The global electrophysiology market size was valued at US$ 6499.7 million in 2020 and is projected to reach US$ 22651.4 million by 2030 registering a CAGR of 14.4% from 2021 to 2030. Key drivers of the electrophysiology market include the increasing incidences of cardiac arrhythmia cases driving the need for diagnostic catheters, ablation procedures.

The Asia-Pacific electrophysiology market was valued at $1,522.2 million in 2020, and is projected to reach $5,640.2 million by 2030, registering a CAGR of 15.1%. Japan was the highest revenue contributor with $684.1 million in 2020, and is estimated to reach $2,538.1 Million by 2030, registering a CAGR of 15.1% . India is estimated to reach $710.7 million by 2030, at a significant CAGR of 15.9%. Japan and China collectively accounted for around 68.8% share in 2020, with the former constituting around 44.9% share. India and Australia are expected to witness considerable CAGRs of 15.9% and 15.3%, respectively, during the forecast period. The cumulative share of these two regions was 24.7% in 2020, and is anticipated to reach 25.8% by 2030.

Further, the increasing geriatric population and increasing cases of chronic diseases will propel the growth of the electrophysiology market in the coming years. Moreover, the rise in healthcare expenditure and technological innovations in the pharmaceutical and medical sectors will augment the growth of the market during the forecast period.

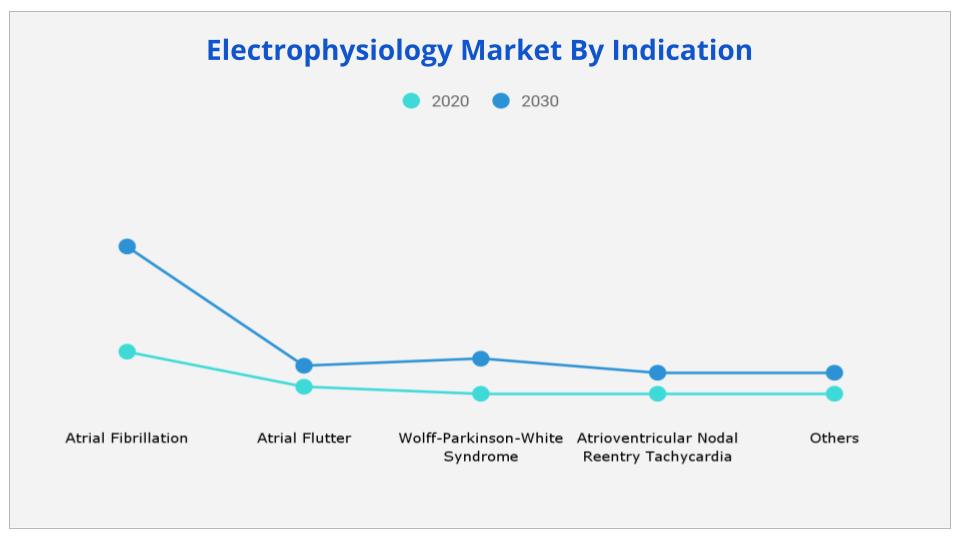

Atrial fibrillation or atrial flutter is the most common type of cardiac arrhythmia. An arrhythmia occurs when the heart beats too fast, slow, or in an irregular way. This necessitates the need for electrophysiology devices such as diagnostic catheters, cardiac ablation procedures which help in the treatment process. Thus the growing cases of cardiac arrhythmia, atrial flutter, and other heart diseases are creating demand for these devices thereby driving the growth of the electrophysiology market during the forecast period.

The elderly population is exposed to a variety of cardiovascular diseases due to advanced aging factors. Also, the number of people suffering from chronic diseases such as obesity, diabetes, and high blood pressure has increased exponentially across the globe. The risks related to the heart rise immensely due to these additional factors. Hence need for early diagnosis is a must for preventing any fatal health problems. Thus the growing elderly population and the rise in chronic diseases have contributed to the need for electrophysiology devices thereby creating lucrative opportunities for the growth of the electrophysiology market in the coming years.

Healthcare expenditure is growing due to the increasing focus of government authorities on effective diagnosis and treatment of disease. There are various technological developments taking place in the medical sector for efficient diagnosis of heart health. For instance leadless pacemakers, electro mapping systems, and ablation catheters to map and treat atrial fibrillation cases. Further, the easy regulatory process and quick approvals by FDA to key market players has intensified the market for electrophysiology devices. Thus growing healthcare expenditure and increasing technological advancements in the medical and pharma sector will drive the growth of the electrophysiology market during the forecast period.

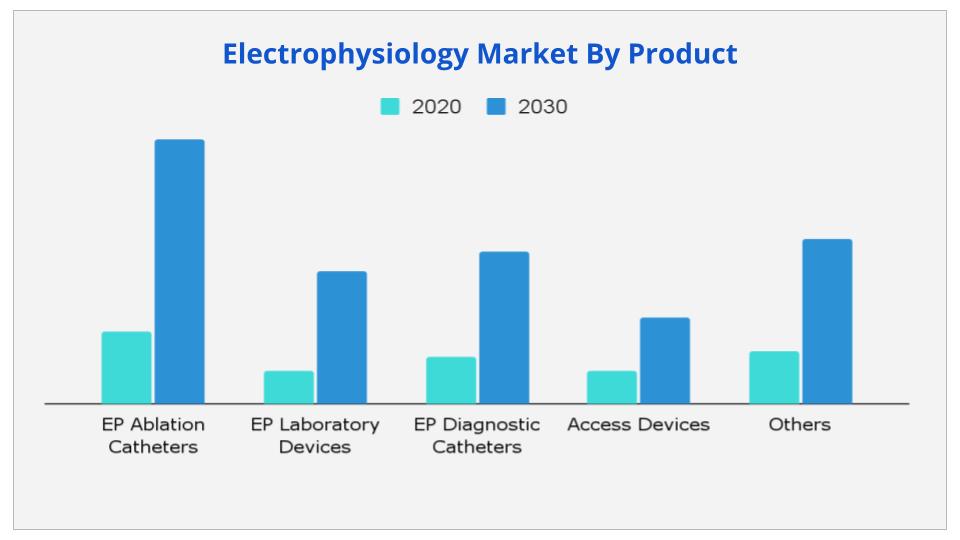

Based on the product, the EP ablation catheters are expected to provide lucrative opportunities for growth in the electrophysiology market share during the forecast period due to technological advancements in ablation catheters and widespread use of ablation procedures.

Based on indication, the atrial fibrillation market is expected to provide lucrative opportunities for growth in the electrophysiology market share due to increasing incidences of atrial fibrillation and the huge aging population.

Based on end-users, the hospitals and cardiac centers are expected to provide lucrative opportunities for growth in the electrophysiology market share due to expanding healthcare infrastructure by governments and private hospitals. However, the ambulatory surgical center segment is expected to grow the fastest due to rapid technological advancements.

Based on region, North America is expected to provide lucrative opportunities for growth in the electrophysiology market share due to the presence of key players and an increasing number of devices along with ablation procedures. On the other hand, Asia- Pacific will grow at the highest CAGR of 15.1% due to growing heart diseases, increasing expenditure, and huge technology advancements.

|

Report Metric |

Details |

|

Base Year: |

2020 |

|

Market Size in 2020: |

USD 6,499.7 Million |

|

Forecast Period: |

2021 to 2030 |

|

Forecast Period 2021 to 2030 CAGR: |

14.4% |

|

2030 Value Projection: |

USD 22,651.4 Million |

|

Largest Market |

North America |

|

No. of Pages: |

270 |

|

Tables & Figures |

126 |

|

Charts |

66 |

|

Segments covered: |

By Product, Indication, and End User, Region |

Ans. Global Electrophysiology market size is estimated to grow at a CAGR of 14.4% over the forecast timeframe and reach a market value of around USD 22,651.4 million by 2030.

Ans. The market value of Electrophysiology in 2020 was 6,499.7 million in 2020.

Ans. The top companies that hold the market share in electrophysiology Market are include Abbott Laboratories, Biotronik SE & Co. KG, Boston Scientific Corporation, CardioFocus, Inc., GE Healthcare, Koninklijke Philips N.V., Johnson & Johnson, Inc., Medtronic Plc., MicroPort Scientific Corporation, and Siemens Healthineers AG.

Ans. The forecast period in the electrophysiology market report is from 2021 to 2030

Ans. Key drivers of the electrophysiology market include the increasing incidences of cardiac arrhythmia cases driving the need for diagnostic catheters, ablation procedures.

Ans. North America is expected to provide lucrative opportunities for growth in the electrophysiology market share due to the presence of key players and an increasing number of devices along with ablation procedures.

CHAPTER 1:INTRODUCTION

1.1.Report description

1.2.Key benefits for stakeholders

1.3.Key market segments

1.4.Research methodology

1.4.1.Secondary research

1.4.2.Primary research

1.4.3.Analyst tools and models

CHAPTER 2:EXECUTIVE SUMMARY

2.1.Key findings of the study

2.2.CXO perspective

CHAPTER 3:MARKET LANDSCAPE

3.1.Market definition and scope

3.2.Key findings

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.4.Top player positioning, 2020

3.5.Market dynamics

3.5.1.Drivers

3.5.1.1.Increase in prevalence of cardiac arrhythmia

3.5.1.2.Increase in demand for minimally invasive procedures

3.5.1.3.Advancements in technology in the field of electrophysiology

3.5.1.4.Increase in number of approvals for electrophysiology devices

3.5.2.Restraint

3.5.2.1.High cost of electrophysiological devices

3.5.3.Opportunities

3.5.3.1.Increase in number of key players to manufacture advanced electrophysiology devices

3.5.3.2.Lucrative opportunities in emerging market

3.5.4.Impact analysis

3.6.Impact analysis of COVID-19 on the electrophysiology market

CHAPTER 4:ELECTROPHYSIOLOGY MARKET, BY PRODUCT

4.1.Overview

4.1.1.Market size and forecast

4.2.EP ablation catheters

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.EP Ablation Catheters, by type

4.2.2.1.Market size and forecast

4.2.2.2.Cryoablation EP catheters

4.2.2.2.1.Market size and forecast

4.2.2.3.Radiofrequency ablation catheters

4.2.2.3.1.Market size and forecast

4.2.2.3.1.1.Market size and forecast

4.2.2.3.2.Irrigated-tip radiofrequency ablation catheters

4.2.2.3.2.1.Market size and forecast

4.2.2.3.3.Conventional radiofrequency ablation catheters

4.2.2.3.3.1.Market size and forecast

4.2.2.4.Microwave ablation systems

4.2.2.4.1.Market size and forecast

4.2.2.5.Laser ablation systems

4.2.2.5.1.Market size and forecast

4.2.2.6.Navigational advanced mapping accessories

4.2.2.6.1.Market size and forecast

4.2.3.Market size and forecast, by region

4.2.4.Market analysis, by country

4.3.EP laboratory devices

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.EP laboratory devices, by type

4.3.2.1.Market size and forecast

4.3.2.2.EP X-Ray systems

4.3.2.2.1.Market size and forecast

4.3.2.3.3D mapping systems

4.3.2.3.1.Market size and forecast

4.3.2.4.EP recording systems

4.3.2.4.1.Market size and forecast

4.3.2.5.EP remote steering systems

4.3.2.5.1.Market size and forecast

4.3.2.6.Others

4.3.2.6.1.Market size and forecast

4.3.3.Market size and forecast, by region

4.3.4.Market analysis, by country

4.4.EP diagnostic catheters

4.4.1.Key market trends, growth factors, and opportunities

4.4.2.EP Diagnostic Catheters, by type

4.4.2.1.Market size and forecast

4.4.2.2.Conventional EP diagnostic catheters

4.4.2.2.1.Market size and forecast

4.4.2.2.2.Steerable diagnostic catheters

4.4.2.2.2.1.Market size and forecast

4.4.2.2.3.Fixed diagnostic catheters

4.4.2.2.3.1.Market size and forecast

4.4.2.3.Advanced EP diagnostic catheters

4.4.2.3.1.Market size and forecast

4.4.2.4.Ultrasound EP diagnostic catheters

4.4.2.4.1.Market size and forecast

4.4.3.Market size and forecast, by region

4.4.4.Market analysis, by country

4.5.Access devices

4.5.1.Key market trends, growth factors, and opportunities

4.5.2.Market size and forecast, by region

4.5.3.Market analysis, by country

4.6.Others

4.6.1.Key market trends, growth factors, and opportunities

4.6.2.Market size and forecast, by region

4.6.3.Market analysis, by country

CHAPTER 5:ELECTROPHYSIOLOGY MARKET, BY INDICATION

5.1.Overview

5.1.1.Market size and forecast

5.2.Atrial fibrillation (AF)

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region

5.2.3.Market analysis, by country

5.3.Atrial flutter

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region

5.3.3.Market analysis, by country

5.4.Wolff-Parkinson-White Syndrome (WPW)

5.4.1.Key market trends, growth factors, and opportunities

5.4.2.Market size and forecast, by region

5.4.3.Market analysis, by country

5.5.Atrioventricular Nodal Reentry Tachycardia (AVNRT)

5.5.1.Key market trends, growth factors, and opportunities

5.5.2.Market size and forecast, by region

5.5.3.Market analysis, by country

5.6.Others

5.6.1.Key market trends, growth factors, and opportunities

5.6.2.Market size and forecast, by region

5.6.3.Market analysis, by country

CHAPTER 6:ELECTROPHYSIOLOGY MARKET, BY END USER

6.1.Overview

6.1.1.Market size and forecast

6.2.Hospitals & cardiac centers

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by region

6.2.3.Market analysis, by country

6.3.Ambulatory surgery centers

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by region

6.3.3.Market analysis, by country

6.4.Others

6.4.1.Key market trends, growth factors, and opportunities

6.4.2.Market size and forecast, by region

6.4.3.Market analysis, by country

CHAPTER 7:ELECTROPHYSIOLOGY MARKET, BY REGION

7.1.Overview

7.1.1.Market size and forecast

7.2.North America

7.2.1.Key market trends, growth factors, and opportunities

7.2.2.North America electrophysiology market, by product

7.2.3.North America electrophysiology market, by indication

7.2.4.North America electrophysiology market, by end user

7.2.5.Market size and forecast, by country

7.2.5.1.U.S.

7.2.5.1.1.U.S. electrophysiology market, by product

7.2.5.1.2.U.S. electrophysiology market, by indication

7.2.5.1.3.U.S. electrophysiology market, by end user

7.2.5.2.Canada

7.2.5.2.1.Canada electrophysiology market, by product

7.2.5.2.2.Canada electrophysiology market, by indication

7.2.5.2.3.Canada electrophysiology market, by end user

7.2.5.3.Mexico

7.2.5.3.1.Mexico electrophysiology market, by product

7.2.5.3.2.Mexico electrophysiology market, by indication

7.2.5.3.3.Mexico electrophysiology market, by end user

7.3.Europe

7.3.1.Key market trends, growth factors, and opportunities

7.3.2.Europe electrophysiology market, by product

7.3.3.Europe electrophysiology market, by indication

7.3.4.Europe electrophysiology market, by end user

7.3.5.Market size and forecast, by country

7.3.5.1.Germany

7.3.5.1.1.Germany electrophysiology market, by product

7.3.5.1.2.Germany electrophysiology market, by indication

7.3.5.1.3.Germany electrophysiology market, by end user

7.3.5.2.France

7.3.5.2.1.France electrophysiology market, by product

7.3.5.2.2.France electrophysiology market, by indication

7.3.5.2.3.France electrophysiology market, by end user

7.3.5.3.UK

7.3.5.3.1.UK electrophysiology market, by product

7.3.5.3.2.UK electrophysiology market, by indication

7.3.5.3.3.UK electrophysiology market, by end user

7.3.5.4.Italy

7.3.5.4.1.Italy electrophysiology market, by product

7.3.5.4.2.Italy electrophysiology market, by indication

7.3.5.4.3.Italy electrophysiology market, by end user

7.3.5.5.Rest of Europe

7.3.5.5.1.Rest of Europe electrophysiology market, by product

7.3.5.5.2.Rest of Europe electrophysiology market, by indication

7.3.5.5.3.Rest of Europe electrophysiology market, by end user

7.4.Asia-Pacific

7.4.1.Key market trends, growth factors, and opportunities

7.4.2.Asia-Pacific electrophysiology market, by product

7.4.3.Asia-Pacific electrophysiology market, by indication

7.4.4.Asia-Pacific electrophysiology market, by end user

7.4.5.Market size and forecast, by country

7.4.5.1.Japan

7.4.5.1.1.Japan electrophysiology market, by product

7.4.5.1.2.Japan electrophysiology market, by indication

7.4.5.1.3.Japan electrophysiology market, by end user

7.4.5.2.China

7.4.5.2.1.China electrophysiology market, by product

7.4.5.2.2.China electrophysiology market, by indication

7.4.5.2.3.China electrophysiology market, by end user

7.4.5.3.Australia

7.4.5.3.1.Australia electrophysiology market, by product

7.4.5.3.2.Australia electrophysiology market, by indication

7.4.5.3.3.Australia electrophysiology market, by end user

7.4.5.4.India

7.4.5.4.1.India electrophysiology market, by product

7.4.5.4.2.India electrophysiology market, by indication

7.4.5.4.3.India electrophysiology market, by end user

7.4.5.5.Rest of Asia-Pacific

7.4.5.5.1.Rest of Asia-Pacific electrophysiology market, by product

7.4.5.5.2.Rest of Asia-Pacific electrophysiology market, by indication

7.4.5.5.3.Rest of Asia-Pacific electrophysiology market, by end user

7.5.LAMEA

7.5.1.Key market trends, growth factors, and opportunities

7.5.2.LAMEA electrophysiology market, by product

7.5.3.LAMEA electrophysiology market, by indication

7.5.4.LAMEA electrophysiology market, by end user

7.5.5.Market size and forecast, by country

7.5.5.1.Brazil

7.5.5.1.1.Brazil electrophysiology market, by product

7.5.5.1.2.Brazil electrophysiology market, by indication

7.5.5.1.3.Brazil electrophysiology market, by end user

7.5.5.2.Saudi Arabia

7.5.5.2.1.Saudi Arabia electrophysiology market, by product

7.5.5.2.2.Saudi Arabia electrophysiology market, by indication

7.5.5.2.3.Saudi Arabia electrophysiology market, by end user

7.5.5.3.South Africa

7.5.5.3.1.South Africa electrophysiology market, by product

7.5.5.3.2.South Africa electrophysiology market, by indication

7.5.5.3.3.South Africa electrophysiology market, by end user

7.5.5.4.Rest of LAMEA

7.5.5.4.1.Rest of LAMEA electrophysiology market, by product

7.5.5.4.2.Rest of LAMEA electrophysiology market, by indication

7.5.5.4.3.Rest of LAMEA electrophysiology market, by end user

CHAPTER 8:COMPANY PROFILES

8.1.ABBOTT LABORATORIES

8.1.1.Company overview

8.1.2.Company snapshot

8.1.3.Operating business segments

8.1.4.Product portfolio

8.1.5.Business performance

8.1.6.Key strategic moves and developments

8.2.Biotronik SE & Co. KG

8.2.1.Company overview

8.2.2.Company snapshot

8.2.3.Operating business segments

8.2.4.Product portfolio

8.2.5.Key strategic moves and developments

8.3.BOSTON SCIENTIFIC CORPORATION

8.3.1.Company overview

8.3.2.Company snapshot

8.3.3.Operating business segments

8.3.4.Product portfolio

8.3.5.Business performance

8.3.6.Key strategic moves and developments

8.4.CardioFocus, Inc.

8.4.1.Company overview

8.4.2.Company snapshot

8.4.3.Operating business segments

8.4.4.Product portfolio

8.4.5.Key strategic moves and developments

8.5.GE Healthcare

8.5.1.Company overview

8.5.2.Company snapshot

8.5.3.Operating business segments

8.5.4.Product portfolio

8.5.5.Business performance

8.6.Koninklijke Philips N.V.

8.6.1.Company overview

8.6.2.Company snapshot

8.6.3.Operating business segments

8.6.4.Product portfolio

8.6.5.Business performance

8.6.6.Key strategic moves and developments

8.7.Johnson & Johnson Services, Inc.

8.7.1.Company overview

8.7.2.Company snapshot

8.7.3.Operating business segments

8.7.4.Product portfolio

8.7.5.Business performance

8.8.Medtronic plc. (Zephyr Technology Corporation)

8.8.1.Company overview

8.8.2.Company snapshot

8.8.3.Operating business segments

8.8.4.Product portfolio

8.8.5.Business performance

8.8.6.Key strategic moves and developments

8.9.MICROPORT SCIENTIFIC CORPORATION

8.9.1.Company overview

8.9.2.Company snapshot

8.9.3.Operating business segments

8.9.4.Product portfolio

8.9.5.Business performance

8.9.6.Key strategic moves and developments

8.10.Siemens Healthineers AG

8.10.1.Company overview

8.10.2.Company snapshot

8.10.3.Operating business segments

8.10.4.Product portfolio

8.10.5.Business performance

Table 01.Electrophysiology Market, By Product, 2020–2030 ($Million)

Table 02.Ep Ablation Catheters Market, By Type, 2020–2030 ($Million)

Table 03.Radiofrequency Ablation Catheters Market, By Type, 2020–2030 ($Million)

Table 04.Ep Ablation Catheters Electrophysiology Market, By Region, 2020–2030 ($Million)

Table 05.Ep Laboratory Devices Market, By Type, 2020–2030 ($Million)

Table 06.Ep Laboratory Devices Electrophysiology Market, By Region, 2020–2030 ($Million)

Table 07.Ep Diagnostic Catheters Market, By Type, 2020–2030 ($Million)

Table 08.Conventional Ep Diagnostic Catheters Market, By Type, 2020–2030 ($Million)

Table 09.Ep Diagnostic Catheters Electrophysiology Market, By Region, 2020–2030 ($Million)

Table 10.Access Devices Electrophysiology Market, By Region, 2020–2030 ($Million)

Table 11.Others Electrophysiology Market, By Region, 2020–2030 ($Million)

Table 12.Electrophysiology Market, By Indication, 2020–2030 ($Million)

Table 13.Electrophysiology Market For Atrial Fibrillation (Af), By Region, 2020–2030 ($Million)

Table 14.Electrophysiology Market For Atrial Flutter, By Region, 2020–2030 ($Million)

Table 15.Electrophysiologymarket For Wolff-Parkinson-White Syndrome (Wpw) , By Region, 2020–2030 ($Million)

Table 16.Electrophysiologymarket For Atrioventricular Nodal Reentry Tachycardia (Avnrt) , By Region, 2020–2030 ($Million)

Table 17.Electrophysiologymarket For Others, By Region, 2020–2030 ($Million)

Table 18.Electrophysiology Market, By End User, 2020–2030 ($Million)

Table 19.Electrophysiology Market For Hospitals & Cardiac Centers, By Region, 2020–2030 ($Million)

Table 20.Electrophysiology Market For Ambulatory Surgery Centers, By Region, 2020–2030 ($Million)

Table 21.Electrophysiology Market For Others, By Region, 2020–2030 ($Million)

Table 22.Electrophysiology Market, By Region, 2020–2030 ($Million)

Table 23.North America Electrophysiology Market, By Product, 2020–2030 ($Million)

Table 24.North America Electrophysiology Market, By Indication, 2020–2030 ($Million)

Table 25.North America Electrophysiology Market, By End User, 2020–2030 ($Million)

Table 26.North America Electrophysiology Market, By Country, 2020–2030 ($Million)

Table 27.U.S. Electrophysiology Market, By Product, 2020–2030 ($Million)

Table 28.U.S. Electrophysiology Market, By Indication, 2020–2030 ($Million)

Table 29.U.S. Electrophysiology Market, By End User, 2020–2030 ($Million)

Table 30.Canada Electrophysiology Market, By Product, 2020–2030 ($Million)

Table 31.Canada Electrophysiology Market, By Indication, 2020–2030 ($Million)

Table 32.Canada Electrophysiology Market, By End User, 2020–2030 ($Million)

Table 33.Mexico Electrophysiology Market, By Product, 2020–2030 ($Million)

Table 34.Mexico Electrophysiology Market, By Indication, 2020–2030 ($Million)

Table 35.Mexico Electrophysiology Market, By End User, 2020–2030 ($Million)

Table 36.Europe Electrophysiology Market, By Product, 2020–2030 ($Million)

Table 37.Europe Electrophysiology Market, By Indication, 2020–2030 ($Million)

Table 38.Europe Electrophysiology Market, By End User, 2020–2030 ($Million)

Table 39.Europe Electrophysiology Market, By Country, 2020–2030 ($Million)

Table 40.Germany Electrophysiology Market, By Product, 2020–2030 ($Million)

Table 41.Germany Electrophysiology Market, By Indication, 2020–2030 ($Million)

Table 42.Germany Electrophysiology Market, By End User, 2020–2030 ($Million)

Table 43.France Electrophysiology Market, By Product, 2020–2030 ($Million)

Table 44.France Electrophysiology Market, By Indication, 2020–2030 ($Million)

Table 45.France Electrophysiology Market, By End User, 2020–2030 ($Million)

Table 46.Uk Electrophysiology Market, By Product, 2020–2030 ($Million)

Table 47.Uk Electrophysiology Market, By Indication, 2020–2030 ($Million)

Table 48.Uk Electrophysiology Market, By End User, 2020–2030 ($Million)

Table 49.Italy Electrophysiology Market, By Product, 2020–2030 ($Million)

Table 50.Italy Electrophysiology Market, By Indication, 2020–2030 ($Million)

Table 51.Italy Electrophysiology Market, By End User, 2020–2030 ($Million)

Table 52.Rest Of Europe Electrophysiology Market, By Product, 2020–2030 ($Million)

Table 53.Rest Of Europe Electrophysiology Market, By Indication, 2020–2030 ($Million)

Table 54.Rest Of Europe Electrophysiology Market, By End User, 2020–2030 ($Million)

Table 55.Asia-Pacific Electrophysiology Market, By Product, 2020–2030 ($Million)

Table 56.Asia-Pacific Electrophysiology Market, By Indication, 2020–2030 ($Million)

Table 57.Asia-Pacific Electrophysiology Market, By End User, 2020–2030 ($Million)

Table 58.Asia-Pacific Electrophysiology Market, By Country, 2020–2030 ($Million)

Table 59.Japan Electrophysiology Market, By Product, 2020–2030 ($Million)

Table 60.Japan Electrophysiology Market, By Indication, 2020–2030 ($Million)

Table 61.Japan Electrophysiology Market, By End User, 2020–2030 ($Million)

Table 62.China Electrophysiology Market, By Product, 2020–2030 ($Million)

Table 63.China Electrophysiology Market, By Indication, 2020–2030 ($Million)

Table 64.China Electrophysiology Market, By End User, 2020–2030 ($Million)

Table 65.Australia Electrophysiology Market, By Product, 2020–2030 ($Million)

Table 66.Australia Electrophysiology Market, By Indication, 2020–2030 ($Million)

Table 67.Australia Electrophysiology Market, By End User, 2020–2030 ($Million)

Table 68.India Electrophysiology Market, By Product, 2020–2030 ($Million)

Table 69.India Electrophysiology Market, By Indication, 2020–2030 ($Million)

Table 70.India Electrophysiology Market, By End User, 2020–2030 ($Million)

Table 71.Rest Of Asia-Pacific Electrophysiology Market, By Product, 2020–2030 ($Million)

Table 72.Rest Of Asia-Pacific Electrophysiology Market, By Indication, 2020–2030 ($Million)

Table 73.Rest Of Asia-Pacific Electrophysiology Market, By End User, 2020–2030 ($Million)

Table 74.Lamea Electrophysiology Market, By Product, 2020–2030 ($Million)

Table 75.Lamea Electrophysiology Market, By Indication, 2020–2030 ($Million)

Table 76.Lamea Electrophysiology Market, By End User, 2020–2030 ($Million)

Table 77.Lamea Electrophysiology Market, By Country, 2020–2030 ($Million)

Table 78.Brazil Electrophysiology Market, By Product, 2020–2030 ($Million)

Table 79.Brazil Electrophysiology Market, By Indication, 2020–2030 ($Million)

Table 80.Brazil Electrophysiology Market, By End User, 2020–2030 ($Million)

Table 81.Saudi Arabia Electrophysiology Market, By Product, 2020–2030 ($Million)

Table 82.Saudi Arabia Electrophysiology Market, By Indication, 2020–2030 ($Million)

Table 83.Saudi Arabia Electrophysiology Market, By End User, 2020–2030 ($Million)

Table 84.South Africa Electrophysiology Market, By Product, 2020–2030 ($Million)

Table 85.South Africa Electrophysiology Market, By Indication, 2020–2030 ($Million)

Table 86.South Africa Electrophysiology Market, By End User, 2020–2030 ($Million)

Table 87.Rest Of Lamea Electrophysiology Market, By Product, 2020–2030 ($Million)

Table 88.Rest Of Lamea Electrophysiology Market, By Indication, 2020–2030 ($Million)

Table 89.Rest Of Lamea Electrophysiology Market, By End User, 2020–2030 ($Million)

Table 90.Abbott: Company Snapshot

Table 91.Abbott: Operating Segment

Table 92.Abbott: Product Portfolio

Table 93.Abbott: Key Strategic Moves And Developments

Table 94.Biotronik: Company Snapshot

Table 95.Biotronik: Oerating Segment

Table 96.Biotronik: Product Portfolio

Table 97.Biotronik: Key Strategic Moves And Developments

Table 98.Boston Scientific: Company Snapshot

Table 99.Boston Scientific: Oerating Segment

Table 100.Boston Scientific: Product Portfolio

Table 101.Boston Scientific: Key Strategic Moves And Developments

Table 102.Cardiofocus: Company Snapshot

Table 103.Cardiofocus: Oerating Segment

Table 104.Cardiofocus: Product Portfolio

Table 105.Cardiofocus: Key Strategic Moves And Developments

Table 106.Ge Healthcare: Company Snapshot

Table 107.Ge Healthcare: Oerating Segment

Table 108.Ge Healthcare : Product Portfolio

Table 109.Philips: Company Snapshot

Table 110.Philips: Operating Segments

Table 111.Philips: Product Portfolio

Table 112.Philips: Key Strategic Moves And Developments

Table 113.J&J: Company Snapshot

Table 114.J&J: Operating Business Segments

Table 115.J&J: Product Portfolio

Table 116.Medtronic: Company Snapshot

Table 117.Medtronic: Operating Segments

Table 118.Medtronic: Product Portfolio

Table 119.Medtronic: Key Strategic Moves And Developments

Table 120.Microport: Company Snapshot

Table 121.Microport: Oerating Segment

Table 122.Microport: Product Portfolio

Table 123.Microport: Key Strategic Moves And Developments

Table 124.Siemens: Company Snapshot

Table 125.Siemens: Oerating Segment

Table 126.Siemens: Product Portfolio

List Of Figures

Figure 01.Electrophysiology Market Segmentation

Figure 02.Top Investment Pockets

Figure 03.Top Winning Strategies, By Year, 2019–2021

Figure 04.Top Winning Strategies, By Development, 2019–2021

Figure 05.Top Winning Strategies, By Company, 2019–2021

Figure 06.Moderate Bargaining Power Of Suppliers

Figure 07.Moderate Bargaining Power Of Buyers

Figure 08.Moderate Threat Of Substitutes

Figure 09.High Threat Of New Entrants

Figure 10.Moderate Intensity Of Rivalry

Figure 11.Top Player Positioning, 2020

Figure 12.Impact Analysis

Figure 13.Electrophysiology Market For Cryoablation Ep Catheters, 2020–2030 ($Million)

Figure 14.Electrophysiology Market For Radiofrequency Ablation Catheters, 2020–2030 ($Million)

Figure 15.Electrophysiology Market For Irrigated-Tip Radiofrequency Ablation Catheters, 2020–2030 ($Million)

Figure 16.Electrophysiology Market For Conventional Radiofrequency Ablation Catheters, 2020–2030 ($Million)

Figure 17.Electrophysiology Market For Microwave Ablation Systems, 2020–2030 ($Million)

Figure 18.Electrophysiology Market For Laser Ablation Systems, 2020–2030 ($Million)

Figure 19.Electrophysiology Market For Navigational Advanced Mapping Accessories, 2020–2030 ($Million)

Figure 20.Comparative Analysis Of Ep Ablation Catheters Electrophysiology Market, By Country, 2020–2030 (%)

Figure 21.Electrophysiology Market For Ep X-Ray Systems, 2020–2030 ($Million)

Figure 22.Electrophysiology Market For 3d Mapping Systems, 2020–2030 ($Million)

Figure 23.Electrophysiology Market For Ep Recording Systems, 2020–2030 ($Million)

Figure 24.Electrophysiology Market For Ep Remote Steering Systems, 2020–2030 ($Million)

Figure 25.Electrophysiology Market For Others, 2020–2030 ($Million)

Figure 26.Comparative Analysis Of Ep Laboratory Devices Electrophysiology Market, By Country, 2020–2030 (%)

Figure 27.Electrophysiology Market For Conventional Ep Diagnostic Catheter, 2020–2030 ($Million)

Figure 28.Electrophysiology Market For Steerable Diagnostic Catheters, 2020–2030 ($Million)

Figure 29.Electrophysiology Market For Fixed Diagnostic Catheters, 2020–2030 ($Million)

Figure 30.Electrophysiology Market For Advanced Ep Diagnostic Catheters, 2020–2030 ($Million)

Figure 31.Electrophysiology Market For Ultrasound Ep Diagnostic Catheters, 2020–2030 ($Million)

Figure 32.Comparative Analysis Of Ep Diagnostic Catheters Electrophysiology Market, By Country, 2020–2030 (%)

Figure 33.Comparative Analysis Of Electrophysiology Market For Access Devices, By Country, 2020–2030 (%)

Figure 34.Comparative Analysis Of Others Electrophysiology Market, By Country, 2020–2030 (%)

Figure 35.Comparative Analysis Of Electrophysiology Market For Atrial Fibrillation (Af), By Country, 2020–2030 (%)

Figure 36.Comparative Analysis Of Electrophysiology Market For Atrial Flutter, By Country, 2020–2030 (%)

Figure 37.Comparative Analysis Of Electrophysiology Market For Wolff-Parkinson-White Syndrome (Wpw), By Country, 2020–2030 (%)

Figure 38.Comparative Analysis Of Electrophysiology Market For Atrioventricular Nodal Reentry Tachycardia (Avnrt), By Country, 2020–2030 (%)

Figure 39.Comparative Analysis Of Electrophysiology Market For Others, By Country, 2020–2030 (%)

Figure 40.Comparative Analysis Of Electrophysiology Market For Hospitals & Cardiac Centers, By Country, 2020–2030 (%)

Figure 41.Comparative Analysis Of Electrophysiology Market For Ambulatory Surgery Centers, By Country, 2020–2030 (%)

Figure 42.Comparative Analysis Of Electrophysiology Market For Others, By Country, 2020–2030 (%)

Figure 43.Abbott: Net Sales, 2018–2020 ($Million)

Figure 44.Abbott: Revenue Share By Segment, 2020 (%)

Figure 45.Abbott: Revenue Share By Region, 2020 (%)

Figure 46.Boston Scientific: Net Sales, 2018–2020 ($Million)

Figure 47.Boston Scientific: Revenue Share, By Segment, 2020 (%)

Figure 48.Boston Scientific: Revenue Share, By Region, 2020 (%)

Figure 49.Ge Healthcare: Net Sales, 2018–2020 ($Million)

Figure 50.Ge Healthcare: Revenue Share, By Segment, 2020 (%)

Figure 51.Ge Healthcare: Revenue Share, By Region, 2020 (%)

Figure 52.Philips: Net Sales, 2018–2020 ($Million)

Figure 53.Philips: Revenue Share By Segment, 2020 (%)

Figure 54.Philips: Revenue Share By Region, 2020(%)

Figure 55.J&J: Net Sales, 2018–2020 ($Million)

Figure 56.J&J: Revenue Share, By Segment, 2020 (%)

Figure 57.J&J: Revenue Share, By Region, 2020 (%)

Figure 58.Medtronic: Net Sales, 2018–2020 ($Million)

Figure 59.Medtronic: Revenue Share By Segment, 2020 (%)

Figure 60.Medtronic: Revenue Share By Region, 2020 (%)

Figure 61.Microport: Net Sales, 2018–2020 ($Million)

Figure 62.Microport: Revenue Share, By Segment, 2020 (%)

Figure 63.Microport: Revenue Share, By Region, 2019 (%)

Figure 64.Siemens: Net Sales, 2019–2021 ($Million)

Figure 65.Siemens: Revenue Share, By Segment, 2021 (%)

Figure 66.Siemens: Revenue Share, By Region, 2021 (%)

Market Analysis and Insights Global SelfInjections MarketDue to the COVID19 pandemic the global SelfInjections market size is estimated to be worth US million in 2022 and is forecast to a readjusted size of US million by 2028 with a CAGR of during the review period.

Market Analysis and Insights Global Blood Analysis Sampling Tube MarketDue to the COVID19 pandemic the global Blood Analysis Sampling Tube market size is estimated to be worth US million in 2022 and is forecast to a readjusted size of US million by 2028 with a CAGR of during the review period.

Market Analysis and Insights Global Breast Xray Machine MarketDue to the COVID19 pandemic the global Breast Xray Machine market size is estimated to be worth US million in 2022 and is forecast to a readjusted size of US million by 2028 with a CAGR of during the review period.

Market Analysis and Insights Global Disposable Hemostat MarketDue to the COVID19 pandemic the global Disposable Hemostat market size is estimated to be worth US million in 2022 and is forecast to a readjusted size of US million by 2028 with a CAGR of during the review period.