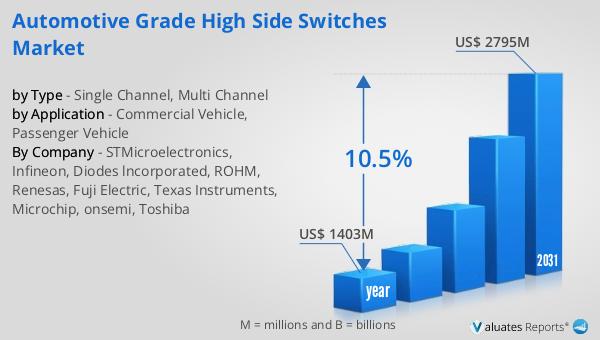

Ans: The Automotive Grade High Side Switches Market witnessing a CAGR of 10.5% during the forecast period 2025-2031.

The global market for Automotive Grade High Side Switches was valued at US$ 1403 million in the year 2024 and is projected to reach a revised size of US$ 2795 million by 2031, growing at a CAGR of 10.5% during the forecast period.

Intelligent Load Management: These switches enable precise control over when and how electrical power reaches vehicle components, from lighting systems to motor controls.

Built-in Protection: Advanced high-side switches incorporate overcurrent protection, thermal shutdown, and short-circuit detection, preventing damage to both the switch and connected loads.

Diagnostic Capabilities: Modern automotive grade switches provide real-time feedback about load status, current consumption, and fault conditions, enabling predictive maintenance and system optimization.

AEC-Q100 Qualification: All automotive grade switches must meet stringent automotive quality standards, ensuring reliable operation across extreme temperature ranges and demanding environmental conditions.

The transition to electric and hybrid vehicles represents the most significant growth driver for automotive grade high-side switches. Electric vehicles require substantially more sophisticated power management compared to traditional internal combustion engine vehicles.

Market Impact: Battery electric vehicle adoption is projected to exceed 25% of global new vehicle sales by 2025, with each EV containing significantly more semiconductor content than conventional vehicles. The semiconductor value per vehicle has increased from approximately $650 in 2020 to over $1,200 by 2028, with high-side switches playing a crucial role in this expansion.

Technical Requirements: EVs demand high-side switches capable of managing high-voltage systems, supporting 400V and 800V architectures that enable faster charging and improved efficiency. These switches must handle increased current loads while maintaining thermal stability and ensuring passenger safety.

ADAS technology is rapidly becoming standard equipment rather than premium features, driving substantial increases in vehicle electronic content and corresponding semiconductor requirements.

Component Requirements: Each ADAS feature requires multiple high-side switches to control sensors, cameras, radar systems, and actuators. As vehicles progress toward higher automation levels (Level 3 and Level 4), the number of electronic control units and associated power management components multiplies significantly.

Safety Imperative: With over 3,000 daily road accident fatalities worldwide, regulatory bodies are mandating advanced safety features. This regulatory push ensures sustained demand for ADAS technologies and their underlying semiconductor components, including intelligent high-side switches.

Modern vehicles are transforming into "computers on wheels," with electronic systems controlling virtually every aspect of vehicle operation from powertrain management to user experience.

Content Growth: The average vehicle now contains hundreds of electronic control units managing systems including infotainment, climate control, lighting, safety systems, and connectivity features. Each system requires reliable power switching solutions, multiplying the per-vehicle demand for high-side switches.

Architecture Evolution: The automotive industry is transitioning from distributed electronic architectures to centralized domain and zone-based designs. This evolution increases the complexity and capability requirements for power management components, favoring advanced multi-channel high-side switches that can manage multiple loads simultaneously.

Multi-channel high-side switches are capturing increasing market share due to their ability to manage multiple loads through a single integrated component, offering significant advantages in space-constrained automotive environments.

Market Leadership: Multi-channel switches hold the majority market share in the automotive grade high-side switch segment, valued for their ability to consolidate multiple power management functions into compact packages.

Integration Benefits: These devices reduce board space requirements, simplify wiring harnesses, lower overall system costs, and improve reliability by minimizing connection points. A single multi-channel switch can replace multiple discrete components while providing integrated diagnostics across all channels.

Application Breadth: Multi-channel switches serve diverse applications including seat position control, power window management, mirror adjustment, lighting control, and HVAC system operation, making them versatile solutions for automotive designers.

The automotive industry is transitioning toward wide bandgap semiconductor materials, particularly silicon carbide and gallium nitride, for next-generation power management applications.

Technology Advantages: Wide bandgap materials offer superior efficiency, higher power density, and improved thermal performance compared to traditional silicon-based switches. These characteristics are essential for extending EV range and supporting fast-charging infrastructure.

Market Growth: Silicon carbide and gallium nitride device demand is projected to increase by 60% combined as EV adoption accelerates. These materials enable high-side switches to operate at higher voltages and temperatures while maintaining efficiency.

Cost Trajectory: While currently more expensive than silicon-based alternatives, ongoing manufacturing improvements and economies of scale are reducing wide bandgap semiconductor costs, accelerating their adoption in mainstream automotive applications.

Geographic factors significantly influence market growth patterns, with Asia Pacific emerging as the dominant force in both automotive production and semiconductor manufacturing.

Asia Pacific Leadership: The region accounts for over 50% of the global automotive semiconductor market, driven by major manufacturing bases in China, Japan, South Korea, and India. China alone is increasing its adoption of domestically produced automotive chips, reaching approximately 15% integration in local EVs.

North American Innovation: North America represents approximately 30% of the market share, characterized by technological advancement and strong EV adoption. The region leads in ADAS development and software-defined vehicle architectures.

European Quality Focus: Europe captures about 20% of the market, supported by stringent automotive safety regulations and strong premium vehicle segments that extensively incorporate advanced electronics.

Infineon Technologies AG: Holds a leading position with comprehensive power semiconductor portfolios supporting vehicle electrification, powertrain efficiency, and functional safety. The company's silicon carbide MOSFETs and power modules enable high-efficiency energy conversion essential for electric vehicles.

STMicroelectronics: Leverages expertise in analog, MEMS, and power electronics, offering silicon carbide and gallium nitride solutions for EV powertrains alongside advanced imaging and sensor technologies supporting driver assistance systems.

NXP Semiconductors: Ranks among top providers of automotive processors and secure connectivity solutions, supporting software-defined vehicles through scalable platforms integrated with intelligent power management capabilities.

Texas Instruments: Provides robust analog integrated circuits, power management solutions, and embedded processors that enhance energy efficiency, infotainment functionality, and safety applications in modern vehicles.

Renesas Electronics Corporation: Leads in automotive microcontrollers, power devices, and system-on-chips, enabling reliable control and performance optimization for ADAS, electrification, and connectivity platforms.

Technology Trends and Future Innovations

The industry trends toward higher integration levels, combining power switching functionality with additional features including current sensing, thermal monitoring, and diagnostic communication protocols within single packages.

System-in-Package Solutions: Advanced packaging technologies enable integration of multiple die and passive components, creating highly functional modules that reduce board space requirements while improving performance.

Thermal Management: New packaging approaches incorporate improved heat dissipation capabilities, essential for managing increased power densities in modern automotive electrical systems.

Next-generation high-side switches incorporate advanced intelligence and communication capabilities, transforming them from simple switching components into sophisticated power management subsystems.

Embedded Diagnostics: Modern switches provide detailed operational data including load current, junction temperature, voltage levels, and fault conditions, enabling predictive maintenance and system optimization.

Network Integration: Integration with automotive communication protocols including CAN, LIN, and FlexRay allows high-side switches to participate in vehicle-wide diagnostic and control systems.

Software Configurability: Programmable protection thresholds, timing parameters, and operating modes enable single hardware designs to serve multiple applications, reducing development costs and inventory complexity.

As vehicles incorporate increasingly safety-critical electronic systems, high-side switches must meet stringent functional safety requirements defined by standards including ISO 26262.

ASIL Ratings: Safety-critical applications require components certified to appropriate Automotive Safety Integrity Levels, driving development of fault-tolerant architectures and robust diagnostic coverage.

Redundancy and Monitoring: Critical systems employ redundant power paths and continuous monitoring to detect and respond to potential failures before they impact vehicle operation.

Investment and Growth Opportunities

New automotive applications create opportunities for specialized high-side switch solutions.

Autonomous Vehicle Systems: Higher levels of vehicle automation require extensive sensor arrays, computing platforms, and actuation systems, each requiring reliable power management.

In-Vehicle Computing: The shift toward software-defined vehicles drives centralized computing architectures requiring sophisticated power distribution and load management capabilities.

Charging Infrastructure: EV charging systems, both onboard and external, represent growing application areas for high-power switching technology.

Innovation Focus Areas

Strategic technology development efforts address key market needs and competitive differentiation.

Wide Bandgap Materials: Continued development of silicon carbide and gallium nitride devices offers opportunities for performance leadership in high-voltage, high-efficiency applications.

Advanced Packaging: Innovative packaging approaches enable higher integration levels, improved thermal performance, and reduced system costs.

Artificial Intelligence Integration: Incorporating AI-driven diagnostic and optimization capabilities into power management systems creates opportunities for differentiation and value addition.

Frequently Asked Questions

Q: What are automotive grade high-side switches? A: Automotive grade high-side switches are semiconductor devices that control electrical power delivery to vehicle components by switching the connection between the power source and the load. They incorporate protection features, diagnostic capabilities, and meet stringent automotive quality standards.

Q: What is driving the growth of this market? A: Primary growth drivers include electric vehicle adoption, increasing ADAS implementation, rising electronic content per vehicle, regulatory pressure for improved safety and efficiency, and the automotive industry's transition toward software-defined architectures.

Q: Which companies lead the automotive grade high-side switch market? A: Market leaders include Infineon Technologies, STMicroelectronics, NXP Semiconductors, Texas Instruments, and Renesas Electronics, among others. These companies offer comprehensive portfolios and maintain strong relationships with automotive manufacturers.

| Report Metric | Details |

| Report Name | Automotive Grade High Side Switches Market |

| Accounted market size in year | US$ 1403 million |

| Forecasted market size in 2031 | US$ 2795 million |

| CAGR | 10.5% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | STMicroelectronics, Infineon, Diodes lncorporated, ROHM, Renesas, Fuji Electric, Texas Instruments, Microchip, onsemi, Toshiba |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Ans: The Automotive Grade High Side Switches Market witnessing a CAGR of 10.5% during the forecast period 2025-2031.

Ans: The Automotive Grade High Side Switches Market size in 2031 will be US$ 2795 million.

Ans: The main players in the Automotive Grade High Side Switches Market are STMicroelectronics, Infineon, Diodes lncorporated, ROHM, Renesas, Fuji Electric, Texas Instruments, Microchip, onsemi, Toshiba

Ans: The Applications covered in the Automotive Grade High Side Switches Market report are Commercial Vehicle, Passenger Vehicle

Ans: The Types covered in the Automotive Grade High Side Switches Market report are Single Channel, Multi Channel

$2900

$4350

$5800

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS