TABLES & FIGURES

TABLE 1. MEMS MARKET, BY TYPE, 2014-2022 ($MILLION)

TABLE 2. SENSOR MARKET, BY TYPE, 2014-2022 ($MILLION)

TABLE 3. GYROSCOPE MARKET, BY REGION, 2014-2022 ($MILLION)

TABLE 4. ACCELEROMETER MARKET, BY REGION, 2014-2022 ($MILLION)

TABLE 5. PRESSURE SENSOR MARKET, BY REGION, 2014-2022 ($MILLION)

TABLE 6. INERTIAL COMBOSMARKET, BY REGION, 2014-2022 ($MILLION)

TABLE 7. MICROPHONE MARKET, BY REGION, 2014-2022 ($MILLION)

TABLE 8. MAGNETOMETER MARKET, BY REGION, 2014-2022 ($MILLION)

TABLE 9. OTHERS (ENVIRONMENT AND OPTICAL SENSOR) MARKET, BY REGION, 2014-2022 ($MILLION)

TABLE 10. ACTUATOR MARKET, BY TYPE, 2014-2022 ($MILLION)

TABLE 11. INKJET SYSTEMS MARKET, BY REGION, 2014-2022 ($MILLION)

TABLE 12. OPTICAL MEMS MARKET, BY REGION, 2014-2022 ($MILLION)

TABLE 13. OSCILLATORS AND RESONATORS MARKET, BY REGION, 2014-2022 ($MILLION)

TABLE 14. MICRO FLUIDIC AND BIO-CHIP MARKET, BY REGION, 2014-2022 ($MILLION)

TABLE 15. RF MEMS MARKET, BY REGION, 2014-2022 ($MILLION)

TABLE 16. OTHERS (PIR AND THERMOPILES, MICROBOLOMETERS, AND DIGITAL COMPASS)MARKET, BY REGION, 2014-2022 ($MILLION)

TABLE 17. MEMS MARKET, BY INDUSTRY VERTICAL, 2014-2022 ($MILLION)

TABLE 18. CONSUMER ELECTRONICS MARKET, BY REGION, 2014-2022 ($MILLION)

TABLE 19. AUTOMOTIVE MARKET, BY REGION, 2014-2022 ($MILLION)

TABLE 20. INDUSTRIAL MARKET, BY REGION, 2014-2022 ($MILLION)

TABLE 21. AEROSPACE & DEFENCE MARKET, BY REGION, 2014-2022 ($MILLION)

TABLE 22. HEALTHCARE MARKET, BY REGION, 2014-2022 ($MILLION)

TABLE 23. TELECOMMUNICATION MARKET, BY REGION, 2014-2022 ($MILLION)

TABLE 24. MEMS MARKET, BY REGION, 2014-2022 ($MILLION)

TABLE 25. NORTH AMERICA: MEMS MARKET, BY TYPE, 2014-2022 ($MILLION)

TABLE 26. NORTH AMERICA: MEMS MARKET, BY COUNTRY, 2014-2022 ($MILLION)

TABLE 27. EUROPE: MEMS MARKET, BY TYPE, 2014-2022 ($MILLION)

TABLE 28. EUROPE: MEMS MARKET, BY COUNTRY, 2014-2022 ($MILLION)

TABLE 29. ASIA-PACIFIC: MEMS MARKET, BY TYPE, 2014-2022 ($MILLION)

TABLE 30. ASIA-PACIFIC: MEMS MARKET, BY COUNTRY, 2014-2022 ($MILLION)

TABLE 31. LAMEA: MEMS MARKET, BY TYPE, 2014-2022 ($MILLION)

TABLE 32. LAMEA: MEMS MARKET, BY COUNTRY, 2014-2022 ($MILLION)

TABLE 33. ANALOG DEVICES, INC: COMPANY SNAPSHOT

TABLE 34. ANALOG DEVICES, INC: OPERATING SEGMENTS

TABLE 35. AVAGO TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 36. AVAGO TECHNOLOGIES: OPERATING SEGMENTS

TABLE 37. DENSO CORPORATION: COMPANY SNAPSHOT

TABLE 38. DENSO CORPORATION: OPERATING SEGMENTS

TABLE 39. HEWLETT-PACKARD CORPORATION: COMPANY SNAPSHOT

TABLE 40. HEWLETT-PACKARD CORPORATION: OPERATING SEGMENTS

TABLE 41. KNOWLES CORPORATION: COMPANY SNAPSHOT

TABLE 42. KNOWLES CORPORATION: OPERATING SEGMENTS

TABLE 43. NXP SEMICONDUCTORS N.V.: COMPANY SNAPSHOT

TABLE 44. NXP SEMICONDUCTORS N.V.: OPERATING SEGMENTS

TABLE 45. PANASONIC CORPORATION: COMPANY SNAPSHOT

TABLE 46. PANASONIC CORPORATION: OPERATING SEGMENTS

TABLE 47. ROBERT BOSCH GMBH: COMPANY SNAPSHOT

TABLE 48. ROBERT BOSCH GMBH: OPERATING SEGMENTS

TABLE 49. ST MICROELECTRONICS N.V.: COMPANY SNAPSHOT

TABLE 50. ST MICROELECTRONICS N.V.: OPERATING SEGMENTS

TABLE 51. TEXAS INSTRUMENTS, INC: COMPANY SNAPSHOT

TABLE 52. TEXAS INSTRUMENTS, INC: OPERATING SEGMENTS FIGURE 1. MEMS MARKET SEGMENTS, REVENUE & CAGR, 2014-2022

FIGURE 2. TOP IMPACTING FACTORS

FIGURE 3. TOP WINNING STRATEGIES: PERCENTAGE DISTRIBUTION (2013 - 2016)

FIGURE 4. TOP INVESTMENT POCKETS IN GLOBAL MEMS MARKET, BY INDUSTRY VERTICAL

FIGURE 5. MARKET SHARE ANALYSIS, 2015

FIGURE 6. WORLDWIDE SUPPLY OF ROBOTS (THOUSANDS)

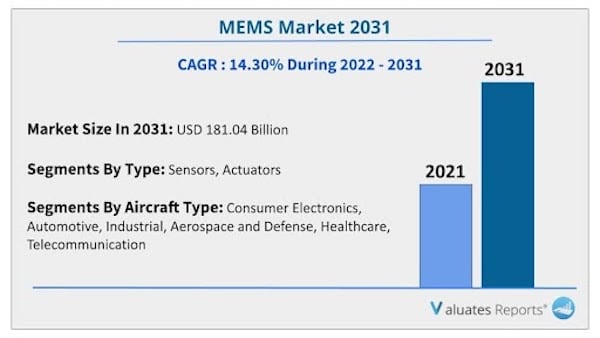

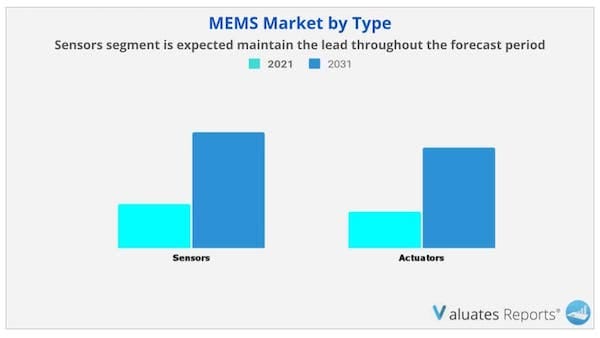

FIGURE 7. GLOBAL MEMS MARKET, BY TYPE

FIGURE 8. GLOBAL MEMS MARKET BY TYPE (REVENUE AND CAGR)

FIGURE 9. GYROSCOPE MARKET ANALYSIS, 2015 & 2022 ($MILLION)

FIGURE 10. MARKET REVENUE & FORECAST OF GYROSCOPE MARKET, 2014-2022 ($MILLION)

FIGURE 11. ACCELEROMETER MARKET ANALYSIS, 2015 & 2022 ($MILLION)

FIGURE 12. MARKET REVENUE & FORECAST OF ACCELEROMETER MARKET, 2014-2022 ($MILLION)

FIGURE 13. PRESSURE SENSOR MARKET ANALYSIS, 2015 & 2022 ($MILLION)

FIGURE 14. MARKET REVENUE & FORECAST OF PRESSURE SENSOR MARKET, 2014-2022 ($MILLION)

FIGURE 15. INERTIAL COMBOS MARKET ANALYSIS, 2015 & 2022 ($MILLION)

FIGURE 16. MARKET REVENUE & FORECAST OF INERTIAL COMBOS MARKET, 2014-2022 ($MILLION)

FIGURE 17. MICROPHONE MARKET ANALYSIS, 2015 & 2022 ($MILLION)

FIGURE 18. MARKET REVENUE & FORECAST OF MICROPHONE MARKET, 2014-2022 ($MILLION)

FIGURE 19. MAGNETOMETER MARKET ANALYSIS, 2015 & 2022 ($MILLION)

FIGURE 20. MARKET REVENUE & FORECAST OF MAGNETOMETER MARKET, 2014-2022 ($MILLION)

FIGURE 21. OTHERS (ENVIRONMENT AND OPTICAL SENSOR) MARKET ANALYSIS, 2015 & 2022 ($MILLION)

FIGURE 22. MARKET REVENUE & FORECAST OF OTHERS (ENVIRONMENT AND OPTICAL SENSOR)GYROSCOPE MARKET, 2014-2022 ($MILLION)

FIGURE 23. INKJET SYSTEMS MARKET ANALYSIS, 2015 & 2022 ($MILLION)

FIGURE 24. MARKET REVENUE & FORECAST OF INKJET SYSTEMS MARKET, 2014-2022 ($MILLION)

FIGURE 25. OPTICAL MEMS MARKET ANALYSIS, 2015 & 2022 ($MILLION)

FIGURE 26. MARKET REVENUE & FORECAST OF OPTICAL MEMS MARKET, 2014-2022 ($MILLION)

FIGURE 27. OSCILLATORS AND RESONATORS MARKET ANALYSIS, 2015 & 2022 ($MILLION)

FIGURE 28. MARKET REVENUE & FORECAST OF OSCILLATORS AND RESONATORS MARKET, 2014-2022 ($MILLION)

FIGURE 29. MICRO FLUIDIC AND BIO-CHIP MARKET ANALYSIS, 2015 & 2022 ($MILLION)

FIGURE 30. MARKET REVENUE & FORECAST OF MICRO FLUIDIC AND BIO-CHIP MARKET, 2014-2022 ($MILLION)

FIGURE 31. RF MEMS MARKET ANALYSIS, 2015 & 2022 ($MILLION)

FIGURE 32. MARKET REVENUE & FORECAST OF RF MEMS MARKET, 2014-2022 ($MILLION)

FIGURE 33. OTHERS (PIR AND THERMOPILES, MICROBOLOMETERS, AND DIGITAL COMPASS)MARKET ANALYSIS, 2015 & 2022 ($MILLION)

FIGURE 34. MARKET REVENUE & FORECAST OF OTHERS (PIR AND THERMOPILES, MICROBOLOMETERS, AND DIGITAL COMPASS)MARKET, 2014-2022 ($MILLION)

FIGURE 35. CONSUMER ELECTRONICS MARKET ANALYSIS, 2015 & 2022 ($MILLION)

FIGURE 36. MARKET REVENUE & FORECAST OF CONSUMER ELECTRONICS MARKET, 2014-2022 ($MILLION)

FIGURE 37. AUTOMOTIVE MARKET ANALYSIS, 2015 & 2022 ($MILLION)

FIGURE 38. MARKET REVENUE & FORECAST OF AUTOMOTIVE MARKET, 2014-2022 ($MILLION)

FIGURE 39. INDUSTRIAL MARKET ANALYSIS, 2015 & 2022 ($MILLION)

FIGURE 40. MARKET REVENUE & FORECAST OF INDUSTRIAL MARKET, 2014-2022 ($MILLION)

FIGURE 41. AEROSPACE & DEFENCE MARKET ANALYSIS, 2015 & 2022 ($MILLION)

FIGURE 42. MARKET REVENUE & FORECAST OF AEROSPACE & DEFENCE MARKET, 2014-2022 ($MILLION)

FIGURE 43. HEALTHCARE MARKET ANALYSIS, 2015 & 2022 ($MILLION)

FIGURE 44. MARKET REVENUE & FORECAST OF HEALTHCARE MARKET, 2014-2022 ($MILLION)

FIGURE 45. TELECOMMUNICATION MARKET ANALYSIS, 2015 & 2022 ($MILLION)

FIGURE 46. MARKET REVENUE & FORECAST OF TELECOMMUNICATION MARKET, 2014-2022 ($MILLION)

FIGURE 47. MEMS MARKET REVENUE BY GEOGRAPHY, 2015 (%)

FIGURE 48. NORTH AMERICA MEMS, REVENUE & CAGR, 2015 & 2022

FIGURE 49. U.S.: MEMS MARKET SIZE, 2014-2022 ($MILLION)

FIGURE 50. CANADA: MEMS MARKET SIZE, 2014-2022 ($MILLION)

FIGURE 51. MEXICO: MEMS MARKET SIZE, 2014-2022 ($MILLION)

FIGURE 52. EUROPE MEMS MARKET, REVENUE & CAGR, 2015 & 2022

FIGURE 53. GERMANY: MEMS MARKET SIZE, 2014-2022 ($MILLION)

FIGURE 54. FRANCE: MEMS MARKET SIZE, 2014-2022 ($MILLION)

FIGURE 55. ITALY: MEMS MARKET SIZE, 2014-2022 ($MILLION)

FIGURE 56. REST OF EUROPE: MEMS MARKET SIZE, 2014-2022 ($MILLION)

FIGURE 57. ASIA-PACIFIC MEMS MARKET, REVENUE & CAGR, 2015-2022

FIGURE 58. CHINA: MEMS MARKET SIZE, 2014-2022 ($MILLION)

FIGURE 59. JAPAN: MEMS MARKET SIZE, 2014-2022 ($MILLION)

FIGURE 60. SOUTH KOREA: MEMS MARKET SIZE, 2014-2022 ($MILLION)

FIGURE 61. TAIWAN: MEMS MARKET SIZE, 2014-2022 ($MILLION)

FIGURE 62. INDIA: MEMS MARKET SIZE, 2014-2022 ($MILLION)

FIGURE 63. REST OF ASIA-PACIFIC: MEMS MARKET SIZE, 2014-2022 ($MILLION)

FIGURE 64. LAMEA MEMS MARKET, REVENUE & CAGR, 2015 & 2022

FIGURE 65. LATIN AMERICA: MEMS MARKET SIZE, 2014-2022 ($MILLION)

FIGURE 66. MIDDLE EAST: MEMS MARKET SIZE, 2014-2022 ($MILLION)

FIGURE 67. AFRICA: MEMS MARKET SIZE, 2014-2022 ($MILLION)

FIGURE 68. ANALOG DEVICES, INC: REVENUE BY YEAR ($MILLION), 2013-2015

FIGURE 69. ANALOG DEVICES, INC: REVENUE BY GEOGRAPHY (%), 2015

FIGURE 70. ANALOG DEVICES, INC: STRATEGY SHARE (%), 2014-2016

FIGURE 71. AVAGO TECHNOLOGIES: REVENUE BY YEAR ($MILLION), 2013-2015

FIGURE 72. AVAGO TECHNOLOGIES: REVENUE BY SEGMENT (%), 2015

FIGURE 73. DENSO CORPORATION: REVENUE BY YEAR ($MILLION), 2014-2016

FIGURE 74. DENSO CORPORATION: REVENUE BY GEOGRAPHY (%), 2016

FIGURE 75. HEWLETT-PACKARD CORPORATION: REVENUE BY YEAR ($MILLION), 2014-2016

FIGURE 76. HEWLETT-PACKARD CORPORATION: REVENUE BY SEGMENT (%), 2016

FIGURE 77. KNOWLES CORPORATION: REVENUE BY YEAR ($MILLION), 2013-2015

FIGURE 78. KNOWLES CORPORATION: REVENUE BY SEGMENT (%), 2015

FIGURE 79. KNOWLES CORPORATION: REVENUE BY GEOGRAPHY (%), 2015

FIGURE 80. KNOWLES CORPORATION: STRATEGY SHARE (%), 2013-2015

FIGURE 81. NXP SEMICONDUCTORS N.V.: REVENUE BY YEAR ($MILLION), 2013-2015

FIGURE 82. NXP SEMICONDUCTORS N.V.: REVENUE BY SEGMENT (%), 2015

FIGURE 83. NXP SEMICONDUCTORS N.V.: REVENUE BY GEOGRAPHY (%), 2015

FIGURE 84. NXP SEMICONDUCTORS N.V.: STRATEGY SHARE (%), 2014-2016

FIGURE 85. PANASONIC CORPORATION: REVENUE BY YEAR ($MILLION), 2014-2016

FIGURE 86. PANASONIC CORPORATION: REVENUE BY SEGMENT (%), 2016

FIGURE 87. PANASONIC CORPORATION: STRATEGY SHARE (%), 2014-2016

FIGURE 88. ROBERT BOSCH GMBH: REVENUE BY YEAR ($MILLION), 2013-2015

FIGURE 89. ROBERT BOSCH GMBH: REVENUE BY SEGMENT (%), 2015

FIGURE 90. ROBERT BOSCH GMBH: REVENUE BY GEOGRAPHY (%), 2015

FIGURE 91. ROBERT BOSCH GMBH: STRATEGY SHARE (%), 2013-2016

FIGURE 92. ST MICROELECTRONICS N.V.: REVENUE BY YEAR ($MILLION), 2013-2015

FIGURE 93. ST MICROELECTRONICS N.V.: REVENUE BY SEGMENT (%), 2015

FIGURE 94. ST MICROELECTRONICS N.V.: REVENUE BY GEOGRAPHY (%), 2015

FIGURE 95. ST MICROELECTRONICS N.V.: STRATEGY SHARE (%), 2014-2016

FIGURE 96. TEXAS INSTRUMENTS, INC: REVENUE BY YEAR ($MILLION), 2013-2015

FIGURE 97. TEXAS INSTRUMENTS, INC: REVENUE BY SEGMENT (%), 2015

FIGURE 98. TEXAS INSTRUMENTS, INC: REVENUE BY PRODUCT (%), 2015

FIGURE 99. TEXAS INSTRUMENTS, INC: REVENUE BY GEOGRAPHY (%), 2015

FIGURE 100. TEXAS INSTRUMENTS, INC: STRATEGY SHARE (%), 2014-201