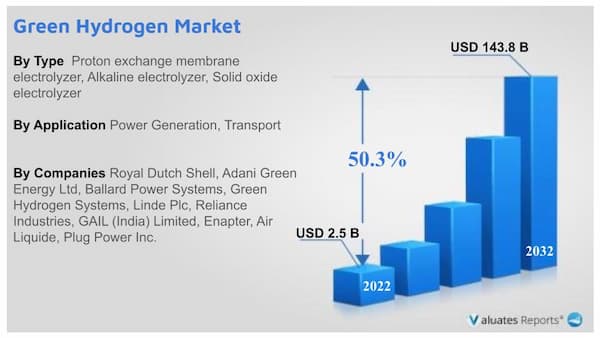

The global green hydrogen market was valued at USD 2.5 Billion in 2022, and is projected to reach USD 143.8 Billion by 2032, growing at a CAGR of 50.3% from 2023 to 2032.

Key drivers of the green hydrogen market include the increasing environmental concerns driving the need for cleaner energy sources. The rising awareness regarding hydrogen as an efficient energy carrier will fuel the demand for the green hydrogen market during the forecast period. Moreover, the rapid use of nuclear and green hydrogen will propel the market ahead in the upcoming years.

Rising environmental consciousness

Fossil fuels meet the global demand for energy. However, it is not renewable and ever-increasing greenhouse gas emissions are posing serious climate challenges. Hydrogen is a clean and sustainable fuel and has the potential to substitute fossil fuel infrastructure. Worldwide energy consumption is growing at a rapid pace. This is directly tied to the excess release of CO2 emissions. The switch to new infrastructure is imminent. This will drive the growth of the green hydrogen market during the forecast period.

Hydrogen is an important component of energy production

Renewable energy usage like wind and solar power is on the rise as countries begin their transition toward decarbonization. Hydrogen is an excellent energy carrier that enables rapid integration and transmission of other energy resources. It facilitates storage, transportation, distribution, and widespread use in several sectors such as fuel cells, oil, and gas industry, automobile industry, and commercial use. This provides huge scope for the growth of the green hydrogen market in the coming years.

Huge opportunities for nuclear and green hydrogen

Zero carbon-hydrogen can be made from the decomposition of water and using heat from nuclear energy in a thermochemical process through high-temperature reactors. Significant research is still required to commercialize the production process. However, hydrogen is currently being deployed radically in transportation fuels, steeling making and metallurgical processes as a replacement for coke. The petrochemical industry utilizes hydrogen in refineries, fertilizers, and as a key chemical raw material. It also has the capability to act as a feedstock for nitrogen fertilizers which in turn will significantly boost agricultural productivity. Such ongoing changes will drastically boost the growth of the green hydrogen market during the forecast period.

Prohibitory costs

Fossil fuels like petroleum, coal, charcoal, and crude oil are readily available everywhere with well-established frameworks and infrastructure. On the other hand, green hydrogen is still relatively new. The complicated market regulations and huge pricing of the power sector and electrolyzer production will hamper the interest of the manufacturers in the short term. The cost of the electrolyzer equipment and its operation hours needs to be regulated properly for making any significant progress in this field. This is expected to deter the growth prospects of the green hydrogen market in the subsequent years.

Proton exchange membrane electrolyzer segment expected to grow during forecast period.

Transport segment projected to grow during forecast period.

Chemical segment is estimated to maintain its leadership status throughout the forecast period.

Aisa-pacific region is expected to dominate the market during the forecast period.

|

Report Metric |

Details |

|

Report Name |

Green Hydrogen Market |

|

Market size value in 2022 |

USD 2.5 Billion |

|

Revenue forecast in 2032 |

USD 143.8 Billion |

|

Growth Rate |

CAGR of 50.3% |

|

Base year considered |

2022 |

|

Forecast Period |

2023-2032 |

|

By Technology |

Proton Exchange Membrane Electrolyzer, Alkaline Electrolyzer, and Solid Oxide Electrolyzer |

|

By Application |

Power Generation, Transport |

|

Report Coverage |

Revenue & volume forecast, company share, competitive landscape, growth factors, and trends |

|

By End User |

Food & Beverages, Medical, Chemical, Petrochemicals, Glass |

|

Segments Covered |

By Type, Application, and Region |

|

Geographic Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Ans. The global green hydrogen market was valued at $2.5 billion in 2022, and is projected to reach $143.8 billion by 2032, growing at a CAGR of 50.3% from 2023 to 2032.

Ans. Some of the major companies are Ballard Power Systems, Enapter, Engie, Green Hydrogen Systems, Hydrogenics, Nikola Motors, Plug Power, SGH2 Energy Global LLC, Shell, and Siemens Gas and Power GmbH & Co. KG.

Ans. Yes, the report includes a COVID-19 impact analysis. Also, it is further extended into every individual segment of the report.

Chapter 1 : INTRODUCTION

Chapter 2 : EXECUTIVE SUMMARY

Chapter 3 : MARKET OVERVIEW

Chapter 4 : GREEN HYDROGEN MARKET, BY TECHNOLOGY

Chapter 5 : GREEN HYDROGEN MARKET, BY APPLICATION

Chapter 6 : GREEN HYDROGEN MARKET, BY END-USE INDUSTRY

Chapter 7 : GREEN HYDROGEN MARKET, BY REGION

FIGURE 01. GREEN HYDROGEN MARKET, 2022-2032

FIGURE 02. SEGMENTATION OF GREEN HYDROGEN MARKET,2022-2032

FIGURE 03. TOP IMPACTING FACTORS IN GREEN HYDROGEN MARKET (2022 TO 2032)

FIGURE 04. TOP INVESTMENT POCKETS IN GREEN HYDROGEN MARKET (2023-2032)

FIGURE 05. LOW BARGAINING POWER OF SUPPLIERS

FIGURE 06. LOW THREAT OF NEW ENTRANTS

FIGURE 07. LOW THREAT OF SUBSTITUTES

FIGURE 08. LOW INTENSITY OF RIVALRY

FIGURE 09. LOW BARGAINING POWER OF BUYERS

FIGURE 10. GLOBAL GREEN HYDROGEN MARKET:DRIVERS, RESTRAINTS AND OPPORTUNITIES

FIGURE 11. IMPACT OF KEY REGULATION: GREEN HYDROGEN MARKET

FIGURE 12. PATENT ANALYSIS BY COMPANY

FIGURE 13. PATENT ANALYSIS BY COUNTRY

FIGURE 14. GREEN HYDROGEN MARKET, BY TECHNOLOGY, 2022 AND 2032(%)

FIGURE 15. COMPARATIVE SHARE ANALYSIS OF GREEN HYDROGEN MARKET FOR PROTON EXCHANGE MEMBRANE ELECTROLYZER, BY COUNTRY 2022 AND 2032(%)

FIGURE 16. COMPARATIVE SHARE ANALYSIS OF GREEN HYDROGEN MARKET FOR ALKALINE ELECTROLYZER, BY COUNTRY 2022 AND 2032(%)

FIGURE 17. COMPARATIVE SHARE ANALYSIS OF GREEN HYDROGEN MARKET FOR SOLID OXIDE ELECTROLYZER, BY COUNTRY 2022 AND 2032(%)

FIGURE 18. GREEN HYDROGEN MARKET, BY APPLICATION, 2022 AND 2032(%)

FIGURE 19. COMPARATIVE SHARE ANALYSIS OF GREEN HYDROGEN MARKET FOR POWER GENERATION, BY COUNTRY 2022 AND 2032(%)

FIGURE 20. COMPARATIVE SHARE ANALYSIS OF GREEN HYDROGEN MARKET FOR TRANSPORT, BY COUNTRY 2022 AND 2032(%)

FIGURE 21. COMPARATIVE SHARE ANALYSIS OF GREEN HYDROGEN MARKET FOR OTHERS, BY COUNTRY 2022 AND 2032(%)

FIGURE 22. GREEN HYDROGEN MARKET, BY END-USE INDUSTRY, 2022 AND 2032(%)

FIGURE 23. COMPARATIVE SHARE ANALYSIS OF GREEN HYDROGEN MARKET FOR FOOD AND BEVERAGES, BY COUNTRY 2022 AND 2032(%)

FIGURE 24. COMPARATIVE SHARE ANALYSIS OF GREEN HYDROGEN MARKET FOR MEDICAL, BY COUNTRY 2022 AND 2032(%)

FIGURE 25. COMPARATIVE SHARE ANALYSIS OF GREEN HYDROGEN MARKET FOR CHEMICAL, BY COUNTRY 2022 AND 2032(%)

FIGURE 26. COMPARATIVE SHARE ANALYSIS OF GREEN HYDROGEN MARKET FOR PETROCHEMICALS, BY COUNTRY 2022 AND 2032(%)

FIGURE 27. COMPARATIVE SHARE ANALYSIS OF GREEN HYDROGEN MARKET FOR GLASS, BY COUNTRY 2022 AND 2032(%)

FIGURE 28. COMPARATIVE SHARE ANALYSIS OF GREEN HYDROGEN MARKET FOR OTHERS, BY COUNTRY 2022 AND 2032(%)

FIGURE 29. GREEN HYDROGEN MARKET BY REGION, 2022 AND 2032(%)

FIGURE 30. U.S. GREEN HYDROGEN MARKET, 2022-2032 ($MILLION)

FIGURE 31. CANADA GREEN HYDROGEN MARKET, 2022-2032 ($MILLION)

FIGURE 32. MEXICO GREEN HYDROGEN MARKET, 2022-2032 ($MILLION)

FIGURE 33. GERMANY GREEN HYDROGEN MARKET, 2022-2032 ($MILLION)

FIGURE 34. FRANCE GREEN HYDROGEN MARKET, 2022-2032 ($MILLION)

FIGURE 35. ITALY GREEN HYDROGEN MARKET, 2022-2032 ($MILLION)

FIGURE 36. UK GREEN HYDROGEN MARKET, 2022-2032 ($MILLION)

FIGURE 37. SPAIN GREEN HYDROGEN MARKET, 2022-2032 ($MILLION)

FIGURE 38. REST OF EUROPE GREEN HYDROGEN MARKET, 2022-2032 ($MILLION)

FIGURE 39. CHINA GREEN HYDROGEN MARKET, 2022-2032 ($MILLION)

FIGURE 40. INDIA GREEN HYDROGEN MARKET, 2022-2032 ($MILLION)

FIGURE 41. JAPAN GREEN HYDROGEN MARKET, 2022-2032 ($MILLION)

FIGURE 42. SOUTH KOREA GREEN HYDROGEN MARKET, 2022-2032 ($MILLION)

FIGURE 43. AUSTRALIA GREEN HYDROGEN MARKET, 2022-2032 ($MILLION)

FIGURE 44. REST OF ASIA-PACIFIC GREEN HYDROGEN MARKET, 2022-2032 ($MILLION)

FIGURE 45. BRAZIL GREEN HYDROGEN MARKET, 2022-2032 ($MILLION)

FIGURE 46. SOUTH ARABIA GREEN HYDROGEN MARKET, 2022-2032 ($MILLION)

FIGURE 47. SOUTH AFRICA GREEN HYDROGEN MARKET, 2022-2032 ($MILLION)

FIGURE 48. REST OF LAMEA GREEN HYDROGEN MARKET, 2022-2032 ($MILLION)

FIGURE 49. TOP WINNING STRATEGIES, BY YEAR (2021-2023)

FIGURE 50. TOP WINNING STRATEGIES, BY DEVELOPMENT (2021-2023)

FIGURE 51. TOP WINNING STRATEGIES, BY COMPANY (2021-2023)

FIGURE 52. PRODUCT MAPPING OF TOP 10 PLAYERS

FIGURE 53. COMPETITIVE DASHBOARD

FIGURE 54. COMPETITIVE HEATMAP: GREEN HYDROGEN MARKET

FIGURE 55. TOP PLAYER POSITIONING, 2022

FIGURE 56. ROYAL DUTCH SHELL: NET REVENUE, 2020-2022 ($MILLION)

FIGURE 57. ROYAL DUTCH SHELL: REVENUE SHARE BY SEGMENT, 2022 (%)

FIGURE 58. ROYAL DUTCH SHELL: REVENUE SHARE BY REGION, 2022 (%)

FIGURE 59. AIR LIQUIDE: NET REVENUE, 2020-2022 ($MILLION)

FIGURE 60. AIR LIQUIDE: REVENUE SHARE BY SEGMENT, 2022 (%)

FIGURE 61. AIR LIQUIDE: REVENUE SHARE BY REGION, 2022 (%)

FIGURE 62. ENAPTER: NET REVENUE, 2020-2022 ($MILLION)

FIGURE 63. ENAPTER: REVENUE SHARE BY SEGMENT, 2022 (%)

FIGURE 64. ENAPTER: REVENUE SHARE BY REGION, 2022 (%)

FIGURE 65. PLUG POWER INC.: NET REVENUE, 2020-2022 ($MILLION)

FIGURE 66. PLUG POWER INC.: REVENUE SHARE BY SEGMENT, 2022 (%)

FIGURE 67. PLUG POWER INC.: REVENUE SHARE BY REGION, 2022 (%)

FIGURE 68. BALLARD POWER SYSTEMS: NET SALES, 2020-2022 ($MILLION)

FIGURE 69. BALLARD POWER SYSTEMS: RESEARCH & DEVELOPMENT EXPENDITURE, 2020-2022 ($MILLION)

FIGURE 70. BALLARD POWER SYSTEMS: REVENUE SHARE BY SEGMENT, 2022 (%)

FIGURE 71. BALLARD POWER SYSTEMS: REVENUE SHARE BY REGION, 2022 (%)

FIGURE 72. LINDE PLC: NET SALES, 2020-2022 ($MILLION)

FIGURE 73. LINDE PLC: RESEARCH & DEVELOPMENT EXPENDITURE, 2020-2022 ($MILLION)

FIGURE 74. LINDE PLC: REVENUE SHARE BY SEGMENT, 2022 (%)

FIGURE 75. LINDE PLC: REVENUE SHARE BY REGION, 2022 (%)

FIGURE 76. RELIANCE INDUSTRIES LIMITED: NET REVENUE, 2020-2022 ($MILLION)

FIGURE 77. RELIANCE INDUSTRIES LIMITED: REVENUE SHARE BY SEGMENT, 2022 (%)

FIGURE 78. RELIANCE INDUSTRIES LIMITED: REVENUE SHARE BY REGION, 2022 (%)

FIGURE 79. GAIL (INDIA) LIMITED: NET REVENUE, 2021-2023 ($MILLION)

FIGURE 80. ADANI GREEN ENERGY LTD: NET REVENUE, 2021-2023 ($MILLION)

$5730

$9600

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS

Add to Cart

Add to Cart

Add to Cart

Add to Cart