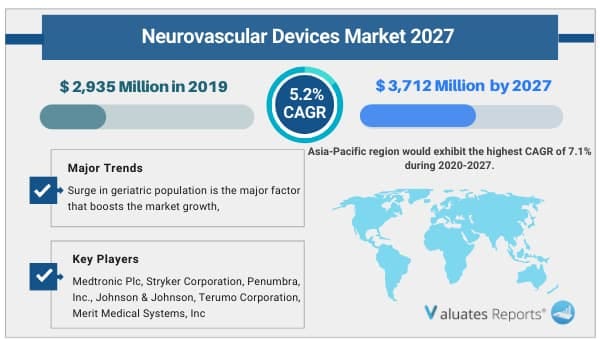

The Neurovascular Devices Market accounted for USD 2,935 Million in 2019, and is expected to reach USD 3,712 Million by 2027, registering a CAGR of 5.2% from 2020 to 2027.

Embolization devices segment is expected to witness a decline owing to delay in elective surgical embolization of un-ruptured aneurysm due to COVID-19 pandemic.

Neurovascular devices are employed in treatment of neurovascular disorders. For instance, neurovascular devices include clips, coils, and stents, which are used in treatment of neurovascular disorders such as brain aneurysm. Similarly, clot retrieval devices, suction & aspiration devices are employed for removal of blood clots form arteries and veins of brain, which can lead to fatal conditions such as stroke. Some other neurovascular devices include carotid artery stents, distal filter devices, and microcatheters. In addition, some neurovascular conditions that are treated by aid of neurovascular devices include aneurysm, arteriovenous malformation and fistulas, ischemic stroke, and stenosis.

Surge in geriatric population is the major factor that boosts the market growth. Furthermore, other factors such as rise in prevalence of neurovascular diseases and surge in adoption of neurovascular devices across the globe also contribute toward growth of the market. In addition, factors such as surge in technological advancements related to neurovascular devices also propel growth of the neurovascular devices market. However, high cost of neurovascular devices and dearth of qualified neurosurgeons to handle these devices restrict growth of the market. Conversely, high growth rate exhibited by developing nations provide lucrative opportunities for players operating in the neurovascular devices market.

Moreover, COVID-19 pandemic has also affected the market adversely. For instance, after COVID-19 was declared as a pandemic by the WHO, countries worldwide adopted nationwide lockdowns to observe social distancing as a measure to contain the spread. This led to disruption, limitation, challenges, and changes in each sector of every industry. Similarly, the neurovascular devices industry was also impacted by the pandemic. For instance, neurovascular devices are used in surgical operations. Thus, limited availability of medical care for conditions other than COVID-19 around the world has impacted the neurovascular market in a negative manner. Furthermore, limited availability of healthcare staff across the world is another factor, which has a negative effect on the neurovascular devices market. In addition, surgeries that are not urgent and can be postponed such as in case of brain aneurysm has also impacted market in a negative way. However, the ischemic stroke segment is less impacted as patients require urgent need for medical attention in case of ischemic stroke.

The global neurovascular devices market is segmented on the basis of product, disease pathology, and region to provide a detailed assessment of the market. By product, the market is divided into embolization devices, revascularization devices, thrombectomy devices, embolic protection devices, and accessory devices.

Moreover, these product categories are further divided into sub segments for a profound understanding. For instance, the embolization devices segment is divided into clippings, embolic coils, coil assist stents, and coil assist balloons. In addition, the embolic coils segment is further divided into bare detachable coils and coated detachable coils.

The revascularization device segment is further divided into carotid artery stents and flow diversion stents. In addition, the thrombectomy devices segment is divided into clot retrieval devices, suction & aspiration devices, and snares. The embolic protection devices segment is divided in distal filter devices and balloon occlusion devices. Similarly, the accessory devices segment is divided into microcatheters and micro guidewires.

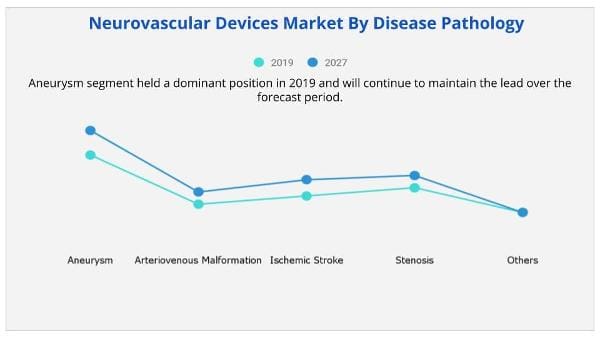

By disease pathology, the market is classified into aneurysm, arteriovenous malformation (AVM), stenosis, ischemic stroke, and others. By region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

On the basis of product, the embolization devices segment held a dominant share in 2019, owing to factors such as rise in prevalence of neurovascular diseases, which require use of embolization devices. For instance, neurovascular disorders such as arteriovenous malformations (AVMs), carotid artery diseases, and intracranial atherosclerotic diseases are highly prevalent and require use of embolization devices. Furthermore, other factors such as surge in launch of new and advanced neurovascular devices also contribute to growth of the market. In addition, the revascularization devices segment is expected to grow at the highest CAGR during the forecast period.

By disease pathology, the aneurysm segment occupied largest neurovascular devices market share in 2019, owing to surge in prevalence of the medical condition. In addition, the ischemic stroke segment is expected to grow rapidly during the forecast period.

In 2019, North America accounted for major share of the neurovascular devices market size, and is expected to continue this trend, owing to presence of large number of key players operating in the neurovascular devices market. For instance, some key players that operate in the region include Stryker Corporation, Penumbra, Inc., Johnson & Johnson, and Merit medical systems, Inc. Thus, presence of key players in the region leads to easy availability of neurovascular devices. Moreover, other factors such as surge in prevalence of neurovascular disorders is another major factor that boosts neurovascular devices market growth in the region. Moreover, Asia-Pacific is expected to exhibit fastest growth rate, owing to surge in awareness related to use of neurovascular devices. The other factors that boost neurovascular devices market growth include surge in healthcare expenditure.

The global neurovascular devices market is highly competitive and the prominent players in the market have adopted various strategies to garner maximum neurovascular devices market share. These include collaboration, product launch, partnership, and acquisition. Major players operating in the market include Medtronic Plc, Stryker Corporation, Penumbra, Inc., Johnson & Johnson, Terumo Corporation, Merit Medical Systems, Inc.., Integer Holdings Corporation, Acandis GmbH., W. L. Gore & Associates, Inc., and Microport Scientific Corporation.

|

Report Metric |

Details |

|

Report Name |

Neurovascular Devices Market |

|

Market size value in 2019 |

USD 2,935 Million |

|

Revenue forecast in 2027 |

USD 3,712 Million |

|

Growth Rate |

5.2% |

|

Base year considered |

2019 |

|

Forecast Period |

2020-2027 |

|

By Product |

Embolization Devices, Revascularization Devices, Embolic Protection Devices, and Accessory Devices |

|

By Disease Pathology |

Aneurysm, Arteriovenous Malformation (AVM), Ischemic Stroke, Stenosis |

|

Report Coverage |

Revenue & volume forecast, company share, competitive landscape, growth factors, and trends |

|

Segments Covered |

By Type, Application, and Region |

|

Geographic Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Ans. The neurovascular devices market accounted for $2,935 million in 2019, and is expected to reach $3,712 million by 2027, registering a CAGR of 5.2% from 2020 to 2027.

Ans. Some of the major companies are Medtronic Plc, Stryker Corporation, Penumbra, Inc., Johnson & Johnson, Terumo Corporation, Merit Medical Systems, Inc

Ans. Yes, the report includes a COVID-19 impact analysis. Also, it is further extended into every individual segment of the report.

CHAPTER 1:INTRODUCTION

1.1.Report description

1.2.Key market segments

1.2.1.List of key players profiled in the report

1.3.Research methodology

1.3.1.Primary research

1.3.2.Secondary research

1.3.3.Analyst tools and models

CHAPTER 2:EXECUTIVE SUMMARY

2.1.Key findings of the study

2.2.CXO perspective

CHAPTER 3:MARKET OVERVIEW

3.1.Market definition and scope

3.2.Key findings

3.2.1.Top Wining Strategies

3.2.2.Top investment pockets

3.3.Market share analysis, 2019

3.4.Key forces shaping neurovascular devices industry/market

3.5.Market dynamics

3.5.1.Drivers

3.5.1.1.Surge in geriatric population across the globe

3.5.1.2.Rise in prevalence of neurovascular diseases

3.5.1.3.Increase in prevalence of underlying disease conditions serve as risk neurovascular diseases.

3.5.1.4.Technological advancements related to neurovascular devices

3.5.2.Restraints

3.5.2.1.High cost of neurovascular devices

3.5.2.2.Dearth of neurosurgeons across the globe

3.5.3.Opportunity

3.5.3.1.Opportunities in emerging markets

3.5.4.Impact Analyses

CHAPTER 4:NEUROVASCULAR DEVICES MARKET, BY PRODUCT

4.1.Overview

4.1.1.Market size and forecast

4.2.Embolization Devices

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast, by type

4.2.2.1.Clippings

4.2.2.1.1.Market size and forecast

4.2.2.2.Embolic Coils

4.2.2.2.1.Market size and forecast

4.2.2.2.2.Bare Detachable Coils

4.2.2.2.2.1.Market size and forecast

4.2.2.2.3.Coated Detachable Coil

4.2.2.2.3.1.Market size and forecast

4.2.2.3.Coil assist stent

4.2.2.3.1.Market size and forecast

4.2.2.4.Coil assist balloon

4.2.2.4.1.Market size and forecast

4.2.3.Market size and forecast, by region

4.2.4.Market analysis, by country

4.3.Revascularization Devices

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Market size and forecast, by type

4.3.2.1.Carotid artery stents

4.3.2.1.1.Market size and forecast

4.3.2.2.Flow diversion stents

4.3.2.2.1.Market size and forecast

4.3.3.Market size and forecast, by region

4.3.4.Market analysis, by country

4.4.Thrombectomy Devices

4.4.1.Key market trends, growth factors, and opportunities

4.4.2.Market size and forecast, by type

4.4.2.1.Clot Retrieval Devices

4.4.2.1.1.Market size and forecast

4.4.2.2.Suction and Aspiration Devices

4.4.2.2.1.Market size and forecast

4.4.2.3.Snares

4.4.2.3.1.Market size and forecast

4.4.3.Market size and forecast, by region

4.4.4.Market analysis, by country

4.5.Embolic Protection Devices

4.5.1.Key market trends, growth factors, and opportunities

4.5.2.Market size and forecast, by type

4.5.2.1.Distal filter devices

4.5.2.1.1.Market size and forecast

4.5.2.2.Balloon Occlusion Devices

4.5.2.2.1.Market size and forecast

4.5.3.Market size and forecast, by region

4.5.4.Market analysis, by country

4.6.Accessory Devices

4.6.1.Key market trends, growth factors, and opportunities

4.6.2.Market size and forecast, by type

4.6.2.1.Microcatheters

4.6.2.1.1.Market size and forecast

4.6.2.2.Microguidewires

4.6.2.2.1.Market size and forecast

4.6.3.Market size and forecast, by region

4.6.4.Market analysis, by country

CHAPTER 5:NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY

5.1.Overview

5.1.1.Market size and forecast

5.2.Aneurysm

5.2.1.Market size and forecast, by region

5.2.2.Market analysis, by country

5.3.Arteriovenous Malformation (AVM)

5.3.1.Market size and forecast, by region

5.3.2.Market analysis, by country

5.4.Ischemic stroke

5.4.1.Market size and forecast, by region

5.4.2.Market analysis, by country

5.5.Stenosis

5.5.1.Market size and forecast, by region

5.5.2.Market analysis, by country

5.6.Others

5.6.1.Market size and forecast, by region

5.6.2.Market analysis, by country

CHAPTER 6:NEUROVASCULAR DEVICES MARKET, BY REGION

6.1.Overview

6.1.1.Market size and forecast

6.2.North America

6.2.1.Key market trends and opportunities

6.2.2.Market analysis, by country

6.2.2.1.U.S.

6.2.2.1.1.U.S. market size and forecast, by product

6.2.2.1.2.U.S. market size and forecast, by disease pathology

6.2.2.2.Canada

6.2.2.2.1.Canada market size and forecast, by product

6.2.2.2.2.Canada market size and forecast, by disease pathology

6.2.2.3.Mexico

6.2.2.3.1.Mexico market size and forecast, by product

6.2.2.3.2.Mexico market size and forecast, by disease pathology

6.2.3.North America market size and forecast, by product

6.2.4.North America market size and forecast, by disease pathology

6.3.Europe

6.3.1.Key market trends and opportunities

6.3.2.Market analysis, by country

6.3.2.1.Germany

6.3.2.1.1.Germany market size and forecast, by product

6.3.2.1.2.Germany market size and forecast, by disease pathology

6.3.2.2.France

6.3.2.2.1.France market size and forecast, by product

6.3.2.2.2.France market size and forecast, by disease pathology

6.3.2.3.UK

6.3.2.3.1.UK market size and forecast, by product

6.3.2.3.2.UK market size and forecast, by disease pathology

6.3.2.4.Italy

6.3.2.4.1.Italy market size and forecast, by product

6.3.2.4.2.Italy market size and forecast, by disease pathology

6.3.2.5.Spain

6.3.2.5.1.Spain market size and forecast, by product

6.3.2.5.2.Spain market size and forecast, by disease pathology

6.3.2.6.Rest of Europe

6.3.2.6.1.Rest of Europe market size and forecast, by product

6.3.2.6.2.Rest of Europe market size and forecast, by disease pathology

6.3.3.Europe market size and forecast, by product

6.3.4.Europe market size and forecast, by disease pathology

6.4.Asia-Pacific

6.4.1.Key market trends and opportunities

6.4.2.Market analysis, by country

6.4.2.1.Japan

6.4.2.1.1.Japan market size and forecast, by product

6.4.2.1.2.Japan market size and forecast, by disease pathology

6.4.2.2.China

6.4.2.2.1.China market size and forecast, by product

6.4.2.2.2.China market size and forecast, by disease pathology

6.4.2.3.Australia

6.4.2.3.1.Australia market size and forecast, by product

6.4.2.3.2.Australia market size and forecast, by disease pathology

6.4.2.4.India

6.4.2.4.1.India market size and forecast, by product

6.4.2.4.2.India market size and forecast, by disease pathology

6.4.2.5.South Korea

6.4.2.5.1.South Korea market size and forecast, by product

6.4.2.5.2.South Korea market size and forecast, by disease pathology

6.4.2.6.Rest of Asia-Pacific

6.4.2.6.1.Rest of Asia-Pacific market size and forecast, by product

6.4.2.6.2.Rest of Asia-Pacific market size and forecast, by disease pathology

6.4.3.Asia-Pacific market size and forecast, by product

6.4.4.Asia-Pacific market size and forecast, by disease pathology

6.5.LAMEA

6.5.1.Key market trends and opportunities

6.5.2.Market analysis, by country

6.5.2.1.Brazil

6.5.2.1.1.Brazil market size and forecast, by product

6.5.2.1.2.Brazil market size and forecast, by disease pathology

6.5.2.2.Saudi Arabia

6.5.2.2.1.Saudi Arabia market size and forecast, by product

6.5.2.2.2.Saudi Arabia market size and forecast, by disease pathology

6.5.2.3.South Africa

6.5.2.3.1.South Africa market size and forecast, by product

6.5.2.3.2.South Africa market size and forecast, by disease pathology

6.5.2.4.Rest of LAMEA

6.5.2.4.1.Rest of LAMEA market size and forecast, by product

6.5.2.4.2.Rest of LAMEA market size and forecast, by disease pathology

6.5.3.LAMEA market size and forecast, by product

6.5.4.LAMEA market size and forecast, by disease pathology

CHAPTER 7:COMPANY PROFILES

7.1.ACANDIS GmbH

7.1.1.Company overview

7.1.2.Company snapshot

7.1.3.Product portfolio

7.1.4.Key strategic moves and developments

7.2.B. BRAUN MELSUNGEN AG

7.2.1.Company overview

7.2.2.Company snapshot

7.2.3.Operating business segments

7.2.4.Product portfolio

7.2.5.Business performance

7.3.INTEGER HOLDINGS CORPORATION

7.3.1.Company overview

7.3.2.Company snapshot

7.3.3.Operating business segments

7.3.4.Product portfolio

7.3.5.Business performance

7.3.6.Key strategic moves and developments

7.4.JOHNSON & JOHNSON (CERENOVUS)

7.4.1.Company overview

7.4.2.Company snapshot

7.4.3.Operating business segments

7.4.4.Product portfolio

7.4.5.Business performance

7.4.6.Key strategic moves and developments

7.5.MICROPORT SCIENTIFIC CORPORATION

7.5.1.Company overview

7.5.2.Company snapshot

7.5.3.Operating business segments

7.5.4.Product portfolio

7.5.5.Business performance

7.6.MEDTRONIC PLC.

7.6.1.Company overview

7.6.2.Company snapshot

7.6.3.Operating business segments

7.6.4.Product portfolio

7.6.5.Business performance

7.6.6.Key strategic moves and developments

7.7.PENUMBRA, INC.

7.7.1.Company overview

7.7.2.Company snapshot

7.7.3.Operating business segments

7.7.4.Product portfolio

7.7.5.Business performance

7.8.PHENOX GmbH

7.8.1.Company overview

7.8.2.Company snapshot

7.8.3.Operating business segments

7.8.4.Product portfolio

7.8.5.Key strategic moves and developments

7.9.STRYKER CORPORATION

7.9.1.Company overview

7.9.2.Company snapshot

7.9.3.Operating business segments

7.9.4.Product portfolio

7.9.5.Business performance

7.9.6.Key strategic moves and developments

7.10.TERUMO CORPORATION (MICROVENTION, INC.)

7.10.1.Company overview

7.10.2.Company snapshot

7.10.3.Operating business segments

7.10.4.Product portfolio

7.10.5.Business performance

7.10.6.Key strategic moves and developments

LIST OF TABLES

TABLE 01.NEUROVASCULAR DEVICES MARKET, BY PRODUCT, 2019-2027 ($MILLION)

TABLE 02.EMBOLIZATION DEVICES, BY TYPE 2019–2027($MILLION)

TABLE 03.EMBOLIC COIL MARKET, BY TYPE 2019–2027($MILLION)

TABLE 04.NEUROVASCULAR DEVICES MARKET FOR EMBOLIZATION DEVICES, BY REGION 2019–2027($MILLION)

TABLE 05.REVASCULARIZATION DEVICES MARKET, BY TYPE 2019–2027($MILLION)

TABLE 06.NEUROVASCULAR DEVICES MARKET FOR REVASCULARIZATION DEVICES, BY REGION 2019–2027($MILLION)

TABLE 07.THROMBECTOMY DEVICES MARKET, BY TYPE 2019–2027($MILLION)

TABLE 08.NEUROVASCULAR DEVICES FOR THROMEBCTOMY DEVICES, BY REGION 2019–2027($MILLION)

TABLE 09.EMBOLIC PROTECTION DEVICES MARKET, BY TYPE 2019–2027($MILLION)

TABLE 10.NEUROVASCULAR DEVICES FOR EMBOLIC PROTECTION DEVICES, BY REGION 2019–2027($MILLION)

TABLE 11.EMBOLIC PROTECTION DEVICES MARKET, BY TYPE 2019–2027($MILLION)

TABLE 12.NEUROVASCULAR DEVICES FOR ACCESSORY DEVICES, BY REGION 2019–2027($MILLION)

TABLE 13.NEUROVASCULAR DEVICES MARKET, BY DISEASE PATHOLOGY, 2019–2027 ($MILLION)

TABLE 14.NEUROVASCULAR DEVICES MARKET FOR ANEURYSM, BY REGION 2019–2027($MILLION)

TABLE 15.NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATION, BY REGION 2019–2027 ($MILLION)

TABLE 16.NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKE, BY REGION 2019–2027 ($MILLION)

TABLE 17.EUROVASCULAR DEVICES MARKET FOR STENOSIS, BY REGION 2019–2027 ($MILLION)

TABLE 18.NEUROVASCULAR DEVICES MARKET FOR OTHERS, BY REGION 2019–2027 ($MILLION)

TABLE 19.NEUROVASCULAR DEVICES MARKET, BY REGION, 2019–2027 ($MILLION)

TABLE 20.NORTH AMERICA NEUROVASCULAR DEVICES MARKET REVENUE, BY COUNTRY, 2020–2027 ($MILLION)

TABLE 21.U.S. NEUROVASCULAR DEVICES MARKET REVENUE, BY PRODUCT, 2020–2027 ($MILLION)

TABLE 22.U.S. NEUROVASCULAR DEVICES MARKET REVENUE, BY DISEASE PATHOLOGY, 2020–2027 ($MILLION)

TABLE 23.CANADA NEUROVASCULAR DEVICES MARKET REVENUE, BY PRODUCT, 2020–2027 ($MILLION)

TABLE 24.CANADA NEUROVASCULAR DEVICES MARKET REVENUE, BY DISEASE PATHOLOGY, 2020–2027 ($MILLION)

TABLE 25.MEXICO NEUROVASCULAR DEVICES MARKET REVENUE, BY PRODUCT, 2020–2027 ($MILLION)

TABLE 26.MEXICO NEUROVASCULAR DEVICES MARKET REVENUE, BY DISEASE PATHOLOGY, 2020–2027 ($MILLION)

TABLE 27.NORTH AMERICA NEUROVASCULAR DEVICES MARKET REVENUE, BY PRODUCT, 2020–2027($MILLION)

TABLE 28.NORTH AMERICA NEUROVASCULAR DEVICES MARKET REVENUE, BY DISEASE PATHOLOGY, 2020–2027($MILLION)

TABLE 29.EUROPE NEUROVASCULAR DEVICES MARKET REVENUE, BY COUNTRY, 2020–2027 ($MILLION)

TABLE 30.GERMANY NEUROVASCULAR DEVICES MARKET REVENUE, BY PRODUCT, 2020–2027 ($MILLION)

TABLE 31.GERMANY NEUROVASCULAR DEVICES MARKET REVENUE, BY DISEASE PATHOLOGY, 2020–2027 ($MILLION)

TABLE 32.FRANCE NEUROVASCULAR DEVICES MARKET REVENUE, BY PRODUCT, 2020–2027 ($MILLION)

TABLE 33.FRANCE NEUROVASCULAR DEVICES MARKET REVENUE, BY DISEASE PATHOLOGY, 2020–2027 ($MILLION)

TABLE 34.UK NEUROVASCULAR DEVICES MARKET REVENUE, BY PRODUCT, 2020–2027 ($MILLION)

TABLE 35.UK NEUROVASCULAR DEVICES MARKET REVENUE, BY DISEASE PATHOLOGY, 2020–2027 ($MILLION)

TABLE 36.ITALY NEUROVASCULAR DEVICES MARKET REVENUE, BY PRODUCT, 2020–2027 ($MILLION)

TABLE 37.ITALY NEUROVASCULAR DEVICES MARKET REVENUE, BY DISEASE PATHOLOGY, 2020–2027 ($MILLION)

TABLE 38.SPAIN NEUROVASCULAR DEVICES MARKET REVENUE, BY PRODUCT, 2020–2027 ($MILLION)

TABLE 39.SPAIN NEUROVASCULAR DEVICES MARKET REVENUE, BY DISEASE PATHOLOGY, 2020–2027 ($MILLION)

TABLE 40.REST OF EUROPE NEUROVASCULAR DEVICES MARKET REVENUE, BY PRODUCT, 2020–2027 ($MILLION)

TABLE 41.REST OF EUROPE NEUROVASCULAR DEVICES MARKET REVENUE, BY DISEASE PATHOLOGY, 2020–2027 ($MILLION)

TABLE 42.EUROPE NEUROVASCULAR DEVICES MARKET REVENUE, BY PRODUCT, 2020–2027($MILLION)

TABLE 43.EUROPE NEUROVASCULAR DEVICES MARKET REVENUE, BY DISEASE PATHOLOGY, 2020–2027($MILLION)

TABLE 44.ASIA-PACIFIC NEUROVASCULAR DEVICES MARKET REVENUE, BY COUNTRY, 2020–2027 ($MILLION)

TABLE 45.JAPAN NEUROVASCULAR DEVICES MARKET REVENUE, BY PRODUCT, 2020–2027 ($MILLION)

TABLE 46.JAPAN NEUROVASCULAR DEVICES MARKET REVENUE, BY DISEASE PATHOLOGY, 2020–2027 ($MILLION)

TABLE 47.CHINA NEUROVASCULAR DEVICES MARKET REVENUE, BY PRODUCT, 2020–2027 ($MILLION)

TABLE 48.CHINA NEUROVASCULAR DEVICES MARKET REVENUE, BY DISEASE PATHOLOGY, 2020–2027 ($MILLION)

TABLE 49.AUSTRALIA NEUROVASCULAR DEVICES MARKET REVENUE, BY PRODUCT, 2020–2027 ($MILLION)

TABLE 50.AUSTRALIA NEUROVASCULAR DEVICES MARKET REVENUE, BY DISEASE PATHOLOGY, 2020–2027 ($MILLION)

TABLE 51.INDIA NEUROVASCULAR DEVICES MARKET REVENUE, BY PRODUCT, 2020–2027 ($MILLION)

TABLE 52.INDIA NEUROVASCULAR DEVICES MARKET REVENUE, BY DISEASE PATHOLOGY, 2020–2027 ($MILLION)

TABLE 53.SOUTH KOREA NEUROVASCULAR DEVICES MARKET REVENUE, BY PRODUCT, 2020–2027 ($MILLION)

TABLE 54.SOUTH KOREA NEUROVASCULAR DEVICES MARKET REVENUE, BY DISEASE PATHOLOGY, 2020–2027 ($MILLION)

TABLE 55.REST OF ASIA-PACIFIC NEUROVASCULAR DEVICES MARKET REVENUE, BY PRODUCT, 2020–2027 ($MILLION)

TABLE 56.REST OF ASIA-PACIFIC NEUROVASCULAR DEVICES MARKET REVENUE, BY DISEASE PATHOLOGY, 2020–2027 ($MILLION)

TABLE 57.ASIA-PACIFIC NEUROVASCULAR DEVICES MARKET REVENUE, BY PRODUCT, 2020–2027($MILLION)

TABLE 58.ASIA-PACIFIC NEUROVASCULAR DEVICES MARKET REVENUE, BY DISEASE PATHOLOGY, 2020–2027($MILLION)

TABLE 59.LAMEA NEUROVASCULAR DEVICES MARKET REVENUE, BY COUNTRY, 2020–2027 ($MILLION)

TABLE 60.BRAZIL NEUROVASCULAR DEVICES MARKET REVENUE, BY PRODUCT, 2020–2027 ($MILLION)

TABLE 61.BRAZIL NEUROVASCULAR DEVICES MARKET REVENUE, BY DISEASE PATHOLOGY, 2020–2027 ($MILLION)

TABLE 62.SAUDI ARABIA NEUROVASCULAR DEVICES MARKET REVENUE, BY PRODUCT, 2020–2027 ($MILLION)

TABLE 63.SAUDI ARABIA NEUROVASCULAR DEVICES MARKET REVENUE, BY DISEASE PATHOLOGY, 2020–2027 ($MILLION)

TABLE 64.SOUTH AFRICA NEUROVASCULAR DEVICES MARKET REVENUE, BY PRODUCT, 2020–2027 ($MILLION)

TABLE 65.SOUTH AFRICA NEUROVASCULAR DEVICES MARKET REVENUE, BY DISEASE PATHOLOGY, 2020–2027 ($MILLION)

TABLE 66.REST OF LAMEA NEUROVASCULAR DEVICES MARKET REVENUE, BY PRODUCT, 2020–2027 ($MILLION)

TABLE 67.REST OF LAMEA NEUROVASCULAR DEVICES MARKET REVENUE, BY DISEASE PATHOLOGY, 2020–2027 ($MILLION)

TABLE 68.LAMEA NEUROVASCULAR DEVICES MARKET REVENUE, BY PRODUCT, 2020–2027($MILLION)

TABLE 69.LAMEA NEUROVASCULAR DEVICES MARKET REVENUE, BY DISEASE PATHOLOGY, 2020–2027($MILLION)

TABLE 70.ACANDIS: COMPANY SNAPSHOT

TABLE 71.ACANDIS: PRODUCT PORTFOLIO

TABLE 72.B. BRAUN: COMPANY SNAPSHOT

TABLE 73.B. BRAUN: OPERATING SEGMENTS

TABLE 74.B. BRAUN: PRODUCT PORTFOLIO

TABLE 75.INTEGER: COMPANY SNAPSHOT

TABLE 76.INTEGER: OPERATING SEGMENTS

TABLE 77.INTEGER: PRODUCT PORTFOLIO

TABLE 78.J&J: COMPANY SNAPSHOT

TABLE 79.J&J: OPERATING SEGMENTS

TABLE 80.J&J: PRODUCT PORTFOLIO

TABLE 81.MICROPORT: COMPANY SNAPSHOT

TABLE 82.MICROPORT: OPERATING SEGMENTS

TABLE 83.MICROPORT: PRODUCT PORTFOLIO

TABLE 84.MEDTRONIC: COMPANY SNAPSHOT

TABLE 85.MEDTRONIC: OPERATING SEGMENTS

TABLE 86.MEDTRONIC: PRODUCT PORTFOLIO

TABLE 87.PENUMBRA: COMPANY SNAPSHOT

TABLE 88.PENUMBRA: OPERATING SEGMENTS

TABLE 89.PENUMBRA: PRODUCT PORTFOLIO

TABLE 90.PHENOX: COMPANY SNAPSHOT

TABLE 91.PHENOX: OPERATING SEGMENTS

TABLE 92.PHENOX: PRODUCT PORTFOLIO

TABLE 93.STRYKER: COMPANY SNAPSHOT

TABLE 94.STRYKER: OPERATING SEGMENTS

TABLE 95.STRYKER: PRODUCT PORTFOLIO

TABLE 96.TERUMO: COMPANY SNAPSHOT

TABLE 97.TERUMO: OERATING SEGMENT

TABLE 98.TERUMO: PRODUCT PORTFOLIO

LIST OF FIGURES

FIGURE 01.GLOBAL NEUROVASCULAR DEVICES MARKET SEGMENTATION

FIGURE 02.TOP WINNING STRATEGIES (2018–2020)

FIGURE 03.TOP WINNING STRATEGIES: PERCENTAGE DISTRIBUTION, (2017–2020)

FIGURE 04.DETAILED STRUCTURE OF COMPANIES AND TYPE OF STRATEGIES

FIGURE 05.TOP INVESTMENT POCKETS

FIGURE 06.MARKET SHARE ANALYSIS, 2019

FIGURE 07.HIGH BARGAINING POWER OF SUPPLIER

FIGURE 08.MODERATE BARGAINING POWER OF BUYERS

FIGURE 09.HIGH THREAT OF SUBSTITUTES

FIGURE 10.MODERATE INTENSITY OF RIVALRYS

FIGURE 11.LOW THREAT OF NEW ENTRANTS

FIGURE 12.GERIATRIC POPULATION (%), 2017–2018

FIGURE 13.IMPACT ANALYSES, NEUROVASCULAR DEVICES MARKET

FIGURE 14.CLIPPINGS MARKET, 2019–2027 ($MILLION)

FIGURE 15.BARE DETATCHABLE COIL MARKET, 2019–2027 ($MILLION)

FIGURE 16.COATED DETATCHABLE MARKET, 2019–2027 ($MILLION)

FIGURE 17.COIL ASSIST STENTS MARKET, 2019–2027 ($MILLION)

FIGURE 18.COIL ASSIST BALLOON MARKET, 2019–2027 ($MILLION)

FIGURE 19.COMPARATIVE SHARE ANALYSIS OF NEUROVASCULAR DEVICES MARKET FOR EMBOLIZATION DEVICES, BY COUNTRY, 2019 & 2027 (%)

FIGURE 20.CAROTID ARTERY STENT MARKET, 2019–2027 ($MILLION)

FIGURE 21.FLOW DIVERSION STENT MARKET, 2019–2027 ($MILLION)

FIGURE 22.COMPARATIVE SHARE ANALYSIS OF NEUROVASCULAR DEVICES MARKET FOR REVASCULARIZATION DEVICES, BY COUNTRY, 2019 & 2027 (%)

FIGURE 23.CLOT RETRIEVAL DEVICES MARKET, 2019–2027 ($MILLION)

FIGURE 24.SUCTION AND ASPIRATION DEVICES MARKET, 2019–2027 ($MILLION)

FIGURE 25.SNARES MARKET, 2019–2027 ($MILLION)

FIGURE 26.COMPARATIVE SHARE ANALYSIS OF NEUROVASCULAR DEVICES MARKET FOR THROMBECTOMY DEVICES, BY COUNTRY, 2019 & 2027 (%)

FIGURE 27.DISTAL FILTER DEVICES MARKET, 2019–2027 ($MILLION)

FIGURE 28.BALLOON OCCLUSION DEVICES MARKET, 2019–2027 ($MILLION)

FIGURE 29.COMPARATIVE SHARE ANALYSIS OF NEUROVASCULAR DEVICES MARKET FOR EMBOLIC PROTECTION DEVICES, BY COUNTRY, 2019 & 2027 (%)

FIGURE 30.MICROCATHETERS DEVICES MARKET, 2019–2027 ($MILLION)

FIGURE 31.MICROGUIDEWIRES DEVICES MARKET, 2019–2027 ($MILLION)

FIGURE 32.COMPARATIVE SHARE ANALYSIS OF NEUROVASCULAR DEVICES MARKET FOR ACCESSORY DEVICES, BY COUNTRY, 2019 & 2027 (%)

FIGURE 33.COMPARATIVE SHARE ANALYSIS OF NEUROVASCULAR DEVICES MARKET FOR ANEURYSM, BY COUNTRY, 2019 & 2027 (%)

FIGURE 34.COMPARATIVE SHARE ANALYSIS OF NEUROVASCULAR DEVICES MARKET FOR ARTERIOVENOUS MALFORMATION, BY COUNTRY, 2019 & 2027 (%)

FIGURE 35.COMPARATIVE SHARE ANALYSIS OF NEUROVASCULAR DEVICES MARKET FOR ISCHEMIC STROKE, BY COUNTRY, 2019 & 2027 (%)

FIGURE 36.COMPARATIVE SHARE ANALYSIS OF NEUROVASCULAR DEVICES MARKET FOR STENOSIS, BY COUNTRY, 2019 & 2027 (%)

FIGURE 37.COMPARATIVE SHARE ANALYSIS OF NEUROVASCULAR DEVICES MARKET FOR OTHERS, BY COUNTRY, 2019 & 2027 (%)

FIGURE 38.U.S. NEUROVASCULAR DEVICES MARKET, 2020–2027 ($MILLION)

FIGURE 39.CANADA NEUROVASCULAR DEVICES MARKET, 2020–2027 ($MILLION)

FIGURE 40.MEXICO NEUROVASCULAR DEVICES MARKET, 2020–2027 ($MILLION)

FIGURE 41.GERMANY NEUROVASCULAR DEVICES MARKET, 2020–2027 ($MILLION)

FIGURE 42.FRANCE NEUROVASCULAR DEVICES MARKET, 2020–2027 ($MILLION)

FIGURE 43.UK NEUROVASCULAR DEVICES MARKET, 2020–2027 ($MILLION)

FIGURE 44.ITALY NEUROVASCULAR DEVICES MARKET, 2020–2027 ($MILLION)

FIGURE 45.SPAIN NEUROVASCULAR DEVICES MARKET, 2020–2027 ($MILLION)

FIGURE 46.REST OF EUROPE NEUROVASCULAR DEVICES MARKET, 2020–2027 ($MILLION)

FIGURE 47.JAPAN NEUROVASCULAR DEVICES MARKET, 2020–2027 ($MILLION)

FIGURE 48.CHINA NEUROVASCULAR DEVICES MARKET, 2020–2027 ($MILLION)

FIGURE 49.AUSTRALIA NEUROVASCULAR DEVICES MARKET, 2020–2027 ($MILLION)

FIGURE 50.INDIA NEUROVASCULAR DEVICES MARKET, 2020–2027 ($MILLION)

FIGURE 51.SOUTH KOREA NEUROVASCULAR DEVICES MARKET, 2020–2027 ($MILLION)

FIGURE 52.REST OF ASIA-PACIFIC NEUROVASCULAR DEVICES MARKET, 2020–2027 ($MILLION)

FIGURE 53.BRAZIL NEUROVASCULAR DEVICES MARKET, 2020–2027 ($MILLION)

FIGURE 54.SAUDI ARABIA NEUROVASCULAR DEVICES MARKET, 2020–2027 ($MILLION)

FIGURE 55.SOUTH AFRICA NEUROVASCULAR DEVICES MARKET, 2020–2027 ($MILLION)

FIGURE 56.REST OF LAMEA NEUROVASCULAR DEVICES MARKET, 2020–2027 ($MILLION)

FIGURE 57.B.BRAUN: NET SALES, 2017–2019 ($MILLION)

FIGURE 58.B.BRAUN: REVENUE SHARE, BY SEGMENT, 2019 (%)

FIGURE 59.B.BRAUN: REVENUE SHARE, BY REGION, 2019 (%)

FIGURE 60.INTEGER: NET SALES, 2017–2019 ($MILLION)

FIGURE 61.INTEGER: REVENUE SHARE, BY SEGMENT, 2019 (%)

FIGURE 62.INTEGER: REVENUE SHARE, BY REGION, 2019(%)

FIGURE 63.J&J: NET SALES, 2017–2019 ($MILLION)

FIGURE 64.J&J: REVENUE SHARE, BY SEGMENT, 2019 (%)

FIGURE 65.J&J: REVENUE SHARE, BY REGION, 2019 (%)

FIGURE 66.MICROPORT: NET SALES, 2017–2019 ($MILLION)

FIGURE 67.MICROPORT: REVENUE SHARE, BY SEGMENT, 2019 (%)

FIGURE 68.MICROPORT: REVENUE SHARE, BY REGION, 2019 (%)

FIGURE 69.MEDTRONIC: NET SALES, 2017–2019 ($MILLION)

FIGURE 70.MEDTRONIC REVENUE SHARE, BY SEGMENTS, 2019 (%)

FIGURE 71.MEDTRONIC PLC: REVENUE SHARE, BY REGIONS, 2019 (%)

FIGURE 72.PENUMBRA: NET SALES, 2017–2019 ($MILLION)

FIGURE 73.PENUMBRA: REVENUE SHARE, BY SEGMENT, 2019 (%)

FIGURE 74.PENUMBRA: REVENUE SHARE, BY REGION, 2019(%)

FIGURE 75.STRYKER: NET SALES, 2017–2019 ($MILLION)

FIGURE 76.STRYKER: REVENUE SHARE, BY SEGMENT, 2019 (%)

FIGURE 77.STRYKER: REVENUE SHARE, BY REGION, 2019(%)

FIGURE 78.TERUMO: NET SALES, 2017–2019 ($MILLION)

FIGURE 79.TERUMO: REVENUE SHARE, BY SEGMENT, 2019 (%)

FIGURE 80.TERUMO: REVENUE SHARE, BY REGION, 2019 (%)

$4904

$7496

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS

Add to Cart

Add to Cart

Add to Cart

Add to Cart