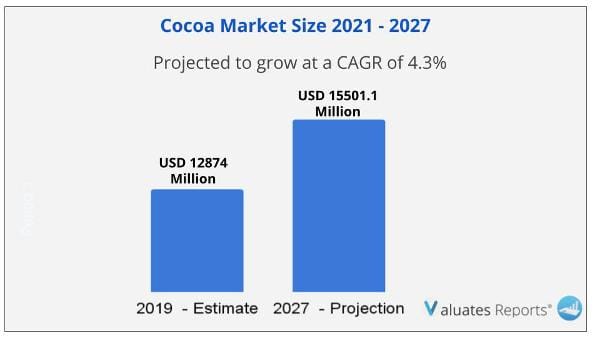

The global cocoa market size was valued at US$ 12874.0 million in 2019 and is projected to reach US$ 15501.1 million by 2027 registering a CAGR of 4.3% from 2021 to 2027. Key drivers of the cocoa market include the growing application of cocoa in a wide variety of industries such as cosmetics, healthcare, pharmaceuticals, food and beverages etc. Other factors contributing to the growth of the cocoa market are increasing chocolate consumption including dark chocolate and usage of different variants of cocoa.

Further growing cases of lifestyle diseases such as high blood pressure, diabetes, cancer, and heart disease have contributed to a shift towards natural food products and cocoa is rich in antioxidants which can help alleviate these health conditions. Hence rising preference for low fat cocoa powder and cocoa from organic sources is fueling the market growth.

Chocolate is the main driver for the growth of the cocoa market. As cocoa is a key ingredient for making chocolates the rising chocolate consumption is driving the growth of the market. Due to growing disposable incomes, the demand for chocolates, bakery and icecreams are rising exponentially over the last few years. Cocoa butter, cocoa powder, and cocoa liquor are being extensively used to meet the rising consumption levels in the food and beverages industry. Moreover, with consumers experimenting with newer variants of chocolates especially dark chocolate the demand for the cocoa market is expected to grow further during the forecast period and will continue to boom in the coming years.

The rising incidences of lifestyle diseases such as high blood pressure, diabetes and heart diseases are prompting consumers to shift to healthy alternatives and become proactive in their choices for food products. As the demand for organic and gluten-free products rises manufacturers are shifting their focus on targeting health-conscious consumers by producing innovative and healthy variants of cocoa with low fat and lesser sugar content. Thus growing lifestyle diseases, an increase in consumer base for avoiding harmful chemicals, and rising product innovations by manufacturers will propel the growth of the market during the forecast period.

Widespread usage of cocoa in a variety of industries

Cocoa as an ingredient finds application in a variety of industries driving the growth of the market. It is used as a key mixture for making chocolates, icecreams, bakeries in the food and beverages industry, in the cosmetics and pharmaceuticals industry as a coloring agent, and also used in making toiletries for the aroma and flavor. Hence the widespread application of cocoa will increase further leading to a huge growth of the cocoa market during the forecast period.

COCOA MARKET SHARE ANALYSIS

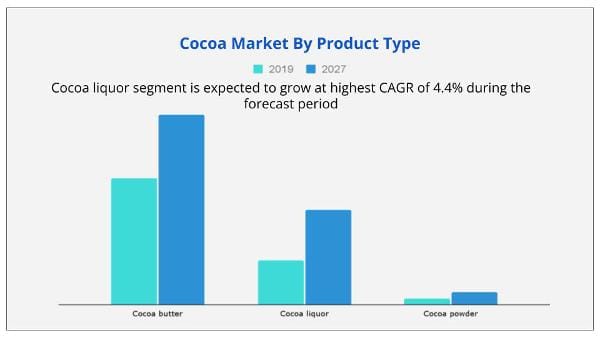

Based on product type, the cocoa liquor segment will provide lucrative opportunities for growth in the cocoa market share as it has contributed US$ 4837.1 million in 2019 and is expected to grow at the highest CAGR of 4.4% during the forecast period.

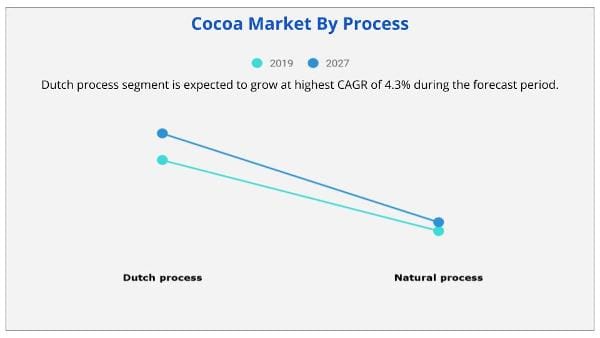

Based on process, Dutch process will provide lucrative opportunities for growth in the cocoa market share and is expected to grow at the highest CAGR of 4.3% during the forecast period due to growing usage of dutch process in cocoa processing for chocolate manufacturing. Further dutch process reduces the bitter taste from cocoa liquor and is interchangeably used with natural processed cocoa by confectionery and bakery industries for adding taste to their food products.

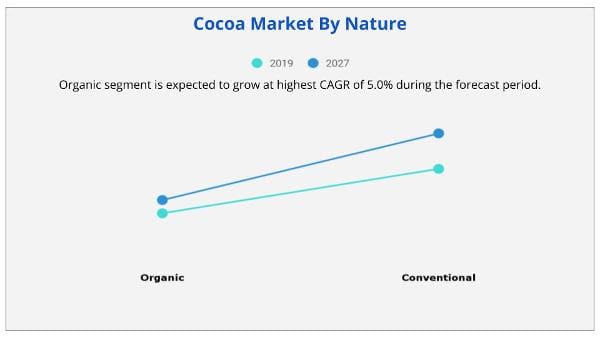

Based on nature, the organic segment will provide lucrative opportunities for growth in the cocoa market share and is expected to grow at the highest CAGR of 5.0% during the forecast period due to growing preference of organic cocoa among health conscious consumers and rising income levels.

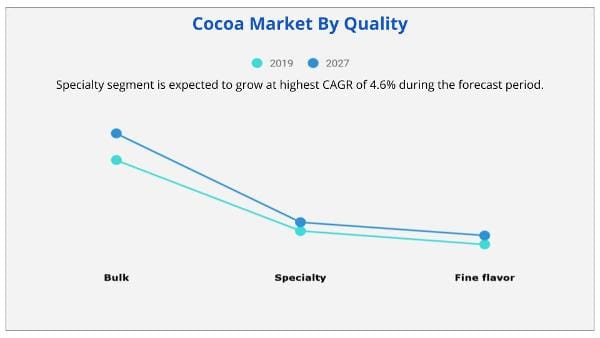

Based on quality, the bulk cocoa segment is expected to provide lucrative opportunities for growth in the cocoa market share as readily available bulk cocoa at cheap prices is the main reason for its huge demand.

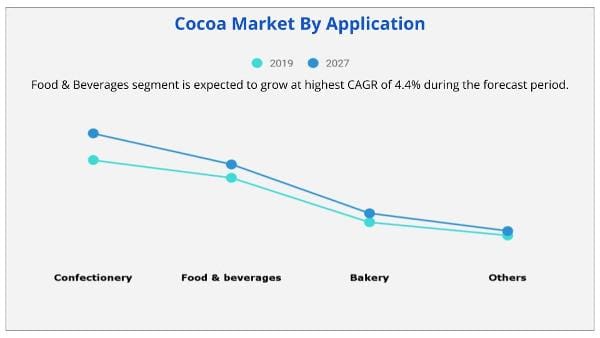

Based on application, the confectionery segment is expected to provide lucrative opportunities for growth in the cocoa market share during the forecast period as a big part of the global cocoa is used by confectionery industry for making chocolate and chocolate related products.

Based on region, Europe is expected to provide lucrative opportunities for growth in the cocoa market share during the forecast period as it is the highest cocoa and chocolate consuming region. Switzerland is the top chocolate consuming country in Europe while Netherlands had the highest imports of cocoa in terms of volume and value in 2019. Furthermore Germany, UK and France are the other top chocolate and cocoa consuming nations.

| Report Metric | Details |

| Report Name | Cocoa Market |

| The market size in 2019 | USD 12874 Million |

| The revenue forecast in 2027 | USD 15501.1Million |

| Growth Rate | Compound Annual Growth Rate (CAGR) of 4.3% from 2021 to 2027 |

| Market size available for years | 2021-2027 |

| Forecast units | Value (USD) |

| Segments covered | Type, End-User, Offerings, and Region |

| Report coverage | Revenue & volume forecast, company share, competitive landscape, growth factors, and trends |

| Geographic regions covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Ans. The global cocoa market size was valued at $12,874.0 million in 2019, and is estimated to reach $15,501.1 million by 2027, registering a CAGR of 4.3% from 2021 to 2027.

Ans. The global cocoa market size is expected to grow at a compound annual growth rate of 4.3% from 2021 to 2027.

Ans. Barry Callebaut Ag, Blommer Chocolate Company, Cargill, Inc., Ciranda, Inc., Guan Chong Cocoa Manufacturer Sdn. Bhd., Olam International Limited, The Hershey Company, Touton S.A., United Cocoa Processor, Inc., Vj Jindal Cocoa Private Limited.

CHAPTER 1:INTRODUCTION

1.1.Research methodology

1.1.1.Secondary research

1.1.2.Primary research

1.1.3.Analyst tools and models

CHAPTER 2:EXECUTIVE SUMMARY

2.1.CXO Perspective

CHAPTER 3:MARKET OVERVIEW

3.1.Market definition and scope

3.2.Top Player Positioning

3.3.Key findings

3.3.1.Top investment pockets

3.4.Porter’s five forces analysis

3.5.Market dynamics

3.5.1.Drivers

3.5.1.1.Growing demand for chocolates across the globe is boosting the cocoa market

3.5.1.2.Europe and Asia-Pacific are driving the cocoa market

3.5.1.3.VSS-compliant production is boosting the demand for the sustainable cocoa

3.5.2.Restraint

3.5.2.1.Availability of substitutes of cocoa may hinder the market growth

3.5.2.2.Dynamic price fluctuations of cocoa beans may hinder the market growth

3.5.3.Opportunities

3.5.3.1.Growing demand for specialty cocoa is offering new opportunities in Europe

3.5.3.2.Storytelling is the trending marketing strategy in the cocoa market

3.6.COVID-19 impact and analysis on cocoa market

3.7.Key Regulations: Impact on market

3.1.Top cocoa producing regions

3.2.Top cocoa importers

3.1.Top cocoa exporters

CHAPTER 4:COCOA MARKET, BY PRODUCT TYPE

4.1.Overview

4.1.1.Market size and forecast

4.2.Cocoa butter

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast

4.3.Cocoa liquor

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Market size and forecast

4.4.Cocoa powder

4.4.1.Key market trends, growth factors, and opportunities

4.4.2.Market size and forecast

CHAPTER 5:COCOA MARKET, BY PROCESS

5.1.Overview

5.1.1.Market size and forecast

5.2.Dutch process

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast

5.3.Natural process

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast

CHAPTER 6:COCOA MARKET, BY NATURE

6.1.Overview

6.1.1.Market size and forecast

6.2.Organic

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast

6.3.Conventional

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast

CHAPTER 7:COCOA MARKET, BY QUALITY

7.1.Overview

7.1.1.Market size and forecast

7.2.Bulk

7.2.1.Key market trends, growth factors, and opportunities

7.2.2.Market size and forecast

7.3.Specialty

7.3.1.Key market trends, growth factors, and opportunities

7.3.2.Market size and forecast

7.4.Fine Flavor

7.4.1.Key market trends, growth factors, and opportunities

7.4.2.Market size and forecast

CHAPTER 8:COCOA MARKET, BY APPLICATION

8.1.Overview

8.1.1.Market size and forecast

8.2.Confectionery

8.2.1.Key market trends, growth factors, and opportunities

8.2.2.Market size and forecast

8.3.Food & Beverages

8.3.1.Key market trends, growth factors, and opportunities

8.3.2.Market size and forecast

8.4.Bakery

8.4.1.Key market trends, growth factors, and opportunities

8.4.2.Market size and forecast

8.5.Others

8.5.1.Key market trends, growth factors, and opportunities

8.5.2.Market size and forecast

CHAPTER 9:COCOA MARKET, BY REGION

9.1.Overview

9.1.1.Market size and forecast, by region

9.2.North America

9.2.1.Key market trends, growth factors, and opportunities

9.2.2.Market size and forecast, by product type

9.2.3.Market size and forecast, by process

9.2.4.Market size and forecast, by nature

9.2.5.Market size and forecast, by quality

9.2.6.Market size and forecast, by application

9.2.7.Market size and forecast, by country

9.2.7.1.U.S.

9.2.7.1.1.Market size and forecast, by product type

9.2.7.1.2.Market size and forecast, by process

9.2.7.1.3.Market size and forecast, by nature

9.2.7.1.4.Market size and forecast, by quality

9.2.7.1.5.Market size and forecast, by application

9.2.7.2.Canada

9.2.7.2.1.Market size and forecast, by product type

9.2.7.2.2.Market size and forecast, by process

9.2.7.2.3.Market size and forecast, by nature

9.2.7.2.4.Market size and forecast, by quality

9.2.7.2.5.Market size and forecast, by application

9.2.7.3.Mexico

9.2.7.3.1.Market size and forecast, by product type

9.2.7.3.2.Market size and forecast, by process

9.2.7.3.3.Market size and forecast, by nature

9.2.7.3.4.Market size and forecast, by quality

9.2.7.3.5.Market size and forecast, by application

9.3.Europe

9.3.1.Key market trends, growth factors, and opportunities

9.3.2.Market size and forecast, by product type

9.3.3.Market size and forecast, by process

9.3.4.Market size and forecast, by nature

9.3.5.Market size and forecast, by quality

9.3.6.Market size and forecast, by application

9.3.7.Market size and forecast, by country

9.3.7.1.The Netherlands

9.3.7.1.1.Market size and forecast, by product type

9.3.7.1.2.Market size and forecast, by process

9.3.7.1.3.Market size and forecast, by nature

9.3.7.1.4.Market size and forecast, by quality

9.3.7.1.5.Market size and forecast, by application

9.3.7.2.German

9.3.7.2.1.Market size and forecast, by product type

9.3.7.2.2.Market size and forecast, by process

9.3.7.2.3.Market size and forecast, by nature

9.3.7.2.4.Market size and forecast, by quality

9.3.7.2.5.Market size and forecast, by application

9.3.7.3.Belgium

9.3.7.3.1.Market size and forecast, by product type

9.3.7.3.2.Market size and forecast, by process

9.3.7.3.3.Market size and forecast, by nature

9.3.7.3.4.Market size and forecast, by quality

9.3.7.3.5.Market size and forecast, by application

9.3.7.4.FRANCE

9.3.7.4.1.Market size and forecast, by product type

9.3.7.4.2.Market size and forecast, by process

9.3.7.4.3.Market size and forecast, by nature

9.3.7.4.4.Market size and forecast, by quality

9.3.7.4.5.Market size and forecast, by application

9.3.7.5.UK

9.3.7.5.1.Market size and forecast, by product type

9.3.7.5.2.Market size and forecast, by process

9.3.7.5.3.Market size and forecast, by nature

9.3.7.5.4.Market size and forecast, by quality

9.3.7.5.5.Market size and forecast, by application

9.3.7.6.Italy

9.3.7.6.1.Market size and forecast, by product type

9.3.7.6.2.Market size and forecast, by process

9.3.7.6.3.Market size and forecast, by nature

9.3.7.6.4.Market size and forecast, by quality

9.3.7.6.5.Market size and forecast, by application

9.3.7.7.SPAIN

9.3.7.7.1.Market size and forecast, by product type

9.3.7.7.2.Market size and forecast, by process

9.3.7.7.3.Market size and forecast, by nature

9.3.7.7.4.Market size and forecast, by quality

9.3.7.7.5.Market size and forecast, by application

9.3.7.8.Switzerland

9.3.7.8.1.Market size and forecast, by product type

9.3.7.8.2.Market size and forecast, by process

9.3.7.8.3.Market size and forecast, by nature

9.3.7.8.4.Market size and forecast, by quality

9.3.7.8.5.Market size and forecast, by application

9.3.7.9.Rest of Europe

9.3.7.9.1.Market size and forecast, by product type

9.3.7.9.2.Market size and forecast, by process

9.3.7.9.3.Market size and forecast, by nature

9.3.7.9.4.Market size and forecast, by quality

9.3.7.9.5.Market size and forecast, by application

9.4.Asia-Pacific

9.4.1.Key market trends, growth factors, and opportunities

9.4.2.Market size and forecast, by product type

9.4.3.Market size and forecast, by process

9.4.4.Market size and forecast, by nature

9.4.5.Market size and forecast, by quality

9.4.6.Market size and forecast, by application

9.4.7.Market size and forecast, by country

9.4.7.1.China

9.4.7.1.1.Market size and forecast, by product type

9.4.7.1.2.Market size and forecast, by process

9.4.7.1.3.Market size and forecast, by nature

9.4.7.1.4.Market size and forecast, by quality

9.4.7.1.5.Market size and forecast, by application

9.4.7.2.Japan

9.4.7.2.1.Market size and forecast, by product type

9.4.7.2.2.Market size and forecast, by process

9.4.7.2.3.Market size and forecast, by nature

9.4.7.2.4.Market size and forecast, by quality

9.4.7.2.5.Market size and forecast, by application

9.4.7.3.India

9.4.7.3.1.Market size and forecast, by product type

9.4.7.3.2.Market size and forecast, by process

9.4.7.3.3.Market size and forecast, by nature

9.4.7.3.4.Market size and forecast, by quality

9.4.7.3.5.Market size and forecast, by application

9.4.7.4.MALAYSIA

9.4.7.4.1.Market size and forecast, by product type

9.4.7.4.2.Market size and forecast, by process

9.4.7.4.3.Market size and forecast, by nature

9.4.7.4.4.Market size and forecast, by quality

9.4.7.4.5.Market size and forecast, by application

9.4.7.5.INDONESIA

9.4.7.5.1.Market size and forecast, by product type

9.4.7.5.2.Market size and forecast, by process

9.4.7.5.3.Market size and forecast, by nature

9.4.7.5.4.Market size and forecast, by quality

9.4.7.5.5.Market size and forecast, by application

9.4.7.6.Singapore

9.4.7.6.1.Market size and forecast, by product type

9.4.7.6.2.Market size and forecast, by process

9.4.7.6.3.Market size and forecast, by nature

9.4.7.6.4.Market size and forecast, by quality

9.4.7.6.5.Market size and forecast, by application

9.4.7.7.REST OF ASIA-PACIFIC

9.4.7.7.1.Market size and forecast, by product type

9.4.7.7.2.Market size and forecast, by process

9.4.7.7.3.Market size and forecast, by nature

9.4.7.7.4.Market size and forecast, by quality

9.4.7.7.5.Market size and forecast, by application

9.5.LAMEA

9.5.1.Key market trends, growth factors, and opportunities

9.5.2.Market size and forecast, by product type

9.5.3.Market size and forecast, by process

9.5.4.Market size and forecast, by nature

9.5.5.Market size and forecast, by quality

9.5.6.Market size and forecast, by application

9.5.7.Market size and forecast, by country

9.5.7.1.Brazil

9.5.7.1.1.Market size and forecast, by product type

9.5.7.1.2.Market size and forecast, by process

9.5.7.1.3.Market size and forecast, by nature

9.5.7.1.4.Market size and forecast, by quality

9.5.7.1.5.Market size and forecast, by application

9.5.7.2.Iran

9.5.7.2.1.Market size and forecast, by product type

9.5.7.2.2.Market size and forecast, by process

9.5.7.2.3.Market size and forecast, by nature

9.5.7.2.4.Market size and forecast, by quality

9.5.7.2.5.Market size and forecast, by application

9.5.7.3.United Arab Emirates

9.5.7.3.1.Market size and forecast, by product type

9.5.7.3.2.Market size and forecast, by process

9.5.7.3.3.Market size and forecast, by nature

9.5.7.3.4.Market size and forecast, by quality

9.5.7.3.5.Market size and forecast, by application

9.5.7.4.REST OF LAMEA

9.5.7.4.1.Market size and forecast, by product type

9.5.7.4.2.Market size and forecast, by process

9.5.7.4.3.Market size and forecast, by nature

9.5.7.4.4.Market size and forecast, by quality

9.5.7.4.5.Market size and forecast, by application

CHAPTER 10:COMPETITION LANDSCAPE

10.1.Top winning strategies

10.2.Product mapping

10.3.Competitive dashboard

10.4.Competitive heatmap

10.5.Key developments

10.5.1.Acquisition

10.5.2.Business Expansion

10.5.3.Partnership

10.5.4.Product launch

CHAPTER 11:COMPANY PROFILES

11.1.BARRY CALLEBAUT AG

11.1.1.Company overview

11.1.2.Key Executives

11.1.3.Company snapshot

11.1.4.Operating business segments

11.1.5.Product portfolio

11.1.6.R&D Expenditure

11.1.7.Business performance

11.1.8.Key strategic moves and developments

11.2.Blommer Chocolate company

11.2.1.Company overview

11.2.2.Key Executives

11.2.3.Company snapshot

11.2.4.Product portfolio

11.3.CARGILL, INC.

11.3.1.Company overview

11.3.2.Key Executives

11.3.3.Company snapshot

11.3.4.Operating business segments

11.3.5.Product portfolio

11.3.6.Business performance

11.3.7.Key strategic moves and developments

11.4.Ciranda, Inc.

11.4.1.Company overview

11.4.2.Key Executives

11.4.3.Company snapshot

11.4.4.Operating business segments

11.4.5.Product portfolio

11.5.GUAN CHONG COCOA MANUFACTURER SDN. BHD.

11.5.1.Company overview

11.5.2.Key Executives

11.5.3.Company snapshot

11.5.4.Operating business segments

11.5.5.Product portfolio

11.5.6.Business performance

11.5.7.Key strategic moves and developments

11.6.OLAM INTERNATIONAL LIMITED

11.6.1.Company overview

11.6.2.Key Executives

11.6.3.Company snapshot

11.6.4.Operating business segments

11.6.5.Product portfolio

11.6.6.Business performance

11.6.7.Key strategic moves and developments

11.7.THE HERSHEY COMPANY

11.7.1.Company overview

11.7.2.Key Executives

11.7.3.Company snapshot

11.7.4.Operating business segments

11.7.5.Product portfolio

11.7.6.R&D Expenditure

11.7.7.Business performance

11.7.8.Key strategic moves and developments

11.8.TOUTON S.A.

11.8.1.Company overview

11.8.2.Key Executives

11.8.3.Company snapshot

11.8.4.Operating business segments

11.8.5.Product portfolio

11.9.United Cocoa Processor, Inc.

11.9.1.Company overview

11.9.2.Key Executives

11.9.3.Company snapshot

11.9.4.Product portfolio

11.10.VJ Jindal Cocoa Private Limited

11.10.1.Company overview

11.10.2.Key Executives

11.10.3.Company snapshot

11.10.4.Product portfolio

LIST OF TABLES

TABLE 01.TOP COCOA PRODUCING REGIONS, BY VOLUME (TONS)

TABLE 02.TOP COCOA IMPORTERS, BY VALUE ($ MILLION)

TABLE 03.TOP COCOA EXPORTERS, BY VALUE ($ MILLION)

TABLE 04.GLOBAL COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 05.COCOA BUTTER MARKET REVENUE, BY REGION, 2019–2027 ($MILLION)

TABLE 06.COCOA LIQUOR MARKET REVENUE, BY REGION, 2019–2027 ($MILLION)

TABLE 07.GLOBAL COCOA POWDER MARKET REVENUE, BY REGION, 2019–2027 ($MILLION)

TABLE 08.GLOBAL COCOA MARKET REVENUE, BY PROCESS 2019–2027 ($MILLION)

TABLE 09.DUTCH PROCESS COCOA MARKET REVENUE, BY REGION, 2019–2027 ($MILLION)

TABLE 10.NATURAL PROCESS COCOA MARKET REVENUE, BY REGION, 2019–2027 ($MILLION)

TABLE 11.GLOBAL COCOA MARKET REVENUE, BY NATURE 2019–2027 ($MILLION)

TABLE 12.ORGANIC COCOA MARKET REVENUE, BY REGION, 2019–2027 ($MILLION)

TABLE 13.CONVENTIONAL COCOA MARKET REVENUE, BY REGION, 2019–2027 ($MILLION)

TABLE 14.GLOBAL COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 15.BULK COCOA MARKET REVENUE, BY REGION, 2019–2027 ($MILLION)

TABLE 16.SPECIALTY COCOA MARKET REVENUE, BY REGION, 2019–2027 ($MILLION)

TABLE 17.FINE FLAVOR COCOA MARKET REVENUE, BY REGION, 2019–2027 ($MILLION)

TABLE 18.GLOBAL COCOA MARKET REVENUE, BY APPLICATION 2019–2027 ($MILLION)

TABLE 19.COCOA MARKET REVENUE FOR CONFECTIONERY, BY REGION, 2019–2027 ($MILLION)

TABLE 20.COCOA MARKET REVENUE FOR FOOD & BEVERAGES, BY REGION, 2019–2027 ($MILLION)

TABLE 21.COCOA MARKET REVENUE FOR BAKERY, BY REGION, 2019–2027 ($MILLION)

TABLE 22.COCOA MARKET REVENUE FOR OTHERS APPLICATION, BY REGION, 2019–2027 ($MILLION)

TABLE 23.COCOA MARKET REVENUE, BY REGION, 2019–2027 ($MILLION)

TABLE 24.NORTH AMERICA COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 25.NORTH AMERICA COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 26.NORTH AMERICA COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 27.NORTH AMERICA COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 28.NORTH AMERICA COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 29.NORTH AMERICA COCOA MARKET REVENUE, BY COUNTRY, 2019–2027 ($MILLION)

TABLE 30.U.S. COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 31.U.S. COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 32.U.S. COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 33.U.S. COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 34.U.S. COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 35.CANADA. COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 36.CANADA COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 37.CANADA COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 38.CANADA COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 39.CANADA COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 40.MEXICO COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 41.MEXICO COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 42.MEXICO COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 43.MEXICO COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 44.MEXICO COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 45.EUROPE COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 46.EUROPE COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 47.EUROPE COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 48.EUROPE COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 49.EUROPE COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 50.EUROPE COCOA MARKET REVENUE, BY COUNTRY, 2019–2027 ($MILLION)

TABLE 51.THE NETHERLANDS COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 52.THE NETHERLANDS COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 53.THE NETHERLANDS COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 54.THE NETHERLANDS COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 55.THE NETHERLANDS COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 56.GERMANY COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 57.GERMANY COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 58.GERMANY COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 59.GERMANY COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 60.GERMANY COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 61.BELGIUM COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 62.BELGIUM COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 63.BELGIUM COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 64.BELGIUM COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 65.BELGIUM COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 66.FRANCE COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 67.FRANCE COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 68.FRANCE COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 69.FRANCE COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 70.FRANCE COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 71.UK. COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 72.UK COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 73.UK COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 74.UK COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 75.UK COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 76.ITALY COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 77.ITALY COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 78.ITALY COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 79.ITALY COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 80.ITALY COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 81.SPAIN COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 82.SPAIN COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 83.SPAIN COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 84.SPAIN COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 85.SPAIN COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 86.SWITZERLAND. COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 87.SWITZERLAND COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 88.SWITZERLAND COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 89.SWITZERLAND COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 90.SWITZERLAND COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 91.REST OF EUROPE COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 92.REST OF EUROPE COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 93.REST OF EUROPE COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 94.REST OF EUROPE COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 95.REST OF EUROPE COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 96.ASIA-PACIFIC COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 97.ASIA-PACIFIC COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 98.ASIA-PACIFIC COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 99.ASIA-PACIFIC COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 100.ASIA-PACIFIC COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 101.ASIA-PACIFIC COCOA MARKET REVENUE, BY COUNTRY, 2019–2027 ($MILLION)

TABLE 102.CHINA COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 103.CHINA COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 104.CHINA COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 105.CHINA COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 106.CHINA COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 107.JAPAN COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 108.JAPAN COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 109.JAPAN COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 110.JAPAN COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 111.JAPAN COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 112.INDIA COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 113.INDIA COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 114.INDIA COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 115.INDIA COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 116.INDIA COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 117.MALAYSIA COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 118.MALAYSIA COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 119.MALAYSIA COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 120.MALAYSIA COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 121.MALAYSIA COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 122.INDONESIA. COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 123.INDONESIA COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 124.INDONESIA COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 125.INDONESIA COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 126.INDONESIA COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 127.SINGAPORE COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 128.SINGAPORE COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 129.SINGAPORE COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 130.SINGAPORE COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 131.SINGAPORE COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 132.REST OF ASIA-PACIFIC COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 133.REST OF ASIA-PACIFIC COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 134.REST OF ASIA-PACIFIC COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 135.REST OF ASIA-PACIFIC COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 136.REST OF ASIA-PACIFIC COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 137.LAMEA COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 138.LAMEA COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 139.LAMEA COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 140.LAMEA COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 141.LAMEA COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 142.LAMEA COCOA MARKET REVENUE, BY COUNTRY, 2019–2027 ($MILLION)

TABLE 143.BRAZIL COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 144.BRAZIL COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 145.BRAZIL COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 146.BRAZIL COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 147.BRAZIL COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 148.IRAN COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 149.IRAN COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 150.IRAN COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 151.IRAN COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 152.IRAN COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 153.UNITED ARAB EMIRATES COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 154.UNITED ARAB EMIRATES COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 155.UNITED ARAB EMIRATES COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 156.UNITED ARAB EMIRATES COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 157.UNITED ARAB EMIRATES COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 158.REST OF LAMEA COCOA MARKET REVENUE, BY PRODUCT TYPE, 2019–2027 ($MILLION)

TABLE 159.REST OF LAMEA COCOA MARKET REVENUE, BY PROCESS, 2019–2027 ($MILLION)

TABLE 160.REST OF LAMEA COCOA MARKET REVENUE, BY NATURE, 2019–2027 ($MILLION)

TABLE 161.REST OF LAMEA COCOA MARKET REVENUE, BY QUALITY, 2019–2027 ($MILLION)

TABLE 162.REST OF LAMEA COCOA MARKET REVENUE, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 163.BARRY CALLEBAUT AG: KEY EXECUTIVES

TABLE 164.BARRY CALLEBAUT AG: COMPANY SNAPSHOT

TABLE 165.BARRY CALLEBAUT AG: OPERATING SEGMENTS

TABLE 166.BARRY CALLEBAUT AG: PRODUCT PORTFOLIO

TABLE 167.BARRY CALLEBAUT AG: R&D EXPENDITURE, 2018–2020 ($MILLION)

TABLE 168.BARRY CALLEBAUT AG: NET SALES, 2018–2020 ($MILLION)

TABLE 169.BLOMMER CHOCOLATE COMPANY: KEY EXECUTIVES

TABLE 170.BLOMMER CHOCOLATE COMPANY: COMPANY SNAPSHOT

TABLE 171.BLOMMER CHOCOLATE COMPANY: PRODUCT PORTFOLIO

TABLE 172.CARGILL, INC.: KEY EXECUTIVES

TABLE 173.CARGILL, INC.: COMPANY SNAPSHOT

TABLE 174.CARGILL, INC.: OPERATING SEGMENTS

TABLE 175.CARGILL, INC.: PRODUCT PORTFOLIO

TABLE 176.CARGILL, INC.: NET SALES, 2018–2020 ($MILLION)

TABLE 177.CIRANDA, INC.: KEY EXECUTIVES

TABLE 178.CIRANDA, INC.: COMPANY SNAPSHOT

TABLE 179.CIRANDA, INC.: OPERATING SEGMENTS

TABLE 180.CIRANDA, INC.: PRODUCT PORTFOLIO

TABLE 181.GUAN CHONG COCOA MANUFACTURER SDN. BHD : KEY EXECUTIVES

TABLE 182.GUAN CHONG COCOA MANUFACTURER SDN. BHD : COMPANY SNAPSHOT

TABLE 183.GUAN CHONG COCOA MANUFACTURER SDN. BHD : OPERATING SEGMENTS

TABLE 184.GUAN CHONG COCOA MANUFACTURER SDN. BHD : PRODUCT PORTFOLIO

TABLE 185.GUAN CHONG COCOA MANUFACTURER SDN. BHD : NET SALES, 2017–2019 ($MILLION)

TABLE 186.OLAM INTERNATIONAL, LTD.: KEY EXECUTIVES

TABLE 187.OLAM INTERNATIONAL, LTD.: COMPANY SNAPSHOT

TABLE 188.OLAM INTERNATIONAL, LTD.: OPERATING SEGMENTS

TABLE 189.OLAM INTERNATIONAL, LTD.: PRODUCT PORTFOLIO

TABLE 190.OLAM INTERNATIONAL, LTD.: NET SALES, 2017–2019 ($MILLION)

TABLE 191.THE HERSHEY COMPANY: KEY EXECUTIVES

TABLE 192.THE HERSHEY COMPANY: COMPANY SNAPSHOT

TABLE 193.THE HERSHEY COMPANY: OPERATING SEGMENTS

TABLE 194.THE HERSHEY COMPANY: PRODUCT PORTFOLIO

TABLE 195.THE HERSHEY COMPANY: R&D EXPENDITURE, 2018–2020 ($MILLION)

TABLE 196.THE HERSHEY COMPANY: NET SALES, 2018–2020 ($MILLION)

TABLE 197.TOUTON S.A.: KEY EXECUTIVES

TABLE 198.TOUTON S.A.: COMPANY SNAPSHOT

TABLE 199.TOUTON S.A.: OPERATING SEGMENTS

TABLE 200.TOUTON S.A.: PRODUCT PORTFOLIO

TABLE 201.UNITED COCOA PROCESSOR, INC.: KEY EXECUTIVES

TABLE 202.UNITED COCOA PROCESSOR, INC.: COMPANY SNAPSHOT

TABLE 203.UNITED COCOA PROCESSOR, INC: PRODUCT PORTFOLIO

TABLE 204.VJ JINDAL COCOA PRIVATE LIMITED: KEY EXECUTIVES

TABLE 205.VJ JINDAL COCOA PRIVATE LIMITED: COMPANY SNAPSHOT

TABLE 206.VJ JINDAL COCOA PRIVATE LIMITED: PRODUCT PORTFOLIO

LIST OF FIGURES

FIGURE 01.COCOA MARKET SNAPSHOT

FIGURE 02.GLOBAL COCOA MARKET: SEGMENTATION

FIGURE 03.TOP PLAYER POSITIONING

FIGURE 04.TOP INVESTMENT POCKETS

FIGURE 05.LOW BARGAINING POWER OF SUPPLIERS

FIGURE 06.MODERATE-HIGH BARGAINING POWER OF BUYERS

FIGURE 07.MODERATE THREAT OF SUBSTITUTION

FIGURE 08.HIGH THREAT OF NEW ENTRANTS

FIGURE 09.MODERATE INTENSITY OF COMPETITIVE RIVALRY

FIGURE 10.COCOA MARKET: DRIVERS, RESTRAINTS, AND OPPORTUNITIES

FIGURE 11.COCOA MARKET, BY PRODUCT TYPE, 2019 (%)

FIGURE 12.COCOA BUTTER MARKET, COMPARATIVE COUNTRY MARKET SHARE ANALYSIS, 2019 AND 2027 (%)

FIGURE 13.COCOA LIQUOR MARKET, COMPARATIVE REGIONAL MARKET SHARE ANALYSIS, 2019 AND 2027 (%)

FIGURE 14.COCOA POWDER MARKET, COMPARATIVE REGIONAL MARKET SHARE ANALYSIS, 2019 AND 2027 (%)

FIGURE 15.GLOBAL COCOA MARKET, BY PROCESS, 2019 (%)

FIGURE 16.DUTCH PROCESS COCOA MARKET, COMPARATIVE COUNTRY MARKET SHARE ANALYSIS, 2019 AND 2027 (%)

FIGURE 17.NATURAL PROCESS COCOA MARKET, COMPARATIVE REGIONAL MARKET SHARE ANALYSIS, 2019 AND 2027 (%)

FIGURE 18.GLOBAL COCOA MARKET, BY NATURE, 2019 (%)

FIGURE 19.ORGANIC COCOA MARKET, COMPARATIVE COUNTRY MARKET SHARE ANALYSIS, 2019 AND 2027 (%)

FIGURE 20.CONVENTIONAL COCOA MARKET, COMPARATIVE REGIONAL MARKET SHARE ANALYSIS, 2019 AND 2027 (%)

FIGURE 21.COCOA MARKET, BY QUALITY, 2019 (%)

FIGURE 22.BULK COCOA MARKET, COMPARATIVE COUNTRY MARKET SHARE ANALYSIS, 2019 AND 2027 (%)

FIGURE 23.SPECIALTY COCOA MARKET, COMPARATIVE REGIONAL MARKET SHARE ANALYSIS, 2019 AND 2027 (%)

FIGURE 24.FINE FLAVOR COCOA MARKET, COMPARATIVE REGIONAL MARKET SHARE ANALYSIS, 2019 AND 2027 (%)

FIGURE 25.GLOBAL COCOA MARKET, BY APPLICATION, 2019 (%)

FIGURE 26.COCOA MARKET FOR CONFECTIONERY, COMPARATIVE COUNTRY MARKET SHARE ANALYSIS, 2019 AND 2027 (%)

FIGURE 27.COCOA MARKET FOR FOOD & BEVERAGES, COMPARATIVE REGIONAL MARKET SHARE ANALYSIS, 2019 AND 2027 (%)

FIGURE 28.COCOA MARKET FOR BAKERY, COMPARATIVE REGIONAL MARKET SHARE ANALYSIS, 2019 AND 2027 (%)

FIGURE 29.COCOA MARKET FOR OTHERS APPLICATION, COMPARATIVE REGIONAL MARKET SHARE ANALYSIS, 2019 AND 2027 (%)

FIGURE 30.COCOA MARKET, BY REGION, 2019 (%)

FIGURE 31.U.S. COCOA MARKET REVENUE, 2019–2027 ($MILLION)

FIGURE 32.CANADA COCOA MARKET REVENUE, 2019–2027 ($MILLION)

FIGURE 33.MEXICO COCOA MARKET REVENUE, 2019–2027 ($MILLION)

FIGURE 34.THE NETHERLANDS COCOA MARKET REVENUE, 2019–2027 ($MILLION)

FIGURE 35.GERMANY COCOA MARKET REVENUE, 2019–2027 ($MILLION)

FIGURE 36.BELGIUM COCOA MARKET REVENUE, 2019–2027 ($MILLION)

FIGURE 37.FRANCE COCOA MARKET REVENUE, 2019–2027 ($MILLION)

FIGURE 38.UK COCOA MARKET REVENUE, 2019–2027 ($MILLION)

FIGURE 39.ITALY COCOA MARKET REVENUE, 2019–2027 ($MILLION)

FIGURE 40.SPAIN COCOA MARKET REVENUE, 2019–2027 ($MILLION)

FIGURE 41.SWITZERLAND COCOA MARKET REVENUE, 2019–2027 ($MILLION)

FIGURE 42.REST OF EUROPE COCOA MARKET REVENUE, 2019–2027 ($MILLION)

FIGURE 43.CHINA COCOA MARKET REVENUE, 2019–2027 ($MILLION)

FIGURE 44.JAPAN COCOA MARKET REVENUE, 2019–2027 ($MILLION)

FIGURE 45.INDIA COCOA MARKET REVENUE, 2019–2027 ($MILLION)

FIGURE 46.MALAYSIA COCOA MARKET REVENUE, 2019–2027 ($MILLION)

FIGURE 47.INDONESIA COCOA MARKET REVENUE, 2019–2027 ($MILLION)

FIGURE 48.SINGAPORE COCOA MARKET REVENUE, 2019–2027 ($MILLION)

FIGURE 49.REST OF ASIA-PACIFIC COCOA MARKET REVENUE, 2019–2027 ($MILLION)

FIGURE 50.BRAZIL COCOA MARKET REVENUE, 2019–2027 ($MILLION)

FIGURE 51.IRAN COCOA MARKET REVENUE, 2019–2027 ($MILLION)

FIGURE 52.UNITED ARAB EMIRATES COCOA MARKET REVENUE, 2019–2027 ($MILLION)

FIGURE 53.REST OF LAMEA COCOA MARKET REVENUE, 2019–2027 ($MILLION)

FIGURE 54.TOP WINNING STRATEGIES, BY YEAR, 2018–2021*

FIGURE 55.TOP WINNING STRATEGIES, BY DEVELOPMENT, 2018–2021* (%)

FIGURE 56.TOP WINNING STRATEGIES, BY COMPANY, 2018–2021*

FIGURE 57.PRODUCT MAPPING OF TOP 10 KEY PLAYERS

FIGURE 58.COMPETITIVE DASHBOARD OF TOP 10 KEY PLAYERS

FIGURE 59.COMPETITIVE HEATMAP OF TOP 10 KEY PLAYERS

FIGURE 60.BARRY CALLEBAUT AG: R&D EXPENDITURE, 2018–2020 ($MILLION)

FIGURE 61.BARRY CALLEBAUT AG: NET SALES, 2018–2020 ($MILLION)

FIGURE 62.BARRY CALLEBAUT AG: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 63.BARRY CALLEBAUT AG: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 64.CARGILL, INC.: NET SALES, 2018–2020 ($MILLION)

FIGURE 65.CARGILL, INC.: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 66.GUAN CHONG COCOA MANUFACTURER SDN. BHD : NET SALES, 2017–2019 ($MILLION)

FIGURE 67.GUAN CHONG COCOA MANUFACTURER SDN. BHD : REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 68.OLAM INTERNATIONAL, LTD.: NET SALES, 2017–2019 ($MILLION)

FIGURE 69.OLAM INTERNATIONAL, LTD.: REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 70.OLAM INTERNATIONAL, LTD.: REVENUE SHARE BY REGION, 2019 (%)

FIGURE 71.THE HERSHEY COMPANY: R&D EXPENDITURE, 2018–2020 ($MILLION)

FIGURE 72.THE HERSHEY COMPANY: NET SALES, 2018–2020 ($MILLION)

FIGURE 73.THE HERSHEY COMPANY: REVENUE SHARE BY SEGMENT, 2020 (%)

$5769

$9995

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS