CHAPTER 1: INTRODUCTION

1.1.REPORT DESCRIPTION

1.2.KEY MARKET SEGMENTS

1.3.KEY BENEFITS

1.4.RESEARCH METHODOLOGY

1.4.1.Primary research

1.4.2.Secondary research

1.4.3.Analyst tools and models

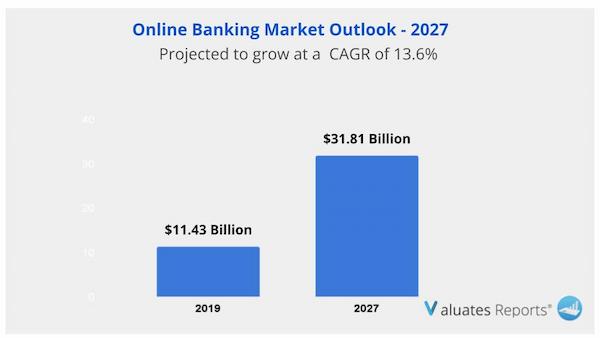

CHAPTER 2: EXECUTIVE SUMMARY

2.1.CXO PERSPECTIVE

CHAPTER 3:MARKET LANDSCAPE

3.1.MARKET DEFINITION AND SCOPE

3.2.KEY FINDINGS

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.PORTER'S FIVE FORCES ANALYSIS

3.3.1.Bargaining power of suppliers

3.3.2.Threat of new entrants

3.3.3.Threat of substitutes

3.3.4.Competitive rivalry

3.3.5.Bargaining power among buyers

3.4.MARKET SHARE ANALYSIS/TOP PLAYER

POSITIONING 2019

3.5.MARKET DYNAMICS

3.5.1.Drivers

3.5.2.Restraints

3.5.3.Opportunities

3.6.COVID-19 IMPACT ANALYSIS ON ONLINE

BANKING MARKET

3.6.1.Impact on online banking market size

3.6.2.Change in consumers trends, preferences, and budget impact due to COVID-19

3.6.3.Framework for solving market challenges faced by online banking solution providers

3.6.4.Economic impact on online banking solution providers

3.6.5.Key player strategies to tackle negative impact in the industry

3.6.6.Opportunity analysis for online banking solution providers

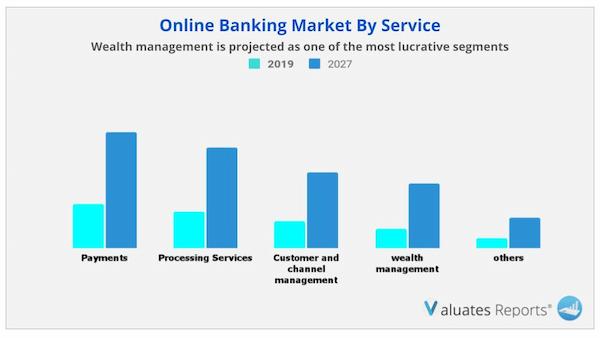

CHAPTER 4:ONLINE BANKING MARKET BY SERVICE TYPE

4.1.OVERVIEW

4.2.PAYMENTS

4.2.1.Key market trends, growth factors and

opportunities

4.2.2.Market size and forecast, by region

4.2.3.Market share analysis, by country

4.3.PROCESSING SERVICES

4.3.1.Key market trends, growth factors and

opportunities

4.3.2.Market size and forecast, by region

4.3.3.Market share analysis, by country

4.4.CUSTOMER & CHANNEL MANAGEMENT

4.4.1.Key market trends, growth factors and

opportunities

4.4.2.Market size and forecast, by region

4.4.3.Market share analysis, by country

4.5.WEALTH MANAGEMENT

4.5.1.Key market trends, growth factors and

opportunities

4.5.2.Market size and forecast, by region

4.5.3.Market share analysis, by country

4.6.OTHERS

4.6.1.Key market trends, growth factors and

opportunities

4.6.2.Market size and forecast, by region

4.6.3.Market share analysis, by country

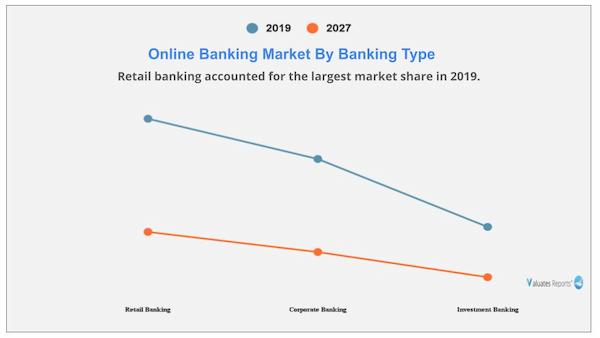

CHAPTER 5: ONLINE BANKING MARKET BY BANKING TYPE

5.1.OVERVIEW

5.2.RETAIL BANKING

5.2.1.Key market trends, growth factors and

opportunities

5.2.2.Market size and forecast, by region

5.2.3.Market share analysis, by country

5.3.CORPORATE BANKING

5.3.1.Key market trends, growth factors and

opportunities

5.3.2.Market size and forecast, by region

5.3.3.Market share analysis, by country

5.4.INVESTMENT BANKING

5.4.1.Key market trends, growth factors and

opportunities

5.4.2.Market size and forecast, by region

5.4.3.Market share analysis, by country

CHAPTER 6:ONLINE BANKING MARKET BY REGION

6.1.OVERVIEW

6.2.NORTH AMERICA

6.2.1.Key market trends and opportunities

6.2.2.Market size and forecast, by service type

6.2.3.Market size and forecast, by banking type

6.2.4.Market size and forecast, by Country

6.2.5.U.S.

6.2.5.1.Market size and forecast, by service type

6.2.5.2.Market size and forecast, by banking type

6.2.6.Canada

6.2.6.1.Market size and forecast, by service type

6.2.6.2.Market size and forecast, by banking type

6.3.EUROPE

6.3.1.Key market trends and opportunities

6.3.2.Market size and forecast, by service type

6.3.3.Market size and forecast, by banking type

6.3.4.Market size and forecast, by Country

6.3.5.UK

6.3.5.1.Market size and forecast, by service type

6.3.5.2.Market size and forecast, by banking type

6.3.6.France

6.3.6.1.Market size and forecast, by service type

6.3.6.2.Market size and forecast, by banking type

6.3.7.Germany

6.3.7.1.Market size and forecast, by service type

6.3.7.2.Market size and forecast, by banking type

6.3.8.Italy

6.3.8.1.Market size and forecast, by service type

6.3.8.2.Market size and forecast, by banking type

6.3.9.Spain

6.3.9.1.Market size and forecast, by service type

6.3.9.2.Market size and forecast, by banking type

6.3.10.Netherlands

6.3.10.1.Market size and forecast, by service type

6.3.10.2.Market size and forecast, by banking

type

6.3.11.Rest of Europe

6.3.11.1.Market size and forecast, by service type

6.3.11.2.Market size and forecast, by banking

type

6.4.ASIA-PACIFIC

6.4.1.Key market trends and opportunities

6.4.2.Market size and forecast, by service type

6.4.3.Market size and forecast, by banking type

6.4.4.Market size and forecast, by Country

6.4.5.China

6.4.5.1.Market size and forecast, by service type

6.4.5.2.Market size and forecast, by banking type

6.4.6.India

6.4.6.1.Market size and forecast, by service type

6.4.6.2.Market size and forecast, by banking type

6.4.7.Japan

6.4.7.1.Market size and forecast, by service type

6.4.7.2.Market size and forecast, by banking type

6.4.8.Singapore

6.4.8.1.Market size and forecast, by service type

6.4.8.2.Market size and forecast, by banking type

6.4.9.Australia

6.4.9.1.Market size and forecast, by service type

6.4.9.2.Market size and forecast, by banking type

6.4.10.Rest of Asia-Pacific

6.4.10.1.Market size and forecast, by service type

6.4.10.2.Market size and forecast, by banking

type

6.5.LAMEA

6.5.1.Key market trends and opportunities

6.5.2.Market size and forecast, by service type

6.5.3.Market size and forecast, by banking type

6.5.4.Market size and forecast, by Country

6.5.5.Latin America

6.5.5.1.Market size and forecast, by service type

6.5.5.2.Market size and forecast, by banking type

6.5.6.Middle East

6.5.6.1.Market size and forecast, by service type

6.5.6.2.Market size and forecast, by banking type

6.5.7.Africa

6.5.7.1.Market size and forecast, by service type

6.5.7.2.Market size and forecast, by banking type

CHAPTER 7:COMPANY PROFILES

7.1.ACI WORLDWIDE, INC

7.1.1.Company overview

7.1.2.Key Executives

7.1.3.Company snapshot

7.1.4.Operating business segments

7.1.5.Product portfolio

7.1.6.Business performance

7.1.7.Key strategic moves and developments

7.2.CAPITAL BANKING SOLUTION

7.2.1.Company overview

7.2.2.Key Executives

7.2.3.Company snapshot

7.2.4.Operating business segments

7.2.5.Product portfolio

7.2.6.Business performance

7.2.7.Key strategic moves and developments

7.3.CGI INC.

7.3.1.Company overview

7.3.2.Key Executives

7.3.3.Company snapshot

7.3.4.Operating business segments

7.3.5.Product portfolio

7.3.6.Business performance

7.3.7.Key strategic moves and developments

7.4.COR FINANCIAL SOLUTIONS LIMITED

7.4.1.Company overview

7.4.2.Key Executives

7.4.3.Company snapshot

7.4.4.Operating business segments

7.4.5.Product portfolio

7.4.6.Business performance

7.4.7.Key strategic moves and developments

7.5.EDGEVERVE SYSTEMS LIMITED

7.5.1.Company overview

7.5.2.Key Executives

7.5.3.Company snapshot

7.5.4.Operating business segments

7.5.5.Product portfolio

7.5.6.Business performance

7.5.7.Key strategic moves and developments

7.6.FISERV, INC.

7.6.1.Company overview

7.6.2.Key Executives

7.6.3.Company snapshot

7.6.4.Operating business segments

7.6.5.Product portfolio

7.6.6.Business performance

7.6.7.Key strategic moves and developments

7.7.MICROSOFT

7.7.1.Company overview

7.7.2.Key Executives

7.7.3.Company snapshot

7.7.4.Operating business segments

7.7.5.Product portfolio

7.7.6.Business performance

7.7.7.Key strategic moves and developments

7.8.ORACLE

7.8.1.Company overview

7.8.2.Key Executives

7.8.3.Company snapshot

7.8.4.Operating business segments

7.8.5.Product portfolio

7.8.6.Business performance

7.8.7.Key strategic moves and developments

7.9.TATA CONSULTANCY SERVICES LIMITED

7.9.1.Company overview

7.9.2.Key Executives

7.9.3.Company snapshot

7.9.4.Operating business segments

7.9.5.Product portfolio

7.9.6.Business performance

7.9.7.Key strategic moves and developments

7.10.TEMENOS HEADQUARTERS SA

7.10.1.Company overview

7.10.2.Key Executives

7.10.3.Company snapshot

7.10.4.Operating business segments

7.10.5.Product portfolio

7.10.6.Business performance

7.10.7.Key strategic moves and development