FEATURED COMPANIES

IBM US

SecureWorks (US)

Symantec (US)

Trustwave (US)

Verizon (US)

AT&T(US)

Atos (France)

BAE Systems (UK)

CenturyLink (US)

DXC (US)

Fortinet (US)

Fujitsu (Japan)

NTT Security (Japan)

Wipro (India)

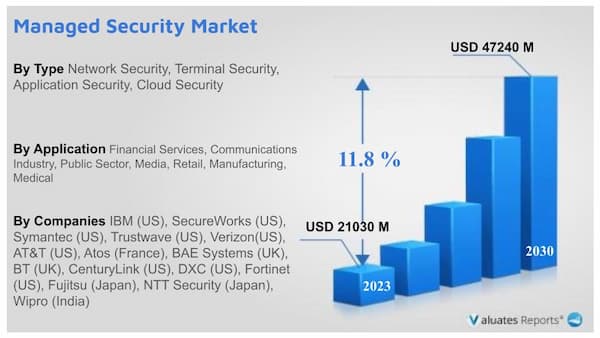

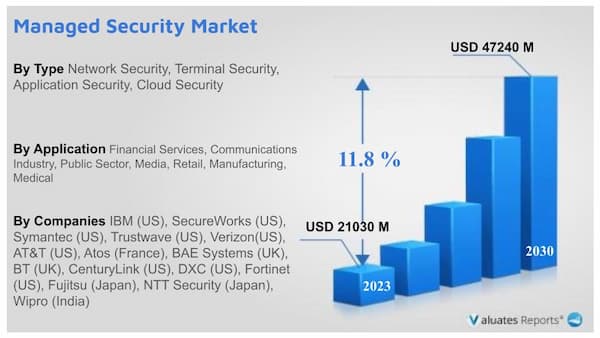

Managed Security Services Market

Stringent regulatory compliances and the increasing sophistication levels of cyber-attacks are expected to drive the Managed Security Services (MSS) market.

The global Managed Security Services market was valued at US$ 21030 million in 2023 and is anticipated to reach US$ 47240 million by 2030, witnessing a CAGR of 11.8% during the forecast period 2024-2030.

North America is expected to hold the largest market size and dominate the MSS market from 2018 to 2023, owing to the early adoption of new and emerging technologies and the presence of a large number of MSSPs in this region.This report aims to provide a comprehensive presentation of the global market for Managed Security Services, with both quantitative and qualitative analysis, to help readers develop business/growth strategies, assess the market competitive situation, analyze their position in the current marketplace, and make informed business decisions regarding Managed Security Services.

Report Scope

The Managed Security Services market size, estimations, and forecasts are provided in terms of revenue ($ millions), considering 2023 as the base year, with history and forecast data for the period from 2019 to 2030. This report segments the global Managed Security Services market comprehensively. Regional market sizes, concerning products by Type, by Application, and by players, are also provided. For a more in-depth understanding of the market, the report provides profiles of the competitive landscape, key competitors, and their respective market ranks. The report also discusses technological trends and new product developments. The report will help the Managed Security Services companies, new entrants, and industry chain related companies in this market with information on the revenues, sales volume, and average price for the overall market and the sub-segments across the different segments, by company, by Type, by Application, and by regions.

Scope of Managed Security Services Market Report

| Report Metric |

Details |

| Report Name |

Managed Security Services Market |

| Segment by Type |

-

Network Security

-

Terminal Security

-

Application Security

-

Cloud Security

|

| Segment by Application |

-

Financial Services

-

Communications Industry

-

Public Sector

-

Media

-

Retail

-

Manufacturing

-

Medical

-

Other

|

| By Region |

- North America (United States, Canada)

- Europe (Germany, France, UK, Italy, Russia) Rest of Europe

- Nordic Countries

- Asia-Pacific (China, Japan, South Korea)

- Southeast Asia (India, Australia)

- Rest of Asia

- Latin America (Mexico, Brazil)

- Rest of Latin America

- Middle East & Africa (Turkey, Saudi Arabia, UAE, Rest of MEA)

|

| By Company |

IBM (US), SecureWorks (US), Symantec (US), Trustwave (US), Verizon(US), AT&T (US), Atos (France), BAE Systems (UK), BT (UK), CenturyLink (US), DXC (US), Fortinet (US), Fujitsu (Japan), NTT Security (Japan), Wipro (India) |

| Forecast units |

USD million in value |

| Report coverage |

Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Managed Security Services Market Trends

The primary factors driving the expansion of the managed security services market size are anticipated to be rising instances of security breaches and an uptick in threats that endanger both large and small organizational structures. With the expansion of business in terms of scale and organizational structure, the job of information security is getting more complex. Organizations are concerned about the rise in security risks and criminal activity by organized cyber-criminal gangs. Additionally, the administration of data protection is finding itself facing a substantial challenge due to the growing complexity of network architecture.

In many cases, Managed Security Services may assist secure the information assets around-the-clock for a fraction of the expense of in-house security staff by offering industry-leading tools, innovations, and knowledge. The managed security service industry is anticipated to grow faster as a result of this MSS cost-saving feature.

The managed security market size is anticipated to grow over the forecast period due to increased usage by the BFSI sector. All banks and financial organizations must uphold tight data security in order to comply with regulatory requirements for the security of sensitive citizen data. Additionally, many firms are looking for a strong data protection system to defend their reputation.

Managed Security Services Market Analysis

Based on type, the market share for managed security services is predicted to be dominated by terminal security. There are an increasing number of endpoints from which a possible assault can originate as businesses grow their operations in outlying locations. This enables businesses to implement terminal threat detection tools to safeguard their endpoints from online dangers.

Based on the region, the greatest market share for managed security services is anticipated to reside in North America. The early adoption of novel and developing technologies as well as the concentration of MSSPs in North America is credited with this supremacy. The number of managed security service providers in North America is rising due to tight information security requirements.

The forecast period is expected to see the highest growth in the Asia Pacific area. Due to rising IT security investment in nations like China and India, this market is expanding quickly. The movement toward stricter cybersecurity rules is another important aspect influencing the growth of the sector.

Major Players in the Managed Security Services Market

IBM (US), SecureWorks (US), Symantec (US), Trustwave (US), Verizon(US), AT&T (US), Atos (France), BAE Systems (UK), BT (UK), CenturyLink (US), DXC (US), Fortinet (US), Fujitsu (Japan), NTT Security (Japan), Wipro (India).

Managed Security Services Market Segmentation

Managed Security Services Market by Type

- Network Security

- Terminal Security

- Application Security

- Cloud Security

Managed Security Services Market by Application

- Financial Services

- Communications Industry

- Public Sector

- Media

- Retail

- Manufacturing

- Medical

- Other

Managed Security Services Market by Region

- North America

- United States

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Russia

- Nordic

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- Southeast Asia

- India

- Australia

- Rest of Asia-Pacific

- Latin America

- Mexico

- Brazil

- Middle East & Africa

- Turkey

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

In the competitive analysis section of the report, leading as well as prominent players of the global Managed Security Services market are broadly studied on the basis of key factors. The report offers comprehensive analysis and accurate statistics on revenue by the player for the period 2015-2020. It also offers detailed analysis supported by reliable statistics on price and revenue (global level) by player for the period 2015-2020.

|

Report Metric |

Details |

|

Report Name |

Managed Security Services Market |

|

Base year |

2020 |

|

Forecast period |

2021-2027 |

|

Units |

Value (USD) |

|

Segments covered |

Type, End User, Offerings, Key Vendors, and Region |

|

Geographic regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

IBM (US), SecureWorks (US), Symantec (US), Trustwave (US), Verizon(US), AT&T (US), Atos (France), BAE Systems (UK), BT (UK), CenturyLink (US), DXC (US), Fortinet (US), Fujitsu (Japan), NTT Security (Japan), Wipro (India). |

1 Report Overview

1.1 Study Scope

1.2 Market Analysis by Type

1.2.1 Global Managed Security Services Market Size Growth Rate by Type: 2019 VS 2023 VS 2030

1.2.2 Network Security

1.2.3 Terminal Security

1.2.4 Application Security

1.2.5 Cloud Security

1.3 Market by Application

1.3.1 Global Managed Security Services Market Growth by Application: 2019 VS 2023 VS 2030

1.3.2 Financial Services

1.3.3 Communications Industry

1.3.4 Public Sector

1.3.5 Media

1.3.6 Retail

1.3.7 Manufacturing

1.3.8 Medical

1.3.9 Other

1.4 Study Objectives

1.5 Years Considered

1.6 Years Considered

2 Global Growth Trends

2.1 Global Managed Security Services Market Perspective (2019-2030)

2.2 Managed Security Services Growth Trends by Region

2.2.1 Global Managed Security Services Market Size by Region: 2019 VS 2023 VS 2030

2.2.2 Managed Security Services Historic Market Size by Region (2019-2024)

2.2.3 Managed Security Services Forecasted Market Size by Region (2025-2030)

2.3 Managed Security Services Market Dynamics

2.3.1 Managed Security Services Industry Trends

2.3.2 Managed Security Services Market Drivers

2.3.3 Managed Security Services Market Challenges

2.3.4 Managed Security Services Market Restraints

3 Competition Landscape by Key Players

3.1 Global Top Managed Security Services Players by Revenue

3.1.1 Global Top Managed Security Services Players by Revenue (2019-2024)

3.1.2 Global Managed Security Services Revenue Market Share by Players (2019-2024)

3.2 Global Managed Security Services Market Share by Company Type (Tier 1, Tier 2, and Tier 3)

3.3 Players Covered: Ranking by Managed Security Services Revenue

3.4 Global Managed Security Services Market Concentration Ratio

3.4.1 Global Managed Security Services Market Concentration Ratio (CR5 and HHI)

3.4.2 Global Top 10 and Top 5 Companies by Managed Security Services Revenue in 2023

3.5 Managed Security Services Key Players Head office and Area Served

3.6 Key Players Managed Security Services Product Solution and Service

3.7 Date of Enter into Managed Security Services Market

3.8 Mergers & Acquisitions, Expansion Plans

4 Managed Security Services Breakdown Data by Type

4.1 Global Managed Security Services Historic Market Size by Type (2019-2024)

4.2 Global Managed Security Services Forecasted Market Size by Type (2025-2030)

5 Managed Security Services Breakdown Data by Application

5.1 Global Managed Security Services Historic Market Size by Application (2019-2024)

5.2 Global Managed Security Services Forecasted Market Size by Application (2025-2030)

6 North America

6.1 North America Managed Security Services Market Size (2019-2030)

6.2 North America Managed Security Services Market Growth Rate by Country: 2019 VS 2023 VS 2030

6.3 North America Managed Security Services Market Size by Country (2019-2024)

6.4 North America Managed Security Services Market Size by Country (2025-2030)

6.5 United States

6.6 Canada

7 Europe

7.1 Europe Managed Security Services Market Size (2019-2030)

7.2 Europe Managed Security Services Market Growth Rate by Country: 2019 VS 2023 VS 2030

7.3 Europe Managed Security Services Market Size by Country (2019-2024)

7.4 Europe Managed Security Services Market Size by Country (2025-2030)

7.5 Germany

7.6 France

7.7 U.K.

7.8 Italy

7.9 Russia

7.10 Nordic Countries

8 Asia-Pacific

8.1 Asia-Pacific Managed Security Services Market Size (2019-2030)

8.2 Asia-Pacific Managed Security Services Market Growth Rate by Region: 2019 VS 2023 VS 2030

8.3 Asia-Pacific Managed Security Services Market Size by Region (2019-2024)

8.4 Asia-Pacific Managed Security Services Market Size by Region (2025-2030)

8.5 China

8.6 Japan

8.7 South Korea

8.8 Southeast Asia

8.9 India

8.10 Australia

9 Latin America

9.1 Latin America Managed Security Services Market Size (2019-2030)

9.2 Latin America Managed Security Services Market Growth Rate by Country: 2019 VS 2023 VS 2030

9.3 Latin America Managed Security Services Market Size by Country (2019-2024)

9.4 Latin America Managed Security Services Market Size by Country (2025-2030)

9.5 Mexico

9.6 Brazil

10 Middle East & Africa

10.1 Middle East & Africa Managed Security Services Market Size (2019-2030)

10.2 Middle East & Africa Managed Security Services Market Growth Rate by Country: 2019 VS 2023 VS 2030

10.3 Middle East & Africa Managed Security Services Market Size by Country (2019-2024)

10.4 Middle East & Africa Managed Security Services Market Size by Country (2025-2030)

10.5 Turkey

10.6 Saudi Arabia

10.7 UAE

11 Key Players Profiles

11.1 IBM (US)

11.1.1 IBM (US) Company Detail

11.1.2 IBM (US) Business Overview

11.1.3 IBM (US) Managed Security Services Introduction

11.1.4 IBM (US) Revenue in Managed Security Services Business (2019-2024)

11.1.5 IBM (US) Recent Development

11.2 SecureWorks (US)

11.2.1 SecureWorks (US) Company Detail

11.2.2 SecureWorks (US) Business Overview

11.2.3 SecureWorks (US) Managed Security Services Introduction

11.2.4 SecureWorks (US) Revenue in Managed Security Services Business (2019-2024)

11.2.5 SecureWorks (US) Recent Development

11.3 Symantec (US)

11.3.1 Symantec (US) Company Detail

11.3.2 Symantec (US) Business Overview

11.3.3 Symantec (US) Managed Security Services Introduction

11.3.4 Symantec (US) Revenue in Managed Security Services Business (2019-2024)

11.3.5 Symantec (US) Recent Development

11.4 Trustwave (US)

11.4.1 Trustwave (US) Company Detail

11.4.2 Trustwave (US) Business Overview

11.4.3 Trustwave (US) Managed Security Services Introduction

11.4.4 Trustwave (US) Revenue in Managed Security Services Business (2019-2024)

11.4.5 Trustwave (US) Recent Development

11.5 Verizon(US)

11.5.1 Verizon(US) Company Detail

11.5.2 Verizon(US) Business Overview

11.5.3 Verizon(US) Managed Security Services Introduction

11.5.4 Verizon(US) Revenue in Managed Security Services Business (2019-2024)

11.5.5 Verizon(US) Recent Development

11.6 AT&T (US)

11.6.1 AT&T (US) Company Detail

11.6.2 AT&T (US) Business Overview

11.6.3 AT&T (US) Managed Security Services Introduction

11.6.4 AT&T (US) Revenue in Managed Security Services Business (2019-2024)

11.6.5 AT&T (US) Recent Development

11.7 Atos (France)

11.7.1 Atos (France) Company Detail

11.7.2 Atos (France) Business Overview

11.7.3 Atos (France) Managed Security Services Introduction

11.7.4 Atos (France) Revenue in Managed Security Services Business (2019-2024)

11.7.5 Atos (France) Recent Development

11.8 BAE Systems (UK)

11.8.1 BAE Systems (UK) Company Detail

11.8.2 BAE Systems (UK) Business Overview

11.8.3 BAE Systems (UK) Managed Security Services Introduction

11.8.4 BAE Systems (UK) Revenue in Managed Security Services Business (2019-2024)

11.8.5 BAE Systems (UK) Recent Development

11.9 BT (UK)

11.9.1 BT (UK) Company Detail

11.9.2 BT (UK) Business Overview

11.9.3 BT (UK) Managed Security Services Introduction

11.9.4 BT (UK) Revenue in Managed Security Services Business (2019-2024)

11.9.5 BT (UK) Recent Development

11.10 CenturyLink (US)

11.10.1 CenturyLink (US) Company Detail

11.10.2 CenturyLink (US) Business Overview

11.10.3 CenturyLink (US) Managed Security Services Introduction

11.10.4 CenturyLink (US) Revenue in Managed Security Services Business (2019-2024)

11.10.5 CenturyLink (US) Recent Development

11.11 DXC (US)

11.11.1 DXC (US) Company Detail

11.11.2 DXC (US) Business Overview

11.11.3 DXC (US) Managed Security Services Introduction

11.11.4 DXC (US) Revenue in Managed Security Services Business (2019-2024)

11.11.5 DXC (US) Recent Development

11.12 Fortinet (US)

11.12.1 Fortinet (US) Company Detail

11.12.2 Fortinet (US) Business Overview

11.12.3 Fortinet (US) Managed Security Services Introduction

11.12.4 Fortinet (US) Revenue in Managed Security Services Business (2019-2024)

11.12.5 Fortinet (US) Recent Development

11.13 Fujitsu (Japan)

11.13.1 Fujitsu (Japan) Company Detail

11.13.2 Fujitsu (Japan) Business Overview

11.13.3 Fujitsu (Japan) Managed Security Services Introduction

11.13.4 Fujitsu (Japan) Revenue in Managed Security Services Business (2019-2024)

11.13.5 Fujitsu (Japan) Recent Development

11.14 NTT Security (Japan)

11.14.1 NTT Security (Japan) Company Detail

11.14.2 NTT Security (Japan) Business Overview

11.14.3 NTT Security (Japan) Managed Security Services Introduction

11.14.4 NTT Security (Japan) Revenue in Managed Security Services Business (2019-2024)

11.14.5 NTT Security (Japan) Recent Development

11.15 Wipro (India)

11.15.1 Wipro (India) Company Detail

11.15.2 Wipro (India) Business Overview

11.15.3 Wipro (India) Managed Security Services Introduction

11.15.4 Wipro (India) Revenue in Managed Security Services Business (2019-2024)

11.15.5 Wipro (India) Recent Development

12 Analyst's Viewpoints/Conclusions

13 Appendix

13.1 Research Methodology

13.1.1 Methodology/Research Approach

13.1.2 Data Source

13.2 Disclaimer

13.3 Author Details

FEATURED COMPANIES

IBM US

SecureWorks (US)

Symantec (US)

Trustwave (US)

Verizon (US)

AT&T(US)

Atos (France)

BAE Systems (UK)

CenturyLink (US)

DXC (US)

Fortinet (US)

Fujitsu (Japan)

NTT Security (Japan)

Wipro (India)

List of Tables

Table 1. Global Managed Security Services Market Size Growth Rate by Type (US$ Million): 2019 VS 2023 VS 2030

Table 2. Key Players of Network Security

Table 3. Key Players of Terminal Security

Table 4. Key Players of Application Security

Table 5. Key Players of Cloud Security

Table 6. Global Managed Security Services Market Size Growth by Application (US$ Million): 2019 VS 2023 VS 2030

Table 7. Global Managed Security Services Market Size by Region (US$ Million): 2019 VS 2023 VS 2030

Table 8. Global Managed Security Services Market Size by Region (2019-2024) & (US$ Million)

Table 9. Global Managed Security Services Market Share by Region (2019-2024)

Table 10. Global Managed Security Services Forecasted Market Size by Region (2025-2030) & (US$ Million)

Table 11. Global Managed Security Services Market Share by Region (2025-2030)

Table 12. Managed Security Services Market Trends

Table 13. Managed Security Services Market Drivers

Table 14. Managed Security Services Market Challenges

Table 15. Managed Security Services Market Restraints

Table 16. Global Managed Security Services Revenue by Players (2019-2024) & (US$ Million)

Table 17. Global Managed Security Services Market Share by Players (2019-2024)

Table 18. Global Top Managed Security Services Players by Company Type (Tier 1, Tier 2, and Tier 3) & (based on the Revenue in Managed Security Services as of 2023)

Table 19. Ranking of Global Top Managed Security Services Companies by Revenue (US$ Million) in 2023

Table 20. Global 5 Largest Players Market Share by Managed Security Services Revenue (CR5 and HHI) & (2019-2024)

Table 21. Key Players Headquarters and Area Served

Table 22. Key Players Managed Security Services Product Solution and Service

Table 23. Date of Enter into Managed Security Services Market

Table 24. Mergers & Acquisitions, Expansion Plans

Table 25. Global Managed Security Services Market Size by Type (2019-2024) & (US$ Million)

Table 26. Global Managed Security Services Revenue Market Share by Type (2019-2024)

Table 27. Global Managed Security Services Forecasted Market Size by Type (2025-2030) & (US$ Million)

Table 28. Global Managed Security Services Revenue Market Share by Type (2025-2030)

Table 29. Global Managed Security Services Market Size by Application (2019-2024) & (US$ Million)

Table 30. Global Managed Security Services Revenue Market Share by Application (2019-2024)

Table 31. Global Managed Security Services Forecasted Market Size by Application (2025-2030) & (US$ Million)

Table 32. Global Managed Security Services Revenue Market Share by Application (2025-2030)

Table 33. North America Managed Security Services Market Size Growth Rate by Country (US$ Million): 2019 VS 2023 VS 2030

Table 34. North America Managed Security Services Market Size by Country (2019-2024) & (US$ Million)

Table 35. North America Managed Security Services Market Size by Country (2025-2030) & (US$ Million)

Table 36. Europe Managed Security Services Market Size Growth Rate by Country (US$ Million): 2019 VS 2023 VS 2030

Table 37. Europe Managed Security Services Market Size by Country (2019-2024) & (US$ Million)

Table 38. Europe Managed Security Services Market Size by Country (2025-2030) & (US$ Million)

Table 39. Asia-Pacific Managed Security Services Market Size Growth Rate by Region (US$ Million): 2019 VS 2023 VS 2030

Table 40. Asia-Pacific Managed Security Services Market Size by Region (2019-2024) & (US$ Million)

Table 41. Asia-Pacific Managed Security Services Market Size by Region (2025-2030) & (US$ Million)

Table 42. Latin America Managed Security Services Market Size Growth Rate by Country (US$ Million): 2019 VS 2023 VS 2030

Table 43. Latin America Managed Security Services Market Size by Country (2019-2024) & (US$ Million)

Table 44. Latin America Managed Security Services Market Size by Country (2025-2030) & (US$ Million)

Table 45. Middle East & Africa Managed Security Services Market Size Growth Rate by Country (US$ Million): 2019 VS 2023 VS 2030

Table 46. Middle East & Africa Managed Security Services Market Size by Country (2019-2024) & (US$ Million)

Table 47. Middle East & Africa Managed Security Services Market Size by Country (2025-2030) & (US$ Million)

Table 48. IBM (US) Company Detail

Table 49. IBM (US) Business Overview

Table 50. IBM (US) Managed Security Services Product

Table 51. IBM (US) Revenue in Managed Security Services Business (2019-2024) & (US$ Million)

Table 52. IBM (US) Recent Development

Table 53. SecureWorks (US) Company Detail

Table 54. SecureWorks (US) Business Overview

Table 55. SecureWorks (US) Managed Security Services Product

Table 56. SecureWorks (US) Revenue in Managed Security Services Business (2019-2024) & (US$ Million)

Table 57. SecureWorks (US) Recent Development

Table 58. Symantec (US) Company Detail

Table 59. Symantec (US) Business Overview

Table 60. Symantec (US) Managed Security Services Product

Table 61. Symantec (US) Revenue in Managed Security Services Business (2019-2024) & (US$ Million)

Table 62. Symantec (US) Recent Development

Table 63. Trustwave (US) Company Detail

Table 64. Trustwave (US) Business Overview

Table 65. Trustwave (US) Managed Security Services Product

Table 66. Trustwave (US) Revenue in Managed Security Services Business (2019-2024) & (US$ Million)

Table 67. Trustwave (US) Recent Development

Table 68. Verizon(US) Company Detail

Table 69. Verizon(US) Business Overview

Table 70. Verizon(US) Managed Security Services Product

Table 71. Verizon(US) Revenue in Managed Security Services Business (2019-2024) & (US$ Million)

Table 72. Verizon(US) Recent Development

Table 73. AT&T (US) Company Detail

Table 74. AT&T (US) Business Overview

Table 75. AT&T (US) Managed Security Services Product

Table 76. AT&T (US) Revenue in Managed Security Services Business (2019-2024) & (US$ Million)

Table 77. AT&T (US) Recent Development

Table 78. Atos (France) Company Detail

Table 79. Atos (France) Business Overview

Table 80. Atos (France) Managed Security Services Product

Table 81. Atos (France) Revenue in Managed Security Services Business (2019-2024) & (US$ Million)

Table 82. Atos (France) Recent Development

Table 83. BAE Systems (UK) Company Detail

Table 84. BAE Systems (UK) Business Overview

Table 85. BAE Systems (UK) Managed Security Services Product

Table 86. BAE Systems (UK) Revenue in Managed Security Services Business (2019-2024) & (US$ Million)

Table 87. BAE Systems (UK) Recent Development

Table 88. BT (UK) Company Detail

Table 89. BT (UK) Business Overview

Table 90. BT (UK) Managed Security Services Product

Table 91. BT (UK) Revenue in Managed Security Services Business (2019-2024) & (US$ Million)

Table 92. BT (UK) Recent Development

Table 93. CenturyLink (US) Company Detail

Table 94. CenturyLink (US) Business Overview

Table 95. CenturyLink (US) Managed Security Services Product

Table 96. CenturyLink (US) Revenue in Managed Security Services Business (2019-2024) & (US$ Million)

Table 97. CenturyLink (US) Recent Development

Table 98. DXC (US) Company Detail

Table 99. DXC (US) Business Overview

Table 100. DXC (US) Managed Security Services Product

Table 101. DXC (US) Revenue in Managed Security Services Business (2019-2024) & (US$ Million)

Table 102. DXC (US) Recent Development

Table 103. Fortinet (US) Company Detail

Table 104. Fortinet (US) Business Overview

Table 105. Fortinet (US) Managed Security Services Product

Table 106. Fortinet (US) Revenue in Managed Security Services Business (2019-2024) & (US$ Million)

Table 107. Fortinet (US) Recent Development

Table 108. Fujitsu (Japan) Company Detail

Table 109. Fujitsu (Japan) Business Overview

Table 110. Fujitsu (Japan) Managed Security Services Product

Table 111. Fujitsu (Japan) Revenue in Managed Security Services Business (2019-2024) & (US$ Million)

Table 112. Fujitsu (Japan) Recent Development

Table 113. NTT Security (Japan) Company Detail

Table 114. NTT Security (Japan) Business Overview

Table 115. NTT Security (Japan) Managed Security Services Product

Table 116. NTT Security (Japan) Revenue in Managed Security Services Business (2019-2024) & (US$ Million)

Table 117. NTT Security (Japan) Recent Development

Table 118. Wipro (India) Company Detail

Table 119. Wipro (India) Business Overview

Table 120. Wipro (India) Managed Security Services Product

Table 121. Wipro (India) Revenue in Managed Security Services Business (2019-2024) & (US$ Million)

Table 122. Wipro (India) Recent Development

Table 123. Research Programs/Design for This Report

Table 124. Key Data Information from Secondary Sources

Table 125. Key Data Information from Primary Sources

List of Figures

Figure 1. Global Managed Security Services Market Size Comparison by Type (2024-2030) & (US$ Million)

Figure 2. Global Managed Security Services Market Share by Type: 2023 VS 2030

Figure 3. Network Security Features

Figure 4. Terminal Security Features

Figure 5. Application Security Features

Figure 6. Cloud Security Features

Figure 7. Global Managed Security Services Market Size Comparison by Application (2024-2030) & (US$ Million)

Figure 8. Global Managed Security Services Market Share by Application: 2023 VS 2030

Figure 9. Financial Services Case Studies

Figure 10. Communications Industry Case Studies

Figure 11. Public Sector Case Studies

Figure 12. Media Case Studies

Figure 13. Retail Case Studies

Figure 14. Manufacturing Case Studies

Figure 15. Medical Case Studies

Figure 16. Other Case Studies

Figure 17. Managed Security Services Report Years Considered

Figure 18. Global Managed Security Services Market Size (US$ Million), Year-over-Year: 2019-2030

Figure 19. Global Managed Security Services Market Size, (US$ Million), 2019 VS 2023 VS 2030

Figure 20. Global Managed Security Services Market Share by Region: 2023 VS 2030

Figure 21. Global Managed Security Services Market Share by Players in 2023

Figure 22. Global Top Managed Security Services Players by Company Type (Tier 1, Tier 2, and Tier 3) & (based on the Revenue in Managed Security Services as of 2023)

Figure 23. The Top 10 and 5 Players Market Share by Managed Security Services Revenue in 2023

Figure 24. North America Managed Security Services Market Size YoY Growth (2019-2030) & (US$ Million)

Figure 25. North America Managed Security Services Market Share by Country (2019-2030)

Figure 26. United States Managed Security Services Market Size YoY Growth (2019-2030) & (US$ Million)

Figure 27. Canada Managed Security Services Market Size YoY Growth (2019-2030) & (US$ Million)

Figure 28. Europe Managed Security Services Market Size YoY Growth (2019-2030) & (US$ Million)

Figure 29. Europe Managed Security Services Market Share by Country (2019-2030)

Figure 30. Germany Managed Security Services Market Size YoY Growth (2019-2030) & (US$ Million)

Figure 31. France Managed Security Services Market Size YoY Growth (2019-2030) & (US$ Million)

Figure 32. U.K. Managed Security Services Market Size YoY Growth (2019-2030) & (US$ Million)

Figure 33. Italy Managed Security Services Market Size YoY Growth (2019-2030) & (US$ Million)

Figure 34. Russia Managed Security Services Market Size YoY Growth (2019-2030) & (US$ Million)

Figure 35. Nordic Countries Managed Security Services Market Size YoY Growth (2019-2030) & (US$ Million)

Figure 36. Asia-Pacific Managed Security Services Market Size YoY Growth (2019-2030) & (US$ Million)

Figure 37. Asia-Pacific Managed Security Services Market Share by Region (2019-2030)

Figure 38. China Managed Security Services Market Size YoY Growth (2019-2030) & (US$ Million)

Figure 39. Japan Managed Security Services Market Size YoY Growth (2019-2030) & (US$ Million)

Figure 40. South Korea Managed Security Services Market Size YoY Growth (2019-2030) & (US$ Million)

Figure 41. Southeast Asia Managed Security Services Market Size YoY Growth (2019-2030) & (US$ Million)

Figure 42. India Managed Security Services Market Size YoY Growth (2019-2030) & (US$ Million)

Figure 43. Australia Managed Security Services Market Size YoY Growth (2019-2030) & (US$ Million)

Figure 44. Latin America Managed Security Services Market Size YoY Growth (2019-2030) & (US$ Million)

Figure 45. Latin America Managed Security Services Market Share by Country (2019-2030)

Figure 46. Mexico Managed Security Services Market Size YoY Growth (2019-2030) & (US$ Million)

Figure 47. Brazil Managed Security Services Market Size YoY Growth (2019-2030) & (US$ Million)

Figure 48. Middle East & Africa Managed Security Services Market Size YoY Growth (2019-2030) & (US$ Million)

Figure 49. Middle East & Africa Managed Security Services Market Share by Country (2019-2030)

Figure 50. Turkey Managed Security Services Market Size YoY Growth (2019-2030) & (US$ Million)

Figure 51. Saudi Arabia Managed Security Services Market Size YoY Growth (2019-2030) & (US$ Million)

Figure 52. IBM (US) Revenue Growth Rate in Managed Security Services Business (2019-2024)

Figure 53. SecureWorks (US) Revenue Growth Rate in Managed Security Services Business (2019-2024)

Figure 54. Symantec (US) Revenue Growth Rate in Managed Security Services Business (2019-2024)

Figure 55. Trustwave (US) Revenue Growth Rate in Managed Security Services Business (2019-2024)

Figure 56. Verizon(US) Revenue Growth Rate in Managed Security Services Business (2019-2024)

Figure 57. AT&T (US) Revenue Growth Rate in Managed Security Services Business (2019-2024)

Figure 58. Atos (France) Revenue Growth Rate in Managed Security Services Business (2019-2024)

Figure 59. BAE Systems (UK) Revenue Growth Rate in Managed Security Services Business (2019-2024)

Figure 60. BT (UK) Revenue Growth Rate in Managed Security Services Business (2019-2024)

Figure 61. CenturyLink (US) Revenue Growth Rate in Managed Security Services Business (2019-2024)

Figure 62. DXC (US) Revenue Growth Rate in Managed Security Services Business (2019-2024)

Figure 63. Fortinet (US) Revenue Growth Rate in Managed Security Services Business (2019-2024)

Figure 64. Fujitsu (Japan) Revenue Growth Rate in Managed Security Services Business (2019-2024)

Figure 65. NTT Security (Japan) Revenue Growth Rate in Managed Security Services Business (2019-2024)

Figure 66. Wipro (India) Revenue Growth Rate in Managed Security Services Business (2019-2024)

Figure 67. Bottom-up and Top-down Approaches for This Report

Figure 68. Data Triangulation

Figure 69. Key Executives Interviewed