LIST OF FIGURE

TABLE 01.COMMERCIAL REFRIGERATION MARKET, BY PRODUCT, 2019–2027 ($MILLION)

TABLE 02.DEEP FREEZERS MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 03.BOTTLE COOLERS MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 04.STORAGE WATER COOLERS MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 05.COMMERCIAL REFRIGERATION MARKET REVENUE, BY REGION, 2019–2027 ($MILLION)

TABLE 06.MEDICAL REFRIGERATOR MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 07.CHEST REFRIGERATOR MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 08.OTHER COMMERCIAL REFRIGERATION MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 09.COMMERCIAL REFRIGERATION MARKET REVENUE, BY END USER, 2019-2027 ($MILLION)

TABLE 10.COMMERCIAL REFRIGERATION MARKET REVENUE FOR FULL SERVICE RESTAURANT & HOTELS, BY REGION, 2019–2027 ($MILLION)

TABLE 11.COMMERCIAL REFRIGERATION MARKET REVENUE FOR FOOD PROCESSING INDUSTRY, BY REGION, 2019–2027 ($MILLION)

TABLE 12.COMMERCIAL REFRIGERATION MARKET REVENUE FOR HOSPITALS, BY REGION, 2019–2027 ($MILLION)

TABLE 13.COMMERCIAL REFRIGERATION MARKET REVENUE FOR RETAIL PHARMACIES, BY REGION, 2019–2027 ($MILLION)

TABLE 14.COMMERCIAL REFRIGERATION MARKET REVENUE FOR SUPERMARKET/HYPERMARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 15.COMMERCIAL REFRIGERATION MARKET REVENUE FOR CONVENIENCE STORES, BY REGION, 2019–2027 ($MILLION)

TABLE 16.COMMERCIAL REFRIGERATION MARKET REVENUE FOR QUICK SERVICE RESTAURANTS, BY REGION, 2019–2027 ($MILLION)

TABLE 17.COMMERCIAL REFRIGERATION MARKET REVENUE FOR OTHERS, BY REGION, 2019–2027 ($MILLION)

TABLE 18.COMMERCIAL REFRIGERATION MARKET REVENUE, BY REGION, 2019–2027 ($MILLION)

TABLE 19.NORTH AMERICA COMMERCIAL REFRIGERATION MARKET REVENUE, BY PRODUCT, 2019–2027 ($MILLION)

TABLE 20.NORTH AMERICA COMMERCIAL REFRIGERATION MARKET REVENUE, BY END USER, 2019–2027 ($MILLION)

TABLE 21.NORTH AMERICA COMMERCIAL REFRIGERATION MARKET REVENUE, BY COUNTRY, 2019–2027 ($MILLION)

TABLE 22.U.S. COMMERCIAL REFRIGERATION MARKET REVENUE, BY PRODUCT, 2019–2027 ($MILLION)

TABLE 23.U.S. COMMERCIAL REFRIGERATION MARKET REVENUE, BY END USER, 2019–2027 ($MILLION)

TABLE 24.CANADA COMMERCIAL REFRIGERATION MARKET REVENUE, BY PRODUCT, 2019–2027 ($MILLION)

TABLE 25.CANADA COMMERCIAL REFRIGERATION MARKET REVENUE, BY END USER, 2019–2027 ($MILLION)

TABLE 26.MEXICO COMMERCIAL REFRIGERATION MARKET REVENUE, BY PRODUCT, 2019–2027 ($MILLION)

TABLE 27.MEXICO COMMERCIAL REFRIGERATION MARKET REVENUE, BY END USER, 2019–2027 ($MILLION)

TABLE 28.EUROPE COMMERCIAL REFRIGERATION MARKET REVENUE, BY PRODUCT, 2019–2027 ($MILLION)

TABLE 29.EUROPE COMMERCIAL REFRIGERATION MARKET REVENUE, BY END USER, 2019–2027 ($MILLION)

TABLE 30.EUROPE COMMERCIAL REFRIGERATION MARKET REVENUE, BY COUNTRY, 2019–2027 ($MILLION)

TABLE 31.GERMANY COMMERCIAL REFRIGERATION MARKET REVENUE, BY PRODUCT, 2019–2027 ($MILLION)

TABLE 32.GERMANY COMMERCIAL REFRIGERATION MARKET REVENUE, BY END USER, 2019–2027 ($MILLION)

TABLE 33.FRANCE COMMERCIAL REFRIGERATION MARKET REVENUE, BY PRODUCT, 2019–2027 ($MILLION)

TABLE 34.FRANCE COMMERCIAL REFRIGERATION MARKET REVENUE, BY END USER, 2019–2027 ($MILLION)

TABLE 35.UK COMMERCIAL REFRIGERATION MARKET REVENUE, BY PRODUCT, 2019–2027 ($MILLION)

TABLE 36.UK COMMERCIAL REFRIGERATION MARKET REVENUE, BY END USER, 2019–2027 ($MILLION)

TABLE 37.ITALY COMMERCIAL REFRIGERATION MARKET REVENUE, BY PRODUCT, 2019–2027 ($MILLION)

TABLE 38.ITALY COMMERCIAL REFRIGERATION MARKET REVENUE, BY END USER, 2019–2027 ($MILLION)

TABLE 39.SPAIN COMMERCIAL REFRIGERATION MARKET REVENUE, BY PRODUCT, 2019–2027 ($MILLION)

TABLE 40.SPAIN COMMERCIAL REFRIGERATION MARKET REVENUE, BY END USER, 2019–2027 ($MILLION)

TABLE 41.REST OF EUROPE COMMERCIAL REFRIGERATION MARKET REVENUE, BY PRODUCT, 2019–2027 ($MILLION)

TABLE 42.REST OF EUROPE COMMERCIAL REFRIGERATION MARKET REVENUE, BY END USER, 2019–2027 ($MILLION)

TABLE 43.ASIA-PACIFIC COMMERCIAL REFRIGERATION MARKET REVENUE, BY PRODUCT, 2019–2027 ($MILLION)

TABLE 44.ASIA-PACIFIC COMMERCIAL REFRIGERATION MARKET REVENUE, BY END USER, 2019–2027 ($MILLION)

TABLE 45.ASIA-PACIFIC COMMERCIAL REFRIGERATION MARKET REVENUE, BY COUNTRY, 2019–2027 ($MILLION)

TABLE 46.CHINA COMMERCIAL REFRIGERATION MARKET REVENUE, BY PRODUCT, 2019–2027 ($MILLION)

TABLE 47.CHINA COMMERCIAL REFRIGERATION MARKET REVENUE, BY END USER, 2019–2027 ($MILLION)

TABLE 48.INDIA COMMERCIAL REFRIGERATION MARKET REVENUE, BY PRODUCT, 2019–2027 ($MILLION)

TABLE 49.INDIA COMMERCIAL REFRIGERATION MARKET REVENUE, BY END USER, 2019–2027 ($MILLION)

TABLE 50.JAPAN COMMERCIAL REFRIGERATION MARKET REVENUE, BY PRODUCT, 2019–2027 ($MILLION)

TABLE 51.JAPAN COMMERCIAL REFRIGERATION MARKET REVENUE, BY END USER, 2019–2027 ($MILLION)

TABLE 52.AUSTRALIA COMMERCIAL REFRIGERATION MARKET REVENUE, BY PRODUCT, 2019–2027 ($MILLION)

TABLE 53.AUSTRALIA COMMERCIAL REFRIGERATION MARKET REVENUE, BY END USER, 2019–2027 ($MILLION)

TABLE 54.REST OF ASIA-PACIFIC COMMERCIAL REFRIGERATION MARKET REVENUE, BY PRODUCT, 2019–2027 ($MILLION)

TABLE 55.REST OF ASIA-PACIFIC COMMERCIAL REFRIGERATION MARKET REVENUE, BY END USER, 2019–2027 ($MILLION)

TABLE 56.LAMEA COMMERCIAL REFRIGERATION MARKET REVENUE, BY PRODUCT, 2019–2027 ($MILLION)

TABLE 57.LAMEA COMMERCIAL REFRIGERATION MARKET REVENUE, BY END USER, 2019–2027 ($MILLION)

TABLE 58.LAMEA COMMERCIAL REFRIGERATION MARKET REVENUE, BY COUNTRY, 2019–2027 ($MILLION)

TABLE 59.BRAZIL COMMERCIAL REFRIGERATION MARKET REVENUE, BY PRODUCT, 2019–2027 ($MILLION)

TABLE 60.BRAZIL COMMERCIAL REFRIGERATION MARKET REVENUE, BY END USER, 2019–2027 ($MILLION)

TABLE 61.UAE COMMERCIAL REFRIGERATION MARKET REVENUE, BY PRODUCT, 2019–2027 ($MILLION)

TABLE 62.UAE COMMERCIAL REFRIGERATION MARKET REVENUE, BY END USER, 2019–2027 ($MILLION)

TABLE 63.SAUDI ARABIA COMMERCIAL REFRIGERATION MARKET REVENUE, BY PRODUCT, 2019–2027 ($MILLION)

TABLE 64.SAUDI ARABIA COMMERCIAL REFRIGERATION MARKET REVENUE, BY END USER, 2019–2027 ($MILLION)

TABLE 65.REST OF LAMEA COMMERCIAL REFRIGERATION MARKET REVENUE, BY PRODUCT, 2019–2027 ($MILLION)

TABLE 66.REST OF LAMEA COMMERCIAL REFRIGERATION MARKET REVENUE, BY END USER, 2019–2027 ($MILLION)

TABLE 67.AB ELECTROLUX: KEY EXECUTIVES

TABLE 68.AB ELECTROLUX: COMPANY SNAPSHOT

TABLE 69.AB ELECTROLUX: PRODUCT PORTFOLIO

TABLE 70.AB ELECTROLUX: R&D EXPENDITURE, 2017–2019 ($MILLION)

TABLE 71.AB ELECTROLUX: NET SALES, 2017–2019 ($MILLION)

TABLE 72.ALI GROUP S.R.L: KEY EXECUTIVES

TABLE 73.ALI GROUP S.R.L.: COMPANY SNAPSHOT

TABLE 74.ALI GROUP S.R.L.: PRODUCT PORTFOLIO

TABLE 75.DAIKIN INDUSTRIES LTD: KEY EXECUTIVES

TABLE 76.DAIKIN INDUSTRIES LTD.: COMPANY SNAPSHOT

TABLE 77.DAIKIN INDUSTRIES LTD.: OPERATING SEGMENTS

TABLE 78.DAIKIN INDUSTRIES LTD.: PRODUCT PORTFOLIO

TABLE 79.DAIKIN INDUSTRIES LTD: R&D EXPENDITURE, 2018–2020 ($MILLION)

TABLE 80.DAIKIN INDUSTRIES LTD: NET SALES, 2018–2020 ($MILLION)

TABLE 81.DOVER CORPORATION: KEY EXECUTIVES

TABLE 82.DOVER CORPORATION: COMPANY SNAPSHOT

TABLE 83.DOVER CORPORATION: OPERATING SEGMENTS

TABLE 84.DOVER CORPORATION: PRODUCT PORTFOLIO

TABLE 85.DOVER CORPORATION: R&D EXPENDITURE, 2017–2019 ($MILLION)

TABLE 86.DOVER CORPORATION: NET SALES, 2017–2019 ($MILLION)

TABLE 87.FRIGOGLASS S.A.I.C: KEY EXECUTIVES

TABLE 88.FRIGOGLASS S.A.I.C.: COMPANY SNAPSHOT

TABLE 89.FRIGOGLASS S.A.I.C.: OPERATING SEGMENTS

TABLE 90.FRIGOGLASS S.A.I.C.: PRODUCT PORTFOLIO

TABLE 91.FRIGOGLASS S.A.I.C: NET SALES, 2017–2019 ($MILLION)

TABLE 92.HAIER ELECTRONICS GROUP CO., LTD: KEY EXECUTIVES

TABLE 93.HAIER ELECTRONICS GROUP CO., LTD.: COMPANY SNAPSHOT

TABLE 94.HAIER ELECTRONICS GROUP CO., LTD: OPERATING SEGMENTS

TABLE 95.HAIER ELECTRONICS GROUP CO., LTD: PRODUCT PORTFOLIO

TABLE 96.HAIER ELECTRONICS GROUP CO., LTD: R&D EXPENDITURE, 2017–2019 ($MILLION)

TABLE 97.HAIER ELECTRONICS GROUP CO., LTD: NET SALES, 2017–2019 ($MILLION)

TABLE 98.ILLINOIS TOOL WORKS INC: KEY EXECUTIVES

TABLE 99.ILLINOIS TOOL WORKS INC.: COMPANY SNAPSHOT

TABLE 100.ILLINOIS TOOL WORKS INC.: OPERATING SEGMENTS

TABLE 101.ILLINOIS TOOL WORKS INC.: PRODUCT PORTFOLIO

TABLE 102.ILLINOIS TOOL WORKS INC: R&D EXPENDITURE, 2017–2019 ($MILLION)

TABLE 103.ILLINOIS TOOL WORKS INC: NET SALES, 2017–2019 ($MILLION)

TABLE 104.JOHNSON CONTROLS INTERNATIONAL PLC: KEY EXECUTIVES

TABLE 105.JOHNSON CONTROLS INTERNATIONAL PLC: COMPANY SNAPSHOT

TABLE 106.JOHNSON CONTROLS INTERNATIONAL PLC.: PRODUCT PORTFOLIO

TABLE 107.JOHNSON CONTROLS INTERNATIONAL PLC.: NET SALES, 2018–2020 ($MILLION)

TABLE 108.PANASONIC CORPORATION: KEY EXECUTIVES

TABLE 109.PANASONIC CORPORATION: COMPANY SNAPSHOT

TABLE 110.PANASONIC CORPORATION: OPERATING SEGMENTS

TABLE 111.PANASONIC CORPORATION: PRODUCT PORTFOLIO

TABLE 112.PANASONIC CORPORATION: R&D EXPENDITURE, 2018–2020 ($MILLION)

TABLE 113.PANASONIC CORPORATION: NET SALES, 2018–2020 ($MILLION)

TABLE 114.UNITED TECHNOLOGIES CORPORATION: KEY EXECUTIVES

TABLE 115.UNITED TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

TABLE 116.UNITED TECHNOLOGIES CORPORATION: OPERATING SEGMENTS

TABLE 117.UNITED TECHNOLOGIES CORPORATION: PRODUCT PORTFOLIO

TABLE 118.UNITED TECHNOLOGIES CORPORATION: R&D EXPENDITURE, 2017–2019 ($MILLION)

TABLE 119.UNITED TECHNOLOGIES CORPORATION: NET SALES, 2017–2019 ($MILLION) LIST OF FIGURE

FIGURE 01.KEY MARKET SEGMENTS

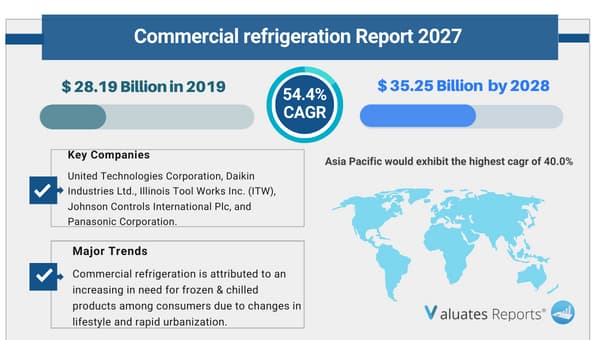

FIGURE 02.GLOBAL COMMERCIAL REFRIGERATION MARKET SNAPSHOT, 2021–2027

FIGURE 03.TOP IMPACTING FACTORS

FIGURE 04.TOP INVESTMENT POCKETS

FIGURE 05.MODERATE BARGAINING POWER OF SUPPLIERS

FIGURE 06.MODERATE-TO-HIGH BARGAINING POWER OF BUYERS

FIGURE 07.MODERATE THREAT OF NEW ENTRANTS

FIGURE 08.HIGH THREAT OF SUBSTITUTES

FIGURE 09.HIGH-TO-MODERATE INTENSITY OF COMPETITIVE RIVALRY

FIGURE 10.COMMERCIAL REFRIGERATION MARKET: VALUE CHAIN ANALYSIS

FIGURE 11.COMMERCIAL REFRIGERATION MARKET, BY PRODUCT, 2019–2027

FIGURE 12.DEEP FREEZERS MARKET, BY COUNTRY, 2019 & 2027 (%)

FIGURE 13.BOTTLE COOLERS MARKET, BY COUNTRY, 2019 & 2027 (%)

FIGURE 14.STORAGE WATER COOLERS MARKET, BY COUNTRY, 2019 & 2027 (%)

FIGURE 15.COMMERCIAL KITCHEN REFRIGERATOR MARKET, BY COUNTRY, 2019 & 2027 (%)

FIGURE 16.MEDICAL REFRIGERATOR MARKET, BY COUNTRY, 2019 & 2027 (%)

FIGURE 17.CHEST REFRIGERATOR MARKET, BY COUNTRY, 2019 & 2027 (%)

FIGURE 18.OTHER COMMERCIAL REFRIGERATION MARKET, BY COUNTRY, 2019 & 2027 (%)

FIGURE 19.COMMERCIAL REFRIGERATION MARKET, BY END USER, 2019-2027

FIGURE 20.COMMERCIAL REFRIGERATION MARKET REVENUE FOR FULL SERVICE RESTAURANT & HOTELS, BY COUNTRY, 2019 & 2027 (%)

FIGURE 21.COMMERCIAL REFRIGERATION MARKET REVENUE FOR FOOD PROCESSING INDUSTRY, BY COUNTRY, 2019 & 2027 (%)

FIGURE 22.COMMERCIAL REFRIGERATION MARKET REVENUE FOR HOSPITALS, BY COUNTRY, 2019 & 2027 (%)

FIGURE 23.COMMERCIAL REFRIGERATION MARKET REVENUE FOR RETAIL PHARMACIES, BY COUNTRY, 2019 & 2027 (%)

FIGURE 24.COMMERCIAL REFRIGERATION MARKET REVENUE FOR SUPERMARKET/HYPERMARKET, BY COUNTRY, 2019 & 2027 (%)

FIGURE 25.COMMERCIAL REFRIGERATION MARKET REVENUE FOR CONVENIENCE STORES, BY COUNTRY, 2019 & 2027 (%)

FIGURE 26.COMMERCIAL REFRIGERATION MARKET REVENUE FOR QUICK SERVICE RESTAURANTS, BY COUNTRY, 2019 & 2027 (%)

FIGURE 27.COMMERCIAL REFRIGERATION MARKET REVENUE FOR OTHERS, BY COUNTRY, 2019 & 2027 (%)

FIGURE 28.COMMERCIAL REFRIGERATION MARKET, BY REGION, 2019-2027

FIGURE 29.U.S. COMMERCIAL REFRIGERATION MARKET REVENUE, 2019-2027 ($MILLION)

FIGURE 30.CANADA COMMERCIAL REFRIGERATION MARKET REVENUE, 2019-2027 ($MILLION)

FIGURE 31.MEXICO COMMERCIAL REFRIGERATION MARKET REVENUE, 2019-2027 ($MILLION)

FIGURE 32.GERMANY COMMERCIAL REFRIGERATION MARKET REVENUE, 2019-2027 ($MILLION)

FIGURE 33.FRANCE COMMERCIAL REFRIGERATION MARKET REVENUE, 2019-2027 ($MILLION)

FIGURE 34.UK COMMERCIAL REFRIGERATION MARKET REVENUE, 2019-2027 ($MILLION)

FIGURE 35.ITALY COMMERCIAL REFRIGERATION MARKET REVENUE, 2019-2027 ($MILLION)

FIGURE 36.SPAIN COMMERCIAL REFRIGERATION MARKET REVENUE, 2019-2027 ($MILLION)

FIGURE 37.REST OF EUROPE COMMERCIAL REFRIGERATION MARKET REVENUE, 2019-2027 ($MILLION)

FIGURE 38.CHINA COMMERCIAL REFRIGERATION MARKET REVENUE, 2019-2027 ($MILLION)

FIGURE 39.INDIA COMMERCIAL REFRIGERATION MARKET REVENUE, 2019-2027 ($MILLION)

FIGURE 40.JAPAN COMMERCIAL REFRIGERATION MARKET REVENUE, 2019-2027 ($MILLION)

FIGURE 41.AUSTRALIA COMMERCIAL REFRIGERATION MARKET REVENUE, 2019-2027 ($MILLION)

FIGURE 42.REST OF ASIA-PACIFIC COMMERCIAL REFRIGERATION MARKET REVENUE, 2019-2027 ($MILLION)

FIGURE 43.BRAZIL COMMERCIAL REFRIGERATION MARKET REVENUE, 2019-2027 ($MILLION)

FIGURE 44.UAE COMMERCIAL REFRIGERATION MARKET REVENUE, 2019-2027 ($MILLION)

FIGURE 45.SAUDI ARABIA COMMERCIAL REFRIGERATION MARKET REVENUE, 2019-2027 ($MILLION)

FIGURE 46.REST OF LAMEA COMMERCIAL REFRIGERATION MARKET REVENUE, 2019-2027 ($MILLION)

FIGURE 47.TOP WINNING STRATEGIES, BY YEAR, 2017–2020*

FIGURE 48.TOP WINNING STRATEGIES, BY DEVELOPMENT, 2017–2020* (%)

FIGURE 49.TOP WINNING STRATEGIES, BY COMPANY, 2017–2020*

FIGURE 50.PRODUCT MAPPING OF TOP 10 KEY PLAYERS

FIGURE 51.COMPETITIVE DASHBOARD OF TOP 10 KEY PLAYERS

FIGURE 52.COMPETITIVE HEATMAP OF TOP 10 KEY PLAYERS

FIGURE 53.AB ELECTROLUX: R&D EXPENDITURE, 2017–2019 ($MILLION)

FIGURE 54.AB ELECTROLUX: NET SALES, 2017–2019($MILLION)

FIGURE 55.AB ELECTROLUX: REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 56.AB ELECTROLUX: REVENUE SHARE BY REGION, 2019 (%)

FIGURE 57.DAIKIN INDUSTRIES LTD: R&D EXPENDITURE, 2018–2020 ($MILLION)

FIGURE 58.DAIKIN INDUSTRIES LTD.: NET SALES, 2018–2020 ($MILLION)

FIGURE 59.DAIKIN INDUSTRIES LTD.: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 60.DAIKIN INDUSTRIES LTD.: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 61.DOVER CORPORATION: R&D EXPENDITURE, 2017–2019 ($MILLION)

FIGURE 62.DOVER CORPORATION: NET SALES, 2017–2019 ($MILLION)

FIGURE 63.DOVER CORPORATION: REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 64.DOVER CORPORATION: REVENUE SHARE BY REGION, 2019 (%)

FIGURE 65.FRIGOGLASS S.A.I.C.: NET SALES, 2017–2019 ($MILLION)

FIGURE 66.FRIGOGLASS S.A.I.C.: REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 67.FRIGOGLASS S.A.I.C.: REVENUE SHARE BY REGION, 2019 (%)

FIGURE 68.HAIER ELECTRONICS GROUP CO., LTD: R&D EXPENDITURE, 2017–2019 ($MILLION)

FIGURE 69.HAIER ELECTRONICS GROUP CO., LTD: NET SALES, 2017–2019 ($MILLION)

FIGURE 70.HAIER ELECTRONICS GROUP CO., LTD: REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 71.HAIER ELECTRONICS GROUP CO., LTD: REVENUE SHARE BY REGION, 2019 (%)

FIGURE 72.ILLINOIS TOOL WORKS INC: R&D EXPENDITURE, 2017–2019 ($MILLION)

FIGURE 73.ILLINOIS TOOL WORKS INC.: NET SALES, 2017–2019 ($MILLION)

FIGURE 74.ILLINOIS TOOL WORKS INC.: REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 75.ILLINOIS TOOL WORKS INC.: REVENUE SHARE BY REGION, 2019 (%)

FIGURE 76.JOHNSON CONTROLS INTERNATIONAL PLC.: NET SALES, 2018–2020 ($MILLION)

FIGURE 77.R&D EXPENDITURE, 2018–2020 ($MILLION)

FIGURE 78.PANASONIC CORPORATION: NET SALES, 2018–2020 ($MILLION)

FIGURE 79.PANASONIC CORPORATION: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 80.PANASONIC CORPORATION: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 81.UNITED TECHNOLOGIES CORPORATION: R&D EXPENDITURE, 2017–2019 ($MILLION)

FIGURE 82.UNITED TECHNOLOGIES CORPORATION: NET SALES, 2017–2019 ($MILLION)

FIGURE 83.UNITED TECHNOLOGIES CORPORATION: REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 84.UNITED TECHNOLOGIES CORPORATION: REVENUE SHARE BY REGION, 2019 (%)

.jpg)