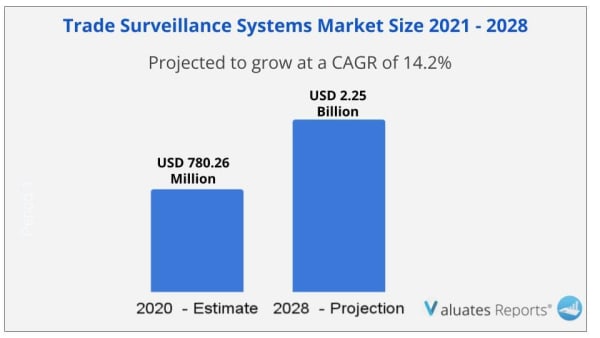

The global trade surveillance systems market size was valued at USD 780.26 Million in 2020, and is projected to reach USD 2.25 Billion by 2028, growing at a CAGR of 14.2% from 2021 to 2028.

Trade surveillance is the implementation of surveillance systems to investigate about manipulative or illegal trading practices in the security markets. Trade surveillance helps in maintaining orderly markets by monitoring and detecting the activities of trading. These include market manipulation, analysis of cross-market & cross asset, examination of trades in suspected areas, trade violence, and pre & post trade to ensure fairness and accuracy of transactions in an organization.

The outbreak of COVID-19 is anticipated to provide lucrative opportunities for the market expansion during the forecast period, owing to rise in need among enterprises to mitigate the impact of several fraudulent trading activities and protecting market integrity during pandemic.

Trading has become complex nowadays in financial firms attributed to increased range of financial instruments. Increase in volume of transactions creates the need to monitor the transactions by financial service firms under regulations such as MiFID II, MAR, and Dodd-Frank. According to SteelEye, it is mandatory for financial firms to implement trade surveillance systems, not only to ensure that firms are complying with regulations, but also to reduce the risk of fraudulent malpractice & protect firms’ reputation. Under the Markets Abuse Regulation (MAR), compliance officers are also equally responsible to monitor and evaluate the company’s trading activity.

Rise in need for safety and security of Trading activities in Financial institutes

Rise in demand for trade surveillance systems on market manipulation such as losing investor confidence, damaging market integrity, fraud behavioral patterning, and insider trading builds pressure on financial firms to invest in holistic trade surveillance system approaches that have less proliferation, ability to collate and monitor multiple structured & unstructured data sets together, and provide financial security in the form of storing large volume of data in the cloud with accuracy.

In recent years, there has been an increase in the number of suspicious trading pattern, in terms of lack of flexibility in deployment, false positives, and data sources that are not truly integrated as per standard compliance which resulted in the need for effective trade surveillance systems in financial institutes. Trade surveillance providers have increased the number of solutions to enhance the overall investor interface experience and to keep themselves ahead of their competitors in the market in the upcoming years.

Surge in Demand for Proactive trade monitoring systems

Increase in malpractices in trading activities among enterprises is influencing the companies to deploy proactive trade surveillance systems to optimize their operations. Moreover, increase in need to gain insights for business planning is anticipated to provide lucrative opportunities for market expansion, as trade surveillance system enables organizations to study the factors that are influencing outcomes and providing the power of decision optimization.

Furthermore, buyers and sellers have also increased their trading in products such as exotic derivatives, swaps, and other over-the-counter (OTC) products on different trading platforms, including electronic communication networks, high-frequency trading and dark pools. At this pace of expansion, it is crucial that firms expand coverage for trade data across markets and deploy proactive trade monitoring systems, as this helps generate better alerts.

The key players profiled in the trade surveillance systems market report are ACA Group, Aquis Exchange, b-next, Cinnober, CRISIL LIMITED, FIS, IBM Corporation, IPC Systems Inc., NICE, and SIA S.P.A. These key players have adopted various strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations, to increase their market penetration and strengthen their foothold in the trade surveillance system market.

| Report Metric | Details |

| Report Name | Trade Surveillance Systems Market |

| The market size in 2020 | USD 780.26 Million |

| The revenue forecast in 2028 | USD 2.25 Billion |

| Growth Rate | CAGR 14.2% |

| Market size available for years | 2021-2028 |

| Forecast units | Value (USD) |

| Segments covered | Type, Application, Industry, Regions |

| Report coverage | Revenue & volume forecast, company share, competitive landscape, growth factors, and trends |

| Geographic regions covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Ans. The global trade surveillance system market size was valued at $780.26 million in 2020, and is projected to reach $2.25 billion by 2028, growing at a CAGR of 14.2% from 2021 to 2028.

Ans. The increase in the need for surveillance systems to control market manipulation and abuse, as well as demanding regulatory compliance, are the primary drivers driving the worldwide trade surveillance system market expansion.

Ans. Asia-Pacific region would exhibit the highest CAGR of 17.2% during 2021 - 2028.

Ans. Yes, the report includes a COVID-19 impact analysis. Also, it is further extended into every individual segment of the report.

Ans. The key players profiled in the trade surveillance system market report are ACA Group, Aquis Exchange, b-next, Cinnober, CRISIL LIMITED, FIS, IBM Corporation, IPC Systems Inc., NICE, and SIA S.P.A.

CHAPTER 1:INTRODUCTION

1.1.Report description

1.2.Key benefits for stakeholders

1.3.Key market segments

1.4.Research methodology

1.4.1.Secondary research

1.4.2.Primary research

1.4.3.Analyst tools & models

CHAPTER 2:EXECUTIVE SUMMARY

2.1.Key findings

2.1.1.Top impacting factors

2.1.2.Top investment pockets

2.2.CXO perspective

CHAPTER 3:MARKET OVERVIEW

3.1.Market definition and scope

3.2.Key forces shaping global trade surveillance system market

3.3.Market dynamics

3.3.1.Drivers

3.3.1.1.Rise in need for safety and security of trading activities in financial institutes

3.3.1.2.Surge in adoption of trade surveillance system by organization to control market manipulation and market abuse

3.3.1.3.Stringent Regulatory Compliance

3.3.2.Restraints

3.3.2.1.High implementation cost

3.3.3.Opportunities

3.3.3.1.Surge in demand for proactive trade monitoring systems

3.3.3.2.Integration of AI and ML in trade surveillance system

3.4.COVID-19 impact analysis on trade surveillance system market

3.4.1.Impact on market size

3.4.2.Consumer trends, preferences, and budget impact

3.4.3.Economic impact

3.4.4.Strategies to tackle negative impact

3.4.5.Opportunity window

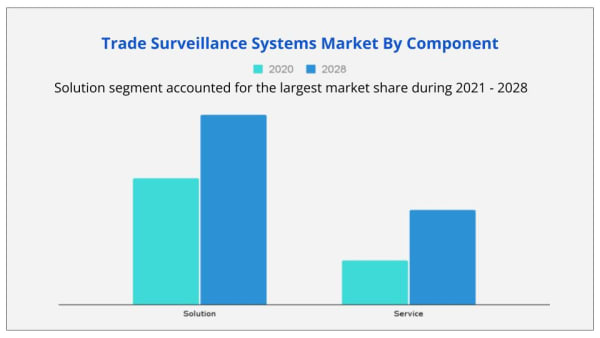

CHAPTER 4:TRADE SURVEILLANCE SYSTEM MARKET, BY COMPONENT

4.1.Overview

4.2.Solution

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Trade surveillance system market, by solution type

4.2.2.1.Reporting & Monitoring

4.2.2.2.Risk & compliance

4.2.3.Market size and forecast, by region

4.2.4.Market analysis, by country

4.3.Service

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Trade Surveillance System market, by service type

4.3.2.1.Training & support service

4.3.2.2.Consulting service

4.3.3.Market size and forecast, by region

4.3.4.Market analysis, by country

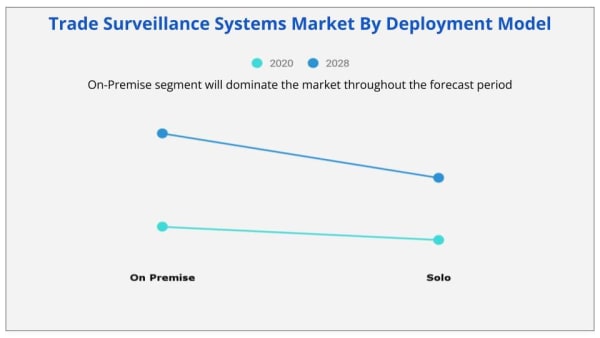

CHAPTER 5:TRADE SURVEILLANCE SYSTEM MARKET, BY DEPLOYMENT MODEL

5.1.Overview

5.2.On-premise

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region

5.2.3.Market analysis, by country

5.3.Cloud

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region

5.3.3.Market analysis, by country

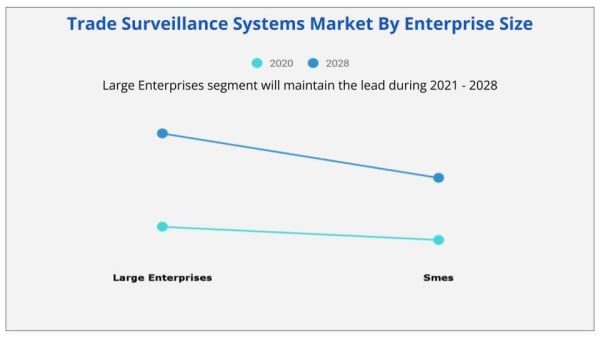

CHAPTER 6:TRADE SURVEILLANCE SYSTEM MARKET, BY ENTERPRISE SIZE

6.1.Overview

6.2.Large Enterprises

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by region

6.2.3.Market analysis, by country

6.3.SMEs

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by region

6.3.3.Market analysis, by country

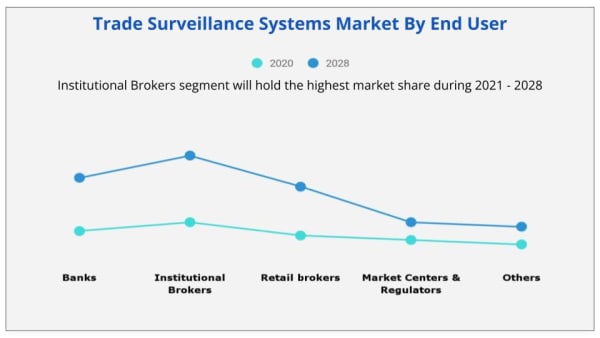

CHAPTER 7:TRADE SURVEILLANCE SYSTEM MARKET, BY END USER

7.1.Overview

7.2.Banks

7.2.1.Key market trends, growth factors, and opportunities

7.2.2.Market size and forecast, by region

7.2.3.Market analysis, by country

7.3.Institutional Brokers

7.3.1.Key market trends, growth factors, and opportunities

7.3.2.Market size and forecast, by region

7.3.3.Market analysis, by country

7.4.Retail Brokers

7.4.1.Key market trends, growth factors, and opportunities

7.4.2.Market size and forecast, by region

7.4.3.Market analysis, by country

7.5.Market Centers & Regulators

7.5.1.Key market trends, growth factors, and opportunities

7.5.2.Market size and forecast, by region

7.5.3.Market analysis, by country

7.6.Others

7.6.1.Key market trends, growth factors, and opportunities

7.6.2.Market size and forecast, by region

7.6.3.Market analysis, by country

CHAPTER 8:TRADE SURVEILLANCE SYSTEM MARKET, BY REGION

8.1.Overview

8.1.1.Market size and forecast, by region

8.2.North America

8.2.1.Key market trends, growth factors, and opportunities

8.2.2.Market size and forecast, by component

8.2.3.Market size and forecast, by deployment model

8.2.4.Market size and forecast, by enterprise size

8.2.5.Market size and forecast, by end user

8.2.6.Market analysis, by country

8.2.6.1.U.S.

8.2.6.1.1.Market size and forecast, by component

8.2.6.1.2.Market size and forecast, by deployment model

8.2.6.1.3.Market size and forecast, by enterprise size

8.2.6.1.4.Market size and forecast, by end user

8.2.6.2.Canada

8.2.6.2.1.Market size and forecast, by component

8.2.6.2.2.Market size and forecast, by deployment model

8.2.6.2.3.Market size and forecast, by enterprise size

8.2.6.2.4.Market size and forecast, by end user

8.3.Europe

8.3.1.Key market trends, growth factors, and opportunities

8.3.2.Market size and forecast, by component

8.3.3.Market size and forecast, by deployment model

8.3.4.Market size and forecast, by enterprise size

8.3.5.Market size and forecast, by end user

8.3.6.Market analysis, by country

8.3.6.1.UK

8.3.6.1.1.Market size and forecast, by component

8.3.6.1.2.Market size and forecast, by deployment model

8.3.6.1.3.Market size and forecast, by enterprise size

8.3.6.1.4.Market size and forecast, by end user

8.3.6.2.Germany

8.3.6.2.1.Market size and forecast, by component

8.3.6.2.2.Market size and forecast, by deployment model

8.3.6.2.3.Market size and forecast, by enterprise size

8.3.6.2.4.Market size and forecast, by end user

8.3.6.3.Switzerland

8.3.6.3.1.Market size and forecast, by component

8.3.6.3.2.Market size and forecast, by deployment model

8.3.6.3.3.Market size and forecast, by enterprise size

8.3.6.3.4.Market size and forecast, by end user

8.3.6.4.France

8.3.6.4.1.Market size and forecast, by component

8.3.6.4.2.Market size and forecast, by deployment model

8.3.6.4.3.Market size and forecast, by enterprise size

8.3.6.4.4.Market size and forecast, by end user

8.3.6.5.Spain

8.3.6.5.1.Market size and forecast, by component

8.3.6.5.2.Market size and forecast, by deployment model

8.3.6.5.3.Market size and forecast, by enterprise size

8.3.6.5.4.Market size and forecast, by end user

8.3.6.6.Rest of Europe

8.3.6.6.1.Market size and forecast, by component

8.3.6.6.2.Market size and forecast, by deployment model

8.3.6.6.3.Market size and forecast, by enterprise size

8.3.6.6.4.Market size and forecast, by end user

8.4.Asia-Pacific

8.4.1.Key market trends, growth factors, and opportunities

8.4.2.Market size and forecast, by component

8.4.3.Market size and forecast, by deployment model

8.4.4.Market size and forecast, by enterprise size

8.4.5.Market size and forecast, by end user

8.4.6.Market analysis, by country

8.4.6.1.China

8.4.6.1.1.Market size and forecast, by component

8.4.6.1.2.Market size and forecast, by deployment model

8.4.6.1.3.Market size and forecast, by enterprise size

8.4.6.1.4.Market size and forecast, by end user

8.4.6.2.Japan

8.4.6.2.1.Market size and forecast, by component

8.4.6.2.2.Market size and forecast, by deployment model

8.4.6.2.3.Market size and forecast, by enterprise size

8.4.6.2.4.Market size and forecast, by end user

8.4.6.3.India

8.4.6.3.1.Market size and forecast, by component

8.4.6.3.2.Market size and forecast, by deployment model

8.4.6.3.3.Market size and forecast, by enterprise size

8.4.6.3.4.Market size and forecast, by end user

8.4.6.4.Australia

8.4.6.4.1.Market size and forecast, by component

8.4.6.4.2.Market size and forecast, by deployment model

8.4.6.4.3.Market size and forecast, by enterprise size

8.4.6.4.4.Market size and forecast, by end user

8.4.6.5.South Korea

8.4.6.5.1.Market size and forecast, by component

8.4.6.5.2.Market size and forecast, by deployment model

8.4.6.5.3.Market size and forecast, by enterprise size

8.4.6.5.4.Market size and forecast, by end user

8.4.6.6.Singapore

8.4.6.6.1.Market size and forecast, by component

8.4.6.6.2.Market size and forecast, by deployment model

8.4.6.6.3.Market size and forecast, by enterprise size

8.4.6.6.4.Market size and forecast, by end user

8.4.6.7.Rest of Asia-Pacific

8.4.6.7.1.Market size and forecast, by component

8.4.6.7.2.Market size and forecast, by deployment model

8.4.6.7.3.Market size and forecast, by enterprise size

8.4.6.7.4.Market size and forecast, by end user

8.5.LAMEA

8.5.1.Key market trends, growth factors, and opportunities

8.5.2.Market size and forecast, by component

8.5.3.Market size and forecast, by deployment model

8.5.4.Market size and forecast, by enterprise size

8.5.5.Market size and forecast, by end user

8.5.6.Market analysis, by country

8.5.6.1.Latin America

8.5.6.1.1.Market size and forecast, by component

8.5.6.1.2.Market size and forecast, by deployment model

8.5.6.1.3.Market size and forecast, by enterprise size

8.5.6.1.4.Market size and forecast, by end user

8.5.6.2.Middle East

8.5.6.2.1.Market size and forecast, by component

8.5.6.2.2.Market size and forecast, by deployment model

8.5.6.2.3.Market size and forecast, by enterprise size

8.5.6.2.4.Market size and forecast, by end user

8.5.6.3.Africa

8.5.6.3.1.Market size and forecast, by component

8.5.6.3.2.Market size and forecast, by deployment model

8.5.6.3.3.Market size and forecast, by enterprise size

8.5.6.3.4.Market size and forecast, by end user

CHAPTER 9:COMPETITIVE LANDSCAPE

9.1.Key players positioning analysis, 2019

9.2.Top winning strategies

CHAPTER 10:COMPANY PROFILE

10.1.ACA Group

10.1.1.Company overview

10.1.2.Key Executives

10.1.3.Company snapshot

10.1.4.Product portfolio

10.1.5.Key strategic moves and developments

10.2.Aquis Exchange

10.2.1.Company overview

10.2.2.Key Executives

10.2.3.Company snapshot

10.2.4.Operating business segments

10.2.5.Product portfolio

10.2.6.R&D Expenditure

10.2.7.Business performance

10.3.B-next

10.3.1.Company overview

10.3.2.Key Executives

10.3.3.Company snapshot

10.3.4.Product portfolio

10.4.Cinnober

10.4.11.Company overview

10.4.2.Key Executives

10.4.3.Company snapshot

10.4.4.Product portfolio

10.5.CRISIL LIMITED

10.5.1.Company overview

10.5.2.Key executives

10.5.3.Company snapshot

10.5.4.Operating business segments

10.5.5.Product portfolio

10.5.6.Business performance

10.6.FIS

10.6.1.Company overview

10.6.2.Key executives

10.6.3.Company snapshot

10.6.4.Operating business segments

10.6.5.Product portfolio

10.6.6.Business performance

10.7.INTERNATIONAL BUSINESS MACHINES CORPORATION

10.7.1.Company overview

10.7.2.Key Executives

10.7.3.Company snapshot

10.7.4.Operating business segments

10.7.5.Product portfolio

10.7.6.R&D Expenditure

10.7.7.Business performance

10.7.8.Key strategic moves and developments

10.8.IPC Systems, Inc

10.8.1.Company overview

10.8.2.Key Executives

10.8.3.Company snapshot

10.8.4.Product portfolio

10.8.5.Key strategic moves and developments

10.9.NICE Ltd

10.9.1.Company overview

10.9.2.Key Executives

10.9.3.Company snapshot

10.9.4.Operating business segments

10.9.5.Product portfolio

10.9.6.R&D Expenditure

10.9.7.Business performance

10.9.8.Key strategic moves and developments

10.10.SIA S.P.A.

10.10.1.Company overview

10.10.2.Key Executives

10.10.3.Company snapshot

10.10.4.Product portfolio

LIST OF TABLES

TABLE 01.GLOBAL TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COMPONENT, 2020-2028 ($MILLION)

TABLE 02.SOLUTION TRADE SURVEILLANCE SYSTEM MARKET, BY REGION 2020–2028 ($MILLION)

TABLE 03.SERVICE TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY REGION 2020-2028 ($MILLION)

TABLE 04.GLOBAL TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODEL, 2020–2028 ($MILLION)

TABLE 05.TRADE SURVEILLANCE SYSTEM MARKET REVENUE FOR ON-PREMISE, BY REGION, 2020–2028 ($MILLION)

TABLE 06.TRADE SURVEILLANCE SYSTEM MARKET REVENUE FOR CLOUD, BY REGION, 2020–2028 ($MILLION)

TABLE 07.GLOBAL TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY ENTERPRISE SIZE, 2020-2028 ($MILLION)

TABLE 08.TRADE SURVEILLANCE SYSTEM MARKET REVENUE FOR LARGE ENTERPRISES, BY REGION, 2020-2028 ($MILLION)

TABLE 09.TRADE SURVEILLANCE SYSTEM MARKET REVENUE FOR SMES, BY REGION, 2020-2028 ($MILLION)

TABLE 10.GLOBAL TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY END USER, 2020-2028 ($MILLION)

TABLE 11.TRADE SURVEILLANCE SYSTEM MARKET REVENUE FOR BANKS, BY REGION, 2020-2028 ($MILLION)

TABLE 12.TRADE SURVEILLANCE SYSTEM MARKET REVENUE FOR INSTITUTIONAL BROKERS, BY REGION, 2020-2028 ($MILLION)

TABLE 13.TRADE SURVEILLANCE SYSTEM MARKET REVENUE FOR RETAIL BROKERS, BY REGION, 2020-2028 ($MILLION)

TABLE 14.TRADE SURVEILLANCE SYSTEM MARKET REVENUE FOR MARKET CENTERS & REGULATORS, BY REGION, 2020-2028 ($MILLION)

TABLE 15.TRADE SURVEILLANCE SYSTEM MARKET REVENUE FOR OTHERS, BY REGION, 2020-2028 ($MILLION)

TABLE 16.TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY REGION, 2020–2028 ($MILLION)

TABLE 17.NORTH AMERICA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COMPONENT, 2020–2028 ($MILLION)

TABLE 18.NORTH AMERICA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODEL, 2020–2028 ($MILLION)

TABLE 19.NORTH AMERICA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY ENTERPRISE SIZE, 2020–2028 ($MILLION)

TABLE 20.NORTH AMERICA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY END USER, 2020–2028($MILLION)

TABLE 21.EUROPE TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COUNTRY, 2020–2028 ($MILLION)

TABLE 22.U.S. TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COMPONENT, 2020–2028 ($MILLION)

TABLE 23.U.S. TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODEL, 2020–2028 ($MILLION)

TABLE 24.U.S. TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY ENTERPRISE SIZE,2020-2028 ($MILLION)

TABLE 25.U.S. TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY END USER, 2020–2028 ($MILLION)

TABLE 26.CANDA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COMPONENT, 2020–2028 ($MILLION)

TABLE 27.CANADA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODEL, 2020–2028 ($MILLION)

TABLE 28.CANADA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY ENTERPRISE SIZE,2020-2028 ($MILLION)

TABLE 29.CANADA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY END USER, 2020–2028 ($MILLION)

TABLE 30.EUROPE TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COMPONENT, 2020–2028 ($MILLION)

TABLE 31.EUROPE TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODEL, 2020–2028 ($MILLION)

TABLE 32.EUROPE TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY ENTERPRISE SIZE, 2020–2028 ($MILLION)

TABLE 33.EUROPE TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY END USER, 2020–2028($MILLION)

TABLE 34.EUROPE TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COUNTRY, 2020–2028 ($MILLION)

TABLE 35.UK TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COMPONENT, 2020–2028 ($MILLION)

TABLE 36.UK TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODEL, 2020–2028 ($MILLION)

TABLE 37.UK TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY ENTERPRISE SIZE,2020-2028 ($MILLION)

TABLE 38.UK TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY END USER, 2020–2028 ($MILLION)

TABLE 39.GERMANY TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COMPONENT, 2020–2028 ($MILLION)

TABLE 40.GERMANY TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODEL, 2020–2028 ($MILLION)

TABLE 41.GERMANY TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY ENTERPRISE SIZE,2020-2028 ($MILLION)

TABLE 42.GERMANY TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY END USER, 2020–2028 ($MILLION)

TABLE 43.SWITZERLAND TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COMPONENT, 2020–2028 ($MILLION)

TABLE 44.SWITZERLAND TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODEL, 2020–2028 ($MILLION)

TABLE 45.SWITZERLAND TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY ENTERPRISE SIZE,2020-2028 ($MILLION)

TABLE 46.SWITZERLAND TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY END USER, 2020–2028 ($MILLION)

TABLE 47.FRANCE TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COMPONENT, 2020–2028 ($MILLION)

TABLE 48.FRANCE TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODEL, 2020–2028 ($MILLION)

TABLE 49.FRANCE TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY ENTERPRISE SIZE,2020-2028 ($MILLION)

TABLE 50.FRANCE TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY END USER, 2020–2028 ($MILLION)

TABLE 51.SPAIN TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COMPONENT, 2020–2028 ($MILLION)

TABLE 52.SPAIN TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODEL, 2020–2028 ($MILLION)

TABLE 53.SPAIN TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY ENTERPRISE SIZE,2020-2028 ($MILLION)

TABLE 54.SPAIN TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY END USER, 2020–2028 ($MILLION)

TABLE 55.REST OF EUROPE TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COMPONENT, 2020–2028 ($MILLION)

TABLE 56.REST OF EUROPE TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODEL, 2020–2028 ($MILLION)

TABLE 57.REST OF EUROPE TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY ENTERPRISE SIZE,2020-2028 ($MILLION)

TABLE 58.REST OF EUROPE TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY END USER, 2020–2028 ($MILLION)

TABLE 59.ASIA-PACIFIC TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COMPONENT, 2020–2028 ($MILLION)

TABLE 60.ASIA-PACIFIC TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODEL, 2020–2028 ($MILLION)

TABLE 61.ASIA-PACIFIC TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY ENTERPRISE SIZE, 2020–2028 ($MILLION)

TABLE 62.ASIA-PACIFIC TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY END USER, 2020–2028($MILLION)

TABLE 63.ASIA-PACIFIC TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COUNTRY, 2020–2028 ($MILLION)

TABLE 64.CHINA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COMPONENT, 2020–2028 ($MILLION)

TABLE 65.CHINA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODEL, 2020–2028 ($MILLION)

TABLE 66.CHINA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY ENTERPRISE SIZE,2020-2028 ($MILLION)

TABLE 67.CHINA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY END USER, 2020–2028 ($MILLION)

TABLE 68.JAPAN TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COMPONENT, 2020–2028 ($MILLION)

TABLE 69.JAPAN TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODEL, 2020–2028 ($MILLION)

TABLE 70.JAPAN TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY ENTERPRISE SIZE,2020-2028 ($MILLION)

TABLE 71.JAPAN TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY END USER, 2020–2028 ($MILLION)

TABLE 72.INDIA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COMPONENT, 2020–2028 ($MILLION)

TABLE 73.INDIA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODEL, 2020–2028 ($MILLION)

TABLE 74.INDIA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY ENTERPRISE SIZE,2020-2028 ($MILLION)

TABLE 75.INDIA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY END USER, 2020–2028 ($MILLION)

TABLE 76.AUSTRALIA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COMPONENT, 2020–2028 ($MILLION)

TABLE 77.AUSTRALIA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODEL, 2020–2028 ($MILLION)

TABLE 78.AUSTRALIA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY ENTERPRISE SIZE,2020-2028 ($MILLION)

TABLE 79.AUSTRALIA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY END USER, 2020–2028 ($MILLION)

TABLE 80.SOUTH KOREA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COMPONENT, 2020–2028 ($MILLION)

TABLE 81.SOUTH KOREA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODEL, 2020–2028 ($MILLION)

TABLE 82.SOUTH KOREA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY ENTERPRISE SIZE,2020-2028 ($MILLION)

TABLE 83.SOUTH KOREA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY END USER, 2020–2028 ($MILLION)

TABLE 84.SINGAPORE TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COMPONENT, 2020–2028 ($MILLION)

TABLE 85.SINGAPORE TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODEL, 2020–2028 ($MILLION)

TABLE 86.SINGAPORE TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY ENTERPRISE SIZE,2020-2028 ($MILLION)

TABLE 87.SINGAPORE TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY END USER, 2020–2028 ($MILLION)

TABLE 88.REST OF ASIA-PACIFIC TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COMPONENT, 2020–2028 ($MILLION)

TABLE 89.REST OF ASIA-PACIFIC TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODEL, 2020–2028 ($MILLION)

TABLE 90.REST OF ASIA-PACIFIC TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY ENTERPRISE SIZE,2020-2028 ($MILLION)

TABLE 91.REST OF ASIS-PACIFIC TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY END USER, 2020–2028 ($MILLION)

TABLE 92.LAMEA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COMPONENT, 2020–2028 ($MILLION)

TABLE 93.LAMEA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODEL, 2020–2028 ($MILLION)

TABLE 94.LAMEA TRADE SURVEILLANCE SYSTEM SOFWARE MARKET REVENUE, BY ENTERPRISE SIZE, 2020–2028 ($MILLION)

TABLE 95.LAMEA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY END USER, 2020–2028($MILLION)

TABLE 96.LAMEA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COUNTRY, 2020–2028 ($MILLION)

TABLE 97.LATIN AMERICA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COMPONENT, 2020–2028 ($MILLION)

TABLE 98.LATIN AMERICA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODEL, 2020–2028 ($MILLION)

TABLE 99.LATIN AMERICA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY ENTERPRISE SIZE,2020-2028 ($MILLION)

TABLE 100.LATIN AMERICA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY END USER, 2020–2028 ($MILLION)

TABLE 101.MIDDLE EAST TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COMPONENT, 2020–2028 ($MILLION)

TABLE 102.MIDDLE EAST TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODEL, 2020–2028 ($MILLION)

TABLE 103.MIDDLE EAST TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY ENTERPRISE SIZE,2020-2028 ($MILLION)

TABLE 104.MIDDLE EAST TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY END USER, 2020–2028 ($MILLION)

TABLE 105.AFRICA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY COMPONENT, 2020–2028 ($MILLION)

TABLE 106.AFRICA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODEL, 2020–2028 ($MILLION)

TABLE 107.AFRICA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY ENTERPRISE SIZE,2020-2028 ($MILLION)

TABLE 108.AFRICA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY END USER, 2020–2028 ($MILLION)

TABLE 109.ACA GROUP: KEY EXECUTIVES

TABLE 110.ACA GROUP: COMPANY SNAPSHOT

TABLE 111.ACA GROUP: PRODUCT PORTFOLIO

TABLE 112.AQUIS EXCHANGE: KEY EXECUTIVES

TABLE 113.AQUIS EXCHANGE: COMPANY SNAPSHOT

TABLE 114.INTERNATIONAL BUSINESS MACHINES CORPORATION: OPERATING SEGMENTS

TABLE 115.AQUIS EXCHANGE: PRODUCT PORTFOLIO

TABLE 116.B-NEXT: KEY EXECUTIVES

TABLE 117.B-NEXT: COMPANY SNAPSHOT

TABLE 118.B-NEXT: PRODUCT PORTFOLIO

TABLE 119.CINNOBER: KEY EXECUTIVES

TABLE 120.CINNOBER: COMPANY SNAPSHOT

TABLE 121.CINNOBER: PRODUCT PORTFOLIO

TABLE 122.CRISIL LIMITED: KEY EXECUTIVES

TABLE 123.CRISIL LIMITED: COMPANY SNAPSHOT

TABLE 124.CRISIL LIMITED: OPERATING SEGMENTS

TABLE 125.CRISIL LIMITED: PRODUCT PORTFOLIO

TABLE 126.FIS: KEY EXECUTIVES

TABLE 127.FIS: COMPANY SNAPSHOT

TABLE 128.FIS: OPERATING SEGMENTS

TABLE 129.FIS: PRODUCT PORTFOLIO

TABLE 130.INTERNATIONAL BUSINESS MACHINES CORPORATION: KEY EXECUTIVES

TABLE 131.INTERNATIONAL BUSINESS MACHINES CORPORATION: COMPANY SNAPSHOT

TABLE 132.INTERNATIONAL BUSINESS MACHINES CORPORATION: OPERATING SEGMENTS

TABLE 133.INTERNATIONAL BUSINESS MACHINES CORPORATION: PRODUCT PORTFOLIO

TABLE 134.IPC SYSTEMS, INC: KEY EXECUTIVES

TABLE 135.IPC SYSTEMS, INC: COMPANY SNAPSHOT

TABLE 136.IPC SYSTEMS, INC: PRODUCT PORTFOLIO

TABLE 137.NICE LTD: KEY EXECUTIVES

TABLE 138.NICE LTD: COMPANY SNAPSHOT

TABLE 139.NICE LTD: OPERATING SEGMENTS

TABLE 140.INTERNATIONAL BUSINESS MACHINES CORPORATION: PRODUCT PORTFOLIO

TABLE 141.SIA S.P.A.: KEY EXECUTIVES

TABLE 142.SIA S.P.A.: COMPANY SNAPSHOT

TABLE 143.SIA S.P.A.: PRODUCT PORTFOLIO

LIST OF FIGURES

FIGURE 01.KEY MARKET SEGMENTS

FIGURE 02.GLOBAL TRADE SURVEILLANCE SYSTEM MARKET SNAPSHOT, BY SEGMENTATION, 2020–2028

FIGURE 03.TRADE SURVEILLANCE SYSTEM MARKET SNAPSHOT, BY REGION, 2020–2028

FIGURE 04.TRADE SURVEILLANCE SYSTEM MARKET: TOP IMPACTING FACTOR

FIGURE 05.TOP INVESTMENT POCKETS

FIGURE 06.MODERATE BARGAINING POWER OF SUPPLIERS

FIGURE 07.MODERATE POWER OF BUYERS

FIGURE 08.MODERATE THREAT OF SUBSTITUTES

FIGURE 09.HIGH THREAT OF NEW ENTRANTS

FIGURE 10.HIGH COMPETITIVE RIVALRY

FIGURE 11.GLOBAL TRADE SURVEILLANCE SYSTEM MARKET REVENUE, BY DEPLOYMENT MODE, 2020–2028 ($MILLION)

FIGURE 12.COMPARATIVE SHARE ANALYSIS FOR SOLUTION TRADE SURVEILLANCE SYSTEM MARKET, BY COUNTRY, 2020 & 2028(%)

FIGURE 13.COMPARATIVE SHARE ANALYSIS FOR SERVICE TRADE SURVEILLANCE SYSTEM MARKET, BY COUNTRY, 2020 & 2028(%)

FIGURE 14.GLOBAL TRADE SURVEILLANCE SYSTEM MARKET, BY DEPLOYMENT MODEL, 2020-2028

FIGURE 15.COMPARATIVE SHARE ANALYSIS OF TRADE SURVEILLANCE SYSTEM MARKET FOR ON-PREMISE, BY COUNTRY, 2020 & 2028 (%)

FIGURE 16.COMPARATIVE SHARE ANALYSIS OF TRADE SURVEILLANCE SYSTEM MARKET FOR CLOUD, BY COUNTRY, 2020 & 2028 (%)

FIGURE 17.GLOBAL TRADE SURVEILLANCE SYSTEM MARKET, BY ENTERPRISE SIZE, 2020-2028

FIGURE 18.COMPARATIVE SHARE ANALYSIS OF TRADE SURVEILLANCE SYSTEM MARKET FOR LARGE ENTERPRISES, BY COUNTRY, 2020 & 2028(%)

FIGURE 19.COMPARATIVE SHARE ANALYSIS OF TRADE SURVEILLANCE SYSTEM MARKET FOR SMES, BY COUNTRY, 2020 & 2028 (%)

FIGURE 20.GLOBAL TRADE SURVEILLANCE SYSTEM MARKET, BY END USER, 2020-2028

FIGURE 21.COMPARATIVE SHARE ANALYSIS OF TRADE SURVEILLANCE SYSTEM MARKET FOR BANKS, BY COUNTRY, 2020 & 2028 (%)

FIGURE 22.COMPARATIVE SHARE ANALYSIS OF TRADE SURVEILLANCE SYSTEM MARKET FOR INSTITUTIONAL BROKERS, BY COUNTRY, 2020 & 2028 (%)

FIGURE 23.COMPARATIVE SHARE ANALYSIS OF TRADE SURVEILLANCE SYSTEM MARKET FOR RETAIL BROKERS, BY COUNTRY, 2020 & 2028(%)

FIGURE 24.COMPARATIVE SHARE ANALYSIS OF TRADE SURVEILLANCE SYSTEM MARKET FOR MARKET CENTERS & REGULATORS, BY COUNTRY, 2020 & 2028(%)

FIGURE 25.COMPARATIVE SHARE ANALYSIS OF TRADE SURVEILLANCE SYSTEM MARKET FOR OTHERS, BY COUNTRY, 2020 & 2028(%)

FIGURE 26.U.S. TRADE SURVEILLANCE SYSTEM MARKET REVENUE, 2020-2028 ($MILLION)

FIGURE 27.CANADA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, 2020-2028 ($MILLION)

FIGURE 28.UK TRADE SURVEILLANCE SYSTEM MARKET REVENUE, 2020-2028 ($MILLION)

FIGURE 29.GERMANY TRADE SURVEILLANCE SYSTEM MARKET REVENUE, 2020-2028 ($MILLION)

FIGURE 30.SWITZERLAND TRADE SURVEILLANCE SYSTEM MARKET REVENUE, 2020-2028 ($MILLION)

FIGURE 31.FRANCE TRADE SURVEILLANCE SYSTEM MARKET REVENUE, 2020-2028 ($MILLION)

FIGURE 32.SPAIN TRADE SURVEILLANCE SYSTEM MARKET REVENUE, 2020-2028 ($MILLION)

FIGURE 33.REST OF EUROPE TRADE SURVEILLANCE SYSTEM MARKET REVENUE, 2020-2028 ($MILLION)

FIGURE 34.CHINA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, 2020-2028 ($MILLION)

FIGURE 35.JAPAN TRADE SURVEILLANCE SYSTEM MARKET REVENUE, 2020-2028 ($MILLION)

FIGURE 36.INDIA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, 2020-2028 ($MILLION)

FIGURE 37.AUSTRALIA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, 2020-2028 ($MILLION)

FIGURE 38.SINGAPORE TRADE SURVEILLANCE SYSTEM MARKET REVENUE, 2020-2028 ($MILLION)

FIGURE 39.SINGAPORE TRADE SURVEILLANCE SYSTEM MARKET REVENUE, 2020-2028 ($MILLION)

FIGURE 40.REST OF ASIA-PACIFIC TRADE SURVEILLANCE SYSTEM MARKET REVENUE, 2020-2028 ($MILLION)

FIGURE 41.LATIN AMERICA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, 2020-2028 ($MILLION)

FIGURE 42.MIDDLE EAST TRADE SURVEILLANCE SYSTEM MARKET REVENUE, 2020-2028 ($MILLION)

FIGURE 43.AFRICA TRADE SURVEILLANCE SYSTEM MARKET REVENUE, 2020-2028 ($MILLION)

FIGURE 44.KEY PLAYER POSITIONING ANLYSIS

FIGURE 45.TOP WINNING STRATEGIES, BY YEAR, 2018–2020

FIGURE 46.TOP WINNING STRATEGIES, BY DEVELOPMENT, 2018-2020

FIGURE 47.R&D EXPENDITURE, 2019–2020 ($MILLION)

FIGURE 48.AQUIS EXCHANGE: REVENUE, 2019–2020 ($MILLION)

FIGURE 49.AQUIS EXCHANGE: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 50.AQUIS EXCHANGE: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 51.CRISIL LIMITED: REVENUE, 2018–2020 ($MILLION)

FIGURE 52.CRISIL LIMITED: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 53.CRISIL LIMITED: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 54.FIS: REVENUE, 2018–2020 ($MILLION)

FIGURE 55.FIS: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 56.FIS: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 57.R&D EXPENDITURE, 2018–2020 ($MILLION)

FIGURE 58.INTERNATIONAL BUSINESS MACHINES CORPORATION: REVENUE, 2018–2020 ($MILLION)

FIGURE 59.INTERNATIONAL BUSINESS MACHINES CORPORATION: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 60.INTERNATIONAL BUSINESS MACHINES CORPORATION: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 61.R&D EXPENDITURE, 2018–2020 ($MILLION)

FIGURE 62.NICE LTD: REVENUE, 2018–2020 ($MILLION)

FIGURE 63.NICE LTD: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 64.NICE LTD: REVENUE SHARE BY REGION, 2020 (%)

$6169

$10665

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS

Add to Cart

Add to Cart

Add to Cart

Add to Cart