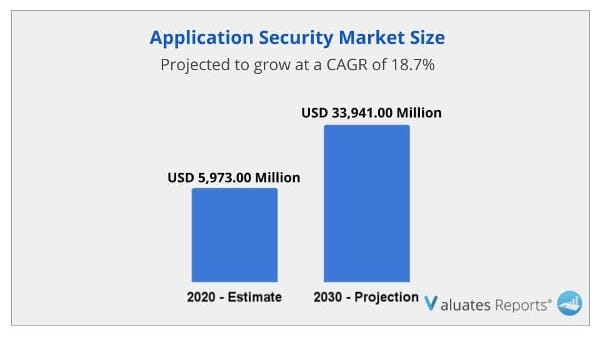

The global application security market size was valued at USD 5,973.00 Million in 2020, and is projected to reach USD 33,941.00 Million by 2030, registering a CAGR of 18.7%.

Application security is the process of securing applications by finding, fixing, and enhancing the security of apps. It adds security capabilities within applications to prevent security vulnerabilities against threats such as unauthorized modification and access. It involves several proactive steps to discover vulnerabilities as well as to patch them before hackers get a chance to exploit them. The application security solutions offer a number of benefits to the enterprises that include keeping the customer data secure to build customer confidence; protection of sensitive data from leaks; and improvement of trust from crucial lenders and investors.

The COVID-19 outbreak has fueled demand for application security solutions in the face of unprecedented circumstances. For instance, a more number of companies are shifting their security efforts toward endpoint security for the work from home systems. In addition, the security teams within the enterprises which do not have resources are adopting these solutions to address various web application security issues; thus, boosting demand for effective application security solutions.

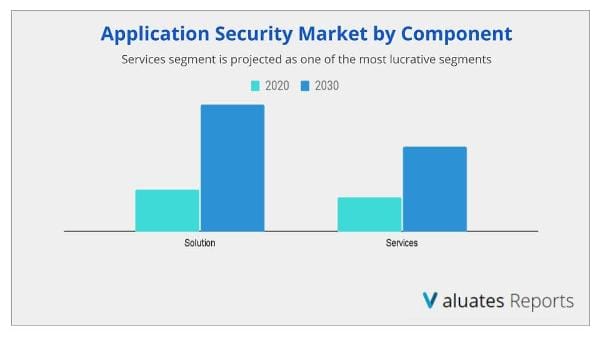

On the basis of component, the solution segment exhibited dominance in the application security market in 2020, and is expected to maintain its dominance in the upcoming years. The rise in demand for mobile application security as well as web application security drives the growth of this segment. For instance, surge in internet penetration as well as adoption of BYOD policies across the organizations lead to the surge in use of a personal device including smartphones, smart wearable, laptops, and tablets to access organization information. Hence, there is rise in demand for application security solutions to avoid data breaches regarding the mobile application.

However, the services segment is expected to witness highest growth, as it ensures effective functioning of application security software throughout the process. In addition, the lack of skill sets and experience of in-house security professionals associated with the software security testing has led to the rise in demand for organizations to outsource their security model; thus, boosting the growth of application security industry.

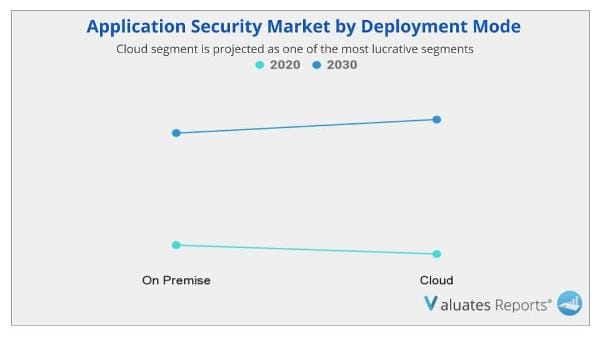

By deployment mode, the global application security market share was dominated by the on-premise segment in 2020 and is expected to maintain its dominance in the upcoming years. On-premise-based solutions are known for better maintenance of servers, and continuous system facilitates the implementation of these application security solutions.

North America dominates the application security market share in 2020 and is expected to maintain its dominance in the upcoming years. Growth of this segment is mainly attributed to the proliferation of mobile devices and rise in cloud based networking along with the presence of major key players such as IBM, Cisco, Veracode, Contrast Security, Synopsis, WhiteHat Security, Onapsis, GitLab, and Qualys. Asia-Pacific is expected to observe highest growth rate during the forecast period, owing to the growth in occurrence of security breaches that targets business applications. In addition, the region is anticipated to experience growth in number of SMEs.

The report focuses on the growth prospects, restraints, and application security market analysis. The study provides Porter’s five forces analysis of the application security industry to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the application security market trends.

The application security market is segmented on the basis of component, deployment mode, organization size, type, testing type, industry vertical, and region. By component, it is categorized into solution and services. By deployment mode, it is classified into on-premise and cloud. By organization size, it is classified into large enterprises and SMEs. By type, it is segmented into web application security and mobile application security. By testing type, it is categorized into static application security testing (SAST), dynamic application security testing (DAST), interactive application security testing (IAST), and runtime application self-protection (RASP)). By industry vertical, it is divided into BFSI, healthcare, IT & telecom, manufacturing, government & public sector, retail & e-commerce, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Post COVID-19, the size of the application security market is estimated to grow from 5,973.0 million in 2020 and projected to reach $33,941.0 million by 2030, at a CAGR of 18.7%. The current estimation of 2030 is projected to be higher than pre-COVID-19 estimates. The COVID-19 outbreak has fueled demand for application security solutions in the face of unprecedented circumstances. For instance, a lot of companies are shifting their security efforts toward endpoint security for the work from home systems. In addition, the security teams within the enterprises have no resources to address various web application security issues; thus, boosting demand for effective application security solutions.

Moreover, application providers for distance learning, teleconferencing, online gaming, healthcare, e-commerce, and entertainment have observed an upsurge in usage as well as boost in revenue. Hence, there is rise in need for such applications to improve their security capabilities. On the other hand, proliferation of healthcare and medical applications further creates lucrative growth opportunities for the application security solutions to avoid breach of the medical data. For instance, according to 2020 study by Intertrust, 71% of healthcare as well as medical apps have at least one serious vulnerability that may lead to a breach of medical data.

The global application security market growth is mainly driven by the factors such as increase in security breaches targeting business applications and strict compliance as well as regulatory requirements for application security. In addition, surge in demand for application security in retail and e-commerce organizations along with the upsurge in smartphone adoption fuels the demand for application security. Moreover, increase in shift towards cloud accessed applications has propelled the demand for application security solutions. However, budget constraints for deploying application security are anticipated to hamper the market growth to some extent. On the other hand, integration of AI and ML in application security is expected to provide lucrative opportunities for the market growth during the forecast period.

Most of the businesses around the globe have incorporated some set of digital transformation initiatives. For instance, according to recent study by OpsRamp, an IT Operations management software-as-a-service (SaaS) platform, despite economic uncertainty caused by COVID-19, 61% of IT and DevOps leaders are expected to increase their digital transformation initiatives and projects. Under the digital transformation initiatives, more number of businesses are adopting applications to provide services to their customers. However, hackers are mainly targeting such applications creating the demand for application security solutions. For instance, in March 2020, Mar Marriott International, Inc. an American multinational company had been hacked, and more than 5 million customer records had been stolen.

There is rise in trend of using artificial intelligence (AI) in cyber security to enhance existing application security capabilities. A number of AI areas such as machine learning (ML) and expert systems are projected to be leveraged to improve application security to predict, derive, or apply implications to identify security vulnerabilities, forecast security threats, and identify the security coding remediation guidance.

In addition, tools such as user & event behavior analytics (UEBA), when powered by AI, can analyze user behavior on endpoints and servers, and detect anomalies that might direct to an unknown attack. Such features fueled by AI can help to protect organizations before the vulnerabilities are officially reported & patched. Hence, integration of AI & ML is expected to create lucrative growth opportunities for the global application security market.

|

Report Metric |

Details |

|

Report Name |

Application Security Market |

|

Market size value in 2020 |

USD 5,973.00 Million |

|

Revenue forecast in 2030 |

USD 33,941.00 Million |

|

Growth Rate |

CAGR 18.7% |

|

Base year considered |

2020 |

|

Historical Data |

2021-2030 |

|

By Type |

Web Application Security and Mobile Application Security |

|

By Testing Type |

Static Application Security Testing (SAST), Dynamic Application Security Testing (DAST), Interactive Application Security Testing (IAST), and Runtime Application Self-Protection (RASP) |

|

By Industry Vertical |

BFSI, Healthcare, IT and Telecom, Manufacturing, Government and Public Sector, Retail & E-commerce |

Ans: The global application security market size was valued at USD 5,973.00 Million in 2020, and is projected to reach USD 33,941.00 Million by 2030, registering a CAGR of 18.7%.

Ans: Some of the major key companies such as IBM, Cisco, Veracode, Contrast Security, Synopsis, WhiteHat Security, Onapsis, GitLab, and Qualys.

Ans: North America dominates the application security market share in 2020 and is expected to maintain its dominance in the upcoming years.

CHAPTER 1:INTRODUCTION

1.1.REPORT DESCRIPTION

1.2.KEY BENEFITS FOR STAKEHOLDERS

1.3.KEY MARKET SEGMENTS

1.3.1.Key market players

1.4.RESEARCH METHODOLOGY

1.4.1.Secondary research

1.4.2.Primary research

1.4.3.Analyst tools & models

CHAPTER 2:EXECUTIVE SUMMARY

2.1.KEY FINDINGS

2.1.1.Top impacting factors

2.1.2.Top investment pockets

2.2.CXO PERSPECTIVE

CHAPTER 3:MARKET OVERVIEW

3.1.MARKET DEFINITION AND SCOPE

3.2.KEY FORCES SHAPING THE APPLICATION SECURITY MARKET

3.3.MARKET DYNAMICS

3.3.1.Drivers

3.3.1.1.Rising security breaches targeting business applications

3.3.1.2.Strict compliance as well as regulatory requirements for application security

3.3.1.3.Rising demand for application security in retail and e-commerce organizations

3.3.1.4.Upsurge in smartphone adoption

3.3.1.5.Increasing sift towards cloud accessed applications

3.3.2.Restraints

3.3.2.1.Budget constraints for deploying application security

3.3.3.Opportunities

3.3.3.1.Integration of AI and ML in application security

3.4.COVID-19 IMPACT ANALYSIS ON THE APPLICATION SECURITY MARKET

3.4.1.Impact on market size

3.4.2.Consumer trends, preferences, and budget impact

3.4.3.Economic impact

3.4.4.Regulatory framework

3.4.5.Key player strategies to tackle negative impact

3.4.6.Opportunity window

CHAPTER 4:APPLICATION SECURITY MARKET, BY COMPONENT

4.1.OVERVIEW

4.2.SOLUTION

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast, by region

4.2.3.Market analysis, by country

4.3.SERVICES

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Market size and forecast, by region

4.3.3.Market analysis, by country

CHAPTER 5:APPLICATION SECURITY MARKET, BY DEPLOYMENT MODE

5.1.OVERVIEW

5.2.ON-PREMISE

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region

5.2.3.Market analysis, by country

5.3.CLOUD

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region

5.3.3.Market analysis, by country

CHAPTER 6:APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE

6.1.OVERVIEW

6.2.LARGE ENTERPRISES

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by region

6.2.3.Market analysis, by country

6.3.SMES

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by region

6.3.3.Market analysis, by country

CHAPTER 7:APPLICATION SECURITY MARKET, BY TYPE

7.1.OVERVIEW

7.2.WEB APPLICATION SECURITY

7.2.1.Key market trends, growth factors, and opportunities

7.2.2.Market size and forecast, by region

7.2.3.Market analysis, by country

7.3.MOBILE APPLICATION SECURITY

7.3.1.Key market trends, growth factors, and opportunities

7.3.2.Market size and forecast, by region

7.3.3.Market analysis, by country

CHAPTER 8:APPLICATION SECURITY MARKET, BY TESTING TYPE

8.1.OVERVIEW

8.2.STATIC APPLICATION SECURITY TESTING (SAST)

8.2.1.Key market trends, growth factors, and opportunities

8.2.2.Market size and forecast, by region

8.2.3.Market analysis, by country

8.3.DYNAMIC APPLICATION SECURITY TESTING (DAST)

8.3.1.Key market trends, growth factors, and opportunities

8.3.2.Market size and forecast, by region

8.3.3.Market analysis, by country

8.4.INTERACTIVE APPLICATION SECURITY TESTING (IAST)

8.4.1.Key market trends, growth factors, and opportunities

8.4.2.Market size and forecast, by region

8.4.3.Market analysis, by country

8.5.RUNTIME APPLICATION SELF-PROTECTION (RASP)

8.5.1.Key market trends, growth factors, and opportunities

8.5.2.Market size and forecast, by region

8.5.3.Market analysis, by country

CHAPTER 9:APPLICATION SECURITY MARKET, BY INDUSTRY VERTICAL

9.1.OVERVIEW

9.2.BFSI

9.2.1.Key market trends, growth factors, and opportunities

9.2.2.Market size and forecast, by region

9.2.3.Market analysis, by country

9.3.HEALTHCARE

9.3.1.Key market trends, growth factors, and opportunities

9.3.2.Market size and forecast, by region

9.3.3.Market analysis, by country

9.4.IT & TELECOM

9.4.1.Key market trends, growth factors, and opportunities

9.4.2.Market size and forecast, by region

9.4.3.Market analysis, by country

9.5.MANUFACTURING

9.5.1.Key market trends, growth factors, and opportunities

9.5.2.Market size and forecast, by region

9.5.3.Market analysis, by country

9.6.GOVERNMENT AND PUBLIC SECTOR

9.6.1.Key market trends, growth factors, and opportunities

9.6.2.Market size and forecast, by region

9.6.3.Market analysis, by country

9.7.RETAIL

9.7.1.Key market trends, growth factors, and opportunities

9.7.2.Market size and forecast, by region

9.7.3.Market analysis, by country

9.8.OTHERS

9.8.1.Key market trends, growth factors, and opportunities

9.8.2.Market size and forecast, by region

9.8.3.Market analysis, by country

CHAPTER 10:APPLICATION SECURITY MARKET, BY REGION

10.1.OVERVIEW

10.2.NORTH AMERICA

10.2.1.Key market trends, growth factors, and opportunities

10.2.2.Market size and forecast, by component

10.2.3.Market size and forecast, by deployment mode

10.2.4.Market size and forecast, by organization size

10.2.5.Market size and forecast, by type

10.2.6.Market size and forecast, by testing type

10.2.7.Market size and forecast, by industry vertical

10.2.8.Market analysis, by country

10.2.8.1.U.S.

