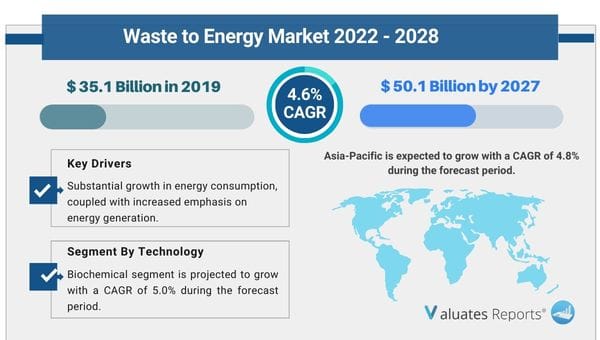

The global waste to energy market size was valued at $35.1 billion in 2019, and is projected to reach $50.1 billion by 2027, growing at a CAGR of 4.6% from 2020 to 2027. Waste to energy (WtE) or energy from waste (EfW) is a process of energy recovery, and the technique of generating energy in the form of heat or electricity from the primary treatment of waste. Most of the WtE processes produce heat or electricity directly through thermal combustion or generate a combustible fuel commodity, including methanol, methane, synthetic fuels, or ethanol.

Continuing the delivery of basic waste management service like waste collection and management has become a major challenge for cities having maximum fallout from COVID-19. As now the world is unlocking halted operations implemented during pandemic, and it is expected that government will partner with the private sector through public-private partnerships to discover sustainable solutions for energy generation from waste.

The global waste to energy market growth is driven by increase in demand for incineration process and rise in public WtE expenditure. Moreover, increase in inclination of consumers toward efficient and easy WtE conversion techniques, such as incineration, gasification, pyrolysis, and various biochemical treatments, including aerobic and anaerobic digestion, is expected to significantly boost the market growth.

The impact of government regulations on global waste to energy market is positive. These regulations encourage the use of waste to energy for meeting the needs of electricity. The U.S. has several federal laws and regulations that govern renewable energy grid interconnections. Federal Power Act (FPA) gives federal authority over electric utilities. The Public Utility Regulatory Policy Act (PURPA) mandates utilities to buy electricity from qualifying facilities, introducing competition into wholesale power markets. Energy Policy Act enables electricity generators to participate in wholesale power markets free from Security and Exchange Commission (SEC) supervision. Public Utility Regulatory Policy Act (PURPA) offers the way for small non-utility generators to enter the market, including renewable energy developers. Further, Canada has set a target of increasing the share of zero-emitting sources to 90% by 2030. The target aims to promote use of renewable and clean energy and contribute toward significant greenhouse gas reductions.

However, rise in concerns related to the environmental hazards associated with the incineration process is expected to affect the overall market growth in developed and developing countries. On the contrary, increase in investments in R&D activities to ensure reliability in terms of environmental effects is expected to provide lucrative opportunities for the market growth in the future.

The global WtE market is segmented on the basis of technology and region. On the basis of technology, the market is divided into thermal, biochemical, and others. The thermal process involves recycling of energy from MSW at high temperature. The thermal technology includes several processes such as combustion or incineration, gasification, and pyrolysis. The major difference among these technologies is the amount of oxygen and temperature involvement during the process that leads to the conversion to final product CO2 and water, or to intermediate useful products.

The incineration segment is anticipated to register a significant CAGR during the forecast period. Increase in waste generation across the world significantly drive the demand for incineration process on a global scale. As the incinerators can treat all kinds of wastes, this process is highly preferred other thermal waste treatment technologies.

The global waste to energy market size is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The market is in its nascent stage. However, rise in demand for power generation and inclination toward renewable energy sources drive the demand for waste to energy in developed and emerging economies. At present, Europe is the major player in the waste to energy market and other regions such as Asia-Pacific, North America, and LAMEA are providing various market opportunities to key players. Asia-Pacific is anticipated to be the fastest growing segment in the waste to energy market.

The key players have adopted various market penetration and growth strategies, such as mergers & acquisitions, to strengthen their Waste to Energy Market share. The key players operating in Waste to Energy Industry include Waste Management Inc., Suez Environment S.A., C&G Environmental Protection Holdings, Constructions industrielles de la Méditerranée (CNIM), China Everbright International Limited, Covanta Energy Corporation, Foster Wheeler A.G., Abu Dhabi National Energy Company PJSC, Babcock & Wilcox Enterprises, Inc., and Veolia Environment.

As companies around the world flow forward with their waste to energy initiatives. Taking a collaborative approach allows organizations to get assistance with known weaknesses while improving the possibilities of favorable results. For example, one new association in the West Midlands vicinity of the UK with Wheelabrator, a waste to energy specialist, is partnering with Verus Energy Limited and Low Carbon, the two environment-centric companies. The collaborative effort will provide enough electricity for around 70,000 houses diverting 395,000 heaps of garbage from landfills or export operations. A similar agreement between a waste management plant and utility carrier is underway inside the United Arab Emirates.

The outbreak of COVID-19 has disrupted the global economy by halting the operations of major industries such as recycling waste industries and energy generating industries. The industries are being kept closed or operated under restricted environments such as less employees and working times. Lockdown was imposed in many countries such as the U.S., China, Spain, Austria, Poland, Korea, India, Germany, the UK, Italy, and France. The pandemic resulted in shortage of labor and raw materials in the recycling and energy generating industry. The severity of the impact may result in closure of some waste to energy manufacturers. Manufacturers had their production halted due to non- availability of labor. This led to a reduction in production output and thus incurring economic losses.

|

Report Metric |

Details |

|

Report Name |

Waste To Energy market |

|

The Market size value in 2019 |

35.1 Billion USD |

|

The Revenue forecast in 2027 |

50.1 Billion USD |

|

Growth Rate |

CAGR of 4.6% from 2020 to 2027 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Mode of Transport Type, End-User, and Region |

|

Report coverage |

Revenue & volume forecast, company share, competitive landscape, growth factors, and trends |

|

Geographic regions covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Companies covered |

Waste Management Inc., Suez Environment S.A., C&G Environmental Protection Holdings, Constructions industrielles de la Méditerranée (CNIM), China Everbright International Limited, Covanta Energy Corporation, Others. |

Ans. The global waste to energy market size was valued at $35.1 billion in 2019, and is projected to reach $50.1 billion by 2027.

Ans. The global waste to energy market is expected to grow at a compound annual growth rate of 4.6% from 2020 to 2027.

Ans. Waste Management Inc., Suez Environment S.A., C&G Environmental Protection Holdings, Constructions industrielles de la Méditerranée (CNIM), China Everbright International Limited, Covanta Energy Corporation, Others.

Ans. The global waste to energy market growth is driven by increase in demand for incineration process and rise in public WtE expenditure.

CHAPTER 1:INTRODUCTION

1.1.Report description

1.2.Key benefits for stakeholders

1.3.Key market segments

1.4.Research methodology

1.4.1.Secondary research

1.4.2.Primary research

1.4.3.Analyst tools and models

CHAPTER 2:EXECUTIVE SUMMARY

2.1.Key findings of the study

2.2.CXO perspective

CHAPTER 3:MARKET OVERVIEW

3.1.Market definition and scope

3.2.Key findings

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five forces analysis

3.4.Market dynamics

3.4.1.Drivers

3.4.1.1.Increase in demand for renewable sources of energy

3.4.1.2.Rise in demand for electricity consumption

3.4.2.Restraints

3.4.2.1.High initial costs

3.4.2.2.Less investments

3.4.3.Opportunity

3.4.3.1.Upsurge in energy demand from Asia-Pacific and Latin America regions

3.5.Top player positioning, 2019

3.6.Value chain analysis

3.7.Impact of government regulations on the market

3.8.Patent analysis

3.8.1.By Country (2012-2019)

3.9.Impact of COVID-19 on global waste to energy Market

CHAPTER 4:GLOBAL WASTE TO ENERGY MARKET, BY TECHNOLOGY

4.1.Overview

4.1.1.Market size and forecast

4.2.Thermal

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast, by region

4.2.3.Market analysis, by country

4.2.4.Incineration

4.2.4.1.Key market trends, growth factors, and opportunities

4.2.4.2.Market size and forecast

4.2.5.Pyrolysis

4.2.5.1.Key market trends, growth factors, and opportunities

4.2.5.2.Market size and forecast

4.2.6.Gasification

4.2.6.1.Key market trends, growth factors, and opportunities

4.2.6.2.Market size and forecast

4.3.Biochemical

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Market size and forecast

4.3.3.Market analysis, by country

4.4.Others

4.4.1.Key market trends, growth factors, and opportunities

4.4.2.Market size and forecast

4.4.3.Market analysis, by country

CHAPTER 5:WASTE TO ENERGY MARKET, BY REGION

5.1.Overview

5.1.1.Market size and forecast

5.2.North America

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by technology

5.2.3.Market size and forecast, by country

5.2.3.1.U.S.

5.2.3.1.1.Market size and forecast, by technology

5.2.3.2.Canada

5.2.3.2.1.Market size and forecast, by technology

5.2.3.3.Mexico

5.2.3.3.1.Market size and forecast, by technology

5.3.Europe

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by technology

5.3.3.Market size and forecast by country

5.3.3.1.France

5.3.3.1.1.Market size and forecast, by technology

5.3.3.2.Germany

5.3.3.2.1.Market size and forecast, by technology

5.3.3.3.UK

5.3.3.3.1.Market size and forecast, by technology

5.3.3.4.Spain

5.3.3.4.1.Market size and forecast, by technology

5.3.3.5.Italy

5.3.3.5.1.Market size and forecast, by technology

5.3.3.6.Russia

5.3.3.6.1.Market size and forecast, by technology

5.3.3.7.Rest of Europe

5.3.3.7.1.Market size and forecast, by technology

5.4.Asia-Pacific

5.4.1.Key market trends, growth factors, and opportunities

5.4.2.Market size and forecast, by technology

5.4.3.Market size and forecast, by country

5.4.3.1.China

5.4.3.1.1.Market size and forecast, by technology

5.4.3.2.Japan

5.4.3.2.1.Market size and forecast, by technology

5.4.3.3.India

5.4.3.3.1.Market size and forecast, by technology

5.4.3.4.Australia

5.4.3.4.1.Market size and forecast, by technology

5.4.3.5.South Korea

5.4.3.5.1.Market size and forecast, by technology

5.4.3.6.Rest of Asia-Pacific

5.4.3.6.1.Market size and forecast, by technology

5.5.LAMEA

5.5.1.Key market trends, growth factors, and opportunities

5.5.2.Market size and forecast, by technology

5.5.3.Market size and forecast, by country

5.5.3.1.Brazil

5.5.3.1.1.Market size and forecast, by technology

5.5.3.2.Argentina

5.5.3.2.1.Market size and forecast, by technology

5.5.3.3.Saudi Arabia

5.5.3.3.1.Market size and forecast, by technology

5.5.3.4.South Africa

5.5.3.4.1.Market size and forecast, by technology

5.5.3.5.Rest of LAMEA

5.5.3.5.1.Market size and forecast, by technology

CHAPTER 6:COMPANY PROFILES

6.1.ABU DHABI NATIONAL ENERGY COMPANY PJSC (TAQA)

6.1.1.Company overview

6.1.2.Company snapshot

6.1.3.Operating business segments

6.1.4.Product portfolio

6.1.5.Business performance

6.2.JOHN WOOD GROUP PLC

6.2.1.Company overview

6.2.2.Company snapshot

6.2.3.Operating business segments

6.2.4.Product portfolio

6.2.5.Business performance

6.2.6.Key strategic moves and developments

6.3.BABCOCK & WILCOX ENTERPRISES, INC.

6.3.1.Company overview

6.3.2.Company snapshot

6.3.3.Operating business segments

6.3.4.Product portfolio

6.3.5.Business performance

6.4.C&G LTD.

6.4.1.Company overview

6.4.2.Company snapshot

6.4.3.Product portfolio

6.5.CHINA EVERBRIGHT INTERNATIONAL LIMITED

6.5.1.Company overview

6.5.2.Company snapshot

6.5.3.Operating business segments

6.5.4.Product portfolio

6.5.5.Business performance

6.6.COVANTA HOLDING CORPORATION

6.6.1.Company overview

6.6.2.Company snapshot

6.6.3.Operating business segments

6.6.4.Product portfolio

6.6.5.Business performance

6.6.6.Key strategic moves and developments

6.7.SUEZ

6.7.1.Company overview

6.7.2.Company snapshot

6.7.3.Operating business segments

6.7.4.Product portfolio

6.7.5.Business performance

6.7.6.Key strategic moves and developments

6.8.VEOLIA

6.8.1.Company overview

6.8.2.Company snapshot

6.8.3.Operating business segments

6.8.4.Product portfolio

6.8.5.Business performance

6.8.6.Key strategic moves and developments

6.9.WASTE MANAGEMENT, INC.

6.9.1.Company overview

6.9.2.Company snapshot

6.9.3.Operating business segments

6.9.4.Product portfolio

6.9.5.Business performance

6.9.6.Key strategic moves and developments

6.10.CNIM

6.10.1.Company overview

6.10.2.Company snapshot

6.10.3.Operating business segments

6.10.4.Product portfolio

6.10.5.Business performance

6.10.6.Key strategic moves and developments

6.11.BLUEFIRE RENEWABLES

6.11.1.Company overview

6.11.2.Company snapshot

6.11.3.Product portfolio

6.12.ENER-CORE, INC.

6.12.1.Company overview

6.12.2.Company snapshot

6.12.3.Product portfolio

6.12.4.Key strategic moves and developments

6.13.PLASCO ENERGY GROUP, INC.

6.13.1.Company overview

6.13.2.Company snapshot

6.13.3.Product portfolio

6.14.WHEELABRATOR TECHNOLOGIES INC.

6.14.1.Company overview

6.14.2.Company snapshot

6.14.3.Product portfolio

LIST OF TABLES

TABLE 01.GLOBAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, MILLION TONS

TABLE 02.GLOBAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, GWH

TABLE 03.GLOBAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, $MILLION

TABLE 04.GLOBAL THERMAL WASTE TO ENERGY MARKET, BY REGION, 2017 – 2025, MILLION TONS

TABLE 05.GLOBAL THERMAL WASTE TO ENERGY MARKET, BY REGION, 2017 – 2025, GWH

TABLE 06.GLOBAL THERMAL WASTE TO ENERGY MARKET, BY REGION, 2017 – 2025, $MILLION

TABLE 07.GLOBAL INCINERATION WASTE TO ENERGY MARKET, BY REGION, 2017 – 2025, MILLION TONS

TABLE 08.GLOBAL INCINERATION WASTE TO ENERGY MARKET, BY REGION, 2017 – 2025, GWH

TABLE 09.GLOBAL INCINERATION WASTE TO ENERGY MARKET, BY REGION, 2017 – 2025, $MILLION

TABLE 10.GLOBAL PYROLYSIS WASTE TO ENERGY MARKET, BY REGION, 2017 – 2025, MILLION TONS

TABLE 11.GLOBAL PYROLYSIS WASTE TO ENERGY MARKET, BY REGION, 2017 – 2025, GWH

TABLE 12.GLOBAL PYROLYSIS WASTE TO ENERGY MARKET, BY REGION, 2017 – 2025, $MILLION

TABLE 13.GLOBAL GASIFICATION WASTE TO ENERGY MARKET, BY REGION, 2017 – 2025, MILLION TONS

TABLE 14.GLOBAL GASIFICATION WASTE TO ENERGY MARKET, BY REGION, 2017 – 2025, GWH

TABLE 15.GLOBAL GASIFICATION WASTE TO ENERGY MARKET, BY REGION, 2017 – 2025, $MILLION

TABLE 16.GLOBAL BIOCHEMICAL WASTE TO ENERGY MARKET, BY REGION, 2017 – 2025, MILLION TONS

TABLE 17.GLOBAL BIOCHEMICAL WASTE TO ENERGY MARKET, BY REGION, 2017 – 2025, GWH

TABLE 18.GLOBAL BIOCHEMICAL WASTE TO ENERGY MARKET, BY REGION, 2017 – 2025, $MILLION

TABLE 19.GLOBAL OTHERS WASTE TO ENERGY MARKET, BY REGION, 2017 – 2025, MILLION TONS

TABLE 20.GLOBAL OTHERS WASTE TO ENERGY MARKET, BY REGION, 2017 – 2025, GWH

TABLE 21.GLOBAL OTHERS WASTE TO ENERGY MARKET, BY REGION, 2017 – 2025, $MILLION

TABLE 22.GLOBAL WASTE TO ENERGY MARKET, BY REGION, 2017-2025, (MILLION TONS)

TABLE 23.GLOBAL WASTE TO ENERGY MARKET, BY REGION, 2017-2025, (GWH)

TABLE 24.GLOBAL WASTE TO ENERGY MARKET, BY REGION, 2017-2025, ($MILLION)

TABLE 25.NORTH AMERICA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 26.NORTH AMERICA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 27.NORTH AMERICA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 28.NORTH AMERICA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 29.NORTH AMERICA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 30.NORTH AMERICA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 31.NORTH AMERICA WASTE TO ENERGY MARKET, BY COUNTRY, 2017-2025, (MILLION TONS)

TABLE 32.NORTH AMERICA WASTE TO ENERGY MARKET, BY COUNTRY, 2017-2025, (GWH)

TABLE 33.NORTH AMERICA WASTE TO ENERGY MARKET, BY COUNTRY, 2017-2025, ($MILLION)

TABLE 34.U.S. WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 35.U.S. WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 36.U.S. WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 37.U.S. THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 38.U.S. THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 39.U.S. THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 40.CANADA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 41.CANADA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 42.CANADA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 43.CANADA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 44.CANADA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 45.CANADA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 46.MEXICO WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 47.MEXICO WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 48.MEXICO WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 49.MEXICO THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 50.MEXICO THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 51.MEXICO THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 52.EUROPE WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 53.EUROPE WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 54.EUROPE WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 55.EUROPE THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 56.EUROPE THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 57.EUROPE THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 58.EUROPE WASTE TO ENERGY MARKET, BY COUNTRY, 2017-2025, (MILLION TONS)

TABLE 59.EUROPE WASTE TO ENERGY MARKET, BY COUNTRY, 2017-2025, (GWH)

TABLE 60.EUROPE WASTE TO ENERGY MARKET, BY COUNTRY, 2017-2025, ($MILLION)

TABLE 61.FRANCE WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 62.FRANCE WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 63.FRANCE WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 64.FRANCE THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 65.FRANCE THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 66.FRANCE THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 67.GERMANY WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 68.GERMANY WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 69.GERMANY WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 70.GERMANY THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 71.GERMANY THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 72.GERMANY THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 73.UK WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 74.UK WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 75.UK WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 76.UK THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 77.UK THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 78.UK THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 79.SPAIN WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 80.SPAIN WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 81.SPAIN WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 82.SPAIN THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 83.SPAIN THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 84.SPAIN THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 85.ITALY WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 86.ITALY WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 87.ITALY WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 88.ITALY THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 89.ITALY THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 90.ITALY THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 91.RUSSIA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 92.RUSSIA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 93.RUSSIA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 94.RUSSIA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 95.RUSSIA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 96.RUSSIA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 97.REST OF EUROPE WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 98.REST OF EUROPE WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 99.REST OF EUROPE WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 100.REST OF EUROPE THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 101.REST OF EUROPE THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 102.REST OF EUROPE THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 103.ASIA-PACIFIC WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 104.ASIA-PACIFIC WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 105.ASIA-PACIFIC WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 106.ASIA-PACIFIC THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 107.ASIA-PACIFIC THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 108.ASIA-PACIFIC THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 109.ASIA-PACIFIC WASTE TO ENERGY MARKET, BY COUNTRY, 2017-2025, (MILLION TONS)

TABLE 110.ASIA-PACIFIC WASTE TO ENERGY MARKET, BY COUNTRY, 2017-2025, (GWH)

TABLE 111.ASIA-PACIFIC WASTE TO ENERGY MARKET, BY COUNTRY, 2017-2025, ($MILLION)

TABLE 112.CHINA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 113.CHINA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 114.CHINA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 115.CHINA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 116.CHINA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 117.CHINA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 118.JAPAN WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 119.JAPAN WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 120.JAPAN WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 121.JAPAN THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 122.JAPAN THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 123.JAPAN THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 124.INDIA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 125.INDIA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 126.INDIA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 127.INDIA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 128.INDIA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 129.INDIA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 130.AUSTRALIA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 131.AUSTRALIA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 132.AUSTRALIA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 133.AUSTRALIA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 134.AUSTRALIA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 135.AUSTRALIA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 136.SOUTH KOREA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 137.SOUTH KOREA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 138.SOUTH KOREA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 139.SOUTH KOREA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 140.SOUTH KOREA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 141.SOUTH KOREA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 142.REST OF ASIA-PACIFIC WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 143.REST OF ASIA-PACIFIC WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 144.REST OF ASIA-PACIFIC WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 145.REST OF ASIA-PACIFIC THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 146.REST OF ASIA-PACIFIC THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 147.REST OF ASIA-PACIFIC THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 148.LAMEA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 149.LAMEA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 150.LAMEA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 151.LAMEA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 152.LAMEA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 153.LAMEA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 154.LAMEA WASTE TO ENERGY MARKET, BY COUNTRY, 2017-2025, (MILLION TONS)

TABLE 155.LAMEA WASTE TO ENERGY MARKET, BY COUNTRY, 2017-2025, (GWH)

TABLE 156.LAMEA WASTE TO ENERGY MARKET, BY COUNTRY, 2017-2025, ($MILLION)

TABLE 157.BRAZIL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 158.BRAZIL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 159.BRAZIL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 160.BRAZIL THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 161.BRAZIL THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 162.BRAZIL THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 163.ARGENTINA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 164.ARGENTINA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 165.ARGENTINA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 166.ARGENTINA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 167.ARGENTINA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 168.ARGENTINA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 169.SAUDI ARABIA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 170.SAUDI ARABIA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 171.SAUDI ARABIA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 172.SAUDI ARABIA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 173.SAUDI ARABIA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 174.SAUDI ARABIA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 175.SOUTH AFRICA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 176.SOUTH AFRICA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 177.SOUTH AFRICA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 178.SOUTH AFRICA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 179.SOUTH AFRICA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 180.SOUTH AFRICA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 181.REST OF LAMEA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 182.REST OF LAMEA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 183.REST OF LAMEA WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 184.REST OF LAMEA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (MILLION TONS)

TABLE 185.REST OF LAMEA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, (GWH)

TABLE 186.REST OF LAMEA THERMAL WASTE TO ENERGY MARKET, BY TECHNOLOGY, 2017-2025, ($MILLION)

TABLE 187.TAQA: COMPANY SNAPSHOT

TABLE 188.TAQA: OPERATING SEGMENTS

TABLE 189.TAQA: PRODUCT PORTFOLIO

TABLE 190.WOOD GROUP: COMPANY SNAPSHOT

TABLE 191.WOOD GROUP: OPERATING SEGMENTS

TABLE 192.WOOD GROUP: PRODUCT PORTFOLIO

TABLE 193.WOOD GROUP: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 194.B&W: COMPANY SNAPSHOT

TABLE 195.B&W: OPERATING SEGMENTS

TABLE 196.B&W: PRODUCT PORTFOLIO

TABLE 197.C&G: COMPANY SNAPSHOT

TABLE 198.C&G: PRODUCT PORTFOLIO

TABLE 199.CHINA EVERBRIGHT INTERNATIONAL LIMITED: COMPANY SNAPSHOT

TABLE 200.CHINA EVERBRIGHT INTERNATIONAL LIMITED: OPERATING SEGMENTS

TABLE 201.CHINA EVERBRIGHT INTERNATIONAL LIMITED: PRODUCT PORTFOLIO

TABLE 202.COVANTA: COMPANY SNAPSHOT

TABLE 203.COVANTA: OPERATING SEGMENTS

TABLE 204.COVANTA: PRODUCT PORTFOLIO

TABLE 205.COVANTA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 206.SUEZ: COMPANY SNAPSHOT

TABLE 207.SUEZ: OPERATING SEGMENTS

TABLE 208.SUEZ: PRODUCT PORTFOLIO

TABLE 209.SUEZ: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 210.VEOLIA: COMPANY SNAPSHOT

TABLE 211.VEOLIA: OPERATING SEGMENTS

TABLE 212.VEOLIA: PRODUCT PORTFOLIO

TABLE 213.VEOLIA: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 214.WM: COMPANY SNAPSHOT

TABLE 215.WM: OPERATING SEGMENTS

TABLE 216.WM: PRODUCT PORTFOLIO

TABLE 217.WM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 218.CNIM: COMPANY SNAPSHOT

TABLE 219.CNIM: OPERATING SEGMENTS

TABLE 220.CNIM: PRODUCT PORTFOLIO

TABLE 221.CNIM: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 222.BLUEFIRE: COMPANY SNAPSHOT

TABLE 223.BLUEFIRE: PRODUCT PORTFOLIO

TABLE 224.ENER-CORE: COMPANY SNAPSHOT

TABLE 225.ENER-CORE: PRODUCT PORTFOLIO

TABLE 226.ENER-CORE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 227.PLASCO: COMPANY SNAPSHOT

TABLE 228.PLASCO: PRODUCT PORTFOLIO

TABLE 229.WHEELABRATOR: COMPANY SNAPSHOT

TABLE 230.WHEELABRATOR: PRODUCT PORTFOLIO

LIST OF FIGURES

FIGURE 01.GLOBAL WASTE TO ENERGY MARKET SEGMENTATION

FIGURE 02.TOP INVESTMENT POCKETS, BY COUNTRY

FIGURE 03.TOP WINNING STRATEGIES, BY YEAR, 2016–2018*

FIGURE 04.TOP WINNING STRATEGIES, BY DEVELOPMENT, 2016–2018* (%)

FIGURE 05.TOP WINNING STRATEGIES, BY COMPANY, 2016–2018*

FIGURE 06.HIGH BARGAINING POWER OF SUPPLIERS

FIGURE 07.LOW BARGAINING POWER OF BUYERS

FIGURE 08.MODERATE THREAT OF NEW ENTRANTS

FIGURE 09.LOW THREAT OF SUBSTITUTES

FIGURE 10.MODERATE INTENSITY OF COMPETITIVE RIVALRY

FIGURE 11.WASTE TO ENERGY MARKET DYNAMICS

FIGURE 12.GLOBAL RENEWABLE ENERGY GENERATION, 2010–2016, GWH

FIGURE 13.GLOBAL ELECTRIC POWER CONSUMPTION, 2010–2014, GWH

FIGURE 14.TOP PLAYER POSITIONNG, 2017

FIGURE 15.PATENT ANALYSIS, BY COUNTRY

FIGURE 16.COMPARATIVE SHARE ANALYSIS OF THERMAL WASTE TO ENERGY MARKET, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 17.COMPARATIVE SHARE ANALYSIS OF BIOCHEMICAL WASTE TO ENERGY MARKET, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 18.COMPARATIVE SHARE ANALYSIS OF OTHERS WASTE TO ENERGY MARKET, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 19.TAQA: REVENUE, 2017–2019 ($MILLION)

FIGURE 20.TAQA: REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 21.TAQA: REVENUE SHARE BY GEOGRAPHY, 2019 (%)

FIGURE 22.WOOD GROUP: REVENUE, 2017–2019 ($MILLION)

FIGURE 23.WOOD GROUP: REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 24.WOOD GROUP: REVENUE SHARE BY GEOGRAPHY, 2019 (%)

FIGURE 25.B&W: REVENUE, 2017–2019 ($MILLION)

FIGURE 26.B&W: REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 27.B&W: REVENUE SHARE BY GEOGRAPHY, 2019 (%)

FIGURE 28.CHINA EVERBRIGHT INTERNATIONAL LIMITED: REVENUE, 2017–2019 ($MILLION)

FIGURE 29.CHINA EVERBRIGHT INTERNATIONAL LIMITED: REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 30.CHINA EVERBRIGHT INTERNATIONAL LIMITED: REVENUE SHARE BY GEOGRAPHY, 2019 (%)

FIGURE 31.COVANTA: REVENUE, 2017–2019 ($MILLION)

FIGURE 32.COVANTA: REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 33.COVANTA: REVENUE SHARE BY GEOGRAPHY, 2019 (%)

FIGURE 34.SUEZ: REVENUE, 2017–2019 ($MILLION)

FIGURE 35.SUEZ: REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 36.SUEZ: REVENUE SHARE BY GEOGRAPHY, 2019 (%)

FIGURE 37.VEOLIA: REVENUE, 2017–2019 ($MILLION)

FIGURE 38.VEOLIA: REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 39.VEOLIA: REVENUE SHARE BY GEOGRAPHY, 2019 (%)

FIGURE 40.WM: REVENUE, 2017–2019 ($MILLION)

FIGURE 41.WM: REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 42.WM: REVENUE SHARE BY GEOGRAPHY, 2019 (%)

FIGURE 43.CNIM: REVENUE, 2017–2019 ($MILLION)

FIGURE 44.CNIM: REVENUE SHARE BY SEGMENT, 2019 (%)

$5769

$6450

$9995

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS