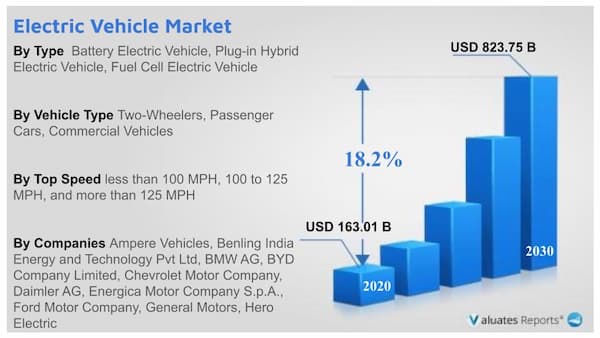

The global electric vehicle market size was valued at $163.01 billion in 2020, and is projected to reach $823.75 billion by 2030, registering a CAGR of 18.2% from 2021 to 2030. Factors such as increase in demand for fuel-efficient, high-performance, & low-emission vehicles, stringent government rules & regulations toward vehicle emission along with reduction in cost of electric vehicle batteries and increasing fuel costs supplement growth of the market.

An electric vehicle operates on electricity unlike its counterpart, which runs on fuel. Instead of internal combustion engine, these vehicles run on an electric motor that requires constant supply of energy from batteries to operate. There are a variety of batteries used in these vehicles. These include lithium ion, molten salt, zinc-air, and various nickel-based designs. The electric vehicle was primarily designed to replace conventional ways of travel as they lead to environmental pollution. It has gained popularity, owing to numerous technological advancements. It outperforms conventional vehicles providing higher fuel economy, low carbon emission & maintenance, convenience of charging at home, smoother drive, and reduced sound from engine. There are three types of electric vehicles batteries, hybrid, and plug-in hybrid electric vehicles. In addition, electric vehicles require no engine oil changes but are slightly expensive than their gasoline equivalents.

Factors such as lack of charging infrastructure, high manufacturing cost, and range anxiety and serviceability are the factors expected to hamper growth of the EV market. Furthermore, factors such as technological advancements, proactive government initiatives and development of self-driving electric vehicle technology are expected to create ample opportunities for the key players operating in the electric vehicle market.

The global electric vehicle market is segmented on the basis of type, vehicle type, vehicle class, top speed, vehicle drive type, and region. By type, it is divided into battery electric vehicle (BEV), plug-in hybrid electric vehicle (PHEV), and fuel cell electric vehicle (FCEV). By vehicle type, it is classified into two-wheelers, passenger cars, and commercial vehicles. By vehicle class, it is classified into mid-priced and luxury class. On the basis of top speed, it is segmented into less than 100 MPH, 100 to 125 MPH, and more than 125 MPH. By vehicle drive type, it is segmented into front wheel drive, rear wheel drive, and all-wheel drive. By region, the market is analyzed across North, Europe, Asia-Pacific and LAMEA.

Asia-Pacific held the largest EV market share of the global electric vehicle industry in 2020. Higher adoption rates of smart mobility services, government regulations, increase in fuel prices, and rise in trend toward adopting non-fossil fuel-based vehicles boost growth of electric vehicles in developing countries such as India, China, and Indonesia, which create lucrative opportunities for the market in this region. Increase in vehicle population and rise in vehicle standards fuel growth of Asia-Pacific. Moreover, various technological advancements related to electric vehicles are taking place, owing to government initiatives, which further propels the market growth. In addition, countries such as China, India, Australia, and Japan are mainly focusing on environmental awareness and new technologies, which drive growth of high-performance electric vehicles.

Moreover, factors such as a significant rise in income levels & an increase in urbanization in emerging countries of Asia-Pacific are reliable engines of growth for the electric vehicle market. In addition, emission regulation & the subsidies for hybrid & electric vehicles in the Asia-Pacific region helped achieve a considerable portion of the overall EV market in Asia-Pacific. Passenger electric vehicles are gaining popularity among consumers by proactive participation of automotive OEMs. According to the IEA Global EV Outlook report, General Motors, Volkswagen, and others are intensifying their efforts in China & will be the leader in the 2030 market with holding shares of around 57%.

Currently, China is the leader in electric vehicle manufacturing and related infrastructures & technologies. The government of China has been implementing strict emission control rules to boost passenger and commercial electric vehicles on roads, therefore, it is expected to fuel demand for electric vehicles in China.

Norway is one of the fastest growing market for electric vehicles in Europe. Significant increasing adoption of electric vehicles in Norway owing to the environmental and growing fuel prices concern primarily driving the growth of market in country. For instance, according to report by CleanTechnica, plugin EV market share in October 2021 is at 89.3%, up from 79.1% in 2020. Also, according to Norwegian Road Foundation (OFV), overall new sales in Norway rose by 25% in 2021 to a record 176,276 cars, of which 65% were fully electric. This market share was up from 54% in 2020. Norway’s parliament has set a non-binding goal that by 2025 all the cars sold need to be zero emissions. This in turn, driving the growth of electric vehicle market in Norway.

Companies have adopted product development and product launch as their key development strategies in the electric vehicle market. The key players operating in this market are Ampere Vehicles, Benling India Energy and Technology Pvt Ltd, BMW AG, BYD Company Limited, Chevrolet Motor Company, Daimler AG, Energica Motor Company S.p.A., Ford Motor Company, General Motors, Hero Electric, Hyundai Motor Company, Karma Automotive, Kia Corporation, Lucid Group, Inc., Mahindra Electric Mobility Limited, NIO, Nissan Motors Co., Ltd., Okinawa Autotech Pvt. Ltd., Rivain, Tata Motors, Tesla, Inc., Toyota Motor Corporation, Volkswagen AG, WM Motor, and Xiaopeng Motors.

By Type

By Vehicle Class

By Top Speed

By Vehicle Drive Type

By Region

Key Players

|

Report Metric |

Details |

|

Report Name |

Electric Vehicle Market |

|

The Market size value in 2020 |

163.01 Billion USD |

|

The Revenue forecast in 2030 |

823.75 Billion USD |

|

Growth Rate |

CAGR of 18.2% |

|

Base year considered |

2020 |

|

Forecast period |

2021-2030 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, End-User, Offerings, and Region |

|

Report coverage |

Revenue & volume forecast, company share, competitive landscape, growth factors, and trends |

|

Geographic regions covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Companies covered |

Tesla, BMW Group, Nissan Motor Corporation, Toyota Motor Corporation, Volkswagen AG, General Motors, Daimler AG, Energica Motor Company S.p.A, BYD Company Motors, and Ford Motor, Others. |

Chapter 1 : INTRODUCTION

1.1.Report description

1.2.Key benefits for stakeholders

1.3.Key market segments

1.4.Research methodology

1.4.1.Primary research

1.4.2.Secondary research

1.4.3.Analyst tools and models

Chapter 2 : EXECUTIVE SUMMARY

2.1.CXO perspective

Chapter 3 : MARKET OVERVIEW

3.1.Market definition and scope

3.2.Key findings

3.2.1.Top impacting factors

3.2.2.Top investment pockets

3.2.3.Top winning strategies

3.3.Porter’s five forces analysis

3.3.1.Moderate-to-high bargaining power of suppliers

3.3.2.Moderate-to-high threat of new entrants

3.3.3.Moderate-to-high threat of substitutes

3.3.4.Moderate-to-High intensity of rivalry

3.3.5.Moderate bargaining power of buyers

3.4.Market share analysis, 2020 (%)

3.5.Market dynamics

3.5.1.Drivers

3.5.1.1.Increase in demand for fuel-efficient, high-performance, and low-emission vehicles

3.5.1.2.Stringent government rules and regulations towards vehicle emission

3.5.1.3.Reduction in cost of electric vehicle batteries

3.5.1.4.Increasing fuel costs

3.5.2.Restraints

3.5.2.1.Lack of charging infrastructure

3.5.2.2.High manufacturing cost

3.5.2.3.Range anxiety and serviceability

3.5.3.Opportunities

3.5.3.1.Technological advancements

3.5.3.2.Proactive government initiatives

3.5.3.3.Development of self-driving electric vehicle technology

3.6.Impact of COVID-19 on the market

3.6.1.Evolution of outbreaks

3.6.1.1.SARS

3.6.1.2.COVID-19

3.6.2.Micro-economic impact analysis

3.6.2.1.Consumer trend

3.6.2.2.Technology trends

3.6.2.3.Regulatory trend

3.6.3.Macro-economic impact analysis

3.6.3.1.GDP

3.6.3.2.Import/export analysis

3.6.3.3.Employment index

3.6.4.Impact on the electric vehicle industry analysis

3.7.Market evolution/Industry roadmap

3.8.Electric Vehicle Industry Value Chain

3.8.1.Raw materials and refinement

3.8.2.Component manufacturers

3.8.3.OEMs & Suppliers

3.8.4.EV charging infrastructure

3.8.5.Maintenance and repair

3.8.6.Reuse and recycle

3.9.Indian Electric Vehicle Infrastructure Market

3.9.1.Overview

3.9.2.Drivers

3.9.2.1.Rising Number of Initiatives and Investments Undertaken by Government Along With Private Players

3.9.2.2.Increasing Adoption of Battery Electric Vehicles Across the Country

3.9.3.Challenges

3.9.4.Recent Developments in Electric Vehicle Infrastructure Market in India

3.9.5.List of EV Infrastructure Providers in India

3.9.6.Is the Indian market consolidated or fragmented?

Chapter 4 : ELECTRIC VEHICLE MARKET, BY TYPE

4.1.Overview

4.2.BEV

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast, by region

4.2.3.Market analysis, by country

4.3.PHEV

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Market size and forecast, by region

4.3.3.Market analysis, by country

4.4.FCEV

4.4.1.Key market trends, growth factors, and opportunities

4.4.2.Market size and forecast, by region

4.4.3.Market analysis, by country

Chapter 5 : ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE

5.1.Overview

5.2.Two-Wheeler

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region

5.2.3.Market analysis, by country

5.3.Passenger Cars

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region

5.3.3.Market analysis, by country

5.4.Commercial Vehicles

5.4.1.Key market trends, growth factors, and opportunities

5.4.2.Market size and forecast, by region

5.4.3.Market analysis, by country

Chapter 6 : ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS

6.1.Overview

6.2.Mid-priced

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by region

6.2.3.Market analysis, by country

6.3.Luxury

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by region

6.3.3.Market analysis, by country

Chapter 7 : ELECTRIC VEHICLE MARKET, BY TOP SPEED

7.1.Overview

7.2.Less Than 100 MPH

7.2.1.Key market trends, growth factors, and opportunities

7.2.2.Market size and forecast, by region

7.2.3.Market analysis, by country

7.3.100 to 125 MPH

7.3.1.Key market trends, growth factors, and opportunities

7.3.2.Market size and forecast, by region

7.3.3.Market analysis, by country

7.4.More Than 125 MPH

7.4.1.Key market trends, growth factors, and opportunities

7.4.2.Market size and forecast, by region

7.4.3.Market analysis, by country

Chapter 8 : ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE

8.1.Overview

8.2.Front Wheel Drive

8.2.1.Key market trends, growth factors, and opportunities

8.2.2.Market size and forecast, by region

8.2.3.Market analysis, by country

8.3.Rear Wheel Drive

8.3.1.Key market trends, growth factors, and opportunities

8.3.2.Market size and forecast, by region

8.3.3.Market analysis, by country

8.4.All Wheel Drive

8.4.1.Key market trends, growth factors, and opportunities

8.4.2.Market size and forecast, by region

8.4.3.Market analysis, by country

Chapter 9 : ELECTRIC VEHICLE MARKET, BY REGION

9.1.Overview

9.2.North America

9.2.1.Key market trends, growth factors, and opportunities

9.2.2.Market size and forecast, by type

9.2.3.Market size and forecast, by vehicle type

9.2.4.Market size and forecast, by vehicle class

9.2.5.Market size and forecast, by top speed

9.2.6.Market size and forecast, by vehicle drive type

9.2.7.Market analysis by country

9.2.7.1.U.S.

9.2.7.1.1.Market size and forecast, by type

9.2.7.1.2.Market size and forecast, by vehicle type

9.2.7.1.3.Market size and forecast, by vehicle class

9.2.7.1.4.Market size and forecast, by top speed

9.2.7.1.5.Market size and forecast, by vehicle drive type

9.2.7.2.Canada

9.2.7.2.1.Market size and forecast, by type

9.2.7.2.2.Market size and forecast, by vehicle type

9.2.7.2.3.Market size and forecast, by vehicle class

9.2.7.2.4.Market size and forecast, by top speed

9.2.7.2.5.Market size and forecast, by vehicle drive type

9.2.7.3.Mexico

9.2.7.3.1.Market size and forecast, by type

9.2.7.3.2.Market size and forecast, by vehicle type

9.2.7.3.3.Market size and forecast, by vehicle class

9.2.7.3.4.Market size and forecast, by top speed

9.2.7.3.5.Market size and forecast, by vehicle drive type

9.3.Europe

9.3.1.Key market trends, growth factors, and opportunities

9.3.2.Market size and forecast, by type

9.3.3.Market size and forecast, by vehicle type

9.3.4.Market size and forecast, by vehicle class

9.3.5.Market size and forecast, by top speed

9.3.6.Market size and forecast, by vehicle drive type

9.3.7.Market analysis by country

9.3.7.1.UK

9.3.7.1.1.Market size and forecast, by type

9.3.7.1.2.Market size and forecast, by vehicle type

9.3.7.1.3.Market size and forecast, by vehicle class

9.3.7.1.4.Market size and forecast, by top speed

9.3.7.1.5.Market size and forecast, by vehicle drive type

9.3.7.2.Germany

9.3.7.2.1.Market size and forecast, by type

9.3.7.2.2.Market size and forecast, by vehicle type

9.3.7.2.3.Market size and forecast, by vehicle class

9.3.7.2.4.Market size and forecast, by top speed

9.3.7.2.5.Market size and forecast, by vehicle drive type

9.3.7.3.France

9.3.7.3.1.Market size and forecast, by type

9.3.7.3.2.Market size and forecast, by vehicle type

9.3.7.3.3.Market size and forecast, by vehicle class

9.3.7.3.4.Market size and forecast, by top speed

9.3.7.3.5.Market size and forecast, by vehicle drive type

9.3.7.4.Netherlands

9.3.7.4.1.Market size and forecast, by type

9.3.7.4.2.Market size and forecast, by vehicle type

9.3.7.4.3.Market size and forecast, by vehicle class

9.3.7.4.4.Market size and forecast, by top speed

9.3.7.4.5.Market size and forecast, by vehicle drive type

9.3.7.5.Norway

9.3.7.5.1.Market size and forecast, by type

9.3.7.5.2.Market size and forecast, by vehicle type

9.3.7.5.3.Market size and forecast, by vehicle class

9.3.7.5.4.Market size and forecast, by top speed

9.3.7.5.5.Market size and forecast, by vehicle drive type

9.3.7.6.Rest of Europe

9.3.7.6.1.Market size and forecast, by type

9.3.7.6.2.Market size and forecast, by vehicle type

9.3.7.6.3.Market size and forecast, by vehicle class

9.3.7.6.4.Market size and forecast, by top speed

9.3.7.6.5.Market size and forecast, by vehicle drive type

9.4.Asia-Pacific

9.4.1.Key market trends, growth factors, and opportunities

9.4.2.Market size and forecast, by type

9.4.3.Market size and forecast, by vehicle type

9.4.4.Market size and forecast, by vehicle class

9.4.5.Market size and forecast, by top speed

9.4.6.Market size and forecast, by vehicle drive type

9.4.7.Market analysis by country

9.4.7.1.China

9.4.7.1.1.Market size and forecast, by type

9.4.7.1.2.Market size and forecast, by vehicle type

9.4.7.1.3.Market size and forecast, by vehicle class

9.4.7.1.4.Market size and forecast, by top speed

9.4.7.1.5.Market size and forecast, by vehicle drive type

9.4.7.2.Japan

9.4.7.2.1.Market size and forecast, by type

9.4.7.2.2.Market size and forecast, by vehicle type

9.4.7.2.3.Market size and forecast, by vehicle class

9.4.7.2.4.Market size and forecast, by top speed

9.4.7.2.5.Market size and forecast, by vehicle drive type

9.4.7.3.India

9.4.7.3.1.Market size and forecast, by type

9.4.7.3.2.Market size and forecast, by vehicle type

9.4.7.3.3.Market size and forecast, by vehicle class

9.4.7.3.4.Market size and forecast, by top speed

9.4.7.3.5.Market size and forecast, by vehicle drive type

9.4.7.4.Singapore

9.4.7.4.1.Market size and forecast, by type

9.4.7.4.2.Market size and forecast, by vehicle type

9.4.7.4.3.Market size and forecast, by vehicle class

9.4.7.4.4.Market size and forecast, by top speed

9.4.7.4.5.Market size and forecast, by vehicle drive type

9.4.7.5.South Korea

9.4.7.5.1.Market size and forecast, by type

9.4.7.5.2.Market size and forecast, by vehicle type

9.4.7.5.3.Market size and forecast, by vehicle class

9.4.7.5.4.Market size and forecast, by top speed

9.4.7.5.5.Market size and forecast, by vehicle drive type

9.4.7.6.Rest of Asia-Pacific

9.4.7.6.1.Market size and forecast, by type

9.4.7.6.2.Market size and forecast, by vehicle type

9.4.7.6.3.Market size and forecast, by vehicle class

9.4.7.6.4.Market size and forecast, by top speed

9.4.7.6.5.Market size and forecast, by vehicle drive type

9.5.LAMEA

9.5.1.Key market trends, growth factors, and opportunities

9.5.2.Market size and forecast, by type

9.5.3.Market size and forecast, by vehicle type

9.5.4.Market size and forecast, by vehicle class

9.5.5.Market size and forecast, by top speed

9.5.6.Market size and forecast, by vehicle drive type

9.5.7.Market analysis by country

9.5.7.1.Latin America

9.5.7.1.1.Market size and forecast, by type

9.5.7.1.2.Market size and forecast, by vehicle type

9.5.7.1.3.Market size and forecast, by vehicle class

9.5.7.1.4.Market size and forecast, by top speed

9.5.7.1.5.Market size and forecast, by vehicle drive type

9.5.7.2.Middle East

9.5.7.2.1.Market size and forecast, by type

9.5.7.2.2.Market size and forecast, by vehicle type

9.5.7.2.3.Market size and forecast, by vehicle class

9.5.7.2.4.Market size and forecast, by top speed

9.5.7.2.5.Market size and forecast, by vehicle drive type

9.5.7.3.Africa

9.5.7.3.1.Market size and forecast, by type

9.5.7.3.2.Market size and forecast, by vehicle type

9.5.7.3.3.Market size and forecast, by vehicle class

9.5.7.3.4.Market size and forecast, by top speed

9.5.7.3.5.Market size and forecast, by vehicle drive type

Chapter 10 : COMPANY PROFILES

10.1.Ampere Vehicles

10.1.1.Company overview

10.1.2.Key executives

10.1.3.Company snapshot

10.1.4.Product portfolio

10.1.5.Key strategic moves and developments

10.2.BENLING INDIA ENERGY AND TECHNOLOGY PVT LTD

10.2.1.Company overview

10.2.2.Company snapshot

10.2.3.Product portfolio

10.3.BMW AG

10.3.1.Company overview

10.3.2.Key executives

10.3.3.Company snapshot

10.3.4.Operating business segments

10.3.5.Product portfolio

10.3.6.R&D expenditure

10.3.7.Business performance

10.3.8.Key strategic moves and developments

10.4.BYD COMPANY LIMITED

10.4.1.Company overview

10.4.2.Key executives

10.4.3.Company snapshot

10.4.4.Operating business segments

10.4.5.Product portfolio

10.4.6.R&D expenditure

10.4.7.Business performance

10.4.8.Key strategic moves and developments

10.5.Chevrolet Motor Company

10.5.1.Company overview

10.5.2.Key executives

10.5.3.Company snapshot

10.5.4.Product portfolio

10.5.5.Key strategic moves and developments

10.6.DAIMLER AG

10.6.1.Company overview

10.6.2.Key executives

10.6.3.Company snapshot

10.6.4.Operating business segments

10.6.5.Product portfolio

10.6.6.R&D expenditure

10.6.7.Business performance

10.6.8.Key strategic moves and developments

10.7.ENERGICA MOTOR COMPANY S. P. A

10.7.1.Company overview

10.7.2.Key executives

10.7.3.Company snapshot

10.7.4.Product portfolio

10.7.5.Business performance

10.7.6.Key strategic moves and developments

10.8.FORD MOTOR COMPANY

10.8.1.Company overview

10.8.2.Key executives

10.8.3.Company snapshot

10.8.4.Operating business segments

10.8.5.Product portfolio

10.8.6.R&D expenditure

10.8.7.Business performance

10.8.8.Key strategic moves and developments

10.9.GENERAL MOTORS

10.9.1.Company overview

10.9.2.Key executives

10.9.3.Company snapshot

10.9.4.Operating business segments

10.9.5.Product portfolio

10.9.6.R&D expenditure

10.9.7.Business performance

10.9.8.Key strategic moves and developments

10.10.Hero Electric

10.10.1.Company overview

10.10.2.Key executives

10.10.3.Company snapshot

10.10.4.Product portfolio

10.10.5.Key strategic moves and developments

10.11.HYUNDAI MOTOR COMPANY

10.11.1.Company overview

10.11.2.Key executives

10.11.3.Company snapshot

10.11.4.Operating business segments

10.11.5.Product portfolio

10.11.6.R&D expenditure

10.11.7.Business performance

10.11.8.Key strategic moves and developments

10.12.KARMA AUTOMOTIVE

10.12.1.Company overview

10.12.2.Key executives

10.12.3.Company snapshot

10.12.4.Product portfolio

10.12.5.Key strategic moves and developments

10.13.Kia Corporation

10.13.1.Company overview

10.13.2.Key executives

10.13.3.Company snapshot

10.13.4.Operating business segments

10.13.5.Product portfolio

10.13.6.R&D expenditure

10.13.7.Business performance

10.13.8.Key strategic moves and developments

10.14.Lucid Group, Inc.

10.14.1.Company overview

10.14.2.Key executives

10.14.3.Company snapshot

10.14.4.Product portfolio

10.14.5.Key strategic moves and developments

10.15.Mahindra Electric Mobility Limited

10.15.1.Company overview

10.15.2.Key executives

10.15.3.Company snapshot

10.15.4.Product portfolio

10.15.5.Key strategic moves and developments

10.16.NIO

10.16.1.Company overview

10.16.2.Key executives

10.16.3.Company snapshot

10.16.4.Operating business segments

10.16.5.Product portfolio

10.16.6.R&D expenditure

10.16.7.Business performance

10.16.8.Key strategic moves and developments

10.17.NISSAN MOTORS CO., LTD.

10.17.1.Company overview

10.17.2.Key executives

10.17.3.Company snapshot

10.17.4.Operating business segments

10.17.5.Product portfolio

10.17.6.R&D expenditure

10.17.7.Business performance

10.17.8.Key strategic moves and developments

10.18.Okinawa Autotech Pvt. Ltd.

10.18.1.Company overview

10.18.2.Key executives

10.18.3.Company snapshot

10.18.4.Product portfolio

10.18.5.Key strategic moves and developments

10.19.RIVIAN

10.19.1.Company overview

10.19.2.Key executives

10.19.3.Company snapshot

10.19.4.Product portfolio

10.19.5.Key strategic moves and developments

10.20.Tata Motors

10.20.1.Company overview

10.20.2.Key executives

10.20.3.Company snapshot

10.20.4.Product portfolio

10.20.5.Operating business segments

10.20.6.R&D expenditure

10.20.7.Business performance

10.20.8.Key strategic moves and developments

10.21.TESLA, INC.

10.21.1.Company overview

10.21.2.Key executives

10.21.3.Company snapshot

10.21.4.Operating business segments

10.21.5.Product portfolio

10.21.6.R&D expenditure

10.21.7.Business performance

10.21.8.Key strategic moves and developments

10.22.TOYOTA MOTOR CORPORATION

10.22.1.Company overview

10.22.2.Key executives

10.22.3.Company snapshot

10.22.4.Operating business segments

10.22.5.Product portfolio

10.22.6.R&D expenditure

10.22.7.Business performance

10.22.8.Key strategic moves and developments

10.23.VOLKSWAGEN AG

10.23.1.Company overview

10.23.2.Key executives

10.23.3.Company snapshot

10.23.4.Operating business segments

10.23.5.Product portfolio

10.23.6.R&D expenditure

10.23.7.Business performance

10.23.8.Key strategic moves and developments

10.24.WM MOTOR

10.24.1.Company overview

10.24.2.Key executives

10.24.3.Company snapshot

10.24.4.Product portfolio

10.24.5.Key strategic moves and developments

10.25.Xiaopeng Motors

10.25.1.Company overview

10.25.2.Key executives

10.25.3.Company snapshot

10.25.4.Operating business segments

10.25.5.Product portfolio

10.25.6.R&D expenditure

10.25.7.Business performance

10.25.8.Key strategic moves and developments

LIST OF TABLES

TABLE 01.RECENT DEVELOPMENTS IN ELECTRIC VEHICLE INFRASTRUCTURE MARKET IN INDIA

TABLE 02.LIST OF EV INFRASTRUCTURE PROVIDERS IN INDIA

TABLE 03.ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 04.ELECTRIC VEHICLE MARKET FOR BEV, BY REGION, 2020–2030 ($MILLION)

TABLE 05.ELECTRIC VEHICLE MARKET FOR PHEV, BY REGION, 2020–2030 ($MILLION)

TABLE 06.ELECTRIC VEHICLE MARKET FOR FCEV, BY REGION, 2020–2030 ($MILLION)

TABLE 07.ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 08.ELECTRIC VEHICLE MARKET FOR TWO-WHEELER, BY REGION, 2020–2030 ($MILLION)

TABLE 09.ELECTRIC VEHICLE MARKET FOR PASSENGER CARS, BY REGION, 2020–2030 ($MILLION)

TABLE 10.ELECTRIC VEHICLE MARKET FOR COMMERCIAL VEHICLES, BY REGION, 2020–2030 ($MILLION)

TABLE 11.ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 ($MILLION)

TABLE 12.ELECTRIC VEHICLE MARKET FOR MID-PRICED, BY REGION, 2020–2030 ($MILLION)

TABLE 13.ELECTRIC VEHICLE MARKET FOR LUXURY, BY REGION, 2020–2030 ($MILLION)

TABLE 14.ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 ($MILLION)

TABLE 15.ELECTRIC VEHICLE MARKET FOR LESS THAN 100 MPH, BY REGION, 2020–2030 ($MILLION)

TABLE 16.ELECTRIC VEHICLE MARKET FOR 100 TO 125 MPH, BY REGION, 2020–2030 ($MILLION)

TABLE 17.ELECTRIC VEHICLE MARKET FOR MORE THAN 125 MPH, BY REGION, 2020–2030 ($MILLION)

TABLE 18.ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2020–2030 ($MILLION)

TABLE 19.ELECTRIC VEHICLE MARKET FOR FRONT WHEEL DRIVE, BY REGION, 2020–2030 ($MILLION)

TABLE 20.ELECTRIC VEHICLE MARKET FOR REAR WHEEL DRIVE, BY REGION, 2020–2030 ($MILLION)

TABLE 21.ELECTRIC VEHICLE MARKET FOR ALL WHEEL DRIVE, BY REGION, 2020–2030 ($MILLION)

TABLE 22.NORTH AMERICA ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 23.NORTH AMERICA ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 24.NORTH AMERICA ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 ($MILLION)

TABLE 25.NORTH AMERICA ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 ($MILLION)

TABLE 26.NORTH AMERICA ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2020–2030 ($MILLION)

TABLE 27.U.S. ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 28.U.S. ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 29.U.S. ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 ($MILLION)

TABLE 30.U.S. ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 ($MILLION)

TABLE 31.U.S. ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2020–2030 ($MILLION)

TABLE 32.CANADA ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 33.CANADA ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 34.CANADA ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 ($MILLION)

TABLE 35.CANADA ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 ($MILLION)

TABLE 36.CANADA ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2020–2030 ($MILLION)

TABLE 37.MEXICO ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 38.MEXICO ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 39.MEXICO VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 ($MILLION)

TABLE 40.MEXICO ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 ($MILLION)

TABLE 41.MEXICO ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2020–2030 ($MILLION)

TABLE 42.EUROPE ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 43.EUROPE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 44.EUROPE ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 ($MILLION)

TABLE 45.EUROPE ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 ($MILLION)

TABLE 46.EUROPE ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2020–2030 ($MILLION)

TABLE 47.UK ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 48.UK ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 49.UK ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 ($MILLION)

TABLE 50.UK ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 ($MILLION)

TABLE 51.UK ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2020–2030 ($MILLION)

TABLE 52.GERMANY ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 53.GERMANY ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 54.GERMANY ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 ($MILLION)

TABLE 55.GERMANY ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 ($MILLION)

TABLE 56.GERMANY ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2020–2030 ($MILLION)

TABLE 57.FRANCE ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 58.FRANCE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 59.FRANCE VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 ($MILLION)

TABLE 60.FRANCE ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 ($MILLION)

TABLE 61.FRANCE ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2020–2030 ($MILLION)

TABLE 62.NETHERLANDS ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 63.NETHERLANDS ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 64.NETHERLANDS ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 ($MILLION)

TABLE 65.NETHERLANDS ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 ($MILLION)

TABLE 66.NETHERLANDS ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2020–2030 ($MILLION)

TABLE 67.NORWAY ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 68.NORWAY ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 69.NORWAY ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 ($MILLION)

TABLE 70.NORWAY ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 ($MILLION)

TABLE 71.NORWAY ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2020–2030 ($MILLION)

TABLE 72.REST OF EUROPE ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 73.REST OF EUROPE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 74.REST OF EUROPE VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 ($MILLION)

TABLE 75.REST OF EUROPE ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 ($MILLION)

TABLE 76.REST OF EUROPE ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2020–2030 ($MILLION)

TABLE 77.ASIA-PACIFIC ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 78.ASIA-PACIFIC ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 79.ASIA-PACIFIC ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 ($MILLION)

TABLE 80.ASIA-PACIFIC ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 ($MILLION)

TABLE 81.ASIA-PACIFIC ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2020–2030 ($MILLION)

TABLE 82.CHINA ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 83.CHINA ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 84.CHINA ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 ($MILLION)

TABLE 85.CHINA ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 ($MILLION)

TABLE 86.CHINA ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2020–2030 ($MILLION)

TABLE 87.JAPAN ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 88.JAPAN ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 89.JAPAN ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 ($MILLION)

TABLE 90.JAPAN ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 ($MILLION)

TABLE 91.JAPAN ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2020–2030 ($MILLION)

TABLE 92.INDIA ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 93.INDIA ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 94.INDIA VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 ($MILLION)

TABLE 95.INDIA ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 ($MILLION)

TABLE 96.INDIA ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2020–2030 ($MILLION)

TABLE 97.SINGAPORE ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 98.SINGAPORE ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 99.SINGAPORE ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 ($MILLION)

TABLE 100.SINGAPORE ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 ($MILLION)

TABLE 101.SINGAPORE ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2020–2030 ($MILLION)

TABLE 102.SOUTH KOREA ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 103.SOUTH KOREA ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 104.SOUTH KOREA ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 ($MILLION)

TABLE 105.SOUTH KOREA ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 ($MILLION)

TABLE 106.SOUTH KOREA ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2020–2030 ($MILLION)

TABLE 107.REST OF ASIA-PACIFIC ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 108.REST OF ASIA-PACIFIC ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 109.REST OF ASIA-PACIFIC VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 ($MILLION)

TABLE 110.REST OF ASIA-PACIFIC ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 ($MILLION)

TABLE 111.REST OF ASIA-PACIFIC ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2020–2030 ($MILLION)

TABLE 112.LAMEA ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 113.LAMEA ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 114.LAMEA ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 ($MILLION)

TABLE 115.LAMEA ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 ($MILLION)

TABLE 116.LAMEA ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2020–2030 ($MILLION)

TABLE 117.LATIN AMERICA ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 118.LATIN AMERICA ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 119.LATIN AMERICA ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 ($MILLION)

TABLE 120.LATIN AMERICA ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 ($MILLION)

TABLE 121.LATIN AMERICA ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2020–2030 ($MILLION)

TABLE 122.MIDDLE EAST ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 123.MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 124.MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 ($MILLION)

TABLE 125.MIDDLE EAST ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 ($MILLION)

TABLE 126.MIDDLE EAST ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2020–2030 ($MILLION)

TABLE 127.AFRICA ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 ($MILLION)

TABLE 128.AFRICA ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 ($MILLION)

TABLE 129.AFRICA VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 ($MILLION)

TABLE 130.AFRICA ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 ($MILLION)

TABLE 131.AFRICA ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVE TYPE, 2020–2030 ($MILLION)

TABLE 132.AMPERE VEHICLES: KEY EXECUTIVES

TABLE 133.AMPERE VEHICLES: COMPANY SNAPSHOT

TABLE 134.AMPERE VEHICLES: PRODUCT PORTFOLIO

TABLE 135.BENLING INDIA ENERGY AND TECHNOLOGY PVT LTD: COMPANY SNAPSHOT

TABLE 136.BENLING INDIA ENERGY AND TECHNOLOGY PVT LTD: PRODUCT PORTFOLIO

TABLE 137.BMW AG: KEY EXECUTIVES

TABLE 138.BMW AG: COMPANY SNAPSHOT

TABLE 139.BMW AG: OPERATING SEGMENTS

TABLE 140.BMW AG: PRODUCT PORTFOLIO

TABLE 141.BMW AG: R&D EXPENDITURE, 2018–2020 ($MILLION)

TABLE 142.BMW AG: NET SALES, 2018–2020 ($MILLION)

TABLE 143.BYD COMPANY LIMITED: KEY EXECUTIVES

TABLE 144.BYD COMPANY LIMITED: COMPANY SNAPSHOT

TABLE 145.BYD COMPANY LIMITED: OPERATING SEGMENTS

TABLE 146.BYD COMPANY LIMITED: PRODUCT PORTFOLIO

TABLE 147.BYD COMPANY LIMITED: R&D EXPENDITURE, 2018–2020 ($MILLION)

TABLE 148.BYD COMPANY LIMITED: NET SALES, 2018–2020 ($MILLION)

TABLE 149.CHEVROLET MOTOR COMPANY: KEY EXECUTIVES

TABLE 150.CHEVROLET MOTOR COMPANY: COMPANY SNAPSHOT

TABLE 151.CHEVROLET MOTOR COMPANY: PRODUCT PORTFOLIO

TABLE 152.DAIMLER AG: KEY EXECUTIVES

TABLE 153.DAIMLER AG: COMPANY SNAPSHOT

TABLE 154.DAIMLER AG: OPERATING SEGMENTS

TABLE 155.DAIMLER AG: PRODUCT PORTFOLIO

TABLE 156.DAIMLER AG: R&D EXPENDITURE, 2018–2020 ($MILLION)

TABLE 157.DAIMLER AG: NET SALES, 2018–2020 ($MILLION)

TABLE 158.ENERGICA MOTOR COMPANY S.P.A.: KEY EXECUTIVES

TABLE 159.ENERGICA MOTOR COMPANY S.P.A.: COMPANY SNAPSHOT

TABLE 160.ENERGICA MOTOR COMPANY S.P.A.: PRODUCT PORTFOLIO

TABLE 161.ENERGICA MOTOR COMPANY S.P.A.: NET SALES, 2018–2020 ($MILLION)

TABLE 162.FORD MOTOR COMPANY: KEY EXECUTIVES

TABLE 163.FORD MOTOR COMPANY: COMPANY SNAPSHOT

TABLE 164.FORD MOTOR COMPANY: OPERATING SEGMENTS

TABLE 165.FORD MOTOR COMPANY: PRODUCT PORTFOLIO

TABLE 166.FORD MOTOR COMPANY: R&D EXPENDITURE, 2018–2020 ($MILLION)

TABLE 167.FORD MOTOR COMPANY: NET SALES, 2018–2020 ($MILLION)

TABLE 168.GENERAL MOTORS: KEY EXECUTIVES

TABLE 169.GENERAL MOTORS: COMPANY SNAPSHOT

TABLE 170.GENERAL MOTORS: OPERATING SEGMENTS

TABLE 171.GENERAL MOTORS: PRODUCT PORTFOLIO

TABLE 172.GENERAL MOTORS: R&D EXPENDITURE, 2018–2020 ($MILLION)

TABLE 173.GENERAL MOTORS: R&D EXPENDITURE, 2018–2020 ($MILLION)

TABLE 174.GENERAL MOTORS: NET SALES, 2018–2020 ($MILLION)

TABLE 175.HERO ELECTRIC: KEY EXECUTIVES

TABLE 176.HERO ELECTRIC: COMPANY SNAPSHOT

TABLE 177.HERO ELECTRIC: PRODUCT PORTFOLIO

TABLE 178.HYUNDAI MOTOR COMPANY: KEY EXECUTIVES

TABLE 179.HYUNDAI MOTOR COMPANY: COMPANY SNAPSHOT

TABLE 180.HYUNDAI MOTOR COMPANY: OPERATING SEGMENTS

TABLE 181.HYUNDAI MOTOR COMPANY: PRODUCT PORTFOLIO

TABLE 182.HYUNDAI MOTOR COMPANY: R&D EXPENDITURE, 2018–2020 ($MILLION)

TABLE 183.HYUNDAI MOTOR COMPANY: NET SALES, 2018–2020 ($MILLION)

TABLE 184.KARMA AUTOMOTIVE: KEY EXECUTIVES

TABLE 185.KARMA AUTOMOTIVE: COMPANY SNAPSHOT

TABLE 186.KARMA AUTOMOTIVE: PRODUCT PORTFOLIO

TABLE 187.KIA CORPORATION: KEY EXECUTIVES

TABLE 188.KIA CORPORATION: COMPANY SNAPSHOT

TABLE 189.KIA CORPORATION: OPERATING SEGMENTS

TABLE 190.KIA CORPORATION: PRODUCT PORTFOLIO

TABLE 191.KIA CORPORATION: R&D EXPENDITURE, 2018–2020 ($MILLION)

TABLE 192.KIA CORPORATION: NET SALES, 2018–2020 ($MILLION)

TABLE 193.LUCID GROUP, INC.: KEY EXECUTIVES

TABLE 194.LUCID GROUP, INC.: COMPANY SNAPSHOT

TABLE 195.LUCID GROUP, INC.: PRODUCT PORTFOLIO

TABLE 196.MAHINDRA ELECTRIC MOBILITY LIMITED: KEY EXECUTIVES

TABLE 197.MAHINDRA ELECTRIC MOBILITY LIMITED: COMPANY SNAPSHOT

TABLE 198.MAHINDRA ELECTRIC MOBILITY LIMITED: PRODUCT PORTFOLIO

TABLE 199.NIO: KEY EXECUTIVES

TABLE 200.NIO: COMPANY SNAPSHOT

TABLE 201.NIO: OPERATING SEGMENTS

TABLE 202.NIO: PRODUCT PORTFOLIO

TABLE 203.NIO: R&D EXPENDITURE, 2018–2020 ($MILLION)

TABLE 204.NIO: NET SALES, 2018–2020 ($MILLION)

TABLE 205.NISSAN MOTORS CO., LTD.: KEY EXECUTIVE

TABLE 206.NISSAN MOTORS CO., LTD.: COMPANY SNAPSHOT

TABLE 207.NISSAN MOTORS CO., LTD.: OPERATING SEGMENTS

TABLE 208.NISSAN MOTORS CO., LTD.: PRODUCT PORTFOLIO

TABLE 209.NISSAN MOTORS CO., LTD.: R&D EXPENDITURE, 2018–2020 ($MILLION)

TABLE 210.NISSAN MOTORS CO., LTD.: NET SALES, 2018–2020 ($MILLION)

TABLE 211.OKINAWA AUTOTECH PVT. LTD.: KEY EXECUTIVES

TABLE 212.OKINAWA AUTOTECH PVT. LTD.: COMPANY SNAPSHOT

TABLE 213.OKINAWA AUTOTECH PVT. LTD.: PRODUCT PORTFOLIO

TABLE 214.RIVIAN: KEY EXECUTIVES

TABLE 215.RIVIAN: COMPANY SNAPSHOT

TABLE 216.RIVIAN: PRODUCT PORTFOLIO

TABLE 217.TATA MOTORS: KEY EXECUTIVES

TABLE 218.TATA MOTORS: COMPANY SNAPSHOT

TABLE 219.TATA MOTORS: PRODUCT PORTFOLIO

TABLE 220.TATA MOTORS.: OPERATING SEGMENTS

TABLE 221.TATA MOTORS.: R&D EXPENDITURE, 2018–2020 ($MILLION)

TABLE 222.TATA MOTORS.: NET SALES, 2018–2020 ($MILLION)

TABLE 223.TESLA, INC.: KEY EXECUTIVES

TABLE 224.TESLA, INC.: COMPANY SNAPSHOT

TABLE 225.TESLA, INC.: OPERATING SEGMENTS

TABLE 226.TESLA, INC.: PRODUCT PORTFOLIO

TABLE 227.TESLA, INC.: R&D EXPENDITURE, 2018–2020 ($MILLION)

TABLE 228.TESLA, INC.: NET SALES, 2018–2020 ($MILLION)

TABLE 229.TOYOTA MOTOR CORPORATION: KEY EXECUTIVES

TABLE 230.TOYOTA MOTOR CORPORATION: COMPANY SNAPSHOT

TABLE 231.TOYOTA MOTOR CORPORATION: OPERATING SEGMENTS

TABLE 232.TOYOTA MOTOR CORPORATION: PRODUCT PORTFOLIO

TABLE 233.TOYOTA MOTOR CORPORATION: R&D EXPENDITURE, 2018–2020 ($MILLION)

TABLE 234.TOYOTA MOTOR CORPORATION: NET SALES, 2018–2020 ($MILLION)

TABLE 235.VOLKSWAGEN AG: KEY EXECUTIVES

TABLE 236.VOLKSWAGEN AG: COMPANY SNAPSHOT

TABLE 237.VOLKSWAGEN AG: OPERATING SEGMENTS

TABLE 238.VOLKSWAGEN AG: PRODUCT PORTFOLIO

TABLE 239.VOLKSWAGEN AG: R&D EXPENDITURE, 2018–2020 ($MILLION)

TABLE 240.VOLKSWAGEN AG: NET SALES, 2018–2020 ($MILLION)

TABLE 241.WM MOTOR: KEY EXECUTIVES

TABLE 242.WM MOTOR: COMPANY SNAPSHOT

TABLE 243.WM MOTOR: PRODUCT PORTFOLIO

TABLE 244.XIAOPENG MOTORS: KEY EXECUTIVES

TABLE 245.XIAOPENG MOTORS: COMPANY SNAPSHOT

TABLE 246.XIAOPENG MOTORS: OPERATING SEGMENTS

TABLE 247.XIAOPENG MOTORS: PRODUCT PORTFOLIO

TABLE 248.XIAOPENG MOTORS: R&D EXPENDITURE, 2018–2020 ($MILLION)

TABLE 249.XIAOPENG MOTORS: NET SALES, 2018–2020 ($MILLION)

LIST OF FIGURES

FIGURE 01.KEY MARKET SEGMENTS

FIGURE 02.EXECUTIVE SUMMARY, BY SEGMENT

FIGURE 03.EXECUTIVE SUMMARY, BY REGION AND BY COUNTRY

FIGURE 04.TOP IMPACTING FACTORS

FIGURE 05.TOP INVESTMENT POCKETS

FIGURE 06.TOP WINNING STRATEGIES, BY YEAR, 2018-2021*

FIGURE 07.TOP WINNING STRATEGIES, BY DEVELOPMENT, 2018-2021*

FIGURE 08.TOP WINNING STRATEGIES, BY COMPANY, 2018-2021*

FIGURE 09.MARKET SHARE ANALYSIS, 2020 (%)

FIGURE 10.MARKET EVOLUTION/INDUSTRY ROADMAP

FIGURE 11.ELECTRIC VEHICLE INDUSTRY VALUE CHAIN

FIGURE 12.ELECTRIC VEHICLE MARKET, BY TYPE, 2020–2030 (%)

FIGURE 13.COMPARATIVE SHARE ANALYSIS OF ELECTRIC VEHICLE MARKET FOR BEV, BY COUNTRY, 2020 & 2030(%)

FIGURE 14.COMPARATIVE SHARE ANALYSIS OF ELECTRIC VEHICLE MARKET FOR PHEV, BY COUNTRY, 2020 & 2030(%)

FIGURE 15.COMPARATIVE SHARE ANALYSIS OF ELECTRIC VEHICLE MARKET FOR FCEV, BY COUNTRY, 2020 & 2030(%)

FIGURE 16.ELECTRIC VEHICLE MARKET, BY VEHICLE TYPE, 2020–2030 (%)

FIGURE 17.COMPARATIVE SHARE ANALYSIS OF ELECTRIC VEHICLE MARKET FOR TWO-WHEELER, BY COUNTRY, 2020 & 2030(%)

FIGURE 18.COMPARATIVE SHARE ANALYSIS OF ELECTRIC VEHICLE MARKET FOR PASSENGER CARS, BY COUNTRY, 2020 & 2030(%)

FIGURE 19.COMPARATIVE SHARE ANALYSIS OF ELECTRIC VEHICLE MARKET FOR COMMERCIAL VEHICLES, BY COUNTRY, 2020 & 2030(%)

FIGURE 20.ELECTRIC VEHICLE MARKET, BY VEHICLE CLASS, 2020–2030 (%)

FIGURE 21.COMPARATIVE SHARE ANALYSIS OF ELECTRIC VEHICLE MARKET FOR MID-PRICED, BY COUNTRY, 2020 & 2030(%)

FIGURE 22.COMPARATIVE SHARE ANALYSIS OF ELECTRIC VEHICLE MARKET FOR LUXURY, BY COUNTRY, 2020 & 2030(%)

FIGURE 23.ELECTRIC VEHICLE MARKET, BY TOP SPEED, 2020–2030 (%)

FIGURE 24.COMPARATIVE SHARE ANALYSIS OF ELECTRIC VEHICLE MARKET FOR LESS THAN 100 MPH, BY COUNTRY, 2020 & 2030(%)

FIGURE 25.COMPARATIVE SHARE ANALYSIS OF ELECTRIC VEHICLE MARKET FOR 100 TO 125 MPH, BY COUNTRY, 2020 & 2030(%)

FIGURE 26.COMPARATIVE SHARE ANALYSIS OF ELECTRIC VEHICLE MARKET FOR MORE THAN 125 MPH, BY COUNTRY, 2020 & 2030(%)

FIGURE 27.ELECTRIC VEHICLE MARKET, BY VEHICLE DRIVETYPE, 2020–2030 (%)

FIGURE 28.COMPARATIVE SHARE ANALYSIS OF ELECTRIC VEHICLE MARKET FOR FRONT WHEEL DRIVE, BY COUNTRY, 2020 & 2030(%)

FIGURE 29.COMPARATIVE SHARE ANALYSIS OF ELECTRIC VEHICLE MARKET FOR REAR WHEEL DRIVE, BY COUNTRY, 2020 & 2030(%)

FIGURE 30.COMPARATIVE SHARE ANALYSIS OF ELECTRIC VEHICLE MARKET FOR ALL WHEEL DRIVE, BY COUNTRY, 2020 & 2030(%)

FIGURE 31.ELECTRIC VEHICLE MARKET, BY REGION, 2020-2030 (%)

FIGURE 32.COMPARATIVE SHARE ANALYSIS OF ELECTRIC VEHICLE MARKET, BY COUNTRY, 2020–2030 (%)

FIGURE 33.U.S. ELECTRIC VEHICLE MARKET, 2020–2030 ($MILLION)

FIGURE 34.CANADA ELECTRIC VEHICLE MARKET, 2020–2030 ($MILLION)

FIGURE 35.MEXICO ELECTRIC VEHICLE MARKET, 2020–2030 ($MILLION)

FIGURE 36.COMPARATIVE SHARE ANALYSIS OF ELECTRIC VEHICLE MARKET, BY COUNTRY, 2020–2030 (%)

FIGURE 37.UK ELECTRIC VEHICLE MARKET, 2020–2030 ($MILLION)

FIGURE 38.GERMANY ELECTRIC VEHICLE MARKET, 2020–2030 ($MILLION)

FIGURE 39.FRANCE ELECTRIC VEHICLE MARKET, 2020–2030 ($MILLION)

FIGURE 40.NETHERLANDS ELECTRIC VEHICLE MARKET, 2020–2030 ($MILLION)

FIGURE 41.NORWAY ELECTRIC VEHICLE MARKET, 2020–2030 ($MILLION)

FIGURE 42.REST OF EUROPE ELECTRIC VEHICLE MARKET, 2020–2030 ($MILLION)

FIGURE 43.COMPARATIVE SHARE ANALYSIS OF ELECTRIC VEHICLE MARKET, BY COUNTRY, 2020–2030 (%)

FIGURE 44.CHINA ELECTRIC VEHICLE MARKET, 2020–2030 ($MILLION)

FIGURE 45.JAPAN ELECTRIC VEHICLE MARKET, 2020–2030 ($MILLION)

FIGURE 46.INDIA ELECTRIC VEHICLE MARKET, 2020–2030 ($MILLION)

FIGURE 47.SINGAPORE ELECTRIC VEHICLE MARKET, 2020–2030 ($MILLION)

FIGURE 48.SOUTH KOREA ELECTRIC VEHICLE MARKET, 2020–2030 ($MILLION)

FIGURE 49.REST OF ASIA-PACIFIC ELECTRIC VEHICLE MARKET, 2020–2030 ($MILLION)

FIGURE 50.COMPARATIVE SHARE ANALYSIS OF ELECTRIC VEHICLE MARKET, BY COUNTRY, 2020–2030 (%)

FIGURE 51.LATIN AMERICA ELECTRIC VEHICLE MARKET, 2020–2030 ($MILLION)

FIGURE 52.MIDDLE EAST ELECTRIC VEHICLE MARKET, 2020–2030 ($MILLION)

FIGURE 53.AFRICA ELECTRIC VEHICLE MARKET, 2020–2030 ($MILLION)

FIGURE 54.BMW AG: R&D EXPENDITURE, 2018–2020 ($MILLION)

FIGURE 55.BMW AG: NET SALES, 2018–2020 ($MILLION)

FIGURE 56.BMW AG: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 57.BMW AG: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 58.BYD COMPANY LIMITED: R&D EXPENDITURE, 2018–2020 ($MILLION)

FIGURE 59.BYD COMPANY LIMITED: NET SALES, 2018–2020 ($MILLION)

FIGURE 60.BYD COMPANY LIMITED: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 61.BYD COMPANY LIMITED: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 62.DAIMLER AG: R&D EXPENDITURE, 2018–2020 ($MILLION)

FIGURE 63.DAIMLER AG: NET SALES, 2018–2020 ($MILLION)

FIGURE 64.DAIMLER AG: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 65.DAIMLER AG: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 66.ENERGICA MOTOR COMPANY S.P.A.: NET SALES, 2018–2020 ($MILLION)

FIGURE 67.ENERGICA MOTOR COMPANY S.P.A.: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 68.FORD MOTOR COMPANY: R&D EXPENDITURE, 2018–2020 ($MILLION)

FIGURE 69.FORD MOTOR COMPANY: NET SALES, 2018–2020 ($MILLION)

FIGURE 70.FORD MOTOR COMPANY: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 71.FORD MOTOR COMPANY: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 72.GENERAL MOTORS: NET SALES, 2018–2020 ($MILLION)

FIGURE 73.GENERAL MOTORS: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 74.GENERAL MOTORS: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 75.HYUNDAI MOTOR COMPANY: R&D EXPENDITURE, 2018–2020 ($MILLION)

FIGURE 76.HYUNDAI MOTOR COMPANY: NET SALES, 2018–2020 ($MILLION)

FIGURE 77.HYUNDAI MOTOR COMPANY: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 78.HYUNDAI MOTOR COMPANY: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 79.KIA CORPORATION: R&D EXPENDITURE, 2018–2020 ($MILLION)

FIGURE 80.KIA CORPORATION: NET SALES, 2018–2020 ($MILLION)

FIGURE 81.KIA CORPORATION: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 82.KIA CORPORATION: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 83.NIO: R&D EXPENDITURE, 2018–2020 ($MILLION)

FIGURE 84.NIO: NET SALES, 2018–2020 ($MILLION)

FIGURE 85.NIO: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 86.NISSAN MOTORS CO., LTD.: R&D EXPENDITURE, 2018–2020 ($MILLION)

FIGURE 87.NISSAN MOTORS CO., LTD.: NET SALES, 2018–2020 ($MILLION)

FIGURE 88.NISSAN MOTORS CO., LTD.: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 89.NISSAN MOTORS CO., LTD.: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 90.TATA MOTORS.: R&D EXPENDITURE, 2018–2020 ($MILLION)

FIGURE 91.TATA MOTORS.: NET SALES, 2018–2020 ($MILLION)

FIGURE 92.TATA MOTORS.: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 93.TATA MOTORS.: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 94.TESLA, INC.: R&D EXPENDITURE, 2018–2020 ($MILLION)

FIGURE 95.TESLA, INC.: NET SALES, 2018–2020 ($MILLION)

FIGURE 96.TESLA, INC.: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 97.TESLA, INC.: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 98.TOYOTA MOTOR CORPORATION: R&D EXPENDITURE, 2018–2020 ($MILLION)

FIGURE 99.TOYOTA MOTOR CORPORATION: NET SALES, 2018–2020 ($MILLION)

FIGURE 100.TOYOTA MOTOR CORPORATION: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 101.TOYOTA MOTOR CORPORATION: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 102.VOLKSWAGEN AG: R&D EXPENDITURE, 2018–2020 ($MILLION)

FIGURE 103.VOLKSWAGEN AG: NET SALES, 2018–2020 ($MILLION)

FIGURE 104.VOLKSWAGEN AG: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 105.VOLKSWAGEN AG: REVENUE SHARE BY REGION, 2020 (%)

FIGURE 106.XIAOPENG MOTORS: R&D EXPENDITURE, 2018–2020 ($MILLION)

FIGURE 107.XIAOPENG MOTORS: NET SALES, 2018–2020 ($MILLION)

FIGURE 108.XIAOPENG MOTORS: REVENUE SHARE BY SEGMENT, 2020 (%)

$5769

$10995

HAVE A QUERY?

OUR CUSTOMER