The global automotive telematics market size was valued at USD 50.4 Billion in 2018, and is projected to reach USD 320.6 Billion by 2026, registering a CAGR of 26.8% from 2019 to 2026.

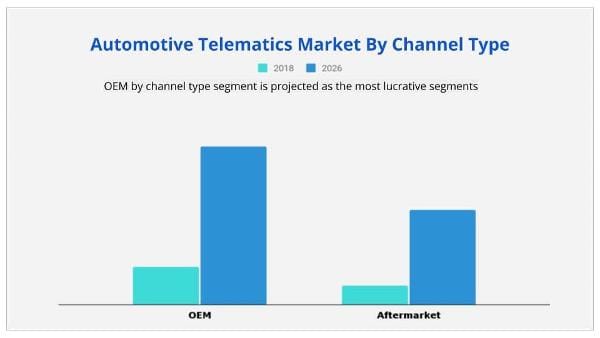

By channel type, the OEM segment was the highest revenue contributor in 2018, accounting for $ 33.7 billion, and is estimated to reach $ 225.6 billion by 2026, registering a CAGR of 27.9% during the forecast period. In 2018, the North America region is anticipated to occupy major chunk of the market share.

Telematics is a methodology of monitoring location and movement of a vehicle by combining Global Positioning System (GPS) and on-boards diagnostics systems. With the help of GPS and diagnostics system, it is possible to record the speed and internal behavior of vehicles. Telematics systems are mainly adopted by automobile insurance companies, fleet management companies, and others to monitor location and behavior of a vehicle. Vehicle telematics solution consists of 3 fundamental parameters i.e. Telematics Control Unit (TCU), telematics cloud server, and the front end- web app and mobile App. The automotive telematics market trends will be deciding on the basis of forecast & active steps taken by an industry manufacturer from the year 2018 to 2026.

The cloud-based telematics server consists of a web server, an application server, and a database. The information collected by TCU is sent to cloud-based telematics server through a GPRS/cellular network over HTTPS and later the data stored in the telematics server can be accessed by end users using either a desktop or mobile application. The major factor that are driving the automotive telematics market share is the increase in integration of real-time fleet monitoring systems in vehicles and increasing use of cloud-based technology for automotive telematics solution.

Telematics technology enables both ride-sharing companies and passengers to keep a closer tab on drivers, manage payments based on the ride maps, and monitor vehicle movement through smartphones in a seamless and secure manner. The automotive telematics market forecasted from 2019 to 2026 by considering all the driving factors that influence equally to the market demand.

Government regulations for vehicle telematics and rise in trend of connectivity solutions drive the growth of the market. In addition, ease of vehicle diagnose due to the telematics systems also propels the automotive telematics market growth. However, threat of data hacking, high installation cost, and lack of uninterrupted & seamless internet connectivity hinder the growth of the market. Furthermore, intelligent transportation system, improved performance of autonomous vehicles, enhancement of business decisions for fleet owners imposes a remarkable growth opportunity for the market.

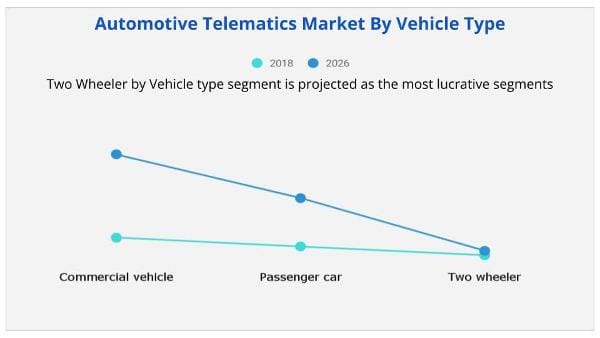

The automotive telematics market is segmented on the basis of channel type, vehicle type, connectivity solutions, application, and region. By channel type, it is bifurcated into OEM and aftermarket. By vehicle type, it is categorized into passenger, commercial vehicles, and two-wheeler. By application, it is classified into fleet/asset management, navigation & location-based system, infotainment system, insurance telematics, safety & security, V2X, others. By connectivity solution, it is divided into embedded, integrated smartphones, and tethered. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key players in the report include Masternaut Limited, TomTom Telematics B.V, Trimble Inc.,Omnitracs ,VERIZON, I.D.Systems, Inc., Airbiquity Inc.,Harman International Industries, Inc., MiX Telematics, Teletrac Navman, and CARTRACK.

Government regulations for vehicle telematics

Government rules and regulations for the safety, security, and tracking of vehicles in different regions drives the growth of the telematics market. For instance, in April 2018, government of India passed a rule for all public transport vehicles over six-seater capacity to have a tracking device installed in them. In addition, in December 2017, the Ministry of Industry and Information Technology (MIIT) and the Standardization Administration of China (SAC) jointly established national guidelines for the development of telematics systems. Therefore, government regulations for vehicle telematics fuel the growth of global automotive telematics market.

Rise in trend of connectivity solutions

Smartphones have changed the definition of connectivity over time. People wish to stay connected with the outer world even while travelling. Now that connectivity has become the need of the hour, automobile manufacturers adopt connectivity solutions in their vehicles to boost their automobile sales. Consumers are expecting their vehicles to perform tasks similar to computers and smart phones. Therefore, the automotive telematics market is expected to grow at a promising rate due to the rise in customer demands for staying connected 24*7 even while travelling.

Ease of vehicle diagnosis

Advance diagnostic system is expected to boost the growth of the automotive telematics market. This system in a car supplies data of the vehicle to both automobile dealers as well as customers, which helps to predict potential automobile issues before their occurrence. In fleet management, it is easy to track vehicle records and decide which vehicle has travelled the most and accordingly offer services with the help of connectivity solutions. Diagnostic systems keep a track of smoke emission and fuel consumption of vehicles, thereby, monitor engine health. Thus, ease of vehicle diagnosis with the help mobile applications is expected to fuel the growth of the market.

Threat of data hacking

Telematics is a relatively new technology. Events, such as unauthorized access to multiple car connectivity solutions or breaking into the in-vehicle connectivity system can restrict the automotive telematics market. The major security concern is that hackers have access to the computer system of cars as well as to the data that it collects and stores. Thus, hacking threats of vehicle with telematics systems is one of the factors expected to hamper the growth of the market.

