market by Application

7.4.4.2. Asia-Pacific Automotive Lithium-ion Battery Market by Application

7.4.4.3. Asia-Pacific Industrial Lithium-ion Battery Market by Application

7.4.5. Market size and forecast, by country

7.4.5.1. China

7.4.5.1.1. Key market trends, growth factors and opportunities

7.4.5.1.2. Market size and forecast, by Component

7.4.5.1.2.1. China Cathode Lithium-ion Battery Market by Type

7.4.5.1.3. Market size and forecast, by Capacity

7.4.5.1.4. Market size and forecast, by Application

7.4.5.1.4.1. China Electrical and Electronics Lithium-ion Battery Market by Application

7.4.5.1.4.2. China Automotive Lithium-ion Battery Market by Application

7.4.5.1.4.3. China Industrial Lithium-ion Battery Market by Application

7.4.5.2. Japan

7.4.5.2.1. Key market trends, growth factors and opportunities

7.4.5.2.2. Market size and forecast, by Component

7.4.5.2.2.1. Japan Cathode Lithium-ion Battery Market by Type

7.4.5.2.3. Market size and forecast, by Capacity

7.4.5.2.4. Market size and forecast, by Application

7.4.5.2.4.1. Japan Electrical and Electronics Lithium-ion Battery Market by Application

7.4.5.2.4.2. Japan Automotive Lithium-ion Battery Market by Application

7.4.5.2.4.3. Japan Industrial Lithium-ion Battery Market by Application

7.4.5.3. India

7.4.5.3.1. Key market trends, growth factors and opportunities

7.4.5.3.2. Market size and forecast, by Component

7.4.5.3.2.1. India Cathode Lithium-ion Battery Market by Type

7.4.5.3.3. Market size and forecast, by Capacity

7.4.5.3.4. Market size and forecast, by Application

7.4.5.3.4.1. India Electrical and Electronics Lithium-ion Battery Market by Application

7.4.5.3.4.2. India Automotive Lithium-ion Battery Market by Application

7.4.5.3.4.3. India Industrial Lithium-ion Battery Market by Application

7.4.5.4. South Korea

7.4.5.4.1. Key market trends, growth factors and opportunities

7.4.5.4.2. Market size and forecast, by Component

7.4.5.4.2.1. South Korea Cathode Lithium-ion Battery Market by Type

7.4.5.4.3. Market size and forecast, by Capacity

7.4.5.4.4. Market size and forecast, by Application

7.4.5.4.4.1. South Korea Electrical and Electronics Lithium-ion Battery Market by Application

7.4.5.4.4.2. South Korea Automotive Lithium-ion Battery Market by Application

7.4.5.4.4.3. South Korea Industrial Lithium-ion Battery Market by Application

7.4.5.5. Australia

7.4.5.5.1. Key market trends, growth factors and opportunities

7.4.5.5.2. Market size and forecast, by Component

7.4.5.5.2.1. Australia Cathode Lithium-ion Battery Market by Type

7.4.5.5.3. Market size and forecast, by Capacity

7.4.5.5.4. Market size and forecast, by Application

7.4.5.5.4.1. Australia Electrical and Electronics Lithium-ion Battery Market by Application

7.4.5.5.4.2. Australia Automotive Lithium-ion Battery Market by Application

7.4.5.5.4.3. Australia Industrial Lithium-ion Battery Market by Application

7.4.5.6. Rest of Asia-Pacific

7.4.5.6.1. Key market trends, growth factors and opportunities

7.4.5.6.2. Market size and forecast, by Component

7.4.5.6.2.1. Rest of Asia-Pacific Cathode Lithium-ion Battery Market by Type

7.4.5.6.3. Market size and forecast, by Capacity

7.4.5.6.4. Market size and forecast, by Application

7.4.5.6.4.1. Rest of Asia-Pacific Electrical and Electronics Lithium-ion Battery Market by Application

7.4.5.6.4.2. Rest of Asia-Pacific Automotive Lithium-ion Battery Market by Application

7.4.5.6.4.3. Rest of Asia-Pacific Industrial Lithium-ion Battery Market by Application

7.5. LAMEA

7.5.1. Key trends and opportunities

7.5.2. Market size and forecast, by Component

7.5.2.1. LAMEA Cathode Lithium-ion Battery Market by Type

7.5.3. Market size and forecast, by Capacity

7.5.4. Market size and forecast, by Application

7.5.4.1. LAMEA Electrical and Electronics Lithium-ion Battery Market by Application

7.5.4.2. LAMEA Automotive Lithium-ion Battery Market by Application

7.5.4.3. LAMEA Industrial Lithium-ion Battery Market by Application

7.5.5. Market size and forecast, by country

7.5.5.1. Brazil

7.5.5.1.1. Key market trends, growth factors and opportunities

7.5.5.1.2. Market size and forecast, by Component

7.5.5.1.2.1. Brazil Cathode Lithium-ion Battery Market by Type

7.5.5.1.3. Market size and forecast, by Capacity

7.5.5.1.4. Market size and forecast, by Application

7.5.5.1.4.1. Brazil Electrical and Electronics Lithium-ion Battery Market by Application

7.5.5.1.4.2. Brazil Automotive Lithium-ion Battery Market by Application

7.5.5.1.4.3. Brazil Industrial Lithium-ion Battery Market by Application

7.5.5.2. South Africa

7.5.5.2.1. Key market trends, growth factors and opportunities

7.5.5.2.2. Market size and forecast, by Component

7.5.5.2.2.1. South Africa Cathode Lithium-ion Battery Market by Type

7.5.5.2.3. Market size and forecast, by Capacity

7.5.5.2.4. Market size and forecast, by Application

7.5.5.2.4.1. South Africa Electrical and Electronics Lithium-ion Battery Market by Application

7.5.5.2.4.2. South Africa Automotive Lithium-ion Battery Market by Application

7.5.5.2.4.3. South Africa Industrial Lithium-ion Battery Market by Application

7.5.5.3. Saudi Arabia

7.5.5.3.1. Key market trends, growth factors and opportunities

7.5.5.3.2. Market size and forecast, by Component

7.5.5.3.2.1. Saudi Arabia Cathode Lithium-ion Battery Market by Type

7.5.5.3.3. Market size and forecast, by Capacity

7.5.5.3.4. Market size and forecast, by Application

7.5.5.3.4.1. Saudi Arabia Electrical and Electronics Lithium-ion Battery Market by Application

7.5.5.3.4.2. Saudi Arabia Automotive Lithium-ion Battery Market by Application

7.5.5.3.4.3. Saudi Arabia Industrial Lithium-ion Battery Market by Application

7.5.5.4. Rest of LAMEA

7.5.5.4.1. Key market trends, growth factors and opportunities

7.5.5.4.2. Market size and forecast, by Component

7.5.5.4.2.1. Rest of LAMEA Cathode Lithium-ion Battery Market by Type

7.5.5.4.3. Market size and forecast, by Capacity

7.5.5.4.4. Market size and forecast, by Application

7.5.5.4.4.1. Rest of LAMEA Electrical and Electronics Lithium-ion Battery Market by Application

7.5.5.4.4.2. Rest of LAMEA Automotive Lithium-ion Battery Market by Application

7.5.5.4.4.3. Rest of LAMEA Industrial Lithium-ion Battery Market by Application

CHAPTER 8: COMPETITIVE LANDSCAPE

8.1. Introduction

8.2. Top winning strategies

8.3. Product Mapping of Top 10 Player

8.4. Competitive Dashboard

8.5. Competitive Heatmap

8.6. Top player positioning, 2022

CHAPTER 9: COMPANY PROFILES

9.1. BYD Co., Ltd.

9.1.1. Company overview

9.1.2. Key Executives

9.1.3. Company snapshot

9.1.4. Operating business segments

9.1.5. Product portfolio

9.1.6. Business performance

9.2. A123 Systems LLC

9.2.1. Company overview

9.2.2. Key Executives

9.2.3. Company snapshot

9.2.4. Operating business segments

9.2.5. Product portfolio

9.3. Hitachi, Ltd.

9.3.1. Company overview

9.3.2. Key Executives

9.3.3. Company snapshot

9.3.4. Operating business segments

9.3.5. Product portfolio

9.3.6. Business performance

9.4. CATL

9.4.1. Company overview

9.4.2. Key Executives

9.4.3. Company snapshot

9.4.4. Operating business segments

9.4.5. Product portfolio

9.4.6. Business performance

9.4.7. Key strategic moves and developments

9.5. LG Chem

9.5.1. Company overview

9.5.2. Key Executives

9.5.3. Company snapshot

9.5.4. Operating business segments

9.5.5. Product portfolio

9.5.6. Business performance

9.5.7. Key strategic moves and developments

9.6. Panasonic Corporation

9.6.1. Company overview

9.6.2. Key Executives

9.6.3. Company snapshot

9.6.4. Operating business segments

9.6.5. Product portfolio

9.6.6. Business performance

9.6.7. Key strategic moves and developments

9.7. Saft Groupe S.A.

9.7.1. Company overview

9.7.2. Key Executives

9.7.3. Company snapshot

9.7.4. Operating business segments

9.7.5. Product portfolio

9.8. SAMSUNG SDI CO., LTD.

9.8.1. Company overview

9.8.2. Key Executives

9.8.3. Company snapshot

9.8.4. Operating business segments

9.8.5. Product portfolio

9.8.6. Business performance

9.8.7. Key strategic moves and developments

9.9. Toshiba Corporation.

9.9.1. Company overview

9.9.2. Key Executives

9.9.3. Company snapshot

9.9.4. Operating business segments

9.9.5. Product portfolio

9.9.6. Business performance

9.9.7. Key strategic moves and developments

9.10. GS Yuasa International Ltd.

9.10.1. Company overview

9.10.2. Key Executives

9.10.3. Company snapshot

9.10.4. Operating business segments

9.10.5. Product portfolio

9.10.6. Business performance

9.10.7. Key strategic moves and developments

LIST OF TABLES

TABLE 01. GLOBAL LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 02. LITHIUM-ION BATTERY MARKET FOR CATHODE, BY REGION, 2022-2032 ($MILLION)

TABLE 03. GLOBAL CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 04. LITHIUM-ION BATTERY MARKET FOR LITHIUM-IRON PHOSPHATE, BY REGION, 2022-2032 ($MILLION)

TABLE 05. LITHIUM-ION BATTERY MARKET FOR LITHIUM-MANGANESE OXIDE, BY REGION, 2022-2032 ($MILLION)

TABLE 06. LITHIUM-ION BATTERY MARKET FOR LITHIUM-NICKEL-COBALT-ALUMINUM OXIDE, BY REGION, 2022-2032 ($MILLION)

TABLE 07. LITHIUM-ION BATTERY MARKET FOR LITHIUM-NICKEL-MANGANESE COBALT, BY REGION, 2022-2032 ($MILLION)

TABLE 08. LITHIUM-ION BATTERY MARKET FOR LITHIUM-TITANATE OXIDE, BY REGION, 2022-2032 ($MILLION)

TABLE 09. LITHIUM-ION BATTERY MARKET FOR ANODE, BY REGION, 2022-2032 ($MILLION)

TABLE 10. LITHIUM-ION BATTERY MARKET FOR ELECTROLYTE, BY REGION, 2022-2032 ($MILLION)

TABLE 11. LITHIUM-ION BATTERY MARKET FOR SEPARATOR, BY REGION, 2022-2032 ($MILLION)

TABLE 12. LITHIUM-ION BATTERY MARKET FOR OTHERS, BY REGION, 2022-2032 ($MILLION)

TABLE 13. GLOBAL LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 14. LITHIUM-ION BATTERY MARKET FOR 0-3,000 MAH, BY REGION, 2022-2032 ($MILLION)

TABLE 15. LITHIUM-ION BATTERY MARKET FOR 3,000- 10,000 MAH, BY REGION, 2022-2032 ($MILLION)

TABLE 16. LITHIUM-ION BATTERY MARKET FOR 10,000- 60,000 MAH, BY REGION, 2022-2032 ($MILLION)

TABLE 17. LITHIUM-ION BATTERY MARKET FOR 100,000 MAH AND ABOVE, BY REGION, 2022-2032 ($MILLION)

TABLE 18. GLOBAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 19. LITHIUM-ION BATTERY MARKET FOR ELECTRICAL AND ELECTRONICS, BY REGION, 2022-2032 ($MILLION)

TABLE 20. GLOBAL ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 21. LITHIUM-ION BATTERY MARKET FOR SMARTPHONES AND TABLET/PC, BY REGION, 2022-2032 ($MILLION)

TABLE 22. LITHIUM-ION BATTERY MARKET FOR UPS, BY REGION, 2022-2032 ($MILLION)

TABLE 23. LITHIUM-ION BATTERY MARKET FOR OTHERS, BY REGION, 2022-2032 ($MILLION)

TABLE 24. LITHIUM-ION BATTERY MARKET FOR AUTOMOTIVE, BY REGION, 2022-2032 ($MILLION)

TABLE 25. GLOBAL AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 26. LITHIUM-ION BATTERY MARKET FOR CARS, BUSES AND TRUCKS, BY REGION, 2022-2032 ($MILLION)

TABLE 27. LITHIUM-ION BATTERY MARKET FOR SCOOTERS AND BIKES, BY REGION, 2022-2032 ($MILLION)

TABLE 28. LITHIUM-ION BATTERY MARKET FOR TRAINS AND AIRCRAFT, BY REGION, 2022-2032 ($MILLION)

TABLE 29. LITHIUM-ION BATTERY MARKET FOR INDUSTRIAL, BY REGION, 2022-2032 ($MILLION)

TABLE 30. GLOBAL INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 31. LITHIUM-ION BATTERY MARKET FOR CRANES AND FORKLIFT, BY REGION, 2022-2032 ($MILLION)

TABLE 32. LITHIUM-ION BATTERY MARKET FOR MINING EQUIPMENT, BY REGION, 2022-2032 ($MILLION)

TABLE 33. LITHIUM-ION BATTERY MARKET FOR SMART GRID AND RENEWABLE ENERGY STORAGE, BY REGION, 2022-2032 ($MILLION)

TABLE 34. LITHIUM-ION BATTERY MARKET FOR OTHERS, BY REGION, 2022-2032 ($MILLION)

TABLE 35. LITHIUM-ION BATTERY MARKET, BY REGION, 2022-2032 ($MILLION)

TABLE 36. NORTH AMERICA LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 37. NORTH AMERICA CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 38. NORTH AMERICA LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 39. NORTH AMERICA LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 40. NORTH AMERICA ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 41. NORTH AMERICA AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 42. NORTH AMERICA INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 43. NORTH AMERICA LITHIUM-ION BATTERY MARKET, BY COUNTRY, 2022-2032 ($MILLION)

TABLE 44. U.S. LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 45. U.S. CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 46. U.S. LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 47. U.S. LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 48. U.S. ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 49. U.S. AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 50. U.S. INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 51. CANADA LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 52. CANADA CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 53. CANADA LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 54. CANADA LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 55. CANADA ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 56. CANADA AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 57. CANADA INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 58. MEXICO LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 59. MEXICO CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 60. MEXICO LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 61. MEXICO LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 62. MEXICO ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 63. MEXICO AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 64. MEXICO INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 65. EUROPE LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 66. EUROPE CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 67. EUROPE LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 68. EUROPE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 69. EUROPE ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 70. EUROPE AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 71. EUROPE INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 72. EUROPE LITHIUM-ION BATTERY MARKET, BY COUNTRY, 2022-2032 ($MILLION)

TABLE 73. GERMANY LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 74. GERMANY CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 75. GERMANY LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 76. GERMANY LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 77. GERMANY ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 78. GERMANY AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 79. GERMANY INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 80. FRANCE LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 81. FRANCE CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 82. FRANCE LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 83. FRANCE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 84. FRANCE ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 85. FRANCE AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 86. FRANCE INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 87. ITALY LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 88. ITALY CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 89. ITALY LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 90. ITALY LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 91. ITALY ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 92. ITALY AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 93. ITALY INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 94. UK LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 95. UK CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 96. UK LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 97. UK LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 98. UK ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 99. UK AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 100. UK INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 101. SPAIN LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 102. SPAIN CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 103. SPAIN LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 104. SPAIN LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 105. SPAIN ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 106. SPAIN AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 107. SPAIN INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 108. REST OF EUROPE LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 109. REST OF EUROPE CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 110. REST OF EUROPE LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 111. REST OF EUROPE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 112. REST OF EUROPE ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 113. REST OF EUROPE AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 114. REST OF EUROPE INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 115. ASIA-PACIFIC LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 116. ASIA-PACIFIC CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 117. ASIA-PACIFIC LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 118. ASIA-PACIFIC LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 119. ASIA-PACIFIC ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 120. ASIA-PACIFIC AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 121. ASIA-PACIFIC INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 122. ASIA-PACIFIC LITHIUM-ION BATTERY MARKET, BY COUNTRY, 2022-2032 ($MILLION)

TABLE 123. CHINA LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 124. CHINA CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 125. CHINA LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 126. CHINA LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 127. CHINA ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 128. CHINA AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 129. CHINA INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 130. JAPAN LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 131. JAPAN CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 132. JAPAN LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 133. JAPAN LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 134. JAPAN ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 135. JAPAN AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 136. JAPAN INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 137. INDIA LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 138. INDIA CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 139. INDIA LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 140. INDIA LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 141. INDIA ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 142. INDIA AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 143. INDIA INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 144. SOUTH KOREA LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 145. SOUTH KOREA CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 146. SOUTH KOREA LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 147. SOUTH KOREA LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 148. SOUTH KOREA ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 149. SOUTH KOREA AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 150. SOUTH KOREA INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 151. AUSTRALIA LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 152. AUSTRALIA CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 153. AUSTRALIA LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 154. AUSTRALIA LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 155. AUSTRALIA ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 156. AUSTRALIA AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 157. AUSTRALIA INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 158. REST OF ASIA-PACIFIC LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 159. REST OF ASIA-PACIFIC CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 160. REST OF ASIA-PACIFIC LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 161. REST OF ASIA-PACIFIC LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 162. REST OF ASIA-PACIFIC ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 163. REST OF ASIA-PACIFIC AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 164. REST OF ASIA-PACIFIC INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 165. LAMEA LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 166. LAMEA CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 167. LAMEA LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 168. LAMEA LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 169. LAMEA ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 170. LAMEA AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 171. LAMEA INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 172. LAMEA LITHIUM-ION BATTERY MARKET, BY COUNTRY, 2022-2032 ($MILLION)

TABLE 173. BRAZIL LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 174. BRAZIL CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 175. BRAZIL LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 176. BRAZIL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 177. BRAZIL ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 178. BRAZIL AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 179. BRAZIL INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 180. SOUTH AFRICA LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 181. SOUTH AFRICA CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 182. SOUTH AFRICA LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 183. SOUTH AFRICA LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 184. SOUTH AFRICA ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 185. SOUTH AFRICA AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 186. SOUTH AFRICA INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 187. SAUDI ARABIA LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 188. SAUDI ARABIA CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 189. SAUDI ARABIA LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 190. SAUDI ARABIA LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 191. SAUDI ARABIA ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 192. SAUDI ARABIA AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 193. SAUDI ARABIA INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 194. REST OF LAMEA LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022-2032 ($MILLION)

TABLE 195. REST OF LAMEA CATHODE LITHIUM-ION BATTERY MARKET, BY TYPE, 2022-2032 ($MILLION)

TABLE 196. REST OF LAMEA LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022-2032 ($MILLION)

TABLE 197. REST OF LAMEA LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 198. REST OF LAMEA ELECTRICAL AND ELECTRONICS LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 199. REST OF LAMEA AUTOMOTIVE LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 200. REST OF LAMEA INDUSTRIAL LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022-2032 ($MILLION)

TABLE 201. BYD CO., LTD.: KEY EXECUTIVES

TABLE 202. BYD CO., LTD.: COMPANY SNAPSHOT

TABLE 203. BYD CO., LTD.: PRODUCT SEGMENTS

TABLE 204. BYD CO., LTD.: PRODUCT PORTFOLIO

TABLE 205. A123 SYSTEMS LLC: KEY EXECUTIVES

TABLE 206. A123 SYSTEMS LLC: COMPANY SNAPSHOT

TABLE 207. A123 SYSTEMS LLC: PRODUCT SEGMENTS

TABLE 208. A123 SYSTEMS LLC: PRODUCT PORTFOLIO

TABLE 209. HITACHI, LTD.: KEY EXECUTIVES

TABLE 210. HITACHI, LTD.: COMPANY SNAPSHOT

TABLE 211. HITACHI, LTD.: SERVICE SEGMENTS

TABLE 212. HITACHI, LTD.: PRODUCT PORTFOLIO

TABLE 213. CATL: KEY EXECUTIVES

TABLE 214. CATL: COMPANY SNAPSHOT

TABLE 215. CATL: PRODUCT SEGMENTS

TABLE 216. CATL: PRODUCT PORTFOLIO

TABLE 217. CATL: KEY STRATERGIES

TABLE 218. LG CHEM: KEY EXECUTIVES

TABLE 219. LG CHEM: COMPANY SNAPSHOT

TABLE 220. LG CHEM: PRODUCT SEGMENTS

TABLE 221. LG CHEM: PRODUCT PORTFOLIO

TABLE 222. LG CHEM: KEY STRATERGIES

TABLE 223. PANASONIC CORPORATION: KEY EXECUTIVES

TABLE 224. PANASONIC CORPORATION: COMPANY SNAPSHOT

TABLE 225. PANASONIC CORPORATION: SERVICE SEGMENTS

TABLE 226. PANASONIC CORPORATION: PRODUCT PORTFOLIO

TABLE 227. PANASONIC CORPORATION: KEY STRATERGIES

TABLE 228. SAFT GROUPE S.A.: KEY EXECUTIVES

TABLE 229. SAFT GROUPE S.A.: COMPANY SNAPSHOT

TABLE 230. SAFT GROUPE S.A.: PRODUCT SEGMENTS

TABLE 231. SAFT GROUPE S.A.: PRODUCT PORTFOLIO

TABLE 232. SAMSUNG SDI CO., LTD.: KEY EXECUTIVES

TABLE 233. SAMSUNG SDI CO., LTD.: COMPANY SNAPSHOT

TABLE 234. SAMSUNG SDI CO., LTD.: PRODUCT SEGMENTS

TABLE 235. SAMSUNG SDI CO., LTD.: PRODUCT PORTFOLIO

TABLE 236. SAMSUNG SDI CO., LTD.: KEY STRATERGIES

TABLE 237. TOSHIBA CORPORATION.: KEY EXECUTIVES

TABLE 238. TOSHIBA CORPORATION.: COMPANY SNAPSHOT

TABLE 239. TOSHIBA CORPORATION.: SERVICE SEGMENTS

TABLE 240. TOSHIBA CORPORATION.: PRODUCT PORTFOLIO

TABLE 241. TOSHIBA CORPORATION.: KEY STRATERGIES

TABLE 242. GS YUASA INTERNATIONAL LTD.: KEY EXECUTIVES

TABLE 243. GS YUASA INTERNATIONAL LTD.: COMPANY SNAPSHOT

TABLE 244. GS YUASA INTERNATIONAL LTD.: PRODUCT SEGMENTS

TABLE 245. GS YUASA INTERNATIONAL LTD.: PRODUCT PORTFOLIO

TABLE 246. GS YUASA INTERNATIONAL LTD.: KEY STRATERGIES

LIST OF FIGURES

FIGURE 01. LITHIUM-ION BATTERY MARKET

FIGURE 02. SEGMENTATION OF LITHIUM-ION BATTERY MARKET

FIGURE 03. TOP INVESTMENT POCKETS IN LITHIUM-ION BATTERY MARKET (2023 TO 2032)

FIGURE 04. MODERATE BARGAINING POWER OF SUPPLIERS

FIGURE 05. HIGH BARGAINING POWER OF BUYERS

FIGURE 06. MODERATE THREAT OF SUBSTITUTION

FIGURE 07. HIGH THREAT OF NEW ENTRANTS

FIGURE 08. HIGH COMPETITIVE RIVALRY

FIGURE 09. DRIVERS, RESTRAINTS AND OPPORTUNITIES: GLOBAL LITHIUM-ION BATTERY MARKET

FIGURE 10. VALUE CHAIN ANALYSIS: LITHIUM-ION BATTERY MARKET

FIGURE 11. PATENT ANALYSIS: LITHIUM-ION BATTERY MARKET

FIGURE 12. LITHIUM-ION BATTERY MARKET, BY COMPONENT, 2022 AND 2032 (%)

FIGURE 13. COMPARATIVE SHARE ANALYSIS OF LITHIUM-ION BATTERY MARKET FOR CATHODE, BY COUNTRY, 2022 AND 2032 (%)

FIGURE 14. COMPARATIVE SHARE ANALYSIS OF LITHIUM-ION BATTERY MARKET FOR ANODE, BY COUNTRY, 2022 AND 2032 (%)

FIGURE 15. COMPARATIVE SHARE ANALYSIS OF LITHIUM-ION BATTERY MARKET FOR ELECTROLYTE, BY COUNTRY, 2022 AND 2032 (%)

FIGURE 16. COMPARATIVE SHARE ANALYSIS OF LITHIUM-ION BATTERY MARKET FOR SEPARATOR, BY COUNTRY, 2022 AND 2032 (%)

FIGURE 17. COMPARATIVE SHARE ANALYSIS OF LITHIUM-ION BATTERY MARKET FOR OTHERS, BY COUNTRY, 2022 AND 2032 (%)

FIGURE 18. LITHIUM-ION BATTERY MARKET, BY CAPACITY, 2022 AND 2032 (%)

FIGURE 19. COMPARATIVE SHARE ANALYSIS OF LITHIUM-ION BATTERY MARKET FOR 0-3,000 MAH, BY COUNTRY, 2022 AND 2032 (%)

FIGURE 20. COMPARATIVE SHARE ANALYSIS OF LITHIUM-ION BATTERY MARKET FOR 3,000- 10,000 MAH, BY COUNTRY, 2022 AND 2032 (%)

FIGURE 21. COMPARATIVE SHARE ANALYSIS OF LITHIUM-ION BATTERY MARKET FOR 10,000- 60,000 MAH, BY COUNTRY, 2022 AND 2032 (%)

FIGURE 22. COMPARATIVE SHARE ANALYSIS OF LITHIUM-ION BATTERY MARKET FOR 100,000 MAH AND ABOVE, BY COUNTRY, 2022 AND 2032 (%)

FIGURE 23. LITHIUM-ION BATTERY MARKET, BY APPLICATION, 2022 AND 2032 (%)

FIGURE 24. COMPARATIVE SHARE ANALYSIS OF LITHIUM-ION BATTERY MARKET FOR ELECTRICAL AND ELECTRONICS, BY COUNTRY, 2022 AND 2032 (%)

FIGURE 25. COMPARATIVE SHARE ANALYSIS OF LITHIUM-ION BATTERY MARKET FOR AUTOMOTIVE, BY COUNTRY, 2022 AND 2032 (%)

FIGURE 26. COMPARATIVE SHARE ANALYSIS OF LITHIUM-ION BATTERY MARKET FOR INDUSTRIAL, BY COUNTRY, 2022 AND 2032 (%)

FIGURE 27. COMPARATIVE SHARE ANALYSIS OF LITHIUM-ION BATTERY MARKET FOR OTHERS, BY COUNTRY, 2022 AND 2032 (%)

FIGURE 28. LITHIUM-ION BATTERY MARKET BY REGION, 2022 AND 2032 (%)

FIGURE 29. U.S. LITHIUM-ION BATTERY MARKET, 2022-2032 ($MILLION)

FIGURE 30. CANADA LITHIUM-ION BATTERY MARKET, 2022-2032 ($MILLION)

FIGURE 31. MEXICO LITHIUM-ION BATTERY MARKET, 2022-2032 ($MILLION)

FIGURE 32. GERMANY LITHIUM-ION BATTERY MARKET, 2022-2032 ($MILLION)

FIGURE 33. FRANCE LITHIUM-ION BATTERY MARKET, 2022-2032 ($MILLION)

FIGURE 34. ITALY LITHIUM-ION BATTERY MARKET, 2022-2032 ($MILLION)

FIGURE 35. UK LITHIUM-ION BATTERY MARKET, 2022-2032 ($MILLION)

FIGURE 36. SPAIN LITHIUM-ION BATTERY MARKET, 2022-2032 ($MILLION)

FIGURE 37. REST OF EUROPE LITHIUM-ION BATTERY MARKET, 2022-2032 ($MILLION)

FIGURE 38. CHINA LITHIUM-ION BATTERY MARKET, 2022-2032 ($MILLION)

FIGURE 39. JAPAN LITHIUM-ION BATTERY MARKET, 2022-2032 ($MILLION)

FIGURE 40. INDIA LITHIUM-ION BATTERY MARKET, 2022-2032 ($MILLION)

FIGURE 41. SOUTH KOREA LITHIUM-ION BATTERY MARKET, 2022-2032 ($MILLION)

FIGURE 42. AUSTRALIA LITHIUM-ION BATTERY MARKET, 2022-2032 ($MILLION)

FIGURE 43. REST OF ASIA-PACIFIC LITHIUM-ION BATTERY MARKET, 2022-2032 ($MILLION)

FIGURE 44. BRAZIL LITHIUM-ION BATTERY MARKET, 2022-2032 ($MILLION)

FIGURE 45. SOUTH AFRICA LITHIUM-ION BATTERY MARKET, 2022-2032 ($MILLION)

FIGURE 46. SAUDI ARABIA LITHIUM-ION BATTERY MARKET, 2022-2032 ($MILLION)

FIGURE 47. REST OF LAMEA LITHIUM-ION BATTERY MARKET, 2022-2032 ($MILLION)

FIGURE 48. TOP WINNING STRATEGIES, BY YEAR, 2020-2023

FIGURE 49. TOP WINNING STRATEGIES, BY DEVELOPMENT, 2020-2023 (%)

FIGURE 50. TOP WINNING STRATEGIES, BY COMPANY, 2020-2023

FIGURE 51. PRODUCT MAPPING OF TOP 10 PLAYERS

FIGURE 52. COMPETITIVE DASHBOARD

FIGURE 53. COMPETITIVE HEATMAP: LITHIUM-ION BATTERY MARKET

FIGURE 54. TOP PLAYER POSITIONING, 2022

FIGURE 55. BYD CO., LTD.: NET REVENUE, 2020-2022 ($MILLION)

FIGURE 56. BYD CO., LTD.: GROSS PROFIT, 2020-2022 ($MILLION)

FIGURE 57. BYD CO., LTD.: RESEARCH AND DEVELOPMENT EXPENDITURE, 2020-2022 ($MILLION)

FIGURE 58. BYD CO., LTD.: REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 59. BYD CO., LTD.: REVENUE SHARE BY REGION, 2021 (%)

FIGURE 60. HITACHI, LTD.: NET REVENUE, 2020-2022 ($MILLION)

FIGURE 61. HITACHI, LTD.: REVENUE SHARE BY SEGMENT, 2022 (%)

FIGURE 62. HITACHI, LTD.: REVENUE SHARE BY REGION, 2022 (%)

FIGURE 63. CATL: NET REVENUE, 2020-2022 ($MILLION)

FIGURE 64. CATL: RESEARCH AND DEVELOPMENT EXPENDITURE, 2020-2022 ($MILLION)

FIGURE 65. CATL: REVENUE SHARE BY SEGMENT, 2022 (%)

FIGURE 66. CATL: REVENUE SHARE BY REGION, 2022 (%)

FIGURE 67. LG CHEM: RESEARCH AND DEVELOPMENT EXPENDITURE, 2020-2022 ($MILLION)

FIGURE 68. LG CHEM: NET SALES, 2020-2022 ($MILLION)

FIGURE 69. LG CHEM: REVENUE SHARE BY SEGMENT, 2022 (%)

FIGURE 70. LG CHEM: REVENUE SHARE BY REGION, 2021 (%)

FIGURE 71. PANASONIC CORPORATION: NET REVENUE, 2020-2022 ($MILLION)

FIGURE 72. PANASONIC CORPORATION: REVENUE SHARE BY SEGMENT, 2022 (%)

FIGURE 73. PANASONIC CORPORATION: REVENUE SHARE BY REGION, 2022 (%)

FIGURE 74. SAMSUNG SDI CO., LTD.: RESEARCH AND DEVELOPMENT EXPENDITURE, 2020-2022 ($MILLION)

FIGURE 75. SAMSUNG SDI CO., LTD.: NET SALES, 2020-2022 ($MILLION)

FIGURE 76. SAMSUNG SDI CO., LTD.: REVENUE SHARE BY SEGMENT, 2022 (%)

FIGURE 77. SAMSUNG SDI CO., LTD.: REVENUE SHARE BY REGION, 2022 (%)

FIGURE 78. TOSHIBA CORPORATION: NET REVENUE, 2020-2022 ($MILLION)

FIGURE 79. TOSHIBA CORPORATION: REVENUE SHARE BY SEGMENT, 2022 (%)

FIGURE 80. TOSHIBA CORPORATION: REVENUE SHARE BY REGION, 2022 (%)

FIGURE 81. GS YUASA INTERNATIONAL LTD.: RESEARCH AND DEVELOPMENT EXPENDITURE, 2020-2022 ($MILLION)

FIGURE 82. GS YUASA INTERNATIONAL LTD.: NET SALES, 2020-2022 ($MILLION)

FIGURE 83. GS YUASA INTERNATIONAL LTD.: REVENUE SHARE BY SEGMENT, 2022 (%)

$5730

$6450

$9600

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS