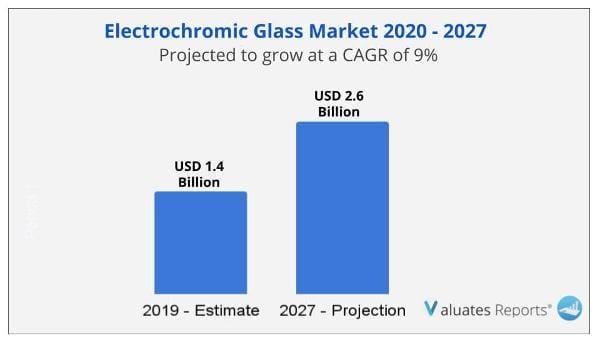

The global electrochromic glass market was valued at USD 1.4 Billion in 2019 and is projected to reach USD 2.6 Billion by 2027, growing at a CAGR of 9% from 2020 to 2027. The electrochromic glass market is predicted to increase due to rising acceptance in various end-user industries such as offices, hospitals, automobiles, and hotels. Electrochromic glass saves energy by preventing extra heat from entering a room, keeping it cooler in the summer, and cutting air conditioning costs. This characteristic is projected to promote its popularity, propelling the Electrochromic glass market forward. Furthermore, the growth in the use of electrochromic glass, as well as features such as privacy at a touch of a button and greater security, are boosting the Electrochromic Glass industry.

Electrochromic glass is a type of smart glass that changes transparency when a voltage is applied to it. The amount of voltage applied to the glass determines whether it turns opaque or translucent.

In the automobile sector, electrochromic glasses are used in car windows and windscreens, for example. In automobiles, electrochromic glass is used in sunroofs, side windows, sun visors, and rear windows. Electrochromic glass, which is better than ordinary glasses, is utilized in these automobile parts to prevent unwanted light and glare, as well as build up heat within the vehicle. This improves vehicle fuel efficiency while cutting CO2 emissions. As a result, the Electrochromic Glass market is expected to grow as the use of electrochromic glass in automobiles increases.

The expansion of the Electrochromic Glass market is likely to be fueled by factors such as architectural beauty combined with practical functionality. Because electrochromic glass dims and brightens to match outside light conditions, it virtually eliminates the need for blinds or curtains, which is crucial for adjusting the atmosphere and temperature of a space while also minimizing a building's energy consumption.

The electrochromic glass tints with a transient electrical charge, which may be removed after the chemical reaction is complete, making this technique extremely energy efficient. They can block out light and reflect a considerable percentage of the heat on a hot day, reducing air conditioning costs. They might even be integrated with other technologies, such as self-cleaning qualities and photovoltaic materials, to make Smart Glasses even smarter, reducing cleaning expenses while also generating electricity. Such benefits are projected to boost acceptance, propelling the Electrochromic Glass market forward.

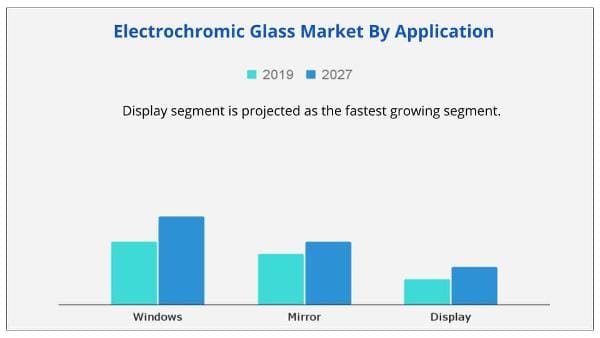

The display segment is expected to expand at the fastest CAGR throughout the projection period, according to the application. The expanding trend of smart homes and smart offices is driving demand for more smart technologies, such as electrochromic smart glass displays. The rising urbanization in Asia-Pacific and LAMEA has the potential to contribute to this market due to development activities in these regions.

Based on region, Asia-Pacific would exhibit a CAGR of 9.9% during 2020-2027.

The Automotive segment is expected to develop at the fastest rate based on end-user. In the electrochromic glass market projection, the automotive category is expected to develop at the fastest rate. Electrochromic glass is utilized in sunroofs, side windows, sun visors, and rear windows in automobiles. Electrochromic glass is used in these automobile parts to reduce unwanted light and glare, as well as build up heat within the car, making it superior to regular glasses. This increases vehicle fuel economy while also lowering carbon emissions.

|

Report Metric |

Details |

|

Report Name |

Electrochromic Glass Market |

|

Market size value in 2019 |

USD 1.4 Billion |

|

Revenue forecast in 2027 |

USD 2.6 Billion |

|

Growth Rate |

CAGR 9% |

|

Base year considered |

2019 |

|

Historical Data for |

2020-2027 |

|

BY Type |

Windows, Mirror, Display. |

|

By Application |

Construction, Automotive, Aerospace. |

Ans: The global electrochromic glass market was valued at USD 1.4 Billion in 2019 and is projected to reach USD 2.6 Billion by 2027, growing at a CAGR of 9% from 2020 to 2027.

Ans: Electrochromic glass is a kind of a smart glass, which changes its transparency when a voltage is passed through it. The glass changes its transparency to opaque or translucent depending on the voltage applied to it.

Ans: Asia-Pacific would exhibit CAGR of 9.9% during 2020-2027.

Ans: The major electrochromic glass manufacturers analyzed in this report include AGC Inc., ChromoGenics AB, Compagnie de Saint-Gobain S.A., Hitachi Chemical Co. Ltd., Kinestral Technologies Inc., Pleotint LLC, Polytronix Inc., Research Frontiers Inc., Smartglass International Ltd., and View Inc.

CHAPTER 1:INTRODUCTION

1.1.Report description

1.2.Key benefits for stakeholders:

1.3.Key market segments

1.4.Research methodology

1.4.1.Primary research

1.4.2.Secondary research

1.4.3.Analyst tools and models

CHAPTER 2:EXECUTIVE SUMMARY

2.1.Key findings

2.1.1.Top investment pockets

2.2.CXO perspective

CHAPTER 3:MARKET OVERVIEW

3.1.Market definition and scope

3.2.Porter’s Five Forces Analysis

3.2.1.Moderate Bargaining power of suppliers

3.2.2.High bargaining power of buyer

3.2.3.Moderate threat of substitute

3.2.4.Highly competitive rivalry

3.2.5.Moderate threat of new entrants

3.3.Patent analysis

3.4.Case study

3.4.1.Case study

3.5.Market share analysis

3.6.Market dynamics

3.6.1.Drivers

3.6.1.1.Rise in construction applications of electrochromic glass

3.6.1.2.Government incentives for installing energy saving solutions

3.6.2.Restraint

3.6.2.1.High price of electrochromic glass

3.6.3.Opportunity

3.6.3.1.Increase in demand from end-use industries

3.7.Pricing analysis ($/Square Meter)

3.8.Value chain analysis

3.9.Impact of government regulations on the global electrochromic glass market

3.10.Impact of COVID-19 on the global electrochromic glass market

3.11.Technical issues in global electrochromic glass market

CHAPTER 4:ELECTROCHROMIC GLASS MARKET, BY APPLICATION

4.1.Overview

4.2.Windows

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast, by region

4.2.3.Market analysis, by country

4.3.Mirror

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Market size and forecast, by region

4.3.3.Market analysis, by country

4.4.Display

4.4.1.Key market trends, growth factors, and opportunities

4.4.2.Market size and forecast, by region

4.4.3.Market analysis, by country

CHAPTER 5:ELECTROCHROMIC GLASS MARKET, BY END-USE INDUSTRY

5.1.Overview

5.2.Construction

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region

5.2.3.Market analysis, by country

5.3.Automotive

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region

5.3.3.Market analysis, by country

5.4.Aerospace

5.4.1.Key market trends, growth factors, and opportunities

5.4.2.Market size and forecast, by region

5.4.3.Market analysis, by country

5.5.Others

5.5.1.Key market trends, growth factors, and opportunities

5.5.2.Market size and forecast, by region

5.5.3.Market analysis, by country

5.5.4.Consumer Electronics

5.5.5.Solar cell

5.5.6.Marine

5.5.7.Railway

5.5.8.Other

CHAPTER 6:ELECTROCHROMIC GLASS MARKET, BY REGION

6.1.Overview

6.2.North America

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by application

6.2.3.Market size and forecast, by end-user industry

6.2.4.Market analysis, by country

6.2.4.1.U.S.

6.2.4.1.1.Market size and forecast, by application

6.2.4.1.2.Market size and forecast, by end-user industry

6.2.4.2.Canada

6.2.4.2.1.Market size and forecast, by application

6.2.4.2.2.Market size and forecast, by end-user industry

6.2.4.3.Mexico

6.2.4.3.1.Market size and forecast, by application

6.2.4.3.2.Market size and forecast, by end-user industry

6.3.Europe

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by application

6.3.3.Market size and forecast, by end-user industry

6.3.4.Market analysis, by country

6.3.4.1.UK

6.3.4.1.1.Market size and forecast, by application

6.3.4.1.2.Market size and forecast, by end-user industry

6.3.4.2.Germany

6.3.4.2.1.Market size and forecast, by application

6.3.4.2.2.Market size and forecast, by end-user industry

6.3.4.3.France

6.3.4.3.1.Market size and forecast, by application

6.3.4.3.2.Market size and forecast, by end-user industry

6.3.4.4.Spain

6.3.4.4.1.Market size and forecast, by application

6.3.4.4.2.Market size and forecast, by end-user industry

6.3.4.5.Italy

6.3.4.5.1.Market size and forecast, by application

6.3.4.5.2.Market size and forecast, by end-user industry

6.3.4.6.Rest of Europe

6.3.4.6.1.Market size and forecast, by application

6.3.4.6.2.Market size and forecast, by end-user industry

6.4.Asia-Pacific

6.4.1.Key market trends, growth factors, and opportunities

6.4.2.Market size and forecast, by application

6.4.3.Market size and forecast, by end-user industry

6.4.4.Market analysis, by country

6.4.4.1.China

6.4.4.1.1.Market size and forecast, by application

6.4.4.1.2.Market size and forecast, by end-user industry

6.4.4.2.Japan

6.4.4.2.1.Market size and forecast, by application

6.4.4.2.2.Market size and forecast, by end-user industry

6.4.4.3.Korea

6.4.4.3.1.Market size and forecast, by application

6.4.4.3.2.Market size and forecast, by end-user industry

6.4.4.4.ASEAN

6.4.4.4.1.Market size and forecast, by application

6.4.4.4.2.Market size and forecast, by end-user industry

6.4.4.5.Rest of Asia-Pacific

6.4.4.5.1.Market size and forecast, by application

6.4.4.5.2.Market size and forecast, by end-user industry

6.5.LAMEA

6.5.1.Key market trends, growth factors, and opportunities

6.5.2.Market size and forecast, by application

6.5.3.Market size and forecast, by end-user industry

6.5.4.Market analysis, by country

6.5.4.1.Brazil

6.5.4.1.1.Market size and forecast, by application

6.5.4.1.2.Market size and forecast, by end-user industry

6.5.4.2.Argentina

6.5.4.2.1.Market size and forecast, by application

6.5.4.2.2.Market size and forecast, by end-user industry

6.5.4.3.South Africa

6.5.4.3.1.Market size and forecast, by application

6.5.4.3.2.Market size and forecast, by end-user industry

6.5.4.4.Rest of LAMEA

6.5.4.4.1.Market size and forecast, by application

6.5.4.4.2.Market size and forecast, by end-user industry

CHAPTER 7:COMPETITIVE LANDSCAPE

7.1.Introduction

7.1.1.Market player positioning, 2019

7.2.Top winning strategies

7.2.1.Top winning strategies, by year

7.2.2.Top winning strategies, by development

7.2.3.Top winning strategies, by company

7.3.Competitive heatmap

7.4.Key developments

7.4.1.New product launches

7.4.2.Expansions

7.4.3.Partnership

7.4.4.Other developments

CHAPTER 8:COMPANY PROFILES:

8.1.AGC Inc.

8.1.1.Company overview

8.1.2.Company snapshot

8.1.3.Operating business segments

8.1.4.Product portfolio

8.1.5.Business performance

8.1.6.Key strategic moves and developments

8.2.CHROMOGENICS AB

8.2.1.Company overview

8.2.2.Company snapshot

8.2.3.Product portfolio

8.2.4.Business performance

8.2.5.Key strategic moves and developments

8.3.COMPAGNIE DE SAINT-GOBAIN S.A.

8.3.1.Company overview

8.3.2.Company snapshot

8.3.3.Operating business segments

8.3.4.Product portfolio

8.3.5.Business performance

8.3.6.Key strategic moves and developments

8.4.HITACHI CHEMICAL CO. LTD.

8.4.1.Company overview

8.4.2.Company snapshot

8.4.3.Operating business segments

8.4.4.Product portfolio

8.4.5.Business performance

8.5.KINESTRAL TECHNOLOGIES INC.

8.5.1.Company overview

8.5.2.Company snapshot

8.5.3.Product portfolio

8.5.4.Key strategic moves and developments

8.6.PLEOTINT LLC

8.6.1.Company overview

8.6.2.Company snapshot

8.6.3.Product portfolio

8.6.4.Key strategic moves and developments

8.7.POLYTRONIX INC.

8.7.1.Company overview

8.7.2.Company snapshot

8.7.3.Product portfolio

8.8.RESEARCH FRONTIERS INC.

8.8.1.Company overview

8.8.2.Company snapshot

8.8.3.Product portfolio

8.8.4.Business performance

8.8.5.Key strategic moves and developments

8.9.SMARTGLASS INTERNATIONAL LTD.

8.9.1.Company overview

8.9.2.Company snapshot

8.9.3.Product portfolio

8.10.VIEW INC.

8.10.1.Company overview

8.10.2.Company snapshot

8.10.3.Product portfolio

8.11.Other key player profiles

8.11.1.Key player snapshot

LIST OF TABLES

TABLE 01.GLOBAL ELECTROCHROMIC GLASS MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 02.ELECTROCHROMIC GLASS MARKET REVENUE FOR WINDOWS, BY REGION 2019–2027 ($MILLION)

TABLE 03.ELECTROCHROMIC GLASS MARKET REVENUE FOR MIRROR, BY REGION 2019–2027 ($MILLION)

TABLE 04.ELECTROCHROMIC GLASS MARKETREVENUE FOR DISPLAY, BY REGION 2019–2027 ($MILLION)

TABLE 05.GLOBAL ELECTROCHROMIC GLASS MARKET, BY END-USE INDUSTRY, 2019–2027 ($MILLION)

TABLE 06.ELECTROCHROMIC GLASS MARKET REVENUE FOR CONSTRUCTION, BY REGION 2019–2027 ($MILLION)

TABLE 07.ELECTROCHROMIC GLASS MARKET REVENUE FOR AUTOMOTIVE, BY REGION 2019–2027 ($MILLION)

TABLE 08.ELECTROCHROMIC GLASS MARKET REVENUE FOR AEROSPACE, BY REGION 2019–2027 ($MILLION)

TABLE 09.ELECTROCHROMIC GLASS MARKET REVENUE FOR OTHERS, BY REGION 2019–2027 ($MILLION)

TABLE 10.ELECTROCHROMIC GLASS MARKET REVENUE FOR CONSUMER GOODS, BY REGION 2019–2027 ($MILLION)

TABLE 11.ELECTROCHROMIC GLASS MARKET REVENUE FOR SOLAR CELL, BY REGION 2019–2027 ($MILLION)

TABLE 12.ELECTROCHROMIC GLASS MARKET REVENUE FOR MARINE, BY REGION 2019–2027 ($MILLION)

TABLE 13.ELECTROCHROMIC GLASS MARKET REVENUE FOR RAILWAY, BY REGION 2019–2027 ($MILLION)

TABLE 14.ELECTROCHROMIC GLASS MARKET REVENUE FOR OTHER, BY REGION 2019–2027 ($MILLION)

TABLE 15.GLOBAL ELECTROCHROMIC GLASS MARKET REVENUE, 2019–2027($MILLION)

TABLE 16.NORTH AMERICAN ELECTROCHROMIC GLASS MARKET REVENUE, BY APPLICATION 2019–2027($MILLION)

TABLE 17.NORTH AMERICAN ELECTROCHROMIC GLASS MARKET REVENUE, BY END-USER INDUSTRY, 2019–2027($MILLION)

TABLE 18.NORTH AMERICAN ELECTROCHROMIC GLASS MARKET REVENUE, BY OTHER END-USER INDUSTRY, 2019–2027($MILLION)

TABLE 19.NORTH AMERICA ELECTROCHROMIC GLASS MARKET REVENUE, BY COUNTRY, 2019–2027($MILLION)

TABLE 20.U.S. ELECTROCHROMIC GLASS MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 21.U.S. ELECTROCHROMIC GLASS MARKET, BY END-USER INDUSTRY, 2019–2027 ($MILLION)

TABLE 22.CANADA ELECTROCHROMIC GLASS MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 23.CANADA ELECTROCHROMIC GLASS MARKET, BY END-USER INDUSTRY, 2019–2027 ($MILLION)

TABLE 24.MEXICO ELECTROCHROMIC GLASS MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 25.MEXICO ELECTROCHROMIC GLASS MARKET, BY END-USER INDUSTRY, 2019–2027 ($MILLION)

TABLE 26.EUROPE ELECTROCHROMIC GLASS MARKET REVENUE, BY APPLICATION 2019–2027($MILLION)

TABLE 27.EUROPE ELECTROCHROMIC GLASS MARKET REVENUE, BY END-USER INDUSTRY, 2019–2027($MILLION)

TABLE 28.EUROPE ELECTROCHROMIC GLASS MARKET REVENUE, BY OTHER END-USER INDUSTRY, 2019–2027($MILLION)

TABLE 29.EUROPE ELECTROCHROMIC GLASS MARKET REVENUE, BY COUNTRY, 2019–2027($MILLION)

TABLE 30.UK ELECTROCHROMIC GLASS MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 31.UK ELECTROCHROMIC GLASS MARKET, BY END-USER INDUSTRY, 2019–2027 ($MILLION)

TABLE 32.GERMANYELECTROCHROMIC GLASS MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 33.GERMANY ELECTROCHROMIC GLASS MARKET, BY END-USER INDUSTRY, 2019–2027 ($MILLION)

TABLE 34.FRANCEELECTROCHROMIC GLASS MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 35.FRANCE ELECTROCHROMIC GLASS MARKET, BY END-USER INDUSTRY, 2019–2027 ($MILLION)

TABLE 36.SPAIN ELECTROCHROMIC GLASS MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 37.SPAIN ELECTROCHROMIC GLASS MARKET, BY END-USER INDUSTRY, 2019–2027 ($MILLION)

TABLE 38.ITALY ELECTROCHROMIC GLASS MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 39.ITALY ELECTROCHROMIC GLASS MARKET, BY END-USER INDUSTRY, 2019–2027 ($MILLION)

TABLE 40.REST OF EUROPE ELECTROCHROMIC GLASS MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 41.REST OF EUROPE ELECTROCHROMIC GLASS MARKET, BY END-USER INDUSTRY, 2019–2027 ($MILLION)

TABLE 42.ASIA-PACIFIC ELECTROCHROMIC GLASS MARKET REVENUE, BY APPLICATION 2019–2027($MILLION)

TABLE 43.ASIA-PACIFIC ELECTROCHROMIC GLASS MARKET REVENUE, BY END-USER INDUSTRY, 2019–2027($MILLION)

TABLE 44.ASIA-PACIFIC ELECTROCHROMIC GLASS MARKET REVENUE, BY OTHER END-USER INDUSTRY, 2019–2027($MILLION)

TABLE 45.ASIA-PACIFIC ELECTROCHROMIC GLASS MARKET REVENUE, BY COUNTRY, 2019–2027($MILLION)

TABLE 46.CHINA ELECTROCHROMIC GLASS MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 47.CHINA ELECTROCHROMIC GLASS MARKET, BY END-USER INDUSTRY, 2019–2027 ($MILLION)

TABLE 48.JAPAN ELECTROCHROMIC GLASS MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 49.JAPAN ELECTROCHROMIC GLASS MARKET, BY END-USER INDUSTRY, 2019–2027 ($MILLION)

TABLE 50.KOREA ELECTROCHROMIC GLASS MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 51.KOREA ELECTROCHROMIC GLASS MARKET, BY END-USER INDUSTRY, 2019–2027 ($MILLION)

TABLE 52.ASEAN ELECTROCHROMIC GLASS MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 53.ASEAN ELECTROCHROMIC GLASS MARKET, BY END-USER INDUSTRY, 2019–2027 ($MILLION)

TABLE 54.REST OF ASIA-PACIFIC ELECTROCHROMIC GLASS MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 55.REST OF ASIA-PACIFIC ELECTROCHROMIC GLASS MARKET, BY END-USER INDUSTRY, 2019–2027 ($MILLION)

TABLE 56.LAMEA ELECTROCHROMIC GLASS MARKET REVENUE, BY APPLICATION 2019–2027($MILLION)

TABLE 57.LAMEA ELECTROCHROMIC GLASS MARKET REVENUE, BY END-USER INDUSTRY, 2019–2027($MILLION)

TABLE 58.LAMEA ELECTROCHROMIC GLASS MARKET REVENUE, BY OTHER END-USER INDUSTRY, 2019–2027($MILLION)

TABLE 59.LAMEA ELECTROCHROMIC GLASS MARKET REVENUE, BY COUNTRY, 2019–2027($MILLION)

TABLE 60.BRAZIL ELECTROCHROMIC GLASS MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 61.BRAZIL ELECTROCHROMIC GLASS MARKET, BY END-USER INDUSTRY, 2019–2027 ($MILLION)

TABLE 62.ARGENTINA ELECTROCHROMIC GLASS MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 63.ARGENTINAELECTROCHROMIC GLASS MARKET, BY END-USER INDUSTRY, 2019–2027 ($MILLION)

TABLE 64.SOUTH AFRICA ELECTROCHROMIC GLASS MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 65.SOUTH AFRICA ELECTROCHROMIC GLASS MARKET, BY END-USER INDUSTRY, 2019–2027 ($MILLION)

TABLE 66.REST OF LAMEA ELECTROCHROMIC GLASS MARKET, BY APPLICATION, 2019–2027 ($MILLION)

TABLE 67.REST OF LAMEA ELECTROCHROMIC GLASS MARKET, BY END-USER INDUSTRY, 2019–2027 ($MILLION)

TABLE 68.KEY NEW PRODUCT LAUNCHES (2016-2019)

TABLE 69.KEY EXPANSIONS (2016-2019)

TABLE 70.KEY PARTNERSHIP (2016-2019)

TABLE 71.OTHER KEY DEVELOPMENTS (2016-2019)

TABLE 72.AGC: COMPANY SNAPSHOT

TABLE 73.AGC: OPERATING SEGMENTS

TABLE 74.AGC: PRODUCT PORTFOLIO

TABLE 75.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 76.AGC: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 77.CHROMOGENICS: COMPANY SNAPSHOT

TABLE 78.CHROMOGENICS: PRODUCT PORTFOLIO

TABLE 79.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 80.CHROMOGENICS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 81.SAINT-GOBAIN: COMPANY SNAPSHOT

TABLE 82.SAINT-GOBAIN: OPERATING SEGMENTS

TABLE 83.SAINT-GOBAIN

TABLE 84.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 85.SAINT-GOBAIN: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 86.HITACHI CHEMICALS: COMPANY SNAPSHOT

TABLE 87.HITACHI CHEMICALS: OPERATING SEGMENTS

TABLE 88.HITACHI CHEMICALS: PRODUCT PORTFOLIO

TABLE 89.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 90.KINESTRAL: COMPANY SNAPSHOT

TABLE 91.KINESTRAL: PRODUCT PORTFOLIO

TABLE 92.KINESTRAL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 93.PLEOTINT: COMPANY SNAPSHOT

TABLE 94.PLEOTINT: PRODUCT PORTFOLIO

TABLE 95.PLEOTINT: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 96.POLYTRONIX: COMPANY SNAPSHOT

TABLE 97.POLYTRONIX: PRODUCT PORTFOLIO

TABLE 98.RESEARCH FRONTIERS: COMPANY SNAPSHOT

TABLE 99.RESEARCH FRONTIERS: PRODUCT PORTFOLIO

TABLE 100.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 101.RESEARCH FRONTIERS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102.SMARTGLASS: COMPANY SNAPSHOT

TABLE 103.SMARTGLASS: PRODUCT PORTFOLIO

TABLE 104.VIEW INC.: COMPANY SNAPSHOT

TABLE 105.VIEW INC.: PRODUCT PORTFOLIO

LIST OF FIGURES

FIGURE 01.KEY MARKET SEGMENTS

FIGURE 02.EXECUTIVE SUMMARY

FIGURE 03.TOP INVESTMENT POCKETS

FIGURE 04.MODERATE BARGAINING POWER OF SUPPLIERS

FIGURE 05.HIGH BARGAINING POWER OF BUYERS

FIGURE 06.MODERATE THREAT OF SUBSTITUTES

FIGURE 07.HIGHLY COMPETITIVE RIVALRY

FIGURE 08.MODERATE THREAT OF NEW ENTRANTS

FIGURE 09.PATENT ANALYSIS, BY REGION, 2012-2020

FIGURE 10.PATENT ANALYSIS, BY COMPANY, 2012-2020

FIGURE 11.MARKET SHARE ANALYSIS, 2019

FIGURE 12.VALUE CHAIN ANALYSIS

FIGURE 13.GLOBAL ELECTROCHROMIC GLASS MARKET, BY APPLICATION, 2019–2027

FIGURE 14.COMPARATIVE ANALYSIS OF ELECTROCHROMIC GLASS MARKET FOR WINDOWS, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 15.COMPARATIVE ANALYSIS OF ELECTROCHROMIC GLASS MARKET FOR MIRROR, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 16.COMPARATIVE ANALYSIS OF ELECTROCHROMIC GLASS MARKET FOR DISPLAY, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 17.GLOBAL ELECTROCHROMIC GLASS MARKET, BY END-USE INDUSTRY, 2019–2027

FIGURE 18.COMPARATIVE ANALYSIS OF ELECTROCHROMIC GLASS MARKET FOR CONSTRUCTION, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 19.COMPARATIVE ANALYSIS OF ELECTROCHROMIC GLASS MARKET FOR AUTOMOTIVE, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 20.COMPARATIVE ANALYSIS OF ELECTROCHROMIC GLASS MARKET FOR AEROSPACE, BY COUNTRY, 2019& 2027 ($MILLION)

FIGURE 21.COMPARATIVE ANALYSIS OF ELECTROCHROMIC GLASS MARKET FOR OTHERS, BY COUNTRY, 2019 & 2027 ($MILLION)

FIGURE 22.U.S. ELECTROCHROMIC GLASS MARKET REVENUE, 2019–2027($MILLION)

FIGURE 23.CANADA ELECTROCHROMIC GLASS MARKET REVENUE, 2019–2027($MILLION)

FIGURE 24.MEXICO ELECTROCHROMIC GLASS MARKET REVENUE, 2019–2027($MILLION)

FIGURE 25.UK ELECTROCHROMIC GLASS MARKET REVENUE, 2019–2027($MILLION)

FIGURE 26.GERMANY ELECTROCHROMIC GLASS MARKET REVENUE, 2019–2027($MILLION)

FIGURE 27.FRANCE ELECTROCHROMIC GLASS MARKET REVENUE, 2019–2027($MILLION)

FIGURE 28.SPAIN ELECTROCHROMIC GLASS MARKET REVENUE, 2019–2027($MILLION)

FIGURE 29.ITALY ELECTROCHROMIC GLASS MARKET REVENUE, 2019–2027($MILLION)

FIGURE 30.REST OF EUROPE ELECTROCHROMIC GLASS MARKET REVENUE, 2019–2027($MILLION)

FIGURE 31.CHINA ELECTROCHROMIC GLASS MARKET REVENUE, 2019–2027($MILLION)

FIGURE 32.JAPAN ELECTROCHROMIC GLASS MARKET REVENUE, 2019–2027($MILLION)

FIGURE 33.KOREA ELECTROCHROMIC GLASS MARKET REVENUE, 2019–2027($MILLION)

FIGURE 34.ASEAN ELECTROCHROMIC GLASS MARKET REVENUE, 2019–2027($MILLION)

FIGURE 35.REST OF ASIA-PACIFIC ELECTROCHROMIC GLASS MARKET REVENUE, 2019–2027($MILLION)

FIGURE 36.BRAZIL ELECTROCHROMIC GLASS MARKET REVENUE, 2019–2027($MILLION)

FIGURE 37.ARGENTINA ELECTROCHROMIC GLASS MARKET REVENUE, 2019–2027($MILLION)

FIGURE 38.SOUTH AFRICA ELECTROCHROMIC GLASS MARKET REVENUE, 2019–2027($MILLION)

FIGURE 39.REST OF LAMEA ELECTROCHROMIC GLASS MARKET REVENUE, 2019–2027($MILLION)

FIGURE 40.MARKET PLAYER POSITIONING, 2019

FIGURE 41.TOP WINNING STRATEGIES, BY YEAR, 2016–2019

FIGURE 42.TOP WINNING STRATEGIES, BY DEVELOPMENT, 2016–2019 (%)

FIGURE 43.TOP WINNING STRATEGIES, BY COMPANY, 2016–2019

FIGURE 44.COMPETITIVE HEATMAP OF KEY PLAYERS

FIGURE 45.AGC: REVENUE, 2017–2019 ($MILLION)

FIGURE 46.AGC: REVENUE SHARE BY SEGMENT, 2019 (%)

FIGURE 47.CHROMOGENICS: REVENUE, 2017–2019 ($MILLION)

FIGURE 48.SAINT-GOBAIN: REVENUE, 2017–2019 ($MILLION)

FIGURE 49.SAINT-GOBAIN: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 50.HITACHI CHEMICALS: REVENUE, 2016–2018 ($MILLION)

FIGURE 51.HITACHI CHEMICALS: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 52.HITACHI CHEMICALS: REVENUE SHARE BY REGION, 2018 (%)

FIGURE 53.RESEARCH FRONTIERS: REVENUE, 2017–2019 ($MILLION)

$5769

$9995

HAVE A QUERY?

OUR CUSTOMER