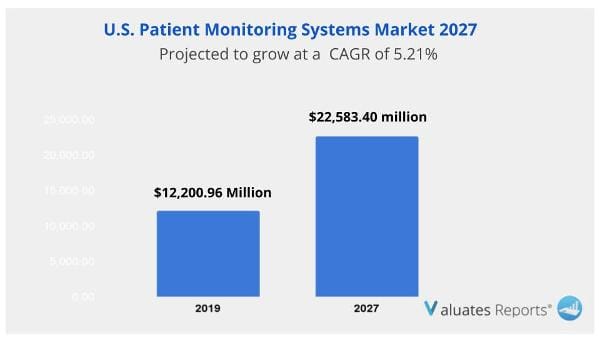

The U.S. patient monitoring market was valued at $12,200.96 million in 2019 and is projected to reach $22,583.40 million by 2027, registering a CAGR of 5.21% from 2020 to 2027.

Patient monitoring is the observation of a disease, condition or one or several medical parameters over time. Various types of patient monitoring systems are used to measure, record, distribute, and display combinations of biometric values such as heart rate, blood oxygen saturation levels (SPO2), blood pressure, and temperature. They are used to monitor patients regularly, which helps to avoid serious problems which helps to reduce number of emergency department visits and duration of hospitalization. Patient monitoring devices such as pulse oximeters, capnographs, and cardiac monitors are increasingly used in major hospitals, clinics, and various outpatient centers. These devices are commonly used during minor and major surgeries to monitor physiological signs of patients and intervene, if any complications occur. These devices can also help healthcare professionals to monitor vital signs of multiple patients at the same time. Some of these devices are also used to alert physicians, in case parameter levels are either above or below the limit set by physicians.

Moreover, with the help of remote monitoring devices, physicians can remotely monitor physiological parameters such as blood glucose level, blood pressure, and heart rate; and accordingly provide appropriate treatment for patients.

Increase in geriatric population and rise in adoption of remote patient monitoring devices are one of the few factors that drive the growth of the market. In addition, rise in prevalence of chronic diseases such as COPD, diabetes, cancer, and atherosclerosis also contribute toward growth of the patient monitoring devices market. Moreover, collaborations between companies, hospitals, and academic institutions are expected to lead to launch of new products, which would help increase the market revenue and, therefore, boost the market growth. However, data privacy & security issues are likely to restrain growth of the market. Moreover, government regulations and reimbursement issues also hamper growth of the U.S patient monitoring system market. Conversely, increase in adoption of AI and analytics is expected to create lucrative opportunities for the market during the forecast period. Further, growth in IoT healthcare applications is also projected to provide significant growth opportunities for the U.S. patient monitoring market.

Though most of the markets are dropping down, COVID-19 outbreak has positively affected various healthcare related markets, one of them being patient monitoring systems. As patient monitoring systems play a crucial role to combat pandemic and monitor patients, the patient monitoring market is witnessing a tremendous growth. Patient monitoring systems including cardiac monitors, respiratory devices, and temperature monitoring devices are facing huge demand, owing to their immense use in patient treatment along with IoT technology. In addition, IoT, specifically when combined with other transformative technologies such as Cloud and Artificial intelligence (AI), lead to a wide range of applications in patient monitoring, which have been beneficial during the crisis.

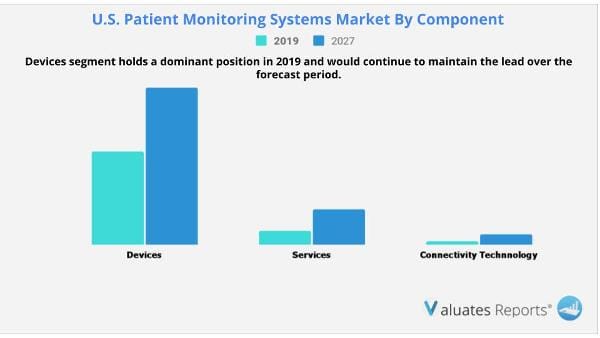

The U.S. patient monitoring system market is segmented into component which is further sub-segmented into devices, services, and connectivity type. By device, the market is further categorized into hemodynamic monitoring devices, neuromonitoring devices, cardiac monitoring devices, fetal & neonatal monitoring devices, respiratory monitoring devices, multiparameter monitoring devices, weight monitoring devices, temperature monitoring devices, and urine output monitoring devices. The service type segment is further divided into consulting, system integration & deployment, and support & maintenance. The connectivity technology type segment is further categorized into cellular IoT - 3G, cellular IoT - 4G, LoRa, Wi-Fi, SIGFOX, wireline, wireless personal area network (WPAN), and others.

The report provides extensive competitive analysis and profiles of key market players such as Abbott Laboratories, Biotronik SE & CO. KG, Boston Scientific Corporation, Medtronic, Inc., F. Hoffmann-La Roche Ltd., GE Healthcare Ltd, Masimo Corporation, Nihon Kohden Corporation, OSI Systems, Inc. (Spacelabs Healthcare), and Koninklijke Philips N.V.

List of Key Players profiled in the report

| Report Metric |

Details |

| Report Name |

U.S. Patient Monitoring Market |

| The Market size value in 2019 |

$12,200.96 Million |

| The Revenue forecast in 2027 |

$22,583.40 Million |

| Growth Rate |

CAGR of 5.21% from 20 19to 2027 |

| Base year considered |

2019 |

| Forecast period |

2019- 2027 |

| Forecast units |

Value (USD) |

| Companies covered |

ABBOTT LABORATORIES, BIOTRONIK SE & CO. KG, BOSTON SCIENTIFIC CORPORATION, GENERAL ELECTRIC COMPANY (GE HEALTHCARE), F. HOFFMANN-LA ROCHE LTD., KONINKLIJKE PHILIPS N.V. (PHILIPS HEALTHCARE), MASIMO CORPORATION, MEDTRONIC PLC., NIHON KOHDEN CORPORATION, OSI Systems, Inc. (Spacelabs Healthcare |

Ans. AC motor is projected as the most lucrative segment.

Ans. The forcast period for U.S. patient monitoring systems market is 2020 to 2027.

Ans. The expected market value of U.S. patient monitoring systems market in 2027 is $22,583.40 million.

Ans. The base year is 2019 in U.S. patient monitoring systems market.

Ans. Top companies such as, Medtronic, Boston Scientific Corporation, Masimo Corporation, Koninklijke Philips N.V, GE Healthcare Ltd and Omron Corporation held a high market position in 2019. These key players held a high market postion owing to the strong geographical foothold in the U.S.

$5769

$6450

$10995

$3840

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS

Add to Cart

Add to Cart

Add to Cart

Add to Cart