List of Tables

Table 1. Global Anti-Money Laundering (AML) Software Market Size Growth Rate by Type (US$ Million): 2020 VS 2024 VS 2031

Table 2. Global Anti-Money Laundering (AML) Software Market Size Growth by Application (US$ Million): 2020 VS 2024 VS 2031

Table 3. Global Market Anti-Money Laundering (AML) Software Market Size (US$ Million) by Region:2020 VS 2024 VS 2031

Table 4. Global Anti-Money Laundering (AML) Software Revenue (US$ Million) Market Share by Region (2020-2025)

Table 5. Global Anti-Money Laundering (AML) Software Revenue Share by Region (2020-2025)

Table 6. Global Anti-Money Laundering (AML) Software Revenue (US$ Million) Forecast by Region (2026-2031)

Table 7. Global Anti-Money Laundering (AML) Software Revenue Share Forecast by Region (2026-2031)

Table 8. Global Anti-Money Laundering (AML) Software Market Size by Type (2020-2025) & (US$ Million)

Table 9. Global Anti-Money Laundering (AML) Software Revenue Market Share by Type (2020-2025)

Table 10. Global Anti-Money Laundering (AML) Software Forecasted Market Size by Type (2026-2031) & (US$ Million)

Table 11. Global Anti-Money Laundering (AML) Software Revenue Market Share by Type (2026-2031)

Table 12. Representative Players of Each Type

Table 13. Global Anti-Money Laundering (AML) Software Market Size by Application (2020-2025) & (US$ Million)

Table 14. Global Anti-Money Laundering (AML) Software Revenue Market Share by Application (2020-2025)

Table 15. Global Anti-Money Laundering (AML) Software Forecasted Market Size by Application (2026-2031) & (US$ Million)

Table 16. Global Anti-Money Laundering (AML) Software Revenue Market Share by Application (2026-2031)

Table 17. New Sources of Growth in Anti-Money Laundering (AML) Software Application

Table 18. Global Anti-Money Laundering (AML) Software Revenue by Players (2020-2025) & (US$ Million)

Table 19. Global Anti-Money Laundering (AML) Software Market Share by Players (2020-2025)

Table 20. Global Top Anti-Money Laundering (AML) Software Players by Company Type (Tier 1, Tier 2, and Tier 3) & (based on the Revenue in Anti-Money Laundering (AML) Software as of 2024)

Table 21. Ranking of Global Top Anti-Money Laundering (AML) Software Companies by Revenue (US$ Million) in 2024

Table 22. Global 5 Largest Players Market Share by Anti-Money Laundering (AML) Software Revenue (CR5 and HHI) & (2020-2025)

Table 23. Global Key Players of Anti-Money Laundering (AML) Software, Headquarters and Area Served

Table 24. Global Key Players of Anti-Money Laundering (AML) Software, Product and Application

Table 25. Global Key Players of Anti-Money Laundering (AML) Software, Date of Enter into This Industry

Table 26. Mergers & Acquisitions, Expansion Plans

Table 27. North America Anti-Money Laundering (AML) Software Revenue by Company (2020-2025) & (US$ Million)

Table 28. North America Anti-Money Laundering (AML) Software Revenue Market Share by Company (2020-2025)

Table 29. North America Anti-Money Laundering (AML) Software Market Size by Type (2020-2025) & (US$ Million)

Table 30. North America Anti-Money Laundering (AML) Software Market Size by Application (2020-2025) & (US$ Million)

Table 31. Europe Anti-Money Laundering (AML) Software Revenue by Company (2020-2025) & (US$ Million)

Table 32. Europe Anti-Money Laundering (AML) Software Revenue Market Share by Company (2020-2025)

Table 33. Europe Anti-Money Laundering (AML) Software Market Size by Type (2020-2025) & (US$ Million)

Table 34. Europe Anti-Money Laundering (AML) Software Market Size by Application (2020-2025) & (US$ Million)

Table 35. China Anti-Money Laundering (AML) Software Revenue by Company (2020-2025) & (US$ Million)

Table 36. China Anti-Money Laundering (AML) Software Revenue Market Share by Company (2020-2025)

Table 37. China Anti-Money Laundering (AML) Software Market Size by Type (2020-2025) & (US$ Million)

Table 38. China Anti-Money Laundering (AML) Software Market Size by Application (2020-2025) & (US$ Million)

Table 39. Oracle Company Details

Table 40. Oracle Business Overview

Table 41. Oracle Anti-Money Laundering (AML) Software Product

Table 42. Oracle Revenue in Anti-Money Laundering (AML) Software Business (2020-2025) & (US$ Million)

Table 43. Oracle Recent Development

Table 44. Thomson Reuters Company Details

Table 45. Thomson Reuters Business Overview

Table 46. Thomson Reuters Anti-Money Laundering (AML) Software Product

Table 47. Thomson Reuters Revenue in Anti-Money Laundering (AML) Software Business (2020-2025) & (US$ Million)

Table 48. Thomson Reuters Recent Development

Table 49. Fiserv Company Details

Table 50. Fiserv Business Overview

Table 51. Fiserv Anti-Money Laundering (AML) Software Product

Table 52. Fiserv Revenue in Anti-Money Laundering (AML) Software Business (2020-2025) & (US$ Million)

Table 53. Fiserv Recent Development

Table 54. SAS Company Details

Table 55. SAS Business Overview

Table 56. SAS Anti-Money Laundering (AML) Software Product

Table 57. SAS Revenue in Anti-Money Laundering (AML) Software Business (2020-2025) & (US$ Million)

Table 58. SAS Recent Development

Table 59. FIS (SunGard) Company Details

Table 60. FIS (SunGard) Business Overview

Table 61. FIS (SunGard) Anti-Money Laundering (AML) Software Product

Table 62. FIS (SunGard) Revenue in Anti-Money Laundering (AML) Software Business (2020-2025) & (US$ Million)

Table 63. FIS (SunGard) Recent Development

Table 64. Experian Company Details

Table 65. Experian Business Overview

Table 66. Experian Anti-Money Laundering (AML) Software Product

Table 67. Experian Revenue in Anti-Money Laundering (AML) Software Business (2020-2025) & (US$ Million)

Table 68. Experian Recent Development

Table 69. ACI Worldwide Company Details

Table 70. ACI Worldwide Business Overview

Table 71. ACI Worldwide Anti-Money Laundering (AML) Software Product

Table 72. ACI Worldwide Revenue in Anti-Money Laundering (AML) Software Business (2020-2025) & (US$ Million)

Table 73. ACI Worldwide Recent Development

Table 74. Fico Company Details

Table 75. Fico Business Overview

Table 76. Fico Anti-Money Laundering (AML) Software Product

Table 77. Fico Revenue in Anti-Money Laundering (AML) Software Business (2020-2025) & (US$ Million)

Table 78. Fico Recent Development

Table 79. Abrigo Company Details

Table 80. Abrigo Business Overview

Table 81. Abrigo Anti-Money Laundering (AML) Software Product

Table 82. Abrigo Revenue in Anti-Money Laundering (AML) Software Business (2020-2025) & (US$ Million)

Table 83. Abrigo Recent Development

Table 84. Nice Actimize Company Details

Table 85. Nice Actimize Business Overview

Table 86. Nice Actimize Anti-Money Laundering (AML) Software Product

Table 87. Nice Actimize Revenue in Anti-Money Laundering (AML) Software Business (2020-2025) & (US$ Million)

Table 88. Nice Actimize Recent Development

Table 89. CS&S Company Details

Table 90. CS&S Business Overview

Table 91. CS&S Anti-Money Laundering (AML) Software Product

Table 92. CS&S Revenue in Anti-Money Laundering (AML) Software Business (2020-2025) & (US$ Million)

Table 93. CS&S Recent Development

Table 94. Nasdaq Verafin Company Details

Table 95. Nasdaq Verafin Business Overview

Table 96. Nasdaq Verafin Anti-Money Laundering (AML) Software Product

Table 97. Nasdaq Verafin Revenue in Anti-Money Laundering (AML) Software Business (2020-2025) & (US$ Million)

Table 98. Nasdaq Verafin Recent Development

Table 99. EastNets Company Details

Table 100. EastNets Business Overview

Table 101. EastNets Anti-Money Laundering (AML) Software Product

Table 102. EastNets Revenue in Anti-Money Laundering (AML) Software Business (2020-2025) & (US$ Million)

Table 103. EastNets Recent Development

Table 104. Napier Technologies Company Details

Table 105. Napier Technologies Business Overview

Table 106. Napier Technologies Anti-Money Laundering (AML) Software Product

Table 107. Napier Technologies Revenue in Anti-Money Laundering (AML) Software Business (2020-2025) & (US$ Million)

Table 108. Napier Technologies Recent Development

Table 109. ComplyAdvantage Company Details

Table 110. ComplyAdvantage Business Overview

Table 111. ComplyAdvantage Anti-Money Laundering (AML) Software Product

Table 112. ComplyAdvantage Revenue in Anti-Money Laundering (AML) Software Business (2020-2025) & (US$ Million)

Table 113. ComplyAdvantage Recent Development

Table 114. AML Partners Company Details

Table 115. AML Partners Business Overview

Table 116. AML Partners Anti-Money Laundering (AML) Software Product

Table 117. AML Partners Revenue in Anti-Money Laundering (AML) Software Business (2020-2025) & (US$ Million)

Table 118. AML Partners Recent Development

Table 119. Dow Jones Company Details

Table 120. Dow Jones Business Overview

Table 121. Dow Jones Anti-Money Laundering (AML) Software Product

Table 122. Dow Jones Revenue in Anti-Money Laundering (AML) Software Business (2020-2025) & (US$ Million)

Table 123. Dow Jones Recent Development

Table 124. LexisNexis (Accuity) Company Details

Table 125. LexisNexis (Accuity) Business Overview

Table 126. LexisNexis (Accuity) Anti-Money Laundering (AML) Software Product

Table 127. LexisNexis (Accuity) Revenue in Anti-Money Laundering (AML) Software Business (2020-2025) & (US$ Million)

Table 128. LexisNexis (Accuity) Recent Development

Table 129. SymphonyAI Company Details

Table 130. SymphonyAI Business Overview

Table 131. SymphonyAI Anti-Money Laundering (AML) Software Product

Table 132. SymphonyAI Revenue in Anti-Money Laundering (AML) Software Business (2020-2025) & (US$ Million)

Table 133. SymphonyAI Recent Development

Table 134. Agile Century Company Details

Table 135. Agile Century Business Overview

Table 136. Agile Century Anti-Money Laundering (AML) Software Product

Table 137. Agile Century Revenue in Anti-Money Laundering (AML) Software Business (2020-2025) & (US$ Million)

Table 138. Agile Century Recent Development

Table 139. First AML Company Details

Table 140. First AML Business Overview

Table 141. First AML Anti-Money Laundering (AML) Software Product

Table 142. First AML Revenue in Anti-Money Laundering (AML) Software Business (2020-2025) & (US$ Million)

Table 143. First AML Recent Development

Table 144. Anti-Money Laundering (AML) Software Market Trends

Table 145. Anti-Money Laundering (AML) Software Market Drivers

Table 146. Anti-Money Laundering (AML) Software Market Challenges

Table 147. Anti-Money Laundering (AML) Software Market Restraints

Table 148. Research Programs/Design for This Report

Table 149. Key Data Information from Secondary Sources

Table 150. Key Data Information from Primary Sources

List of Figures

Figure 1. Anti-Money Laundering (AML) Software Product Picture

Figure 2. Global Anti-Money Laundering (AML) Software Market Share by Type: 2024 VS 2031

Figure 3. Cloud-based Features

Figure 4. On-premise Features

Figure 5. Global Anti-Money Laundering (AML) Software Market Share by Application: 2024 VS 2031

Figure 6. Banking

Figure 7. Securities and Insurance

Figure 8. Other Financial Institutions

Figure 9. Anti-Money Laundering (AML) Software Report Years Considered

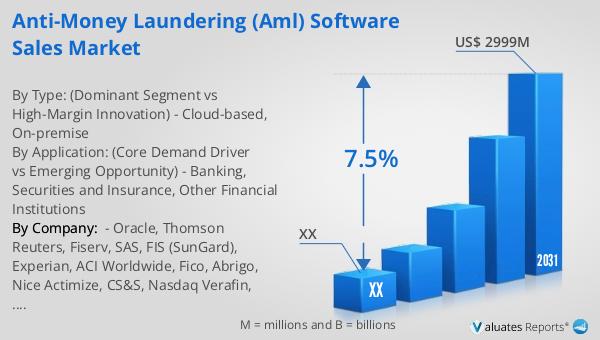

Figure 10. Global Anti-Money Laundering (AML) Software Market Size (US$ Million), Year-over-Year: 2020-2031

Figure 11. Global Anti-Money Laundering (AML) Software Market Size, (US$ Million), 2020 VS 2024 VS 2031

Figure 12. Global Anti-Money Laundering (AML) Software Revenue Market Share by Region: 2020 VS 2024

Figure 13. North America Anti-Money Laundering (AML) Software Revenue (US$ Million) Growth Rate (2020-2031)

Figure 14. Europe Anti-Money Laundering (AML) Software Revenue (US$ Million) Growth Rate (2020-2031)

Figure 15. China Anti-Money Laundering (AML) Software Revenue (US$ Million) Growth Rate (2020-2031)

Figure 16. Global Anti-Money Laundering (AML) Software Market Share by Players in 2024

Figure 17. Global Top Anti-Money Laundering (AML) Software Players by Company Type (Tier 1, Tier 2, and Tier 3) & (based on the Revenue in Anti-Money Laundering (AML) Software as of 2024)

Figure 18. The Top 10 and 5 Players Market Share by Anti-Money Laundering (AML) Software Revenue in 2024

Figure 19. North America Anti-Money Laundering (AML) Software Market Share by Type (2020-2025)

Figure 20. North America Anti-Money Laundering (AML) Software Market Share by Application (2020-2025)

Figure 21. Europe Anti-Money Laundering (AML) Software Market Share by Type (2020-2025)

Figure 22. Europe Anti-Money Laundering (AML) Software Market Share by Application (2020-2025)

Figure 23. China Anti-Money Laundering (AML) Software Market Share by Type (2020-2025)

Figure 24. China Anti-Money Laundering (AML) Software Market Share by Application (2020-2025)

Figure 25. Oracle Revenue Growth Rate in Anti-Money Laundering (AML) Software Business (2020-2025)

Figure 26. Thomson Reuters Revenue Growth Rate in Anti-Money Laundering (AML) Software Business (2020-2025)

Figure 27. Fiserv Revenue Growth Rate in Anti-Money Laundering (AML) Software Business (2020-2025)

Figure 28. SAS Revenue Growth Rate in Anti-Money Laundering (AML) Software Business (2020-2025)

Figure 29. FIS (SunGard) Revenue Growth Rate in Anti-Money Laundering (AML) Software Business (2020-2025)

Figure 30. Experian Revenue Growth Rate in Anti-Money Laundering (AML) Software Business (2020-2025)

Figure 31. ACI Worldwide Revenue Growth Rate in Anti-Money Laundering (AML) Software Business (2020-2025)

Figure 32. Fico Revenue Growth Rate in Anti-Money Laundering (AML) Software Business (2020-2025)

Figure 33. Abrigo Revenue Growth Rate in Anti-Money Laundering (AML) Software Business (2020-2025)

Figure 34. Nice Actimize Revenue Growth Rate in Anti-Money Laundering (AML) Software Business (2020-2025)

Figure 35. CS&S Revenue Growth Rate in Anti-Money Laundering (AML) Software Business (2020-2025)

Figure 36. Nasdaq Verafin Revenue Growth Rate in Anti-Money Laundering (AML) Software Business (2020-2025)

Figure 37. EastNets Revenue Growth Rate in Anti-Money Laundering (AML) Software Business (2020-2025)

Figure 38. Napier Technologies Revenue Growth Rate in Anti-Money Laundering (AML) Software Business (2020-2025)

Figure 39. ComplyAdvantage Revenue Growth Rate in Anti-Money Laundering (AML) Software Business (2020-2025)

Figure 40. AML Partners Revenue Growth Rate in Anti-Money Laundering (AML) Software Business (2020-2025)

Figure 41. Dow Jones Revenue Growth Rate in Anti-Money Laundering (AML) Software Business (2020-2025)

Figure 42. LexisNexis (Accuity) Revenue Growth Rate in Anti-Money Laundering (AML) Software Business (2020-2025)

Figure 43. SymphonyAI Revenue Growth Rate in Anti-Money Laundering (AML) Software Business (2020-2025)

Figure 44. Agile Century Revenue Growth Rate in Anti-Money Laundering (AML) Software Business (2020-2025)

Figure 45. First AML Revenue Growth Rate in Anti-Money Laundering (AML) Software Business (2020-2025)

Figure 46. Bottom-up and Top-down Approaches for This Report

Figure 47. Data Triangulation

Figure 48. Key Executives Interviewed