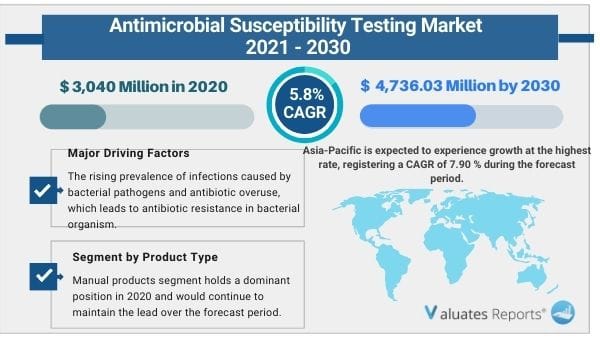

The global antimicrobial susceptibility testing market size was valued at US$ 3040.00 million in 2020 and is projected to reach US$ 4736.03 million by 2030 registering a CAGR of 5.8% from 2021 to 2030. Key drivers of the antimicrobial susceptibility testing market include the growing number of infectious disease epidemics due to a lack of proper hygiene, sanitation, and water supply especially in developing economies.

The overconsumption of antibiotics leading to drug resistance and growing chronic diseases will propel the growth of the antimicrobial susceptibility market in the coming years.

The surge in Hospital-Acquired Infections( HAIs) and rising patient population will fuel the demand for the market during the review period. Moreover, the growing automation in susceptibility testing will augment the market moving forward.

The rapid spread of infectious diseases

The continuous rise in global travel trends and underdeveloped healthcare infrastructure in developing regions are contributing to the emergence of several infectious diseases. There are newer variants and older diseases developing at a faster pace. People globally are traveling more to unknown and farthest locations of the world and getting exposed to newer diseases. This increases the need for rapid development of drugs which in turn will drive the growth of the antimicrobial susceptibility testing market. Additional causes involve a lack of basic hygiene, sanitation, etc.

Rampant usage of antibiotics

Antibiotic resistance is a big threat to global health. A growing number of diseases such as pneumonia, and tuberculosis are getting difficult to treat as antibiotics become less efficient. Common infectious problems are taking longer with rising hospital stays and increasing mortality levels. Hazardous exploitation of available medicines has created new resistance mechanisms in microorganisms. This makes antimicrobial susceptibility testing crucial for clinicians and scientists to discover newer treatment options. These factors will ultimately surge the growth of the antimicrobial susceptibility testing market.

Universal prevalence of HAIs

Longer hospital stays and an increasing number of chronic diseases such as diabetes, and obesity are all contributing to the growth of healthcare patients. This increases the chances of infections caused. These are all viral, bacterial, and fungal pathogens. Testing will prove to be an important step in clinical laboratories. Hence such factors will augment the growth of the antimicrobial susceptibility testing market in the subsequent years.

The advent of automated instruments

Automation is spreading quickly with the invention of newer devices that are adept at tracking several pathogenic bacterium and other microorganisms. The results are accurate, fast, and widespread with no or minimal scope for false results. There are systems that directly monitor the growth of the organism and directly provide results from blood culture bottles within 4-6 hrs. This is much lower than conventional testing procedures. These will surge the growth of the antimicrobial susceptibility testing market in the coming decades.

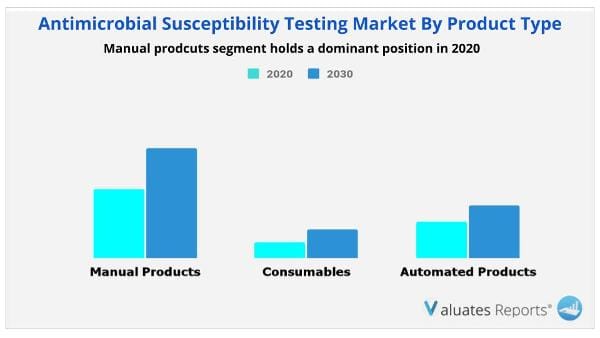

Based on product type, the manual segment will provide lucrative opportunities for growth in the antimicrobial susceptibility testing market share due to ease of use, lower cost, and rising demand for MIC strips, and disks due to drug resistance, and new disease epidemics.

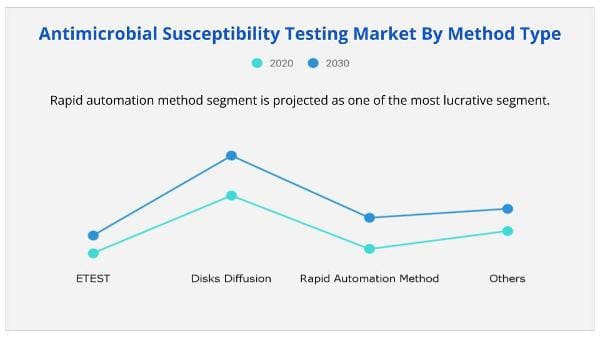

Based on method type, the disk diffusion segment will witness significant growth in the antimicrobial susceptibility testing market share due to the simple usage systems and cheaper methods. However, the rapid automation segment will grow the fastest during the review period.

Based on end-user the hospitals and diagnostic laboratories will maintain dominance in the antimicrobial susceptibility testing market share due to growing HAIs, drug-resistant cases, and the need for the development of new treatment methods.

Based on region, North America will maintain the lead in the antimicrobial susceptibility testing market share due to the presence of key industry players, government focus on solving antibiotic resistivity, and well-developed healthcare infrastructure. However, the Asia-Pacific region will rise the fastest owing to a growing economy, increasing healthcare investments, and a huge population base.

| Report Metric | Details |

| Report Name | Antimicrobial Susceptibility Testing Market |

| The market size in 2020 | USD 3,040 Million |

| The revenue forecast in 2030 | USD 4,736.03 Million |

| Growth Rate | Compound Annual Growth Rate (CAGR) of 5.8% from 2021 to 2030 |

| Market size available for years | 2021-2030 |

| Forecast units | Value (USD) |

| Segments covered | By Product Type, End-User, Method Type, and Region |

| Report coverage | Revenue & volume forecast, company share, competitive landscape, growth factors, and trends |

| Geographic regions covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Ans. The global antimicrobial susceptibility testing market was valued at $3,040.00 million in 2020, and is projected to reach $4,736.03 million by 2030, registering a CAGR of 5.8% from 2021 to 2030.

Ans. The global antimicrobial susceptibility testing market is expected to grow at a compound annual growth rate of 5.8% from 2020 to 2027.

Ans. Accelerate Diagnostics, Inc., Becton, Dickinson and Company, Biomerieux SA, Bio-Rad Laboratories, Inc., Bruker, Danaher Corporation (Beckman Coulter), F. Hoffmann-La Roche AG, HiMedia Laboratories, Merck KGaA (MilliporeSigma), Thermo Fisher Scientific.

Ans. The rising prevalence of infections caused by bacterial pathogens and antibiotic overuse, which leads to antibiotic resistance in bacterial organisms; the development of better standards for fungal susceptibility; and the growing use of rapid commercial AST systems for fungal testing are all driving the Antimicrobial Susceptibility Testing market forward.

CHAPTER 1:INTRODUCTION

1.1.Report description

Key benefits for stakeholders

1.2.Key market segments

1.3.Research methodology

1.3.1.Secondary research

1.3.2.Primary research

1.3.3.Analyst tools and models

CHAPTER 2:EXECUTIVE SUMMARY

2.1.Key findings of the study

2.2.CXO perspective

CHAPTER 3:MARKET LANDSCAPE

3.1.Market definition and scope

3.2.Key findings

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.4.Top player positioning, 2020

3.5.Market dynamics

3.5.1.Drivers

3.5.1.1.Rising incidence of infectious diseases coupled with epidemic & pandemic occurrences

3.5.1.2.Increasing adoption of antimicrobial susceptibility testing

3.5.1.3.Development of Manual and Automated Products

3.5.2.Restraint

3.5.2.1.High cost of automated AST systems & stringent government regulations

3.5.3.Opportunity

3.5.3.1.Awareness initiatives for antimicrobial resistance and its control

3.5.4.Impact analysis

3.6.Impact analysis of COVID-19 on the antimicrobial susceptibility testing market

CHAPTER 4:ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE

4.1.Overview

4.1.1.Market size and forecast

4.2.Manual Products

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast, by region

4.2.3.Market analysis, by country

4.2.4.Market analysis, by end user

4.3.Automated Products

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Market size and forecast, by region

4.3.3.Market analysis, by country

4.3.4.Market analysis, by end user

4.4.Consumables

4.4.1.Key market trends, growth factors, and opportunities

4.4.2.Market size and forecast, by region

4.4.3.Market analysis, by country

4.4.4.Market analysis, by end user

CHAPTER 5:ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE

5.1.Overview

5.1.1.Market size and forecast

5.2.ETEST

5.2.1.Market size and forecast, by region

5.2.2.Market analysis, by country

5.3.Disks Diffusion

5.3.1.Market size and forecast, by region

5.3.2.Market analysis, by country

5.4.Rapid Automation Method

5.4.1.Market size and forecast, by region

5.4.2.Market analysis, by country

5.5.Others

5.5.1.Market size and forecast, by region

5.5.2.Market analysis, by country

CHAPTER 6:ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER

6.1.Overview

6.1.1.Market size and forecast

6.2.Hospitals & Diagnostic Laboratories

6.2.1.Market size and forecast, by region

6.2.2.Market analysis, by country

6.3.Pharmaceutical & Biotechnology Companies

6.3.1.Market size and forecast, by region

6.3.2.Market analysis, by country

6.4.Others

6.4.1.Market size and forecast, by region

6.4.2.Market analysis, by country

CHAPTER 7:ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY REGION

7.1.Overview

7.1.1.Market size and forecast

7.2.North America

7.2.1.Key market trends, growth factors, and opportunities

7.2.2.North America Antimicrobial susceptibility testing market, by Product Type

7.2.3.North America Antimicrobial susceptibility testing market, by Method Type

7.2.4.North America Antimicrobial susceptibility testing market, by End User

7.2.5.Market size and forecast, by country

7.2.5.1.U.S.

7.2.5.1.1.U.S. Antimicrobial susceptibility testing market, by Product Type

7.2.5.1.2.U.S. Antimicrobial susceptibility testing market, by Method Type

7.2.5.1.3.U.S. Antimicrobial susceptibility testing market, by End User

7.2.5.2.Canada

7.2.5.2.1.Canada Antimicrobial susceptibility testing market, by Product Type

7.2.5.2.2.Canada Antimicrobial susceptibility testing market, by Method Type

7.2.5.2.3.Canada Antimicrobial susceptibility testing market, by End User

7.2.5.3.Mexico

7.2.5.3.1.Mexico Antimicrobial susceptibility testing market, by Product Type

7.2.5.3.2.Mexico Antimicrobial susceptibility testing market, by Method Type

7.2.5.3.3.Mexico Antimicrobial susceptibility testing market, by End User

7.3.Europe

7.3.1.Key market trends, growth factors, and opportunities

7.3.2.Europe Antimicrobial susceptibility testing market, by Product Type

7.3.3.Europe Antimicrobial susceptibility testing market, by Method Type

7.3.4.Europe Antimicrobial susceptibility testing market, by End User

7.3.5.Market size and forecast, by country

7.3.5.1.Germany

7.3.5.1.1.Germany Antimicrobial susceptibility testing market, by Product Type

7.3.5.1.2.Germany Antimicrobial susceptibility testing market, by Method Type

7.3.5.1.3.Germany Antimicrobial susceptibility testing market, by End User

7.3.5.2.France

7.3.5.2.1.France Antimicrobial susceptibility testing market, by Product Type

7.3.5.2.2.France Antimicrobial susceptibility testing market, by Method Type

7.3.5.2.3.France Antimicrobial susceptibility testing market, by End User

7.3.5.3.UK

7.3.5.3.1.UK Antimicrobial susceptibility testing market, by Product Type

7.3.5.3.2.UK Antimicrobial susceptibility testing market, by Method Type

7.3.5.3.3.UK Antimicrobial susceptibility testing market, by End User

7.3.5.4.Italy

7.3.5.4.1.Italy Antimicrobial susceptibility testing market, by Product Type

7.3.5.4.2.Italy Antimicrobial susceptibility testing market, by Method Type

7.3.5.4.3.Italy Antimicrobial susceptibility testing market, by End User

7.3.5.5.Spain

7.3.5.5.1.Spain Antimicrobial susceptibility testing market, by Product Type

7.3.5.5.2.Spain Antimicrobial susceptibility testing market, by Method Type

7.3.5.5.3.Spain Antimicrobial susceptibility testing market, by End User

7.3.5.6.Rest of Europe

7.3.5.6.1.Rest of Europe Antimicrobial susceptibility testing market, by Product Type

7.3.5.6.2.Rest of Europe Antimicrobial susceptibility testing market, by Method Type

7.3.5.6.3.Rest of Europe Antimicrobial susceptibility testing market, by End User

7.4.Asia-Pacific

7.4.1.Key market trends, growth factors, and opportunities

7.4.2.Asia-Pacific Antimicrobial susceptibility testing market, by Product Type

7.4.3.Asia-Pacific Antimicrobial susceptibility testing market, by Method Type

7.4.4.Asia-Pacific Antimicrobial susceptibility testing market, by End User

7.4.5.Market size and forecast, by country

7.4.5.1.Japan

7.4.5.1.1.Japan Antimicrobial susceptibility testing market, by Product Type

7.4.5.1.2.Japan Antimicrobial susceptibility testing market, by Method Type

7.4.5.1.3.Japan Antimicrobial susceptibility testing market, by End User

7.4.5.2.China

7.4.5.2.1.China Antimicrobial susceptibility testing market, by Product Type

7.4.5.2.2.China Antimicrobial susceptibility testing market, by Method Type

7.4.5.2.3.China Antimicrobial susceptibility testing market, by End User

7.4.5.3.Australia

7.4.5.3.1.Australia Antimicrobial susceptibility testing market, by Product Type

7.4.5.3.2.Australia Antimicrobial susceptibility testing market, by Method Type

7.4.5.3.3.Australia Antimicrobial susceptibility testing market, by End User

7.4.5.4.India

7.4.5.4.1.India Antimicrobial susceptibility testing market, by Product Type

7.4.5.4.2.India Antimicrobial susceptibility testing market, by Method Type

7.4.5.4.3.India Antimicrobial susceptibility testing market, by End User

7.4.5.5.South Korea

7.4.5.5.1.South Korea Antimicrobial susceptibility testing market, by Product Type

7.4.5.5.2.South Korea Antimicrobial susceptibility testing market, by Method Type

7.4.5.5.3.South Korea Antimicrobial susceptibility testing market, by End User

7.4.5.6.Rest of Asia-Pacific

7.4.5.6.1.Rest of Asia-Pacific Antimicrobial susceptibility testing market, by Product Type

7.4.5.6.2.Rest of Asia-Pacific Antimicrobial susceptibility testing market, by Method Type

7.4.5.6.3.Rest of Asia-Pacific Antimicrobial susceptibility testing market, by End User

7.5.LAMEA

7.5.1.Key market trends, growth factors, and opportunities

7.5.2.LAMEA Antimicrobial susceptibility testing market, by Product Type

7.5.3.LAMEA Antimicrobial susceptibility testing market, by Method Type

7.5.4.LAMEA Antimicrobial susceptibility testing market, by End User

7.5.5.Market size and forecast, by country

7.5.5.1.Brazil

7.5.5.1.1.Brazil Antimicrobial susceptibility testing market, by Product Type

7.5.5.1.2.Brazil Antimicrobial susceptibility testing market, by Method Type

7.5.5.1.3.Brazil Antimicrobial susceptibility testing market, by End User

7.5.5.2.Saudi Arabia

7.5.5.2.1.Saudi Arabia Antimicrobial susceptibility testing market, by Product Type

7.5.5.2.2.Saudi Arabia Antimicrobial susceptibility testing market, by Method Type

7.5.5.2.3.Saudi Arabia Antimicrobial susceptibility testing market, by End User

7.5.5.3.South Africa

7.5.5.3.1.South Africa Antimicrobial susceptibility testing market, by Product Type

7.5.5.3.2.South Africa Antimicrobial susceptibility testing market, by Method Type

7.5.5.3.3.South Africa Antimicrobial susceptibility testing market, by End User

7.5.5.4.Rest of LAMEA

7.5.5.4.1.Rest of LAMEA Antimicrobial susceptibility testing market, by Product Type

7.5.5.4.2.Rest of LAMEA Antimicrobial susceptibility testing market, by Method Type

7.5.5.4.3.Rest of LAMEA Antimicrobial susceptibility testing market, by End User

CHAPTER 8:COMPANY PROFILES

8.1.ACCELERATE DIAGNOSTICS, INC.

8.1.1.Company overview

8.1.2.Company snapshot

8.1.3.Operating business segments

8.1.4.Product portfolio

8.1.5.Business performance

8.1.6.Key strategic moves and developments

8.2.BECTON, DICKINSON, AND COMPANY

8.2.1.Company overview

8.2.2.Company snapshot

8.2.3.Operating business segments

8.2.4.Product portfolio

8.2.5.Business performance

8.2.6.Key strategic moves and developments

8.3.BIO-RAD LABORATORIES, INC.

8.3.1.Company overview

8.3.2.Company snapshot

8.3.3.Operating business segments

8.3.4.Product portfolio

8.3.5.Business performance

8.4.BRUKER CORPORATION

8.4.1.Company overview

8.4.2.Company snapshot

8.4.3.Operating business segments

8.4.4.Product portfolio

8.4.5.Business performance

8.4.6.Key strategic moves and developments

8.5.COMPAGNIE MERIEUX ALLIANCE SAS (BIOMERIEUX S.A.)

8.5.1.Company overview

8.5.2.Company snapshot

8.5.3.Operating business segments

8.5.4.Product portfolio

8.5.5.Key strategic moves and developments

8.6.DANAHER CORPORATION (BECKMAN COULTER INC.)

8.6.1.Company overview

8.6.2.Company snapshot

8.6.3.Operating business segments

8.6.4.Product portfolio

8.6.5.Business performance

8.6.6.Key strategic moves and developments

8.7.F. HOFFMANN-LA ROCHE AG

8.7.1.Company overview

8.7.2.Company snapshot

8.7.3.Operating business segments

8.7.4.Product portfolio

8.7.5.Business performance

8.7.6.Key strategic moves and developments

8.8.HIMEDIA LABORATORIES

8.8.1.Company overview

8.8.2.Operating business segments

8.8.3.Product portfolio

8.9.MERCK KGAA (MILLIPORE SIGMA)

8.9.1.Company overview

8.9.2.Company snapshot

8.9.3.Operating business segments

8.9.4.Product portfolio

8.9.5.Business performance

8.10.THERMO FISHER SCIENTIFIC, INC.

8.10.1.Company overview

8.10.2.Company snapshot

8.10.3.Operating business segments

8.10.4.Product portfolio

8.10.5.Business performance

8.10.6.Key strategic moves and developments

LIST OF TABLES

TABLE 01.GLOBAL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 02.ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR MANUAL PRODUCTS MARKET, BY REGION, 2020-2030 ($MILLION)

TABLE 03.ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR MANUAL PRODUCTS MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 04.ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR AUTOMATED PRODUCTS, BY REGION, 2020-2030 ($MILLION)

TABLE 05.ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR AUTOMATED PRODUCTS MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 06.CONSUMABLES SUSCEPTIBILITY TESTING MARKET FOR ANTIMICROBIAL, BY REGION, 2020-2030 ($MILLION)

TABLE 07.ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR CONSUMABLES MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 08.GLOBAL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 09.ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR ETEST, BY REGION, 2020-2030 ($MILLION)

TABLE 10.ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR DISKS DIFFUSION, BY REGION, 2020-2030 ($MILLION)

TABLE 11.ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR RAPID AUTOMATION METHOD, BY REGION, 2020-2030 ($MILLION)

TABLE 12.ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR OTHERS, BY REGION, 2020-2030 ($MILLION)

TABLE 13.GLOBAL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 14.ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY REGION, 2020-2030 ($MILLION)

TABLE 15.ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2020-2030 ($MILLION)

TABLE 16.ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR OTHERS, BY REGION, 2020-2030 ($MILLION)

TABLE 17.ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY REGION, 2020-2030 ($MILLION)

TABLE 18.NORTH AMERICA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 19.NORTH AMERICA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 20.NORTH AMERICA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 21.NORTH AMERICA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY COUNTRY, 2020-2030 ($MILLION)

TABLE 22.U.S. ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 23.U.S. ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 24.U.S. ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 25.CANADA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 26.CANADA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 27.CANADA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 28.MEXICO ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 29.MEXICO ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 30.MEXICO ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 31.EUROPE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 32.EUROPE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 33.EUROPE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 34.EUROPE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY COUNTRY, 2020-2030 ($MILLION)

TABLE 35.GERMANY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 36.GERMANY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 37.GERMANY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 38.FRANCE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 39.FRANCE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 40.FRANCE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 41.UK ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 42.UK ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 43.UK ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 44.ITALY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 45.ITALY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 46.ITALY ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 47.SPAIN ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 48.SPAIN ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 49.SPAIN ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 50.REST OF EUROPE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 51.REST OF EUROPE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 52.REST OF EUROPE ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 53.ASIA-PACIFIC ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 54.ASIA-PACIFIC ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 55.ASIA-PACIFIC ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 56.ASIA-PACIFIC ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY COUNTRY, 2020-2030 ($MILLION)

TABLE 57.JAPAN ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 58.JAPAN ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 59.JAPAN ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 60.CHINA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 61.CHINA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 62.CHINA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 63.AUSTRALIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 64.AUSTRALIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 65.AUSTRALIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 66.INDIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 67.INDIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 68.INDIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 69.SOUTH KOREA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 70.SOUTH KOREA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 71.SOUTH KOREA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 72.REST OF ASIA-PACIFIC ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 73.REST OF ASIA-PACIFIC ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 74.REST OF ASIA-PACIFIC ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 75.LAMEA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 76.LAMEA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 77.LAMEA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 78.LAMEA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY COUNTRY, 2020-2030 ($MILLION)

TABLE 79.BRAZIL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 80.BRAZIL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 81.BRAZIL ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 82.SAUDI ARABIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 83.SAUDI ARABIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 84.SAUDI ARABIA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 85.SOUTH AFRICA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 86.SOUTH AFRICA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 87.SOUTH AFRICA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 88.REST OF LAMEA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT TYPE, 2020-2030 ($MILLION)

TABLE 89.REST OF LAMEA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD TYPE, 2020-2030 ($MILLION)

TABLE 90.REST OF LAMEA ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 91.ACCELERATE: COMPANY SNAPSHOT

TABLE 92.ACCELERATE: OPERATING SEGMENT

TABLE 93.ACCELERATE: PRODUCT PORTFOLIO

TABLE 94.ACCELERATE: KEY DEVELOPMENTS

TABLE 95.BD: COMPANY SNAPSHOT

TABLE 96.BD: OPERATING SEGMENTS

TABLE 97.BD: PRODUCT PORTFOLIO

TABLE 98.BD: KEY DEVELOPMENTS

TABLE 99.BIORAD: COMPANY SNAPSHOT

TABLE 100.BIORAD: OPERATING SEGMENTS

TABLE 101.BIORAD: PRODUCT PORTFOLIO

TABLE 102.BRUKER: SNAPSHOT

TABLE 103.BRUKER: OPERATING SEGMENTS

TABLE 104.BRUKER: PRODUCT PORTFOLIO

TABLE 105.COMPAGNIE: COMPANY SNAPSHOT

TABLE 106.COMPAGNIE: OPERATING SEGMENT

TABLE 107.COMPAGNIE: PRODUCT PORTFOLIO

TABLE 108.COMPAGNIE: KEY DEVELOPMENTS

TABLE 109.DANAHER: COMPANY SNAPSHOT

TABLE 110.DANAHER: PRODUCT SEGMENTS

TABLE 111.DANAHER: PRODUCT PORTFOLIO

TABLE 112.DANAHER: KEY DEVELOPMENTS

TABLE 113.ROCHE: COMPANY SNAPSHOT

TABLE 114.ROCHE: PRODUCT SEGMENTS

TABLE 115.ROCHE: PRODUCT PORTFOLIO

TABLE 116.ROCHE: KEY DEVELOPMENTS

TABLE 117.HIMEDIA: COMPANY SNAPSHOT

TABLE 118.HIMEDIA: OPERATING SEGMENTS

TABLE 119.HIMEDIA: PRODUCT PORTFOLIO

TABLE 120.MERCK: COMPANY SNAPSHOT

TABLE 121.MERCK: OPERATING SEGMENTS

TABLE 122.MERCK: PRODUCT PORTFOLIO

TABLE 123.THERMO FISHER: COMPANY SNAPSHOT

TABLE 124.THERMO FISHER: OPERATING SEGMENTS

TABLE 125.THERMO FISHER: PRODUCT PORTFOLIO

TABLE 126.THERMOFISHER: KEY DEVELOPMENTS

LIST OF FIGURES

FIGURE 01.ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET SEGMENTATION

FIGURE 02.TOP INVESTMENT POCKETS

FIGURE 03.TOP WINNING STRATEGIES, BY YEAR, 2018–2020

FIGURE 04.TOP WINNING STRATEGIES, BY DEVELOPMENT, 2018–2020

FIGURE 05.TOP WINNING STRATEGIES, BY COMPANY, 2018–2020

FIGURE 06.HIGH BARGAINING POWER OF SUPPLIERS

FIGURE 07.MODERATE BARGAINING POWER OF BUYERS

FIGURE 08.MODERATE THREAT OF SUBSTITUTES

FIGURE 09.HIGH THREAT OF NEW ENTRANTS

FIGURE 10.HIGH INTENSITY OF RIVALRY

FIGURE 11.TOP PLAYER POSITIONING, 2020

FIGURE 12.IMPACT ANALYSIS

FIGURE 13.COMPARATIVE ANALYSIS OF MANUAL PRODUCTS MARKET, BY COUNTRY, 2020-2030 (%)

FIGURE 14.COMPARATIVE ANALYSIS OF ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR AUTOMATED PRODUCTS, BY COUNTRY, 2020-2030 (%)

FIGURE 15.COMPARATIVE ANALYSIS OF ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR CONSUMABLES, BY COUNTRY, 2020-2030 (%)

FIGURE 16.COMPARATIVE ANALYSIS OF ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR ETEST, BY COUNTRY, 2020-2030 (%)

FIGURE 17.COMPARATIVE ANALYSIS OF ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR DISK DIFFUSION, BY COUNTRY, 2020-2030 (%)

FIGURE 18.COMPARATIVE ANALYSIS OF ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR RAPID AUTOMATION METHOD, BY COUNTRY, 2020-2030 (%)

FIGURE 19.COMPARATIVE ANALYSIS OF ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR OTHERS, BY COUNTRY, 2020-2030 (%)

FIGURE 20.COMPARATIVE ANALYSIS OF ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2020-2030 (%)

FIGURE 21.COMPARATIVE ANALYSIS OF ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2020-2030 (%)

FIGURE 22.COMPARATIVE ANALYSIS OF ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR OTHERS, BY COUNTRY, 2020-2030 (%)

FIGURE 23.ACCELERATE: NET SALES, 2018–2020 ($MILLION)

FIGURE 24.ACCELERATE: REVENUE SHARE BY REGION, 2020(%)

FIGURE 25.BD: NET SALES, 2018–2020 ($MILLION)

FIGURE 26.BD: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 27.BD: REVENUE SHARE BY REGION, 2020(%)

FIGURE 28.BIORAD: NET SALES, 2018–2020 ($MILLION)

FIGURE 29.BIORAD: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 30.BIORAD: REVENUE SHARE BY REGION, 2020(%)

FIGURE 31.BRUKER: NET SALES, 2018–2020 ($MILLION)

FIGURE 32.BRUKER: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 33.BRUKER: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 34.DANAHER: NET SALES, 2018–2020 ($MILLION)

FIGURE 35.DANAHER: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 36.DANAHER: REVENUE SHARE BY REGION, 2020(%)

FIGURE 37.ROCHE: NET SALES, 2018–2020 ($MILLION)

FIGURE 38.ROCHE: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 39.ROCHE: REVENUE SHARE BY REGION, 2020(%)

FIGURE 40.MERCK: NET SALES, 2018–2020 ($MILLION)

FIGURE 41.MERCK: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 42.MERCK: REVENUE SHARE BY REGION, 2020(%)

FIGURE 43.THERMO FISHER: NET SALES, 2018–2020 ($MILLION)

FIGURE 44.THERMO FISHER: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 45.THERMO FISHER: REVENUE SHARE BY REGION, 2020(%)

$6168

$6929

$10663

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS