The global marine engine market size was valued at USD 11.62 billion in 2020 and is projected to reach USD 18.09 billion by 2030 growing at a CAGR of 4.7% from 2021 to 2030. Key drivers of the marine engines market include the growing adoption of two-stroke marine engines in ships due to superior torque and the ability to carry more weight.

The global seaborne trading activities are rising continuously driving the demand for international marine freight transportation which will augment the marine engines market growth.

However, the gradual adoption of electric vessels and volatile transport, as well as inventory prices, will spur the market penetration in the scheduled period.

Furthermore, the preference for dual-fuel engines and developments in engine technology will drive the growth of the market during the forecast period.

The popularity of two-stroke engine capacity

Ships and other marine vessels prefer two-stroke engines owing to their less fuel consumption which reduces operational costs. They have better thermal and power efficiency and are reliable. Moreover, these engines have fewer maintenance requirements and have a higher power-to-weight ratio which makes transportation of bulky goods easy. The direct starting and reversal mechanism is smooth. Hance cargo transportation is rising rapidly which will spur the growth of the marine engines market during the review period.

Increasing seaborne freight transport

Shipping transportation covers a substantial part of the global trade. With the advent of globalization, import-export trade activities have risen significantly. The majority portion of traded goods and services are shipped through marine vessels. The emergence of containerization has increased the efficiency of bulky cargo transport. This will ultimately drive the demand for the marine engines market during the forecast period.

Adoption of electric vessels

The marine industry accounts for a huge release of greenhouse gas emissions. In addition to it, harmful particles such as nitrogen oxide, sulfur oxide, soot, and fine dust are also emitted. Hence green maritime and decarbonization are gaining steam in the shipping industry. Government bodies are supporting the electrification of marine vessels. These ships run on electric batteries and are cheaper than diesel fuels. This will create restrictions for the marine engines market surge in the subsequent years.

Rapid research in dual-fuel engines

The demand for eco-friendly marine transportation has augmented the rise of dual-fuel marine engines. These engines have the capacity to run on both natural gas and diesel fuel. They emit lower CO2, nitrogen oxides, and particulate matter. This also leads to fuel cost savings. Hence rapid R&D initiatives are being undertaken by key players in designing the newer dual-fuel engine technology. This will enhance the penetration of the marine engines market during the forecast period.

Based on type, the bulk carriers segment dominated the global market in 2020. Bulk carriers are the workhorses of the merchant fleet, transporting raw materials like grain, iron ore, and coal, as well as finished goods like bauxite, cement, fertilizers, rice, sugar, and timber.

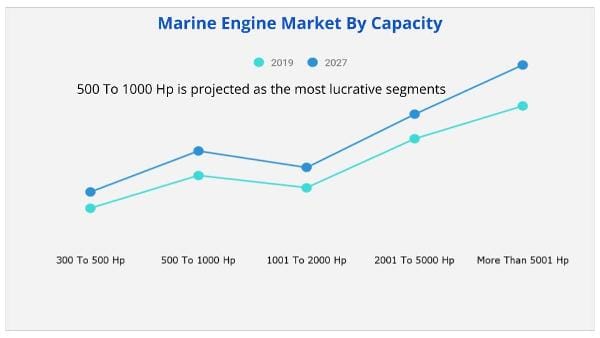

Based on capacity, In 2020, the segment of marine engines with more than 5001 horsepower dominated the global market.

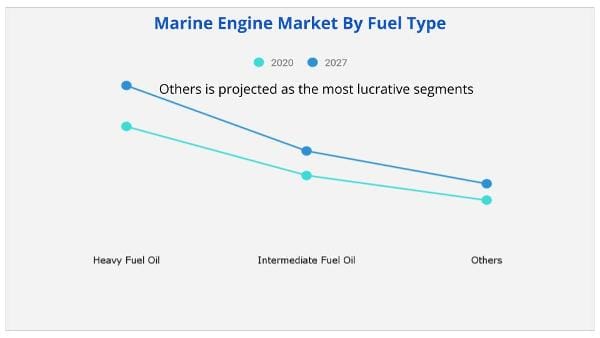

Based on fuel type, the heavy fuel oil segment is expected to lead the marine engine market during the forecast period.

Based on region, The Asia-Pacific region is expected to have the highest CAGR during the forecast period.

Covid-19 Impact Analysis

|

Report Metric |

Details |

|

Report Name |

Marine Engine Market |

|

The Market size value in 2020 |

11.62 Billion USD |

|

The Revenue forecast in 2030 |

18.09 Billion USD |

|

Growth Rate |

CAGR of 4.7% from 2021 to 2030 |

|

Base year considered |

2021 |

|

Forecast period |

2021- 2030 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, End-User, Offerings, and Region |

|

Report coverage |

Revenue & volume forecast, company share, competitive landscape, growth factors, and trends |

|

Geographic regions covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Companies covered |

Cummins Inc., Hyundai Heavy Industries Co., Ltd, MAN Energy Solutions, Mercury Marine, Mitsubishi Heavy Industries Ltd, Rolls Royce plc, Volvo Penta, Wartsila, and Yanmar Holdings Co., Ltd. |

Ans. The global marine engine market size was valued at USD 11.62 billion in 2020 and is projected to reach USD 18.09 billion by 2030.

Ans. The global marine engine market is expected to grow at a compound annual growth rate of 4.7% from 2021 to 2030.

Ans. The key players operating in the global marine engine market include Caterpillar Inc., Cummins Inc., Hyundai Heavy Industries Co., Ltd, MAN Energy Solutions, Mercury Marine, Mitsubishi Heavy Industries Ltd, Rolls Royce plc, Volvo Penta, Wartsila, and Yanmar Holdings Co., Ltd.

CHAPTER 1:INTRODUCTION

1.1.Report description

1.2.Key benefits for stakeholders

1.3.Key market segments

1.4.Research methodology

1.4.1.Primary research

1.4.2.Secondary research

1.4.3.Analyst tools and models

CHAPTER 2:EXECUTIVE SUMMARY

2.1.CXO perspective

CHAPTER 3:MARKET OVERVIEW

3.1.Market definition and scope

3.2.Key findings

3.2.1.Top impacting factors

3.2.2.Top investment pockets

3.2.3.Top winning strategies

3.3.Porter’s five forces analysis

3.4.Market share analysis (2020)

3.4.1.Market share analysis for marine engines

3.5.Market dynamics

3.5.1.Drivers

3.5.1.1.Increase in international marine freight transport

3.5.1.2.High demand for two stroke marine engines

3.5.1.3.Increase in water sports and leisure activities

3.5.2.Restraints

3.5.2.1.Rise in adoption of fully electric vessels

3.5.2.2.Fluctuations in transportation and inventory costs

3.5.3.Opportunities

3.5.3.1.Rise in adoption of dual fuel-based marine engines

3.5.3.2.Development of engine technology

3.6.Impact of COVID-19 on the market

3.6.1.Evolution of outbreaks

3.6.1.1.COVID-19

3.6.2.Micro-economic impact analysis

3.6.2.1.Consumer trend

3.6.2.2.Technology trends

3.6.2.3.Regulatory trend

3.6.3.COVID-19 impact analysis

CHAPTER 4:MARINE ENGINE MARKET, SHIP TYPE

4.1.Overview

4.2.Bulk carriers

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast, by region

4.2.3.Market analysis, by country

4.3.General cargo ships

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Market size and forecast, by region

4.3.3.Market analysis, by country

4.4.Container ships

4.4.1.Key market trends, growth factors, and opportunities

4.4.2.Market size and forecast, by region

4.4.3.Market analysis, by country

4.5.Ferries and passenger ships

4.5.1.Key market trends, growth factors, and opportunities

4.5.2.Market size and forecast, by region

4.5.3.Market analysis, by country

4.6.Oil tankers

4.6.1.Key market trends, growth factors, and opportunities

4.6.2.Market size and forecast, by region

4.6.3.Market analysis, by country

4.7.Others

4.7.1.Key market trends, growth factors, and opportunities

4.7.2.Market size and forecast, by region

4.7.3.Market analysis, by country

CHAPTER 5:MARINE ENGINE MARKET, BY CAPACITY

5.1.Overview

5.2.300 to 500 HP

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region

5.2.3.Market analysis, by country

5.3.500 to 1000 HP

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region

5.3.3.Market analysis, by country

5.4.1001 to 2000 HP

5.4.1.Key market trends, growth factors, and opportunities

5.4.2.Market size and forecast, by region

5.4.3.Market analysis, by country

5.5.2001 to 5000 HP

5.5.1.Key market trends, growth factors, and opportunities

5.5.2.Market size and forecast, by region

5.5.3.Market analysis, by country

5.6.More Than 5001 HP

5.6.1.Key market trends, growth factors, and opportunities

5.6.2.Market size and forecast, by region

5.6.3.Market analysis, by country

CHAPTER 6:MARINE ENGINE MARKET, BY FUEL TYPE

6.1.Overview

6.2.Heavy Fuel Oil (HFO)

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by region

6.2.3.Market analysis, by country

6.3.Intermediate fuel oil (IFO)

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by region

6.3.3.Market analysis, by country

6.4.Others

6.4.1.Key market trends, growth factors, and opportunities

6.4.2.Market size and forecast, by region

6.4.3.Market analysis, by country

CHAPTER 7:MARINE ENGINE MARKET, BY REGION

7.1.Overview

7.2.North America

7.2.1.Key market trends, growth factors, and opportunities

7.2.2.Market size and forecast, by ship type

7.2.3.Market size and forecast, by capacity

7.2.4.Market size and forecast, by fuel type

7.2.5.Market size and forecast, by country

7.2.5.1.U.S.

7.2.5.1.1.Market size and forecast, by ship type

7.2.5.1.2.Market size and forecast, by capacity

7.2.5.1.3.Market size and forecast, by fuel type

7.2.5.2.Canada

7.2.5.2.1.Market size and forecast, by ship type

7.2.5.2.2.Market size and forecast, by capacity

7.2.5.2.3.Market size and forecast, by fuel type

7.2.5.3.Mexico

7.2.5.3.1.Market size and forecast, by ship type

7.2.5.3.2.Market size and forecast, by capacity

7.2.5.3.3.Market size and forecast, by fuel type

7.3.Europe

7.3.1.Key market trends, growth factors, and opportunities

7.3.2.Market size and forecast, by ship type

7.3.3.Market size and forecast, by capacity

7.3.4.Market size and forecast, by fuel type

7.3.5.Market size and forecast, by country

7.3.5.1.France

7.3.5.1.1.Market size and forecast, by ship type

7.3.5.1.2.Market size and forecast, by capacity

7.3.5.1.3.Market size and forecast, by fuel type

7.3.5.2.Germany

7.3.5.2.1.Market size and forecast, by ship type

7.3.5.2.2.Market size and forecast, by capacity

7.3.5.2.3.Market size and forecast, by fuel type

7.3.5.3.Italy

7.3.5.3.1.Market size and forecast, by ship type

7.3.5.3.2.Market size and forecast, by capacity

7.3.5.3.3.Market size and forecast, by fuel type

7.3.5.4.Spain

7.3.5.4.1.Market size and forecast, by ship type

7.3.5.4.2.Market size and forecast, by capacity

7.3.5.4.3.Market size and forecast, by fuel type

7.3.5.5.UK

7.3.5.5.1.Market size and forecast, by ship type

7.3.5.5.2.Market size and forecast, by capacity

7.3.5.5.3.Market size and forecast, by fuel type

7.3.5.6.Rest of Europe

7.3.5.6.1.Market size and forecast, by ship type

7.3.5.6.2.Market size and forecast, by capacity

7.3.5.6.3.Market size and forecast, by fuel type

7.4.Asia-Pacific

7.4.1.Key market trends, growth factors, and opportunities

7.4.2.Market size and forecast, by ship type

7.4.3.Market size and forecast, by capacity

7.4.4.Market size and forecast, by fuel type

7.4.5.Market size and forecast, by country

7.4.5.1.China

7.4.5.1.1.Market size and forecast, by ship type

7.4.5.1.2.Market size and forecast, by capacity

7.4.5.1.3.Market size and forecast, by fuel type

7.4.5.2.India

7.4.5.2.1.Market size and forecast, by ship type

7.4.5.2.2.Market size and forecast, by capacity

7.4.5.2.3.Market size and forecast, by fuel type

7.4.5.3.Japan

7.4.5.3.1.Market size and forecast, by ship type

7.4.5.3.2.Market size and forecast, by capacity

7.4.5.3.3.Market size and forecast, by fuel type

7.4.5.4.South Korea

7.4.5.4.1.Market size and forecast, by ship type

7.4.5.4.2.Market size and forecast, by capacity

7.4.5.4.3.Market size and forecast, by fuel type

7.4.5.5.Rest of Asia-Pacific

7.4.5.5.1.Market size and forecast, by ship type

7.4.5.5.2.Market size and forecast, by capacity

7.4.5.5.3.Market size and forecast, by fuel type

7.5.LAMEA

7.5.1.Key market trends, growth factors, and opportunities

7.5.2.Market size and forecast, by ship type

7.5.3.Market size and forecast, by capacity

7.5.4.Market size and forecast, by fuel type

7.5.5.Market size and forecast, by country

7.5.5.1.Latin America

7.5.5.1.1.Market size and forecast, by ship type

7.5.5.1.2.Market size and forecast, by capacity

7.5.5.1.3.Market size and forecast, by fuel type

7.5.5.2.Middle East

7.5.5.2.1.Market size and forecast, by ship type

7.5.5.2.2.Market size and forecast, by capacity

7.5.5.2.3.Market size and forecast, by fuel type

7.5.5.3.Africa

7.5.5.3.1.Market size and forecast, by ship type

7.5.5.3.2.Market size and forecast, by capacity

7.5.5.3.3.Market size and forecast, by fuel type

CHAPTER 8:COMPANY PROFILES

8.1.CATERPILLAR INC.

8.1.1.Company overview

8.1.2.Key executives

8.1.3.Company snapshot

8.1.4.Operating business segments

8.1.5.Product portfolio

8.1.6.R&D expenditure

8.1.7.Business performance

8.1.8.Key strategic moves and developments

8.2.CUMMINS INC.

8.2.1.Company overview

8.2.2.Key executives

8.2.3.Company snapshot

8.2.4.Operating business segments

8.2.5.Product portfolio

8.2.6.R&D expenditure

8.2.7.Business performance

8.2.8.Key strategic moves and developments

8.3.HYUNDAI HEAVY INDUSTRIES CO., LTD.

8.3.1.Company overview

8.3.2.Key executives

8.3.3.Company snapshot

8.3.4.Operating business segments

8.3.5.Product portfolio

8.3.6.Business performance

8.3.7.Key strategic moves and developments

8.4.MAN ENERGY SOLUTION

8.4.1.Company overview

8.4.2.Key executives

8.4.3.Company snapshot

8.4.4.Operating business segments

8.4.5.Product portfolio

8.4.6.R&D expenditure

8.4.7.Business performance

8.4.8.Key strategic moves and developments

8.5.MERCURY MARINE

8.5.1.Company overview

8.5.2.Key executives

8.5.3.Company snapshot

8.5.4.Operating business segments

8.5.5.Product portfolio

8.5.6.Business performance

8.5.7.Key strategic moves and developments

8.6.MITSUBISHI HEAVY INDUSTRIES, LTD.

8.6.1.Company overview

8.6.2.Key executives

8.6.3.Company snapshot

8.6.4.Operating business segments

8.6.5.Product portfolio

8.6.6.R&D expenditure

8.6.7.Business performance

8.6.8.Key strategic moves and developments

8.7.ROLLS-ROYCE PLC

8.7.1.Company overview

8.7.2.Key executives

8.7.3.Company snapshot

8.7.4.Operating business segments

8.7.5.Product portfolio

8.7.6.R&D expenditure

8.7.7.Business performance

8.7.8.Key strategic moves and developments

8.8.VOLVO PENTA

8.8.1.Company overview

8.8.2.Key executives

8.8.3.Company snapshot

8.8.4.Operating business segments

8.8.5.Product portfolio

8.8.6.Business performance

8.8.7.Key strategic moves and developments

8.9.WARTSILA

8.9.1.Company overview

8.9.2.Key executives

8.9.3.Company snapshot

8.9.4.Operating business segments

8.9.5.Product portfolio

8.9.6.R&D expenditure

8.9.7.Business performance

8.9.8.Key strategic moves and developments

8.10.YANMAR CO., LTD

8.10.1.Company overview

8.10.2.Key executives

8.10.3.Company snapshot

8.10.4.Product portfolio

8.10.5.Business performance

8.10.6.Key strategic moves and developments

LIST OF TABLES

TABLE 01.MARINE ENGINE MARKET, BY SHIP TYPE, 2020–2030 ($MILLION)

TABLE 02.MARINE ENGINE MARKET FOR BULK CARRIERS, BY REGION 2020–2030 ($MILLION)

TABLE 03.BULK CARRIERS MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 04.MARINE ENGINE MARKET FOR GENERAL CARGO SHIPS, BY REGION 2020–2030 ($MILLION)

TABLE 05.GENERAL CARGO SHIP MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 06.MARINE ENGINE MARKET FOR CONTAINER SHIPS, BY REGION 2020–2030 ($MILLION)

TABLE 07.CONTAINER SHIP MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 08.MARINE ENGINE MARKET FOR FERRIES AND PASSENGER SHIPS, BY REGION 2020–2030 ($MILLION)

TABLE 09.FERRIES AND PASSENGER SHIPS MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 10.MARINE ENGINE MARKET FOR OIL TANKERS, BY REGION 2020–2030 ($MILLION)

TABLE 11.OIL TANKERS MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 12.MARINE ENGINE MARKET FOR OTHERS, BY REGION 2020–2030 ($MILLION)

TABLE 13.OTHERS MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 14.MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 15.MARINE ENGINE MARKET FOR 300 TO 500 HP, BY REGION 2020–2030 ($MILLION)

TABLE 16.MARINE ENGINE MARKET FOR 500 TO 1000HP, BY REGION 2020–2030 ($MILLION)

TABLE 17.MARINE ENGINE MARKET FOR 1001 TO 2000 HP, BY REGION 2020–2030 ($MILLION)

TABLE 18.MARINE ENGINE MARKET FOR 2001 TO 5000 HP, BY REGION 2020–2030 ($MILLION)

TABLE 19.MARINE ENGINE MARKET FOR MORE THAN 5001 HP, BY REGION 2020–2030 ($MILLION)

TABLE 20.MARINE ENGINE MARKET, BY FUEL TYPE, 2020–2030 ($MILLION)

TABLE 21.MARINE ENGINE MARKET FOR HEAVY FUEL OILS, BY REGION 2020–2030 ($MILLION)

TABLE 22.MARINE ENGINE MARKET FOR INTERMEDIATE FUEL OILS, BY REGION 2020–2030 ($MILLION)

TABLE 23.MARINE ENGINE MARKET FOR OTHERS, BY REGION 2020–2030 ($MILLION)

TABLE 24.MARINE ENGINE MARKET, BY REGION, 2020–2030 ($MILLION)

TABLE 25.NORTH AMERICA MARINE ENGINE MARKET, BY SHIP TYPE, 2020–2030 ($MILLION)

TABLE 26.NORTH AMERICA MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 27.NORTH AMERICA MARINE ENGINE MARKET, BY FUEL TYPE, 2020–2030 ($MILLION)

TABLE 28.U.S. MARINE ENGINE MARKET, BY SHIP TYPE, 2020–2030 ($MILLION)

TABLE 29.U.S. MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 30.U.S. MARINE ENGINE MARKET, BY FUEL TYPE, 2020–2030 ($MILLION)

TABLE 31.CANADA MARINE ENGINE MARKET, BY SHIP TYPE, 2020–2030 ($MILLION)

TABLE 32.CANADA MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 33.CANADA MARINE ENGINE MARKET, BY FUEL TYPE, 2020–2030 ($MILLION)

TABLE 34.MEXICO MARINE ENGINE MARKET, BY SHIP TYPE, 2020–2030 ($MILLION)

TABLE 35.MEXICO MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 36.MEXICO MARINE ENGINE MARKET, BY FUEL TYPE, 2020–2030 ($MILLION)

TABLE 37.EUROPE MARINE ENGINE MARKET, BY SHIP TYPE, 2020–2030 ($MILLION)

TABLE 38.EUROPE MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 39.EUROPE MARINE ENGINE MARKET, BY FUEL TYPE, 2020–2030 ($MILLION)

TABLE 40.FRANCE MARINE ENGINE MARKET, BY SHIP TYPE, 2020–2030 ($MILLION)

TABLE 41.FRANCE MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 42.FRANCE MARINE ENGINE MARKET, BY FUEL TYPE, 2020–2030 ($MILLION)

TABLE 43.GERMANY MARINE ENGINE MARKET, BY SHIP TYPE, 2020–2030 ($MILLION)

TABLE 44.GERMANY MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 45.GERMANY MARINE ENGINE MARKET, BY FUEL TYPE, 2020–2030 ($MILLION)

TABLE 46.ITALY MARINE ENGINE MARKET, BY SHIP TYPE, 2020–2030 ($MILLION)

TABLE 47.ITALY MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 48.ITALY MARINE ENGINE MARKET, BY FUEL TYPE, 2020–2030 ($MILLION)

TABLE 49.SPAIN MARINE ENGINE MARKET, BY SHIP TYPE, 2020–2030 ($MILLION)

TABLE 50.SPAIN MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 51.SPAIN MARINE ENGINE MARKET, BY FUEL TYPE, 2020–2030 ($MILLION)

TABLE 52.UK MARINE ENGINE MARKET, BY SHIP TYPE, 2020–2030 ($MILLION)

TABLE 53.UK MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 54.UK MARINE ENGINE MARKET, BY FUEL TYPE, 2020–2030 ($MILLION)

TABLE 55.REST OF EUROPE MARINE ENGINE MARKET, BY SHIP TYPE, 2020–2030 ($MILLION)

TABLE 56.REST OF EUROPE MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 57.REST OF EUROPE MARINE ENGINE MARKET, BY FUEL TYPE, 2020–2030 ($MILLION)

TABLE 58.ASIA-PACIFIC MARINE ENGINE MARKET, BY SHIP TYPE, 2020–2030 ($MILLION)

TABLE 59.ASIA-PACIFIC MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 60.ASIA-PACIFIC MARINE ENGINE MARKET, BY FUEL TYPE, 2020–2030 ($MILLION)

TABLE 61.CHINA MARINE ENGINE MARKET, BY SHIP TYPE, 2020–2030 ($MILLION)

TABLE 62.CHINA MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 63.CHINA MARINE ENGINE MARKET, BY FUEL TYPE, 2020–2030 ($MILLION)

TABLE 64.INDIA MARINE ENGINE MARKET, BY SHIP TYPE, 2020–2030 ($MILLION)

TABLE 65.INDIA MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 66.INDIA MARINE ENGINE MARKET, BY FUEL TYPE, 2020–2030 ($MILLION)

TABLE 67.JAPAN MARINE ENGINE MARKET, BY SHIP TYPE, 2020–2030 ($MILLION)

TABLE 68.JAPAN MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 69.JAPAN MARINE ENGINE MARKET, BY FUEL TYPE, 2020–2030 ($MILLION)

TABLE 70.SOUTH KOREA MARINE ENGINE MARKET, BY SHIP TYPE, 2020–2030 ($MILLION)

TABLE 71.SOUTH KOREA MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 72.SOUTH KOREA MARINE ENGINE MARKET, BY FUEL TYPE, 2020–2030 ($MILLION)

TABLE 73.REST OF ASIA-PACIFIC MARINE ENGINE MARKET, BY SHIP TYPE, 2020–2030 ($MILLION)

TABLE 74.REST OF ASIA-PACIFIC MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 75.REST OF ASIA-PACIFIC MARINE ENGINE MARKET, BY FUEL TYPE, 2020–2030 ($MILLION)

TABLE 76.LAMEA MARINE ENGINE MARKET, BY SHIP TYPE, 2020–2030 ($MILLION)

TABLE 77.LAMEA MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 78.LAMEA MARINE ENGINE MARKET, BY FUEL TYPE, 2020–2030 ($MILLION)

TABLE 79.LATIN AMERICA MARINE ENGINE MARKET, BY SHIP TYPE, 2020–2030 ($MILLION)

TABLE 80.LATIN AMERICA MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 81.LATIN AMERICA MARINE ENGINE MARKET, BY FUEL TYPE, 2020–2030 ($MILLION)

TABLE 82.MIDDLE EAST MARINE ENGINE MARKET, BY SHIP TYPE, 2020–2030 ($MILLION)

TABLE 83.MIDDLE EAST MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 84.MIDDLE EAST MARINE ENGINE MARKET, BY FUEL TYPE, 2020–2030 ($MILLION)

TABLE 85.AFRICA MARINE ENGINE MARKET, BY SHIP TYPE, 2020–2030 ($MILLION)

TABLE 86.AFRICA MARINE ENGINE MARKET, BY CAPACITY, 2020–2030 ($MILLION)

TABLE 87.AFRICA MARINE ENGINE MARKET, BY FUEL TYPE, 2020–2030 ($MILLION)

TABLE 88.CATERPILLAR INC.: KEY EXECUTIVES

TABLE 89.CATERPILLAR INC.: COMPANY SNAPSHOT

TABLE 90.CATERPILLAR INC.: OPERATING SEGMENTS

TABLE 91.CATERPILLAR INC: PRODUCT PORTFOLIO

TABLE 92.CATERPILLAR INC.: R&D EXPENDITURE, 2018–2020 ($MILLION)

TABLE 93.CATERPILLAR: NET SALES, 2018–2020 ($MILLION)

TABLE 94.CUMMINS INC.: KEY EXECUTIVES

TABLE 95.CUMMINS INC.: COMPANY SNAPSHOT

TABLE 96.CUMMINS INC.: OPERATING SEGMENTS

TABLE 97.CUMMINS INC: PRODUCT PORTFOLIO

TABLE 98.CUMMINS INC.: R&D EXPENDITURE, 2019–2021 ($MILLION)

TABLE 99.CUMMINS INC.: NET SALES, 2018–2020 ($MILLION)

TABLE 100.HYUNDAI HEAVY INDUSTRIES CO., LTD: KEY EXECUTIVE

TABLE 101.HYUNDAI HEAVY INDUSTRIES CO., LTD: COMPANY SNAPSHOT

TABLE 102.HYUNDAI HEAVY INDUSTRIES CO., LTD OPERATING SEGMENTS

TABLE 103.HYUNDAI HEAVY INDUSTRIES CO., LTD: PRODUCT PORTFOLIO

TABLE 104.HYUNDAI HEAVY INDUSTRIES CO., LTD: NET SALES, 2019–2021 ($MILLION)

TABLE 105.MAN ENERGY SOLUTIONS.: KEY EXECUTIVES

TABLE 106.MAN ENERGY SOLUTIONS: COMPANY SNAPSHOT

TABLE 107.MAN ENERGY SOLUTIONS: OPERATING SEGMENTS

TABLE 108.MAN ENERGY SOLUTIONS: PRODUCT PORTFOLIO

TABLE 109.MAN ENERGY SOLUTIONS: R&D EXPENDITURE, 2018–2020 ($MILLION)

TABLE 110.MAN ENERGY SOLUTIONS: NET SALES, 2018–2020 ($MILLION)

TABLE 111.MERCURY MARINE: KEY EXECUTIVES

TABLE 112.MERCURY MARINE: COMPANY SNAPSHOT

TABLE 113.MERCURY MARINE: OPERATING SEGMENTS

TABLE 114.MERCURY MARINE: PRODUCT PORTFOLIO

TABLE 115.MERCURY MARINE: NET SALES, 2019–2021 ($MILLION)

TABLE 116.MITSUBISHI HEAVY INDUSTRIES LTD.: KEY EXECUTIVES

TABLE 117.MITSUBISHI HEAVY INDUSTRIES LTD.: COMPANY SNAPSHOT

TABLE 118.MITSUBISHI HEAVY INDUSTRIES LTD.: OPERATING SEGMENTS

TABLE 119.MITSUBISHI HEAVY INDUSTRIES LTD.: PRODUCT PORTFOLIO

TABLE 120.MITSUBISHI HEAVY INDUSTRIES LTD: R&D EXPENDITURE, 2019–2021 ($MILLION)

TABLE 121.MITSUBISHI HEAVY INDUSTRIES LTD: NET SALES, 2018–2020 ($MILLION)

TABLE 122.ROLLS ROYCE PLC: KEY EXECUTIVES

TABLE 123.ROLLS ROYCE PLC: COMPANY SNAPSHOT

TABLE 124.ROLLS ROYCE PLC: OPERATING SEGMENTS

TABLE 125.ROLLS ROYCE PLC: PRODUCT PORTFOLIO

TABLE 126.ROLLS ROYCE PLC: R&D EXPENDITURE, 2019–2021 ($MILLION)

TABLE 127.ROLLS ROYCE PLC: NET SALES, 2018–2020 ($MILLION)

TABLE 128.VOLVO PENTA: KEY EXECUTIVES

TABLE 129.VOLVO PENTA: COMPANY SNAPSHOT

TABLE 130.VOLVO PENTA: OPERATING SEGMENTS

TABLE 131.VOLVO PENTA: PRODUCT PORTFOLIO

TABLE 132.VOLVO PENTA: NET SALES, 2018–2020 ($MILLION)

TABLE 133.WARTSILA: KEY EXECUTIVES

TABLE 134.WARTSILA: COMPANY SNAPSHOT

TABLE 135.WARTSILA OPERATING SEGMENTS

TABLE 136.WARTSILA: PRODUCT PORTFOLIO

TABLE 137.WARTSILA: R&D EXPENDITURE, 2019–2021 ($MILLION)

TABLE 138.WARTSILA: NET SALES, 2019–2021 ($MILLION)

TABLE 139.YANMAR CO., LTD.: KEY EXECUTIVE

TABLE 140.YANMAR CO., LTD.: COMPANY SNAPSHOT

TABLE 141.YANMAR CO., LTD.: PRODUCT PORTFOLIO

TABLE 142.YANMAR CO., LTD.: NET SALES, 2019–2021 ($MILLION)

LIST OF FIGURES

FIGURE 01.KEY MARKET SEGMENTS

FIGURE 02.MARINE ENGINE MARKET SNAPSHOT, BY SEGMENTATION, 2020–2030

FIGURE 03.MARINE ENGINE MARKET SNAPSHOT, BY REGION, 2020–2030

FIGURE 04.TOP IMPACTING FACTORS

FIGURE 05.TOP INVESTMENT POCKETS

FIGURE 06.TOP WINNING STRATEGIES, BY YEAR, 2019–2022*

FIGURE 07.TOP WINNING STRATEGIES, BY YEAR, 2019–2022*

FIGURE 08.TOP WINNING STRATEGIES, BY COMPANY, 2019–2022*

FIGURE 09.MODERATE TO HIGH BARGAINING POWER OF SUPPLIERS

FIGURE 10.MODERATE TO HIGH BARGAINING POWER OF BUYERS

FIGURE 11.MODERATE TO HIGH THREAT OF NEW ENTRANTS

FIGURE 12.MODERATE THREAT OF SUBSTITUTES

FIGURE 13.MODERATE TO HIGH COMPETITIVE RIVALARY

FIGURE 14.NORTH AMERICA MARKET SHARE ANALYSIS (2020)

FIGURE 15.EUROPE MARKET SHARE ANALYSIS (2020)

FIGURE 16.ASIA-PACIFIC MARKET SHARE ANALYSIS (2020)

FIGURE 17.LAMEA MARKET SHARE ANALYSIS (2020)

FIGURE 18.INTERNATIONAL MARITIME TRADE (2010-2019)

FIGURE 19.MARINE ENGINE MARKET SHARE, BY SHIP TYPE, 2020–2030 (%)

FIGURE 20.COMPARATIVE SHARE ANALYSIS OF MARINE ENGINE MARKET FOR BULK CARRIERS, BY COUNTRY, 2020 & 2030($MILLION)

FIGURE 21.COMPARATIVE SHARE ANALYSIS OF MARINE ENGINE MARKET FOR GENERAL CARGO SHIPS, BY COUNTRY, 2020 & 2030 (%)

FIGURE 22.COMPARATIVE SHARE ANALYSIS OF MARINE ENGINE MARKET FOR CONTAINER SHIPS, BY COUNTRY, 2020 & 2030 ($MILLION)

FIGURE 23.COMPARATIVE SHARE ANALYSIS OF MARINE ENGINE MARKET FOR FERRIES AND PASSENGER SHIPS, BY COUNTRY, 2020 & 2030($MILLION)

FIGURE 24.COMPARATIVE SHARE ANALYSIS OF MARINE ENGINE MARKET FOR OIL TANKER, BY COUNTRY, 2020 & 2030 ($MILLION)

FIGURE 25.COMPARATIVE SHARE ANALYSIS OF MARINE ENGINE MARKET FOR OTHERS, BY COUNTRY, 2020 & 2030 ($MILLION)

FIGURE 26.MARINE ENGINE MARKET SHARE, BY CAPACITY, 2020–2030 (%)

FIGURE 27.COMPARATIVE SHARE ANALYSIS OF MARINE ENGINE MARKET FOR 300 HP TO 500 HP, BY COUNTRY, 2020 & 2030 ($MILLION)

FIGURE 28.COMPARATIVE SHARE ANALYSIS OF MARINE ENGINE MARKET FOR 500 TO 1000HP, BY COUNTRY, 2020 & 2030 ($MILLION)

FIGURE 29.COMPARATIVE SHARE ANALYSIS OF MARINE ENGINE MARKET FOR 1001 TO 2000 HP, BY COUNTRY, 2020 & 2030 ($ MILLION)

FIGURE 30.COMPARATIVE SHARE ANALYSIS OF MARINE ENGINE MARKET FOR 2001 TO 5000 HP, BY COUNTRY, 2020 & 2030 ($MILLION)

FIGURE 31.COMPARATIVE SHARE ANALYSIS OF MARINE ENGINE MARKET FOR MORE THAN 5001 HP, BY COUNTRY, 2020 & 2030 ($MILLION)

FIGURE 32.MARINE ENGINE MARKET SHARE, BY FUEL TYPE, 2020–2030 (%)

FIGURE 33.COMPARATIVE SHARE ANALYSIS OF MARINE ENGINE MARKET FOR HEAVY FUEL OILS, BY COUNTRY, 2020 & 2030 ($MILLION)

FIGURE 34.COMPARATIVE SHARE ANALYSIS OF MARINE ENGINE MARKET FOR INTERMEDIATE FUEL OILS, BY COUNTRY, 2020 & 2030 ($MILLION)

FIGURE 35.COMPARATIVE SHARE ANALYSIS OF MARINE ENGINE MARKET FOR OTHERS, BY COUNTRY, 2020 & 2030 ($MILLION)

FIGURE 36.MARINE ENGINE MARKET, BY REGION, 2021–2030 (%)

FIGURE 37.COMPARATIVE SHARE ANALYSIS OF MARINE ENGINE MARKET, BY COUNTRY, 2020–2030 (%)

FIGURE 38.U.S. MARINE ENGINE MARKET, 2020–2030 ($MILLION)

FIGURE 39.CANADA MARINE ENGINE MARKET, 2020–2030 ($MILLION)

FIGURE 40.MEXICO MARINE ENGINE MARKET, 2020–2030 ($MILLION)

FIGURE 41.COMPARATIVE SHARE ANALYSIS OF MARINE ENGINE MARKET, BY COUNTRY, 2020–2030 (%)

FIGURE 42.FRANCE MARINE ENGINE MARKET, 2020–2030 ($MILLION)

FIGURE 43.GERMANY MARINE ENGINE MARKET, 2020–2030 ($MILLION)

FIGURE 44.ITALY MARINE ENGINE MARKET, 2020–2030 ($MILLION)

FIGURE 45.SPAIN MARINE ENGINE MARKET, 2020–2030 ($MILLION)

FIGURE 46.UK MARINE ENGINE MARKET, 2020–2030 ($MILLION)

FIGURE 47.REST OF EUROPE MARINE ENGINE MARKET, 2020–2030 ($MILLION)

FIGURE 48.COMPARATIVE SHARE ANALYSIS OF MARINE ENGINE MARKET, BY COUNTRY, 2020–2030 (%)

FIGURE 49.CHINA MARINE ENGINE MARKET, 2020–2030 ($MILLION)

FIGURE 50.INDIA MARINE ENGINE MARKET, 2020–2030 ($MILLION)

FIGURE 51.JAPAN MARINE ENGINE MARKET, 2020–2030 ($MILLION)

FIGURE 52.SOUTH KOREA MARINE ENGINE MARKET, 2020–2030 ($MILLION)

FIGURE 53.REST OF ASIA-PACIFIC MARINE ENGINE MARKET, 2020–2030 ($MILLION)

FIGURE 54.COMPARATIVE SHARE ANALYSIS OF MARINE ENGINE MARKET, BY COUNTRY, 2020–2030 (%)

FIGURE 55.LATIN AMERICA MARINE ENGINE MARKET, 2020–2030 ($MILLION)

FIGURE 56.MIDDLE EAST MARINE ENGINE MARKET, 2020–2030 ($MILLION)

FIGURE 57.AFRICA MARINE ENGINE MARKET, 2020–2030 ($MILLION)

FIGURE 58.CATERPILLAR INC.: R&D EXPENDITURE, 2018–2020 ($MILLION)

FIGURE 59.CATERPILLAR INC.: NET SALES, 2018–2020 ($MILLION)

FIGURE 60.CATERPILLAR INC.: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 61.CATERPILLAR INC.: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 62.CUMMINS INC.: R&D EXPENDITURE, 2019–2021 ($MILLION)

FIGURE 63.CUMMINS INC.NET SALES, 2019–2021 ($MILLION)

FIGURE 64.CUMMINS INC.REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 65.CUMMINS INC.: REVENUE SHARE BY REGION, 2021 (%)

FIGURE 66.HYUNDAI HEAVY INDUSTRIES CO., LTD A: NET SALES, 2019–2021 ($MILLION)

FIGURE 67.HYUNDAI HEAVY INDUSTRIES CO., LTD: REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 68.MAN ENERGY SOLUTIONS: R&D EXPENDITURE, 2018–2020 ($MILLION)

FIGURE 69.MAN ENERGY SOLUTIONS: NET SALES, 2019–2021 ($MILLION

FIGURE 70.MERCURY MARINE: NET SALES, 2019–2021 ($MILLION)

FIGURE 71.MITSUBISHI HEAVY INDUSTRIES LTD.: R&D EXPENDITURE, 2019–2021 ($MILLION)

FIGURE 72.MITSUBISHI HEAVY INDUSTRIES LTD: NET SALES, 2019–2021 ($MILLION)

FIGURE 73.MITSUBISHI HEAVY INDUSTRIES LTD: REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 74.MITSUBISHI HEAVY INDUSTRIES LTD: REVENUE SHARE BY REGION, 2021 (%)

FIGURE 75.ROLLS ROYCE PLC: R&D EXPENDITURE, 2019–2021 ($MILLION)

FIGURE 76.ROLLS ROYCE PLC: NET SALES, 2019–2021 ($MILLION)

FIGURE 77.ROLLS ROYCE PLC: REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 78.ROLLS ROYCE PLC: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 79.VOLVO PENTA: NET SALES, 2019–2021 ($MILLION)

FIGURE 80.VOLVO PENTA: REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 81.VOLVO PENTA: REVENUE SHARE BY REGION, 2021 (%)

FIGURE 82.WARTSILA: R&D EXPENDITURE, 2019–2021 ($MILLION)

FIGURE 83.WARTSILA: NET SALES, 2019–2021 ($MILLION)

FIGURE 84.WARTSILA: REVENUE SHARE BY REGION, 2021 (%)

FIGURE 85.WARTSILA: REVENUE SHARE BY REGION, 2021 (%)

FIGURE 86.YANMAR CO., LTD.: NET SALES, 2018–2020 ($MILLION)

$5769

$6450

$9995

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS