The sodium silicate market size was valued at $7.2 billion in 2019 and is anticipated to generate $9.2 billion by 2027. The market is projected to experience a growth at a CAGR of 3.7% from 2020 to 2027. The sodium silicate market growth is attributed to rise in application in detergents and the soap industry. Moreover, factors such as the rise in demand from the rubber and tire industry for abrasion and wear-resistant properties acts as sodium silicate market drivers. Furthermore, increased demand from the pulp & paper industry especially recycled and waste paper also attributes toward the sodium silicate market growth. However, the availability of substitutes and hazardous effects on human restraint the market growth. Meanwhile, growth in the construction industry that has applications of sodium silicate offers a lucrative opportunity for the sodium silicate industry growth.

The sodium silicate market suffered medium impact from the outbreak due to a halt in production and manufacturing activities, which resulted in a supply-demand gap.

Sodium silicate is a colorless compound of oxides of sodium and silica. Sodium silicate is used in soaps, detergents and in the manufacture of silica gel. It is used as a cement, binder, filler, and adhesive. In addition, it is used as a wall coating, in concrete, fireproofing material, and as a sealant. It is also used to preserve eggs and wood. Sodium silicate also finds use in the textile and pharmaceutical industries. Neutral sodium silicate in liquid form is suitable for use in pharmaceutical and toilet preparations.

Sodium silicates of certain ratios are used for application over concrete floors for hardening making dustless concrete floors and protecting pervious building materials against the effects of moisture. It is also used in foundries and welding electrode industries. In ceramic industries, sodium silicate is used as a deflocculant in the preparation of casting slips for keeping solid particles in suspension without settling. Sodium silicate is used in refractories industries as an air-setting bond for manufacturing refractory cements and mortars. In vitreous enamel industries, it is used for cleaning the metal, known as pickling, prior to enameling.

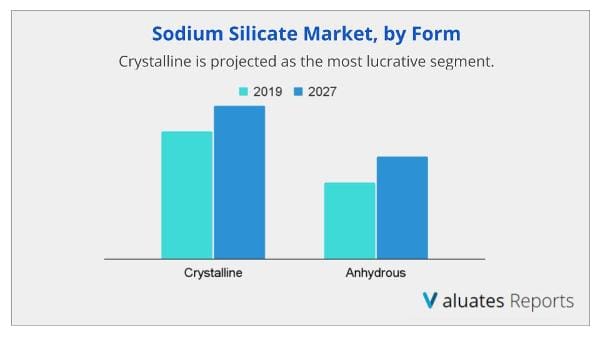

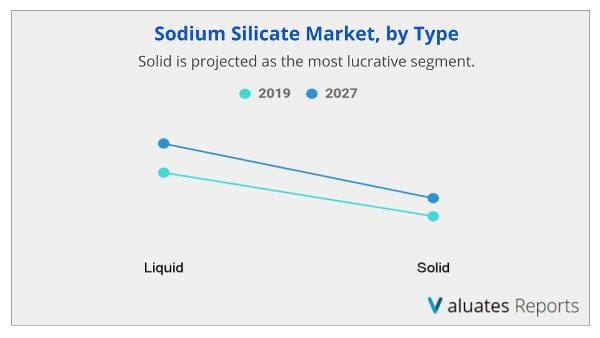

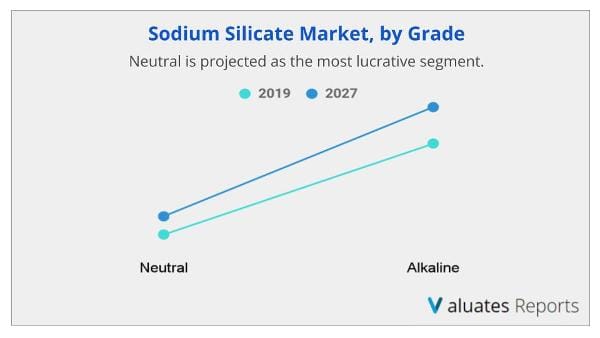

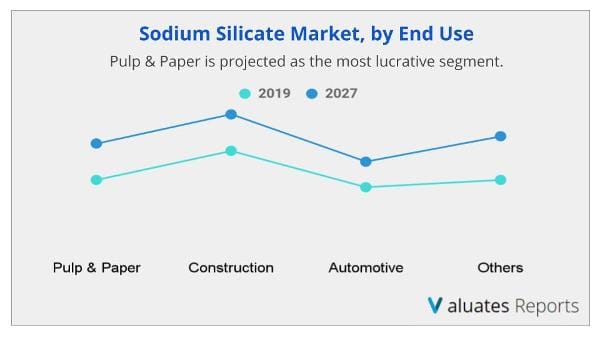

The sodium silicate market is segmented on the basis of form, type, grade, application, end use, and region. Depending on form, the market is segmented into crystalline and anhydrous. By type, the market is bifurcated into liquid and solid. The grade segment is further divided into neutral and alkaline. Based on application, the market is divided into paints, adhesives, refractories, tube winding, detergent, catalyst, and others. Based on the end use, the market is categorized into pulp & paper, construction, automotive, and others.

Based on region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The key players operating in the market are Tokuyama Corporation, Evonik Industries AG, Merck Millipore Limited, Nippon Chemical Industrial Co. Ltd., PQ Group Holdings Inc., Occidental Petroleum Corporation, CIECH S.A., Sinchem Silica Gel Co. Ltd., Shijiazhuang Shuanglian Chemical Industry Co. Ltd., and Kiran Global Chem Limited.

By form, the sodium silicate market is bifurcated into crystalline and anhydrous. The sodium silicate market was dominated by the crystalline segment in 2019. It is also expected to continue the growth at higher CAGR during the forecast period. This is attributed to application in fireproofing mixtures, in laundry, dairy, metal, and floor cleaning. They are also used in deinking paper, insecticides, fungicides, washing carbonated drink bottles, and antimicrobial compounds. Such application of crystalline sodium silicates drives market growth.

By type, the sodium silicate is divided into liquid and solid. The liquid segment dominated the market share in 2019. This was attributed to its use in many industrial and commercial applications such as in detergent/cleaning compounds, pulp and paper, paper board, building products/construction, textiles, ceramics, petroleum processing, and metals. Such application of liquid sodium silicates drives the market growth. However, the solid segment is expected to grow at a higher CAGR during the forecast period, owing to ease of handling and storage facilities.

Depending on grade, the market is segmented into neutral and alkaline. The alkaline segment dominated the market share in 2019, owing to applications in adhesives & binders, pulp & paper, deinking, detergents/soaps, catalysts, textiles, drilling fluids, mineral processing, refractory cements, and zeolites. However, the neutral segment is expected to grow at a higher CAGR during the forecast period, owing to increased applications in wastewater treatment.

The application segment is divided into paints, adhesives, refractories, tube winding, detergent, catalyst, and others. The detergent segment dominated the market share in 2019, owing to increased cleaning and washing activities. However, the adhesive segment is expected to grow at a higher CAGR during the forecast period, owing to ease in applying, suitable viscosity, ease in penetration, and high strength.

By end-use, the market is segmented into pulp & paper, construction, automotive, and others. The construction segment dominated the market in 2019, owing to use in soil stabilization, concrete hardening, and cement refractories. However, the pulp & paper segment is projected to grow at a higher CAGR, owing to increased use in fresh as well as recycled paper for de-inking and brightening pulps.

By region, the sodium silicate market analysis is done across North America, Europe, Asia-Pacific, LAMEA (Latin America, Middle East, and Africa). Asia-Pacific dominated the market in 2019, owing to presence of large number of corporations. However, North America is projected to grow at a higher CAGR during the forecast period, owing to rising activities in construction, detergent, catalyst, tube winding, and paper & pulp application of sodium silicate.

By Form

By Type

By Grade

By Application

By End Use

By Region

|

Report Metric |

Details |

|

Report Name |

Sodium Silicate Market |

|

The Market size value in 2019 |

7.2 Billion USD |

|

The Revenue forecast in 2027 |

9.2 Billion USD |

|

Growth Rate |

CAGR of 3.7% from 2020 to 2027 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, End-User, Offerings, and Region |

|

Report coverage |

Revenue & volume forecast, company share, competitive landscape, growth factors, and trends |

|

Geographic regions covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Ans. North America is projected to grow at a higher CAGR during the forecast period, owing to rising activities in construction, detergent, catalyst, tube winding, and paper & pulp application of sodium silicate.

Ans. Depending on grade, The alkaline segment dominated the market share in 2019, owing to applications in adhesives & binders, pulp & paper, deinking, detergents/soaps, catalysts, textiles, drilling fluids, mineral processing, refractory cements, and zeolites

Ans. The forecast period for the sodium silicate market is 2020 to 2027.

Ans. Increasing demand for other sodium derivatives such as zeolites and precipitated silica as catalysts in bio and chemical processes is expected to drive product demand over the forecast period.

Ans. The top companies operating in the sodium silicate market are Tokuyama Corporation, Evonik Industries AG, Merck Millipore Limited, Nippon Chemical Industrial Co. Ltd., PQ Group Holdings Inc., Occidental Petroleum Corporation, CIECH S.A., Sinchem Silica Gel Co. Ltd., Shijiazhuang Shuanglian Chemical Industry Co. Ltd., and Kiran Global Chem Limited.

Ans. The sodium silicate market was valued at $7.2 billion in 2019 and is anticipated to generate $9.2 billion by 2027. The market is projected to experience a growth at a CAGR of 3.7% from 2020 to 2027.

TABLE OF CONTENT

CHAPTER 1:INTRODUCTION

1.1.Report description

1.2.Key benefits for stakeholders

1.3.Key market segments

1.4.Research methodology

1.4.1.Primary research

1.4.2.Secondary research

1.4.3.Analyst tools and models

CHAPTER 2:EXECUTIVE SUMMARY

2.1.Key findings of the study

2.2.CXO perspective

CHAPTER 3:MARKET LANDSCAPE

3.1.Market definition and scope

3.2.Key findings

3.2.1.Top investment pockets

3.3.Porter's five forces analysis

3.4.Value chain analysis

3.5.Market dynamics

3.5.1.Drivers

3.5.1.1.Growth in demand in detergents & soaps and rubber & tire industry

3.5.1.2.Increased demand from pulp & paper industry

3.5.2.Restraint

3.5.2.1.Hazardous nature of sodium silicate

3.5.2.2.Presence of substitutes

3.5.3.Opportunity

3.5.3.1.Growth in applications in the construction industry

3.6.Pricing analysis

3.7.Patent analysis

3.8.Impact of COVID-19 on the sodium silicate market

CHAPTER 4:SODIUM SILICATE MARKET, BY FORM

4.1.Overview

4.1.1.Market size and forecast

4.2.Crystalline

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast, by region

4.3.Anhydrous

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Market size and forecast, by region

CHAPTER 5:SODIUM SILICATE MARKET, BY TYPE

5.1.Overview

5.1.1.Market size and forecast

5.2.Liquid

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region

5.3.Solid

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region

CHAPTER 6:SODIUM SILICATE MARKET, BY GRADE

6.1.Overview

6.1.1.Market size and forecast

6.2.Neutral

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by region

6.3.Alkaline

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by region

CHAPTER 7:SODIUM SILICATE MARKET, BY APPLICATION

7.1.Overview

7.1.1.Market size and forecast

7.2.Paints

7.2.1.Key market trends, growth factors, and opportunities

7.2.2.Market size and forecast, by region

7.3.Adhesives

7.3.1.Key market trends, growth factors, and opportunities

7.3.2.Market size and forecast, by region

7.4.Refractories

7.4.1.Key market trends, growth factors, and opportunities

7.4.2.Market size and forecast, by region

7.5.Tube winding

7.5.1.Key market trends, growth factors, and opportunities

7.5.2.Market size and forecast, by region

7.6.Detergents

7.6.1.Key market trends, growth factors, and opportunities

7.6.2.Market size and forecast, by region

7.7.Catalyst

7.7.1.Key market trends, growth factors, and opportunities

7.7.2.Market size and forecast, by region

7.8.Others

7.8.1.Key market trends, growth factors, and opportunities

7.8.2.Market size and forecast, by region

CHAPTER 8:SODIUM SILICATE MARKET, BY END-USE

8.1.Overview

8.1.1.Market size and forecast

8.2.Pulp &paper

8.2.1.Key market trends, growth factors, and opportunities

8.2.2.Market size and forecast, by region

8.3.Construction

8.3.1.Key market trends, growth factors, and opportunities

8.3.2.Market size and forecast, by region

8.4.Automotive

8.4.1.Key market trends, growth factors, and opportunities

8.4.2.Market size and forecast, by region

8.5.Others

8.5.1.Key market trends, growth factors, and opportunities

8.5.2.Market size and forecast, by region

CHAPTER 9:SODIUM SILICATE MARKET, BY REGION

9.1.Overview

9.1.1.Market size and forecast

9.2.North America

9.2.1.Key market trends, growth factors, and opportunities

9.2.2.Market size and forecast, by form

9.2.3.Market size and forecast, by type

9.2.4.Market size and forecast, by grade

9.2.5.Market size and forecast, by application

9.2.6.Market size and forecast, by end use

9.2.7.Market share analysis, by country

9.2.8.U.S.

9.2.8.1.Market size and forecast, by form

9.2.8.2.Market size and forecast, by type

9.2.8.3.Market size and forecast

9.2.8.4.Market size and forecast, by application

9.2.8.5.Market size and forecast, by end use

9.2.9.Canada

9.2.9.1.Market size and forecast, by form

9.2.9.2.Market size and forecast, by type

9.2.9.3.Market size and forecast

9.2.9.4.Market size and forecast, by application

9.2.9.5.Market size and forecast, by end use

9.2.10.Mexico

9.2.10.1.Market size and forecast, by form

9.2.10.2.Market size and forecast, by type

9.2.10.3.Market size and forecast

9.2.10.4.Market size and forecast, by application

9.2.10.5.Market size and forecast, by end use

9.3.Europe

9.3.1.Key market trends, growth factors, and opportunities

9.3.2.Market size and forecast, by form

9.3.3.Market size and forecast, by type

9.3.4.Market size and forecast, by grade

9.3.5.Market size and forecast, by application

9.3.6.Market size and forecast, by end use

Market share analysis, by country

9.3.7.Germany

9.3.7.1.Market size and forecast, by form

9.3.7.2.Market size and forecast, by type

9.3.7.3.Market size and forecast

9.3.7.4.Market size and forecast, by application

9.3.7.5.Market size and forecast, by end use

9.3.8.UK

9.3.8.1.Market size and forecast, by form

9.3.8.2.Market size and forecast, by type

9.3.8.3.Market size and forecast

9.3.8.4.Market size and forecast, by application

9.3.8.5.Market size and forecast, by end use

9.3.9.France

9.3.9.1.Market size and forecast, by form

9.3.9.2.Market size and forecast, by type

9.3.9.3.Market size and forecast

9.3.9.4.Market size and forecast, by application

9.3.9.5.Market size and forecast, by end use

9.3.10.Italy

9.3.10.1.Market size and forecast, by form

9.3.10.2.Market size and forecast, by type

9.3.10.3.Market size and forecast

9.3.10.4.Market size and forecast, by application

9.3.10.5.Market size and forecast, by end use

9.3.11.Spain

9.3.11.1.Market size and forecast, by form

9.3.11.2.Market size and forecast, by type

9.3.11.3.Market size and forecast

9.3.11.4.Market size and forecast, by application

9.3.11.5.Market size and forecast, by end use

9.3.12.Rest of Europe

9.3.12.1.Market size and forecast, by form

9.3.12.2.Market size and forecast, by type

9.3.12.3.Market size and forecast

9.3.12.4.Market size and forecast, by application

9.3.12.5.Market size and forecast, by end use

9.4.Asia-Pacific

9.4.1.Key market trends, growth factors, and opportunities

9.4.2.Market size and forecast, by form

9.4.3.Market size and forecast, by type

9.4.4.Market size and forecast, by grade

9.4.5.Market size and forecast, by application

9.4.6.Market size and forecast, by end use

9.4.7.Market share analysis, by country

9.4.8.China

9.4.8.1.Market size and forecast, by form

9.4.8.2.Market size and forecast, by type

9.4.8.3.Market size and forecast

9.4.8.4.Market size and forecast, by application

9.4.8.5.Market size and forecast, by end use

9.4.9.Japan

9.4.9.1.Market size and forecast, by form

9.4.9.2.Market size and forecast, by type

9.4.9.3.Market size and forecast

9.4.9.4.Market size and forecast, by application

9.4.9.5.Market size and forecast, by end use

9.4.10.India

9.4.10.1.Market size and forecast, by form

9.4.10.2.Market size and forecast, by type

9.4.10.3.Market size and forecast

9.4.10.4.Market size and forecast, by application

9.4.10.5.Market size and forecast, by end use

9.4.11.South Korea

9.4.11.1.Market size and forecast, by form

9.4.11.2.Market size and forecast, by type

9.4.11.3.Market size and forecast

9.4.11.4.Market size and forecast, by application

9.4.11.5.Market size and forecast, by end use

9.4.12.Australia

9.4.12.1.Market size and forecast, by form

9.4.12.2.Market size and forecast, by type

9.4.12.3.Market size and forecast

9.4.12.4.Market size and forecast, by application

9.4.12.5.Market size and forecast, by end use

9.4.13.Rest of Asia-Pacific

9.4.13.1.Market size and forecast, by form

9.4.13.2.Market size and forecast, by type

9.4.13.3.Market size and forecast

9.4.13.4.Market size and forecast, by application

9.4.13.5.Market size and forecast, by end use

9.5.LAMEA

9.5.1.Key market trends, growth factors, and opportunities

9.5.2.Market size and forecast, by form

9.5.3.Market size and forecast, by type

9.5.4.Market size and forecast, by grade

9.5.5.Market size and forecast, by application

9.5.6.Market size and forecast, by end use

9.5.7.Market share analysis, by country

9.5.8.Brazil

9.5.8.1.Market size and forecast, by form

9.5.8.2.Market size and forecast, by type

9.5.8.3.Market size and forecast

9.5.8.4.Market size and forecast, by application

9.5.8.5.Market size and forecast, by end use

9.5.9.South Africa

9.5.9.1.Market size and forecast, by form

9.5.9.2.Market size and forecast, by type

9.5.9.3.Market size and forecast

9.5.9.4.Market size and forecast, by application

9.5.9.5.Market size and forecast, by end use

9.5.10.Saudi Arabia

9.5.10.1.Market size and forecast, by form

9.5.10.2.Market size and forecast, by type

9.5.10.3.Market size and forecast

9.5.10.4.Market size and forecast, by application

9.5.10.5.Market size and forecast, by end use

9.5.11.Rest of LAMEA

9.5.11.1.Market size and forecast, by form

9.5.11.2.Market size and forecast, by type

9.5.11.3.Market size and forecast

9.5.11.4.Market size and forecast, by application

9.5.11.5.Market size and forecast, by end use

CHAPTER 10:COMPETITIVE LANDSCAPE

10.1.Introduction

10.1.1.Market player positioning, 2020

10.2.Top winning strategies

10.2.1.Top winning strategies, by year

10.2.2.Top winning strategies, by development

10.2.3.Top winning strategies, by company

10.3.Product mapping of top 10 player

10.4.Competitive dashboard

10.5.Competitive heatmap

10.6.Key developments

10.6.1.Expansions

10.6.2.Other developments

CHAPTER 11:COMPANY PROFILES

11.1.CIECH S.A.

11.1.1.Company overview

11.1.2.Company snapshot

11.1.3.Operating business segments

11.1.4.Product portfolio

11.1.5.Business performance

11.1.6.Key strategic moves and developments

11.2.EVONIK INDUSTRIES AG

11.2.1.Company overview

11.2.2.Company snapshot

11.2.3.Operating business segments

11.2.4.Product portfolio

11.2.5.Business performance

11.3.KIRAN GLOBAL CHEM LIMITED

11.3.1.Company overview

11.3.2.Company snapshot

11.3.3.Product portfolio

11.4.MERCK MILLIPORE LIMITED

11.4.1.Company overview

11.4.2.Company snapshot

11.4.3.Operating business segments

11.4.4.Product portfolio

11.4.5.Business performance

11.5.NIPPON CHEMICAL INDUSTRIAL CO., LTD.

11.5.1.Company overview

11.5.2.Company snapshot

11.5.3.Operating business segments

11.5.4.Product portfolio

11.5.5.Business performance

11.6.OCCIDENTAL PETROLEUM CORPORATION

11.6.1.Company overview

11.6.2.Company snapshot

11.6.3.Operating business segments

11.6.4.Product portfolio

11.6.5.Business performance

11.7.PQ GROUP HOLDINGS INC.

11.7.1.Company overview

11.7.2.Company snapshot

11.7.3.Operating business segments

11.7.4.Product portfolio

11.7.5.Business performance

11.7.6.Key strategic moves and developments

11.8.SHIJIAZHUANG SHUANGLIAN CHEMICAL INDUSTRY CO. LTD.

11.8.1.Company overview

11.8.2.Company snapshot

11.8.3.Product portfolio

11.9.SINCHEM SILICA GEL CO. LTD.

11.9.1.Company overview

11.9.2.Company snapshot

11.9.3.Product portfolio

11.10.TOKUYAMA CORPORATION

11.10.1.Company overview

11.10.2.Company snapshot

11.10.3.Operating business segments

11.10.4.Product portfolio

11.10.5.Business performance

LIST OF TABLES & FIGURES

TABLE 01.GLOBAL SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 02.GLOBAL SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILO TONS)

TABLE 03.CRYSTALLINE SODIUM SILICATE MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 04.CRYSTALLINE SODIUM SILICATE MARKET, BY REGION, 2019–2027 (KILO TONS)

TABLE 05.ANHYDROUS SODIUM SILICATE MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 06.ANHYDROUS SODIUM SILICATE MARKET, BY REGION, 2019–2027 (KILO TONS)

TABLE 07.GLOBAL SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 08.GLOBAL SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILO TONS)

TABLE 09.LIQUID SODIUM SILICATE MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 10.LIQUID SODIUM SILICATE MARKET, BY REGION, 2019–2027 (KILO TONS)

TABLE 11.SOLID SODIUM SILICATE MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 12.SOLID SODIUM SILICATE MARKET, BY REGION, 2019–2027 (KILO TONS)

TABLE 13.GLOBAL SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 14.GLOBAL SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILO TONS)

TABLE 15.NEUTRAL SODIUM SILICATE MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 16.NEUTRAL SODIUM SILICATE MARKET, BY REGION, 2019–2027 (KILO TONS)

TABLE 17.ALKALINE SODIUM SILICATE MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 18.ALKALINE SODIUM SILICATE MARKET, BY REGION, 2019–2027 (KILO TONS)

TABLE 19.GLOBAL SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 20.GLOBAL SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILO TONS)

TABLE 21.SODIUM SILICATE PAINTS MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 22.SODIUM SILICATE PAINTS MARKET, BY REGION, 2019–2027 (KILO TONS)

TABLE 23.SODIUM SILICATE ADHESIVES MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 24.SODIUM SILICATE ADHESIVES MARKET, BY REGION, 2019–2027 (KILO TONS)

TABLE 25.SODIUM SILICATE REFRACTORIES MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 26.SODIUM SILICATE REFRACTORIES MARKET, BY REGION, 2019–2027 (KILO TONS)

TABLE 27.SODIUM SILICATE TUBE WINDING MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 28.SODIUM SILICATE TUBE WINDING MARKET, BY REGION, 2019–2027 (KILO TONS)

TABLE 29.SODIUM SILICATE DETERGENTS MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 30.SODIUM SILICATE DETERGENTS MARKET, BY REGION, 2019–2027 (KILO TONS)

TABLE 31.SODIUM SILICATE CATALYST MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 32.SODIUM SILICATE CATALYST MARKET, BY REGION, 2019–2027 (KILO TONS)

TABLE 33.SODIUM SILICATE OTHERS MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 34.SODIUM SILICATE OTHERS MARKET, BY REGION, 2019–2027 (KILO TONS)

TABLE 35.GLOBAL SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 36.GLOBAL SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILO TONS)

TABLE 37.SODIUM SILICATE PULP & PAPER MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 38.SODIUM SILICATE PULP & PAPER MARKET, BY REGION, 2019–2027 (KILO TONS)

TABLE 39.SODIUM SILICATE CONSTRUCTION MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 40.SODIUM SILICATE CONSTRUCTION MARKET, BY REGION, 2019–2027 (KILO TONS)

TABLE 41.SODIUM SILICATE AUTOMOTIVE MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 42.SODIUM SILICATE AUTOMOTIVE MARKET, BY REGION, 2019–2027 (KILO TONS)

TABLE 43.SODIUM SILICATE OTHERS MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 44.SODIUM SILICATE OTHERS MARKET, BY REGION, 2019–2027 (KILO TONS)

TABLE 45.SODIUM SILICATE MARKET, BY REGION, 2019-2027 ($MILLION)

TABLE 46.SODIUM SILICATE MARKET, BY REGION, 2019-2027 (KILOTONS)

TABLE 47.NORTH AMERICA SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 48.NORTH AMERICA SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILOTONS)

TABLE 49.NORTH AMERICA SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 50.NORTH AMERICA SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILOTONS)

TABLE 51.NORTH AMERICA SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 52.NORTH AMERICA SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILOTONS)

TABLE 53.NORTH AMERICA SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 54.NORTH AMERICA SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILOTONS)

TABLE 55.NORTH AMERICA SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 56.NORTH AMERICA SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILOTONS)

TABLE 57.NORTH AMERICA SODIUM SILICATE MARKET, BY COUNTRY, 2019–2027 ($MILLION)

TABLE 58.NORTH AMERICA SODIUM SILICATE MARKET, BY COUNTRY, 2019–2027 (KILOTONS)

TABLE 59.U.S. SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 60.U.S. SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILOTONS)

TABLE 61.U.S. SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 62.U.S. SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILOTONS)

TABLE 63.U.S. SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 64.U.S. SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILOTONS)

TABLE 65.U.S. SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 66.U.S. SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILOTONS)

TABLE 67.U.S. SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 68.U.S. SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILOTONS)

TABLE 69.CANADA SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 70.CANADA SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILOTONS)

TABLE 71.CANADA SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 72.CANADA SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILOTONS)

TABLE 73.CANADA SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 74.CANADA SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILOTONS)

TABLE 75.CANADA SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 76.CANADA SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILOTONS)

TABLE 77.CANADA SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 78.CANADA SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILOTONS)

TABLE 79.MEXICO SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 80.MEXICO SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILOTONS)

TABLE 81.MEXICO SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 82.MEXICO SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILOTONS)

TABLE 83.MEXICO SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 84.MEXICO SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILOTONS)

TABLE 85.MEXICO SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 86.MEXICO SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILOTONS)

TABLE 87.MEXICO SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 88.MEXICO SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILOTONS)

TABLE 89.EUROPE SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 90.EUROPE SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILOTONS)

TABLE 91.EUROPE SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 92.EUROPE SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILOTONS)

TABLE 93.EUROPE SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 94.EUROPE SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILOTONS)

TABLE 95.EUROPE SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 96.EUROPE SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILOTONS)

TABLE 97.EUROPE SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 98.EUROPE SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILOTONS)

TABLE 99.EUROPE SODIUM SILICATE MARKET, BY COUNTRY, 2019–2027 ($MILLION)

TABLE 100.EUROPE SODIUM SILICATE MARKET, BY COUNTRY, 2019–2027 (KILOTONS)

TABLE 101.GERMANY SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 102.GERMANY SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILOTONS)

TABLE 103.GERMANY SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 104.GERMANY SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILOTONS)

TABLE 105.GERMANY SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 106.GERMANY SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILOTONS)

TABLE 107.GERMANY SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 108.GERMANY SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILOTONS)

TABLE 109.GERMANY SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 110.GERMANY SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILOTONS)

TABLE 111.UK SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 112.UK SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILOTONS)

TABLE 113.UK SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 114.UK SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILOTONS)

TABLE 115.UK SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 116.UK SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILOTONS)

TABLE 117.UK SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 118.UK SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILOTONS)

TABLE 119.UK SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 120.UK SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILOTONS)

TABLE 121.FRANCE SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 122.FRANCE SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILOTONS)

TABLE 123.FRANCE SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 124.FRANCE SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILOTONS)

TABLE 125.FRANCE SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 126.FRANCE SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILOTONS)

TABLE 127.FRANCE SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 128.FRANCE SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILOTONS)

TABLE 129.FRANCE SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 130.FRANCE SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILOTONS)

TABLE 131.ITALY SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 132.ITALY SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILOTONS)

TABLE 133.ITALY SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 134.ITALY SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILOTONS)

TABLE 135.ITALY SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 136.ITALY SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILOTONS)

TABLE 137.ITALY SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 138.ITALY SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILOTONS)

TABLE 139.ITALY SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 140.ITALY SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILOTONS)

TABLE 141.SPAIN SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 142.SPAIN SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILOTONS)

TABLE 143.SPAIN SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 144.SPAIN SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILOTONS)

TABLE 145.SPAIN SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 146.SPAIN SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILOTONS)

TABLE 147.SPAIN SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 148.SPAIN SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILOTONS)

TABLE 149.SPAIN SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 150.SPAIN SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILOTONS)

TABLE 151.REST OF EUROPE SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 152.REST OF EUROPE SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILOTONS)

TABLE 153.REST OF EUROPE SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 154.REST OF EUROPE SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILOTONS)

TABLE 155.REST OF EUROPE SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 156.REST OF EUROPE SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILOTONS)

TABLE 157.REST OF EUROPE SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 158.REST OF EUROPE SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILOTONS)

TABLE 159.REST OF EUROPE SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 160.REST OF EUROPE SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILOTONS)

TABLE 161.ASIA-PACIFIC SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 162.ASIA-PACIFIC SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILOTONS)

TABLE 163.ASIA-PACIFIC SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 164.ASIA-PACIFIC SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILOTONS)

TABLE 165.ASIA-PACIFIC SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 166.ASIA-PACIFIC SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILOTONS)

TABLE 167.ASIA-PACIFIC SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 168.ASIA-PACIFIC SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILOTONS)

TABLE 169.ASIA-PACIFIC SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 170.ASIA-PACIFIC SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILOTONS)

TABLE 171.ASIA-PACIFIC SODIUM SILICATE MARKET, BY COUNTRY, 2019–2027 ($MILLION)

TABLE 172.ASIA-PACIFIC SODIUM SILICATE MARKET, BY COUNTRY, 2019–2027 (KILOTONS)

TABLE 173.CHINA SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 174.CHINA SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILOTONS)

TABLE 175.CHINA SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 176.CHINA SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILOTONS)

TABLE 177.CHINA SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 178.CHINA SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILOTONS)

TABLE 179.CHINA SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 180.CHINA SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILOTONS)

TABLE 181.CHINA SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 182.CHINA SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILOTONS)

TABLE 183.JAPAN SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 184.JAPAN SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILOTONS)

TABLE 185.JAPAN SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 186.JAPAN SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILOTONS)

TABLE 187.JAPAN SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 188.JAPAN SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILOTONS)

TABLE 189.JAPAN SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 190.JAPAN SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILOTONS)

TABLE 191.JAPAN SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 192.JAPAN SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILOTONS)

TABLE 193.INDIA SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 194.INDIA SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILOTONS)

TABLE 195.INDIA SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 196.INDIA SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILOTONS)

TABLE 197.INDIA SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 198.INDIA SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILOTONS)

TABLE 199.INDIA SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 200.INDIA SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILOTONS)

TABLE 201.INDIA SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 202.INDIA SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILOTONS)

TABLE 203.SOUTH KOREA SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 204.SOUTH KOREA SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILOTONS)

TABLE 205.SOUTH KOREA SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 206.SOUTH KOREA SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILOTONS)

TABLE 207.SOUTH KOREA SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 208.SOUTH KOREA SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILOTONS)

TABLE 209.SOUTH KOREA SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 210.SOUTH KOREA SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILOTONS)

TABLE 211.SOUTH KOREA SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 212.SOUTH KOREA SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILOTONS)

TABLE 213.AUSTRALIA SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 214.AUSTRALIA SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILOTONS)

TABLE 215.AUSTRALIA SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 216.AUSTRALIA SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILOTONS)

TABLE 217.AUSTRALIA SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 218.AUSTRALIA SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILOTONS)

TABLE 219.AUSTRALIA SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 220.AUSTRALIA SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILOTONS)

TABLE 221.AUSTRALIA SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 222.AUSTRALIA SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILOTONS)

TABLE 223.REST OF ASIA-PACIFIC SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 224.REST OF ASIA-PACIFIC SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILOTONS)

TABLE 225.REST OF ASIA-PACIFIC SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 226.REST OF ASIA-PACIFIC SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILOTONS)

TABLE 227.REST OF ASIA-PACIFIC SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 228.REST OF ASIA-PACIFIC SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILOTONS)

TABLE 229.REST OF ASIA-PACIFIC SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 230.REST OF ASIA-PACIFIC SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILOTONS)

TABLE 231.REST OF ASIA-PACIFIC SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 232.REST OF ASIA-PACIFIC SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILOTONS)

TABLE 233.LAMEA SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 234.LAMEA SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILOTONS)

TABLE 235.LAMEA SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 236.LAMEA SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILOTONS)

TABLE 237.LAMEA SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 238.LAMEA SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILOTONS)

TABLE 239.LAMEA SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 240.LAMEA SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILOTONS)

TABLE 241.LAMEA SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 242.LAMEA SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILOTONS)

TABLE 243.LAMEA SODIUM SILICATE MARKET, BY COUNTRY, 2019–2027 ($MILLION)

TABLE 244.LAMEA SODIUM SILICATE MARKET, BY COUNTRY, 2019–2027 (KILOTONS)

TABLE 245.BRAZIL SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 246.BRAZIL SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILOTONS)

TABLE 247.BRAZIL SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 248.BRAZIL SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILOTONS)

TABLE 249.BRAZIL SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 250.BRAZIL SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILOTONS)

TABLE 251.BRAZIL SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 252.BRAZIL SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILOTONS)

TABLE 253.BRAZIL SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 254.BRAZIL SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILOTONS)

TABLE 255.SOUTH AFRICA SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 256.SOUTH AFRICA SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILOTONS)

TABLE 257.SOUTH AFRICA SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 258.SOUTH AFRICA SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILOTONS)

TABLE 259.SOUTH AFRICA SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 260.SOUTH AFRICA SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILOTONS)

TABLE 261.SOUTH AFRICA SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 262.SOUTH AFRICA SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILOTONS)

TABLE 263.SOUTH AFRICA SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 264.SOUTH AFRICA SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILOTONS)

TABLE 265.SAUDI ARABIA SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 266.SAUDI ARABIA SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILOTONS)

TABLE 267.SAUDI ARABIA SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 268.SAUDI ARABIA SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILOTONS)

TABLE 269.SAUDI ARABIA SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 270.SAUDI ARABIA SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILOTONS)

TABLE 271.SAUDI ARABIA SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 272.SAUDI ARABIA SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILOTONS)

TABLE 273.SAUDI ARABIA SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 274.SAUDI ARABIA SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILOTONS)

TABLE 275.REST OF LAMEA SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILLION)

TABLE 276.REST OF LAMEA SODIUM SILICATE MARKET, BY FORM, 2019–2027 (KILOTONS)

TABLE 277.REST OF LAMEA SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILLION)

TABLE 278.REST OF LAMEA SODIUM SILICATE MARKET, BY TYPE, 2019–2027 (KILOTONS)

TABLE 279.REST OF LAMEA SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILLION)

TABLE 280.REST OF LAMEA SODIUM SILICATE MARKET, BY GRADE, 2019–2027 (KILOTONS)

TABLE 281.REST OF LAMEA SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 282.REST OF LAMEA SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 (KILOTONS)

TABLE 283.REST OF LAMEA SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILLION)

TABLE 284.REST OF LAMEA SODIUM SILICATE MARKET, BY END USE, 2019–2027 (KILOTONS)

TABLE 285.KEY EXPANSIONS (2016-2019)

TABLE 286.OTHER KEY DEVELOPMENTS (2016-2019)

TABLE 287.CIECH: COMPANY SNAPSHOT

TABLE 288.CIECH: OPERATING SEGMENTS

TABLE 289.CIECH: PRODUCT PORTFOLIO

TABLE 290.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 291.CIECH: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 292.EVONIK: COMPANY SNAPSHOT

TABLE 293.EVONIK: OPERATING SEGMENTS

TABLE 294.EVONIK: PRODUCT PORTFOLIO

TABLE 295.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 296.KIRAN GLOBAL: COMPANY SNAPSHOT

TABLE 297.KIRAN GLOBAL: PRODUCT PORTFOLIO

TABLE 298.MERCK: COMPANY SNAPSHOT

TABLE 299.MERCK: OPERATING SEGMENTS

TABLE 300.MERCK: PRODUCT PORTFOLIO

TABLE 301.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 302.NIPPON CHEMICAL: COMPANY SNAPSHOT

TABLE 303.NIPPON CHEMICAL: OPERATING SEGMENTS

TABLE 304.NIPPON CHEMICAL: PRODUCT PORTFOLIO

TABLE 305.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 306.OCCIDENTAL PETROLEUM CORPORATION: COMPANY SNAPSHOT

TABLE 307.OCCIDENTAL PETROLEUM CORPORATION: OPERATING SEGMENTS

TABLE 308.OCCIDENTAL PETROLEUM CORPORATION: PRODUCT PORTFOLIO

TABLE 309.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 310.PQ GROUP: COMPANY SNAPSHOT

TABLE 311.PQ GROUP: OPERATING SEGMENTS

TABLE 312.PQ GROUP: PRODUCT PORTFOLIO

TABLE 313.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 314.PQ GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 315.SHUANGLIAN CHEMICAL: COMPANY SNAPSHOT

TABLE 316.SHUANGLIAN CHEMICAL: PRODUCT PORTFOLIO

TABLE 317.SINCHEM: COMPANY SNAPSHOT

TABLE 318.SINCHEM: PRODUCT PORTFOLIO

TABLE 319.TOKUYAMA: COMPANY SNAPSHOT

TABLE 320.TOKUYAMA: OPERATING SEGMENTS

TABLE 321.TOKUYAMA: PRODUCT PORTFOLIO

TABLE 322.OVERALL FINANCIAL STATUS ($MILLION)

LIST OF FIGURES

FIGURE 01.KEY MARKET SEGMENTS

FIGURE 02.GLOBAL SODIUM SILICATE MARKET SNAPSHOT, BY SEGMENT

FIGURE 03.GLOBAL SODIUM SILICATE MARKET SNAPSHOT, BY COUNTRY

FIGURE 04.TOP INVESTMENT POCKETS

FIGURE 05.LOW BARGAINING POWER OF SUPPLIERS

FIGURE 06.HIGH THREAT OF NEW ENTRANTS

FIGURE 07.HIGH THREAT OF SUBSTITUTES

FIGURE 08.LOW INTENSITY OF RIVALRY

FIGURE 09.HIGH BARGAINING POWER OF BUYERS

FIGURE 10.VALUE CHAIN ANALYSIS FOR SODIUM SILICATE MARKET

FIGURE 11.SODIUM SILICATE MARKET DYNAMICS

FIGURE 12.SODIUM SILICATEPRICING ANALYSIS

FIGURE 13.SODIUM SILICATEPATENT ANALYSIS

FIGURE 14.GLOBAL SODIUM SILICATE MARKET, BY FORM, 2019–2027 ($MILILION)

FIGURE 15.COMPARATIVE ANALYSIS OF CRYSTALLINESODIUM SILICATE MARKET, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 16.COMPARATIVE ANALYSIS OF ANHYDROUSSODIUM SILICATE MARKET, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 17.GLOBAL SODIUM SILICATE MARKET, BY TYPE, 2019–2027 ($MILILION)

FIGURE 18.COMPARATIVE ANALYSIS OF LIQUID SODIUM SILICATE MARKET, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 19.COMPARATIVE ANALYSIS OF SOLID SODIUM SILICATE MARKET, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 20.GLOBAL SODIUM SILICATE MARKET, BY GRADE, 2019–2027 ($MILILION)

FIGURE 21.COMPARATIVE ANALYSIS OF NEUTRAL SODIUM SILICATE MARKET, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 22.COMPARATIVE ANALYSIS OF ALKALINE SODIUM SILICATE MARKET, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 23.GLOBAL SODIUM SILICATE MARKET, BY APPLICATION, 2019–2027 ($MILILION)

FIGURE 24.COMPARATIVE ANALYSIS OF SODIUM SILICATE PAINTS MARKET, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 25.COMPARATIVE ANALYSIS OF SODIUM SILICATEADHESIVES MARKET, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 26.COMPARATIVE ANALYSIS OF SODIUM SILICATE REFRACTORIES MARKET, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 27.COMPARATIVE ANALYSIS OF SODIUM SILICATE TUBE WINDING MARKET, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 28.COMPARATIVE ANALYSIS OF SODIUM SILICATE DETERGENTS MARKET, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 29.COMPARATIVE ANALYSIS OF SODIUM SILICATE CATALYST MARKET, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 30.COMPARATIVE ANALYSIS OF SODIUM SILICATE OTHERS MARKET, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 31.GLOBAL SODIUM SILICATE MARKET, BY END USE, 2019–2027 ($MILILION)

FIGURE 32.COMPARATIVE ANALYSIS OF SODIUM SILICATE PULP & PAPER MARKET, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 33.COMPARATIVE ANALYSIS OF SODIUM SILICATE CONSTRUCTION MARKET, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 34.COMPARATIVE ANALYSIS OF SODIUM SILICATE AUTOMOTIVE MARKET, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 35.COMPARATIVE ANALYSIS OF SODIUM SILICATE OTHERS MARKET, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 36.U.S. SODIUM SILICATE MARKET REVENUE, 2019–2027 (MILLION)

FIGURE 37.CANADA SODIUM SILICATE MARKET REVENUE, 2019–2027 (MILLION)

FIGURE 38.MEXICO SODIUM SILICATE MARKET REVENUE, 2019–2027 (MILLION)

FIGURE 39.GERMANY SODIUM SILICATE MARKET REVENUE, 2019–2027 (MILLION)

FIGURE 40.UKSODIUM SILICATE MARKET REVENUE, 2019–2027 (MILLION)

FIGURE 41.FRANCE SODIUM SILICATE MARKET REVENUE, 2019–2027 (MILLION)

FIGURE 42.ITALY SODIUM SILICATE MARKET REVENUE, 2019–2027 (MILLION)

FIGURE 43.SPAIN SODIUM SILICATE MARKET REVENUE, 2019–2027 (MILLION)

FIGURE 44.REST OF EUROPE SODIUM SILICATE MARKET REVENUE, 2019–2027 (MILLION)

FIGURE 45.CHINA SODIUM SILICATE MARKET REVENUE, 2019–2027 (MILLION)

FIGURE 46.JAPAN SODIUM SILICATE MARKET REVENUE, 2019–2027 (MILLION)

FIGURE 47.INDIA SODIUM SILICATE MARKET REVENUE, 2019–2027 (MILLION)

FIGURE 48.SOUTH KOREA SODIUM SILICATE MARKET REVENUE, 2019–2027 (MILLION)

FIGURE 49.AUSTRALIA SODIUM SILICATE MARKET REVENUE, 2019–2027 (MILLION)

FIGURE 50.REST OF ASIA-PACIFIC SODIUM SILICATE MARKET REVENUE, 2019–2027 (MILLION)

FIGURE 51.BRAZIL SODIUM SILICATE MARKET REVENUE, 2019–2027 (MILLION)

FIGURE 52.SOUTH AFRICA SODIUM SILICATE MARKET REVENUE, 2019–2027 (MILLION)

FIGURE 53.SAUDI ARABIA SODIUM SILICATE MARKET REVENUE, 2019–2027 (MILLION)

FIGURE 54.REST OF LAMEA SODIUM SILICATE MARKET REVENUE, 2019–2027 (MILLION)

FIGURE 55.MARKET PLAYER POSITIONING, 2020

FIGURE 56.TOP WINNING STRATEGIES, BY YEAR, 2017–2020

FIGURE 57.TOP WINNING STRATEGIES, BY DEVELOPMENT, 2017–2020 (%)

FIGURE 58.TOP WINNING STRATEGIES, BY COMPANY, 2017–2020

FIGURE 59.PRODUCT MAPPING OF TOP 10 PLAYERS

FIGURE 60.COMPETITIVE DASHBOARD

FIGURE 61.COMPETITIVE HEATMAP OF KEY PLAYERS

FIGURE 62.CIECH: REVENUE, 2017–2019 ($MILLION)

FIGURE 63.CIECH: REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 64.CIECH: REVENUE SHARE BY REGION, 2019 (%)

FIGURE 65.EVONIK: REVENUE, 2017–2019 ($MILLION)

FIGURE 66.EVONIK: REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 67.EVONIK: REVENUE SHARE BY REGION, 2019 (%)

FIGURE 68.MERCK: REVENUE, 2017–2019 ($MILLION)

FIGURE 69.MERCK: REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 70.MERCK: REVENUE SHARE BY REGION, 2019 (%)

FIGURE 71.NIPPON CHEMICAL: REVENUE, 2018–2020 ($MILLION)

FIGURE 72.OCCIDENTAL PETROLEUM CORPORATION: REVENUE, 2017–2019 ($MILLION)

FIGURE 73.OCCIDENTAL PETROLEUM CORPORATION: REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 74.OCCIDENTAL PETROLEUM CORPORATION: REVENUE SHARE BY REGION, 2019 (%)

FIGURE 75.PQ GROUP: REVENUE, 2017–2019 ($MILLION)

FIGURE 76.PQ GROUP: REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 77.TOKUYAMA: NET SALES, 2018–2020 ($MILLION)

FIGURE 78.TOKUYAMA: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 79.TOKUYAMA: REVENUE SHARE BY REGION, 2020 (%)

$5769

$8995

HAVE A QUERY?

OUR CUSTOMER