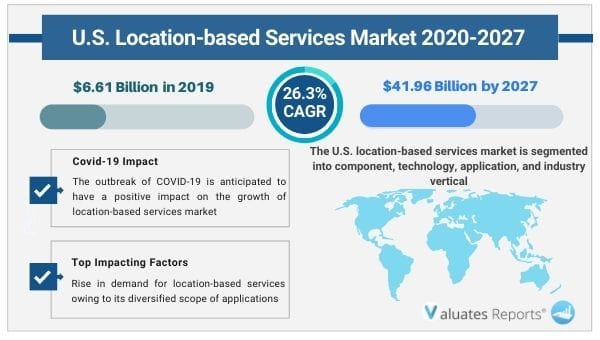

The U.S. location-based services market size was valued at $6.61 billion in 2019 and is projected to reach $41.96 billion by 2027, growing at a CAGR of 26.3% from 2020 to 2027. The report focuses on the growth prospects, restraints, and location-based services market analysis. The study provides Porter’s five forces analysis of the location-based services industry to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, the threat of substitutes, and bargaining power of buyers.

The advent of digitalization boosts the need for location-based services (LBS), owing to its capability to offer customized marketing strategy solutions, which, in turn, creates new revenue growth opportunities for players opting for these solutions. Location-based services proliferate the demand for analytical solutions, due to their ability to provide and analyze real-time geo-data. For instance, retailers can strategize their marketing campaigns on the basis of customer locations for the nearest store or location-based offers. This is likely to help retailers with new and advanced revenue growth opportunities, which, in turn, is expected to boost the location-based services market during the forecast period.

By component, the hardware segment was the highest contributor in the location-based services market in the year 2019, due to the advent of digitalization among various industry verticals and high penetration of smartphones among individuals across the country. A rise in penetration of smartphones and increase in usage of 3G & 4G networks drive the U.S. market growth. In addition, key players have focused on developing low-priced GPS and other components to cater to the increasing demand of consumers, which significantly contributes toward the growth of the U.S. market.

Moreover, surge in adoption of mobile commerce and social media activities is expected to supplement the adoption of hardware components in the LBS market. However, services segment is expected to grow with the highest CAGR during the forecast period, due to increase in demand for services-as-a-solution in digital transformation activities among industries. Thus, major players operating in the U.S. location-based services market are investing in innovative location-based analytical solutions to gain competitive advantages.

The outbreak of COVID-19 is anticipated to have a positive impact on the growth of location-based services market. With the emergence COVID-19, the use of location-based services is likely to enable governments to address the impact of social distancing and facilitate tracking patterns of movements of individuals and traffic patterns. Innovations and advances in location-based services post COVID-19 outbreak with features such as real-time tracking, location-based marketing, and geo-tagging, have further supported the market growth.

The report focuses on the growth prospects, restraints, and location-based services market analysis. The study provides Porter’s five forces analysis of the location-based services industry to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers.

The U.S. location-based services market is segmented into component, technology, application, and industry vertical. By component, the market is categorized into solution, services and connectivity technology. The applications covered in the study include location-based advertising, business intelligence & analytics, fleet management, mapping and navigation, local search & information, social networking & entertainment, proximity marketing, asset tracking, and others. Depending on industry vertical, the LBS industry is segregated into transportation & logistics, manufacturing, government & public utilities, retail, healthcare & life sciences, media & entertainment, IT & telecom, BFSI, hospitality, and others.

Key players of the location-based services market analyzed in the research include Alcatel-Lucent SA, Apple, Inc., AT&T Inc., Cisco Systems, Inc., Google Inc., HERE, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, and Qualcomm Inc. and others. They have adopted various strategies including new product launches, collaborations, partnerships, mergers & acquisitions, joint ventures, agreements, and others to gain a stronghold and international presence across U.S.

Rise in demand for location-based services owing to its diversified scope of applications is a major factor expected to drive the growth of the market. Surge in demand for location-based services among various industry verticals for applications such as location-based advertising, business intelligence & analytics, and fleet management is further expected to offer remunerative opportunities for the expansion of the global LBS industry during the forecast period. The U.S. location based services market trends are as follows:

New product launches to flourish the market

expected to drive the growth of the market. Surge in demand for location-based services among various industry verticals for applications such as location-based advertising, business intelligence & analytics, and fleet management is further expected to offer remunerative opportunities for the expansion of the U.S. location based industry during the forecast period.

The growth of the LBS market is driven by the diversified scope of applications across various sectors. For instance, LBS is used for navigation, traffic management, asset tracking, and proximity-based marketing. In addition, it finds its application in fraud prevention, mobile workforce management, and context advertising. Energy & resource management agencies use LBS for evaluation of land cover, vegetation, water resource management, and geology mapping. The defense & military sector utilize LBS for surveillance, battlefront analysis, and strategy formulation. In civil engineering, LBS solution is used for resource mapping, evaluation of geological information, and estimation of suitable location for building, planning, & construction activities. In addition, transportation, media & entertainment, insurance, and tourism sectors offer a wide scope of applications for LBS.

Location-based services are used to provide information about user’s location through internet by using real-time geo-data. The advent of smart devices, wireless technologies, cloud computing, Internet of Things (IoT), and smartphone applications has led to aggrandized traffic on websites. This has fueled the adoption of LBS to improve services and enhance user experience depending upon the end user’s location, which, in turn, is expected drive the market growth. Therefore, LBS has gained importance across various sectors, including government authorities, defense & intelligence, transportation, telecommunication, manufacturing, e-retailing, energy, and natural resource management. Furthermore, increase in penetration of connected devices and machine-to-machine communication systems has notably boosted the need for real-time location-based data sets. This has significantly driven the demand for Internet of Things (IoT) devices across diverse sectors, which is helping companies to develop smart geo-mapping solutions. Thus, aforementioned are key factors are expected to fuel the growth of the U.S. market growth during the forecast period.

$4239

$4612

$6432

$2746

HAVE A QUERY?

OUR CUSTOMER