The Canada financial guarantee market was valued at $1.32 billion in 2020, and is projected to reach $2.19 billion by 2028, growing at a CAGR of 7.3% from 2021 to 2028. Key drivers of the industry include growing international trade activities leading to cross-border transactions for various goods and services. The expansion of import-export trade in the region will boost the Canada financial guarantee market during the review period.

Technological advancements and lower risks related to financial transactions will boost the market growth in the coming years. However, growing trade wars and a lack of credit facilities for SMEs(Small and Medium Scale Enterprises) will hamper the market surge during the forecast period.

Global Trade expansion

International trade is increasing rapidly with free trade agreements providing early access to fast-growing markets. The participation of SMEs in global trade and diversification of businesses has benefited the Canadian economy. Backed by financial guarantees the seller gets assured of the payment delivery and the purchaser can negotiate favorable deal terms. Moreover leveraging the internet and other digital technologies have helped reduced storage time and transaction costs along with improved distribution networks. These factors will provide immense opportunities for the growth of the financial guarantee market.

Increasing Import-Export volume of goods

Canada’s import and export trade business is increasing rapidly. Cross-border exchange of goods and services is at a high. The industries contributing to the export growth are oil, gas extraction, aluminum, SUVs, light trucks, aircraft, engines, cars, automobiles, copper, phosphate, meat, beef, poultry, etc. Its key importers include gold, delivery trucks, cabbage, and aqueous paints. This necessitates the need for a strong financial guarantor for the smooth conduction of business activities. This in turn is expected to drive the growth of the financial guarantee market during the forecast period.

Innovations in the financial sector

Global trade practices and payments have augmented the need for digital technologies in financial institutions. This reduces risk, eliminates unnecessary documentation, and provides exposure to a new market for growth. Advanced systems such as APIs(Application Programming Interfaces), and Blockchain provide a secure server for sending payments without any currency exchange risks. These factors will fuel the demand for the financial guarantee market in the upcoming years.

Protectionism and lack of adequate financing facilities

The burgeoning trade wars and tariff barriers will create obstacles. In addition to it, small and medium-scale enterprises with low-profit margins are unable to gain the trust of banks. This creates hindrances in acquiring a guarantee as the scrutiny becomes tough. The difficulty in paying the service fees to financial institutions further adds to the problem. This in turn is expected to hinder the growth of the financial guarantee market during the review period.

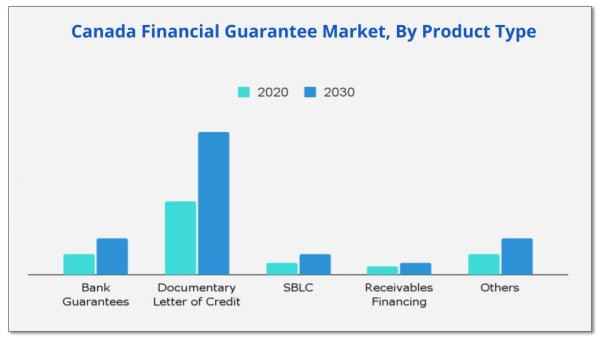

Based on type, the documentary letter of credit segment is expected to maintain dominance in the Canada financial guarantee market share during the forecast period.

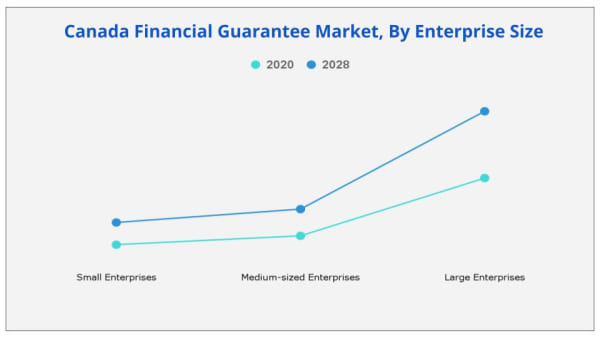

Based on enterprise size, the large enterprise segment will provide lucrative opportunities for growth in the financial guarantee market share. On the other hand, the small enterprises' segment will grow the fastest at a CAGR of 8.7% during the review period.

Based on end-users, the importers' segment will grow the highest in the financial guarantee market share owing to the growing import of goods from other countries and engaging in global transactions.

| Report Metric | Details |

| Report Name | Canada Financial Guarantee Market |

| The market size in 2020 | USD 1.32 billion |

| The revenue forecast in 2028 | USD 2.19 Billion |

| Growth Rate | CAGR of 7.3% |

| Market size available for years | 2021-2028 |

| Forecast units | Value (USD) |

| Segments covered | Type, Application, Industry, Regions |

| Report coverage | Revenue & volume forecast, company share, competitive landscape, growth factors, and trends |

| Geographic regions covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Ans. The Canada financial guarantee market was valued at $1.32 billion in 2020, and is projected to reach $2.19 billion by 2028, growing at a CAGR of 7.3% from 2021 to 2028.

Ans. Factors such as lowering the financial risks and technological advancements in the field of financing drives the growth of the Canada Financial Guarantee market

Ans. The key players profiled in the report include Scotia Bank, Toronto Dominion, Banque Nationale du Canada (National Bank of Canada), Banque de Montreal (Bank of Montreal), BNP Paribas, HSBC, Citibank, CIBC, Royal Bank of Canada, and Export Development Canada, and many more.

Ans. The forecast period for the Canada Financial Guarantee Market is 2021 to 2028.

Ans. The small-sized Enterprises segment will grow at a highest CAGR of 8.7% during 2021 - 2028.

Table of Content

CHAPTER 1: INTRODUCTION

1.1. REPORT DESCRIPTION

1.2. KEY MARKET SEGMENTS

1.3. KEY BENEFITS

1.4. RESEARCH METHODOLOGY

1.4.1. Primary research

1.4.2. Secondary research

1.4.3. Analyst tools and models

CHAPTER 2: EXECUTIVE SUMMARY

2.1. CXO PERSPECTIVE

CHAPTER 3: MARKET LANDSCAPE

3.1. MARKET DEFINITION AND SCOPE

3.2. KEY FINDINGS

3.2.1. Top investment pockets

3.2.2. Top winning strategies

3.3. PORTER'S FIVE FORCES ANALYSIS

3.3.1. Bargaining power of suppliers

3.3.2. Threat of new entrants

3.3.3. Threat of substitutes

3.3.4. Competitive rivalry

3.3.5. Bargaining power among buyers

3.4. MARKET DYNAMICS

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunities

3.5. COVID-19 IMPACT ANALYSIS

3.5.1. Impact on Canada financial guarantee market size

3.5.2. Change in traders trends, preferences, and budget impact due to

COVID-19

3.5.3. Regulatory framework for solving market challenges faced by

companies providing financial guarantee products & services

3.5.4. Economic impact on financial guarantee providers

3.5.6. Key player strategies to tackle negative impact in the industry

3.5.7. Opportunity analysis for companies providing a financial guarantee in the country

CHAPTER 4: CANADA FINANCIAL GUARANTEE MARKET BY TYPE

4.1. OVERVIEW

4.2. ADVANCE PAYMENT GUARANTEE

4.2.1. Key market trends, growth factors and opportunities

4.2.2. Market size and forecast,

4.3. BID/TENDER GUARANTEE

4.3.1. Key market trends, growth factors and opportunities

4.3.2. Market size and forecast,

4.4. WARRANTY GUARANTEE

4.4.1. Key market trends, growth factors and opportunities

4.4.2. Market size and forecast,

4.5. OTHERS

4.5.1. Key market trends, growth factors and opportunities

4.5.2. Market size and forecast,

CHAPTER 5: CANADA FINANCIAL GUARANTEE MARKET BY ENTERPRISE SIZE

5.1. OVERVIEW

5.2. SMALL ENTERPRISES

5.2.1. Key market trends, growth factors and opportunities

5.2.2. Market size and forecast,

5.3. MEDIUM-SIZED ENTERPRISES

5.3.1. Key market trends, growth factors and opportunities

5.3.2. Market size and forecast,

5.4. LARGE ENTERPRISES

5.4.1. Key market trends, growth factors and opportunities

5.4.2. Market size and forecast,

CHAPTER 6: COMPANY PROFILES

6.1. BNP PARIBAS

6.1.1. Company overview

6.1.2. Key Executives

6.1.3. Company snapshot

6.1.4. Operating business segments

6.1.5. Product portfolio

6.1.6. Business performance

6.1.7. Key strategic moves and developments

6.2. CITIGROUP INC.

6.2.1. Company overview

6.2.2. Key Executives

6.2.3. Company snapshot

6.2.4. Operating business segments

6.2.5. Product portfolio

6.2.6. Business performance

6.2.7. Key strategic moves and developments

6.3. EXPORT DEVELOPMENT CANADA

6.3.1. Company overview

6.3.2. Key Executives

6.3.3. Company snapshot

6.3.4. Operating business segments

6.3.5. Product portfolio

6.3.6. Business performance

6.3.7. Key strategic moves and developments

6.4. HABIB CANADIAN BANK

6.4.1. Company overview

6.4.2. Key Executives

6.4.3. Company snapshot

6.4.4. Operating business segments

6.4.5. Product portfolio

6.4.6. Business performance

6.4.7. Key strategic moves and developments

6.5. INDUSTRIAL AND COMMERCIAL BANK OF CHINA (CANADA)

6.5.1. Company overview

6.5.2. Key Executives

6.5.3. Company snapshot

6.5.4. Operating business segments

6.5.5. Product portfolio

6.5.6. Business performance

6.5.7. Key strategic moves and developments

6.6. ROYAL BANK OF CANADA

6.6.1. Company overview

6.6.2. Key Executives

6.6.3. Company snapshot

6.6.4. Operating business segments

6.6.5. Product portfolio

6.6.6. Business performance

6.6.7. Key strategic moves and developments

6.7. SCOTIABANK.COM

6.7.1. Company overview

6.7.2. Key Executives

6.7.3. Company snapshot

6.7.4. Operating business segments

6.7.5. Product portfolio

6.7.6. Business performance

6.7.7. Key strategic moves and developments

6.8. COMPANY 8

6.8.1. Company overview

6.8.2. Key Executives

6.8.3. Company snapshot

6.8.4. Operating business segments

6.8.5. Product portfolio

6.8.6. Business performance

6.8.7. Key strategic moves and developments

6.9. COMPANY 9

6.9.1. Company overview

6.9.2. Key Executives

6.9.3. Company snapshot

6.9.4. Operating business segments

6.9.5. Product portfolio

6.9.6. Business performance

6.9.7. Key strategic moves and developments

6.10. COMPANY 10

6.10.1. Company overview

6.10.2. Key Executives

6.10.3. Company snapshot

6.10.4. Operating business segments

6.10.5. Product portfolio

6.10.6. Business performance

6.10.7. Key strategic moves and developments

List of Tables & Figures

Table 1. Canada Financial Guarantee Market, By Type 2020-2028 ($Million)

Table 2. Canada Financial Guarantee Market, By Enterprise Size 2020-2028 ($Million)

Table 3. Canada Financial Guarantee Market For , 2020-2028 ($Million)

Table 4. Bnp Paribas: Company Snapshot

Table 5. Bnp Paribas: Operating Segments

Table 6. Citigroup Inc.: Company Snapshot

Table 7. Citigroup Inc.: Operating Segments

Table 8. Export Development Canada: Company Snapshot

Table 9. Export Development Canada: Operating Segments

Table 10. Habib Canadian Bank : Company Snapshot

Table 11. Habib Canadian Bank : Operating Segments

Table 12. Industrial And Commercial Bank Of China (Canada) : Company Snapshot

Table 13. Industrial And Commercial Bank Of China (Canada) : Operating Segments

Table 14. Royal Bank Of Canada: Company Snapshot

Table 15. Royal Bank Of Canada: Operating Segments

Table 16. Scotiabank.Com: Company Snapshot

Table 17. Scotiabank.Com: Operating Segments

Table 18. Company 8: Company Snapshot

Table 19. Company 8: Operating Segments

Table 20. Company 9: Company Snapshot

Table 21. Company 9: Operating Segments

Table 22. Company 10: Company Snapshot

Table 23. Company 10: Operating Segments

List Of Figures

Figure 1. Canada Financial Guarantee Market Segmentation

Figure 2. Top Investment Pocket

Figure 3. Top Winning Strategies (%)

Figure 4. Canada Financial Guarantee Market For Advance Payment Guarantee, 2020-2028 ($Million)

Figure 5. Canada Financial Guarantee Market For Bid/Tender Guarantee, 2020-2028 ($Million)

Figure 6. Canada Financial Guarantee Market For Warranty Guarantee, 2020-2028 ($Million)

Figure 7. Canada Financial Guarantee Market For Others, 2020-2028 ($Million)

Figure 8. Canada Financial Guarantee Market For Small Enterprises, 2020-2028 ($Million)

Figure 9. Canada Financial Guarantee Market For Medium-sized Enterprises, 2020-2028 ($Million)

Figure 10. Canada Financial Guarantee Market For Large Enterprises, 2020-2028 ($Million)

$5570

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS