List of Tables

Table 1. Automotive & Vehicle Insurance Market Trends

Table 2. Automotive & Vehicle Insurance Market Drivers & Opportunity

Table 3. Automotive & Vehicle Insurance Market Challenges

Table 4. Automotive & Vehicle Insurance Market Restraints

Table 5. Global Automotive & Vehicle Insurance Revenue by Company (2019-2024) & (US$ Million)

Table 6. Global Automotive & Vehicle Insurance Revenue Market Share by Company (2019-2024)

Table 7. Key Companies Automotive & Vehicle Insurance Manufacturing Base Distribution and Headquarters

Table 8. Key Companies Automotive & Vehicle Insurance Product Type

Table 9. Key Companies Time to Begin Mass Production of Automotive & Vehicle Insurance

Table 10. Global Automotive & Vehicle Insurance Companies Market Concentration Ratio (CR5 and HHI)

Table 11. Global Top Companies Market Share by Company Type (Tier 1, Tier 2, and Tier 3) & (based on the Revenue in Automotive & Vehicle Insurance as of 2023)

Table 12. Mergers & Acquisitions, Expansion Plans

Table 13. Global Automotive & Vehicle Insurance Sales Value by Type: 2019 VS 2023 VS 2030 (US$ Million)

Table 14. Global Automotive & Vehicle Insurance Sales Value by Type (2019-2024) & (US$ Million)

Table 15. Global Automotive & Vehicle Insurance Sales Value by Type (2025-2030) & (US$ Million)

Table 16. Global Automotive & Vehicle Insurance Sales Market Share in Value by Type (2019-2024) & (%)

Table 17. Global Automotive & Vehicle Insurance Sales Market Share in Value by Type (2025-2030) & (%)

Table 18. Global Automotive & Vehicle Insurance Sales Value by Application: 2019 VS 2023 VS 2030 (US$ Million)

Table 19. Global Automotive & Vehicle Insurance Sales Value by Application (2019-2024) & (US$ Million)

Table 20. Global Automotive & Vehicle Insurance Sales Value by Application (2025-2030) & (US$ Million)

Table 21. Global Automotive & Vehicle Insurance Sales Market Share in Value by Application (2019-2024) & (%)

Table 22. Global Automotive & Vehicle Insurance Sales Market Share in Value by Application (2025-2030) & (%)

Table 23. Global Automotive & Vehicle Insurance Sales Value by Region: 2019 VS 2023 VS 2030 (US$ Million)

Table 24. Global Automotive & Vehicle Insurance Sales Value by Region (2019-2024) & (US$ Million)

Table 25. Global Automotive & Vehicle Insurance Sales Value by Region (2025-2030) & (US$ Million)

Table 26. Global Automotive & Vehicle Insurance Sales Value by Region (2019-2024) & (%)

Table 27. Global Automotive & Vehicle Insurance Sales Value by Region (2025-2030) & (%)

Table 28. Key Countries/Regions Automotive & Vehicle Insurance Sales Value Growth Trends, (US$ Million): 2019 VS 2023 VS 2030

Table 29. Key Countries/Regions Automotive & Vehicle Insurance Sales Value, (2019-2024) & (US$ Million)

Table 30. Key Countries/Regions Automotive & Vehicle Insurance Sales Value, (2025-2030) & (US$ Million)

Table 31. State Farm Basic Information List

Table 32. State Farm Description and Business Overview

Table 33. State Farm Automotive & Vehicle Insurance Products, Services and Solutions

Table 34. Revenue (US$ Million) in Automotive & Vehicle Insurance Business of State Farm (2019-2024)

Table 35. State Farm Recent Developments

Table 36. GEICO Basic Information List

Table 37. GEICO Description and Business Overview

Table 38. GEICO Automotive & Vehicle Insurance Products, Services and Solutions

Table 39. Revenue (US$ Million) in Automotive & Vehicle Insurance Business of GEICO (2019-2024)

Table 40. GEICO Recent Developments

Table 41. Progressive Basic Information List

Table 42. Progressive Description and Business Overview

Table 43. Progressive Automotive & Vehicle Insurance Products, Services and Solutions

Table 44. Revenue (US$ Million) in Automotive & Vehicle Insurance Business of Progressive (2019-2024)

Table 45. Progressive Recent Developments

Table 46. Allstate Basic Information List

Table 47. Allstate Description and Business Overview

Table 48. Allstate Automotive & Vehicle Insurance Products, Services and Solutions

Table 49. Revenue (US$ Million) in Automotive & Vehicle Insurance Business of Allstate (2019-2024)

Table 50. Allstate Recent Developments

Table 51. USAA Basic Information List

Table 52. USAA Description and Business Overview

Table 53. USAA Automotive & Vehicle Insurance Products, Services and Solutions

Table 54. Revenue (US$ Million) in Automotive & Vehicle Insurance Business of USAA (2019-2024)

Table 55. USAA Recent Developments

Table 56. Liberty Mutual Basic Information List

Table 57. Liberty Mutual Description and Business Overview

Table 58. Liberty Mutual Automotive & Vehicle Insurance Products, Services and Solutions

Table 59. Revenue (US$ Million) in Automotive & Vehicle Insurance Business of Liberty Mutual (2019-2024)

Table 60. Liberty Mutual Recent Developments

Table 61. Farmers Basic Information List

Table 62. Farmers Description and Business Overview

Table 63. Farmers Automotive & Vehicle Insurance Products, Services and Solutions

Table 64. Revenue (US$ Million) in Automotive & Vehicle Insurance Business of Farmers (2019-2024)

Table 65. Farmers Recent Developments

Table 66. Nationwide Basic Information List

Table 67. Nationwide Description and Business Overview

Table 68. Nationwide Automotive & Vehicle Insurance Products, Services and Solutions

Table 69. Revenue (US$ Million) in Automotive & Vehicle Insurance Business of Nationwide (2019-2024)

Table 70. Nationwide Recent Developments

Table 71. Travelers Basic Information List

Table 72. Travelers Description and Business Overview

Table 73. Travelers Automotive & Vehicle Insurance Products, Services and Solutions

Table 74. Revenue (US$ Million) in Automotive & Vehicle Insurance Business of Travelers (2019-2024)

Table 75. Travelers Recent Developments

Table 76. American Family Basic Information List

Table 77. American Family Description and Business Overview

Table 78. American Family Automotive & Vehicle Insurance Products, Services and Solutions

Table 79. Revenue (US$ Million) in Automotive & Vehicle Insurance Business of American Family (2019-2024)

Table 80. American Family Recent Developments

Table 81. Key Raw Materials Lists

Table 82. Raw Materials Key Suppliers Lists

Table 83. Automotive & Vehicle Insurance Downstream Customers

Table 84. Automotive & Vehicle Insurance Distributors List

Table 85. Research Programs/Design for This Report

Table 86. Key Data Information from Secondary Sources

Table 87. Key Data Information from Primary Sources

Table 88. Business Unit and Senior & Team Lead Analysts

List of Figures

Figure 1. Automotive & Vehicle Insurance Product Picture

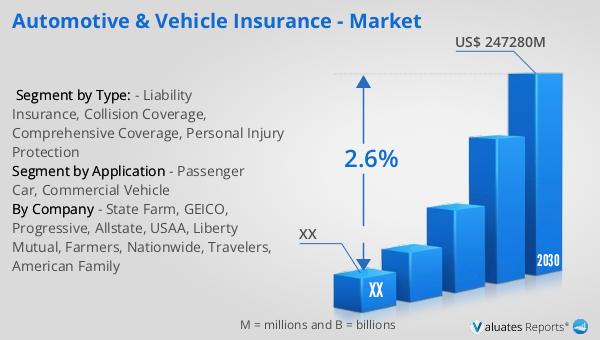

Figure 2. Global Automotive & Vehicle Insurance Sales Value, 2019 VS 2023 VS 2030 (US$ Million)

Figure 3. Global Automotive & Vehicle Insurance Sales Value (2019-2030) & (US$ Million)

Figure 4. Automotive & Vehicle Insurance Report Years Considered

Figure 5. Global Automotive & Vehicle Insurance Players Revenue Ranking (2023) & (US$ Million)

Figure 6. The 5 and 10 Largest Manufacturers in the World: Market Share by Automotive & Vehicle Insurance Revenue in 2023

Figure 7. Automotive & Vehicle Insurance Market Share by Company Type (Tier 1, Tier 2, and Tier 3): 2019 VS 2023

Figure 8. Liability Insurance Picture

Figure 9. Collision Coverage Picture

Figure 10. Comprehensive Coverage Picture

Figure 11. Personal Injury Protection Picture

Figure 12. Global Automotive & Vehicle Insurance Sales Value by Type (2019 VS 2023 VS 2030) & (US$ Million)

Figure 13. Global Automotive & Vehicle Insurance Sales Value Market Share by Type, 2023 & 2030

Figure 14. Product Picture of Passenger Car

Figure 15. Product Picture of Commercial Vehicle

Figure 16. Global Automotive & Vehicle Insurance Sales Value by Application (2019 VS 2023 VS 2030) & (US$ Million)

Figure 17. Global Automotive & Vehicle Insurance Sales Value Market Share by Application, 2023 & 2030

Figure 18. North America Automotive & Vehicle Insurance Sales Value (2019-2030) & (US$ Million)

Figure 19. North America Automotive & Vehicle Insurance Sales Value by Country (%), 2023 VS 2030

Figure 20. Europe Automotive & Vehicle Insurance Sales Value (2019-2030) & (US$ Million)

Figure 21. Europe Automotive & Vehicle Insurance Sales Value by Country (%), 2023 VS 2030

Figure 22. Asia Pacific Automotive & Vehicle Insurance Sales Value (2019-2030) & (US$ Million)

Figure 23. Asia Pacific Automotive & Vehicle Insurance Sales Value by Country (%), 2023 VS 2030

Figure 24. South America Automotive & Vehicle Insurance Sales Value (2019-2030) & (US$ Million)

Figure 25. South America Automotive & Vehicle Insurance Sales Value by Country (%), 2023 VS 2030

Figure 26. Middle East & Africa Automotive & Vehicle Insurance Sales Value (2019-2030) & (US$ Million)

Figure 27. Middle East & Africa Automotive & Vehicle Insurance Sales Value by Country (%), 2023 VS 2030

Figure 28. Key Countries/Regions Automotive & Vehicle Insurance Sales Value (%), (2019-2030)

Figure 29. United States Automotive & Vehicle Insurance Sales Value, (2019-2030) & (US$ Million)

Figure 30. United States Automotive & Vehicle Insurance Sales Value by Type (%), 2023 VS 2030

Figure 31. United States Automotive & Vehicle Insurance Sales Value by Application (%), 2023 VS 2030

Figure 32. Europe Automotive & Vehicle Insurance Sales Value, (2019-2030) & (US$ Million)

Figure 33. Europe Automotive & Vehicle Insurance Sales Value by Type (%), 2023 VS 2030

Figure 34. Europe Automotive & Vehicle Insurance Sales Value by Application (%), 2023 VS 2030

Figure 35. China Automotive & Vehicle Insurance Sales Value, (2019-2030) & (US$ Million)

Figure 36. China Automotive & Vehicle Insurance Sales Value by Type (%), 2023 VS 2030

Figure 37. China Automotive & Vehicle Insurance Sales Value by Application (%), 2023 VS 2030

Figure 38. Japan Automotive & Vehicle Insurance Sales Value, (2019-2030) & (US$ Million)

Figure 39. Japan Automotive & Vehicle Insurance Sales Value by Type (%), 2023 VS 2030

Figure 40. Japan Automotive & Vehicle Insurance Sales Value by Application (%), 2023 VS 2030

Figure 41. South Korea Automotive & Vehicle Insurance Sales Value, (2019-2030) & (US$ Million)

Figure 42. South Korea Automotive & Vehicle Insurance Sales Value by Type (%), 2023 VS 2030

Figure 43. South Korea Automotive & Vehicle Insurance Sales Value by Application (%), 2023 VS 2030

Figure 44. Southeast Asia Automotive & Vehicle Insurance Sales Value, (2019-2030) & (US$ Million)

Figure 45. Southeast Asia Automotive & Vehicle Insurance Sales Value by Type (%), 2023 VS 2030

Figure 46. Southeast Asia Automotive & Vehicle Insurance Sales Value by Application (%), 2023 VS 2030

Figure 47. India Automotive & Vehicle Insurance Sales Value, (2019-2030) & (US$ Million)

Figure 48. India Automotive & Vehicle Insurance Sales Value by Type (%), 2023 VS 2030

Figure 49. India Automotive & Vehicle Insurance Sales Value by Application (%), 2023 VS 2030

Figure 50. Automotive & Vehicle Insurance Industrial Chain

Figure 51. Automotive & Vehicle Insurance Manufacturing Cost Structure

Figure 52. Channels of Distribution (Direct Sales, and Distribution)

Figure 53. Bottom-up and Top-down Approaches for This Report

Figure 54. Data Triangulation