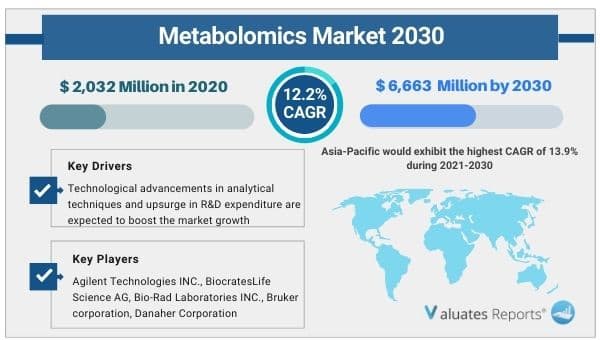

The global metabolomics market size was valued at USD 2,032 Million in 2020, and is projected to reach USD 6,663 Million by 2030, registering a CAGR of 12.2% from 2021 to 2030. Key drivers of the metabolomics market include the growing importance of precision medicine for the early diagnosis of chronic diseases. The surge in technological advancements in metabolomics analysis techniques and R&D spending will propel the metabolomics market ahead in the upcoming years.

Further, the covid 19 outbreak and biomarker discovery processes will increase the market penetration during the forecast period. However, the high cost of medical devices and shortage of skilled medical professionals will hinder the market growth in the forecasted period.

Personalized medication

Metabolomics is playing a prominent part in the development of precision medicines through customized phenotyping and individual drug responses. Several chronic diseases such as Alzheimer’s, diabetes, and cancer are being studied for identifying novel therapeutic approaches. This is being done through phenotyping tumors and personal cancer cell therapies. It also helps in the quicker screening of drugs, faster clinical trials, and quick drug discovery through efficient patient selection. These factors will fuel the growth of the metabolomics market during the review period.

Rapid innovations

In the last couple of years, numerous technologies have been developed for biomedical research and for determining the changes in metabolite levels. Mass spectrometers, chromatography, gas or liquid chromatography, and capillary electrophoresis are a combination of techniques used extensively for screening biomarkers and metabolites. They identify high-resolution individual molecular pieces. Moreover, pharmaceutical R&D spending is expected to rise in the coming years as target therapies take center stage in the medical sector. These events will ultimately surge the growth of the metabolomics market during the forecast period.

Pandemic impact

Covid 19 has augmented the need for metabolomics study. Mass-spectrometry techniques are being used to identify specific spectral patterns in nasopharyngeal swab specimens of covid infected patients. Moreover, active studies are going on for metabolomics-based prognostic markers to be used in serum and plasma specimens. This will save diagnosis time and enable large-scale screening of the population in healthcare settings. Biomarker discovery will further enhance the process. This in turn will drive the growth of the metabolomics market during the review period.

Restrain:

The metabolomic analysis is based on a combination of analytic tools for achieving higher accuracy and data. Hence one has to invest in multiple types of equipment for setting up their own laboratory. The additional maintenance cost is way too expensive and out of reach for many people. In addition to it, there is a dearth of good quality professionals for data management and handling purposes. This will create restrictions for the metabolomics market in the future.

Based on application, the bioinformatics tools, and services segment is expected to witness considerable growth in the metabolomics market share due to rapid utilization for study and research. Based on application, the biomarker discovery segment will grow the highest in the metabolomics market share due to the rise of personalized medication, patient health status monitoring, and R&D initiatives. Based on indication, the cancer segment will be the dominating factor in the metabolomics market share due to its extensive application in cancer therapies.

Based on region, North America is expected to provide lucrative opportunities for growth in the metabolomics market share due to the presence of big pharmaceutical players and rising biomedical research.

|

Report Metric |

Details |

|

Report Name |

Metabolomics Market |

|

Market size value in 2020 |

USD 2,032 Million |

|

Revenue forecast in 2030 |

USD 6,663 Million |

|

Growth Rate |

12.2% |

|

Base year considered |

2020 |

|

Forecast Period |

2021-2030 |

|

By Products and Services |

Metabolomics Instruments and Metabolomics Bioinformatics Tools & Service |

|

By Application |

Biomarker Discovery, Drug Discovery, Toxicology Testing, Nutrigenomics, Functional Genomics, Personalized Medicine |

|

Report Coverage |

Revenue & volume forecast, company share, competitive landscape, growth factors, and trends |

|

Segments Covered |

By Type, Application, and Region |

|

Geographic Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Ans. The global metabolomics market size was valued at $2,032 Million in 2020, and is projected to reach $6,663 Million by 2030, registering a CAGR of 12.2% from 2021 to 2030.

Ans. The key players operating in the global Metabolomics market include Agilent Technologies INC., BiocratesLife Science AG, Bio-Rad Laboratories INC., Bruker corporation, Danaher Corporation

Ans. Yes, the report includes a COVID-19 impact analysis. Also, it is further extended into every individual segment of the report.

LIST OF TABLES

TABLE 1.GLOBAL METABOLOMICS MARKET, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 2.GLOBAL METABOLOMICS MARKET FOR METABOLOMICS INSTRUMENTS, BY REGION, 2020-2030 ($MILLION)

TABLE 3.GLOBAL METABOLOMICS MARKET FOR METABOLOMICS BIOINFORMATICS TOOLS AND SERVICES, BY REGION, 2020-2030 ($MILLION)

TABLE 4.GLOBAL METABOLOMICS MARKET, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 5.GLOBAL METABOLOMICS MARKET FOR BIOMARKER DISCOVERY, BY REGION, 2020-2030 ($MILLION)

TABLE 6.GLOBAL METABOLOMICS MARKET FOR DRUG DISCOVERY, BY REGION, 2020-2030 ($MILLION)

TABLE 7.GLOBAL METABOLOMICS MARKET FOR TOXICOLOGY TESTING, BY REGION, 2020-2030 ($MILLION)

TABLE 8.GLOBAL METABOLOMICS MARKET FOR NUTRIGENOMICS, BY REGION, 2020-2030 ($MILLION)

TABLE 9.GLOBAL METABOLOMICS MARKET FOR FUNCTIONAL GENOMICS, BY REGION, 2020-2030 ($MILLION)

TABLE 10.GLOBAL METABOLOMICS MARKET FOR PERSONALIZED MEDICINE, BY REGION, 2020-2030 ($MILLION)

TABLE 11.GLOBAL METABOLOMICS MARKET FOR OTHER APPLICATIONS, BY REGION, 2020-2030 ($MILLION)

TABLE 12.GLOBAL METABOLOMICS MARKET, BY INDICATION, 2020-2030 ($MILLION)

TABLE 13.GLOBAL METABOLOMICS MARKET FOR CANCER, BY REGION, 2020-2030 ($MILLION)

TABLE 14.GLOBAL METABOLOMICS MARKET FOR CARDIOVASCULAR DISORDERS, BY REGION, 2020-2030 ($MILLION)

TABLE 15.GLOBAL METABOLOMICS MARKET FOR NEUROLOGICAL DISORDERS, BY REGION, 2020-2030 ($MILLION)

TABLE 16.GLOBAL METABOLOMICS MARKET FOR INBORN ERRORS OF METABOLISM, BY REGION, 2020-2030 ($MILLION)

TABLE 17.GLOBAL METABOLOMICS MARKET FOR OTHER INDICATIONS, BY REGION, 2020-2030 ($MILLION)

TABLE 18.GLOBAL METABOLOMICS MARKET, BY REGION, 2020-2030 ($MILLION)

TABLE 19.NORTH AMERICA METABOLOMICS, BY Region, 2020-2030 ($MILLION)

TABLE 20.NORTH AMERICA METABOLOMICS, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 21.NORTH AMERICA METABOLOMICS, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 22.NORTH AMERICA METABOLOMICS, BY INDICATION, 2020-2030 ($MILLION)

TABLE 23.UNITED STATES METABOLOMICS, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 24.UNITED STATES METABOLOMICS, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 25.UNITED STATES METABOLOMICS, BY INDICATION, 2020-2030 ($MILLION)

TABLE 26.CANADA METABOLOMICS, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 27.CANADA METABOLOMICS, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 28.CANADA METABOLOMICS, BY INDICATION, 2020-2030 ($MILLION)

TABLE 29.MEXICO METABOLOMICS, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 30.MEXICO METABOLOMICS, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 31.MEXICO METABOLOMICS, BY INDICATION, 2020-2030 ($MILLION)

TABLE 32.EUROPE METABOLOMICS, BY Region, 2020-2030 ($MILLION)

TABLE 33.EUROPE METABOLOMICS, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 34.EUROPE METABOLOMICS, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 35.EUROPE METABOLOMICS, BY INDICATION, 2020-2030 ($MILLION)

TABLE 36.GERMANY METABOLOMICS, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 37.GERMANY METABOLOMICS, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 38.GERMANY METABOLOMICS, BY INDICATION, 2020-2030 ($MILLION)

TABLE 39.FRANCE METABOLOMICS, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 40.FRANCE METABOLOMICS, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 41.FRANCE METABOLOMICS, BY INDICATION, 2020-2030 ($MILLION)

TABLE 42.UK METABOLOMICS, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 43.UK METABOLOMICS, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 44.UK METABOLOMICS, BY INDICATION, 2020-2030 ($MILLION)

TABLE 45.ITALY METABOLOMICS, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 46.ITALY METABOLOMICS, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 47.ITALY METABOLOMICS, BY INDICATION, 2020-2030 ($MILLION)

TABLE 48.SPAIN METABOLOMICS, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 49.SPAIN METABOLOMICS, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 50.SPAIN METABOLOMICS, BY INDICATION, 2020-2030 ($MILLION)

TABLE 51.REST OF EUROPE METABOLOMICS, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 52.REST OF EUROPE METABOLOMICS, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 53.REST OF EUROPE METABOLOMICS, BY INDICATION, 2020-2030 ($MILLION)

TABLE 54.ASIA-PACIFIC METABOLOMICS, BY Region, 2020-2030 ($MILLION)

TABLE 55.ASIA-PACIFIC METABOLOMICS, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 56.ASIA-PACIFIC METABOLOMICS, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 57.ASIA-PACIFIC METABOLOMICS, BY INDICATION, 2020-2030 ($MILLION)

TABLE 58.JAPAN METABOLOMICS, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 59.JAPAN METABOLOMICS, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 60.JAPAN METABOLOMICS, BY INDICATION, 2020-2030 ($MILLION)

TABLE 61.CHINA METABOLOMICS, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 62.CHINA METABOLOMICS, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 63.CHINA METABOLOMICS, BY INDICATION, 2020-2030 ($MILLION)

TABLE 64.AUSTRALIA METABOLOMICS, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 65.AUSTRALIA METABOLOMICS, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 66.AUSTRALIA METABOLOMICS, BY INDICATION, 2020-2030 ($MILLION)

TABLE 67.INDIA METABOLOMICS, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 68.INDIA METABOLOMICS, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 69.INDIA METABOLOMICS, BY INDICATION, 2020-2030 ($MILLION)

TABLE 70.SOUTH KOREA METABOLOMICS, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 71.SOUTH KOREA METABOLOMICS, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 72.SOUTH KOREA METABOLOMICS, BY INDICATION, 2020-2030 ($MILLION)

TABLE 73.REST OF ASIA-PACIFIC METABOLOMICS, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 74.REST OF ASIA-PACIFIC METABOLOMICS, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 75.REST OF ASIA-PACIFIC METABOLOMICS, BY INDICATION, 2020-2030 ($MILLION)

TABLE 76.LAMEA METABOLOMICS, BY Region, 2020-2030 ($MILLION)

TABLE 77.LAMEA METABOLOMICS, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 78.LAMEA METABOLOMICS, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 79.LAMEA METABOLOMICS, BY INDICATION, 2020-2030 ($MILLION)

TABLE 80.BRAZIL METABOLOMICS, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 81.BRAZIL METABOLOMICS, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 82.BRAZIL METABOLOMICS, BY INDICATION, 2020-2030 ($MILLION)

TABLE 83.SAUDI ARABIA METABOLOMICS, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 84.SAUDI ARABIA METABOLOMICS, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 85.SAUDI ARABIA METABOLOMICS, BY INDICATION, 2020-2030 ($MILLION)

TABLE 86.SOUTH AFRICA METABOLOMICS, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 87.SOUTH AFRICA METABOLOMICS, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 88.SOUTH AFRICA METABOLOMICS, BY INDICATION, 2020-2030 ($MILLION)

TABLE 89.REST OF LAMEA METABOLOMICS, BY PRODUCT AND SERVICES, 2020-2030 ($MILLION)

TABLE 90.REST OF LAMEA METABOLOMICS, BY APPLICATION, 2020-2030 ($MILLION)

TABLE 91.REST OF LAMEA METABOLOMICS, BY INDICATION, 2020-2030 ($MILLION)

TABLE 92.AGILENT TECHNOLOGIES, INC.: KEY EXECUTIVES

TABLE 93.AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT

TABLE 94.AGILENT TECHNOLOGIES, INC.: OPERATING SEGMENTS

TABLE 95.AGILENT TECHNOLOGIES, INC.: PRODUCT PORTFOLIO

TABLE 96.AGILENT TECHNOLOGIES, INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 97.DANAHER CORPORATION: KEY EXECUTIVES

TABLE 98.DANAHER CORPORATION: COMPANY SNAPSHOT

TABLE 99.DANAHER CORPORATION: OPERATING SEGMENTS

TABLE 100.DANAHER CORPORATION: PRODUCT PORTFOLIO

TABLE 101.DANAHER CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102.BIOCRATES LIFE SCIENCES AG: KEY EXECUTIVES

TABLE 103.BIOCRATES LIFE SCIENCES AG: COMPANY SNAPSHOT

TABLE 104.BIOCRATES LIFE SCIENCES AG: OPERATING SEGMENTS

TABLE 105.BIOCRATES LIFE SCIENCES AG: PRODUCT PORTFOLIO

TABLE 106.BIOCRATES LIFE SCIENCES AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 107.BRUKER CORPORATION: KEY EXECUTIVES

TABLE 108.BRUKER CORPORATION: COMPANY SNAPSHOT

TABLE 109.BRUKER CORPORATION: OPERATING SEGMENTS

TABLE 110.BRUKER CORPORATION: PRODUCT PORTFOLIO

TABLE 111.BRUKER CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 112.LECO CORPORATION: KEY EXECUTIVES

TABLE 113.LECO CORPORATION: COMPANY SNAPSHOT

TABLE 114.LECO CORPORATION: OPERATING SEGMENTS

TABLE 115.LECO CORPORATION: PRODUCT PORTFOLIO

TABLE 116.LECO CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 117.METABOLON, INC.: KEY EXECUTIVES

TABLE 118.METABOLON, INC.: COMPANY SNAPSHOT

TABLE 119.METABOLON, INC.: OPERATING SEGMENTS

TABLE 120.METABOLON, INC.: PRODUCT PORTFOLIO

TABLE 121.METABOLON, INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 122.HUMAN METABOLOME TECHNOLOGIES, INC.: KEY EXECUTIVES

TABLE 123.HUMAN METABOLOME TECHNOLOGIES, INC.: COMPANY SNAPSHOT

TABLE 124.HUMAN METABOLOME TECHNOLOGIES, INC.: OPERATING SEGMENTS

TABLE 125.HUMAN METABOLOME TECHNOLOGIES, INC.: PRODUCT PORTFOLIO

TABLE 126.HUMAN METABOLOME TECHNOLOGIES, INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 127.BIO-RAD LABORATORIES, INC.: KEY EXECUTIVES

TABLE 128.BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT

TABLE 129.BIO-RAD LABORATORIES, INC.: OPERATING SEGMENTS

TABLE 130.BIO-RAD LABORATORIES, INC.: PRODUCT PORTFOLIO

TABLE 131.BIO-RAD LABORATORIES, INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 132.SHIMADZU CORPORATION: KEY EXECUTIVES

TABLE 133.SHIMADZU CORPORATION: COMPANY SNAPSHOT

TABLE 134.SHIMADZU CORPORATION: OPERATING SEGMENTS

TABLE 135.SHIMADZU CORPORATION: PRODUCT PORTFOLIO

TABLE 136.SHIMADZU CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 137.WATERS CORPORATION: KEY EXECUTIVES

TABLE 138.WATERS CORPORATION: COMPANY SNAPSHOT

TABLE 139.WATERS CORPORATION: OPERATING SEGMENTS

TABLE 140.WATERS CORPORATION: PRODUCT PORTFOLIO

TABLE 141.WATERS CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 1.GLOBAL METABOLOMICS MARKET SEGMENTATION

FIGURE 2.GLOBAL METABOLOMICS MARKET

FIGURE 3.SEGMENTATION METABOLOMICS MARKET

FIGURE 4.TOP INVESTMENT POCKET IN METABOLOMICS MARKET

FIGURE 5.TOP WINNING STRATEGIES, 2019-2021*

FIGURE 6.TOP WINNING STRATEGIES, BY DEVELOPMENT, 2019-2021(%)

FIGURE 7.TOP WINNING STRATEGIES, BY COMPANY, 2019-2021*

FIGURE 8.MODERATE BARGAINING POWER OF BUYERS

FIGURE 9.MODERATE BARGAINING POWER OF SUPPLIERS

FIGURE 10.MODERATE THREAT OF NEW ENTRANTS

FIGURE 11.LOW THREAT OF SUBSTITUTION

FIGURE 12.HIGH COMPETITIVE RIVALRY

FIGURE 13.TOP PLAYER POSITIONING, 2020

FIGURE 14.MARKET SHARE ANALYSIS, 2020

FIGURE 15.RESTRAINTS AND DRIVERS: METABOLOMICS MARKET

FIGURE 16.METABOLOMICS MARKET SEGMENTATION, BY PRODUCT AND SERVICES

FIGURE 17.METABOLOMICS MARKET FOR METABOLOMICS INSTRUMENTS, BY COUNTRY, 2020-2030 ($MILLION)

FIGURE 18.METABOLOMICS MARKET FOR METABOLOMICS BIOINFORMATICS TOOLS AND SERVICES, BY COUNTRY, 2020-2030 ($MILLION)

FIGURE 19.METABOLOMICS MARKET SEGMENTATION, BY APPLICATION

FIGURE 20.METABOLOMICS MARKET FOR BIOMARKER DISCOVERY, BY COUNTRY, 2020-2030 ($MILLION)

FIGURE 21.METABOLOMICS MARKET FOR DRUG DISCOVERY, BY COUNTRY, 2020-2030 ($MILLION)

FIGURE 22.METABOLOMICS MARKET FOR TOXICOLOGY TESTING, BY COUNTRY, 2020-2030 ($MILLION)

FIGURE 23.METABOLOMICS MARKET FOR NUTRIGENOMICS, BY COUNTRY, 2020-2030 ($MILLION)

FIGURE 24.METABOLOMICS MARKET FOR FUNCTIONAL GENOMICS, BY COUNTRY, 2020-2030 ($MILLION)

FIGURE 25.METABOLOMICS MARKET FOR PERSONALIZED MEDICINE, BY COUNTRY, 2020-2030 ($MILLION)

FIGURE 26.METABOLOMICS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020-2030 ($MILLION)

FIGURE 27.METABOLOMICS MARKET SEGMENTATION, BY INDICATION

FIGURE 28.METABOLOMICS MARKET FOR CANCER, BY COUNTRY, 2020-2030 ($MILLION)

FIGURE 29.METABOLOMICS MARKET FOR CARDIOVASCULAR DISORDERS, BY COUNTRY, 2020-2030 ($MILLION)

FIGURE 30.METABOLOMICS MARKET FOR NEUROLOGICAL DISORDERS, BY COUNTRY, 2020-2030 ($MILLION)

FIGURE 31.METABOLOMICS MARKET FOR INBORN ERRORS OF METABOLISM, BY COUNTRY, 2020-2030 ($MILLION)

FIGURE 32.METABOLOMICS MARKET FOR OTHER INDICATIONS, BY COUNTRY, 2020-2030 ($MILLION)

FIGURE 33.AGILENT TECHNOLOGIES, INC.: NET SALES, 2018-2020 ($MILLION)

FIGURE 34.AGILENT TECHNOLOGIES, INC.: REVENUE SHARE, BY SEGMENT, 2020 (%)

FIGURE 35.AGILENT TECHNOLOGIES, INC.: REVENUE SHARE, BY REGION, 2020 (%)

FIGURE 36.DANAHER CORPORATION: NET SALES, 2018-2020 ($MILLION)

FIGURE 37.DANAHER CORPORATION: REVENUE SHARE, BY SEGMENT, 2020 (%)

FIGURE 38.DANAHER CORPORATION: REVENUE SHARE, BY REGION, 2020 (%)

FIGURE 39.BIOCRATES LIFE SCIENCES AG: NET SALES, 2018-2020 ($MILLION)

FIGURE 40.BIOCRATES LIFE SCIENCES AG: REVENUE SHARE, BY SEGMENT, 2020 (%)

FIGURE 41.BIOCRATES LIFE SCIENCES AG: REVENUE SHARE, BY REGION, 2020 (%)

FIGURE 42.BRUKER CORPORATION: NET SALES, 2018-2020 ($MILLION)

FIGURE 43.BRUKER CORPORATION: REVENUE SHARE, BY SEGMENT, 2020 (%)

FIGURE 44.BRUKER CORPORATION: REVENUE SHARE, BY REGION, 2020 (%)

FIGURE 45.LECO CORPORATION: NET SALES, 2018-2020 ($MILLION)

FIGURE 46.LECO CORPORATION: REVENUE SHARE, BY SEGMENT, 2020 (%)

FIGURE 47.LECO CORPORATION: REVENUE SHARE, BY REGION, 2020 (%)

FIGURE 48.METABOLON, INC.: NET SALES, 2018-2020 ($MILLION)

FIGURE 49.METABOLON, INC.: REVENUE SHARE, BY SEGMENT, 2020 (%)

FIGURE 50.METABOLON, INC.: REVENUE SHARE, BY REGION, 2020 (%)

FIGURE 51.HUMAN METABOLOME TECHNOLOGIES, INC.: NET SALES, 2018-2020 ($MILLION)

FIGURE 52.HUMAN METABOLOME TECHNOLOGIES, INC.: REVENUE SHARE, BY SEGMENT, 2020 (%)

FIGURE 53.HUMAN METABOLOME TECHNOLOGIES, INC.: REVENUE SHARE, BY REGION, 2020 (%)

FIGURE 54.BIO-RAD LABORATORIES, INC.: NET SALES, 2018-2020 ($MILLION)

FIGURE 55.BIO-RAD LABORATORIES, INC.: REVENUE SHARE, BY SEGMENT, 2020 (%)

FIGURE 56.BIO-RAD LABORATORIES, INC.: REVENUE SHARE, BY REGION, 2020 (%)

FIGURE 57.SHIMADZU CORPORATION: NET SALES, 2018-2020 ($MILLION)

FIGURE 58.SHIMADZU CORPORATION: REVENUE SHARE, BY SEGMENT, 2020 (%)

FIGURE 59.SHIMADZU CORPORATION: REVENUE SHARE, BY REGION, 2020 (%)

FIGURE 60.WATERS CORPORATION: NET SALES, 2018-2020 ($MILLION)

FIGURE 61.WATERS CORPORATION: REVENUE SHARE, BY SEGMENT, 2020 (%)

FIGURE 62.WATERS CORPORATION: REVENUE SHARE, BY REGION, 2020 (%)

$6168

$10663

HAVE A QUERY?

OUR CUSTOMER