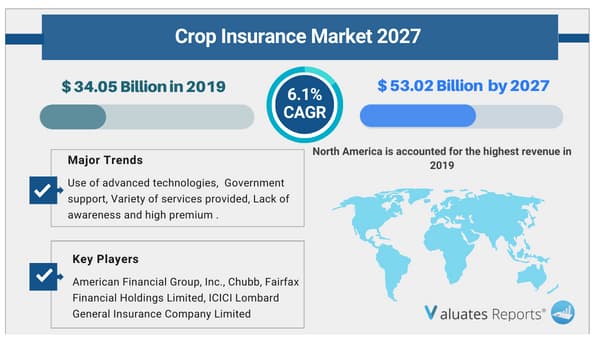

The global crop insurance market size was valued at USD 34.05 Billion in 2019, and is projected to reach USD 53.02 Billion by 2027, growing at a CAGR of 6.1% from 2020 to 2027. Key drivers of the crop insurance market include the rise in digital initiatives and technological innovations.

The favorable government support and subsidies will fuel the growth of the crop insurance market during the forecast period. The launching of several crop insurance product lines and coverage of multiple agricultural stakeholders will drive the growth of the market in the coming years.

Use of advanced technologies

The large-scale adoption of satellites, drones, artificial intelligence, IoT, mobile applications, and web-based platforms is helping farmers to detect diseased crops, predict weather patterns, and store data related to land size, and shape for harvesting crops. Cloud integrated analytics provide real-time accurate estimates of crop distribution, yield, and actual photographic evidence. Historical data can be accessed for risk measurement and insurance calculation. Farmers are onboarded for providing climate-specific crop information so that companies can customize their insurance products for small landholders. Remote sensing capabilities provide input-based loss identification streamlining the claims payout process. Satellite imagery can exactly pinpoint the entire crop health status, productivity, and moisture levels. It narrows down field inspections by assigning detailed GPS coordinates. Moreover, companies can monitor the air temperature beforehand to predict upcoming threats and measure the validity of claims in case of any yield loss. Farmers can provide this data as evidence for compensation. The data of entire agricultural operations are integrated onto a single platform for enhanced visibility and transparency. These factors will boost the growth of the crop insurance market during the forecast period.

Government support

Several government authorities have initiated schemes and incentives to protect farmers from fluctuations in revenue, pricing, and yields. Subsidized funding enables them to avail crop insurance products at cheaper rates. As risks related to climate change increase, there is a greater need for building a resilient financial and insurance ecosystem. Public organizations take up partial risk guarantees on behalf of small landowners. Regulatory interventions are being undertaken to improve the financial services of the agricultural industry by introducing lending quotas, interest rate caps, and dispute mechanisms for contract farming. Moreover, several organizations are collaborating for building innovative insurance products and premium subsidies. For instance, Global Index Insurance Facility and Disaster Risk Finance and Insurance program have initiated partnerships to work on several insurance projects. These factors will boost the growth of the crop insurance market during the forecast period.

Variety of services provided

Agriculture is exposed to a range of problems like droughts, floods, weeds, plant diseases, and locust attacks. The majority of the population engaged in farming are small landowners. Their income gets reduced drastically whenever any natural calamity strikes their crops. Hence insurance providers are integrating with banking companies to launch extensive insurance products in order to strengthen the functioning of all related stakeholders. The benefits accrued are farmers get protection against climactic losses. The economic protection leads them to adopt the latest farming practices for improving yield. Cooperatives and other agricultural institutions are able to increase their lending capacity. The government expenditure on several relief initiatives is reduced to some extent. Moreover, insurance companies provide a highly effective anti-inflationary measure by securing agricultural assets in rural areas. Such factors will boost the growth of the crop insurance market in the coming years.

Lack of awareness and high premium

In spite of all the solutions offered by crop insurance, it suffers from certain issues. Farmers are generally not equipped with the complex terminologies and technical know-how of premium payment and claim settlement process. If they get caught up in an enormous cycle of debt and are unable to repay their agricultural loan the insurance ceases to exist as it is linked to their loan-taking capacity. Furthermore, small farmers with very little income have to pay high premiums which ultimately creates a financial burden. Fraudulent claims involving the nexus of large farmers, bank officials, and government employees ruin the novel intention behind insurance coverage. This is expected to deter the growth of the crop insurance market in the forthcoming years.

Based on coverage, the multiple peril crop insurance segment is expected to dominate in the crop insurance market share due to the huge demand for multiple and customized crop insurance needs.

Based on the distribution channel, the insurance companies segment is expected to witness considerable growth in the crop insurance market share.

Based on region, North America will dominate in the crop insurance market share due to rapid technological innovations, increasing awareness levels of crop insurance policies, and favorable government regulations. While Asia-Pacific will grow the fastest due to its huge population base and rising demand for food security.

| Report Metric |

Details |

| Report Name |

Crop Insurance Market |

| Market size value in 2019 |

USD 34.05 Billion |

| Revenue forecast in 2027 |

USD 53.02 Billion |

| Growth Rate |

CAGR of 6.1% |

| Base year considered |

2019 |

| Forecast Period |

2020-2027 |

| By Coverage |

Multi-peril Crop Insurance [MPCI] and Crop-hail Insurance |

| By Distribution Channel |

Banks, Insurance Companies, Brokers/Agents |

| Report Coverage |

Revenue & volume forecast, company share, competitive landscape, growth factors, and trends |

| Segments Covered |

By Type, Application, and Region |

| Geographic Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Ans. The global crop insurance market size was valued at $34.05 billion in 2019, and is projected to reach $53.02 billion by 2027, growing at a CAGR of 6.1% from 2020 to 2027.

Ans. The report analyses the profiles of key players operating in the market, which include Agriculture Insurance Company of India Limited (AIC), American Financial Group, Inc., Chubb, Fairfax Financial Holdings Limited

Ans. Yes, the report includes a COVID-19 impact analysis. Also, it is further extended into every individual segment of the report.

$6169

$6930

$9665

$4126

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS

Add to Cart

Add to Cart

Add to Cart

Add to Cart