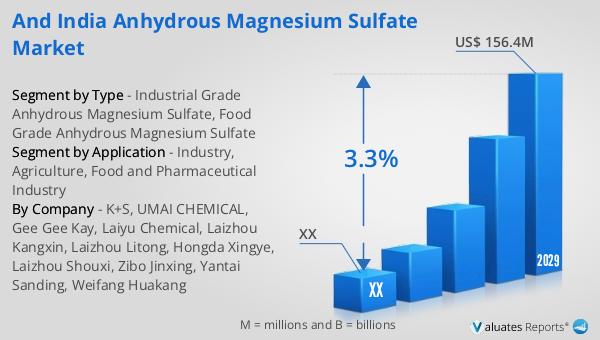

Ans: The and India Anhydrous Magnesium Sulfate Market size in 2029 will be US$ 156.4 million.

The global Anhydrous Magnesium Sulfate revenue was US$ 124.3 million in 2022 and is forecast to a readjusted size of US$ 156.4 million by 2029 with a CAGR of 3.3% during the forecast period (2023-2029).

Government Infrastructure and Agricultural Development Programs

National governments have launched comprehensive agricultural modernization initiatives that emphasize soil health management and sustainable farming practices. Public investment in irrigation infrastructure and drought mitigation strategies has increased awareness of soil amendment requirements. Agricultural extension programs are educating farming communities about micronutrient management and magnesium deficiency correction. Environmental ministries have introduced guidelines addressing sustainable fertilizer usage and nutrient runoff prevention, influencing product formulation and application methodologies within the agricultural sector.

Indian governmental agencies have prioritized soil testing infrastructure development and nutrient management awareness campaigns across rural districts. State-level agricultural departments are implementing subsidy programs for micronutrient fertilizers to address widespread soil deficiencies. National food security strategies emphasize yield optimization through balanced fertilization practices, creating favorable conditions for soil amendment product adoption.

Pharmaceutical Sector Expansion Driving Industrial Demand

The global pharmaceutical manufacturing landscape is experiencing geographic diversification, with emerging markets establishing production capabilities for active pharmaceutical ingredients and finished dosage forms. Anhydrous magnesium sulfate serves as a critical desiccant in pharmaceutical processing and as an excipient in various formulations. The biosimilars market expansion is generating increased demand for high-purity drying agents throughout purification and formulation processes. Contract manufacturing organizations are scaling operations to accommodate biotechnology sector growth, requiring reliable supplies of pharmaceutical-grade chemical intermediates.

Quality standards for pharmaceutical excipients continue to evolve, with pharmacopoeial authorities updating monographs to reflect advancing analytical capabilities and purity expectations. Manufacturing process validation requirements emphasize consistent raw material quality, influencing supplier qualification criteria and procurement strategies within pharmaceutical supply chains.

Construction Industry Innovation and Performance Requirements

Building material manufacturers are incorporating advanced chemical additives to enhance concrete performance characteristics and durability profiles. Anhydrous magnesium sulfate finds application in specialty cement formulations designed for specific environmental conditions and structural requirements. The infrastructure development wave across emerging economies is creating sustained demand for construction chemicals that improve project longevity and reduce maintenance requirements. Green building certification programs are influencing material selection criteria, with emphasis on products that contribute to energy efficiency and environmental performance.

Prefabrication and modular construction methodologies require materials with consistent quality attributes and rapid curing characteristics. The shift toward performance-based specifications rather than prescriptive formulations is enabling innovation in construction chemical applications.

Expanding Applications in Chemical Manufacturing

Process industries are utilizing anhydrous magnesium sulfate as a dehydrating agent in organic synthesis and chemical purification operations. The specialty chemicals sector is experiencing growth driven by diverse end-use industries requiring customized formulations and high-purity intermediates. Catalysis research is uncovering novel applications for magnesium compounds in chemical transformation processes. The transition toward continuous manufacturing in chemical production is influencing demand patterns for process chemicals and drying agents.

Environmental regulations addressing volatile organic compound emissions are encouraging adoption of efficient dehydration methodologies in chemical processing. The pharmaceutical and fine chemicals industries are implementing process intensification strategies that require effective moisture removal solutions.

Agricultural Productivity Imperatives and Soil Health Focus

Global food security challenges are intensifying focus on agricultural productivity enhancement through scientifically informed nutrient management. Precision agriculture technologies enable targeted micronutrient application based on soil testing and crop requirements. The organic farming movement is exploring permissible soil amendments that address nutrient deficiencies while maintaining certification standards. Climate change adaptation strategies in agriculture include soil health improvement as a fundamental component of resilience building.

Research institutions are documenting the relationship between magnesium availability and crop stress tolerance, influencing agricultural input recommendations. Extension services are promoting integrated nutrient management approaches that consider micronutrient contributions alongside primary fertilizers.

Quality Standardization and Supply Chain Transparency

Industrial consumers are implementing stringent supplier qualification processes that emphasize product consistency, traceability, and documentation. Industry associations are developing quality standards and best practice guidelines for chemical intermediates used in regulated industries. Supply chain disruptions have heightened awareness of supplier diversification and local sourcing strategies. Digital supply chain platforms are enabling enhanced transparency and communication between chemical suppliers and end users.

Analytical testing capabilities are expanding within user facilities, enabling incoming material verification and quality assurance. The trend toward vertical integration in certain industries is influencing procurement strategies and supplier relationship dynamics.

| Report Metric | Details |

| Report Name | and India Anhydrous Magnesium Sulfate Market |

| Forecasted market size in 2029 | US$ 156.4 million |

| CAGR | 3.3% |

| Forecasted years | 2023 - 2029 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | K+S, UMAI CHEMICAL, Gee Gee Kay, Laiyu Chemical, Laizhou Kangxin, Laizhou Litong, Hongda Xingye, Laizhou Shouxi, Zibo Jinxing, Yantai Sanding, Weifang Huakang |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Ans: The and India Anhydrous Magnesium Sulfate Market size in 2029 will be US$ 156.4 million.

Ans: The top 5 companies totally hold almost 65% of the global market in 2019.

Ans: According to IMF (its July update to its World Economic Outlook), India’s GDP growth is projected at 6.1% in 2023, powered by domestic investment.

Ans: The main players in the and India Anhydrous Magnesium Sulfate Market are K+S, UMAI CHEMICAL, Gee Gee Kay, Laiyu Chemical, Laizhou Kangxin, Laizhou Litong, Hongda Xingye, Laizhou Shouxi, Zibo Jinxing, Yantai Sanding, Weifang Huakang

Ans: The Applications covered in the and India Anhydrous Magnesium Sulfate Market report are Industry, Agriculture, Food and Pharmaceutical Industry

Ans: The Types covered in the and India Anhydrous Magnesium Sulfate Market report are Industrial Grade Anhydrous Magnesium Sulfate, Food Grade Anhydrous Magnesium Sulfate

$4350

$6525

$8700

HAVE A QUERY?

OUR CUSTOMER