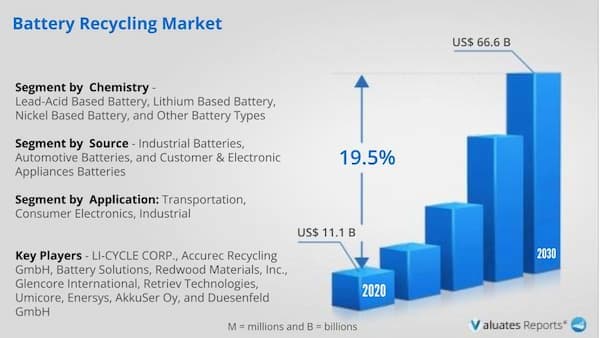

The global battery recycling market size was valued at USD 11.1 Billion in 2020, and is expected to reach USD 66.6 Billion by 2030, registering a CAGR of 19.5% from 2021 to 2030. Battery recycling is referred to collection of lithium-ion batteries through various sources including automotive, industrial, consumer & electronics appliances and recovery of metals of element through recycling processes. The global market estimation includes revenue reported by selling these recovered metals or elements whether that goes into further battery recycling or other second usage applications. Reportedly, most metals recovered go into battery manufacturing only for the second use of batteries in low power applications.

Factors such as government regulations, environmental safety, and awareness among people are expected to drive growth of the global battery recycling market. However, improper separation of harmful materials used in battery, improper dismantling, and improper shredding are expected to hamper the battery recycling market growth during the forecast period. Factors such as aesthetic design of battery, accessible installation of batteries, and provision of protective layers to mitigate risk of fire and short circuiting are anticipated to make way for different growth opportunities in the global market.

The global battery recycling market is segmented into chemistry, source, application, and region. By chemistry, the market is divided into lead–acid battery, lithium-ion battery, nickel-based battery, and other battery types. Further segmentation can be done on the basis of source into industrial batteries, automotive batteries, and customer & electronic appliances batteries. By application, the market is categorized into transportation, consumer electronics, industrial, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific and LAMEA.

The global battery recycling market covers in-depth information of the major industry participants. Some of the major players in the market include LI-CYCLE CORP., Accurec Recycling GmbH, Battery Solutions, Redwood Materials, Inc., Glencore International, Retriev Technologies, Umicore, Enersys, AkkuSer Oy, and Duesenfeld GmbH. Other players in the value chain of the market include Neometals Ltd., Primobius, Green Li-ion Pvt., Ltd., SungEel MCC Americas, Redux GmbH, and others.

Key players are adopting numerous strategies, such as technology launch, business expansion, agreement, partnership, and collaboration to stay competitive in the market. For instance, in May, 2021, Li-Cycle Corp. signed an agreement with Ultium Cells LLC (a joint venture of General Motors and LG Energy Solution). This agreement aimed at recycling of up to 100% of the scrap generated by battery cell manufacturing at Ultium’s Lordstown, Ohio mega-factory.

By battery chemistry, the lead acid battery segment held the largest market share in 2020, owing to the fact that lead-acid battery is highly profitable in terms of recycling, has low cost over other battery types, and its greater adoption as it is the first commercial battery in energy storage applications. On the other hand, lithium-ion battery recycling may gather great momentum during the forecast period in response to the growing efforts to develop patented recycling methods.

On the basis of source, the industrial batteries segment registered highest market share of 51.3% during the forecast period, owing to the wide application included in the industrial segment starting from renewable energy integration to forklift batteries, and UPS systems. Therefore, batteries are collected largely from an industrial source for recycling.

By application, the transportation segment garnered the highest battery recycling market share in 2020. This is attributed to the growing adoption of electric & hybrid vehicles and increasing efforts to promote electrification in the overall automotive industry. In addition, rapid growth of EV industry across the developing economies is anticipated to fuel the market growth in the coming years.

Europe garnered highest growth rate in the global market in 2020, in terms of revenue, and is anticipated to maintain its dominance during the forecast period. This is attributed to numerous factors such as presence of huge consumer base and existence of key players in the region. Moreover, regulations toward environmental pollution and rapid growth of the electric vehicle industry in the region are anticipated to contribute toward growth of the market in Europe.

Lockdowns imposed due to the outbreak of COVID-19 pandemic resulted in temporary ban on import & export and manufacturing & processing activities across various industries, which decreased demand for batteries from various automotive and non-automotive end users. This resulted in decline in the market growth in the second, third, and fourth quarters of 2020. However, the battery recycling market is expected to recover by the 2nd quarter of 2021 as COVID-19 vaccination has started in various economies across the globe, which is expected to improve the global economy.

| Report Metric | Details |

| Report Name | Global Battery Recycling Market |

| Base Year | 2021 |

| Forecasted years | 2022-2030 |

| By Company |

|

| Segment by Chemistry |

|

| Segment by Source |

|

| Segment by Application |

|

| Consumption by Region |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

CHAPTER 1:INTRODUCTION

1.1.Report description

1.2.Key benefits for stakeholders

1.3.Key market segments

1.4.Research methodology

1.4.1.Primary research

1.4.2.Secondary research

1.5.Analyst tools and moels

CHAPTER 2:EXECUTIVE SUMMARY

2.1.Key findings of the study

2.2.CXO perspective

CHAPTER 3:MARKET LANDSCAPE

3.1.Market definition and scope

3.2.Key findings

3.2.1.Top investment pockets

3.3.Porter's five forces analysis

3.5.Market share analysis & top player positioning, 2020

3.5.1.Top player positioning, 2020

3.6.Market dynamics

3.6.1.Drivers

3.6.1.1.Rise in awareness towards environmental pollution owing to battery disposal

3.6.1.2.High recycling rate associated with lead acid batteries

3.6.2.Restraint

3.6.2.1.Focus on lowering cost of lithium-ion battery rather than its recyclability

3.6.3.Opportunities

3.6.3.1.Rapid growth of electric vehicle industry

3.7.Value chain

3.8.Impact of key regulations on the global Battery recycling market

3.9.Impact of COVID-19 outburst on the Battery recycling market

CHAPTER 4:BATTERY RECYCLING MARKET, BY CHEMISTRY

4.1.Overview

4.1.1.Market size and forecast

4.2.LEAD ACID BATTERY

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast, by region

4.2.3.Market analysis, by country

4.3.LITHIUM-BASED BATTERY

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Market size and forecast, by region

4.3.3.Market analysis, by country

4.4.NICKEL-BASED BATTERY

4.4.1.Key market trends, growth factors, and opportunities

4.4.2.Market size and forecast, by region

4.4.3.Market analysis, by country

4.5.Others

4.5.1.Key market trends, growth factors, and opportunities

4.5.2.Market size and forecast, by region

4.5.3.Market analysis, by country

CHAPTER 5:BATTERY RECYCLING MARKET, BY SOURCE

5.1.Overview

5.1.1.Market size and forecast

5.2.AUTOMOTIVE BATTERIES

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region

5.2.3.Market analysis, by country

5.3.INDUSTRIAL BATTERIES

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region

5.3.3.Market analysis, by country

5.4.CONSUMER& ELECTRONICS APPLIANCE BATTERIES

5.4.1.Key market trends, growth factors, and opportunities

5.4.2.Market size and forecast, by region

5.4.3.Market analysis, by country

CHAPTER 6:BATTERY RECYCLING MARKET, BY APPLICATION

6.1.Overview

6.1.1.Market size and forecast

6.2.TRANSPORTATION

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by region

6.2.3.Market analysis, by country

6.3.CONSUMER ELECTRONICS

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by region

6.3.3.Market analysis, by country

6.4.INDUSTRIAL

6.4.1.Key market trends, growth factors, and opportunities

6.4.2.Market size and forecast, by region

6.4.3.Market analysis, by country

6.5.Others

6.5.1.Key market trends, growth factors, and opportunities

6.5.2.Market size and forecast, by region

6.5.3.Market analysis, by country

CHAPTER 7:BATTERY RECYCLING MARKET, BY REGION

7.1.Overview

7.1.1.Market size and forecast

7.2.North America

7.2.1.Key market trends, growth factors, and opportunities

7.2.2.Market size and forecast, by CHEMISTRY

7.2.3.Market size and forecast, by SOURCE

7.2.4.Market size and forecast, by APPLICATION

7.2.5.Market share analysis, by country

7.2.5.1.U.S.

7.2.5.1.1.Market size and forecast, by CHEMISTRY

7.2.5.1.2.Market size and forecast, by SOURCE

7.2.5.1.3.Market size and forecast, by APPLICATION

7.2.5.2.Canada

7.2.5.2.1.Market size and forecast, by CHEMISTRY

7.2.5.2.2.Market size and forecast, by SOURCE

7.2.5.2.3.Market size and forecast, by APPLICATION

7.2.5.3.Mexico

7.2.5.3.1.Market size and forecast, by CHEMISTRY

7.2.5.3.2.Market size and forecast, by SOURCE

7.2.5.3.3.Market size and forecast, by APPLICATION

7.3.Europe

7.3.1.Key market trends, growth factors, and opportunities

7.3.2.Market size and forecast, by CHEMISTRY

7.3.3.Market size and forecast, by SOURCE

7.3.4.Market size and forecast, by APPLICATION

7.3.5.Market share analysis, by country

7.3.5.1.Germany

7.3.5.1.1.Market size and forecast, by CHEMISTRY

7.3.5.1.2.Market size and forecast, by SOURCE

7.3.5.1.3.Market size and forecast, by APPLICATION

7.3.5.2.UK

7.3.5.2.1.Market size and forecast, by CHEMISTRY

7.3.5.2.2.Market size and forecast, by SOURCE

7.3.5.2.3.Market size and forecast, by APPLICATION

7.3.5.3.France

7.3.5.3.1.Market size and forecast, by CHEMISTRY

7.3.5.3.2.Market size and forecast, by SOURCE

7.3.5.3.3.Market size and forecast, by APPLICATION

7.3.5.4.Italy

7.3.5.4.1.Market size and forecast, by CHEMISTRY

7.3.5.4.2.Market size and forecast, by SOURCE

7.3.5.4.3.Market size and forecast, by APPLICATION

7.3.5.5.Spain

7.3.5.5.1.Market size and forecast, by CHEMISTRY

7.3.5.5.2.Market size and forecast, by SOURCE

7.3.5.5.3.Market size and forecast, by APPLICATION

7.3.5.6.Rest of Europe

7.3.5.6.1.Market size and forecast, by CHEMISTRY

7.3.5.6.2.Market size and forecast, by SOURCE

7.3.5.6.3.Market size and forecast, by APPLICATION

7.4.Asia-Pacific

7.4.1.Key market trends, growth factors, and opportunities

7.4.2.Market size and forecast, by CHEMISTRY

7.4.3.Market size and forecast, by SOURCE

7.4.4.Market size and forecast, by APPLICATION

7.4.5.Market share analysis, by country

7.4.5.1.China

7.4.5.1.1.Market size and forecast, by CHEMISTRY

7.4.5.1.2.Market size and forecast, by SOURCE

7.4.5.1.3.Market size and forecast, by APPLICATION

7.4.5.2.Japan

7.4.5.2.1.Market size and forecast, by CHEMISTRY

7.4.5.2.2.Market size and forecast, by SOURCE

7.4.5.2.3.Market size and forecast, by APPLICATION

7.4.5.3.India

7.4.5.3.1.Market size and forecast, by CHEMISTRY

7.4.5.3.2.Market size and forecast, by SOURCE

7.4.5.3.3.Market size and forecast, by APPLICATION

7.4.5.4.South Korea

7.4.5.4.1.Market size and forecast, by CHEMISTRY

7.4.5.4.2.Market size and forecast, by SOURCE

7.4.5.4.3.Market size and forecast, by APPLICATION

7.4.5.5.Australia

7.4.5.5.1.Market size and forecast, by CHEMISTRY

7.4.5.5.2.Market size and forecast, by SOURCE

7.4.5.5.3.Market size and forecast, by APPLICATION

7.4.5.6.Rest of Asia-Pacific

7.4.5.6.1.Market size and forecast, by CHEMISTRY

7.4.5.6.2.Market size and forecast, by SOURCE

7.4.5.6.3.Market size and forecast, by APPLICATION

7.5.LAMEA

7.5.1.Key market trends, growth factors, and opportunities

7.5.2.Market size and forecast, by CHEMISTRY

7.5.3.Market size and forecast, by SOURCE

7.5.4.Market size and forecast, by APPLICATION

7.5.5.Market share analysis, by country

7.5.5.1.Brazil

7.5.5.1.1.Market size and forecast, by CHEMISTRY

7.5.5.1.2.Market size and forecast, by SOURCE

7.5.5.1.3.Market size and forecast, by APPLICATION

7.5.5.2.Saudi Arabia

7.5.5.2.1.Market size and forecast, by CHEMISTRY

7.5.5.2.2.Market size and forecast, by SOURCE

7.5.5.2.3.Market size and forecast, by APPLICATION

7.5.5.3.South Africa

7.5.5.3.1.Market size and forecast, by CHEMISTRY

7.5.5.3.2.Market size and forecast, by SOURCE

7.5.5.3.3.Market size and forecast, by APPLICATION

7.5.5.4.Rest of LAMEA

7.5.5.4.1.Market size and forecast, by CHEMISTRY

7.5.5.4.2.Market size and forecast, by SOURCE

7.5.5.4.3.Market size and forecast, by APPLICATION

CHAPTER 8:COMPETITIVE LANDSCAPE

8.1.Introduction

8.2.Product mapping of top 10 players

8.3.Competitive Heatmap

8.4.Key development

8.4.1.Business Expansion

8.4.2.New Product

8.4.3.Acquisition

CHAPTER 9:COMPANY PROFILES

9.1.LI-CYCLE CORP.

9.1.1.Company overview

9.1.2.Key executives

9.1.3.Company snapshot

9.1.4.Product portfolio

9.1.5.Key strategic moves and developments

9.2.ACCUREC-Recycling GmbH

9.2.1.Company overview

9.2.2.Key executives

9.2.3.Company snapshot

9.2.4.Product portfolio

9.3.Battery Solutions

9.3.1.Company overview

9.3.2.Key executives

9.3.3.Company snapshot

9.3.4.Product portfolio

9.4.Redwood Materials, Inc.

9.4.1.Company overview

9.4.2.Key executives

9.4.3.Company snapshot

9.4.4.Product portfolio

9.4.5.Key strategic moves and developments

9.5.Glencore

9.5.1.Company overview

9.5.2.Key executives

9.5.3.Company snapshot

9.5.4.Operating business segments

9.5.5.Product portfolio

9.5.6.Business performance

9.6.Retriev Technologies

9.6.1.Company overview

9.6.2.Key executives

9.6.3.Company snapshot

9.6.4.Product portfolio

9.6.5.Key strategic moves and developments

9.7.Umicore

9.7.1.Company overview

9.7.2.Key executives

9.7.3.Company snapshot

9.7.4.Operating business segments

9.7.5.Product portfolio

9.7.6.Business performance

9.8.Duesenfeld Gmbh

9.8.1.Company overview

9.8.2.Key executives

9.8.3.Company snapshot

9.8.4.Product portfolio

9.9.ENERSYS.

9.9.1.Company overview

9.9.2.Key executives

9.9.3.Company snapshot

9.9.4.Operating business segments

9.9.5.Product portfolio

9.9.6.Business performance

9.10.Ganfeng Lithium Co., Ltd.

9.10.1.Company overview

9.10.2.Key executives

9.10.3.Company snapshot

9.10.4.Operating business segments

9.10.5.Product portfolio

9.10.6.Business performance

LIST OF TABLES

TABLE 01.GLOBAL BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020–2030($MILLION)

TABLE 02.LEAD ACID BATTERY RECYCLING MARKET, BY REGION, 2020-2030 ($MILLION)

TABLE 03.LITHIUM-BASED BATTERY RECYCLING MARKET, BY REGION, 2020-2030 ($MILLION)

TABLE 04.NICKEL-BASED BATTERY RECYCLING MARKET, BY REGION, 2020-2030 ($MILLION)

TABLE 05.OTHER BATTERY RECYCLING MARKET, BY REGION, 2020-2030 ($MILLION)

TABLE 06.GLOBAL BATTERY RECYCLING MARKET, BY SOURCE, 2020–2030 ($MILLION)

TABLE 07.BATTERY RECYCLING MARKET,FOR AUTOMOTIVE BATTERIES, BY REGION, 2020-2030 ($MILLION)

TABLE 08.BATTERY RECYCLING MARKET, FOR INDUSTRIAL BATTERIES, BY REGION, 2020-2030 ($MILLION)

TABLE 09.BATTERY RECYCLING MARKET, FOR CONSUMER& ELECTRONICS APPLIANCE BATTERIES, BY REGION, 2020-2030 ($MILLION)

TABLE 10.BATTERY RECYCLING MARKET, BY APPLICATION, 2020–2030 ($MILLION)

TABLE 11.BATTERY RECYCLING MARKET,FOR TRANSPORTATION, BY REGION, 2020–2030 ($MILLION)

TABLE 12.BATTERY RECYCLING MARKET,FOR CONSUMER ELECTRONICS, BY REGION, 2020–2030 ($MILLION)

TABLE 13.BATTERY RECYCLING MARKET,FOR INDUSTRIAL, BY REGION, 2020–2030 ($MILLION)

TABLE 14.BATTERY RECYCLING MARKET,FOR OTHERS, BY REGION, 2020–2030 ($MILLION)

TABLE 15.BATTERY RECYCLING MARKET, BY REGION, 2020-2030 ($MILLION)

TABLE 16.NORTH AMERICA BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2030 ($MILLION)

TABLE 17.NORTH AMERICA BATTERY RECYCLING MARKET, BY SOURCE, 2020-2030 ($MILLION)

TABLE 18.NORTH AMERICA BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 19.NORTH AMERICA BATTERY RECYCLING MARKET, BY COUNTRY, 2020-2030 ($MILLION)

TABLE 20.U.S. BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2030 ($MILLION)

TABLE 21.U.S. BATTERY RECYCLING MARKET, BY SOURCE, 2020-2030 ($MILLION)

TABLE 22.U.S. BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 23.CANADA BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2030 ($MILLION)

TABLE 24.CANADA BATTERY RECYCLING MARKET, BY SOURCE, 2020-2030 ($MILLION)

TABLE 25.CANADA BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 26.MEXICO BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2030 ($MILLION)

TABLE 27.MEXICO BATTERY RECYCLING MARKET, BY SOURCE, 2020-2030 ($MILLION)

TABLE 28.MEXICO BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 29.EUROPE BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2030 ($MILLION)

TABLE 30.EUROPE BATTERY RECYCLING MARKET, BY SOURCE, 2020-2030 ($MILLION)

TABLE 31.EUROPE BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 32.EUROPE BATTERY RECYCLING MARKET, BY COUNTRY, 2020-2030 ($MILLION)

TABLE 33.GERMANY BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2030 ($MILLION)

TABLE 34.GERMANY BATTERY RECYCLING MARKET, BY SOURCE, 2020-2030 ($MILLION)

TABLE 35.GERMANY BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 36.UK BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2030 ($MILLION)

TABLE 37.UK BATTERY RECYCLING MARKET, BY SOURCE, 2020-2030 ($MILLION)

TABLE 38.UK BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 39.FRANCE BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2030 ($MILLION)

TABLE 40.FRANCE BATTERY RECYCLING MARKET, BY SOURCE, 2020-2030 ($MILLION)

TABLE 41.FRANCE BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 42.ITALY BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2030 ($MILLION)

TABLE 43.ITALY BATTERY RECYCLING MARKET, BY SOURCE, 2020-2030 ($MILLION)

TABLE 44.ITALY BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 45.SPAIN BATTERY RECYCLING MARKET, BY CHEMISTRY ($MILLION)

TABLE 46.SPAIN BATTERY RECYCLING MARKET, BY SOURCE, 2020-2030 ($MILLION)

TABLE 47.SPAIN BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 48.REST OF EUROPE BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2030 ($MILLION)

TABLE 49.REST OF EUROPE BATTERY RECYCLING MARKET, BY SOURCE, 2020-2030 ($MILLION)

TABLE 50.REST OF EUROPE BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 51.ASIA-PACIFIC BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2030 ($MILLION)

TABLE 52.ASIA-PACIFIC BATTERY RECYCLING MARKET, BY SOURCE, 2020-2030 ($MILLION)

TABLE 53.ASIA-PACIFIC BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 54.ASIA-PACIFIC BATTERY RECYCLING MARKET, BY COUNTRY, 2020-2030 ($MILLION)

TABLE 55.CHINA BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2030 ($MILLION)

TABLE 56.CHINA BATTERY RECYCLING MARKET, BY SOURCE, 2020-2030 ($MILLION)

TABLE 57.CHINA BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 58.JAPAN BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2030 ($MILLION)

TABLE 59.JAPAN BATTERY RECYCLING MARKET, BY SOURCE, 2020-2030 ($MILLION)

TABLE 60.JAPAN BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 61.INDIA BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2030 ($MILLION)

TABLE 62.INDIA BATTERY RECYCLING MARKET, BY SOURCE, 2020-2030 ($MILLION)

TABLE 63.INDIA BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 64.SOUTH KOREA BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2030 ($MILLION)

TABLE 65.SOUTH KOREA BATTERY RECYCLING MARKET, BY SOURCE, 2020-2030 ($MILLION)

TABLE 66.SOUTH KOREA BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 67.AUSTRALIA BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2030 ($MILLION)

TABLE 68.AUSTRALIA BATTERY RECYCLING MARKET, BY SOURCE, 2020-2030 ($MILLION)

TABLE 69.AUSTRALIA BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 70.REST OF ASIA-PACIFIC BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2030 ($MILLION)

TABLE 71.REST OF ASIA-PACIFIC BATTERY RECYCLING MARKET, BY SOURCE, 2020-2030 ($MILLION)

TABLE 72.REST OF ASIA-PACIFIC BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 73.LAMEA BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2030 ($MILLION)

TABLE 74.LAMEA BATTERY RECYCLING MARKET, BY SOURCE, 2020-2030 ($MILLION)

TABLE 75.LAMEA BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 76.LAMEA BATTERY RECYCLING MARKET, BY COUNTRY, 2020-2030 ($MILLION)

TABLE 77.BRAZIL BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2030 ($MILLION)

TABLE 78.BRAZIL BATTERY RECYCLING MARKET, BY SOURCE, 2020-2030 ($MILLION)

TABLE 79.BRAZIL BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 80.SAUDI ARABIA BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2030 ($MILLION)

TABLE 81.SAUDI ARABIA BATTERY RECYCLING MARKET, BY SOURCE, 2020-2030 ($MILLION)

TABLE 82.SAUDI ARABIA BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 83.SOUTH AFRICA BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2030 ($MILLION)

TABLE 84.SOUTH AFRICA BATTERY RECYCLING MARKET, BY SOURCE, 2020-2030 ($MILLION)

TABLE 85.SOUTH AFRICA BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 86.REST OF LAMEA BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020-2030 ($MILLION)

TABLE 87.REST OF LAMEA BATTERY RECYCLING MARKET, BY SOURCE, 2020-2030 ($MILLION)

TABLE 88.REST OF LAMEA BATTERY RECYCLING MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 89.KEY BUSINESS EXPANSION

TABLE 90.KEY NEW PRODUCT

TABLE 91.KEY ACQUISITION

TABLE 92.LI-CYCLE CORP..: KEY EXECUTIVES

DESIGNATION

TABLE 93.LI-CYCLE CORP..: COMPANY SNAPSHOT

TABLE 94.LI-CYCLE CORP.

TABLE 95.LI-CYCLE CORP.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 96.ACCUREC-RECYCLING GMBH.: KEY EXECUTIVES

TABLE 97.ACCUREC-RECYCLING GMBH.: COMPANY SNAPSHOT

TABLE 98.ACCUREC-RECYCLING GMBH.: PRODUCT PORTFOLIO

TABLE 99.BATTERY SOLUTIONS: KEY EXECUTIVES

TABLE 100.BATTERY SOLUTIONS: COMPANY SNAPSHOT

TABLE 101.BATTERY SOLUTIONS: PRODUCT PORTFOLIO

TABLE 102.REDWOOD MATERIALS, INC.: KEY EXECUTIVES

TABLE 103.REDWOOD MATERIALS, INC.: COMPANY SNAPSHOT

TABLE 104.REDWOOD MATERIALS, INC.: PRODUCT PORTFOLIO

TABLE 105.REDWOOD MATERIALS, INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 106.GLENCORE: KEY EXECUTIVES

TABLE 107.GLENCORE: COMPANY SNAPSHOT

TABLE 108.GLENCORE: OPERATING SEGMENTS

TABLE 109.GLENCORE: PRODUCT PORTFOLIO

TABLE 110.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 111.RETRIEV TECHNOLOGIES.: KEY EXECUTIVES

TABLE 112.RETRIEV TECHNOLOGIES.: COMPANY SNAPSHOT

TABLE 113.RETRIEV TECHNOLOGIES.: PRODUCT PORTFOLIO

TABLE 114.RETRIEV TECHNOLOGIES.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 115.UMICORE.: KEY EXECUTIVES

TABLE 116.UMICORE.: COMPANY SNAPSHOT

TABLE 117.UMICORE.: OPERATING SEGMENTS

TABLE 118.UMICORE.: PRODUCT PORTFOLIO

TABLE 119.UMICORE.: NET SALES, 2018–2020 ($MILLION)

TABLE 120.JOHNSON CONTROLS: KEY EXECUTIVES

TABLE 121.JOHNSON CONTROLS.: COMPANY SNAPSHOT

TABLE 122.JOHNSON CONTROLS.: PRODUCT PORTFOLIO

TABLE 123.ENERSYS.: KEY EXECUTIVES

TABLE 124.ENERSYS.: COMPANY SNAPSHOT

TABLE 125.ENERSYS.: OPERATING SEGMENTS

TABLE 126.ENERSYS.: PRODUCT PORTFOLIO

TABLE 127.ENERSYS..: NET SALES, 2019–2021 ($MILLION)

TABLE 128.GANFENG LITHIUM CO., LTD.: KEY EXECUTIVES

TABLE 129.GANFENG LITHIUM CO., LTD.: COMPANY SNAPSHOT

TABLE 130.GANFENG LITHIUM CO., LTD..: OPERATING SEGMENTS

TABLE 131.GANFENG LITHIUM CO., LTD..: PRODUCT PORTFOLIO

TABLE 132.OVERALL FINANCIAL STATUS ($MILLION)

LIST OF FIGURES

FIGURE 01.KEY MARKET SEGMENTS

FIGURE 02.EXECUTIVE SUMMARY, BY SEGMENT

FIGURE 03.EXECUTIVE SUMMARY, BY COUNTRY

FIGURE 04.TOP INVESTMENT POCKETS, BY COUNTRY

FIGURE 05.HIGH BARGAINING POWER OF SUPPLIERS

FIGURE 06.MODERATE THREAT OF NEW ENTRANTS

FIGURE 07.MODERATE THREAT OF SUBSTITUTES

FIGURE 08.MODERATE INTENSITY OF RIVALRY

FIGURE 09.HIGH BARGAINING POWER OF BUYERS

FIGURE 10.TOP PLAYER POSITIONING, 2020

FIGURE 11.MARKET DYNAMICS

FIGURE 12.BATTERY RECYCLING MARKET: VALUE CHAIN

FIGURE 13.GLOBAL BATTERY RECYCLING MARKET, BY CHEMISTRY, 2020–2030 ($MILLION)

FIGURE 14.COMPARATIVE SHARE ANALYSIS OF LEAD ACID BATTERY RECYCLING MARKET, BY COUNTRY, 2020 & 2030 ($MILLION)

FIGURE 15.COMPARATIVE SHARE ANALYSIS OF LITHIUM-BASED BATTERY RECYCLING MARKET, BY COUNTRY, 2020 & 2030 ($MILLION)

FIGURE 16.COMPARATIVE SHARE ANALYSIS OF NICKEL-BASED BATTERY RECYCLING MARKET, BY COUNTRY, 2020 & 2030 ($MILLION)

FIGURE 17.COMPARATIVE SHARE ANALYSIS OF OTHER BATTERY RECYCLING MARKET, BY COUNTRY, 2020 & 2030 ($MILLION)

FIGURE 18.GLOBAL BATTERY RECYCLING MARKET, BY SOURCE, 2020–2030 ($MILLION)

FIGURE 19.COMPARATIVE SHARE ANALYSIS OF BATTERY RECYCLING MARKET, FOR AUTOMOTIVE BATTERIES , BY COUNTRY, 2020 & 2030 ($MILLION)

FIGURE 20.COMPARATIVE SHARE ANALYSIS OF BATTERY RECYCLING MARKET, FOR INDUSTRIAL BATTERIES , BY COUNTRY, 2020 & 2030 ($MILLION)

FIGURE 21.COMPARATIVE SHARE ANALYSIS OF BATTERY RECYCLING MARKET, FOR CONSUMER& ELECTRONICS APPLIANCE BATTERIES , BY COUNTRY, 2020 & 2030 ($MILLION)

FIGURE 22.BATTERY RECYCLING MARKET, BY APPLICATION, 2020–2030 ($MILLION)

FIGURE 23.COMPARATIVE ANALYSIS OF BATTERY RECYCLING MARKET, FOR TRANSPORTATION, BY COUNTRY, 2020 & 2030 ($MILLION)

FIGURE 24.COMPARATIVE ANALYSIS OF BATTERY RECYCLING MARKET, FOR CONSUMER ELECTRONICS, BY COUNTRY, 2020 & 2030 ($MILLION)

FIGURE 25.COMPARATIVE ANALYSIS OF BATTERY RECYCLING MARKET, FOR INDUSTRIAL, BY COUNTRY, 2020 & 2030 ($MILLION)

FIGURE 26.COMPARATIVE ANALYSIS OF BATTERY RECYCLING MARKET, FOR OTHERS, BY COUNTRY, 2020 & 2030 ($MILLION)

FIGURE 27.U.S. BATTERY RECYCLING MARKET REVENUE, 2020-2030 ($MILLION)

FIGURE 28.CANADA BATTERY RECYCLING MARKET REVENUE, 2020-2030 ($MILLION)

FIGURE 29.MEXICO BATTERY RECYCLING MARKET REVENUE, 2020-2030 ($MILLION)

FIGURE 30.GERMANY BATTERY RECYCLING MARKET REVENUE, 2020-2030 ($MILLION)

FIGURE 31.UK BATTERY RECYCLING MARKET REVENUE, 2020-2030 ($MILLION)

FIGURE 32.FRANCE BATTERY RECYCLING MARKET REVENUE, 2020-2030 ($MILLION)

FIGURE 33.ITALY BATTERY RECYCLING MARKET REVENUE, 2020-2030 ($MILLION)

FIGURE 34.SPAIN BATTERY RECYCLING MARKET REVENUE, 2020-2030 ($MILLION)

FIGURE 35.REST OF EUROPE BATTERY RECYCLING MARKET REVENUE, 2020-2030 ($MILLION)

FIGURE 36.CHINA BATTERY RECYCLING MARKET REVENUE, 2020-2030 ($MILLION)

FIGURE 37.JAPAN BATTERY RECYCLING MARKET REVENUE, 2020-2030 ($MILLION)

FIGURE 38.INDIA BATTERY RECYCLING MARKET REVENUE, 2020-2030 ($MILLION)

FIGURE 39.SOUTH KOREA BATTERY RECYCLING MARKET REVENUE, 2020-2030 ($MILLION)

FIGURE 40.AUSTRALIA BATTERY RECYCLING MARKET REVENUE, 2020-2030 ($MILLION)

FIGURE 41.REST OF ASIA-PACIFIC BATTERY RECYCLING MARKET REVENUE, 2020-2030 ($MILLION)

FIGURE 42.BRAZIL BATTERY RECYCLING MARKET REVENUE, 2020-2030 ($MILLION)

FIGURE 43.SAUDI ARABIA BATTERY RECYCLING MARKET REVENUE, 2020-2030 ($MILLION)

FIGURE 44.SOUTH AFRICA BATTERY RECYCLING MARKET REVENUE, 2020-2030 ($MILLION)

FIGURE 45.REST OF LAMEA BATTERY RECYCLING MARKET REVENUE, 2020-2030 ($MILLION)

FIGURE 46.PRODUCT MAPPING OF TOP 10 PLAYERS SOURCE: COMPANY WEBSITE,

FIGURE 47.COMPETITIVE HEATMAP

FIGURE 48.GLENCORE: REVENUE, 2018–2020 ($MILLION)

FIGURE 49.GLENCORE: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 50.GLENCORE: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 51.UMICORE.: NET SALES, 2019–2021 ($MILLION)

FIGURE 52.UMICORE.: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 53.UMICORE.: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 54.ENERSYS.: NET SALES, 2019–2021 ($MILLION)

FIGURE 55.ENERSYS.: REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 56.GANFENG LITHIUM CO., LTD.: REVENUE, 2018–2020 ($MILLION)

FIGURE 57.GANFENG LITHIUM CO., LTD.: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 58.GANFENG LITHIUM CO., LTD.: REVENUE SHARE BY REGION, 2020 (%)

$5769

$10663

HAVE A QUERY?

OUR CUSTOMER