List of Tables

Table 1. Global Biomanufacturing in Pharmaceutical Market Size Growth Rate by Type (US$ Million): 2020 VS 2024 VS 2031

Table 2. Key Players of Antibody Drugs

Table 3. Key Players of Recombinant Protein Drugs

Table 4. Key Players of Blood Products

Table 5. Key Players of Vaccine Preparations

Table 6. Key Players of CAR-T Drugs

Table 7. Key Players of Small Nucleic Acid Drugs

Table 8. Key Players of Others

Table 9. Global Biomanufacturing in Pharmaceutical Market Size Growth Rate by Class (US$ Million): 2020 VS 2024 VS 2031

Table 10. Key Players of Monoclonal Antibodies

Table 11. Key Players of Antibody-drug Conjugates (ADCs)

Table 12. Key Players of Peptide Drugs

Table 13. Key Players of Enzyme Replacement Therapy

Table 14. Key Players of Human Albumin

Table 15. Key Players of Immunoglobulins

Table 16. Key Players of Coagulation Factors

Table 17. Global Biomanufacturing in Pharmaceutical Market Size Growth by Application (US$ Million): 2020 VS 2024 VS 2031

Table 18. Global Biomanufacturing in Pharmaceutical Market Size by Region (US$ Million): 2020 VS 2024 VS 2031

Table 19. Global Biomanufacturing in Pharmaceutical Market Size by Region (2020-2025) & (US$ Million)

Table 20. Global Biomanufacturing in Pharmaceutical Market Share by Region (2020-2025)

Table 21. Global Biomanufacturing in Pharmaceutical Forecasted Market Size by Region (2026-2031) & (US$ Million)

Table 22. Global Biomanufacturing in Pharmaceutical Market Share by Region (2026-2031)

Table 23. Biomanufacturing in Pharmaceutical Market Trends

Table 24. Biomanufacturing in Pharmaceutical Market Drivers

Table 25. Biomanufacturing in Pharmaceutical Market Challenges

Table 26. Biomanufacturing in Pharmaceutical Market Restraints

Table 27. Global Biomanufacturing in Pharmaceutical Revenue by Players (2020-2025) & (US$ Million)

Table 28. Global Biomanufacturing in Pharmaceutical Market Share by Players (2020-2025)

Table 29. Global Top Biomanufacturing in Pharmaceutical Players by Company Type (Tier 1, Tier 2, and Tier 3) & (based on the Revenue in Biomanufacturing in Pharmaceutical as of 2024)

Table 30. Ranking of Global Top Biomanufacturing in Pharmaceutical Companies by Revenue (US$ Million) in 2024

Table 31. Global 5 Largest Players Market Share by Biomanufacturing in Pharmaceutical Revenue (CR5 and HHI) & (2020-2025)

Table 32. Global Key Players of Biomanufacturing in Pharmaceutical, Headquarters and Area Served

Table 33. Global Key Players of Biomanufacturing in Pharmaceutical, Product and Application

Table 34. Global Key Players of Biomanufacturing in Pharmaceutical, Date of Enter into This Industry

Table 35. Mergers & Acquisitions, Expansion Plans

Table 36. Global Biomanufacturing in Pharmaceutical Market Size by Type (2020-2025) & (US$ Million)

Table 37. Global Biomanufacturing in Pharmaceutical Revenue Market Share by Type (2020-2025)

Table 38. Global Biomanufacturing in Pharmaceutical Forecasted Market Size by Type (2026-2031) & (US$ Million)

Table 39. Global Biomanufacturing in Pharmaceutical Revenue Market Share by Type (2026-2031)

Table 40. Global Biomanufacturing in Pharmaceutical Market Size by Application (2020-2025) & (US$ Million)

Table 41. Global Biomanufacturing in Pharmaceutical Revenue Market Share by Application (2020-2025)

Table 42. Global Biomanufacturing in Pharmaceutical Forecasted Market Size by Application (2026-2031) & (US$ Million)

Table 43. Global Biomanufacturing in Pharmaceutical Revenue Market Share by Application (2026-2031)

Table 44. North America Biomanufacturing in Pharmaceutical Market Size Growth Rate by Country (US$ Million): 2020 VS 2024 VS 2031

Table 45. North America Biomanufacturing in Pharmaceutical Market Size by Country (2020-2025) & (US$ Million)

Table 46. North America Biomanufacturing in Pharmaceutical Market Size by Country (2026-2031) & (US$ Million)

Table 47. Europe Biomanufacturing in Pharmaceutical Market Size Growth Rate by Country (US$ Million): 2020 VS 2024 VS 2031

Table 48. Europe Biomanufacturing in Pharmaceutical Market Size by Country (2020-2025) & (US$ Million)

Table 49. Europe Biomanufacturing in Pharmaceutical Market Size by Country (2026-2031) & (US$ Million)

Table 50. Asia-Pacific Biomanufacturing in Pharmaceutical Market Size Growth Rate by Region (US$ Million): 2020 VS 2024 VS 2031

Table 51. Asia-Pacific Biomanufacturing in Pharmaceutical Market Size by Region (2020-2025) & (US$ Million)

Table 52. Asia-Pacific Biomanufacturing in Pharmaceutical Market Size by Region (2026-2031) & (US$ Million)

Table 53. Latin America Biomanufacturing in Pharmaceutical Market Size Growth Rate by Country (US$ Million): 2020 VS 2024 VS 2031

Table 54. Latin America Biomanufacturing in Pharmaceutical Market Size by Country (2020-2025) & (US$ Million)

Table 55. Latin America Biomanufacturing in Pharmaceutical Market Size by Country (2026-2031) & (US$ Million)

Table 56. Middle East & Africa Biomanufacturing in Pharmaceutical Market Size Growth Rate by Country (US$ Million): 2020 VS 2024 VS 2031

Table 57. Middle East & Africa Biomanufacturing in Pharmaceutical Market Size by Country (2020-2025) & (US$ Million)

Table 58. Middle East & Africa Biomanufacturing in Pharmaceutical Market Size by Country (2026-2031) & (US$ Million)

Table 59. Roche Company Details

Table 60. Roche Business Overview

Table 61. Roche Biomanufacturing in Pharmaceutical Product

Table 62. Roche Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 63. Roche Recent Development

Table 64. Merck Company Details

Table 65. Merck Business Overview

Table 66. Merck Biomanufacturing in Pharmaceutical Product

Table 67. Merck Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 68. Merck Recent Development

Table 69. Novo Nordisk Company Details

Table 70. Novo Nordisk Business Overview

Table 71. Novo Nordisk Biomanufacturing in Pharmaceutical Product

Table 72. Novo Nordisk Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 73. Novo Nordisk Recent Development

Table 74. Sanofi Company Details

Table 75. Sanofi Business Overview

Table 76. Sanofi Biomanufacturing in Pharmaceutical Product

Table 77. Sanofi Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 78. Sanofi Recent Development

Table 79. Johnson & Johnson Company Details

Table 80. Johnson & Johnson Business Overview

Table 81. Johnson & Johnson Biomanufacturing in Pharmaceutical Product

Table 82. Johnson & Johnson Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 83. Johnson & Johnson Recent Development

Table 84. AbbVie Company Details

Table 85. AbbVie Business Overview

Table 86. AbbVie Biomanufacturing in Pharmaceutical Product

Table 87. AbbVie Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 88. AbbVie Recent Development

Table 89. Amgen Company Details

Table 90. Amgen Business Overview

Table 91. Amgen Biomanufacturing in Pharmaceutical Product

Table 92. Amgen Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 93. Amgen Recent Development

Table 94. AstraZeneca Company Details

Table 95. AstraZeneca Business Overview

Table 96. AstraZeneca Biomanufacturing in Pharmaceutical Product

Table 97. AstraZeneca Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 98. AstraZeneca Recent Development

Table 99. Takeda Pharmaceuticals Company Details

Table 100. Takeda Pharmaceuticals Business Overview

Table 101. Takeda Pharmaceuticals Biomanufacturing in Pharmaceutical Product

Table 102. Takeda Pharmaceuticals Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 103. Takeda Pharmaceuticals Recent Development

Table 104. Bristol-Myers Squib Company Details

Table 105. Bristol-Myers Squib Business Overview

Table 106. Bristol-Myers Squib Biomanufacturing in Pharmaceutical Product

Table 107. Bristol-Myers Squib Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 108. Bristol-Myers Squib Recent Development

Table 109. Pfizer Company Details

Table 110. Pfizer Business Overview

Table 111. Pfizer Biomanufacturing in Pharmaceutical Product

Table 112. Pfizer Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 113. Pfizer Recent Development

Table 114. Eli Lilly Company Details

Table 115. Eli Lilly Business Overview

Table 116. Eli Lilly Biomanufacturing in Pharmaceutical Product

Table 117. Eli Lilly Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 118. Eli Lilly Recent Development

Table 119. Novartis Company Details

Table 120. Novartis Business Overview

Table 121. Novartis Biomanufacturing in Pharmaceutical Product

Table 122. Novartis Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 123. Novartis Recent Development

Table 124. GSK Company Details

Table 125. GSK Business Overview

Table 126. GSK Biomanufacturing in Pharmaceutical Product

Table 127. GSK Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 128. GSK Recent Development

Table 129. CSL Limited Company Details

Table 130. CSL Limited Business Overview

Table 131. CSL Limited Biomanufacturing in Pharmaceutical Product

Table 132. CSL Limited Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 133. CSL Limited Recent Development

Table 134. Regeneron Pharmaceuticals Company Details

Table 135. Regeneron Pharmaceuticals Business Overview

Table 136. Regeneron Pharmaceuticals Biomanufacturing in Pharmaceutical Product

Table 137. Regeneron Pharmaceuticals Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 138. Regeneron Pharmaceuticals Recent Development

Table 139. Gilford Company Details

Table 140. Gilford Business Overview

Table 141. Gilford Biomanufacturing in Pharmaceutical Product

Table 142. Gilford Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 143. Gilford Recent Development

Table 144. Biogen Company Details

Table 145. Biogen Business Overview

Table 146. Biogen Biomanufacturing in Pharmaceutical Product

Table 147. Biogen Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 148. Biogen Recent Development

Table 149. GileadSciences Company Details

Table 150. GileadSciences Business Overview

Table 151. GileadSciences Biomanufacturing in Pharmaceutical Product

Table 152. GileadSciences Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 153. GileadSciences Recent Development

Table 154. Moderna Company Details

Table 155. Moderna Business Overview

Table 156. Moderna Biomanufacturing in Pharmaceutical Product

Table 157. Moderna Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 158. Moderna Recent Development

Table 159. Sarepta Therapeutics, Inc. Company Details

Table 160. Sarepta Therapeutics, Inc. Business Overview

Table 161. Sarepta Therapeutics, Inc. Biomanufacturing in Pharmaceutical Product

Table 162. Sarepta Therapeutics, Inc. Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 163. Sarepta Therapeutics, Inc. Recent Development

Table 164. Changchun High-Tech Industry Company Details

Table 165. Changchun High-Tech Industry Business Overview

Table 166. Changchun High-Tech Industry Biomanufacturing in Pharmaceutical Product

Table 167. Changchun High-Tech Industry Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 168. Changchun High-Tech Industry Recent Development

Table 169. Sino Biopharmaceutical Limited Company Details

Table 170. Sino Biopharmaceutical Limited Business Overview

Table 171. Sino Biopharmaceutical Limited Biomanufacturing in Pharmaceutical Product

Table 172. Sino Biopharmaceutical Limited Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 173. Sino Biopharmaceutical Limited Recent Development

Table 174. Sobi Company Details

Table 175. Sobi Business Overview

Table 176. Sobi Biomanufacturing in Pharmaceutical Product

Table 177. Sobi Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 178. Sobi Recent Development

Table 179. 3SBio Inc. Company Details

Table 180. 3SBio Inc. Business Overview

Table 181. 3SBio Inc. Biomanufacturing in Pharmaceutical Product

Table 182. 3SBio Inc. Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 183. 3SBio Inc. Recent Development

Table 184. Beijing Tiantan Biological Company Details

Table 185. Beijing Tiantan Biological Business Overview

Table 186. Beijing Tiantan Biological Biomanufacturing in Pharmaceutical Product

Table 187. Beijing Tiantan Biological Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 188. Beijing Tiantan Biological Recent Development

Table 189. Innovent Biologics Company Details

Table 190. Innovent Biologics Business Overview

Table 191. Innovent Biologics Biomanufacturing in Pharmaceutical Product

Table 192. Innovent Biologics Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 193. Innovent Biologics Recent Development

Table 194. Qilu Pharmaceutical Company Details

Table 195. Qilu Pharmaceutical Business Overview

Table 196. Qilu Pharmaceutical Biomanufacturing in Pharmaceutical Product

Table 197. Qilu Pharmaceutical Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 198. Qilu Pharmaceutical Recent Development

Table 199. Boehringer Ingelheim Company Details

Table 200. Boehringer Ingelheim Business Overview

Table 201. Boehringer Ingelheim Biomanufacturing in Pharmaceutical Product

Table 202. Boehringer Ingelheim Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 203. Boehringer Ingelheim Recent Development

Table 204. BeiGene Company Details

Table 205. BeiGene Business Overview

Table 206. BeiGene Biomanufacturing in Pharmaceutical Product

Table 207. BeiGene Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 208. BeiGene Recent Development

Table 209. Jiangsu Hengrui Pharmaceuticals Company Details

Table 210. Jiangsu Hengrui Pharmaceuticals Business Overview

Table 211. Jiangsu Hengrui Pharmaceuticals Biomanufacturing in Pharmaceutical Product

Table 212. Jiangsu Hengrui Pharmaceuticals Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 213. Jiangsu Hengrui Pharmaceuticals Recent Development

Table 214. Hualan Biological Company Details

Table 215. Hualan Biological Business Overview

Table 216. Hualan Biological Biomanufacturing in Pharmaceutical Product

Table 217. Hualan Biological Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 218. Hualan Biological Recent Development

Table 219. Shanghai Henlius Biotech Company Details

Table 220. Shanghai Henlius Biotech Business Overview

Table 221. Shanghai Henlius Biotech Biomanufacturing in Pharmaceutical Product

Table 222. Shanghai Henlius Biotech Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 223. Shanghai Henlius Biotech Recent Development

Table 224. Taibang Biologic Company Details

Table 225. Taibang Biologic Business Overview

Table 226. Taibang Biologic Biomanufacturing in Pharmaceutical Product

Table 227. Taibang Biologic Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 228. Taibang Biologic Recent Development

Table 229. Gan & Lee Pharmaceuticals Company Details

Table 230. Gan & Lee Pharmaceuticals Business Overview

Table 231. Gan & Lee Pharmaceuticals Biomanufacturing in Pharmaceutical Product

Table 232. Gan & Lee Pharmaceuticals Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 233. Gan & Lee Pharmaceuticals Recent Development

Table 234. Anhui Anke Biotechnology Company Details

Table 235. Anhui Anke Biotechnology Business Overview

Table 236. Anhui Anke Biotechnology Biomanufacturing in Pharmaceutical Product

Table 237. Anhui Anke Biotechnology Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 238. Anhui Anke Biotechnology Recent Development

Table 239. Tonghua Dongbao Pharmaceutical Company Details

Table 240. Tonghua Dongbao Pharmaceutical Business Overview

Table 241. Tonghua Dongbao Pharmaceutical Biomanufacturing in Pharmaceutical Product

Table 242. Tonghua Dongbao Pharmaceutical Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 243. Tonghua Dongbao Pharmaceutical Recent Development

Table 244. Shanghai Junshi Biosciences Company Details

Table 245. Shanghai Junshi Biosciences Business Overview

Table 246. Shanghai Junshi Biosciences Biomanufacturing in Pharmaceutical Product

Table 247. Shanghai Junshi Biosciences Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 248. Shanghai Junshi Biosciences Recent Development

Table 249. Sichuan Yuanda Shuyang Pharmaceutical Company Details

Table 250. Sichuan Yuanda Shuyang Pharmaceutical Business Overview

Table 251. Sichuan Yuanda Shuyang Pharmaceutical Biomanufacturing in Pharmaceutical Product

Table 252. Sichuan Yuanda Shuyang Pharmaceutical Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 253. Sichuan Yuanda Shuyang Pharmaceutical Recent Development

Table 254. Kexing Biopharm Company Details

Table 255. Kexing Biopharm Business Overview

Table 256. Kexing Biopharm Biomanufacturing in Pharmaceutical Product

Table 257. Kexing Biopharm Revenue in Biomanufacturing in Pharmaceutical Business (2020-2025) & (US$ Million)

Table 258. Kexing Biopharm Recent Development

Table 259. Research Programs/Design for This Report

Table 260. Key Data Information from Secondary Sources

Table 261. Key Data Information from Primary Sources

Table 262. Authors List of This Report

List of Figures

Figure 1. Biomanufacturing in Pharmaceutical Picture

Figure 2. Global Biomanufacturing in Pharmaceutical Market Size Comparison by Type (2020-2031) & (US$ Million)

Figure 3. Global Biomanufacturing in Pharmaceutical Market Share by Type: 2024 VS 2031

Figure 4. Antibody Drugs Features

Figure 5. Recombinant Protein Drugs Features

Figure 6. Blood Products Features

Figure 7. Vaccine Preparations Features

Figure 8. CAR-T Drugs Features

Figure 9. Small Nucleic Acid Drugs Features

Figure 10. Others Features

Figure 11. Global Biomanufacturing in Pharmaceutical Market Size Comparison by Class (2020-2031) & (US$ Million)

Figure 12. Monoclonal Antibodies Features

Figure 13. Antibody-drug Conjugates (ADCs) Features

Figure 14. Peptide Drugs Features

Figure 15. Enzyme Replacement Therapy Features

Figure 16. Human Albumin Features

Figure 17. Immunoglobulins Features

Figure 18. Coagulation Factors Features

Figure 19. COVID-19 Vaccines Features

Figure 20. Other Vaccines Features

Figure 21. Global Biomanufacturing in Pharmaceutical Market Size by Application (2020-2031) & (US$ Million)

Figure 22. Global Biomanufacturing in Pharmaceutical Market Share by Application: 2024 VS 2031

Figure 23. Oncology Case Studies

Figure 24. Infectious Diseases Case Studies

Figure 25. Immune and Inflammatory Diseases Case Studies

Figure 26. Endocrine and Metabolic Diseases Case Studies

Figure 27. Neurological Diseases Case Studies

Figure 28. Hematologic Diseases Case Studies

Figure 29. Others Case Studies

Figure 30. Biomanufacturing in Pharmaceutical Report Years Considered

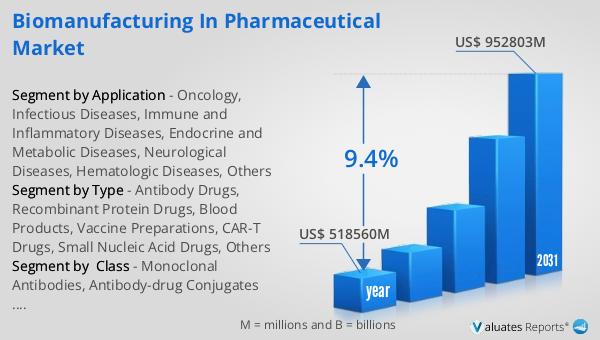

Figure 31. Global Biomanufacturing in Pharmaceutical Market Size (US$ Million), Year-over-Year: 2020-2031

Figure 32. Global Biomanufacturing in Pharmaceutical Market Size, (US$ Million), 2020 VS 2024 VS 2031

Figure 33. Global Biomanufacturing in Pharmaceutical Market Share by Region: 2024 VS 2031

Figure 34. Global Biomanufacturing in Pharmaceutical Market Share by Players in 2024

Figure 35. Global Biomanufacturing in Pharmaceutical Market Share by Company Type (Tier 1, Tier 2, and Tier 3)

Figure 36. The Top 10 and 5 Players Market Share by Biomanufacturing in Pharmaceutical Revenue in 2024

Figure 37. North America Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 38. North America Biomanufacturing in Pharmaceutical Market Share by Country (2020-2031)

Figure 39. United States Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 40. Canada Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 41. Europe Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 42. Europe Biomanufacturing in Pharmaceutical Market Share by Country (2020-2031)

Figure 43. Germany Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 44. France Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 45. U.K. Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 46. Italy Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 47. Russia Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 48. Ireland Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 49. Asia-Pacific Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 50. Asia-Pacific Biomanufacturing in Pharmaceutical Market Share by Region (2020-2031)

Figure 51. China Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 52. Japan Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 53. South Korea Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 54. Southeast Asia Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 55. India Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 56. Australia & New Zealand Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 57. Latin America Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 58. Latin America Biomanufacturing in Pharmaceutical Market Share by Country (2020-2031)

Figure 59. Mexico Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 60. Brazil Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 61. Middle East & Africa Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 62. Middle East & Africa Biomanufacturing in Pharmaceutical Market Share by Country (2020-2031)

Figure 63. Israel Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 64. Saudi Arabia Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 65. UAE Biomanufacturing in Pharmaceutical Market Size YoY Growth (2020-2031) & (US$ Million)

Figure 66. Roche Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 67. Merck Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 68. Novo Nordisk Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 69. Sanofi Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 70. Johnson & Johnson Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 71. AbbVie Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 72. Amgen Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 73. AstraZeneca Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 74. Takeda Pharmaceuticals Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 75. Bristol-Myers Squib Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 76. Pfizer Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 77. Eli Lilly Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 78. Novartis Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 79. GSK Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 80. CSL Limited Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 81. Regeneron Pharmaceuticals Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 82. Gilford Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 83. Biogen Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 84. GileadSciences Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 85. Moderna Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 86. Sarepta Therapeutics, Inc. Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 87. Changchun High-Tech Industry Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 88. Sino Biopharmaceutical Limited Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 89. Sobi Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 90. 3SBio Inc. Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 91. Beijing Tiantan Biological Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 92. Innovent Biologics Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 93. Qilu Pharmaceutical Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 94. Boehringer Ingelheim Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 95. BeiGene Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 96. Jiangsu Hengrui Pharmaceuticals Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 97. Hualan Biological Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 98. Shanghai Henlius Biotech Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 99. Taibang Biologic Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 100. Gan & Lee Pharmaceuticals Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 101. Anhui Anke Biotechnology Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 102. Tonghua Dongbao Pharmaceutical Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 103. Shanghai Junshi Biosciences Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 104. Sichuan Yuanda Shuyang Pharmaceutical Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 105. Kexing Biopharm Revenue Growth Rate in Biomanufacturing in Pharmaceutical Business (2020-2025)

Figure 106. Bottom-up and Top-down Approaches for This Report

Figure 107. Data Triangulation

Figure 108. Key Executives Interviewed