10.2.8.1.1.Market size and forecast, by component

10.2.8.1.2.Market size and forecast, by deployment mode

10.2.8.1.3.Market size and forecast, by organization size

10.2.8.1.4.Market size and forecast, by type

10.2.8.1.5.Market size and forecast, by testing type

10.2.8.1.6.Market size and forecast, by industry vertical

10.2.8.2.Canada

10.2.8.2.1.Market size and forecast, by component

10.2.8.2.2.Market size and forecast, by deployment mode

10.2.8.2.3.Market size and forecast, by organization size

10.2.8.2.4.Market size and forecast, by type

10.2.8.2.5.Market size and forecast, by testing type

10.2.8.2.6.Market size and forecast, by industry vertical

10.3.EUROPE

10.3.1.Key market trends, growth factors, and opportunities

10.3.2.Market size and forecast, by component

10.3.3.Market size and forecast, by deployment mode

10.3.4.Market size and forecast, by organization size

10.3.5.Market size and forecast, by type

10.3.6.Market size and forecast, by testing type

10.3.7.Market size and forecast, by industry vertical

10.3.8.Market analysis, by country

10.3.8.1.Germany

10.3.8.1.1.Market size and forecast, by component

10.3.8.1.2.Market size and forecast, by deployment mode

10.3.8.1.3.Market size and forecast, by organization size

10.3.8.1.4.Market size and forecast, by type

10.3.8.1.5.Market size and forecast, by testing type

10.3.8.1.6.Market size and forecast, by industry vertical

10.3.8.2.UK

10.3.8.2.1.Market size and forecast, by component

10.3.8.2.2.Market size and forecast, by deployment mode

10.3.8.2.3.Market size and forecast, by organization size

10.3.8.2.4.Market size and forecast, by type

10.3.8.2.5.Market size and forecast, by testing type

10.3.8.2.6.Market size and forecast, by industry vertical

10.3.8.3.France

10.3.8.3.1.Market size and forecast, by component

10.3.8.3.2.Market size and forecast, by deployment mode

10.3.8.3.3.Market size and forecast, by organization size

10.3.8.3.4.Market size and forecast, by type

10.3.8.3.5.Market size and forecast, by testing type

10.3.8.3.6.Market size and forecast, by industry vertical

10.3.8.4.Spain

10.3.8.4.1.Market size and forecast, by component

10.3.8.4.2.Market size and forecast, by deployment mode

10.3.8.4.3.Market size and forecast, by organization size

10.3.8.4.4.Market size and forecast, by type

10.3.8.4.5.Market size and forecast, by testing type

10.3.8.4.6.Market size and forecast, by industry vertical

10.3.8.5.Rest of Europe

10.3.8.5.1.Market size and forecast, by component

10.3.8.5.2.Market size and forecast, by deployment mode

10.3.8.5.3.Market size and forecast, by organization size

10.3.8.5.4.Market size and forecast, by type

10.3.8.5.5.Market size and forecast, by testing type

10.3.8.5.6.Market size and forecast, by industry vertical

10.4.ASIA-PACIFIC

10.4.1.Key market trends, growth factors, and opportunities

10.4.2.Market size and forecast, by component

10.4.3.Market size and forecast, by deployment mode

10.4.4.Market size and forecast, by organization size

10.4.5.Market size and forecast, by type

10.4.6.Market size and forecast, by testing type

10.4.7.Market size and forecast, by industry vertical

10.4.8.Market analysis, by country

10.4.8.2.China

10.4.8.2.1.Market size and forecast, by component

10.4.8.2.2.Market size and forecast, by deployment mode

10.4.8.2.3.Market size and forecast, by organization size

10.4.8.2.4.Market size and forecast, by type

10.4.8.2.5.Market size and forecast, by testing type

10.4.8.2.6.Market size and forecast, by industry vertical

10.4.8.3.India

10.4.8.3.1.Market size and forecast, by component

10.4.8.3.2.Market size and forecast, by deployment mode

10.4.8.3.3.Market size and forecast, by organization size

10.4.8.3.4.Market size and forecast, by type

10.4.8.3.5.Market size and forecast, by testing type

10.4.8.3.6.Market size and forecast, by industry vertical

10.4.8.4.Japan

10.4.8.4.1.Market size and forecast, by component

10.4.8.4.2.Market size and forecast, by deployment mode

10.4.8.4.3.Market size and forecast, by organization size

10.4.8.4.4.Market size and forecast, by type

10.4.8.4.5.Market size and forecast, by testing type

10.4.8.4.6.Market size and forecast, by industry vertical

10.4.8.5.Australia

10.4.8.5.1.Market size and forecast, by component

10.4.8.5.2.Market size and forecast, by deployment mode

10.4.8.5.3.Market size and forecast, by organization size

10.4.8.5.4.Market size and forecast, by type

10.4.8.5.5.Market size and forecast, by testing type

10.4.8.5.6.Market size and forecast, by industry vertical

10.4.8.6.South Korea

10.4.8.6.1.Market size and forecast, by component

10.4.8.6.2.Market size and forecast, by deployment mode

10.4.8.6.3.Market size and forecast, by organization size

10.4.8.6.4.Market size and forecast, by type

10.4.8.6.5.Market size and forecast, by testing type

10.4.8.6.6.Market size and forecast, by industry vertical

10.4.8.7.Rest of Asia-Pacific

10.4.8.7.1.Market size and forecast, by component

10.4.8.7.2.Market size and forecast, by deployment mode

10.4.8.7.3.Market size and forecast, by organization size

10.4.8.7.4.Market size and forecast, by type

10.4.8.7.5.Market size and forecast, by testing type

10.4.8.7.6.Market size and forecast, by industry vertical

10.5.LAMEA

10.5.1.Key market trends, growth factors, and opportunities

10.5.2.Market size and forecast, by component

10.5.3.Market size and forecast, by deployment mode

10.5.4.Market size and forecast, by organization size

10.5.5.Market size and forecast, by type

10.5.6.Market size and forecast, by testing type

10.5.7.Market size and forecast, by industry vertical

10.5.8.Market analysis, by country

10.5.8.1.Latin America

10.5.8.1.1.Market size and forecast, by component

10.5.8.1.2.Market size and forecast, by deployment mode

10.5.8.1.3.Market size and forecast, by organization size

10.5.8.1.4.Market size and forecast, by type

10.5.8.1.5.Market size and forecast, by testing type

10.5.8.1.6.Market size and forecast, by industry vertical

10.5.8.2.Middle East

10.5.8.2.1.Market size and forecast, by component

10.5.8.2.2.Market size and forecast, by deployment mode

10.5.8.2.3.Market size and forecast, by organization size

10.5.8.2.4.Market size and forecast, by type

10.5.8.2.5.Market size and forecast, by testing type

10.5.8.2.6.Market size and forecast, by industry vertical

10.5.8.3.Africa

10.5.8.3.1.Market size and forecast, by component

10.5.8.3.2.Market size and forecast, by deployment mode

10.5.8.3.3.Market size and forecast, by organization size

10.5.8.3.4.Market size and forecast, by type

10.5.8.3.5.Market size and forecast, by testing type

10.5.8.3.6.Market size and forecast, by industry vertical

CHAPTER 11:COMPETITIVE LANDSCAPE

11.1.KEY PLAYER POSITIONING ANALYSIS, 2020

11.2.TOP WINNING STRATEGIES

11.3.COMPETITIVE DASHBOARD

11.4.KEY DEVELOPMENTS

11.4.1.New product launches

11.4.2.Collaboration

11.4.3.Acquisition

11.4.4.Partnership

CHAPTER 12:COMPANY PROFILE

12.1.CAPEGEMINI

12.1.1.Company overview

12.1.2.Key executives

12.1.3.Company snapshot

12.1.4.Product portfolio

12.1.5.Business performance

12.1.6.Key strategic moves and developments

12.2.CISCO SYSTEMS, INC.

12.2.1.Company overview

12.2.2.Key executives

12.2.3.Company snapshot

12.2.5.Product portfolio

12.2.6.R&D expenditure

12.2.7.Business performance

12.2.8.Key strategic moves and developments

12.3.HCL TECHNOLOGIES

12.3.1.Company overview

12.3.2.Key executive

12.3.3.Company snapshot

12.3.4.Operating business segments

12.3.5.Product portfolio

12.3.6.Business performance

12.3.7.Key strategic moves and developments

12.4.INTERNATIONAL BUSINESS MACHINES CORPORATION

12.4.1.Company overview

12.4.2.Key executives

12.4.3.Company snapshot

12.4.4.Operating business segments

12.4.5.Product portfolio

12.4.6.Business performance

12.4.7.Key strategic moves and developments

12.5.MICROFOCUS

12.5.1.Company overview

12.5.2.Key executive

12.5.3.Company snapshot

12.5.4.Product portfolio

12.5.5.R&D expenditure

12.5.6.Business performance

12.5.7.Key strategic moves and developments

12.6.QUALYS

12.6.1.Company overview

12.6.2.Key executives

12.6.3.Company snapshot

12.6.4.Product portfolio

12.6.5.R&D expenditure

12.6.6.Business performance

12.6.7.Key strategic moves and developments

12.7.RAPID7

12.7.1.Company overview

12.7.2.Key executives

12.7.3.Company snapshot

12.7.4.Product portfolio

12.7.5.R&D expenditure

12.7.6.Business performance

12.7.7.Key strategic moves and developments

12.8.SYNOPSYS

12.8.1.Company overview

12.8.2.Key executives

12.8.3.Company snapshot

12.8.4.Product portfolio

12.8.5.R&D expenditure

12.8.6.Business performance

12.8.7.Key strategic moves and developments

12.9.VERACODE

12.9.1.Company overview

12.9.2.Key executive

12.9.3.Company snapshot

12.9.4.Product portfolio

12.9.5.Key strategic moves and developments

12.10.WHITEHAT SECURITY

12.10.1.Company overview

12.10.2.Key executives

12.10.3.Company snapshot

12.10.4.Product portfolio

12.10.5.Key strategic moves and developments

LIST OF TABLES

TABLE 01.APPLICATION SECURITY MARKET, BY COMPONENT, 2020–2030 ($MILLION)

TABLE 02.APPLICATION SECURITY MARKET, BY REGION, 2020–2030 ($MILLION)

TABLE 03.APPLICATION SECURITY MARKET FOR SERVICES, BY REGION, 2020–2030 ($MILLION)

TABLE 04.APPLICATION SECURITY MARKET, BY DEPLOYMENT MODE, 2020–2030 ($MILLION)

TABLE 05.APPLICATION SECURITY MARKET FOR ON-PREMISE, BY REGION, 2020–2030 ($MILLION)

TABLE 06.APPLICATION SECURITY MARKET FOR CLOUD, BY REGION, 2020–2030 ($MILLION)

TABLE 07.APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2020–2030 ($MILLION)

TABLE 08.APPLICATION SECURITY MARKET FOR LARGE ENTERPRISES, BY REGION, 2020–2030 ($MILLION)

TABLE 09.APPLICATION SECURITY MARKET FOR SMES, BY REGION, 2020–2030 ($MILLION)

TABLE 10.APPLICATION SECURITY MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 11.APPLICATION SECURITY MARKET FOR WEB APPLICATION SECURITY, BY REGION, 2020–2030 ($MILLION)

TABLE 12.APPLICATION SECURITY MARKET FOR MOBILE APPLICATION SECURITY, BY REGION, 2020–2030 ($MILLION)

TABLE 13.APPLICATION SECURITY MARKET, BY TESTING TYPE, 2020–2030 ($MILLION)

TABLE 14.APPLICATION SECURITY MARKET FOR STATIC APPLICATION SECURITY TESTING (SAST), BY REGION, 2020–2030 ($MILLION)

TABLE 15.APPLICATION SECURITY MARKET FOR DYNAMIC APPLICATION SECURITY TESTING (DAST), BY REGION, 2020–2030 ($MILLION)

TABLE 16.APPLICATION SECURITY MARKET FOR INTERACTIVE APPLICATION SECURITY TESTING (IAST), BY REGION, 2020–2030 ($MILLION)

TABLE 17.APPLICATION SECURITY MARKET FOR RUNTIME APPLICATION SELF-PROTECTION (RASP), BY REGION, 2020–2030 ($MILLION)

TABLE 18.APPLICATION SECURITY MARKET, BY INDUSTRY VERTICAL, 2020–2030 ($MILLION)

TABLE 19.APPLICATION SECURITY MARKET FOR BFSI, BY REGION, 2020–2030 ($MILLION)

TABLE 20.APPLICATION SECURITY MARKET FOR HEALTHCARE, BY REGION, 2020–2030 ($MILLION)

TABLE 21.APPLICATION SECURITY MARKET FOR IT & TELECOM, BY REGION, 2020–2030 ($MILLION)

TABLE 22.APPLICATION SECURITY MARKET FOR MANUFACTURING, BY REGION, 2020–2030 ($MILLION)

TABLE 23.APPLICATION SECURITY MARKET FOR GOVERNMENT AND PUBLIC SECTOR, BY REGION, 2020–2030 ($MILLION)

TABLE 24.APPLICATION SECURITY MARKET FOR RETAIL, BY REGION, 2020–2030 ($MILLION)

TABLE 25.APPLICATION SECURITY MARKET FOR OTHERS, BY REGION, 2020–2030 ($MILLION)

TABLE 26.APPLICATION SECURITY MARKET, BY REGION, 2020–2030 ($MILLION)

TABLE 27.NORTH AMERICA APPLICATION SECURITY MARKET, BY COMPONENT, 2020–2030 ($MILLION)

TABLE 28.NORTH AMERICA APPLICATION SECURITY MARKET, BY DEPLOYMENT MODE, 2020–2030 ($MILLION)

TABLE 29.NORTH AMERICA APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2020–2030 ($MILLION)

TABLE 30.NORTH AMERICA APPLICATION SECURITY MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 31.NORTH AMERICA APPLICATION SECURITY MARKET, BY TESTING TYPE, 2020–2030 ($MILLION)

TABLE 32.NORTH AMERICA APPLICATION SECURITY MARKET, BY INDUSTRY VERTICAL, 2020–2030 ($MILLION)

TABLE 33.NORTH AMERICA APPLICATION SECURITY MARKET, BY COUNTRY, 2020–2030 ($MILLION)

TABLE 34.U.S. APPLICATION SECURITY MARKET, BY COMPONENT, 2020–2030 ($MILLION)

TABLE 35.U.S. APPLICATION SECURITY MARKET, BY DEPLOYMENT MODE, 2020–2030 ($MILLION)

TABLE 36.U.S. APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2020–2030 ($MILLION)

TABLE 37.U.S. APPLICATION SECURITY MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 38.U.S. APPLICATION SECURITY MARKET, BY TESTING TYPE, 2020–2030 ($MILLION)

TABLE 39.U.S. APPLICATION SECURITY MARKET, BY INDUSTRY VERTICAL, 2020–2030 ($MILLION)

TABLE 40.CANADA APPLICATION SECURITY MARKET, BY COMPONENT, 2020–2030 ($MILLION)

TABLE 41.CANADA APPLICATION SECURITY MARKET, BY DEPLOYMENT MODE, 2020–2030 ($MILLION)

TABLE 42.CANADA APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2020–2030 ($MILLION)

TABLE 43.CANADA APPLICATION SECURITY MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 44.CANADA APPLICATION SECURITY MARKET, BY TESTING TYPE, 2020–2030 ($MILLION)

TABLE 45.CANADA APPLICATION SECURITY MARKET, BY INDUSTRY VERTICAL, 2020–2030 ($MILLION)

TABLE 46.EUROPE APPLICATION SECURITY MARKET, BY COMPONENT, 2020–2030 ($MILLION)

TABLE 47.EUROPE APPLICATION SECURITY MARKET, BY DEPLOYMENT MODE, 2020–2030 ($MILLION)

TABLE 48.EUROPE APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2020–2030 ($MILLION)

TABLE 49.EUROPE APPLICATION SECURITY MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 50.EUROPE APPLICATION SECURITY MARKET, BY TESTING TYPE, 2020–2030 ($MILLION)

TABLE 51.EUROPE APPLICATION SECURITY MARKET, BY INDUSTRY VERTICAL, 2020–2030 ($MILLION)

TABLE 52.EUROPE APPLICATION SECURITY MARKET, BY COUNTRY, 2020–2030 ($MILLION)

TABLE 53.GERMANY APPLICATION SECURITY MARKET, BY COMPONENT, 2020–2030 ($MILLION)

TABLE 54.GERMANY APPLICATION SECURITY MARKET, BY DEPLOYMENT MODE, 2020–2030 ($MILLION)

TABLE 55.GERMANY APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2020–2030 ($MILLION)

TABLE 56.GERMANY APPLICATION SECURITY MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 57.GERMANY APPLICATION SECURITY MARKET, BY TESTING TYPE, 2020–2030 ($MILLION)

TABLE 58.GERMANY APPLICATION SECURITY MARKET, BY INDUSTRY VERTICAL, 2020–2030 ($MILLION)

TABLE 59.UK APPLICATION SECURITY MARKET, BY COMPONENT, 2020–2030 ($MILLION)

TABLE 60.UK APPLICATION SECURITY MARKET, BY DEPLOYMENT MODE, 2020–2030 ($MILLION)

TABLE 61.UK APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2020–2030 ($MILLION)

TABLE 62.UK APPLICATION SECURITY MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 63.UK APPLICATION SECURITY MARKET, BY TESTING TYPE, 2020–2030 ($MILLION)

TABLE 64.UK APPLICATION SECURITY MARKET, BY INDUSTRY VERTICAL, 2020–2030 ($MILLION)

TABLE 65.FRANCE APPLICATION SECURITY MARKET, BY COMPONENT, 2020–2030 ($MILLION)

TABLE 66.FRANCE APPLICATION SECURITY MARKET, BY DEPLOYMENT MODE, 2020–2030 ($MILLION)

TABLE 67.FRANCE APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2020–2030 ($MILLION)

TABLE 68.FRANCE APPLICATION SECURITY MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 69.FRANCE APPLICATION SECURITY MARKET, BY TESTING TYPE, 2020–2030 ($MILLION)

TABLE 70.FRANCE APPLICATION SECURITY MARKET, BY INDUSTRY VERTICAL, 2020–2030 ($MILLION)

TABLE 71.SPAIN APPLICATION SECURITY MARKET, BY COMPONENT, 2020–2030 ($MILLION)

TABLE 72.SPAIN APPLICATION SECURITY MARKET, BY DEPLOYMENT MODE, 2020–2030 ($MILLION)

TABLE 73.SPAIN APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2020–2030 ($MILLION)

TABLE 74.SPAIN APPLICATION SECURITY MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 75.SPAIN APPLICATION SECURITY MARKET, BY TESTING TYPE, 2020–2030 ($MILLION)

TABLE 76.SPAIN APPLICATION SECURITY MARKET, BY INDUSTRY VERTICAL, 2020–2030 ($MILLION)

TABLE 77.REST OF EUROPE APPLICATION SECURITY MARKET, BY COMPONENT, 2020–2030 ($MILLION)

TABLE 78.REST OF EUROPE APPLICATION SECURITY MARKET, BY DEPLOYMENT MODE, 2020–2030 ($MILLION)

TABLE 79.REST OF EUROPE APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2020–2030 ($MILLION)

TABLE 80.REST OF EUROPE APPLICATION SECURITY MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 81.REST OF EUROPE APPLICATION SECURITY MARKET, BY TESTING TYPE, 2020–2030 ($MILLION)

TABLE 82.REST OF EUROPE APPLICATION SECURITY MARKET, BY INDUSTRY VERTICAL, 2020–2030 ($MILLION)

TABLE 83.ASIA-PACIFIC APPLICATION SECURITY MARKET, BY COMPONENT, 2020–2030 ($MILLION)

TABLE 84.ASIA-PACIFIC APPLICATION SECURITY MARKET, BY DEPLOYMENT MODE, 2020–2030 ($MILLION)

TABLE 85.ASIA-PACIFIC APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2020–2030 ($MILLION)

TABLE 86.ASIA-PACIFIC APPLICATION SECURITY MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 87.ASIA-PACIFIC APPLICATION SECURITY MARKET, BY TESTING TYPE, 2020–2030 ($MILLION)

TABLE 88.ASIA-PACIFIC APPLICATION SECURITY MARKET, BY INDUSTRY VERTICAL, 2020–2030 ($MILLION)

TABLE 89.ASIA-PACIFIC APPLICATION SECURITY MARKET, BY COUNTRY, 2020–2030 ($MILLION)

TABLE 90.CHINA APPLICATION SECURITY MARKET, BY COMPONENT, 2020–2030 ($MILLION)

TABLE 91.CHINA APPLICATION SECURITY MARKET, BY DEPLOYMENT MODE, 2020–2030 ($MILLION)

TABLE 92.CHINA APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2020–2030 ($MILLION)

TABLE 93.CHINA APPLICATION SECURITY MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 94.CHINA APPLICATION SECURITY MARKET, BY TESTING TYPE, 2020–2030 ($MILLION)

TABLE 95.CHINA APPLICATION SECURITY MARKET, BY INDUSTRY VERTICAL, 2020–2030 ($MILLION)

TABLE 96.INDIA APPLICATION SECURITY MARKET, BY COMPONENT, 2020–2030 ($MILLION)

TABLE 97.INDIA APPLICATION SECURITY MARKET, BY DEPLOYMENT MODE, 2020–2030 ($MILLION)

TABLE 98.INDIA APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2020–2030 ($MILLION)

TABLE 99.INDIA APPLICATION SECURITY MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 100.INDIA APPLICATION SECURITY MARKET, BY TESTING TYPE, 2020–2030 ($MILLION)

TABLE 101.INDIA APPLICATION SECURITY MARKET, BY INDUSTRY VERTICAL, 2020–2030 ($MILLION)

TABLE 102.JAPAN APPLICATION SECURITY MARKET, BY COMPONENT, 2020–2030 ($MILLION)

TABLE 103.JAPAN APPLICATION SECURITY MARKET, BY DEPLOYMENT MODE, 2020–2030 ($MILLION)

TABLE 104.JAPAN APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2020–2030 ($MILLION)

TABLE 105.JAPAN APPLICATION SECURITY MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 106.JAPAN APPLICATION SECURITY MARKET, BY TESTING TYPE, 2020–2030 ($MILLION)

TABLE 107.JAPAN APPLICATION SECURITY MARKET, BY INDUSTRY VERTICAL, 2020–2030 ($MILLION)

TABLE 108.AUSTRALIA APPLICATION SECURITY MARKET, BY COMPONENT, 2020–2030 ($MILLION)

TABLE 109.AUSTRALIA APPLICATION SECURITY MARKET, BY DEPLOYMENT MODE, 2020–2030 ($MILLION)

TABLE 110.AUSTRALIA APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2020–2030 ($MILLION)

TABLE 111.AUSTRALIA APPLICATION SECURITY MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 112.AUSTRALIA APPLICATION SECURITY MARKET, BY TESTING TYPE, 2020–2030 ($MILLION)

TABLE 113.AUSTRALIA APPLICATION SECURITY MARKET, BY INDUSTRY VERTICAL, 2020–2030 ($MILLION)

TABLE 114.SOUTH KOREA APPLICATION SECURITY MARKET, BY COMPONENT, 2020–2030 ($MILLION)

TABLE 115.SOUTH KOREA APPLICATION SECURITY MARKET, BY DEPLOYMENT MODE, 2020–2030 ($MILLION)

TABLE 116.SOUTH KOREA APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2020–2030 ($MILLION)

TABLE 117.SOUTH KOREA APPLICATION SECURITY MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 118.SOUTH KOREA APPLICATION SECURITY MARKET, BY TESTING TYPE, 2020–2030 ($MILLION)

TABLE 119.SOUTH KOREA APPLICATION SECURITY MARKET, BY INDUSTRY VERTICAL, 2020–2030 ($MILLION)

TABLE 120.REST OF ASIA-PACIFIC APPLICATION SECURITY MARKET, BY COMPONENT, 2020–2030 ($MILLION)

TABLE 121.REST OF ASIA-PACIFIC APPLICATION SECURITY MARKET, BY DEPLOYMENT MODE, 2020–2030 ($MILLION)

TABLE 122.REST OF ASIA-PACIFIC APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2020–2030 ($MILLION)

TABLE 123.REST OF ASIA-PACIFIC APPLICATION SECURITY MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 124.REST OF ASIA-PACIFIC APPLICATION SECURITY MARKET, BY TESTING TYPE, 2020–2030 ($MILLION)

TABLE 125.REST OF ASIA-PACIFIC APPLICATION SECURITY MARKET, BY INDUSTRY VERTICAL, 2020–2030 ($MILLION)

TABLE 126.LAMEA APPLICATION SECURITY MARKET, BY COMPONENT, 2020–2030 ($MILLION)

TABLE 127.LAMEA APPLICATION SECURITY MARKET, BY DEPLOYMENT MODE, 2020–2030 ($MILLION)

TABLE 128.LAMEA APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2020–2030 ($MILLION)

TABLE 129.LAMEA APPLICATION SECURITY MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 130.LAMEA APPLICATION SECURITY MARKET, BY TESTING TYPE, 2020–2030 ($MILLION)

TABLE 131.LAMEA APPLICATION SECURITY MARKET, BY INDUSTRY VERTICAL, 2020–2030 ($MILLION)

TABLE 132.LAMEA APPLICATION SECURITY MARKET, BY COUNTRY, 2020–2030 ($MILLION)

TABLE 133.LATIN AMERICA APPLICATION SECURITY MARKET, BY COMPONENT, 2020–2030 ($MILLION)

TABLE 134.LATIN AMERICA APPLICATION SECURITY MARKET, BY DEPLOYMENT MODE, 2020–2030 ($MILLION)

TABLE 135.LATIN AMERICA APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2020–2030 ($MILLION)

TABLE 136.LATIN AMERICA APPLICATION SECURITY MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 137.LATIN AMERICA APPLICATION SECURITY MARKET, BY TESTING TYPE, 2020–2030 ($MILLION)

TABLE 138.LATIN AMERICA APPLICATION SECURITY MARKET, BY INDUSTRY VERTICAL, 2020–2030 ($MILLION)

TABLE 139.MIDDLE EAST APPLICATION SECURITY MARKET, BY COMPONENT, 2020–2030 ($MILLION)

TABLE 140.MIDDLE EAST APPLICATION SECURITY MARKET, BY DEPLOYMENT MODE, 2020–2030 ($MILLION)

TABLE 141.MIDDLE EAST APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2020–2030 ($MILLION)

TABLE 142.MIDDLE EAST APPLICATION SECURITY MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 143.MIDDLE EAST APPLICATION SECURITY MARKET, BY TESTING TYPE, 2020–2030 ($MILLION)

TABLE 144.MIDDLE EAST APPLICATION SECURITY MARKET, BY INDUSTRY VERTICAL, 2020–2030 ($MILLION)

TABLE 145.AFRICA APPLICATION SECURITY MARKET, BY COMPONENT, 2020–2030 ($MILLION)

TABLE 146.AFRICA APPLICATION SECURITY MARKET, BY DEPLOYMENT MODE, 2020–2030 ($MILLION)

TABLE 147.AFRICA APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2020–2030 ($MILLION)

TABLE 148.AFRICA APPLICATION SECURITY MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 149.AFRICA APPLICATION SECURITY MARKET, BY TESTING TYPE, 2020–2030 ($MILLION)

TABLE 150.AFRICA APPLICATION SECURITY MARKET, BY INDUSTRY VERTICAL, 2020–2030 ($MILLION)

TABLE 151.KEY NEW PRODUCT LAUNCHES (2017-2020)

TABLE 152.COLLABORATION (2017-2020)

TABLE 153.ACQUISTION (2017-2020)

TABLE 154.PARTNERSHIP (2017-2020)

TABLE 155.CAPGEMINI.: KEY EXECUTIVES

TABLE 156.CAPGEMINI: COMPANY SNAPSHOT

TABLE 157.CAPGEMINI: PRODUCT PORTFOLIO

TABLE 158.CISCO SYSTEMS, INC.: KEY EXECUTIVES

TABLE 159.CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

TABLE 161.CISCO SYSTEMS, INC.: PRODUCT PORTFOLIO

TABLE 162.HCL TECHNOLOGIES LTD: KEY EXECUTIVE

TABLE 163.HCL TECHNOLOGIES LTD: COMPANY SNAPSHOT

TABLE 164.HCL TECHNOLOGIES LTD.: OPERATING SEGMENTS

TABLE 165.HCL TECHNOLOGIES LTD.: PRODUCT PORTFOLIO

TABLE 166.INTERNATIONAL BUSINESS MACHINES CORPORATION: KEY EXECUTIVES

TABLE 167.INTERNATIONAL BUSINESS MACHINES CORPORATION: COMPANY SNAPSHOT

TABLE 168.INTERNATIONAL BUSINESS MACHINES CORPORATION: OPERATING SEGMENTS

TABLE 169.INTERNATIONAL BUSINESS MACHINES CORPORATION: PRODUCT PORTFOLIO

TABLE 170.MICRO FOCUS INTERNATIONAL PLC.: KEY EXECUTIVE

TABLE 171.MICRO FOCUS INTERNATIONAL PLC.: COMPANY SNAPSHOT

TABLE 172.MICRO FOCUS INTERNATIONAL PLC.: PRODUCT PORTFOLIO

TABLE 173.QUALYS: KEY EXECUTIVES

TABLE 174.QUALYS: COMPANY SNAPSHOT

TABLE 175.QUALYS: PRODUCT PORTFOLIO

TABLE 176.RAPID7: KEY EXECUTIVES

TABLE 177.RAPID7: COMPANY SNAPSHOT

TABLE 178.INNOVAYA: PRODUCT PORTFOLIO

TABLE 179.SYNOPSYS: KEY EXECUTIVES

TABLE 180.SYNOPSYS: COMPANY SNAPSHOT

TABLE 181.NEMETSCHEK: PRODUCT PORTFOLIO

TABLE 182.VERACODE: KEY EXECUTIVE

TABLE 183.VERACODE: COMPANY SNAPSHOT

TABLE 184.VERACODE: PRODUCT PORTFOLIO

TABLE 185.NTT LTD.: KEY EXECUTIVES

TABLE 186.NTT LTD.: COMPANY SNAPSHOT

TABLE 187.NTT LTD.: PRODUCT PORTFOLIO

LIST OF FIGURES

FIGURE 01.KEY MARKET SEGMENTS

FIGURE 02.APPLICATION SECURITY MARKET SNAPSHOT, BY SEGMENT, 2020–2030

FIGURE 03.APPLICATION SECURITY MARKET SNAPSHOT, BY COUNTRY, 2020–2030

FIGURE 04.TOP IMPACTING FACTORS

FIGURE 05.TOP INVESTMENT POCKETS

FIGURE 06.MODERATE-TO-HIGH BARGAINING POWER OF SUPPLIERS

FIGURE 07.HIGH BARGAINING POWER OF BUYERS

FIGURE 08.MODERATE-TO-HIGH THREAT OF SUBSTITUTES

FIGURE 09.MODERATE-TO-HIGH THREAT OF NEW ENTRANTS

FIGURE 10.HIGH COMPETITIVE RIVALRY

FIGURE 11.MARKET DYNAMICS: GLOBAL APPLICATION SECURITY MARKET

FIGURE 12.APPLICATION SECURITY MARKET, BY COMPONENT, 2020–2030 ($MILLION)

FIGURE 13.COMPARATIVE SHARE ANALYSIS OF APPLICATION SECURITY MARKET, BY COUNTRY, 2020 & 2030 (%)

FIGURE 14.COMPARATIVE SHARE ANALYSIS OF APPLICATION SECURITY MARKET FOR SERVICES, BY COUNTRY, 2020 & 2030 (%)

FIGURE 15.APPLICATION SECURITY MARKET, BY DEPLOYMENT MODE, 2020–2030 ($MILLION)

FIGURE 16.COMPARATIVE SHARE ANALYSIS OF APPLICATION SECURITY MARKET FOR ON-PREMISE, BY COUNTRY, 2020 & 2030 (%)

FIGURE 17.COMPARATIVE SHARE ANALYSIS OF APPLICATION SECURITY MARKET FOR CLOUD, BY COUNTRY, 2020 & 2030 (%)

FIGURE 18.APPLICATION SECURITY MARKET, BY ORGANIZATION SIZE, 2020–2030 ($MILLION)

FIGURE 19.COMPARATIVE SHARE ANALYSIS OF APPLICATION SECURITY MARKET FOR LARGE ENTERPRISES, BY COUNTRY, 2020 & 2030 (%)

FIGURE 20.COMPARATIVE SHARE ANALYSIS OF APPLICATION SECURITY MARKET FOR SMES, BY COUNTRY, 2020 & 2030 (%)

FIGURE 21.APPLICATION SECURITY MARKET, BY TYPE, 2020–2030 ($MILLION)

FIGURE 22.COMPARATIVE SHARE ANALYSIS OF APPLICATION SECURITY MARKET FOR WEB APPLICATION SECURITY, BY COUNTRY, 2020 & 2030 (%)

FIGURE 23.COMPARATIVE SHARE ANALYSIS OF APPLICATION SECURITY MARKET FOR MOBILE APPLICATION SECURITY, BY COUNTRY, 2020 & 2030 (%)

FIGURE 24.APPLICATION SECURITY MARKET, BY TESTING TYPE, 2020–2030 ($MILLION)

FIGURE 25.COMPARATIVE SHARE ANALYSIS OF APPLICATION SECURITY MARKET FOR STATIC APPLICATION SECURITY TESTING (SAST), BY COUNTRY, 2020 & 2030 (%)

FIGURE 26.COMPARATIVE SHARE ANALYSIS OF APPLICATION SECURITY MARKET FOR DYNAMIC APPLICATION SECURITY TESTING (DAST), BY COUNTRY, 2020 & 2030 (%)

FIGURE 27.COMPARATIVE SHARE ANALYSIS OF APPLICATION SECURITY MARKET FOR INTERACTIVE APPLICATION SECURITY TESTING (IAST), BY COUNTRY, 2020 & 2030 (%)

FIGURE 28.COMPARATIVE SHARE ANALYSIS OF APPLICATION SECURITY MARKET FOR RUNTIME APPLICATION SELF-PROTECTION (RASP), BY COUNTRY, 2020 & 2030 (%)

FIGURE 29.APPLICATION SECURITY MARKET, BY INDUSTRY VERTICAL, 2020–2030 ($MILLION)

FIGURE 30.COMPARATIVE SHARE ANALYSIS OF APPLICATION SECURITY MARKET FOR BFSI, BY COUNTRY, 2020 & 2030 (%)

FIGURE 31.COMPARATIVE SHARE ANALYSIS OF APPLICATION SECURITY MARKET FOR HEALTHCARE, BY COUNTRY, 2020 & 2030 (%)

FIGURE 32.COMPARATIVE SHARE ANALYSIS OF APPLICATION SECURITY MARKET FOR IT & TELECOM, BY COUNTRY, 2020 & 2030 (%)

FIGURE 33.COMPARATIVE SHARE ANALYSIS OF APPLICATION SECURITY MARKET FOR MANUFACTURING, BY COUNTRY, 2020 & 2030 (%)

FIGURE 34.COMPARATIVE SHARE ANALYSIS OF APPLICATION SECURITY MARKET FOR GOVERNMENT AND PUBLIC SECTOR, BY COUNTRY, 2020 & 2030 (%)

FIGURE 35.COMPARATIVE SHARE ANALYSIS OF APPLICATION SECURITY MARKET FOR RETAIL, BY COUNTRY, 2020 & 2030 (%)

FIGURE 36.COMPARATIVE SHARE ANALYSIS OF APPLICATION SECURITY MARKET FOR OTHERS, BY COUNTRY, 2020 & 2030 (%)

FIGURE 37.U.S. APPLICATION SECURITY MARKET, 2020–2030 ($MILLION)

FIGURE 38.CANADA APPLICATION SECURITY MARKET, 2020–2030 ($MILLION)

FIGURE 39.GERMANY APPLICATION SECURITY MARKET, 2020–2030 ($MILLION)

FIGURE 40.UK APPLICATION SECURITY MARKET, 2020–2030 ($MILLION)

FIGURE 41.FRANCE APPLICATION SECURITY MARKET, 2020–2030 ($MILLION)

FIGURE 42.SPAIN APPLICATION SECURITY MARKET, 2020–2030 ($MILLION)

FIGURE 43.REST OF EUROPE APPLICATION SECURITY MARKET, 2020–2030 ($MILLION)

FIGURE 44.CHINA APPLICATION SECURITY MARKET, 2020–2030 ($MILLION)

FIGURE 45.INDIA APPLICATION SECURITY MARKET, 2020–2030 ($MILLION)

FIGURE 46.JAPAN APPLICATION SECURITY MARKET, 2020–2030 ($MILLION)

FIGURE 47.AUSTRALIA APPLICATION SECURITY MARKET, 2020–2030 ($MILLION)

FIGURE 48.SOUTH KOREA APPLICATION SECURITY MARKET, 2020–2030 ($MILLION)

FIGURE 49.REST OF ASIA-PACIFIC APPLICATION SECURITY MARKET, 2020–2030 ($MILLION)

FIGURE 50.LATIN AMERICA APPLICATION SECURITY MARKET, 2020–2030 ($MILLION)

FIGURE 51.MIDDLE EAST APPLICATION SECURITY MARKET, 2020–2030 ($MILLION)

FIGURE 52.AFRICA APPLICATION SECURITY MARKET, 2020–2030 ($MILLION)

FIGURE 53.KEY PLAYER POSITIONING ANALYSIS: GLOBAL APPLICATION SECURITY MARKET

FIGURE 54.TOP WINNING STRATEGIES, BY YEAR, 2017-2021

FIGURE 55.TOP WINNING STRATEGIES, BY DEVELOPMENT, 2017-2021

FIGURE 56.TOP WINNING STRATEGIES, BY COMPANY, 2017-2021

FIGURE 57.COMPETITIVE DASHBOARD

FIGURE 58.COMPETITIVE DASHBOARD

FIGURE 59.COMPETITIVE HEATMAP OF KEY PLAYERS

FIGURE 60.CAPGEMINI: REVENUE, 2018–2020 ($MILLION)

FIGURE 61.CAPGEMINI: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 62.R&D EXPENDITURE, 2018–2020 ($MILLION)

FIGURE 63.CISCO SYSTEMS, INC: REVENUE, 2018–2020 ($MILLION)

FIGURE 64.CISCO SYSTEMS, INC: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 65.CISCO SYSTEMS, INC: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 66.HCL TECHNOLOGIES LTD.: REVENUE, 2018–2020 ($MILLION)

FIGURE 67.HCL TECHNOLOGIES LTD.: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 68.HCL TECHNOLOGIES LTD.: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 69.INTERNATIONAL BUSINESS MACHINES CORPORATION: REVENUE, 2018–2020 ($MILLION)

FIGURE 70.INTERNATIONAL BUSINESS MACHINES CORPORATION: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 71.INTERNATIONAL BUSINESS MACHINES CORPORATION: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 72.MICRO FOCUS INTERNATIONAL PLC.: REVENUE, 2018–2020 ($MILLION)

FIGURE 73.MICRO FOCUS INTERNATIONAL PLC.: REVENUE SHARE BY REGION, 2020(%)

FIGURE 74.R&D EXPENDITURE, 2018–20120 ($MILLION)

FIGURE 75.QUALYS: REVENUE, 2018–2020 ($MILLION)

FIGURE 76.QUALYS: REVENUE SHARE, BY REGION, 2020 (%)

FIGURE 77.R&D EXPENDITURE, 2018–20120 ($MILLION)

FIGURE 78.RAPID7: REVENUE, 2018–2020 ($MILLION)

FIGURE 79.RAPID7: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 80.R&D EXPENDITURE, 2018–20120 ($MILLION)

FIGURE 81.SYNOPSYS: REVENUE, 2018–2020 ($MILLION)

FIGURE 82.SYNOPSYS: REVENUE SHARE BY REGION, 2020 (%)

$6169

$10665

HAVE A QUERY?

OUR CUSTOMER