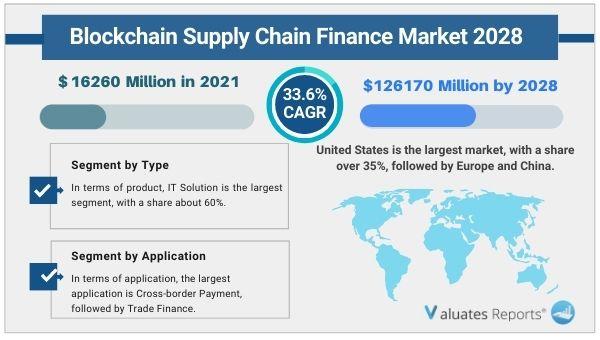

The global Blockchain Supply Chain Finance market size is projected to reach US$ 126170 million by 2028, from US$ 16260 million in 2021, at a CAGR of 33.6% during 2022-2028. Key drivers of the blockchain supply chain finance market include the rising use of blockchain in supply chain finance. The advent of advanced technologies will fuel the demand for the blockchain supply chain finance market during the forecast period. Furthermore, the integration with IoT will provide lucrative growth opportunities in the upcoming years.

Global Blockchain Supply Chain Finance key players include IBM, Ripple, Accenture, etc. Global top three manufacturers hold a share of about 55%. The United States is the largest market, with a share of over 35%, followed by Europe and China, both have a share of about 45 percent. In terms of product, IT Solution is the largest segment, with a share of about 60%. And in terms of application, the largest application is Cross-border Payment, followed by Trade Finance. Blockchain Supply Chain Finance is the application of blockchain technology in the financial field. The financial services industry is the driving force of global economic development and is also one of the most centered industries. The asymmetric information between the two parties in the financial market leads to the failure to establish an effective credit mechanism.

Financial institutions and banks can easily verify the transaction details between a supplier and a retailer through blockchain. All the data regarding payments, invoicing, physical transfer of goods, and lending transactions are recorded efficiently in the distributed ledgers. This removes the need for physical audits and makes the process cost-effective. The risk factors are eliminated. Smart contracts can verify the contractual obligations and issue payment alerts whenever the time comes. Cross-border payment systems will benefit immensely. Hence these factors will surge the growth of the blockchain supply chain finance market in the upcoming years.

Technological developmentsThe rapid innovations in blockchain technology are being felt across several industry verticals. Intermediaries in the supply chain can be removed completely lowering costs. As it is a distributed system the transparency levels are high thereby preventing opaqueness in the financial industry. Each and every transaction follows a predictable, pre-approved route and since they are irrevocable the chances of fraud are much less than before. Data privacy is upheld as every consumer is in full control of their confidential information online. These will drive the growth of the blockchain supply chain finance market during the forecast period.

Blockchain and IoT integrationIoT-enabled blockchain will solve many critical issues faced by the supply chain industry. For instance, data sharing will become fast providing traceability across the entire supply chain process. Access to information will be universal without the ownership of a single entity removing chances of fraud. Moreover, IoT will facilitate the seamless flow of information from the physical world regarding materials, and goods to the digital space. The advanced monitoring will ensure the auditing process is free of any human errors. This in turn will augment the growth of the blockchain supply chain finance market in the future.

Lack of awarenessThere is a general lack of knowledge and awareness regarding the technology as it is still new. Companies are coming up with their own versions of the same network creating the problem of silos. Then there are regulations that have not been able to keep pace with the rapid changes in the field. These issues will hamper the general growth prospects of the blockchain supply chain finance market during the forecast period.

Based on type, the IT segment is expected to maintain the lead in the blockchain supply chain finance market share with 60% penetration.

Based on application, cross-border payments will provide lucrative opportunities for growth in the blockchain supply chain finance market share.

Based on region, North America will witness considerable growth with the US capturing about 35% market share followed by Europe and China at a total share of 45%.

|

Report Metric |

Details |

|

Report Name |

Blockchain Supply Chain Finance Market |

|

The market size in 2021 |

$16260 Million |

|

The revenue forecast in 2028 |

$126170 Million |

|

Growth Rate |

CAGR of 33.6% from 2022 to 2028 |

|

Base year considered |

2022 |

|

Forecast period |

2022-2028 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, End-User, Offerings, and Region |

|

Market by Type |

IT Solution, FinTech, Bank, Consulting, Exchange and Other |

|

Market by Applications/Enduser |

Cross-border Payment, Trade Finance, Digital Currency, Identity Management, Others |

|

Report coverage |

Revenue & volume forecast, company share, competitive landscape, growth factors, and trends |

|

Geographic regions covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Ans. The global Blockchain Supply Chain Finance market size is projected to reach US$ 126170 million by 2028, from US$ 16260 million in 2021.

Ans. Some key players operating in the blockchain supply chain finance market are IBM, Ripple, Rubix by Deloitte, Accenture, Plc Distributed Ledger Technologies, Oklink, Nasdaq Linq, Oracle. AWS, Citi Bank.

Ans. The global blockchain supply chain finance market is estimated to grow with a Compound Annual Growth Rate (CAGR) of 33.6% during the forecast period

Ans. Yes, the report includes a COVID-19 impact analysis. Also, it is further extended into every individual segment of the report.

Ans. The United States is the largest consumption countries of blockchain supply chain finance in the world in the past few years and it will keep increasing in the next few years.

Table of Contents

1 Report Business Overview

1.1 Study Scope

1.2 Market Analysis by Type

1.2.1 Global Blockchain Supply Chain Finance Market Size Growth Rate by Type, 2017 VS 2021 VS 2028

1.2.2 IT Solution

1.2.3 FinTech

1.2.4 Bank

1.2.5 Consulting

1.2.6 Exchange and Other

1.3 Market by Application

1.3.1 Global Blockchain Supply Chain Finance Market Size Growth Rate by Application, 2017 VS 2021 VS 2028

1.3.2 Cross-border Payment

1.3.3 Trade Finance

1.3.4 Digital Currency

1.3.5 Identity Management

1.3.6 Others

1.4 Study Objectives

1.5 Years Considered

2 Global Growth Trends

2.1 Global Blockchain Supply Chain Finance Market Perspective (2017-2028)

2.2 Blockchain Supply Chain Finance Growth Trends by Region

2.2.1 Blockchain Supply Chain Finance Market Size by Region: 2017 VS 2021 VS 2028

2.2.2 Blockchain Supply Chain Finance Historic Market Size by Region (2017-2022)

2.2.3 Blockchain Supply Chain Finance Forecasted Market Size by Region (2023-2028)

2.3 Blockchain Supply Chain Finance Market Dynamics

2.3.1 Blockchain Supply Chain Finance Industry Trends

2.3.2 Blockchain Supply Chain Finance Market Drivers

2.3.3 Blockchain Supply Chain Finance Market Challenges

2.3.4 Blockchain Supply Chain Finance Market Restraints

3 Competition Landscape by Key Players

3.1 Global Top Blockchain Supply Chain Finance Players by Revenue

3.1.1 Global Top Blockchain Supply Chain Finance Players by Revenue (2017-2022)

3.1.2 Global Blockchain Supply Chain Finance Revenue Market Share by Players (2017-2022)

3.2 Global Blockchain Supply Chain Finance Market Share by Company Type (Tier 1, Tier 2, and Tier 3)

3.3 Players Covered: Ranking by Blockchain Supply Chain Finance Revenue

3.4 Global Blockchain Supply Chain Finance Market Concentration Ratio

3.4.1 Global Blockchain Supply Chain Finance Market Concentration Ratio (CR5 and HHI)

3.4.2 Global Top 10 and Top 5 Companies by Blockchain Supply Chain Finance Revenue in 2021

3.5 Blockchain Supply Chain Finance Key Players Head office and Area Served

3.6 Key Players Blockchain Supply Chain Finance Product Solution and Service

3.7 Date of Enter into Blockchain Supply Chain Finance Market

3.8 Mergers & Acquisitions, Expansion Plans

4 Blockchain Supply Chain Finance Breakdown Data by Type

4.1 Global Blockchain Supply Chain Finance Historic Market Size by Type (2017-2022)

4.2 Global Blockchain Supply Chain Finance Forecasted Market Size by Type (2023-2028)

5 Blockchain Supply Chain Finance Breakdown Data by Application

5.1 Global Blockchain Supply Chain Finance Historic Market Size by Application (2017-2022)

5.2 Global Blockchain Supply Chain Finance Forecasted Market Size by Application (2023-2028)

6 North America

6.1 North America Blockchain Supply Chain Finance Market Size (2017-2028)

6.2 North America Blockchain Supply Chain Finance Market Size by Type

6.2.1 North America Blockchain Supply Chain Finance Market Size by Type (2017-2022)

6.2.2 North America Blockchain Supply Chain Finance Market Size by Type (2023-2028)

6.2.3 North America Blockchain Supply Chain Finance Market Share by Type (2017-2028)

6.3 North America Blockchain Supply Chain Finance Market Size by Application

6.3.1 North America Blockchain Supply Chain Finance Market Size by Application (2017-2022)

6.3.2 North America Blockchain Supply Chain Finance Market Size by Application (2023-2028)

6.3.3 North America Blockchain Supply Chain Finance Market Share by Application (2017-2028)

6.4 North America Blockchain Supply Chain Finance Market Size by Country

6.4.1 North America Blockchain Supply Chain Finance Market Size by Country (2017-2022)

6.4.2 North America Blockchain Supply Chain Finance Market Size by Country (2023-2028)

6.4.3 U.S.

6.4.4 Canada

7 Europe

7.1 Europe Blockchain Supply Chain Finance Market Size (2017-2028)

7.2 Europe Blockchain Supply Chain Finance Market Size by Type

7.2.1 Europe Blockchain Supply Chain Finance Market Size by Type (2017-2022)

7.2.2 Europe Blockchain Supply Chain Finance Market Size by Type (2023-2028)

7.2.3 Europe Blockchain Supply Chain Finance Market Share by Type (2017-2028)

7.3 Europe Blockchain Supply Chain Finance Market Size by Application

7.3.1 Europe Blockchain Supply Chain Finance Market Size by Application (2017-2022)

7.3.2 Europe Blockchain Supply Chain Finance Market Size by Application (2023-2028)

7.3.3 Europe Blockchain Supply Chain Finance Market Share by Application (2017-2028)

7.4 Europe Blockchain Supply Chain Finance Market Size by Country

7.4.1 Europe Blockchain Supply Chain Finance Market Size by Country (2017-2022)

7.4.2 Europe Blockchain Supply Chain Finance Market Size by Country (2023-2028)

7.4.3 Germany

7.4.4 France

7.4.5 U.K.

7.4.6 Italy

7.4.7 Russia

7.4.8 Nordic Countries

8 Asia-Pacific

8.1 Asia-Pacific Blockchain Supply Chain Finance Market Size (2017-2028)

8.2 Asia-Pacific Blockchain Supply Chain Finance Market Size by Type

8.2.1 Asia-Pacific Blockchain Supply Chain Finance Market Size by Type (2017-2022)

8.2.2 Asia-Pacific Blockchain Supply Chain Finance Market Size by Type (2023-2028)

8.2.3 Asia-Pacific Blockchain Supply Chain Finance Market Share by Type (2017-2028)

8.3 Asia-Pacific Blockchain Supply Chain Finance Market Size by Application

8.3.1 Asia-Pacific Blockchain Supply Chain Finance Market Size by Application (2017-2022)

8.3.2 Asia-Pacific Blockchain Supply Chain Finance Market Size by Application (2023-2028)

8.3.3 Asia-Pacific Blockchain Supply Chain Finance Market Share by Application (2017-2028)

8.4 Asia-Pacific Blockchain Supply Chain Finance Market Size by Region

8.4.1 Asia-Pacific Blockchain Supply Chain Finance Market Size by Region (2017-2022)

8.4.2 Asia-Pacific Blockchain Supply Chain Finance Market Size by Region (2023-2028)

8.4.3 China

8.4.4 Japan

8.4.5 South Korea

8.4.6 Southeast Asia

8.4.7 India

8.4.8 Australia

9 Latin America

9.1 Latin America Blockchain Supply Chain Finance Market Size (2017-2028)

9.2 Latin America Blockchain Supply Chain Finance Market Size by Type

9.2.1 Latin America Blockchain Supply Chain Finance Market Size by Type (2017-2022)

9.2.2 Latin America Blockchain Supply Chain Finance Market Size by Type (2023-2028)

9.2.3 Latin America Blockchain Supply Chain Finance Market Share by Type (2017-2028)

9.3 Latin America Blockchain Supply Chain Finance Market Size by Application

9.3.1 Latin America Blockchain Supply Chain Finance Market Size by Application (2017-2022)

9.3.2 Latin America Blockchain Supply Chain Finance Market Size by Application (2023-2028)

9.3.3 Latin America Blockchain Supply Chain Finance Market Share by Application (2017-2028)

9.4 Latin America Blockchain Supply Chain Finance Market Size by Country

9.4.1 Latin America Blockchain Supply Chain Finance Market Size by Country (2017-2022)

9.4.2 Latin America Blockchain Supply Chain Finance Market Size by Country (2023-2028)

9.4.3 Mexico

9.4.4 Brazil

10 Middle East & Africa

10.1 Middle East & Africa Blockchain Supply Chain Finance Market Size (2017-2028)

10.2 Middle East & Africa Blockchain Supply Chain Finance Market Size by Type

10.2.1 Middle East & Africa Blockchain Supply Chain Finance Market Size by Type (2017-2022)

10.2.2 Middle East & Africa Blockchain Supply Chain Finance Market Size by Type (2023-2028)

10.2.3 Middle East & Africa Blockchain Supply Chain Finance Market Share by Type (2017-2028)

10.3 Middle East & Africa Blockchain Supply Chain Finance Market Size by Application

10.3.1 Middle East & Africa Blockchain Supply Chain Finance Market Size by Application (2017-2022)

10.3.2 Middle East & Africa Blockchain Supply Chain Finance Market Size by Application (2023-2028)

10.3.3 Middle East & Africa Blockchain Supply Chain Finance Market Share by Application (2017-2028)

10.4 Middle East & Africa Blockchain Supply Chain Finance Market Size by Country

10.4.1 Middle East & Africa Blockchain Supply Chain Finance Market Size by Country (2017-2022)

10.4.2 Middle East & Africa Blockchain Supply Chain Finance Market Size by Country (2023-2028)

10.4.3 Turkey

10.4.4 Saudi Arabia

10.4.5 UAE

11 Key Players Profiles

11.1 IBM

11.1.1 IBM Company Details

11.1.2 IBM Business Overview

11.1.3 IBM Blockchain Supply Chain Finance Introduction

11.1.4 IBM Revenue in Blockchain Supply Chain Finance Business (2017-2022)

11.1.5 IBM Recent Developments

11.2 Ripple

11.2.1 Ripple Company Details

11.2.2 Ripple Business Overview

11.2.3 Ripple Blockchain Supply Chain Finance Introduction

11.2.4 Ripple Revenue in Blockchain Supply Chain Finance Business (2017-2022)

11.2.5 Ripple Recent Developments

11.3 Rubix by Deloitte

11.3.1 Rubix by Deloitte Company Details

11.3.2 Rubix by Deloitte Business Overview

11.3.3 Rubix by Deloitte Blockchain Supply Chain Finance Introduction

11.3.4 Rubix by Deloitte Revenue in Blockchain Supply Chain Finance Business (2017-2022)

11.3.5 Rubix by Deloitte Recent Developments

11.4 Accenture

11.4.1 Accenture Company Details

11.4.2 Accenture Business Overview

11.4.3 Accenture Blockchain Supply Chain Finance Introduction

11.4.4 Accenture Revenue in Blockchain Supply Chain Finance Business (2017-2022)

11.4.5 Accenture Recent Developments

11.5 Distributed Ledger Technologies

11.5.1 Distributed Ledger Technologies Company Details

11.5.2 Distributed Ledger Technologies Business Overview

11.5.3 Distributed Ledger Technologies Blockchain Supply Chain Finance Introduction

11.5.4 Distributed Ledger Technologies Revenue in Blockchain Supply Chain Finance Business (2017-2022)

11.5.5 Distributed Ledger Technologies Recent Developments

11.6 Oklink

11.6.1 Oklink Company Details

11.6.2 Oklink Business Overview

11.6.3 Oklink Blockchain Supply Chain Finance Introduction

11.6.4 Oklink Revenue in Blockchain Supply Chain Finance Business (2017-2022)

11.6.5 Oklink Recent Developments

11.7 Nasdaq Linq

11.7.1 Nasdaq Linq Company Details

11.7.2 Nasdaq Linq Business Overview

11.7.3 Nasdaq Linq Blockchain Supply Chain Finance Introduction

11.7.4 Nasdaq Linq Revenue in Blockchain Supply Chain Finance Business (2017-2022)

11.7.5 Nasdaq Linq Recent Developments

11.8 Oracle

11.8.1 Oracle Company Details

11.8.2 Oracle Business Overview

11.8.3 Oracle Blockchain Supply Chain Finance Introduction

11.8.4 Oracle Revenue in Blockchain Supply Chain Finance Business (2017-2022)

11.8.5 Oracle Recent Developments

11.9 AWS

11.9.1 AWS Company Details

11.9.2 AWS Business Overview

11.9.3 AWS Blockchain Supply Chain Finance Introduction

11.9.4 AWS Revenue in Blockchain Supply Chain Finance Business (2017-2022)

11.9.5 AWS Recent Developments

11.10 Citi Bank

11.10.1 Citi Bank Company Details

11.10.2 Citi Bank Business Overview

11.10.3 Citi Bank Blockchain Supply Chain Finance Introduction

11.10.4 Citi Bank Revenue in Blockchain Supply Chain Finance Business (2017-2022)

11.10.5 Citi Bank Recent Developments

11.11 ELayaway

11.11.1 ELayaway Company Details

11.11.2 ELayaway Business Overview

11.11.3 ELayaway Blockchain Supply Chain Finance Introduction

11.11.4 ELayaway Revenue in Blockchain Supply Chain Finance Business (2017-2022)

11.11.5 ELayaway Recent Developments

11.12 HSBC

11.12.1 HSBC Company Details

11.12.2 HSBC Business Overview

11.12.3 HSBC Blockchain Supply Chain Finance Introduction

11.12.4 HSBC Revenue in Blockchain Supply Chain Finance Business (2017-2022)

11.12.5 HSBC Recent Developments

11.13 Ant Financial

11.13.1 Ant Financial Company Details

11.13.2 Ant Financial Business Overview

11.13.3 Ant Financial Blockchain Supply Chain Finance Introduction

11.13.4 Ant Financial Revenue in Blockchain Supply Chain Finance Business (2017-2022)

11.13.5 Ant Financial Recent Developments

11.14 JD Financial

11.14.1 JD Financial Company Details

11.14.2 JD Financial Business Overview

11.14.3 JD Financial Blockchain Supply Chain Finance Introduction

11.14.4 JD Financial Revenue in Blockchain Supply Chain Finance Business (2017-2022)

11.14.5 JD Financial Recent Developments

11.15 Qihoo 360

11.15.1 Qihoo 360 Company Details

11.15.2 Qihoo 360 Business Overview

11.15.3 Qihoo 360 Blockchain Supply Chain Finance Introduction

11.15.4 Qihoo 360 Revenue in Blockchain Supply Chain Finance Business (2017-2022)

11.15.5 Qihoo 360 Recent Developments

11.16 Tecent

11.16.1 Tecent Company Details

11.16.2 Tecent Business Overview

11.16.3 Tecent Blockchain Supply Chain Finance Introduction

11.16.4 Tecent Revenue in Blockchain Supply Chain Finance Business (2017-2022)

11.16.5 Tecent Recent Developments

11.17 Baidu

11.17.1 Baidu Company Details

11.17.2 Baidu Business Overview

11.17.3 Baidu Blockchain Supply Chain Finance Introduction

11.17.4 Baidu Revenue in Blockchain Supply Chain Finance Business (2017-2022)

11.17.5 Baidu Recent Developments

11.18 Huawei

11.18.1 Huawei Company Details

11.18.2 Huawei Business Overview

11.18.3 Huawei Blockchain Supply Chain Finance Introduction

11.18.4 Huawei Revenue in Blockchain Supply Chain Finance Business (2017-2022)

11.18.5 Huawei Recent Developments

11.19 Bitspark

11.19.1 Bitspark Company Details

11.19.2 Bitspark Business Overview

11.19.3 Bitspark Blockchain Supply Chain Finance Introduction

11.19.4 Bitspark Revenue in Blockchain Supply Chain Finance Business (2017-2022)

11.19.5 Bitspark Recent Developments

11.20 SAP

11.20.1 SAP Company Details

11.20.2 SAP Business Overview

11.20.3 SAP Blockchain Supply Chain Finance Introduction

11.20.4 SAP Revenue in Blockchain Supply Chain Finance Business (2017-2022)

11.20.5 SAP Recent Developments

12 Analyst's Viewpoints/Conclusions

13 Appendix

13.1 Research Methodology

13.1.1 Methodology/Research Approach

13.1.2 Data Source

13.2 Author Details

13.3 Disclaimer

List of Tables

Table 1. Global Blockchain Supply Chain Finance Market Size Growth Rate by Type (US$ Million), 2017 VS 2021 VS 2028

Table 2. Key Players of IT Solution

Table 3. Key Players of FinTech

Table 4. Key Players of Bank

Table 5. Key Players of Consulting

Table 6. Key Players of Exchange and Other

Table 7. Global Blockchain Supply Chain Finance Market Size Growth Rate by Application (US$ Million), 2017 VS 2021 VS 2028

Table 8. Global Blockchain Supply Chain Finance Market Size by Region (US$ Million): 2017 VS 2021 VS 2028

Table 9. Global Blockchain Supply Chain Finance Market Size by Region (2017-2022) & (US$ Million)

Table 10. Global Blockchain Supply Chain Finance Market Share by Region (2017-2022)

Table 11. Global Blockchain Supply Chain Finance Forecasted Market Size by Region (2023-2028) & (US$ Million)

Table 12. Global Blockchain Supply Chain Finance Market Share by Region (2023-2028)

Table 13. Blockchain Supply Chain Finance Market Trends

Table 14. Blockchain Supply Chain Finance Market Drivers

Table 15. Blockchain Supply Chain Finance Market Challenges

Table 16. Blockchain Supply Chain Finance Market Restraints

Table 17. Global Blockchain Supply Chain Finance Revenue by Players (2017-2022) & (US$ Million)

Table 18. Global Blockchain Supply Chain Finance Revenue Share by Players (2017-2022)

Table 19. Global Top Blockchain Supply Chain Finance by Company Type (Tier 1, Tier 2, and Tier 3) & (based on the Revenue in Blockchain Supply Chain Finance as of 2021)

Table 20. Ranking of Global Top Blockchain Supply Chain Finance Companies by Revenue (US$ Million) in 2021

Table 21. Global 5 Largest Players Market Share by Blockchain Supply Chain Finance Revenue (CR5 and HHI) & (2017-2022)

Table 22. Key Players Headquarters and Area Served

Table 23. Key Players Blockchain Supply Chain Finance Product Solution and Service

Table 24. Date of Enter into Blockchain Supply Chain Finance Market

Table 25. Mergers & Acquisitions, Expansion Plans

Table 26. Global Blockchain Supply Chain Finance Market Size by Type (2017-2022) & (US$ Million)

Table 27. Global Blockchain Supply Chain Finance Revenue Market Share by Type (2017-2022)

Table 28. Global Blockchain Supply Chain Finance Forecasted Market Size by Type (2023-2028) & (US$ Million)

Table 29. Global Blockchain Supply Chain Finance Revenue Market Share by Type (2023-2028)

Table 30. Global Blockchain Supply Chain Finance Market Size by Application (2017-2022) & (US$ Million)

Table 31. Global Blockchain Supply Chain Finance Revenue Share by Application (2017-2022)

Table 32. Global Blockchain Supply Chain Finance Forecasted Market Size by Application (2023-2028) & (US$ Million)

Table 33. Global Blockchain Supply Chain Finance Revenue Share by Application (2023-2028)

Table 34. North America Blockchain Supply Chain Finance Market Size by Type (2017-2022) & (US$ Million)

Table 35. North America Blockchain Supply Chain Finance Market Size by Type (2023-2028) & (US$ Million)

Table 36. North America Blockchain Supply Chain Finance Market Size by Application (2017-2022) & (US$ Million)

Table 37. North America Blockchain Supply Chain Finance Market Size by Application (2023-2028) & (US$ Million)

Table 38. North America Blockchain Supply Chain Finance Market Size by Country (2017-2022) & (US$ Million)

Table 39. North America Blockchain Supply Chain Finance Market Size by Country (2023-2028) & (US$ Million)

Table 40. Europe Blockchain Supply Chain Finance Market Size by Type (2017-2022) & (US$ Million)

Table 41. Europe Blockchain Supply Chain Finance Market Size by Type (2023-2028) & (US$ Million)

Table 42. Europe Blockchain Supply Chain Finance Market Size by Application (2017-2022) & (US$ Million)

Table 43. Europe Blockchain Supply Chain Finance Market Size by Application (2023-2028) & (US$ Million)

Table 44. Europe Blockchain Supply Chain Finance Market Size by Country (2017-2022) & (US$ Million)

Table 45. Europe Blockchain Supply Chain Finance Market Size by Country (2023-2028) & (US$ Million)

Table 46. Asia Pacific Blockchain Supply Chain Finance Market Size by Type (2017-2022) & (US$ Million)

Table 47. Asia Pacific Blockchain Supply Chain Finance Market Size by Type (2023-2028) & (US$ Million)

Table 48. Asia Pacific Blockchain Supply Chain Finance Market Size by Application (2017-2022) & (US$ Million)

Table 49. Asia Pacific Blockchain Supply Chain Finance Market Size by Application (2023-2028) & (US$ Million)

Table 50. Asia Pacific Blockchain Supply Chain Finance Market Size by Region (2017-2022) & (US$ Million)

Table 51. Asia Pacific Blockchain Supply Chain Finance Market Size by Region (2023-2028) & (US$ Million)

Table 52. Latin America Blockchain Supply Chain Finance Market Size by Type (2017-2022) & (US$ Million)

Table 53. Latin America Blockchain Supply Chain Finance Market Size by Type (2023-2028) & (US$ Million)

Table 54. Latin America Blockchain Supply Chain Finance Market Size by Application (2017-2022) & (US$ Million)

Table 55. Latin America Blockchain Supply Chain Finance Market Size by Application (2023-2028) & (US$ Million)

Table 56. Latin America Blockchain Supply Chain Finance Market Size by Country (2017-2022) & (US$ Million)

Table 57. Latin America Blockchain Supply Chain Finance Market Size by Country (2023-2028) & (US$ Million)

Table 58. Middle East and Africa Blockchain Supply Chain Finance Market Size by Type (2017-2022) & (US$ Million)

Table 59. Middle East and Africa Blockchain Supply Chain Finance Market Size by Type (2023-2028) & (US$ Million)

Table 60. Middle East and Africa Blockchain Supply Chain Finance Market Size by Application (2017-2022) & (US$ Million)

Table 61. Middle East and Africa Blockchain Supply Chain Finance Market Size by Application (2023-2028) & (US$ Million)

Table 62. Middle East and Africa Blockchain Supply Chain Finance Market Size by Country (2017-2022) & (US$ Million)

Table 63. Middle East and Africa Blockchain Supply Chain Finance Market Size by Country (2023-2028) & (US$ Million)

Table 64. IBM Company Details

Table 65. IBM Business Overview

Table 66. IBM Blockchain Supply Chain Finance Product

Table 67. IBM Revenue in Blockchain Supply Chain Finance Business (2017-2022) & (US$ Million)

Table 68. IBM Recent Developments

Table 69. Ripple Company Details

Table 70. Ripple Business Overview

Table 71. Ripple Blockchain Supply Chain Finance Product

Table 72. Ripple Revenue in Blockchain Supply Chain Finance Business (2017-2022) & (US$ Million)

Table 73. Ripple Recent Developments

Table 74. Rubix by Deloitte Company Details

Table 75. Rubix by Deloitte Business Overview

Table 76. Rubix by Deloitte Blockchain Supply Chain Finance Product

Table 77. Rubix by Deloitte Revenue in Blockchain Supply Chain Finance Business (2017-2022) & (US$ Million)

Table 78. Rubix by Deloitte Recent Developments

Table 79. Accenture Company Details

Table 80. Accenture Business Overview

Table 81. Accenture Blockchain Supply Chain Finance Product

Table 82. Accenture Revenue in Blockchain Supply Chain Finance Business (2017-2022) & (US$ Million)

Table 83. Accenture Recent Developments

Table 84. Distributed Ledger Technologies Company Details

Table 85. Distributed Ledger Technologies Business Overview

Table 86. Distributed Ledger Technologies Blockchain Supply Chain Finance Product

Table 87. Distributed Ledger Technologies Revenue in Blockchain Supply Chain Finance Business (2017-2022) & (US$ Million)

Table 88. Distributed Ledger Technologies Recent Developments

Table 89. Oklink Company Details

Table 90. Oklink Business Overview

Table 91. Oklink Blockchain Supply Chain Finance Product

Table 92. Oklink Revenue in Blockchain Supply Chain Finance Business (2017-2022) & (US$ Million)

Table 93. Oklink Recent Developments

Table 94. Nasdaq Linq Company Details

Table 95. Nasdaq Linq Business Overview

Table 96. Nasdaq Linq Blockchain Supply Chain Finance Product

Table 97. Nasdaq Linq Revenue in Blockchain Supply Chain Finance Business (2017-2022) & (US$ Million)

Table 98. Nasdaq Linq Recent Developments

Table 99. Oracle Company Details

Table 100. Oracle Business Overview

Table 101. Oracle Blockchain Supply Chain Finance Product

Table 102. Oracle Revenue in Blockchain Supply Chain Finance Business (2017-2022) & (US$ Million)

Table 103. Oracle Recent Developments

Table 104. AWS Company Details

Table 105. AWS Business Overview

Table 106. AWS Blockchain Supply Chain Finance Product

Table 107. AWS Revenue in Blockchain Supply Chain Finance Business (2017-2022) & (US$ Million)

Table 108. AWS Recent Developments

Table 109. Citi Bank Company Details

Table 110. Citi Bank Business Overview

Table 111. Citi Bank Blockchain Supply Chain Finance Product

Table 112. Citi Bank Revenue in Blockchain Supply Chain Finance Business (2017-2022) & (US$ Million)

Table 113. Citi Bank Recent Developments

Table 114. ELayaway Company Details

Table 115. ELayaway Business Overview

Table 116. ELayaway Blockchain Supply Chain Finance Product

Table 117. ELayaway Revenue in Blockchain Supply Chain Finance Business (2017-2022) & (US$ Million)

Table 118. ELayaway Recent Developments

Table 119. HSBC Company Details

Table 120. HSBC Business Overview

Table 121. HSBC Blockchain Supply Chain Finance Product

Table 122. HSBC Revenue in Blockchain Supply Chain Finance Business (2017-2022) & (US$ Million)

Table 123. HSBC Recent Developments

Table 124. Ant Financial Company Details

Table 125. Ant Financial Business Overview

Table 126. Ant Financial Blockchain Supply Chain Finance Product

Table 127. Ant Financial Revenue in Blockchain Supply Chain Finance Business (2017-2022) & (US$ Million)

Table 128. Ant Financial Recent Developments

Table 129. JD Financial Company Details

Table 130. JD Financial Business Overview

Table 131. JD Financial Blockchain Supply Chain Finance Product

Table 132. JD Financial Revenue in Blockchain Supply Chain Finance Business (2017-2022) & (US$ Million)

Table 133. JD Financial Recent Developments

Table 134. Qihoo 360 Company Details

Table 135. Qihoo 360 Business Overview

Table 136. Qihoo 360 Blockchain Supply Chain Finance Product

Table 137. Qihoo 360 Revenue in Blockchain Supply Chain Finance Business (2017-2022) & (US$ Million)

Table 138. Qihoo 360 Recent Developments

Table 139. Tecent Company Details

Table 140. Tecent Business Overview

Table 141. Tecent Blockchain Supply Chain Finance Product

Table 142. Tecent Revenue in Blockchain Supply Chain Finance Business (2017-2022) & (US$ Million)

Table 143. Tecent Recent Developments

Table 144. Baidu Company Details

Table 145. Baidu Business Overview

Table 146. Baidu Blockchain Supply Chain Finance Product

Table 147. Baidu Revenue in Blockchain Supply Chain Finance Business (2017-2022) & (US$ Million)

Table 148. Baidu Recent Developments

Table 149. Huawei Company Details

Table 150. Huawei Business Overview

Table 151. Huawei Blockchain Supply Chain Finance Product

Table 152. Huawei Revenue in Blockchain Supply Chain Finance Business (2017-2022) & (US$ Million)

Table 153. Huawei Recent Developments

Table 154. Bitspark Company Details

Table 155. Bitspark Business Overview

Table 156. Bitspark Blockchain Supply Chain Finance Product

Table 157. Bitspark Revenue in Blockchain Supply Chain Finance Business (2017-2022) & (US$ Million)

Table 158. Bitspark Recent Developments

Table 159. SAP Company Details

Table 160. SAP Business Overview

Table 161. SAP Blockchain Supply Chain Finance Product

Table 162. SAP Revenue in Blockchain Supply Chain Finance Business (2017-2022) & (US$ Million)

Table 163. SAP Recent Developments

Table 164. Research Programs/Design for This Report

Table 165. Key Data Information from Secondary Sources

Table 166. Key Data Information from Primary Sources

List of Figures

Figure 1. Global Blockchain Supply Chain Finance Market Share by Type: 2021 VS 2028

Figure 2. IT Solution Features

Figure 3. FinTech Features

Figure 4. Bank Features

Figure 5. Consulting Features

Figure 6. Exchange and Other Features

Figure 7. Global Blockchain Supply Chain Finance Market Share by Application: 2021 VS 2028

Figure 8. Cross-border Payment Case Studies

Figure 9. Trade Finance Case Studies

Figure 10. Digital Currency Case Studies

Figure 11. Identity Management Case Studies

Figure 12. Others Case Studies

Figure 13. Blockchain Supply Chain Finance Report Years Considered

Figure 14. Global Blockchain Supply Chain Finance Market Size (US$ Million), Year-over-Year: 2017-2028

Figure 15. Global Blockchain Supply Chain Finance Market Size, (US$ Million), 2017 VS 2021 VS 2028

Figure 16. Global Blockchain Supply Chain Finance Market Share by Region: 2021 VS 2028

Figure 17. Global Blockchain Supply Chain Finance Market Share by Players in 2021

Figure 18. Global Top Blockchain Supply Chain Finance Players by Company Type (Tier 1, Tier 2, and Tier 3) & (based on the Revenue in Blockchain Supply Chain Finance as of 2021)

Figure 19. The Top 10 and 5 Players Market Share by Blockchain Supply Chain Finance Revenue in 2021

Figure 20. North America Blockchain Supply Chain Finance Market Size YoY (2017-2028) & (US$ Million)

Figure 21. North America Blockchain Supply Chain Finance Market Size Market Share by Type (2017-2028)

Figure 22. North America Blockchain Supply Chain Finance Market Size Market Share by Application (2017-2028)

Figure 23. North America Blockchain Supply Chain Finance Market Size Share by Country (2017-2028)

Figure 24. United States Blockchain Supply Chain Finance Market Size YoY Growth (2017-2028) & (US$ Million)

Figure 25. Canada Blockchain Supply Chain Finance Market Size YoY Growth (2017-2028) & (US$ Million)

Figure 26. Europe Blockchain Supply Chain Finance Market Size YoY (2017-2028) & (US$ Million)

Figure 27. Europe Blockchain Supply Chain Finance Market Size Market Share by Type (2017-2028)

Figure 28. Europe Blockchain Supply Chain Finance Market Size Market Share by Application (2017-2028)

Figure 29. Europe Blockchain Supply Chain Finance Market Size Share by Country (2017-2028)

Figure 30. Germany Blockchain Supply Chain Finance Market Size YoY Growth (2017-2028) & (US$ Million)

Figure 31. France Blockchain Supply Chain Finance Market Size YoY Growth (2017-2028) & (US$ Million)

Figure 32. U.K. Blockchain Supply Chain Finance Market Size YoY Growth (2017-2028) & (US$ Million)

Figure 33. Italy Blockchain Supply Chain Finance Market Size YoY Growth (2017-2028) & (US$ Million)

Figure 34. Russia Blockchain Supply Chain Finance Market Size YoY Growth (2017-2028) & (US$ Million)

Figure 35. Nordic Countries Blockchain Supply Chain Finance Market Size YoY Growth (2017-2028) & (US$ Million)

Figure 36. Asia-Pacific Blockchain Supply Chain Finance Market Size YoY (2017-2028) & (US$ Million)

Figure 37. Asia Pacific Blockchain Supply Chain Finance Market Size Market Share by Type (2017-2028)

Figure 38. Asia Pacific Blockchain Supply Chain Finance Market Size Market Share by Application (2017-2028)

Figure 39. Asia Pacific Blockchain Supply Chain Finance Market Size Share by Region (2017-2028)

Figure 40. China Blockchain Supply Chain Finance Market Size YoY Growth (2017-2028) & (US$ Million)

Figure 41. Japan Blockchain Supply Chain Finance Market Size YoY Growth (2017-2028) & (US$ Million)

Figure 42. South Korea Blockchain Supply Chain Finance Market Size YoY Growth (2017-2028) & (US$ Million)

Figure 43. Southeast Asia Blockchain Supply Chain Finance Market Size YoY Growth (2017-2028) & (US$ Million)

Figure 44. India Blockchain Supply Chain Finance Market Size YoY Growth (2017-2028) & (US$ Million)

Figure 45. Australia Blockchain Supply Chain Finance Market Size YoY Growth (2017-2028) & (US$ Million)

Figure 46. Latin America Blockchain Supply Chain Finance Market Size YoY (2017-2028) & (US$ Million)

Figure 47. Latin America Blockchain Supply Chain Finance Market Size Market Share by Type (2017-2028)

Figure 48. Latin America Blockchain Supply Chain Finance Market Size Market Share by Application (2017-2028)

Figure 49. Latin America Blockchain Supply Chain Finance Market Size Share by Country (2017-2028)

Figure 50. Mexico Blockchain Supply Chain Finance Market Size YoY Growth (2017-2028) & (US$ Million)

Figure 51. Brazil Blockchain Supply Chain Finance Market Size YoY Growth (2017-2028) & (US$ Million)

Figure 52. Middle East & Africa Blockchain Supply Chain Finance Market Size YoY (2017-2028) & (US$ Million)

Figure 53. Middle East and Africa Blockchain Supply Chain Finance Market Size Market Share by Type (2017-2028)

Figure 54. Middle East and Africa Blockchain Supply Chain Finance Market Size Market Share by Application (2017-2028)

Figure 55. Middle East and Africa Blockchain Supply Chain Finance Market Size Share by Country (2017-2028)

Figure 56. Turkey Blockchain Supply Chain Finance Market Size YoY Growth (2017-2028) & (US$ Million)

Figure 57. Saudi Arabia Blockchain Supply Chain Finance Market Size YoY Growth (2017-2028) & (US$ Million)

Figure 58. UAE Blockchain Supply Chain Finance Market Size YoY Growth (2017-2028) & (US$ Million)

Figure 59. IBM Revenue Growth Rate in Blockchain Supply Chain Finance Business (2017-2022)

Figure 60. Ripple Revenue Growth Rate in Blockchain Supply Chain Finance Business (2017-2022)

Figure 61. Rubix by Deloitte Revenue Growth Rate in Blockchain Supply Chain Finance Business (2017-2022)

Figure 62. Accenture Revenue Growth Rate in Blockchain Supply Chain Finance Business (2017-2022)

Figure 63. Distributed Ledger Technologies Revenue Growth Rate in Blockchain Supply Chain Finance Business (2017-2022)

Figure 64. Oklink Revenue Growth Rate in Blockchain Supply Chain Finance Business (2017-2022)

Figure 65. Nasdaq Linq Revenue Growth Rate in Blockchain Supply Chain Finance Business (2017-2022)

Figure 66. Oracle Revenue Growth Rate in Blockchain Supply Chain Finance Business (2017-2022)

Figure 67. AWS Revenue Growth Rate in Blockchain Supply Chain Finance Business (2017-2022)

Figure 68. Citi Bank Revenue Growth Rate in Blockchain Supply Chain Finance Business (2017-2022)

Figure 69. ELayaway Revenue Growth Rate in Blockchain Supply Chain Finance Business (2017-2022)

Figure 70. HSBC Revenue Growth Rate in Blockchain Supply Chain Finance Business (2017-2022)

Figure 71. Ant Financial Revenue Growth Rate in Blockchain Supply Chain Finance Business (2017-2022)

Figure 72. JD Financial Revenue Growth Rate in Blockchain Supply Chain Finance Business (2017-2022)

Figure 73. Qihoo 360 Revenue Growth Rate in Blockchain Supply Chain Finance Business (2017-2022)

Figure 74. Tecent Revenue Growth Rate in Blockchain Supply Chain Finance Business (2017-2022)

Figure 75. Baidu Revenue Growth Rate in Blockchain Supply Chain Finance Business (2017-2022)

Figure 76. Huawei Revenue Growth Rate in Blockchain Supply Chain Finance Business (2017-2022)

Figure 77. Bitspark Revenue Growth Rate in Blockchain Supply Chain Finance Business (2017-2022)

Figure 78. SAP Revenue Growth Rate in Blockchain Supply Chain Finance Business (2017-2022)

Figure 79. Bottom-up and Top-down Approaches for This Report

Figure 80. Data Triangulation

Figure 81. Key Executives Interviewed

$4900

$9800

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS