The UK and Ireland virtual event market size was valued at $3.1 billion in 2019, and is expected to grow at a CAGR of 13.3% to reach $36.1 billion by 2027. Virtual event is a digitally simulated proceeding, which covers a wide range of activities, from video and audio conferencing to live streaming and broadcasting. These events are conducted by companies during product launch and introduction of new services.

New regulations regarding work in various IT/BPO firms are expected to boost the flexibility for these companies to adopt work-from-home and work-from-anywhere policies. The virtual event market is witnessing higher demand as most of the firms have adopted the work-from-home policy, owing to the implementation of lockdown by the COVID-19-affected countries to prevent community spread of the disease. Thus, stay-at-home measures have resulted in increased opportunities for virtual event companies to integrate new technologies and develop products and services with distinguishing features to gain a competitive edge over others.

Advertisements and promotions remain a vital business practice pre COVID, during COVID, or post COVID to increase awareness about products and services offered by various companies. Before pandemic, individuals preferred to attend events physically, however, post the outbreak of the pandemic, individuals are strictly restricted to stay home. Thus, virtual events are gaining momentum during the pandemic. Similar to how individuals are restricted to attain virtual events, sponsors are left with no choice other than virtual events. Thus, sponsorship is done to provide material support to events or organizations.

However, lack of awareness among audience about technology is one of the major restraining factors of the UK and Ireland virtual event market. Event planners are responsible for smooth functioning of the event apps and event web portals on all devices and all browsers. If there are any restrictions, that should be clearly mentioned beforehand. Not everyone is likely to be equally technically savvy—thus, the entire onboarding process has to be made as simple as possible. Thus, all these factors collectively are likely to hamper the UK and Ireland virtual event market growth.

COVID-19 has put actual events to a total halt, therefore, associations are congregating to the virtual event platform to deliver and convey the content to the crowd. Various trade shows and meetings have been canceled and delayed as a result of concerns encompassing the novel coronavirus episode. During this pandemic, lockdown on in-person occasions has brought about an upsurge of virtual events being conducted. A remote participant can take interest in the virtual event from any side of the world, given that the individual has access to the web.

Digitally simulated proceedings use web-based platforms such as BigMarker, GoToWebinar, HeySummit, HeySummit, and SpotMe to connect several attendees from across the world and include interactive engagement features, such as polling, question & answer (Q&A) sessions, and chat boxes. Key players in the industry are constantly striving to gain an edge over their competitors by launching state-of-the-art products or solutions for attendees.

The UK and Ireland virtual event market is segmented into event type, revenue source, age group, and country. On the basis of event type, the market is classified into webinar; conference; entertainment; virtual expo, fairs, & festivals; and others.

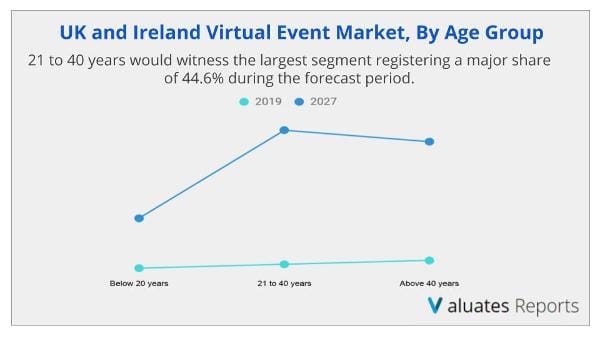

Depending on revenue source, it is fragmented into ticket sale, sponsorship, and others. Depending on age group, it is fragmented into below 20 years, 21 to 40 years, and above 40 years. Further, the report is analyzed in two countries the UK and Ireland.

According to the UK and Ireland virtual event market analysis on the basis of type, the entertainment segment accounted for the maximum share in the 2019. This is attributed to the fact that such music concerts and events offer valuable opportunity for promoters and brands to align themselves with people attending concerts. Moreover, streaming services in the music industry are creating new opportunities along with new distribution methods and media platforms that provide additional scope for brands to align and interact with world’s leading artists.

By revenue source, the sponsorship segment dominated the market, which accounted for 53.3% UK and Ireland virtual event market share in 2019, and is expected to continue this trend throughout the UK and Ireland virtual event market forecast period. This is attributed to the fact that sponsorship serves as a powerful and effective marketing tool to increase and reinforce brand awareness among targeted niche markets. Moreover, it is the key for strong marketing, owing to the fact that most of the events use sponsorship support to offer more exciting programs and to help defray rising costs. Advertising is considered a quantitative medium, whereas sponsorship is considered a qualitative medium. In addition, sponsorship serves as an ideal solution that complements other marketing programs in delivering event-related messages to people.

On the basis of age group, the 21 to 40 years age group segment dominated the market in 2019, accounting for 44.6% of the market share, and is expected to continue this trend in the near future. This is attributed to active participation of individuals aged between 21 and 40 years in events such as exhibitions, conferences, seminars, and music concerts. In addition, increase in interest toward entrepreneur & business seminars and conferences that offer proper guideline & direction to the youth for establishing start-ups along with arrangement of music concerts and festive gatherings is anticipated to positively impact the growth of the UK and Ireland virtual event industry.

Country wise, the UK held the major share of 69% in the UK and Ireland virtual event market in 2019, as companies are being more prudent about their spending and therefore not travelling afield for meetings due to the outbreak of the COVID-19 pandemic. Moreover, the UK has been successful in winning conferences of international associations with over half of the top cities and countries selected as destinations for international association conferences being in the country. In addition, surge in adoption of smart devices and rise in internet penetration have supplemented the market growth. Furthermore, the UK and Ireland virtual event market is witnessing rapid growth due to increase in trend of online booking for music concerts, sports, and other events.

Key Market Segments

By Event Type

Revenue Source

Age Group

Country

TABLE OF CONTENT

CHAPTER 1:INTRODUCTION

1.1.Report description

1.2.Key market benefits for stakeholders

1.3.Key market segments

1.4.Research methodology

1.4.1.Secondary research

1.4.2.Primary research

1.4.3.Analyst tools and models

CHAPTER 2:EXECUTIVE SUMMARY

2.1.Snapshot

2.2.CXO perspective

CHAPTER 3:MARKET OVERVIEW

3.1.Market definition and scope

3.2.Key findings

3.2.1.Top investment pocket

3.3.Porter's five forces analysis

3.3.1.Bargaining power of suppliers

3.3.2.Bargaining power of buyers

3.3.3.Threat of new entrants

3.3.4.Threat of substitutes

3.3.5.Competitive rivalry

3.5.Market dynamics

3.5.1.Drivers

3.5.1.1.Increase in trend of work-from-home policy

3.5.1.2.Rise in sponsorship for virtual events

3.5.1.3.Low operational cost involved in organizing virtual events

3.5.1.4.Increase in globalization of businesses

3.5.2.Restraints

3.5.2.1.Lack of awareness among audience about technology

3.5.3.Opportunity

3.5.3.1.Technological advancements in virtual event industry

3.6.COVID-19 impact analysis

3.6.1.Introduction

3.6.2.Impact on the virtual event industry

CHAPTER 4:UK AND IRELAND VIRTUAL EVENTS MARKET, BY EVENT TYPE

4.1.Overview

4.1.1.Market size and forecast

4.2.Webinar

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast

4.2.3.Market analysis by country

4.3.Conference

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Market size and forecast

4.3.3.Market analysis by country

4.4.Virtual expo, fairs, & festivals

4.4.1.Key market trends, growth factors, and opportunities

4.4.2.Market size and forecast

4.4.3.Market analysis by country

4.5.Entertainment

4.5.1.Key market trends, growth factors, and opportunities

4.5.2.Market size and forecast

4.5.3.Market analysis by country

4.6.Others

4.6.1.Key market trends, growth factors, and opportunities

4.6.2.Market size and forecast

4.6.3.Market analysis by country

CHAPTER 5:UK AND IRELAND VIRTUAL EVENTS MARKET, BY REVENUE SOURCE

5.1.Overview

5.1.1.Market size and forecast

5.2.Ticket sale

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast

5.2.3.Market analysis by country

5.3.Sponsorship

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast

5.3.3.Market analysis by country

5.4.Others

5.4.1.Key market trends, growth factors, and opportunities

5.4.2.Market size and forecast

5.4.3.Market analysis by country

CHAPTER 6:UK AND IRELAND VIRTUAL EVENTS MARKET, BY AGE GROUP

6.1.Overview

6.1.1.Market size and forecast

6.2.Below 20 years

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast

6.2.3.Market analysis by country

6.3.21 to 40 years

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast

6.3.3.Market analysis by country

6.4.Above 40 years

6.4.1.Key market trends, growth factors, and opportunities

6.4.2.Market size and forecast

6.4.3.Market analysis by country

CHAPTER 7:UK AND IRELAND VIRTUAL EVENTS MARKET, BY COUNTRY

7.1.Overview

7.2.UK

7.2.1.Market size and forecast, by event type

7.2.2.Market size and forecast, by revenue source

7.2.3.Market size and forecast, by age group

7.3.Ireland

7.3.1.Market size and forecast, by event type

7.3.2.Market size and forecast, by revenue source

7.3.3.Market size and forecast, by age group

CHAPTER 8:COMPETITION LANDSCAPE

8.1.Top winning strategies

8.1.1.Acquisition

8.2.Service mapping

8.3.Competitive dashboard

8.4.Competitive heatmap

CHAPTER 9:COMPANY PROFILES

9.1.FIRST EVENT

9.1.1.Company overview

9.1.2.Key executives

9.1.3.Company snapshot

9.1.4.Service portfolio

9.2.GEORGE P JOHNSON EVENT MARKETING PRIVATE LIMITED

9.2.1.Company overview

9.2.2.Key executives

9.2.3.Company snapshot

9.2.4.Service portfolio

9.3.GROOVEYARD EVENTS LIMITED

9.3.1.Company overview

9.3.2.Company snapshot

9.3.3.Service portfolio

9.4.HOPIN

9.4.1.Company overview

9.4.2.Key executives

9.4.3.Company snapshot

9.4.4.Service portfolio

9.4.5.Key strategic moves and developments

9.5.JULIA CHARLES EVENT MANAGEMENT LTD.

9.5.1.Company overview

9.5.2.Key executives

9.5.3.Company snapshot

9.5.4.Service portfolio

9.6.MGN EVENTS LTD.

9.6.1.Company overview

9.6.2.Key executives

9.6.3.Company snapshot

9.6.4.Service portfolio

9.7.SAVILLE GROUP LTD.

9.7.1.Company overview

9.7.2.Key executives

9.7.3.Company snapshot

9.7.4.Service portfolio

9.8.SEVEN EVENTS LTD.

9.8.1.Company overview

9.8.2.Key executives

9.8.3.Company snapshot

9.8.4.Service portfolio

9.9.THE EVENTS COMPANY

9.9.1.Company overview

9.9.2.Company snapshot

9.9.3.Service portfolio

9.10.VERVE LIVE AGENCY

9.10.1.Company overview

9.10.2.Key executives

9.10.3.Company snapshot

9.10.4.Service portfolio

LIST OF TABLES & FIGURES

TABLE 01.UK AND IRELAND VIRTUAL EVENTS MARKET, BY EVENT TYPE, 2019-2027 ($MILLION)

TABLE 02.UK AND IRELAND VIRTUAL WEBINAR EVENT MARKET, BY COUNTRY, 2019-2027 ($MILLION)

TABLE 03.UK AND IRELAND VIRTUAL CONFERENCE EVENT MARKET, BY COUNTRY, 2019-2027 ($MILLION)

TABLE 04.UK AND IRELAND VIRTUAL EXPO, FAIRS, & FESTIVALS EVENT MARKET, BY COUNTRY, 2019-2027 ($MILLION)

TABLE 05.UK AND IRELAND VIRTUAL ENTERTAINMENT EVENT MARKET, BY COUNTRY, 2019-2027 ($MILLION)

TABLE 06.UK AND IRELAND VIRTUAL OTHER EVENTS MARKET, BY COUNTRY, 2019-2027 ($MILLION)

TABLE 07.UK AND IRELAND VIRTUAL EVENTS MARKET, BY REVENUE SOURCE, 2019-2027 ($MILLION)

TABLE 08.UK AND IRELAND VIRTUAL EVENTS MARKET FOR TICKET SALE, BY COUNTRY, 2019-2027 ($MILLION)

TABLE 09.UK AND IRELAND VIRTUAL EVENTS MARKET FOR SPONSORSHIP, BY COUNTRY, 2019-2027 ($MILLION)

TABLE 10.UK AND IRELAND VIRTUAL EVENTS MARKET FOR OTHERS, BY COUNTRY, 2019-2027 ($MILLION)

TABLE 11.UK AND IRELAND VIRTUAL EVENTS MARKET, BY AGE GROUP, 2019-2027 ($MILLION)

TABLE 12.UK AND IRELAND VIRTUAL EVENTS MARKET FOR BELOW 20 YEARS, BY COUNTRY, 2019-2027 ($MILLION)

TABLE 13.UK AND IRELAND VIRTUAL EVENTS MARKET FOR 21 TO 40 YEARS, BY COUNTRY, 2019-2027 ($MILLION)

TABLE 14.UK AND IRELAND VIRTUAL EVENTS MARKET FOR ABOVE 40 YEARS, BY COUNTRY, 2019-2027 ($MILLION)

TABLE 15.UK VIRTUAL EVENT MARKET, BY EVENT TYPE, 2019-2027 ($MILLION)

TABLE 16.UK VIRTUAL EVENT MARKET, BY REVENUE SOURCE, 2019-2027 ($MILLION)

TABLE 17.UK VIRTUAL EVENT MARKET, BY AGE GROUP, 2019-2027 ($MILLION)

TABLE 18.IRELAND VIRTUAL EVENT MARKET, BY EVENT TYPE, 2019-2027 ($MILLION)

TABLE 19.IRELAND VIRTUAL EVENT MARKET, BY REVENUE SOURCE, 2019-2027 ($MILLION)

TABLE 20.IRELAND VIRTUAL EVENT MARKET, BY AGE GROUP, 2019-2027 ($MILLION)

TABLE 21.FIRST EVENT: KEY EXECUTIVES

TABLE 22.FIRST EVENT: COMPANY SNAPSHOT

TABLE 23.FIRST EVENT: SERVICE PORTFOLIO

TABLE 24.GEORGE P. JOHNSON: KEY EXECUTIVES

TABLE 25.GEORGE P. JOHNSON: COMPANY SNAPSHOT

TABLE 26.GEORGE P. JOHNSON: SERVICE PORTFOLIO

TABLE 27.GROOVEYARD EVENTS LIMITED: COMPANY SNAPSHOT

TABLE 28.GROOVEYARD EVENTS LIMITED: SERVICE PORTFOLIO

TABLE 29.HOPIN: KEY EXECUTIVES

TABLE 30.HOPIN: COMPANY SNAPSHOT

TABLE 31.HOPIN: SERVICE PORTFOLIO

TABLE 32.JULIA CHARLES EVENT MANAGEMENT LTD: KEY EXECUTIVES

TABLE 33.JULIA CHARLES EVENT MANAGEMENT LTD: COMPANY SNAPSHOT

TABLE 34.JULIA CHARLES EVENT MANAGEMENT LTD: SERVICE PORTFOLIO

TABLE 35.MGN EVENTS LTD: KEY EXECUTIVES

TABLE 36.MGN EVENTS LTD: COMPANY SNAPSHOT

TABLE 37.MGN EVENTS LTD: SERVICE PORTFOLIO

TABLE 38.SAVILLE GROUP LTD: KEY EXECUTIVES

TABLE 39.SAVILLE GROUP LTD: COMPANY SNAPSHOT

TABLE 40.SAVILLE GROUP LTD: SERVICE PORTFOLIO

TABLE 41.SEVEN EVENTS LTD: KEY EXECUTIVES

TABLE 42.SEVEN EVENTS LTD: COMPANY SNAPSHOT

TABLE 43.SEVEN EVENTS LTD: SERVICE PORTFOLIO

TABLE 44.THE EVENTS COMPANY: COMPANY SNAPSHOT

TABLE 45.THE EVENTS COMPANY: SERVICE PORTFOLIO

TABLE 46.VERVE LIVE AGENCY: KEY EXECUTIVES

TABLE 47.VERVE LIVE AGENCY: COMPANY SNAPSHOT

TABLE 48.VERVE LIVE AGENCY: SERVICE PORTFOLIO

FIGURE

FIGURE 01.KEY MARKET SEGMENTS

FIGURE 02.UK AND IRELAND VIRTUAL EVENTS MARKET SNAPSHOT, BY SEGMENTATION, 2021–2027

FIGURE 03.TOP INVESTMENT POCKETS, BY EVENT TYPE

FIGURE 04.MODERATE BARGAINING POWER OF SUPPLIERS

FIGURE 05.HIGH BARGAINING POWER OF BUYERS

FIGURE 06.HIGH THREAT OF NEW ENTRANTS

FIGURE 07.MODERATE THREAT OF SUBSTITUTION

FIGURE 08.HIGH INTENSITY OF COMPETITIVE RIVALRY

FIGURE 09.UK AND IRELAND VIRTUAL EVENTS MARKET SHARE, BY EVENT TYPE, 2019(%)

FIGURE 10.COMPARATIVE REVENUE SHARE ANALYSIS OF UK AND IRELAND VIRTUAL WEBINAR EVENT MARKET, BY COUNTRY, 2019 & 2027 (%)

FIGURE 11.COMPARATIVE REVENUE SHARE ANALYSIS OF UK AND IRELAND VIRTUAL CONFERENCE EVENT MARKET, BY COUNTRY, 2019 & 2027 (%)

FIGURE 12.COMPARATIVE REVENUE SHARE ANALYSIS FOR UK AND IRELAND VIRTUAL EXPO, FAIRS, & FESTIVALS EVENT MARKET, BY COUNTRY, 2019 & 2027 (%)

FIGURE 13.COMPARATIVE REVENUE SHARE ANALYSIS OF UK AND IRELAND VIRTUAL ENTERTAINMENT EVENT MARKET, BY COUNTRY, 2019 & 2027 (%)

FIGURE 14.COMPARATIVE REVENUE SHARE ANALYSIS OF UK AND IRELAND VIRTUAL OTHER EVENTS MARKET, BY COUNTRY, 2019 & 2027 (%)

FIGURE 15.UK AND IRELAND VIRTUAL EVENTS MARKET SHARE, BY REVENUE SOURCE, 2019(%)

FIGURE 16.COMPARATIVE REVENUE SHARE ANALYSIS OF UK AND IRELAND VIRTUAL EVENTS MARKET FOR TICKET SALE, BY COUNTRY, 2019 & 2027 (%)

FIGURE 17.COMPARATIVE REVENUE SHARE ANALYSIS OF UK AND IRELAND VIRTUAL EVENTS MARKET FOR SPONSORSHIP, BY COUNTRY, 2019 & 2027 (%)

FIGURE 18.COMPARATIVE REVENUE SHARE ANALYSIS OF UK AND IRELAND VIRTUAL EVENTS MARKET FOR OTHERS, BY COUNTRY, 2019 & 2027 (%)

FIGURE 19.UK AND IRELAND VIRTUAL EVENTS MARKET SHARE, BY AGE GROUP, 2019(%)

FIGURE 20.COMPARATIVE REVENUE SHARE ANALYSIS OF UK AND IRELAND VIRTUAL EVENTS MARKET FOR BELOW 20 YEARS, BY COUNTRY, 2019 & 2027 (%)

FIGURE 21.COMPARATIVE REVENUE SHARE ANALYSIS OF UK AND IRELAND VIRTUAL EVENTS MARKET FOR 21 TO 40 YEARS, BY COUNTRY, 2019 & 2027 (%)

FIGURE 22.COMPARATIVE REVENUE SHARE ANALYSIS OF UK AND IRELAND VIRTUAL EVENTS MARKET FOR ABOVE 40 YEARS, BY COUNTRY, 2019 & 2027 (%)

FIGURE 23.UK AND IRELAND VIRTUAL EVENTS MARKET SHARE, BY COUNTRY, 2019(%)

FIGURE 24.SERVICE MAPPING OF TOP 10 KEY PLAYERS

FIGURE 25.COMPETITIVE DASHBOARD OF TOP 10 KEY PLAYERS

FIGURE 26.COMPETITIVE HEATMAP OF TOP 10 KEY PLAYERS

$4499

$6868

HAVE A QUERY?

OUR CUSTOMER