High installation cost

The additional costs incurred while providing connectivity in a vehicle is expected to restrict the growth of the automotive telematics market. Providing connectivity solutions in the vehicle incurs additional expenses to consumers in the form of hardware, connectivity solutions, and telecom service charges. These additional costs bestowed upon the consumer have a significant impact on the automotive telematics market. Thus, high installation cost of telematics systems in vehicles is expected to hinder the market.

Lack of uninterrupted & seamless internet connectivity

The main objective of telematics solutions is to keep consumers connected to the outside world. People need a continuous access to the Internet while travelling. Consumers expect their cars to perform tasks similar to their computers or smart phones. Interrupted connectivity restrict the growth of the telematics segment as it fails to offer a seamless Internet service. This is mainly due to inconsistency in the network offered by service providers, which varies for different regions.

Intelligent transportation system

The safety services offered in vehicles with telematics solutions are an appropriate example of cutting-edge aftermarket technology, which involves sharing data between vehicles and humans. Safety is a combination of telecommunication and automobile technology used to improve vehicle efficiency, reduce fuel consumption & maintenance cost, enhance security & safety measures, and assist the driver to enhance the overall driving experience. Features such as live traffic updates, automatic toll transactions, insurance telematics, road-side assistance in case of accidents or breakdowns and smart routing & tracking is expected to provide an exponential growth opportunity for the key players operating in the automotive telematics market.

Better driver and vehicle safety

Real-time monitoring, geofencing, and diagnostic features are incorporated in vehicles due to the increase in demand for fleet safety and security in transportation of goods through commercial vehicles. According to telematics service providers, telematics in overall the automotive industry is expected to grow rapidly in developing nations. Asia-Pacific has witnessed strong adoption of solutions such as installation of Global Positioning System (GPS) in commercial vehicles, due to regulatory mandates. Therefore, increase in need for safety and security is expected to boost the growth of the automotive telematics market.

North America

U.S.

Canada

Mexico

Europe

UK

Germany

France

Russia

Italy

Rest of Europe

Asia-Pacific

China

Japan

India

South Korea

Rest of Asia-Pacific

LAMEA

Latin America

Middle East

Africa

|

Report Metric |

Details |

|

Report Name |

Automotive Telematics Market |

|

Market size value in 2019 |

USD 50.4 Billion |

|

Revenue forecast in 2026 |

USD 320.6 Billion |

|

Growth Rate |

26.8% |

|

Base year considered |

2019 |

|

Forecast Period |

2020-2026 |

|

By Channel |

OEM and Aftermarket |

|

By Vehicle Type |

Commercial Vehicle, Passenger Car, and Two-Wheeler |

|

By Application |

Fleet/Asset Management, Navigation & Location-Based System, Infotainment System, Insurance Telematic, Safety & Security, V2X |

|

By Connectivity Solution |

Embedded, Integrated Smartphones, and Tethered |

|

Report Coverage |

Revenue & volume forecast, company share, competitive landscape, growth factors, and trends |

|

Segments Covered |

By Type, Application, and Region |

|

Geographic Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Ans. The global automotive telematics market size was valued at $50.4 billion in 2018, and is projected to reach $320.6 billion by 2026, registering a CAGR of 26.8% from 2019 to 2026.

Ans. Some of the major companies are Masternaut Limited, TomTom Telematics B.V, Trimble Inc.,Omnitracs ,VERIZON, I.D.Systems, Inc., Airbiquity Inc.,Harman International Industries, Inc., MiX Telematics, Teletrac Navman, and CARTRACK.

Ans. Yes, the report includes a COVID-19 impact analysis. Also, it is further extended into every individual segment of the report.

CHAPTER 1: INTRODUCTION

1.1. Report description

1.2. Key benefits for stakeholders

1.3. Key market segments

1.4. Research methodology

1.4.1. Primary research

1.4.2. Secondary research

1.4.3. Analyst tools and models

CHAPTER 2: EXECUTIVE SUMMARY

2.1. CXO perspective

CHAPTER 3: MARKET OVERVIEW

3.1. Market definition and scope

3.2. Key findings

3.2.1. Top impacting factors

3.2.2. Top investment pockets

3.2.3. Top winning strategies

3.3. Porter’s five forces analysis

3.4. Key player positioning (2017)

3.5. Market dynamics

3.5.1. Drivers

3.5.1.1. Government regulations for vehicle telematics

3.5.1.2. Rise in trend of connectivity solutions

3.5.1.3. Ease of vehicle diagnosis

3.5.1.4. Integration of real-time fleet monitoring systems in vehicles

3.5.1.5. Increase in use of cloud-based technology for automotive telematics solution

3.5.2. Restraints

3.5.2.1. Threat of data hacking

3.5.2.2. High installation cost

3.5.2.3. Lack of uninterrupted & seamless internet connectivity

3.5.3. Opportunities

3.5.3.1. Intelligent transportation system

3.5.3.2. Improved performance of autonomous vehicles

3.5.3.3. Better driver and vehicle safety

3.5.3.4. Enhancement of business decisions for fleet owners

CHAPTER 4: AUTOMOTIVE TELEMATICS MARKET, BY CHANNEL TYPE

4.1. Overview

4.2. OEM

4.2.1. Key market trends, growth factors and opportunities

4.2.2. Market size and forecast, by region

4.2.3. Market analysis by country

4.3. Aftermarket

4.3.1. Key market trends, growth factors, and opportunities

4.3.2. Market size and forecast, by region

4.3.3. Market analysis by country

CHAPTER 5: AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE

5.1. Overview

5.2. Passenger vehicle

5.2.1. Key market trends, growth factors and opportunities

5.2.2. Market size and forecast, by region

5.2.3. Market analysis by country

5.3. Commercial Vehicle

5.3.1. Key market trends, growth factors, and opportunities

5.3.2. Market size and forecast, by region

5.3.3. Market analysis by country

5.4. Two Wheeler

5.4.1. Key market trends, growth factors, and opportunities

5.4.2. Market size and forecast, by region

5.4.3. Market analysis by country

CHAPTER 6: AUTOMOTIVE TELEMATICS MARKET, BY APPLICATION

6.1. Overview

6.2. Fleet/Asset management

6.2.1. Key market trends, growth factors and opportunities

6.2.2. Market size and forecast, by region

6.2.3. Market analysis by country

6.3. Navigation & location-based system

6.3.1. Key market trends, growth factors and opportunities

6.3.2. Market size and forecast, by region

6.3.3. Market analysis by country

6.4. Infotainment system

6.4.1. Key market trends, growth factors and opportunities

6.4.2. Market size and forecast, by region

6.4.3. Market analysis by country

6.5. Insurance telematics

6.5.1. Key market trends, growth factors and opportunities

6.5.2. Market size and forecast, by region

6.5.3. Market analysis by country

6.6. Safety & Security

6.6.1. Key market trends, growth factors and opportunities

6.6.2. Market size and forecast, by region

6.6.3. Market analysis by country

6.7. V2X

6.7.1. Key market trends, growth factors and opportunities

6.7.2. Market size and forecast, by region

6.7.3. Market analysis by country

6.8. Others

6.8.1. Key market trends, growth factors and opportunities

6.8.2. Market size and forecast, by region

6.8.3. Market analysis by country

CHAPTER 7: AUTOMOTIVE TELEMATICS MARKET, BY CONNECTIVITY SOLUTIONS

7.1. Overview

7.2. Embedded

7.2.1. Key market trends, growth factors and opportunities

7.2.2. Market size and forecast, by region

7.2.3. Market analysis by country

7.3. Integrated smartphones

7.3.1. Key market trends, growth factors, and opportunities

7.3.2. Market size and forecast, by region

7.3.3. Market analysis by country

7.4. Tethered

7.4.1. Key market trends, growth factors, and opportunities

7.4.2. Market size and forecast, by region

7.4.3. Market analysis by country

CHAPTER 8: AUTOMOTIVE TELEMATICS MARKET, BY REGION

8.1. Overview

8.2. North America

8.2.1. Key market trends, growth factors, and opportunities

8.2.2. Market size and forecast, by channel type

8.2.3. Market size and forecast, by application

8.2.4. Market size and forecast, connectivity solutions

8.2.5. Market size and forecast, by vehicle type

8.2.6. Market analysis by country

8.2.6.1. U.S.

8.2.6.1.1. Market size and forecast, by channel type

8.2.6.1.2. Market size and forecast, by vehicle type

8.2.6.1.3. Market size and forecast, by application

8.2.6.1.4. Market size and forecast, connectivity solutions

8.2.6.2. Canada

8.2.6.2.1. Market size and forecast, by Channel type

8.2.6.2.2. Market size and forecast, by vehicle type

8.2.6.2.3. Market size and forecast, by application

8.2.6.2.4. Market size and forecast, connectivity solutions

8.2.6.3. Mexico

8.2.6.3.1. Market size and forecast, by Channel type

8.2.6.3.2. Market size and forecast, by vehicle type

8.2.6.3.3. Market size and forecast, by application

8.2.6.3.4. Market size and forecast, connectivity solutions

8.3. Europe

8.3.1. Key market trends, growth factors, and opportunities

8.3.2. Market size and forecast, by channel type

8.3.3. Market size and forecast, by vehicle type

8.3.4. Market size and forecast, by application

8.3.5. Market size and forecast, connectivity solutions

8.3.6. Market analysis by country

8.3.6.1. UK

8.3.6.1.1. Market size and forecast, by Channel type

8.3.6.1.2. Market size and forecast, by vehicle type

8.3.6.1.3. Market size and forecast, by application

8.3.6.1.4. Market size and forecast, connectivity solutions

8.3.6.2. Germany

8.3.6.2.1. Market size and forecast, by channel type

8.3.6.2.2. Market size and forecast, by vehicle type

8.3.6.2.3. Market size and forecast, by application

8.3.6.2.4. Market size and forecast, connectivity solutions

8.3.6.3. France

8.3.6.3.1. Market size and forecast, by channel type

8.3.6.3.2. Market size and forecast, by vehicle type

8.3.6.3.3. Market size and forecast, by application

8.3.6.3.4. Market size and forecast, connectivity solutions

8.3.6.4. Russia

8.3.6.4.1. Market size and forecast, by Channel type

8.3.6.4.2. Market size and forecast, by vehicle type

8.3.6.4.3. Market size and forecast, by application

8.3.6.4.4. Market size and forecast, connectivity solutions

8.3.6.5. Italy

8.3.6.5.1. Market size and forecast, by Channel type

8.3.6.5.2. Market size and forecast, by vehicle type

8.3.6.5.3. Market size and forecast, by application

8.3.6.5.4. Market size and forecast, connectivity solutions

8.3.6.6. Rest of Europe

8.3.6.6.1. Market size and forecast, by Channel type

8.3.6.6.2. Market size and forecast, by vehicle type

8.3.6.6.3. Market size and forecast, by application

8.3.6.6.4. Market size and forecast, connectivity solutions

8.4. Asia-Pacific

8.4.1. Key market trends, growth factors, and opportunities

8.4.2. Market size and forecast, by channel type

8.4.3. Market size and forecast, by vehicle type

8.4.4. Market size and forecast, by application

8.4.5. Market size and forecast, connectivity solutions

8.4.6. Market analysis by country

8.4.6.1. China

8.4.6.1.1. Market size and forecast, by channel type

8.4.6.1.2. Market size and forecast, by vehicle type

8.4.6.1.3. Market size and forecast, by application

8.4.6.1.4. Market size and forecast, connectivity solutions

8.4.6.2. India

8.4.6.2.1. Market size and forecast, by channel type

8.4.6.2.2. Market size and forecast, by vehicle type

8.4.6.2.3. Market size and forecast, by application

8.4.6.2.4. Market size and forecast, connectivity solutions

8.4.6.3. Japan

8.4.6.3.1. Market size and forecast, by channel type

8.4.6.3.2. Market size and forecast, by vehicle type

8.4.6.3.3. Market size and forecast, by application

8.4.6.3.4. Market size and forecast, connectivity solutions

8.4.6.4. South Korea

8.4.6.4.1. Market size and forecast, by channel type

8.4.6.4.2. Market size and forecast, by vehicle type

8.4.6.4.3. Market size and forecast, by application

8.4.6.4.4. Market size and forecast, connectivity solutions

8.4.6.5. Rest of Asia-Pacific

8.4.6.5.1. Market size and forecast, by Channel type

8.4.6.5.2. Market size and forecast, by vehicle type

8.4.6.5.3. Market size and forecast, by application

8.4.6.5.4. Market size and forecast, connectivity solutions

8.5. LAMEA

8.5.1. Key market trends, growth factors, and opportunities

8.5.2. Market size and forecast, by channel type

8.5.3. Market size and forecast, by vehicle type

8.5.4. Market size and forecast, by application

8.5.5. Market size and forecast, connectivity solutions

8.5.6. Market analysis by country

8.5.6.1. Latin America

8.5.6.1.1. Market size and forecast, by channel type

8.5.6.1.2. Market size and forecast, by vehicle type

8.5.6.1.3. Market size and forecast, by application

8.5.6.1.4. Market size and forecast, connectivity solutions

8.5.6.2. Middle East

8.5.6.2.1. Market size and forecast, by channel type

8.5.6.2.2. Market size and forecast, by vehicle type

8.5.6.2.3. Market size and forecast, by application

8.5.6.2.4. Market size and forecast, connectivity solutions

8.5.6.3. Africa

8.5.6.3.1. Market size and forecast, by channel type

8.5.6.3.2. Market size and forecast, by vehicle type

8.5.6.3.3. Market size and forecast, by application

8.5.6.3.4. Market size and forecast, connectivity solutions

CHAPTER 9: COMPANY PROFILE

9.1. CARTRACK

9.1.1. Company overview

9.1.2. Company snapshot

9.1.3. Product portfolio

9.1.4. Business performance

9.1.5. Key strategic moves and developments

9.2. MASTERNAUT LIMITED

9.2.1. Company overview

9.2.2. Company snapshot

9.2.3. Product portfolio

9.2.4. Business performance

9.2.5. Key strategic moves and developments

9.3. MIX TELEMATICS

9.3.1. Company overview

9.3.2. Company snapshot

9.3.3. Operating business segments

9.3.4. Product portfolio

9.3.5. Business performance

9.3.6. Key strategic moves and developments

9.4. OMNITRACS

9.4.1. Company overview

9.4.2. Company snapshot

9.4.3. Operating business segments

9.4.4. Product portfolio

9.4.5. Key strategic moves and developments

9.5. TOMTOM TELEMATICS BV.

9.5.1. Company overview

9.5.2. Company snapshot

9.5.3. Operating business segments

9.5.4. Product portfolio

9.5.5. Business performance

9.5.6. Key strategic moves and developments

9.6. TRIMBLE INC.

9.6.1. Company overview

9.6.2. Company snapshot

9.6.3. Operating business segments

9.6.4. Product portfolio

9.6.5. Business performance

9.6.6. Key strategic moves and developments

9.7. VERIZON

9.7.1. Company overview

9.7.2. Company snapshot

9.7.3. Operating business segments

9.7.4. Product portfolio

9.7.5. Business performance

9.7.6. Key strategic moves and developments

9.8. HARMAN INTERNATIONAL (SAMSUNG ELECTRONICS)

9.8.1. Company overview

9.8.2. Company snapshot

9.8.3. Operating business segments

9.8.4. Product portfolio

9.8.5. Business performance

9.8.6. Key strategic moves and developments

9.9. I.D.Systems, Inc.

9.9.1. Company overview

9.9.2. Company snapshot

9.9.3. Operating business segments

9.9.4. Product portfolio

9.9.5. Business performance

9.9.6. Key strategic moves and developments

9.10. Teletrac Navman

9.10.1. Company overview

9.10.2. Company snapshot

9.10.3. Operating business segments

9.10.4. Product portfolio

9.10.5. Key strategic moves and developments

9.11. Airbiquity Inc.

9.11.1. Company overview

9.11.2. Company snapshot

9.11.3. Product portfolio

9.11.4. Key strategic moves and developments

TABLE 01. GLOBAL AUTOMOTIVE TELEMATICS MARKET, BY CHANNEL TYPE, 2018–2026($BILLION)

TABLE 02. AUTOMOTIVE TELEMATICS MARKET REVENUE FOR AUTOMOTIVE OEM, BY REGION 2018–2026 ($BILLION)

TABLE 03. AUTOMOTIVE TELEMATICS MARKET REVENUE FOR AFTERMARKET TELEMATICS, BY REGION 2018–2026 ($BILLION)

TABLE 04. GLOBAL AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2018–2026($BILLION)

TABLE 05. AUTOMOTIVE TELEMATICS MARKET REVENUE FOR AUTOMOTIVE PASSENGER VEHICLES, BY REGION 2018–2026 ($BILLION)

TABLE 06. AUTOMOTIVE TELEMATICS MARKET REVENUE FOR COMMERCIAL VEHICLES, BY REGION 2018–2026 ($BILLION)

TABLE 07. AUTOMOTIVE TELEMATICS MARKET REVENUE FOR TWO WHEELER, BY REGION 2018–2026 ($BILLION)

TABLE 08. GLOBAL AUTOMOTIVE TELEMATICS MARKET, BY APPLICATION, 2018–2026($BILLION)

TABLE 09. AUTOMOTIVE TELEMATICS MARKET REVENUE FOR FLEET MANAGEMENT, BY REGION 2018–2026 ($BILLION)

TABLE 10. AUTOMOTIVE TELEMATICS MARKET REVENUE FOR NAVIGATION & LOCATION BASED SYSETM, BY REGION 2018–2026 ($BILLION)

TABLE 11. AUTOMOTIVE TELEMATICS MARKET REVENUE FOR INFOTAINMENT SYSTEM, BY REGION 2018–2026 ($BILLION)

TABLE 12. AUTOMOTIVE TELEMATICS MARKET REVENUE FOR INSURANCE TELEMATICS, BY REGION 2018–2026 ($BILLION)

TABLE 13. AUTOMOTIVE TELEMATICS MARKET REVENUE FOR SAFETY & SECURITY, BY REGION 2018–2026 ($BILLION)

TABLE 14. AUTOMOTIVE TELEMATICS MARKET REVENUE FOR V2X, BY REGION 2018–2026 ($BILLION)

TABLE 15. AUTOMOTIVE TELEMATICS MARKET REVENUE FOR OTHERS, BY REGION 2018–2026 ($BILLION)

TABLE 16. GLOBAL AUTOMOTIVE TELEMATICS MARKET, CONNECTIVITY SOLUTIONS, 2018–2026($BILLION)

TABLE 17. AUTOMOTIVE TELEMATICS MARKET REVENUE FOR EMBEDDED, BY REGION 2018–2026 ($BILLION)

TABLE 18. AUTOMOTIVE TELEMATICS MARKET REVENUE FOR INTEGRATED SMARTPHONES, BY REGION 2018–2026($BILLION)

TABLE 19. AUTOMOTIVE TELEMATICS MARKET REVENUE FOR TETHERED, BY REGION 2018–2026($BILLION)

TABLE 20. NORTH AMERICAN AUTOMOTIVE TELEMATICS MARKET, BY CHANNEL TYPE, 2018–2026 ($BILLION)

TABLE 21. NORTH AMERICAN AUTOMOTIVE TELEMATICS MARKET, BY APPLICATION, 2018–2026 ($BILLION)

TABLE 22. NORTH AMERICAN AUTOMOTIVE TELEMATICS MARKET, CONNECTIVITY SOLUTIONS, 2018–2026 ($BILLION)

TABLE 23. NORTH AMERICAN AUTOMOTIVE TELEMATICS MARKET, VEHICLE TYPE, 2018–2026 ($BILLION)

TABLE 24. U. S. AUTOMOTIVE TELEMATICS MARKET, BY CHANNEL TYPE, 2018–2026 ($BILLION)

TABLE 25. U. S. AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2018–2026 ($BILLION)

TABLE 26. U. S. AUTOMOTIVE TELEMATICS MARKET, BY APPLICATION, 2018–2026 ($BILLION)

TABLE 27. U. S. AUTOMOTIVE TELEMATICS MARKET, CONNECTIVITY SOLUTIONS, 2018–2026 ($BILLION)

TABLE 28. CANADA AUTOMOTIVE TELEMATICS MARKET, BY CHANNEL TYPE, 2018–2026 ($BILLION)

TABLE 29. CANADA AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2018–2026 ($BILLION)

TABLE 30. CANADA AUTOMOTIVE TELEMATICS MARKET, BY APPLICATION, 2018–2026 ($BILLION)

TABLE 31. CANADA AUTOMOTIVE TELEMATICS MARKET, CONNECTIVITY SOLUTIONS, 2018–2026 ($BILLION)

TABLE 32. MEXICO AUTOMOTIVE TELEMATICS MARKET, BY CHANNEL TYPE, 2018–2026 ($BILLION)

TABLE 33. MEXICO AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2018–2026 ($BILLION)

TABLE 34. MEXICO AUTOMOTIVE TELEMATICS MARKET, BY APPLICATION, 2018–2026 ($BILLION)

TABLE 35. MEXICO AUTOMOTIVE TELEMATICS MARKET, CONNECTIVITY SOLUTIONS, 2018–2026 ($BILLION)

TABLE 36. EUROPEAN AUTOMOTIVE TELEMATICS MARKET, BY CHANNEL TYPE, 2018–2026 ($BILLION)

TABLE 37. EUROPEAN AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2018–2026 ($BILLION)

TABLE 38. EUROPE AUTOMOTIVE TELEMATICS MARKET, BY APPLICATION, 2018–2026 ($BILLION)

TABLE 39. EUROPEAN AUTOMOTIVE TELEMATICS MARKET, CONNECTIVITY SOLUTIONS, 2018–2026 ($BILLION)

TABLE 40. UK AUTOMOTIVE TELEMATICS MARKET, BY CHANNEL TYPE, 2018–2026 ($BILLION)

TABLE 41. UK AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2018–2026 ($BILLION)

TABLE 42. UK AUTOMOTIVE TELEMATICS MARKET, BY APPLICATION, 2018–2026 ($BILLION)

TABLE 43. UK AUTOMOTIVE TELEMATICS MARKET, CONNECTIVITY SOLUTIONS, 2018–2026 ($BILLION)

TABLE 44. GERMANY AUTOMOTIVE TELEMATICS MARKET, BY CHANNEL TYPE, 2018–2026 ($BILLION)

TABLE 45. GERMANY AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2018–2026 ($BILLION)

TABLE 46. GERMANY AUTOMOTIVE TELEMATICS MARKET, BY APPLICATION, 2018–2026 ($BILLION)

TABLE 47. GERMANY AUTOMOTIVE TELEMATICS MARKET, CONNECTIVITY SOLUTIONS, 2018–2026 ($BILLION)

TABLE 48. FRANCE AUTOMOTIVE TELEMATICS MARKET, BY CHANNEL TYPE, 2018–2026 ($BILLION)

TABLE 49. FRANCE AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2018–2026 ($BILLION)

TABLE 50. FRANCE AUTOMOTIVE TELEMATICS MARKET, BY APPLICATION, 2018–2026 ($BILLION)

TABLE 51. FRANCE AUTOMOTIVE TELEMATICS MARKET, CONNECTIVITY SOLUTIONS, 2018–2026 ($BILLION)

TABLE 52. RUSSIA AUTOMOTIVE TELEMATICS MARKET, BY CHANNEL TYPE, 2018–2026 ($BILLION)

TABLE 53. RUSSIA AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2018–2026 ($BILLION)

TABLE 54. RUSSIA AUTOMOTIVE TELEMATICS MARKET, BY APPLICATION, 2018–2026 ($BILLION)

TABLE 55. RUSSIA AUTOMOTIVE TELEMATICS MARKET, CONNECTIVITY SOLUTIONS, 2018–2026 ($BILLION)

TABLE 56. ITALY AUTOMOTIVE TELEMATICS MARKET, BY CHANNEL TYPE, 2018–2026 ($BILLION)

TABLE 57. ITALY AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2018–2026 ($BILLION)

TABLE 58. ITALY AUTOMOTIVE TELEMATICS MARKET, BY APPLICATION, 2018–2026 ($BILLION)

TABLE 59. ITALY AUTOMOTIVE TELEMATICS MARKET, CONNECTIVITY SOLUTIONS, 2018–2026 ($BILLION)

TABLE 60. REST OF EUROPE AUTOMOTIVE TELEMATICS MARKET, BY CHANNEL TYPE, 2018–2026 ($BILLION)

TABLE 61. REST OF EUROPE AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2018–2026 ($BILLION)

TABLE 62. REST OF EUROPE AUTOMOTIVE TELEMATICS MARKET, BY APPLICATION, 2018–2026 ($BILLION)

TABLE 63. REST OF EUROPE AUTOMOTIVE TELEMATICS MARKET, CONNECTIVITY SOLUTIONS, 2018–2026 ($BILLION)

TABLE 64. ASIA-PACIFIC AUTOMOTIVE TELEMATICS MARKET, BY CHANNEL TYPE, 2018–2026 ($BILLION)

TABLE 65. ASIA-PACIFIC AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2018–2026 ($BILLION)

TABLE 66. ASIA PACIFIC AUTOMOTIVE TELEMATICS MARKET, BY APPLICATION, 2018–2026 ($BILLION)

TABLE 67. ASIA-PACIFIC AUTOMOTIVE TELEMATICS MARKET, CONNECTIVITY SOLUTIONS, 2018–2026 ($BILLION)

TABLE 68. CHINA AUTOMOTIVE TELEMATICS MARKET, BY CHANNEL TYPE, 2018–2026 ($BILLION)

TABLE 69. CHINA AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2018–2026 ($BILLION)

TABLE 70. CHINA AUTOMOTIVE TELEMATICS MARKET, BY APPLICATION, 2018–2026 ($BILLION)

TABLE 71. CHINA AUTOMOTIVE TELEMATICS MARKET, CONNECTIVITY SOLUTIONS, 2018–2026 ($BILLION)

TABLE 72. INDIA AUTOMOTIVE TELEMATICS MARKET, BY CHANNEL TYPE, 2018–2026 ($BILLION)

TABLE 73. INDIA AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2018–2026 ($BILLION)

TABLE 74. INDIA AUTOMOTIVE TELEMATICS MARKET, BY APPLICATION, 2018–2026 ($BILLION)

TABLE 75. INDIA AUTOMOTIVE TELEMATICS MARKET, CONNECTIVITY SOLUTIONS, 2018–2026 ($BILLION)

TABLE 76. JAPAN AUTOMOTIVE TELEMATICS MARKET, BY CHANNEL TYPE, 2018–2026 ($BILLION)

TABLE 77. JAPAN AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2018–2026 ($BILLION)

TABLE 78. JAPAN AUTOMOTIVE TELEMATICS MARKET, BY APPLICATION, 2018–2026 ($BILLION)

TABLE 79. JAPAN AUTOMOTIVE TELEMATICS MARKET, CONNECTIVITY SOLUTIONS, 2018–2026 ($BILLION)

TABLE 80. SOUTH KOREA AUTOMOTIVE TELEMATICS MARKET, BY CHANNEL TYPE, 2018–2026 ($BILLION)

TABLE 81. SOUTH KOREA AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2018–2026 ($BILLION)

TABLE 82. SOUTH KOREA AUTOMOTIVE TELEMATICS MARKET, BY APPLICATION, 2018–2026 ($BILLION)

TABLE 83. SOUTH KOREA AUTOMOTIVE TELEMATICS MARKET, CONNECTIVITY SOLUTIONS, 2018–2026 ($BILLION)

TABLE 84. REST OF ASIA-PACIFIC AUTOMOTIVE TELEMATICS MARKET, BY CHANNEL TYPE, 2018–2026 ($BILLION)

TABLE 85. REST OF ASIA PACIFIC AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2018–2026 ($BILLION)

TABLE 86. REST OF ASIA PACIFIC AUTOMOTIVE TELEMATICS MARKET, BY APPLICATION, 2018–2026 ($BILLION)

TABLE 87. REST OF ASIA-PACIFIC AUTOMOTIVE TELEMATICS MARKET, CONNECTIVITY SOLUTIONS, 2018–2026 ($BILLION)

TABLE 88. LAMEA AUTOMOTIVE TELEMATICS MARKET, BY CHANNEL TYPE, 2018–2026 ($BILLION)

TABLE 89. LAMEA AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2018–2026 ($BILLION)

TABLE 90. LAMEA AUTOMOTIVE TELEMATICS MARKET, BY APPLICATION, 2018–2026 ($BILLION)

TABLE 91. LAMEA AUTOMOTIVE TELEMATICS MARKET, CONNECTIVITY SOLUTIONS, 2018–2026 ($BILLION)

TABLE 92. LATIN AMERICA AUTOMOTIVE TELEMATICS MARKET, BY CHANNEL TYPE, 2018–2026 ($BILLION)

TABLE 93. LATIN AMERCIA AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2018–2026 ($BILLION)

TABLE 94. LATIN AMERICA AUTOMOTIVE TELEMATICS MARKET, BY APPLICATION, 2018–2026 ($BILLION)

TABLE 95. LATIN AMERICA AUTOMOTIVE TELEMATICS MARKET, CONNECTIVITY SOLUTIONS, 2018–2026 ($BILLION)

TABLE 96. MIDDLE EAST AUTOMOTIVE TELEMATICS MARKET, BY CHANNEL TYPE, 2018–2026 ($BILLION)

TABLE 97. MIDDLE EAST AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2018–2026 ($BILLION)

TABLE 98. MIDDLE EAST AUTOMOTIVE TELEMATICS MARKET, BY APPLICATION, 2018–2026 ($BILLION)

TABLE 99. MIDDLE EAST AUTOMOTIVE TELEMATICS MARKET, CONNECTIVITY SOLUTIONS, 2018–2026 ($BILLION)

TABLE 100. AFRICA AUTOMOTIVE TELEMATICS MARKET, BY CHANNEL TYPE, 2018–2026 ($BILLION)

TABLE 101. AFRICA AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, 2018–2026 ($BILLION)

TABLE 102. AFRICA AUTOMOTIVE TELEMATICS MARKET, BY APPLICATION, 2018–2026 ($BILLION)

TABLE 103. AFRICA AUTOMOTIVE TELEMATICS MARKET, CONNECTIVITY SOLUTIONS, 2018–2026 ($BILLION)

TABLE 104. CARTRACK: COMPANY SNAPSHOT

TABLE 105. CARTRACK: PRODUCT PORTFOLIO

TABLE 106. CARTRACK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 107. MASTERNAUT LIMITED: COMPANY SNAPSHOT

TABLE 108. MASTERNAUT LIMITED: PRODUCT PORTFOLIO

TABLE 109. MASTERNAUT LIMITED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 110. MIX TELEMATICS: COMPANY SNAPSHOT

TABLE 111. MIX TELEMATICS: OPERATING SEGMENTS

TABLE 112. MIX TELEMATICS: PRODUCT PORTFOLIO

TABLE 113. MIX TELEMATICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 114. OMNITRACS: COMPANY SNAPSHOT

TABLE 115. OMNITRACS: OPERATING SEGMENTS

TABLE 116. OMNITRACS: PRODUCT PORTFOLIO

TABLE 117. OMNITRACS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 118. TOMTOM TELEMATICS BV.: COMPANY SNAPSHOT

TABLE 119. TOMTOM TELEMATICS BV.: OPERATING SEGMENTS

TABLE 120. TOMTOM TELEMATICS BV.: PRODUCT PORTFOLIO

TABLE 121. TOMTOM TELEMATICS BV.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 122. TRIMBLE INC.,: COMPANY SNAPSHOT

TABLE 123. TRIMBLE INC.,: OPERATING SEGMENTS

TABLE 124. TRIMBLE INC.,: PRODUCT PORTFOLIO

TABLE 125. TRIMBLE INC.,: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 126. VERIZON CONNECT: COMPANY SNAPSHOT

TABLE 127. VERIZON: OPERATING SEGMENTS

TABLE 128. VERIZON CONNECT: PRODUCT PORTFOLIO

TABLE 129. VERIZON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 130. HARMAN INTERNATIONAL (SAMSUNG ELECTRONICS): COMPANY SNAPSHOT

TABLE 131. HARMAN INTERNATIONAL (SAMSUNG ELECTRONICS): OPERATING SEGMENTS

TABLE 132. HARMAN INTERNATIONAL (SAMSUNG ELECTRONICS): PRODUCT PORTFOLIO

TABLE 133. HARMAN INTERNATIONAL (SAMSUNG ELECTRONICS): KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 134. I.D. SYSTEMS: COMPANY SNAPSHOT

TABLE 135. I.D. SYSTEMS OPERATING SEGMENTS

TABLE 136. I.D. SYSTEMS :PRODUCT PORTFOLIO

TABLE 137. I.D. SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 138. TELECTRAC NAVMAN: COMPANY SNAPSHOT

TABLE 139. TELECTRAC NAVMAN OPERATING SEGMENTS

TABLE 140. TELECTRAC NAVMAN: PRODUCT PORTFOLIO

TABLE 141. TELECTRAC NAVMAN KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 142. AIRBIQUITY INC.: COMPANY SNAPSHOT

TABLE 143. AIRBIQUITY INC. OPERATING SEGMENTS

TABLE 144. AIRBIQUITY INC. KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 01. KEY MARKET SEGMENTS

FIGURE 02. EXECUTIVE SUMMARY

FIGURE 03. EXECUTIVE SUMMARY

FIGURE 04. TOP IMPACTING FACTORS

FIGURE 05. TOP INVESTMENT POCKETS

FIGURE 06. TOP WINNING STRATEGIES, BY YEAR, 2015–2019*

FIGURE 07. TOP WINNING STRATEGIES, BY YEAR, 2015–2019*

FIGURE 08. TOP WINNING STRATEGIES, BY COMPANY, 2015–2019*

FIGURE 09. MODERATE-TO-HIGH BARGAINING POWER OF SUPPLIERS

FIGURE 10. MODERATE-TO-HIGH THREAT OF NEW ENTRANTS

FIGURE 11. MODERATE THREAT OF SUBSTITUTES

FIGURE 12. HIGH-TO-MODERATE INTENSITY OF RIVALRY

FIGURE 13. HIGH-TO-MODERATE BARGAINING POWER OF BUYERS

FIGURE 14. KEY PLAYER POSITIONING (2018)

FIGURE 15. GLOBAL AUTOMOTIVE TELEMATICS MARKET SHARE, BY CHANNEL TYPE, 2018–2026(%)

FIGURE 16. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE TELEMATICS MARKET FOR AUTOMOTIVE OEM, BY COUNTRY, 2018 & 2026 (%)

FIGURE 17. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE TELEMATICS MARKET FOR AFTERMARKET TELEMATICS, BY COUNTRY, 2018 & 2026 (%)

FIGURE 18. GLOBAL AUTOMOTIVE TELEMATICS MARKET SHARE, BY VEHICLE TYPE, 2018–2026(%)

FIGURE 19. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE TELEMATICS MARKET FOR AUTOMOTIVE PASSENEGR VEHICLES, BY COUNTRY, 2018 & 2026 (%)

FIGURE 20. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE TELEMATICS MARKET FOR COMMERCIAL VEHICLES, BY COUNTRY, 2018 & 2026 (%)

FIGURE 21. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE TELEMATICS MARKET FOR TWO WHEELER, BY COUNTRY, 2018 & 2026 (%)

FIGURE 22. GLOBAL AUTOMOTIVE TELEMATICS MARKET SHARE, BY APPLICATION, 2018–2026(%)

FIGURE 23. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE TELEMATICS MARKET FOR FLEET MANAGEMENT, BY COUNTRY, 2018 & 2026 (%)

FIGURE 24. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE TELEMATICS MARKET FOR NAVIGATION & LOCATION BASED SYSTEM, BY COUNTRY, 2018 & 2026 (%)

FIGURE 25. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE TELEMATICS MARKET FOR INFOTAINMENT SYSTEM, BY COUNTRY, 2018 & 2026 (%)

FIGURE 26. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE TELEMATICS MARKET FOR INSURANCE TELEMATICS, BY COUNTRY, 2018 & 2026 (%)

FIGURE 27. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE TELEMATICS MARKET FOR SAFETY & SECURITY, BY COUNTRY, 2018 & 2026 (%)

FIGURE 28. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE TELEMATICS MARKET FOR V2X, BY COUNTRY, 2018 & 2026 (%)

FIGURE 29. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE TELEMATICS MARKET FOR OTHERS, BY COUNTRY, 2018 & 2026 (%)

FIGURE 30. GLOBAL AUTOMOTIVE TELEMATICS MARKET SHARE, CONNECTIVITY SOLUTIONS, 2018–2026(%)

FIGURE 31. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE TELEMATICS MARKET FOR EMBEDDED, BY COUNTRY, 2018 & 2026 (%)

FIGURE 32. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE TELEMATICS MARKET FOR INTERGRATED SMARTPHONES, BY COUNTRY, 2018 & 2026 (%)

FIGURE 33. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE TELEMATICS MARKET FOR TETHERED, BY COUNTRY, 2018 & 2026 (%)

FIGURE 34. AUTOMOTIVE TELEMATICS MARKET, BY REGION, 2018–2026 (%)

FIGURE 35. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE TELEMATICS MARKET, BY COUNTRY, 2018–2026(%)

FIGURE 36. U. S. AUTOMOTIVE TELEMATICS MARKET, 2018–2026 ($BILLION)

FIGURE 37. CANADA AUTOMOTIVE TELEMATICS MARKET, 2018–2026 ($BILLION)

FIGURE 38. MEXICO AUTOMOTIVE TELEMATICS MARKET, 2018–2026 ($BILLION)

FIGURE 39. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE TELEMATICS MARKET, BY COUNTRY, 2018–2026(%)

FIGURE 40. UK AUTOMOTIVE TELEMATICS MARKET, 2018–2026 ($BILLION)

FIGURE 41. GERMANY AUTOMOTIVE TELEMATICS MARKET, 2018–2026 ($BILLION)

FIGURE 42. FRANCE AUTOMOTIVE TELEMATICS MARKET, 2018–2026 ($BILLION)

FIGURE 43. RUSSIA AUTOMOTIVE TELEMATICS MARKET, 2018–2026 ($BILLION)

FIGURE 44. ITALY AUTOMOTIVE TELEMATICS MARKET, 2018–2026 ($BILLION)

FIGURE 45. REST OF EUROPE AUTOMOTIVE TELEMATICS MARKET, 2018–2026 ($BILLION)

FIGURE 46. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE TELEMATICS MARKET, BY COUNTRY, 2018–2026(%)

FIGURE 47. CHINA AUTOMOTIVE TELEMATICS MARKET, 2018–2026 ($BILLION)

FIGURE 48. INDIA AUTOMOTIVE TELEMATICS MARKET, 2018–2026 ($BILLION)

FIGURE 49. JAPAN AUTOMOTIVE TELEMATICS MARKET, 2018–2026 ($BILLION)

FIGURE 50. SOUTH KOREA AUTOMOTIVE TELEMATICS MARKET, 2018–2026 ($BILLION)

FIGURE 51. REST OF ASIA-PACIFIC AUTOMOTIVE TELEMATICS MARKET, 2018–2026 ($BILLION)

FIGURE 52. COMPARATIVE SHARE ANALYSIS OF AUTOMOTIVE TELEMATICS MARKET, BY COUNTRY, 2018–2026(%)

FIGURE 53. LATIN AMERICA AUTOMOTIVE TELEMATICS MARKET, 2018–2026 ($BILLION)

FIGURE 54. MIDDLE EAST AUTOMOTIVE TELEMATICS MARKET, 2018–2026 ($BILLION)

FIGURE 55. AFRICA AUTOMOTIVE TELEMATICS MARKET, 2018–2026 ($BILLION)

FIGURE 56. CARTRACK: REVENUE, 2015–2017 ($BILLION)

FIGURE 57. CARTRACK: REVENUE SHARE BY REGION, 2017 (%)

FIGURE 58. FLEETCOR TECHNOLOGIES INC.: REVENUE, 2014–2016 ($BILLION)

FIGURE 59. FLEETCOR TECHNOLOGIES INC.: REVENUE SHARE BY REGION, 2016 (%)

FIGURE 60. MIX TELEMATICS: REVENUE, 2015–2017 ($BILLION)

FIGURE 61. MIX TELEMATICS: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 62. MIX TELEMATICS: REVENUE SHARE BY REGION, 2017 (%)

FIGURE 63. TOMTOM TELEMATICS BV.: REVENUE, 2015–2017 ($BILLION)

FIGURE 64. TOMTOM TELEMATICS BV: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 65. TOMTOM TELEMATICS BV: REVENUE SHARE BY REGION, 2017 (%)

FIGURE 66. TRIMBLE INC.: REVENUE, 2016–2018 ($BILLION)

FIGURE 67. TRIMBLE INC.: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 68. TRIMBLE INC.: REVENUE SHARE BY REGION, 2017 (%)

FIGURE 69. VERIZON: REVENUE, 2015–2017 ($BILLION)

FIGURE 70. VERIZON: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 71. HARMAN INTERNATIONAL (SAMSUNG ELECTRONICS): REVENUE, 2016–2018 ($BILLION)

FIGURE 72. HARMAN INTERNATIONAL (SAMSUNG ELECTRONICS): REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 73. HARMAN INTERNATIONAL (SAMSUNG ELECTRONICS): REVENUE SHARE BY REGION, 2018 (%)

FIGURE 74. I.D. SYSTEMS REVENUE, 2016–2018 ($BILLION)

FIGURE 75. I.D. SYSTEMS: REVENUE SHARE BY SERVICE SEGMENT, 2018 (%)

$5370

$8995

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS