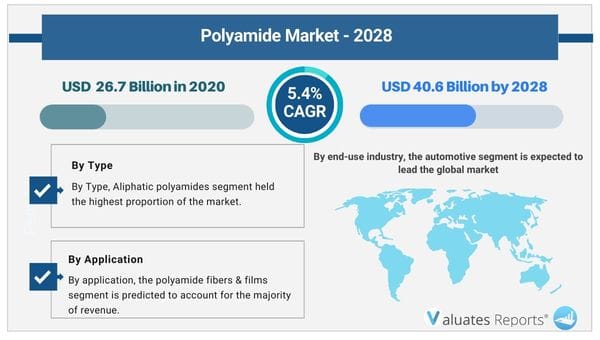

The global polyamide market size was valued at $26.7 billion in 2020 and is projected to reach $40.6 billion by 2028, growing at a CAGR of 5.4% from 2021 to 2028. Key drivers of the polyamide market include booming automobile sales.

The rising use of polyamide in the electronics and electrical industry will fuel the growth of the market during the forecast period.

The preference for bio-based polyamide will drive the demand for the polyamide market in the coming years.

Automobile industry

Polyamides are the largest thermoplastic engineered materials. They offer quicker parts integration and reduced weight in comparison to metal containers. Manufacturers are increasingly deploying plastic chain tensioner guides made from polyamides for better wear and tear performance, reduced noise, and safety of car’s powertrains. They are also integrated into automotive cooling systems and headlight bezels. This will boost the growth of the polyamide market during the forecast period. Doors, tailgate handles, front-end grilles, fuel caps, wheel covers, trimmers, exterior mirrors, and lids are all made of polyamide films. It is used extensively in glass-reinforced plastics for structural parts, engine covers, rocker valves, airbag containers, manifolds, and interior, and exterior automobile parts.

Electrical and electronics industry

Polyamides have superior mechanical, thermal, electrical, and chemical properties. They are highly useful in microelectronic products and high-voltage electrical engineering due to their high thermal stability, stronger insulation, and low dielectric constant. They have high glass transition temperature and easy processability making them suitable for many integrated electronic devices. This will surge the demand for the polyamide market in the subsequent years. The product is present in different shapes and sizes such as substrates, coatings, and advanced electrical insulation capacity. They are used as an intermetallic layer for large-scale integration in microelectronics. Polyamides are excellent bone pad redistribution options for ICs and superior buffer layers. They are comfortable as the right kind of substrate for PCB technologies and provide an additional protective coating for space applications. It is efficient as high-temperature capacitors for energy storage and next-generation insulating layers for aeronautic cables. Furthermore, They are used in isolated gate drivers, organic electronic items, and as high-temperature wires in electrical motor applications. The substrate is perfect for digital isolators and high thermal class enamel.

Bio-based polyamides

The growing environmental concerns and huge investments in R&D initiatives for manufacturing specialized polyamides have given rise to bio-based polyamides. They are a class of bioplastics derived from renewable resources like natural fats and oils etc. It is based entirely on sebacic acid which is produced through step-growth polymerization. These polyamides have excellent mechanical properties, high tensile strength, high reliance, abrasion resistance, and toughness along with added flexibility. The rising focus on its eco-friendly nature will boost the growth of the polyamide market in the upcoming years. They are far better than their traditional counterparts such as huge impact strength, low moisture absorption, and advanced chemical resistance. Other beneficial properties include long elongation and high melting points. Bioploymaides are gradually getting used in oil and gas pipes, powder coatings, vehicle fuel lines, electric cables, sports shoes, carpets, tires, etc. It is also used in electronic casing, pneumatic air brake tubing, and toothbrushes.

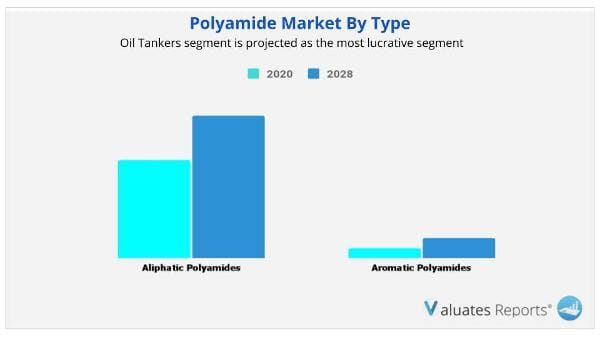

Based on type, Aliphatic polyamide is the largest segment in the polyamide market share due to rising production for use in the automotive, electrical, and packaging industries.

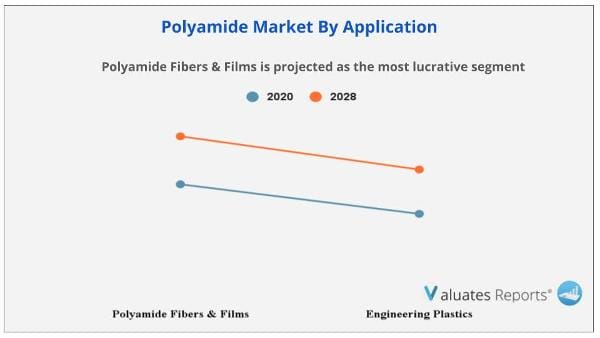

Based on application, the polyamide fibers and films segment will grow the highest in the polyamide market share with 56.4% penetration due to rising urbanization, and increasing use in household care items, packaging, etc.

Based on the end-user industry, the automotive segment will be the most lucrative with a market share of 30.4% due to the rising use in the production of radiator fans, oil filters, gears, and other vehicle parts.

Based on region, Asia-pacific will be the most dominating segment with 33.8% share due to the rapid expansion of the automobile manufacturing industry and huge consumer demand for several consumption items.

| Report Metric | Details |

| Report Name | Polyamide Market |

| The market size in 2020 | 26.7 Billion USD |

| The revenue forecast in 2030 | 40.6 Billion USD |

| Growth Rate | CAGR of 5.4% from 2021 to 2030 |

| Market size available for years | 2021-2030 |

| Forecast units | Value (USD) |

| Segments covered | Type, End-User and Region |

| Report coverage | Revenue & volume forecast, company share, competitive landscape, growth factors, and trends |

| Geographic regions covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Ans. The global polyamide market size was valued at $26.7 billion in 2020, and is projected to reach $40.6 billion by 2028, growing at a CAGR of 5.4% from 2021 to 2028.

Ans. The global polyamide market growing at a CAGR of 5.4% from 2021 to 2028.

Ans. Some of the major companies are Ascend Performance Materials LLC, Arkema SA, BASF SE, Evonik Industries AG, Gujarat State Fertilizers & Chemicals Limited (GSFC), Koch Industries, Lanxess, Mitsubishi Chemical Holdings, Radici Group, Royal DSM.

CHAPTER 1:INTRODUCTION

1.1.Report description

1.2.Key benefits for stakeholders

1.3.Key market segments

1.4.Research methodology

1.4.1.Secondary research

1.4.2.Primary research

1.5.Analyst tools and models

CHAPTER 2:EXECUTIVE SUMMARY

2.1.Key findings of the study

2.2.CXO perspective

CHAPTER 3:MARKET OVERVIEW

3.1.Market definition and scope

3.2.Key findings

3.2.1.Top investment pockets

3.3.Porter’s five forces analysis

3.4.Market dynamics

3.4.1.Drivers

3.4.1.1.Increase in demand for PA-6 in the electrical and electronics sector

3.4.1.2.Increase in demand for electric vehicles

3.4.2.Restraint

3.4.2.1.Changing crude prices to hamper market growth

3.4.3.Opportunity

3.4.3.1.Favorable government policies encouraging electric vehicles

3.5.Patent analysis

3.5.1.Patent analysis by country (2015-2020)

3.6.Impact of government rules and regulations

3.7.Impact of corona (COVID-19) outbreak on the global polyamide market

3.8.Pricing analysis

CHAPTER 4:POLYAMIDE MARKET, BY TYPE

4.1.Overview

4.1.1.Market size and forecast

4.2.Aliphatic Polyamides

4.2.1.Key market trends, growth factors, and opportunities

4.2.1.1.PA6

4.2.1.2.PA66

4.2.1.3.Others

4.2.2.Market size and forecast, by region

4.2.3.Market share analysis, by country

4.2.4.Market size and forecast, by aliphatic polyamides

4.3.Aromatic Polyamides

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Aramid

4.3.3.Polyphthalamide

4.3.4.Market size and forecast, by region

4.3.5.Market share analysis, by country

4.3.6.Market size and forecast, by aromatic polyamide

CHAPTER 5:POLYAMIDE MARKET, BY APPLICATION

5.1.Overview

5.1.1.Market size and forecast

5.2.Polyamide fibers & films

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region

5.2.3.Market share analysis, by country

5.3.Engineering plastics

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region

5.3.3.Market share analysis, by country

CHAPTER 6:POLYAMIDE MARKET, BY END-USE INDUSTRY

6.1.Overview

6.1.1.Market size and forecast

6.2.Automotive

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by region

6.2.3.Market share analysis, by country

6.3.Electrical & electronics

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by region

6.3.3.Market share analysis, by country

6.4.Textile

6.4.1.Key market trends, growth factors, and opportunities

6.4.2.Market size and forecast, by region

6.4.3.Market share analysis, by country

6.5.Construction

6.5.1.Key market trends, growth factors, and opportunities

6.5.2.Market size and forecast, by region

6.5.3.Market share analysis, by country

6.6.Packaging

6.6.1.Key market trends, growth factors, and opportunities

6.6.2.Market size and forecast, by region

6.6.3.Market share analysis, by country

6.7.Consumer Goods

6.7.1.Key market trends, growth factors, and opportunities

6.7.2.Market size and forecast, by region

6.7.3.Market share analysis, by country

6.8.Others

6.8.1.Key market trends, growth factors, and opportunities

6.8.2.Market size and forecast, by region

6.8.3.Market share analysis, by country

CHAPTER 7:POLYAMIDE MARKET, BY REGION

7.1.Overview

7.1.1.Market size and forecast, by region

7.2.North America

7.2.1.Key market trends, growth factors, and opportunities

7.2.2.Market size and forecast, by type

7.2.3.Market size and forecast, by aliphatic polyamides

7.2.4.Market size and forecast, by aromatic polyamides

7.2.5.Market size and forecast, by application

7.2.6.Market size and forecast, by end-use industry

7.2.7.Market size and forecast, by country

7.2.8.U.S.

7.2.8.1.Market size and forecast, by type

7.2.8.2.Market size and forecast, by aliphatic polyamides

7.2.8.3.Market size and forecast, by aromatic polyamides

7.2.8.4.Market size and forecast, by application

7.2.8.5.Market size and forecast, by end-use industry

7.2.9.Canada

7.2.9.1.Market size and forecast, by type

7.2.9.2.Market size and forecast, by aliphatic polyamides

7.2.9.3.Market size and forecast, by aromatic polyamides

7.2.9.4.Market size and forecast, by application

7.2.9.5.Market size and forecast, by end-use industry

7.2.10.Mexico

7.2.10.1.Market size and forecast, by type

7.2.10.2.Market size and forecast, by aliphatic polyamides

7.2.10.3.Market size and forecast, by aromatic polyamides

7.2.10.4.Market size and forecast, by application

7.2.10.5.Market size and forecast, by end-use industry

7.3.Europe

7.3.1.Key market trends, growth factors, and opportunities

7.3.2.Market size and forecast, by type

7.3.3.Market size and forecast, by aliphatic polyamides

7.3.4.Market size and forecast, by aromatic polyamides

7.3.5.Market size and forecast, by application

7.3.6.Market size and forecast, by end-use industry

7.3.7.Market size and forecast, by country

7.3.8.Germany

7.3.8.1.Market size annd-use industry

7.3.9.UK

7.3.9.1.Market size and forecast, by type

7.3.9.2.Market size and forecast, by aliphatic polyamides

7.3.9.3.Market size and forecast, by aromatic polyamides

7.3.9.4.Market size and forecast, by application

7.3.9.5.Market size and forecast, by end-use industry

7.3.10.France

7.3.10.1.Market size and forecast, by type

7.3.10.2.Market size and forecast, by aliphatic polyamides

7.3.10.3.Market size and forecast, by aromatic polyamides

7.3.10.4.Market size and forecast, by application

7.3.10.5.Market size and forecast, by end-use industry

7.3.11.Italy

7.3.11.1.Market size and forecast, by type

7.3.11.2.Market size and forecast, by aliphatic polyamides

7.3.11.3.Market size and forecast, by aromatic polyamides

7.3.11.4.Market size and forecast, by application

7.3.11.5.Market size and forecast, by end-use industry

7.3.12.Spain

7.3.12.1.Market size and forecast, by type

7.3.12.2.Market size and forecast, by aliphatic polyamides

7.3.12.3.Market size and forecast, by aromatic polyamides

7.3.12.4.Market size and forecast, by application

7.3.12.5.Market size and forecast, by end-use industry

7.3.13.Rest of Europe

7.3.13.1.Market size and forecast, by type

7.3.13.2.Market size and forecast, by aliphatic polyamides

7.3.13.3.Market size and forecast, by aromatic polyamides

7.3.13.4.Market size and forecast, by application

7.3.13.5.Market size and forecast, by end-use industry

7.4.Asia-Pacific

7.4.1.Key market trends, growth factors, and opportunities

7.4.2.Market size and forecast, by type

7.4.3.Market size and forecast, by aliphatic polyamides

7.4.4.Market size and forecast, by aromatic polyamides

7.4.5.Market size and forecast, by application

7.4.6.Market size and forecast, by end-use industry

7.4.7.Market size and forecast, by country

7.4.8.China

7.4.8.1.Market size and forecast, by type

7.4.8.2.Market size and forecast, by aliphatic polyamides

7.4.8.3.Market size and forecast, by aromatic polyamides

7.4.8.4.Market size and forecast, by application

7.4.8.5.Market size and forecast, by end-use industry

7.4.9.Japan

7.4.9.1.Market size and forecast, by type

7.4.9.2.Market size and forecast, by aliphatic polyamides

7.4.9.3.Market size and forecast, by aromatic polyamides

7.4.9.4.Market size and forecast, by application

7.4.9.5.Market size and forecast, by end-use industry

7.4.10.India

7.4.10.1.Market size and forecast, by type

7.4.10.2.Market size and forecast, by aliphatic polyamides

7.4.10.3.Market size and forecast, by aromatic polyamides

7.4.10.4.Market size and forecast, by application

7.4.10.5.Market size and forecast, by end-use industry

7.4.11.South Korea

7.4.11.1.Market size and forecast, by type

7.4.11.2.Market size and forecast, by aliphatic polyamides

7.4.11.3.Market size and forecast, by aromatic polyamides

7.4.11.4.Market size and forecast, by application

7.4.11.5.Market size and forecast, by end-use industry

7.4.12.Rest of Asia-Pacific

7.4.12.1.Market size and forecast, by type

7.4.12.2.Market size and forecast, by aliphatic polyamides

7.4.12.3.Market size and forecast, by aromatic polyamides

7.4.12.4.Market size and forecast, by application

7.4.12.5.Market size and forecast, by end-use industry

7.5.LAMEA

7.5.1.Key market trends, growth factors, and opportunities

7.5.2.Market size and forecast, by type

7.5.3.Market size and forecast, by aliphatic polyamides

7.5.4.Market size and forecast, by aromatic polyamides

7.5.5.Market size and forecast, by application

7.5.6.Market size and forecast, by end-use industry

7.5.8.Market size and forecast, by country

7.5.9.Brazil

7.5.9.1.Market size and forecast, by type

7.5.9.2.Market size and forecast, by aliphatic polyamides

7.5.9.3.Market size and forecast, by aromatic polyamides

7.5.9.4.Market size and forecast, by application

7.5.9.5.Market size and forecast, by end-use industry

7.5.10.Saudi Arabia

7.5.10.1.Market size and forecast, by type

7.5.10.2.Market size and forecast, by aliphatic polyamides

7.5.10.3.Market size and forecast, by aromatic polyamides

7.5.10.4.Market size and forecast, by application

7.5.10.5.Market size and forecast, by end-use industry

7.5.11.South Africa

7.5.11.1.Market size and forecast, by type

7.5.11.2.Market size and forecast, by aliphatic polyamides

7.5.11.3.Market size and forecast, by aromatic polyamides

7.5.11.4.Market size and forecast, by application

7.5.11.5.Market size and forecast, by end-use industry

7.5.12.Rest of LAMEA

7.5.12.1.Market size and forecast, by type

7.5.12.2.Market size and forecast, by aliphatic polyamides

7.5.12.3.Market size and forecast, by aromatic polyamides

7.5.12.4.Market size and forecast, by application

7.5.12.5.Market size and forecast, by end-use industry

CHAPTER 8:COMPETITIVE LANDSCAPE

8.1.INTRODUCTION

8.1.1.MARKET PLAYER POSITIONING, 2020

8.2.TOP WINNING STRATEGIES

8.2.1.Top winning strategies, by year

8.2.2.Top winning strategies, by development

8.2.3.Top winning strategies, by company

8.3.PRODUCT MAPPING OF TOP 10 PLAYER

8.4.COMPETITIVE HEATMAP

8.5.KEY DEVELOPMENTS

8.5.1.New product launches

8.5.2.Expansions

8.5.3.Acquisition

CHAPTER 9:COMPANY PROFILES:

9.1.Ascend Performance Materials LLC

9.1.1.Company overview

9.1.2.Company snapshot

9.1.3.Product portfolio

9.1.4.Key strategic moves and developments

9.2.ARKEMA S.A.

9.2.1.Company overview

9.2.2.Company snapshot

9.2.3.Operating business segments

9.2.4.Product portfolio

9.2.5.Business performance

9.2.6.Key strategic moves and developments

9.3.BASF SE

9.3.1.Company overview

9.3.2.Company snapshot

9.3.3.Operating business segments

9.3.4.Product portfolio

9.3.5.Business performance

9.3.6.Key strategic moves and developments

9.4.EVONIK INDUSTRIES AG

9.4.1.Company overview

9.4.2.Company snapshot

9.4.3.Operating business segments

9.4.4.Product portfolio

9.4.5.Business performance

9.4.6.Key strategic moves and developments

9.5.Gujarat State Fertilizers & Chemicals Limited (GSFC)

9.5.1.Company overview

9.5.2.Company snapshot

9.5.3.Operating business segments

9.5.4.Product portfolio

9.5.5.Business performance

9.6.KOCH INDUSTRIES

9.6.1.Company overview

9.6.2.Company snapshot

9.6.3.Product portfolio

9.7.LANXESS AG

9.7.1.Company overview

9.7.2.Company snapshot

9.7.3.Operating business segments

9.7.4.Product portfolio

9.7.5.Business performance

9.8.MITSUBISHI CHEMICAL HOLDINGS

9.8.1.Company overview

9.8.2.Company snapshot

9.8.3.Operating business segments

9.8.4.Product portfolio

9.8.5.Business performance

9.9.Radici Group

9.9.1.Company overview

9.9.2.Company snapshot

9.9.3.Product portfolio

9.9.4.Business performance

9.9.5.Key strategic moves and developments

9.10.Royal DSM

9.10.1.Company overview

9.10.2.Company snapshot

9.10.3.Operating business segments

9.10.4.Product portfolio

9.10.5.Business performance

LIST OF TABLES

TABLE 01.POLYAMIDE PRICING FORECAST BY TYPE,2020–2028 ($/KILOTON)

TABLE 02.POLYAMIDE PRICING FORECAST BY REGION,2020–2028 ($/KILOTON)

TABLE 03.POLYAMIDE MARKET, BY TYPE, 2020–2028(KILOTONS)

TABLE 04.POLYAMIDE MARKET, BY TYPE, 2020–2028 ($MILLION)

TABLE 05.POLYAMIDE MARKET FOR ALIPHATIC POLYAMIDES, BY REGION, 2020–2028(KILOTONS)

TABLE 06.POLYAMIDE MARKET FOR ALIPHATIC POLYAMIDES, BY REGION, 2020–2028 ($MILLION)

TABLE 07.POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDE BY TYPE, 2020–2028 (KILOTONS)

TABLE 08.POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDE BY TYPE, 2020–2028 ($MILLION)

TABLE 09.POLYAMIDE MARKET FOR AROMATIC POLYAMIDES, BY REGION, 2020–2028(KILOTONS)

TABLE 10.POLYAMIDE MARKET FOR AROMATIC POLYAMIDES, BY REGION, 2020–2028 ($MILLION)

TABLE 11.POLYAMIDES MARKET FOR AROMATIC POLYAMIDE BY TYPE, 2020–2028 (KILOTONS)

TABLE 12.POLYAMIDES MARKET FOR AROMATIC POLYAMIDE BY TYPE, 2020–2028 ($MILLION)

TABLE 13.POLYAMIDE MARKET, BY APPLICATION, 2020–2028(KILOTONS)

TABLE 14.POLYAMIDE MARKET, BY FABRIC TYPE, 2020–2028 ($MILLION)

TABLE 15.POLYAMIDE MARKET FOR POLYAMIDE FIBERS & FILMS, BY REGION, 2020–2028(KILOTONS)

TABLE 16.POLYAMIDE MARKET FOR POLYAMIDE FIBERS & FILMS, BY REGION, 2020–2028 ($MILLION)

TABLE 17.POLYAMIDE MARKET FOR ENGINEERING PLASTICS, BY REGION, 2020–2028(KILOTONS)

TABLE 18.POLYAMIDE MARKET FOR THERMOPLASTIC, BY REGION, 2020–2028 ($MILLION)

TABLE 19.POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028(KILOTONS)

TABLE 20.POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028 ($MILLION)

TABLE 21.POLYAMIDE MARKET FOR AUTOMOTIVE, BY REGION, 2020–2028(KILOTONS)

TABLE 22.POLYAMIDE MARKET FOR AUTOMOTIVE, BY REGION, 2020–2028 ($MILLION)

TABLE 23.POLYAMIDE MARKET FOR ELECTRICAL & ELECTRONICS, BY REGION, 2020–2028(KILOTONS)

TABLE 24.POLYAMIDE MARKET FOR ELECTRICAL & ELECTRONICS, BY REGION, 2020–2028 ($MILLION)

TABLE 25.POLYAMIDE MARKET FOR TEXTILE, BY REGION, 2020–2028(KILOTONS)

TABLE 26.POLYAMIDE MARKET FOR TEXTILE, BY REGION, 2020–2028 ($MILLION)

TABLE 27.POLYAMIDE MARKET FOR CONSTRUCTION, BY REGION, 2020–2028(KILOTONS)

TABLE 28.POLYAMIDE MARKET FOR CONSTRUCTION, BY REGION, 2020–2028 ($MILLION)

TABLE 29.POLYAMIDE MARKET FOR PACKAGING, BY REGION, 2020–2028(KILOTONS)

TABLE 30.POLYAMIDE MARKET FOR PACKAGING, BY REGION, 2020–2028 ($MILLION)

TABLE 31.POLYAMIDE MARKET FOR CONSUMER GOODS, BY REGION, 2020–2028(KILOTONS)

TABLE 32.POLYAMIDE MARKET FOR CONSUMER GOODS, BY REGION, 2020–2028 ($MILLION)

TABLE 33.POLYAMIDE MARKET FOR OTHERS, BY REGION, 2020–2028(KILOTONS)

TABLE 34.POLYAMIDE MARKET FOR OTHERS, BY REGION, 2020–2028 ($MILLION)

TABLE 35.POLYAMIDE MARKET, BY REGION 2020–2028(KILOTONS)

TABLE 36.POLYAMIDE MARKET, BY REGION 2020–2028 ($MILLION)

TABLE 37.NORTH AMERICA POLYAMIDE MARKET, BY TYPE, 2020–2028(KILOTONS)

TABLE 38.NORTH AMERICA POLYAMIDE MARKET, BY TYPE, 2020–2028 ($MILLION)

TABLE 39.NORTH AMERICA POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 40.NORTH AMERICA POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 41.NORTH AMERICA POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 42.NORTH AMERICA POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 43.NORTH AMERICA POLYAMIDE MARKET, BY APPLICATION, 2020–2028(KILOTONS)

TABLE 44.NORTH AMERICA POLYAMIDE MARKET, BY APPLICATION, 2020–2028 ($MILLION)

TABLE 45.NORTH AMERICA POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028(KILOTONS)

TABLE 46.NORTH AMERICA POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028 ($MILLION)

TABLE 47.NORTH AMERICA POLYAMIDE MARKET, BY COUNTRY 2020–2028(KILOTONS)

TABLE 48.NORTH AMERICA POLYAMIDE MARKET, BY COUNTRY 2020–2028 ($MILLION)

TABLE 49.U.S. POLYAMIDE MARKET, BY TYPE, 2020–2028(KILOTONS)

TABLE 50.U.S. POLYAMIDE MARKET, BY TYPE, 2020–2028 ($MILLION)

TABLE 51.U.S. POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 52.U.S. POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 53.U.S. POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 54.U.S. POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 55.U.S. POLYAMIDE MARKET, BY APPLICATION, 2020–2028(KILOTONS)

TABLE 56.U.S. POLYAMIDE MARKET, BY APPLICATION, 2020–2028 ($MILLION)

TABLE 57.U.S. POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028(KILOTONS)

TABLE 58.U.S. POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028 ($MILLION)

TABLE 59.CANADA POLYAMIDE MARKET, BY TYPE, 2020–2028(KILOTONS)

TABLE 60.CANADA POLYAMIDE MARKET, BY TYPE, 2020–2028 ($MILLION)

TABLE 61.CANADA POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 62.CANADA POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 63.CANADA POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 64.CANADA POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 65.CANADA POLYAMIDE MARKET, BY APPLICATION, 2020–2028(KILOTONS)

TABLE 66.CANADA POLYAMIDE MARKET, BY APPLICATION, 2020–2028 ($MILLION)

TABLE 67.CANADA POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028(KILOTONS)

TABLE 68.CANADA POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028 ($MILLION)

TABLE 69.MEXICO POLYAMIDE MARKET, BY TYPE, 2020–2028(KILOTONS)

TABLE 70.MEXICO POLYAMIDE MARKET, BY TYPE, 2020–2028 ($MILLION)

TABLE 71.MEXICO POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 72.MEXICO POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 73.MEXICO POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 74.MEXICO POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 75.MEXICO POLYAMIDE MARKET, BY APPLICATION, 2020–2028(KILOTONS)

TABLE 76.MEXICO POLYAMIDE MARKET, BY APPLICATION, 2020–2028 ($MILLION)

TABLE 77.MEXICO POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028(KILOTONS)

TABLE 78.MEXICO POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028 ($MILLION)

TABLE 79.EUROPE POLYAMIDE MARKET, BY TYPE, 2020–2028(KILOTONS)

TABLE 80.EUROPE POLYAMIDE MARKET, BY TYPE, 2020–2028 ($MILLION)

TABLE 81.EUROPE POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 82.EUROPE POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 83.EUROPE POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 84.EUROPE POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 85.EUROPE POLYAMIDE MARKET, BY APPLICATION, 2020–2028(KILOTONS)

TABLE 86.EUROPE POLYAMIDE MARKET, BY APPLICATION, 2020–2028 ($MILLION)

TABLE 87.EUROPE POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028(KILOTONS)

TABLE 88.EUROPE POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028 ($MILLION)

TABLE 89.EUROPE POLYAMIDE MARKET, BY COUNTRY 2020–2028(KILOTONS)

TABLE 90.EUROPE POLYAMIDE MARKET, BY COUNTRY 2020–2028 ($MILLION)

TABLE 91.GERMANY POLYAMIDE MARKET, BY TYPE, 2020–2028(KILOTONS)

TABLE 92.GERMANY POLYAMIDE MARKET, BY TYPE, 2020–2028 ($MILLION)

TABLE 93.GERMANY POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 94.GERMANY POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 95.GERMANY POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 96.GERMANY POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 97.GERMANY POLYAMIDE MARKET, BY APPLICATION, 2020–2028(KILOTONS)

TABLE 98.GERMANY POLYAMIDE MARKET, BY APPLICATION, 2020–2028 ($MILLION)

TABLE 99.GERMANY POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028(KILOTONS)

TABLE 100.GERMANY POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028 ($MILLION)

TABLE 101.UK POLYAMIDE MARKET, BY TYPE, 2020–2028(KILOTONS)

TABLE 102.UK POLYAMIDE MARKET, BY TYPE, 2020–2028 ($MILLION)

TABLE 103.UK POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 104.UK POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 105.UK POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 106.UK POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 107.UK POLYAMIDE MARKET, BY APPLICATION, 2020–2028(KILOTONS)

TABLE 108.UK POLYAMIDE MARKET, BY APPLICATION, 2020–2028 ($MILLION)

TABLE 109.UK POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028(KILOTONS)

TABLE 110.UK POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028 ($MILLION)

TABLE 111.FRANCE POLYAMIDE MARKET, BY TYPE, 2020–2028(KILOTONS)

TABLE 112.FRANCE POLYAMIDE MARKET, BY TYPE, 2020–2028 ($MILLION)

TABLE 113.FRANCE POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 114.FRANCE POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 115.FRANCE POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 116.FRANCE POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 117.FRANCE POLYAMIDE MARKET, BY APPLICATION, 2020–2028(KILOTONS)

TABLE 118.FRANCE POLYAMIDE MARKET, BY APPLICATION, 2020–2028 ($MILLION)

TABLE 119.FRANCE POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028(KILOTONS)

TABLE 120.FRANCE POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028 ($MILLION)

TABLE 121.ITALY POLYAMIDE MARKET, BY TYPE, 2020–2028(KILOTONS)

TABLE 122.ITALY POLYAMIDE MARKET, BY TYPE, 2020–2028 ($MILLION)

TABLE 123.ITALY POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 124.ITALY POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 125.ITALY POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 126.ITALY POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 127.ITALY POLYAMIDE MARKET, BY APPLICATION, 2020–2028(KILOTONS)

TABLE 128.ITALY POLYAMIDE MARKET, BY APPLICATION, 2020–2028 ($MILLION)

TABLE 129.ITALY POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028(KILOTONS)

TABLE 130.ITALY POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028 ($MILLION)

TABLE 131.SPAIN POLYAMIDE MARKET, BY TYPE, 2020–2028(KILOTONS)

TABLE 132.SPAIN POLYAMIDE MARKET, BY TYPE, 2020–2028 ($MILLION)

TABLE 133.SPAIN POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 134.SPAIN POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 135.SPAIN POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 136.SPAIN POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 137.SPAIN POLYAMIDE MARKET, BY APPLICATION, 2020–2028(KILOTONS)

TABLE 138.SPAIN POLYAMIDE MARKET, BY APPLICATION, 2020–2028 ($MILLION)

TABLE 139.SPAIN POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028(KILOTONS)

TABLE 140.SPAIN POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028 ($MILLION)

TABLE 141.REST OF EUROPE POLYAMIDE MARKET, BY TYPE, 2020–2028(KILOTONS)

TABLE 142.REST OF EUROPE POLYAMIDE MARKET, BY TYPE, 2020–2028 ($MILLION)

TABLE 143.REST OF EUROPE POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 144.REST OF EUROPE POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 145.REST OF EUROPE POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 146.REST OF EUROPE POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 147.REST OF EUROPE POLYAMIDE MARKET, BY APPLICATION, 2020–2028(KILOTONS)

TABLE 148.REST OF EUROPE POLYAMIDE MARKET, BY APPLICATION, 2020–2028 ($MILLION)

TABLE 149.REST OF EUROPE POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028(KILOTONS)

TABLE 150.REST OF EUROPE POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028 ($MILLION)

TABLE 151.ASIA-PACIFIC POLYAMIDE MARKET, BY TYPE, 2020–2028(KILOTONS)

TABLE 152.ASIA-PACIFIC POLYAMIDE MARKET, BY TYPE, 2020–2028 ($MILLION)

TABLE 153.ASIA-PACIFIC POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 154.ASIA-PACIFIC POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 155.ASIA-PACIFIC POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 156.ASIA-PACIFIC POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 157.ASIA-PACIFIC POLYAMIDE MARKET, BY APPLICATION, 2020–2028(KILOTONS)

TABLE 158.ASIA-PACIFIC POLYAMIDE MARKET, BY APPLICATION, 2020–2028 ($MILLION)

TABLE 159.ASIA-PACIFIC POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028(KILOTONS)

TABLE 160.ASIA-PACIFIC POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028 ($MILLION)

TABLE 161.ASIA-PACIFIC POLYAMIDE MARKET, BY COUNTRY 2020–2028(KILOTONS)

TABLE 162.ASIA-PACIFIC POLYAMIDE MARKET, BY COUNTRY 2020–2028 ($MILLION)

TABLE 163.CHINA POLYAMIDE MARKET, BY TYPE, 2020–2028(KILOTONS)

TABLE 164.CHINA POLYAMIDE MARKET, BY TYPE, 2020–2028 ($MILLION)

TABLE 165.CHINA POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 166.CHINA POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 167.CHINA POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 168.CHINA POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 169.CHINA POLYAMIDE MARKET, BY APPLICATION, 2020–2028(KILOTONS)

TABLE 170.CHINA POLYAMIDE MARKET, BY APPLICATION, 2020–2028 ($MILLION)

TABLE 171.CHINA POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028(KILOTONS)

TABLE 172.CHINA POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028 ($MILLION)

TABLE 173.JAPAN POLYAMIDE MARKET, BY TYPE, 2020–2028(KILOTONS)

TABLE 174.JAPAN POLYAMIDE MARKET, BY TYPE, 2020–2028 ($MILLION)

TABLE 175.JAPAN POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 176.JAPAN POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 177.JAPAN POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 178.JAPAN POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 179.JAPAN POLYAMIDE MARKET, BY APPLICATION, 2020–2028(KILOTONS)

TABLE 180.JAPAN POLYAMIDE MARKET, BY APPLICATION, 2020–2028 ($MILLION)

TABLE 181.JAPAN POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028(KILOTONS)

TABLE 182.JAPAN POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028 ($MILLION)

TABLE 183.INDIA POLYAMIDE MARKET, BY TYPE, 2020–2028(KILOTONS)

TABLE 184.INDIA POLYAMIDE MARKET, BY TYPE, 2020–2028 ($MILLION)

TABLE 185.INDIA POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 186.INDIA POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 187.INDIA POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 188.INDIA POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 189.INDIA POLYAMIDE MARKET, BY APPLICATION, 2020–2028(KILOTONS)

TABLE 190.INDIA POLYAMIDE MARKET, BY APPLICATION, 2020–2028 ($MILLION)

TABLE 191.INDIA POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028(KILOTONS)

TABLE 192.INDIA POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028 ($MILLION)

TABLE 193.SOUTH KOREA POLYAMIDE MARKET, BY TYPE, 2020–2028(KILOTONS)

TABLE 194.SOUTH KOREA POLYAMIDE MARKET, BY TYPE, 2020–2028 ($MILLION)

TABLE 195.SOUTH KOREA POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 196.SOUTH KOREA POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 197.SOUTH KOREA POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 198.SOUTH KOREA POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 199.SOUTH KOREA POLYAMIDE MARKET, BY APPLICATION, 2020–2028(KILOTONS)

TABLE 200.SOUTH KOREA POLYAMIDE MARKET, BY APPLICATION, 2020–2028 ($MILLION)

TABLE 201.SOUTH KOREA POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028(KILOTONS)

TABLE 202.SOUTH KOREA POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028 ($MILLION)

TABLE 203.REST OF ASIA-PACIFIC POLYAMIDE MARKET, BY TYPE, 2020–2028(KILOTONS)

TABLE 204.REST OF ASIA-PACIFIC POLYAMIDE MARKET, BY TYPE, 2020–2028 ($MILLION)

TABLE 205.REST OF ASIA-PACIFIC POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 206.REST OF ASIA-PACIFIC POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 207.REST OF ASIA-PACIFIC POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 208.REST OF ASIA-PACIFIC POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 209.REST OF ASIA-PACIFIC POLYAMIDE MARKET, BY APPLICATION, 2020–2028(KILOTONS)

TABLE 210.REST OF ASIA-PACIFIC POLYAMIDE MARKET, BY APPLICATION, 2020–2028 ($MILLION)

TABLE 211.REST OF ASIA-PACIFIC POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028(KILOTONS)

TABLE 212.REST OF ASIA-PACIFIC POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028 ($MILLION)

TABLE 213.LAMEA POLYAMIDE MARKET, BY TYPE, 2020–2028(KILOTONS)

TABLE 214.LAMEA POLYAMIDE MARKET, BY TYPE, 2020–2028 ($MILLION)

TABLE 215.LAMEA POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 216.LAMEA POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 217.LAMEA POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 218.LAMEA POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 219.LAMEA POLYAMIDE MARKET, BY APPLICATION, 2020–2028(KILOTONS)

TABLE 220.LAMEA POLYAMIDE MARKET, BY APPLICATION, 2020–2028 ($MILLION)

TABLE 221.LAMEA POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028(KILOTONS)

TABLE 222.LAMEA POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028 ($MILLION)

TABLE 223.LAMEA POLYAMIDE MARKET, BY COUNTRY 2020–2028(KILOTONS)

TABLE 224.LAMEA POLYAMIDE MARKET, BY COUNTRY 2020–2028 ($MILLION)

TABLE 225.BRAZIL POLYAMIDE MARKET, BY TYPE, 2020–2028(KILOTONS)

TABLE 226.BRAZIL POLYAMIDE MARKET, BY TYPE, 2020–2028 ($MILLION)

TABLE 227.BRAZIL POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 228.BRAZIL POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 229.BRAZIL POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 230.BRAZIL POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 231.BRAZIL POLYAMIDE MARKET, BY APPLICATION, 2020–2028(KILOTONS)

TABLE 232.BRAZIL POLYAMIDE MARKET, BY APPLICATION, 2020–2028 ($MILLION)

TABLE 233.BRAZIL POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028(KILOTONS)

TABLE 234.BRAZIL POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028 ($MILLION)

TABLE 235.SAUDI ARABIA POLYAMIDE MARKET, BY TYPE, 2020–2028(KILOTONS)

TABLE 236.SAUDI ARABIA POLYAMIDE MARKET, BY TYPE, 2020–2028 ($MILLION)

TABLE 237.SAUDI ARABIA POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 238.SAUDI ARABIA POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 239.SAUDI ARABIA POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 240.SAUDI ARABIA POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 241.SAUDI ARABIA POLYAMIDE MARKET, BY APPLICATION, 2020–2028(KILOTONS)

TABLE 242.SAUDI ARABIA POLYAMIDE MARKET, BY APPLICATION, 2020–2028 ($MILLION)

TABLE 243.SAUDI ARABIA POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028(KILOTONS)

TABLE 244.SAUDI ARABIA POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028 ($MILLION)

TABLE 245.SOUTH AFRICA POLYAMIDE MARKET, BY TYPE, 2020–2028(KILOTONS)

TABLE 246.SOUTH AFRICA POLYAMIDE MARKET, BY TYPE, 2020–2028 ($MILLION)

TABLE 247.SOUTH AFRICA POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 248.SOUTH AFRICA POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 249.SOUTH AFRICA POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 250.SOUTH AFRICA POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 251.SOUTH AFRICA POLYAMIDE MARKET, BY APPLICATION, 2020–2028(KILOTONS)

TABLE 252.SOUTH AFRICA POLYAMIDE MARKET, BY APPLICATION, 2020–2028 ($MILLION)

TABLE 253.SOUTH AFRICA POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028(KILOTONS)

TABLE 254.SOUTH AFRICA POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028 ($MILLION)

TABLE 255.REST OF LAMEA POLYAMIDE MARKET, BY TYPE, 2020–2028(KILOTONS)

TABLE 256.REST OF LAMEA POLYAMIDE MARKET, BY TYPE, 2020–2028 ($MILLION)

TABLE 257.REST OF LAMEA POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 258.REST OF LAMEA POLYAMIDES MARKET FOR ALIPHATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 259.REST OF LAMEA POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 (KILOTONS)

TABLE 260.REST OF LAMEA POLYAMIDES MARKET FOR AROMATIC POLYAMIDES BY TYPE, 2020–2028 ($MILLION)

TABLE 261.REST OF LAMEA POLYAMIDE MARKET, BY APPLICATION, 2020–2028(KILOTONS)

TABLE 262.REST OF LAMEA POLYAMIDE MARKET, BY APPLICATION, 2020–2028 ($MILLION)

TABLE 263.REST OF LAMEA POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028(KILOTONS)

TABLE 264.REST OF LAMEA POLYAMIDE MARKET, BY END-USE INDUSTRY, 2020–2028 ($MILLION)

TABLE 265.KEY NEW PRODUCT LAUNCHES (2017-2021)

TABLE 266.KEY EXPANSIONS (2017-2021)

TABLE 267.KEY ACQUISITION (2017-2021)

TABLE 268.ASCEND PERFORMANCE MATERIALS LLC: COMPANY SNAPSHOT

TABLE 269.ASCEND PERFORMANCE MATERIALS LLC: PRODUCT PORTFOLIO

TABLE 270.ASCEND PERFORMANCE MATERIALS LLC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 271.ARKEMA S.A.: COMPANY SNAPSHOT

TABLE 272.ARKEMA S.A.: OPERATING SEGMENTS

TABLE 273.ARKEMA S.A.: PRODUCT PORTFOLIO

TABLE 274.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 275.ARKEMA S.A.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 276.BASF SE: COMPANY SNAPSHOT

TABLE 277.BASF SE: OPERATING SEGMENTS

TABLE 278.BASF: PRODUCT PORTFOLIO

TABLE 279.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 280.BASF: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 281.EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

TABLE 282.EVONIK INDUSTRIES AG: OPERATING SEGMENTS

TABLE 283.EVONIK INDUSTRIES AG: PRODUCT PORTFOLIO

TABLE 284.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 285.EVONIK: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 286.GSFC: COMPANY SNAPSHOT

TABLE 287.GSFC: OPERATING SEGMENTS

TABLE 288.GSFC: PRODUCT PORTFOLIO

TABLE 289.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 290.KOCH: COMPANY SNAPSHOT

TABLE 291.KOCH: PRODUCT PORTFOLIO

TABLE 292.LANXESS: COMPANY SNAPSHOT

TABLE 293.LANXESS: OPERATING SEGMENTS

TABLE 294.LANXESS: PRODUCT PORTFOLIO

TABLE 295.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 296.MITSUBISHI: COMPANY SNAPSHOT

TABLE 297.MITSUBISHI: OPERATING SEGMENTS

TABLE 298.MITSUBISHI: PRODUCT PORTFOLIO

TABLE 299.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 300.RADICI GROUP: COMPANY SNAPSHOT

TABLE 301.RADICI GROUP: PRODUCT PORTFOLIO

TABLE 302.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 303.RADICI GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 304.ROYAL DSM: COMPANY SNAPSHOT

TABLE 305.ROYAL DSM: OPERATING SEGMENTS

TABLE 306.ROYAL DSM: PRODUCT PORTFOLIO

TABLE 307.OVERALL FINANCIAL STATUS ($MILLION)

LIST OF FIGURES

FIGURE 01.GLOBAL POLYAMIDE MARKET SEGMENTATION

FIGURE 02.TOP INVESTMENT POCKETS, BY TYPE (2020)

FIGURE 03.MODERATE BARGAINING POWER OF SUPPLIERS

FIGURE 04.LOW BARGAINING POWER OF BUYERS

FIGURE 05.MODERATE THREAT OF NEW ENTRANTS

FIGURE 06.MODERATE THREAT OF SUBSTITUTES

FIGURE 07.HIGH INTENSITY OF COMPETITIVE RIVALRY

FIGURE 08.POLYAMIDE MARKET DYNAMICS

FIGURE 09.PATENT ANALYSIS, BY COUNTRY

FIGURE 10.POLYAMIDE MARKET REVENUE, BY TYPE, 2020–2028($MILLION)

FIGURE 11.COMPARATIVE ANALYSIS OF POLYAMIDE MARKET FOR ALIPHATIC POLYAMIDES, BY COUNTRY, 2020–2028($MILLION)

FIGURE 12.COMPARATIVE ANALYSIS OF POLYAMIDE MARKET FOR AROMATIC POLYAMIDES, BY COUNTRY, 2020–2028 ($MILLION)

FIGURE 13.POLYAMIDE MARKET REVENUE, BY APPLICATION 2020–2028, ($MILLION)

FIGURE 14.COMPARATIVE ANALYSIS OF POLYAMIDE MARKET FOR POLYAMIDE FIBERS & FILMS, BY COUNTRY, 2020–2028 ($MILLION)

FIGURE 15.COMPARATIVE ANALYSIS OF POLYAMIDE MARKET FOR ENGINEERING PLASTICS, BY COUNTRY, 2020–2028 ($MILLION)

FIGURE 16.POLYAMIDE MARKET REVENUE, BY END-USE INDUSTRY 2020–2028, ($MILLION)

FIGURE 17.COMPARATIVE ANALYSIS OF POLYAMIDE MARKET FOR AUTOMOTIVE, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 18.COMPARATIVE ANALYSIS OF POLYAMIDE MARKET FOR ELECTRICAL & ELECTRONICS, BY COUNTRY, 2020–2028 ($MILLION)

FIGURE 19.COMPARATIVE ANALYSIS OF POLYAMIDE MARKET FOR TEXTILE, BY COUNTRY, 2020–2028 ($MILLION)

FIGURE 20.COMPARATIVE ANALYSIS OF POLYAMIDE MARKET FOR CONSTRUCTION, BY COUNTRY, 2020–2028 ($MILLION)

FIGURE 21.COMPARATIVE ANALYSIS OF POLYAMIDE MARKET FOR PACKAGING, BY COUNTRY, 2020–2028 ($MILLION)

FIGURE 22.COMPARATIVE ANALYSIS OF POLYAMIDE MARKET FOR CONSUMER GOODS, BY COUNTRY, 2020–2028 ($MILLION)

FIGURE 23.COMPARATIVE ANALYSIS OF POLYAMIDE MARKET FOR OTHERS, BY COUNTRY, 2020–2028 ($MILLION)

FIGURE 24.U.S. REVENUE FOR POLYAMIDE 2020–2028, ($MILLION)

FIGURE 25.CANADA REVENUE FOR POLYAMIDE 2020–2028, ($MILLION)

FIGURE 26.MEXICO REVENUE FOR POLYAMIDE 2020–2028, ($MILLION)

FIGURE 27.GERMANY REVENUE FOR POLYAMIDE 2020–2028, ($MILLION)

FIGURE 28.UK REVENUE FOR POLYAMIDE 2020–2028, ($MILLION)

FIGURE 29.FRANCE REVENUE FOR POLYAMIDE 2020–2028, ($MILLION)

FIGURE 30.FRANCE REVENUE FOR POLYAMIDE 2020–2028, ($MILLION)

FIGURE 31.SPAIN REVENUE FOR POLYAMIDE 2020–2028, ($MILLION)

FIGURE 32.REST OF EUROPE REVENUE FOR POLYAMIDE 2020–2028, ($MILLION)

FIGURE 33.CHINA REVENUE FOR POLYAMIDE 2020–2028, ($MILLION)

FIGURE 34.JAPAN REVENUE FOR POLYAMIDE 2020–2028, ($MILLION)

FIGURE 35.INDIA REVENUE FOR POLYAMIDE 2020–2028, ($MILLION)

FIGURE 36.SOUTH KOREA REVENUE FOR POLYAMIDE 2020–2028, ($MILLION)

FIGURE 37.REST OF ASIA-PACIFIC REVENUE FOR POLYAMIDE 2020–2028, ($MILLION)

FIGURE 38.BRAZIL REVENUE FOR POLYAMIDE 2020–2028, ($MILLION)

FIGURE 39.SAUDI ARABIA REVENUE FOR POLYAMIDE 2020–2028, ($MILLION)

FIGURE 40.SOUTH AFRICA REVENUE FOR POLYAMIDE 2020–2028, ($MILLION)

FIGURE 41.REST OF LAMEA REVENUE FOR POLYAMIDE 2020–2028, ($MILLION)

FIGURE 42.MARKET PLAYER POSITIONING, 2020

FIGURE 43.TOP WINNING STRATEGIES, BY YEAR, 2017–2021

FIGURE 44.TOP WINNING STRATEGIES, BY DEVELOPMENT, 2017–2021 (%)

FIGURE 45.TOP WINNING STRATEGIES, BY COMPANY, 2017–2021

FIGURE 46.PRODUCT MAPPING OF TOP 10 PLAYERS

FIGURE 47.COMPETITIVE HEATMAP OF KEY PLAYERS

FIGURE 48.ARKEMA S.A.: NET SALES, 2018–2020 ($MILLION)

FIGURE 49.ARKEMA S.A.: REVENUE SHARE, BY SEGMENT, 2020 (%)

FIGURE 50.BASF: REVENUE, 2018–2020 ($MILLION)

FIGURE 51.BASF: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 52.BASF: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 53.EVONIK: REVENUE, 2018–2020 ($MILLION)

FIGURE 54.EVONIK INDUSTRIES AG: REVENUE SHARE, BY SEGMENT, 2020 (%)

FIGURE 55.EVONIK INDUSTRIES AG: REVENUE SHARE, BY REGION, 2020 (%)

FIGURE 56.GSFC: REVENUE, 2017–2019 ($MILLION)

FIGURE 57.GSFC: REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 58.LANXESS: REVENUE, 2018–2020 ($MILLION)

FIGURE 59.LANXESS: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 60.LANXESS: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 61.MITSUBISHI: REVENUE, 2018–2020 ($MILLION)

FIGURE 62.MITSUBISHI: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 63.RADICI GROUP: REVENUE, 2017–2019 ($MILLION)

FIGURE 64.ROYAL DSM: REVENUE, 2018–2020 ($MILLION)

FIGURE 65.ROYAL DSM: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 66.ROYAL DSM: REVENUE SHARE BY REGION, 2020 (%)

$5769

$8995

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS