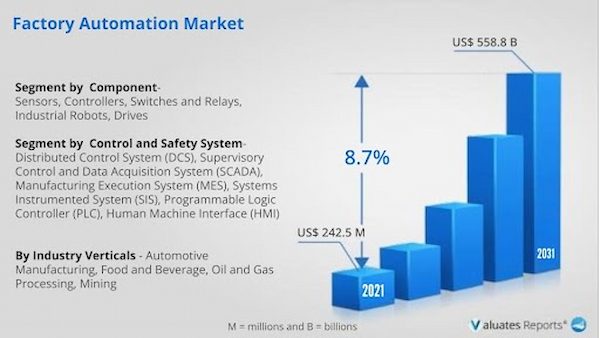

The global factory automation market was valued at USD 242.5 Billion in 2021 and is projected to reach USD 558.8 Billion by 2031, growing at a CAGR of 8.7% from 2022 to 2031.

According to Himanshu Jangra Lead Analyst, Semiconductor and Electronics, at Allied Market Research, the factory automation market is expected to showcase remarkable growth during the forecast period of 2022-2031. The report contains a thorough examination of the market size, factory automation market trends, key market players, sales analysis, major driving factors, and key investment pockets. The report on the factory automation market provides an overview of the market as well as market definition and scope. The ongoing technological advancements and surge in demand for control and safety systems have an impact on market growth. Furthermore, the report provides a quantitative and qualitative analysis of the factory automation market, as well as a breakdown of the pain points, value chain analysis, and key regulations.

Factory automation implies to a set of technologies & automatic control devices that enhance the productivity & quality of products and simultaneously decrease the production cost. Also known as industrial automation, it minimizes human intervention in the industry and ensures superior performance as compared to humans. It comprises the use of computers, robots, control systems, and information technologies to handle industrial processes.

The outbreak of COVID-19 has significantly impacted the growth of the factory automation solution in 2020, owing to a significant impact on prime players operating in the supply chain. However, the rise in demand for industrial Internet of Things solutions across prime manufacturing sectors is one of the major factors that propel the market growth during the COVID-19 pandemic. On the contrary, the market was principally hit by several obstacles amid the COVID-19 pandemic, such as a lack of skilled workforce availability and delay or cancelation of projects due to partial or complete lockdowns, globally.

The development of 5G wireless technology and the adoption of industry 4.0 drive the demand for factory automation solutions in a variety of industries, including fiber & textiles, infrastructure, plastics, pharmaceuticals, and others. Digitalization, industrial IoT, and digital twin expansion are anticipated to be the key trends in the factory automation industry. The Internet of Things (IoT) is essential to automation technology as it facilitates the development of efficient, cost-efficient, and responsive system architectures. Solutions for the industrial internet of things (IIoT) help connect industrial assets, rapidly & simply generate transparency, and boost efficiency. The full lifecycle of device management and shop floor software is made simpler by IIoT and edge computing solutions. In order to automate the manufacturing process and improve the customer experience, businesses implement IIoT technologies. IIoT solutions are anticipated to be adopted so quickly across industries, which would help the market grow during the forecast period.

Industrial IoT solutions such as factory robotics and automated manufacturing equipment use sophisticated analytics, edge computing, cloud computing, artificial intelligence (AI), and machine learning to evaluate machine data and gain insightful knowledge that can be used to maximize asset availability and productivity. For instance, IndustrialEdge, MindSphere, and Mendix from Siemens are industrial IoT solutions that deliver insights from industrial data using cutting-edge technologies such as AI, edge computing, cloud, and advanced analytics. Schmalz, a manufacturer of vacuum automation and ergonomic handling solutions makes use of Siemens Industrial IoT's capabilities to improve its extended analytics and customer maintenance offerings. Therefore, this continued growth of Industrial IoT across industries is expected to drive market expansion during the forecast period..

The global factory automation market is expected to witness notable growth during the forecast period, owing to an increase in demand for automation for qualitative and reliable manufacturing. Moreover, the industry players are focusing on increasing the efficiency of the manufacturing process to achieve low-cost and high-quality production results, which majorly drives the factory automation market. Furthermore, an increase in the adoption of industry 4.0 revolutions is projected to shape the future of manufacturing industries by standardizing the processes.

However, the limited availability of professionals and awareness regarding security, and the high costs for implementation of factory automation systems are one of the prime factors that restrain the factory automation market growth. An increase in demand for automation in Asian countries such as China and Japan is projected to provide a lucrative opportunity to expand the factory automation market during the forecast period.

On the basis of components, the market is divided into sensors, controllers, switches & relays, industrial robots, drives, and others. In 2021, the industrial robots segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period.

By control and safety systems, the market is classified into Distributed Control System (DCS), Supervisory Control and Data Acquisition System (SCADA), Manufacturing Execution System (MES), Systems Instrumented Systems (SIS), Programmable Logic Controller (PLC), and Human Machine Interface (HMI). The Supervisory Control and Data Acquisition System (SCADA) segment dominated the factory automation industry in 2021 in terms of revenue and is expected to dominate the market during the forecast period.

On the basis of industry vertical, the market is divided into automotive manufacturing, food & beverage, oil & gas processing, mining, and others. In 2021, the automotive manufacturing segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period.

Region-wise, the factory automation market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, France, Germany, and Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). Europe remains a significant participant in the factory automation market forecast. Major organizations and government institutions in the country are intensely putting resources into technology.

COMPETITION ANALYSIS

Competitive analysis and profiles of the major global Factory automation market players that have been provided in the report include, ABB Ltd, Danaher Industrial Ltd, Emerson Electric Co., General Electric, Honeywell International Inc., Mitsubishi, Electric Corporation, OMRON Corporation, Rockwell Automation Inc., Schneider Electric, Siemens AG and Yokogawa Electric Corporation.

Country Analysis

Country-wise, the U.S. acquired a prime share in the factory automation market overview in the North American region and is expected to grow at a high CAGR of 8.01% during the forecast period of 2022-2031. The U.S. holds a dominant position in the factory automation market, owing to the rise in investment by prime vendors to boost automation solutions.

In Europe, Germany dominated the factory automation market in terms of revenue in 2021 and is expected to follow the same trend during the forecast period. Furthermore, Germany is expected to emerge as the fastest-growing country in Europe's factory automation with a CAGR of 6.39%, owing to a significant development in Industrial IoT, in the country.

In Asia-Pacific, Japan is expected to emerge as a significant market for factory automation, owing to a significant rise in investment by prime players in next-generation automation solutions to boost the factory automation market.

In LAMEA, Latin America garnered a significant factory automation market share in 2021 owing to the presence of prime vendors such as ABB Ltd, Middle East Builders Mechanical Group, and others that are significantly investing in factory automation in Latin America. Moreover, the Middle East region is expected to grow at a high CAGR of 9.79% from 2022 to 2031.

Due to the rising demand for automation for high-quality and dependable production, the factory automation market is anticipated to expand significantly over the course of the forecast period. Additionally, industry participants are concentrating on enhancing the manufacturing process efficiency to achieve low-cost and high-quality production outputs, which significantly fuel the factory automation market size. The future of manufacturing industries is also expected to be influenced by the increased use of industry 4.0 revolutions, which will standardize operations. One of the main constraints limiting the growth of the factory automation market is the lack of professionals, lack of security awareness, and high implementation costs for factory automation systems. The rise in automation demand in Asian nations like China and Japan will present lucrative opportunities for prime vendors operating in this region.

HISTORICAL DATA & INFORMATION

The factory automation market is highly competitive, owing to the strong presence of existing vendors. Vendors of factory automation machines with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies adopted by key vendors increase.

KEY DEVELOPMENTS/ STRATEGIES

ABB Ltd, Rockwell Automation Inc., Siemens AG, Emerson Electric Co., and Mitsubishi Electric Corporation are the top 5 companies holding a prime share in the factory automation market. Top market players have adopted various strategies, such as product launch, partnerships, innovation, and product development, to expand their foothold in the factory automation market.

Key Benefits For Stakeholders

| Report Metric | Details |

| Report Name | Global Factory Automation Market |

| Base Year | 2021 |

| Forecasted years | 2022-2031 |

| By Company |

|

| Segment by Industry Verticals |

|

| Segment by Component |

|

| Segment by Control and Safety System |

|

| Consumption by Region |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

List of Tables

List of Figures

$5820

$9870

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS