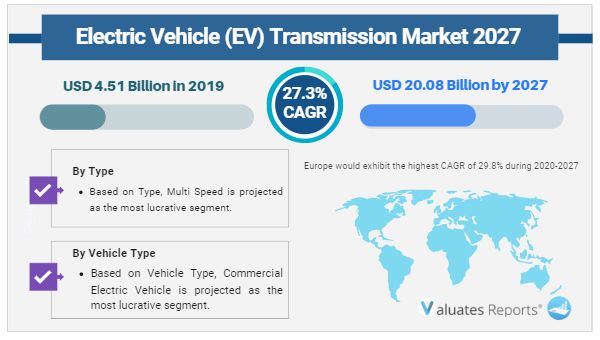

The global electric vehicle (EV) transmission market was valued at $4.51 billion in 2019, and is projected to reach $20.08 billion by 2027, registering a CAGR of 27.3%.

COVID-19 has presented the world with an unprecedented economic, humanitarian, and healthcare challenge. Rapid spread of the disease has led to a significant impact on the global automotive industry, with a downturn in demand for new and old vehicles. The electric vehicle segment is hit hard by this pandemic as these automobiles are mostly considered as modern day mobility and at the same time are costlier enough for ownership. Due to the pandemic and its rapid spread across the globe, the demand & supply chain for numerous products came to a halt due to the unavailability of transportation medium. Moreover, during the end of 2020, the situation came in control in some countries due to which the demand & supply gap was fulfilled and there was significant growth in the registration of new vehicles due to the need to avoid public transport to commute from one place to another.

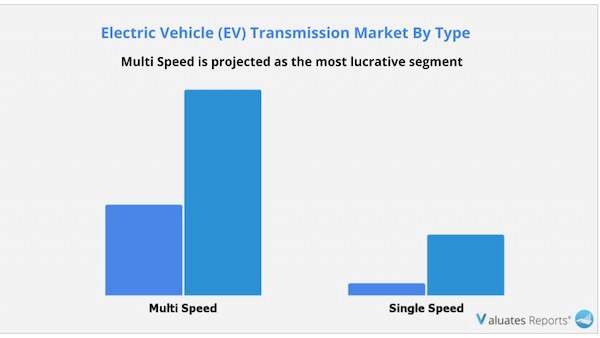

Electric vehicle transmission in electric vehicle is used to transfer mechanical power from the electric traction motor to the wheels. Majority of the electric vehicles are installed with single speed transmission as they are enough for efficient working in today’s date. However, there are also vehicle types for which the use of multi-speed transmission is advantageous.

In addition, many leading players operating in the EV transmission market are working on multi-speed transmission sailing operation and load shifting capability for electric vehicle and planning to launch the same in future. The development of electric vehicle is gathering momentum at a significant rate, owing to the need to meet government emission targets and future fuel consumption. Attributed to this remarkable growth and continuous development in battery driven automobiles, restraints related to vehicle weight, battery capacity, and others that hinder the growth of the electric vehicle industry are expected to be eliminated during the forecast period.

Factors such as rise in demand for fuel efficient and low-emission vehicles and growth in production of electric vehicles are driving the EV transmission market growth. In addition, government initiatives to support adoption of electric vehicle are anticipated to boost the growth of the market. However, high cost of electric vehicles is hindering the growth of the electric vehicle (EV) transmission market. Furthermore, technological advancements in electric vehicles and incorporation of Vehicle-To-Grid (V2g) EV charging stations are expected to provide remarkable growth opportunities for the key players operating in the EV transmission market.

The global electric vehicle (EV) transmission market is segmented based on type, vehicle type, transmission system, and region. Based on type, the electric vehicle (EV) transmission industry is bifurcated into single speed and multi speed. Based on vehicle type, it is divided into passenger electric vehicle, commercial electric vehicle and off-highway electric vehicle. Based on transmission systems, it is categorized as automated manual transmissions, continuously variable transmissions, dedicated hybrid transmission/dual clutch transmissions and automatic transmissions. Based on region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Key players including Aisin Seiki Co., Ltd., Allison Transmission Inc., AVL List GmbH, BorgWarner Inc, Continental AG, Dana Limited, Eaton, JATCO Ltd., Schaeffler Technologies AG & Co. KG, ZF Friedrichshafen AG and others account for a major electric vehicle (EV) transmission market share.

Rising demand for fuel efficient & low-emission vehicles

Gasoline being a fossil fuel is not a renewable source of energy and is projected to exhaust in the future. To support sustainable development, it is important to develop and use alternative sources of fuel. This involves use of electric vehicles that do not use gas and are more economical than conventional vehicles. An electric vehicle converts over 50% of the electrical energy from the grid to power at the wheels, whereas gas-powered vehicle only manages to convert about 17%–21% of the energy stored in gasoline. The demand for fuel-efficient vehicles has increased recently, owing to rise in price of petrol and diesel. This is attributed to depleting fossil fuel reserves and growth in tendency of companies to gain maximum profit from these oil reserves. Therefore, these factors give rise to the need for electrically powered vehicles for travel, which, in turn, is anticipated to propel the growth of the electric vehicle (EV) transmission market.

Growth in production of electric vehicles

In recent years, demand and production of electric vehicles have increased significantly as electric vehicles have several advantages over fuel-powered automobiles. Components, such as fan belts, oil, air filters, head caskets, timing belts, cylinder heads, and spark plugs, do not require replacement, thereby making them cheaper and efficient for fuel-powered automobiles. This makes electric vehicle a preferred choice, thereby restraining the fuel-powered automobile market growth. Therefore, increase in production of electric vehicles boosts the growth of the electric vehicle (EV) transmission market.

High cost of electric vehicles

Electric vehicles are advantageous over conventional vehicles; however, their cost is higher than traditional vehicles. The additional cost of buying an electric vehicle instead of fuel-powered vehicle is mainly due to the high cost of battery. Involvement of expensive manufacturing process and use of costly raw materials are the major reasons for the high cost of electric vehicles. Therefore, these factors add up to the cost of electric vehicle, which, in turn, hinders the growth of the electric vehicle (EV) transmission market.

Technological advancement in electric vehicles

Automobile companies focus on the production of advanced electric vehicle systems that are expected to have lower emission at relatively lower costs. Companies have also started producing downsized engines to be implemented in vehicles as smaller engines help achieve the upcoming BHARAT STAGE VI emission norms.

This is attributed to the fact that they produce lesser emissions compared to heavier and larger engines. The compact and cost-effective design of these downsized small engines also adds another dimension to their usefulness. Therefore, the development of advanced electric vehicles transmission presents various opportunities for leading players operating in the electric vehicle (EV) transmission market.

COVID-19 IMPACT ANALYSIS

Key Benefits For Stakeholders

| Report Metric | Details |

| Report Name | Electric Vehicle (EV) Transmission Market |

| Base Year | 2020 |

| Forecasted years | 2020-2027 |

| By Company |

|

| By Type |

|

| By Vehicle Type |

|

| By Transmission System |

|

| Segment by Region |

|

| Forecast units | USD Billion in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Ans. The global electric vehicle (EV) transmission market was valued at $4.51 billion in 2019, and is projected to reach $20.08 billion by 2027, registering a CAGR of 27.3%.

Ans. Multi Speed is projected as the most lucrative segment.

Ans. Europe would exhibit the highest CAGR of 29.8% during 2020-2027.

Ans. Automatic Transmission is projected as the most lucrative segment.

Ans. Commercial Electric Vehicle is projected as the most lucrative segment.

Table of Content :

CHAPTER 1: INTRODUCTION

1.1. Report description

1.2. Key benefits for stakeholders

1.3. Key market segments

1.4. Research methodology

1.4.1. Primary research

1.4.2. Secondary research

1.4.3. Analyst tools and models

CHAPTER 2: EXECUTIVE SUMMARY

2.1. CXO perspective

CHAPTER 3: MARKET OVERVIEW

3.1. Market definition and scope

3.2. Key findings

3.2.1. Top impacting factors

3.2.2. Top investment pockets

3.2.3. Top winning strategies

3.3. Porter’s five forces analysis

3.4. Market share analysis (2018)

3.5. Market dynamics

3.5.1. Drivers

3.5.1.1. Rising demand for fuel efficient and low-emission vehicles.

3.5.1.2. Growth in production of electric vehicles.

3.5.1.3. Government initiative to support adoption of electric vehicle

3.5.2. Restraint

3.5.2.1. High cost of electric vehicles

3.5.3. Opportunities

3.5.3.1. Technological advancement in electric vehicles

3.5.3.2. Incorporation of Vehicle-To-Grid (V2g) EV Charging Stations

CHAPTER 4: EV TRANSMISSION MARKET, BY TYPE

4.1. Overview

4.2. SINGLE SPEED TRANSMISSION

4.2.1. Key market trends, growth factors and opportunities

4.2.2. Market size and forecast, by region

4.2.3. Market analysis by country

4.3. MULTI SPEED TRANSMISSION

4.3.1. Key market trends, growth factors, and opportunities

4.3.2. Market size and forecast, by region

4.3.3. Market analysis by country

CHAPTER 5: EV TRANSMISSION MARKET, BY VEHICLE TYPE

5.1. Overview

5.2. Battery electric vehicle

5.2.1. Key market trends, growth factors and opportunities

5.2.2. Market size and forecast, by region

5.2.3. Market analysis by country

5.3. Hybrid electric vehicle

5.3.1. Key market trends, growth factors, and opportunities

5.3.2. Market size and forecast, by region

5.3.3. Market analysis by country

5.4. Plug-in hybrid electric vehicle

5.4.1. Key market trends, growth factors, and opportunities

5.4.2. Market size and forecast, by region

5.4.3. Market analysis by country

5.5. Others

5.5.1. Key market trends, growth factors, and opportunities

5.5.2. Market size and forecast, by region

5.5.3. Market analysis by country

CHAPTER 6: EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM

6.1. Overview

6.2. AMT Transmissions

6.2.1. Key market trends, growth factors and opportunities

6.2.2. Market size and forecast, by region

6.2.3. Market analysis by country

6.3. CVT Transmissions

6.3.1. Key market trends, growth factors, and opportunities

6.3.2. Market size and forecast, by region

6.3.3. Market analysis by country

6.4. DCT/DHT Transmissions

6.4.1. Key market trends, growth factors, and opportunities

6.4.2. Market size and forecast, by region

6.4.3. Market analysis by country

6.5. AT Transmission

6.5.1. Key market trends, growth factors, and opportunities

6.5.2. Market size and forecast, by region

6.5.3. Market analysis by country

CHAPTER 7: EV TRANSMISSION MARKET, BY REGION

7.1. Overview

7.2. North America

7.2.1. Key market trends, growth factors, and opportunities

7.2.2. Market size and forecast, by Type

7.2.3. Market size and forecast, by vehicle type

7.2.4. Market size and forecast, by Transmission System

7.2.5. Market analysis by country

7.2.5.1. U.S.

7.2.5.1.1. Market size and forecast, by Type

7.2.5.1.2. Market size and forecast, by vehicle type

7.2.5.1.3. Market size and forecast, by Transmission System

7.2.5.2. Canada

7.2.5.2.1. Market size and forecast, by Type

7.2.5.2.2. Market size and forecast, by vehicle type

7.2.5.2.3. Market size and forecast, by Transmission System

7.2.5.3. Mexico

7.2.5.3.1. Market size and forecast, by Type

7.2.5.3.2. Market size and forecast, by vehicle type

7.2.5.3.3. Market size and forecast, by Transmission System

7.3. Europe

7.3.1. Key market trends, growth factors, and opportunities

7.3.2. Market size and forecast, by Type

7.3.3. Market size and forecast, by vehicle type

7.3.4. Market size and forecast, by Transmission System

7.3.5. Market analysis by country

7.3.5.1. U.K.

7.3.5.1.1. Market size and forecast, by Type

7.3.5.1.2. Market size and forecast, by vehicle type

7.3.5.1.3. Market size and forecast, by Transmission System

7.3.5.2. Germany

7.3.5.2.1. Market size and forecast, by Type

7.3.5.2.2. Market size and forecast, by vehicle type

7.3.5.2.3. Market size and forecast, by Transmission System

7.3.5.3. France

7.3.5.3.1. Market size and forecast, by Type

7.3.5.3.2. Market size and forecast, by vehicle type

7.3.5.3.3. Market size and forecast, by Transmission System

7.3.5.4. Italy

7.3.5.4.1. Market size and forecast, by Type

7.3.5.4.2. Market size and forecast, by vehicle type

7.3.5.4.3. Market size and forecast, by Transmission System

7.3.5.5. Rest of Europe

7.3.5.5.1. Market size and forecast, by Type

7.3.5.5.2. Market size and forecast, by vehicle type

7.3.5.5.3. Market size and forecast, by Transmission System

7.4. Asia-Pacific

7.4.1. Key market trends, growth factors, and opportunities

7.4.2. Market size and forecast, by Type

7.4.3. Market size and forecast, by vehicle type

7.4.4. Market size and forecast, by Transmission System

7.4.5. Market analysis by country

7.4.5.1. South Korea

7.4.5.1.1. Market size and forecast, by Type

7.4.5.1.2. Market size and forecast, by vehicle type

7.4.5.1.3. Market size and forecast, by Transmission System

7.4.5.2. China

7.4.5.2.1. Market size and forecast, by Type

7.4.5.2.2. Market size and forecast, by vehicle type

7.4.5.2.3. Market size and forecast, by Transmission System

7.4.5.3. Japan

7.4.5.3.1. Market size and forecast, by Type

7.4.5.3.2. Market size and forecast, by vehicle type

7.4.5.3.3. Market size and forecast, by Transmission System

7.4.5.4. India

7.4.5.4.1. Market size and forecast, by Type

7.4.5.4.2. Market size and forecast, by vehicle type

7.4.5.4.3. Market size and forecast, by Transmission System

7.4.5.5. Rest of Asia-Pacific

7.4.5.5.1. Market size and forecast, by Type

7.4.5.5.2. Market size and forecast, by vehicle type

7.4.5.5.3. Market size and forecast, by Transmission System

7.5. LAMEA

7.5.1. Key market trends, growth factors, and opportunities

7.5.2. Market size and forecast, by Type

7.5.3. Market size and forecast, by vehicle type

7.5.4. Market size and forecast, by Transmission System

7.5.5. Market analysis by country

7.5.5.1. Latin America

7.5.5.1.1. Market size and forecast, by Type

7.5.5.1.2. Market size and forecast, by vehicle type

7.5.5.1.3. Market size and forecast, by Transmission System

7.5.5.2. Middle East

7.5.5.2.1. Market size and forecast, by Type

7.5.5.2.2. Market size and forecast, by vehicle type

7.5.5.2.3. Market size and forecast, by Transmission System

7.5.5.3. Africa

7.5.5.3.1. Market size and forecast, by Type

7.5.5.3.2. Market size and forecast, by vehicle type

7.5.5.3.3. Market size and forecast, by Transmission System

CHAPTER 8: COMPANY PROFILES

8.1. AISIN SEIKI CO., LTD.

8.1.1. Company overview

8.1.2. Company snapshot

8.1.3. Operating business segments

8.1.4. Product portfolio

8.1.5. Business performance

8.2. Allison Transmission Inc.

8.2.1. Company overview

8.2.2. Company snapshot

8.2.3. Operating business segments

8.2.4. Product portfolio

8.2.5. Business performance

8.2.6. Key strategic moves and developments

8.3. AVL List GmbH

8.3.1. Company overview

8.3.2. Company snapshot

8.3.3. Product portfolio

8.4. BorgWarner Inc.

8.4.1. Company overview

8.4.2. Company snapshot

8.4.3. Operating business segments

8.4.4. Product portfolio

8.4.5. Business performance

8.4.6. Key strategic moves and developments

8.5. Continental AG

8.5.1. Company overview

8.5.2. Company snapshot

8.5.3. Operating business segments

8.5.4. Product portfolio

8.5.5. Business performance

8.5.6. Key strategic moves and developments

8.6. Dana Limited.

8.6.1. Company overview

8.6.2. Company snapshot

8.6.3. Operating business segments

8.6.4. Product portfolio

8.6.5. Business performance

8.6.6. Key strategic moves and developments

8.7. Eaton

8.7.1. Company overview

8.7.2. Company snapshot

8.7.3. Operating business segments

8.7.4. Product portfolio

8.7.5. Business performance

8.7.6. Key strategic moves and developments

8.8. JATCO Ltd.

8.8.1. Company overview

8.8.2. Company snapshot

8.8.3. Product portfolio

8.8.4. Key strategic moves and developments

8.9. Schaeffler Technologies AG & Co. KG

8.9.1. Company overview

8.9.2. Company snapshot

8.9.3. Operating business segments

8.9.4. Business performance

8.10. ZF Friedrichshafen AG

8.10.1. Company overview

8.10.2. Company snapshot

8.10.3. Operating business segments

8.10.4. Product portfolio

8.10.5. Business performance

LIST OF TABLES

TABLE 01. GLOBAL EV TRANSMISSION MARKET, BY TYPE, 2018-2026($MILLION)

TABLE 02. EV TRANSMISSION MARKET REVENUE FOR SINGLE SPEED TRANSMISSION, BY REGION 2018-2026 ($MILLION)

TABLE 03. EV TRANSMISSION MARKET REVENUE FOR MULTI SPEED TRANSMISSION, BY REGION 2018-2026 ($MILLION)

TABLE 04. GLOBAL EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018-2026($MILLION)

TABLE 05. GLOBAL EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018-2026(MILLION UNITS)

TABLE 06. EV TRANSMISSION MARKET REVENUE FOR BATTERY ELECTRIC VEHICLE, BY REGION 2018-2026 ($MILLION)

TABLE 07. EV TRANSMISSION MARKET REVENUE FOR HYBRID ELECTRIC VEHICLE, BY REGION 2018-2026 ($MILLION)

TABLE 08. EV TRANSMISSION MARKET REVENUE FOR PLUG-IN HYBRID ELECTRIC VEHICLE, BY REGION 2018–2026 ($MILLION)

TABLE 09. EV TRANSMISSION MARKET REVENUE FOR OTHERS, BY REGION 2018–2026 ($MILLION)

TABLE 10. GLOBAL EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM, 2018-2026($MILLION)

TABLE 11. EV TRANSMISSION MARKET REVENUE FOR AMT TRANSMISSIONS, BY REGION 2018-2026 ($MILLION)

TABLE 12. EV TRANSMISSION MARKET REVENUE FOR CVT TRANSMISSIONS, BY REGION 2018-2026 ($MILLION)

TABLE 13. EV TRANSMISSION MARKET REVENUE FOR DCT/DHT TRANSMISSIONS, BY REGION 2018–2026 ($MILLION)

TABLE 14. EV TRANSMISSION MARKET REVENUE FOR AT TRANSMISSION, BY REGION 2018–2026 ($MILLION)

TABLE 15. NORTH AMERICAN EV TRANSMISSION MARKET, BY TYPE, 2018–2026 ($MILLION)

TABLE 16. NORTH AMERICAN EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018–2026 ($MILLION)

TABLE 17. NORTH AMERICAN EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018–2026 (MILLION UNITS)

TABLE 18. NORTH AMERICAN EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM, 2018–2026 ($MILLION)

TABLE 19. U. S. EV TRANSMISSION MARKET, BY TYPE, 2018–2026 ($MILLION)

TABLE 20. U. S. EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018–2026 ($MILLION)

TABLE 21. U. S. EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018–2026 (MILLION UNITS)

TABLE 22. U. S. EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM, 2018–2026 ($MILLION)

TABLE 23. CANADA EV TRANSMISSION MARKET, BY TYPE, 2018–2026 ($MILLION)

TABLE 24. CANADA EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018–2026 ($MILLION)

TABLE 25. CANADA EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM, 2018–2026 ($MILLION)

TABLE 26. MEXICO EV TRANSMISSION MARKET, BY TYPE, 2018–2026 ($MILLION)

TABLE 27. MEXICO EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018–2026 ($MILLION)

TABLE 28. MEXICO EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM, 2018–2026 ($MILLION)

TABLE 29. EUROPEAN EV TRANSMISSION MARKET, BY TYPE, 2018–2026 ($MILLION)

TABLE 30. EUROPEAN EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018–2026 ($MILLION)

TABLE 31. EUROPEAN EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM, 2018–2026 ($MILLION)

TABLE 32. U.K. EV TRANSMISSION MARKET, BY TYPE, 2018–2026 ($MILLION)

TABLE 33. U.K. EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018–2026 ($MILLION)

TABLE 34. U.K. EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM, 2018–2026 ($MILLION)

TABLE 35. GERMANY EV TRANSMISSION MARKET, BY TYPE, 2018–2026 ($MILLION)

TABLE 36. GERMANY EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018–2026 ($MILLION)

TABLE 37. GERMANY EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM, 2018–2026 ($MILLION)

TABLE 38. FRANCE EV TRANSMISSION MARKET, BY TYPE, 2018–2026 ($MILLION)

TABLE 39. FRANCE EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018–2026 ($MILLION)

TABLE 40. FRANCE EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM, 2018–2026 ($MILLION)

TABLE 41. ITALY EV TRANSMISSION MARKET, BY TYPE, 2018–2026 ($MILLION)

TABLE 42. ITALY EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018–2026 ($MILLION)

TABLE 43. ITALY EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM, 2018–2026 ($MILLION)

TABLE 44. REST OF EUROPE EV TRANSMISSION MARKET, BY TYPE, 2018–2026 ($MILLION)

TABLE 45. REST OF EUROPE EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018–2026 ($MILLION)

TABLE 46. REST OF EUROPE EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM, 2018–2026 ($MILLION)

TABLE 47. ASIA-PACIFIC EV TRANSMISSION MARKET, BY TYPE, 2018–2026 ($MILLION)

TABLE 48. ASIA-PACIFIC EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018–2026 ($MILLION)

TABLE 49. ASIA-PACIFIC EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM, 2018–2026 ($MILLION)

TABLE 50. SOUTH KOREA EV TRANSMISSION MARKET, BY TYPE, 2018–2026 ($MILLION)

TABLE 51. SOUTH KOREA EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018–2026 ($MILLION)

TABLE 52. SOUTH KOREA EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM, 2018–2026 ($MILLION)

TABLE 53. CHINA EV TRANSMISSION MARKET, BY TYPE, 2018–2026 ($MILLION)

TABLE 54. CHINA EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018–2026 ($MILLION)

TABLE 55. CHINA EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM, 2018–2026 ($MILLION)

TABLE 56. JAPAN EV TRANSMISSION MARKET, BY TYPE, 2018–2026 ($MILLION)

TABLE 57. JAPAN EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018–2026 ($MILLION)

TABLE 58. JAPAN EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM, 2018–2026 ($MILLION)

TABLE 59. INDIA EV TRANSMISSION MARKET, BY TYPE, 2018–2026 ($MILLION)

TABLE 60. INDIA EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018–2026 ($MILLION)

TABLE 61. INDIA EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM, 2018–2026 ($MILLION)

TABLE 62. REST OF ASIA-PACIFIC EV TRANSMISSION MARKET, BY TYPE, 2018–2026 ($MILLION)

TABLE 63. REST OF ASIA-PACIFIC EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018–2026 ($MILLION)

TABLE 64. REST OF ASIA-PACIFIC EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM, 2018–2026 ($MILLION)

TABLE 65. LAMEA EV TRANSMISSION MARKET, BY TYPE, 2018–2026 ($MILLION)

TABLE 66. LAMEA EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018–2026 ($MILLION)

TABLE 67. LAMEA EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM, 2018–2026 ($MILLION)

TABLE 68. LATIN AMERICA EV TRANSMISSION MARKET, BY TYPE, 2018–2026 ($MILLION)

TABLE 69. LATIN AMERICA EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018–2026 ($MILLION)

TABLE 70. LATIN AMERICA EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM, 2018–2026 ($MILLION)

TABLE 71. MIDDLE EAST EV TRANSMISSION MARKET, BY TYPE, 2018–2026 ($MILLION)

TABLE 72. MIDDLE EAST EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018–2026 ($MILLION)

TABLE 73. MIDDLE EAST EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM, 2018–2026 ($MILLION)

TABLE 74. AFRICA EV TRANSMISSION MARKET, BY TYPE, 2018–2026 ($MILLION)

TABLE 75. AFRICA EV TRANSMISSION MARKET, BY VEHICLE TYPE, 2018–2026 ($MILLION)

TABLE 76. AFRICA EV TRANSMISSION MARKET, BY TRANSMISSION SYSTEM, 2018–2026 ($MILLION)

TABLE 77. AISIN SEIKI CO., LTD.: COMPANY SNAPSHOT

TABLE 78. AISIN SEIKI CO.,: OPERATING SEGMENTS

TABLE 79. AISIN SEIKI CO.,: PRODUCT PORTFOLIO

TABLE 80. ALLISON TRANSMISSION INC.: COMPANY SNAPSHOT

TABLE 81. ALLISON TRANSMISSION INC.: OPERATING SEGMENTS

TABLE 82. ALLISON TRANSMISSION INC.: PRODUCT PORTFOLIO

TABLE 83. ALLISON TRANSMISSION INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 84. AVL LIST GMBH: COMPANY SNAPSHOT

TABLE 85. AVL LIST GMBH: PRODUCT PORTFOLIO

TABLE 86. BORGWARNER INC.: COMPANY SNAPSHOT

TABLE 87. BORGWARNER INC.: OPERATING SEGMENTS

TABLE 88. BORGWARNER INC.: PRODUCT PORTFOLIO

TABLE 89. BORGWARNER INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 90. CONTINENTAL AG: COMPANY SNAPSHOT

TABLE 91. CONTINENTAL AG: OPERATING SEGMENTS

TABLE 92. CONTINENTAL AG: PRODUCT PORTFOLIO

TABLE 93. CONTINENTAL AG: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 94. DANA INCORPORATED: COMPANY SNAPSHOT

TABLE 95. DANA INCORPORATED: OPERATING SEGMENTS

TABLE 96. DANA INCORPORATED: PRODUCT PORTFOLIO

TABLE 97. DANA INCORPORATED: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 98. EATON: COMPANY SNAPSHOT

TABLE 99. EATON: OPERATING SEGMENTS

TABLE 100. EATON: PRODUCT PORTFOLIO

TABLE 101. EATON: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102. JATCO LTD.: COMPANY SNAPSHOT

TABLE 103. JATCO LTD.: PRODUCT PORTFOLIO

TABLE 104. JATCO LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 105. SCHAEFFLER TECHNOLOGIES AG & CO. KG.: COMPANY SNAPSHOT

TABLE 106. SCHAEFFLER TECHNOLOGIES AG & CO. KG.: OPERATING SEGMENTS

TABLE 107. ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT

TABLE 108. ZF FRIEDRICHSHAFEN AG: OPERATING SEGMENTS

TABLE 109. ZF FRIEDRICHSHAFEN AG: PRODUCT PORTFOLIO

LIST OF FIGURES

FIGURE 01. KEY MARKET SEGMENTS

FIGURE 02. EXECUTIVE SUMMARY

FIGURE 03. EXECUTIVE SUMMARY

FIGURE 04. TOP IMPACTING FACTORS

FIGURE 05. TOP INVESTMENT POCKETS

FIGURE 06. TOP WINNING STRATEGIES, BY YEAR, 2014–2018*

FIGURE 07. TOP WINNING STRATEGIES, BY YEAR, 2014–2018*

FIGURE 08. TOP WINNING STRATEGIES, BY COMPANY, 2014–2018*

FIGURE 09. MODERATE-TO-HIGH BARGAINING POWER OF SUPPLIERS

FIGURE 10. MODERATE-TO-HIGH THREAT OF NEW ENTRANTS

FIGURE 11. MODERATE THREAT OF SUBSTITUTES

FIGURE 12. HIGH-TO-MODERATE INTENSITY OF RIVALRY

FIGURE 13. HIGH-TO-MODERATE BARGAINING POWER OF BUYERS

FIGURE 14. MARKET SHARE ANALYSIS (2018)

FIGURE 15. GLOBAL EV TRANSMISSION MARKET SHARE, BY TYPE, 2018–2026 (%)

FIGURE 16. COMPARATIVE SHARE ANALYSIS OF EV TRANSMISSION MARKET FOR SINGLE SPEED TRANSMISSION, BY COUNTRY, 2017 & 2025 (%)

FIGURE 17. COMPARATIVE SHARE ANALYSIS OF EV TRANSMISSION MARKET FOR MULTI SPEED TRANSMISSION, BY COUNTRY, 2017 & 2025 (%)

FIGURE 18. GLOBAL EV TRANSMISSION MARKET SHARE, BY VEHICLE TYPE, 2018–2026 (%)

FIGURE 19. COMPARATIVE SHARE ANALYSIS OF EV TRANSMISSION MARKET FOR BATTERY ELECTRIC VEHICLE, BY COUNTRY, 2017 & 2025 (%)

FIGURE 20. COMPARATIVE SHARE ANALYSIS OF EV TRANSMISSION MARKET FOR HYBRID ELECTRIC VEHICLE, BY COUNTRY, 2017 & 2025 (%)

FIGURE 21. COMPARATIVE SHARE ANALYSIS OF EV TRANSMISSION MARKET FOR PLUG-IN HYBRID ELECTRIC VEHICLE, BY COUNTRY, 2017 & 2025 (%)

FIGURE 22. COMPARATIVE SHARE ANALYSIS OF EV TRANSMISSION MARKET FOR OTHERS, BY COUNTRY, 2017 & 2025 (%)

FIGURE 23. GLOBAL EV TRANSMISSION MARKET SHARE, BY TRANSMISSION SYSTEM, 2018–2026 (%)

FIGURE 24. COMPARATIVE SHARE ANALYSIS OF EV TRANSMISSION MARKET FOR AMT TRANSMISSIONS, BY COUNTRY, 2017 & 2025 (%)

FIGURE 25. COMPARATIVE SHARE ANALYSIS OF EV TRANSMISSION MARKET FOR CVT TRANSMISSIONS, BY COUNTRY, 2017 & 2025 (%)

FIGURE 26. COMPARATIVE SHARE ANALYSIS OF EV TRANSMISSION MARKET FOR DCT/DHT TRANSMISSIONS, BY COUNTRY, 2017 & 2025 (%)

FIGURE 27. COMPARATIVE SHARE ANALYSIS OF EV TRANSMISSION MARKET FOR AT TRANSMISSION, BY COUNTRY, 2017 & 2025 (%)

FIGURE 28. EV TRANSMISSION MARKET, BY REGION, 2018-2026 (%)

FIGURE 29. COMPARATIVE SHARE ANALYSIS OF EV TRANSMISSION MARKET, BY COUNTRY, 2018–2026 (%)

FIGURE 30. U. S. EV TRANSMISSION MARKET, 2018–2026 ($MILLION)

FIGURE 31. CANADA EV TRANSMISSION MARKET, 2018–2026 ($MILLION)

FIGURE 32. MEXICO EV TRANSMISSION MARKET, 2018–2026 ($MILLION)

FIGURE 33. COMPARATIVE SHARE ANALYSIS OF EV TRANSMISSION MARKET, BY COUNTRY, 2018–2026 (%)

FIGURE 34. U.K. EV TRANSMISSION MARKET, 2018–2026 ($MILLION)

FIGURE 35. GERMANY EV TRANSMISSION MARKET, 2018–2026 ($MILLION)

FIGURE 36. FRANCE EV TRANSMISSION MARKET, 2018–2026 ($MILLION)

FIGURE 37. ITALY EV TRANSMISSION MARKET, 2018–2026 ($MILLION)

FIGURE 38. REST OF EUROPE EV TRANSMISSION MARKET, 2018–2026 ($MILLION)

FIGURE 39. COMPARATIVE SHARE ANALYSIS OF EV TRANSMISSION MARKET, BY COUNTRY, 2018–2026 (%)

FIGURE 40. SOUTH KOREA EV TRANSMISSION MARKET, 2018–2026 ($MILLION)

FIGURE 41. CHINA EV TRANSMISSION MARKET, 2018–2026 ($MILLION)

FIGURE 42. JAPAN EV TRANSMISSION MARKET, 2018–2026 ($MILLION)

FIGURE 43. INDIA EV TRANSMISSION MARKET, 2018–2026 ($MILLION)

FIGURE 44. REST OF ASIA-PACIFIC EV TRANSMISSION MARKET, 2018–2026 ($MILLION)

FIGURE 45. COMPARATIVE SHARE ANALYSIS OF EV TRANSMISSION MARKET, BY COUNTRY, 2018–2026 (%)

FIGURE 46. LATIN AMERICA EV TRANSMISSION MARKET, 2018–2026 ($MILLION)

FIGURE 47. MIDDLE EAST EV TRANSMISSION MARKET, 2018–2026 ($MILLION)

FIGURE 48. AFRICA EV TRANSMISSION MARKET, 2018–2026 ($MILLION)

FIGURE 49. AISIN SEIKI CO.,: REVENUE, 2016–2019 ($MILLION)

FIGURE 50. AISIN SEIKI CO.,: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 51. ALLISON TRANSMISSION INC.: REVENUE, 2016–2018 ($MILLION)

FIGURE 52. ALLISON TRANSMISSION INC.: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 53. ALLISON TRANSMISSION INC.: REVENUE SHARE BY GEOGRAPHY, 2018 (%)

FIGURE 54. BORGWARNER INC.: REVENUE, 2016–2018 ($MILLION)

FIGURE 55. BORGWARNER INC.: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 56. BORGWARNER INC.: REVENUE SHARE BY GEOGRAPHY, 2017 (%)

FIGURE 57. CONTINENTAL AG: REVENUE, 2015–2017 ($MILLION)

FIGURE 58. CONTINENTAL AG: REVENUE SHARE BY SEGMENT, 2017 (%)

FIGURE 59. CONTINENTAL AG: REVENUE SHARE BY GEOGRAPHY, 2017 (%)

FIGURE 60. DANA INCORPORATED: REVENUE, 2016–2018 ($MILLION)

FIGURE 61. DANA INCORPORATED: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 62. DANA INCORPORATED: REVENUE SHARE BY GEOGRAPHY, 2018 (%)

FIGURE 63. EATON: REVENUE, 2016–2018 ($MILLION)

FIGURE 64. EATON: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 65. EATON: REVENUE SHARE BY GEOGRAPHY, 2018 (%)

FIGURE 66. SCHAEFFLER TECHNOLOGIES AG & CO. KG.: REVENUE, 2016–2018 ($MILLION)

FIGURE 67. SCHAEFFLER TECHNOLOGIES AG & CO. KG.: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 68. SCHAEFFLER TECHNOLOGIES AG & CO. KG.: REVENUE SHARE BY GEOGRAPHY, 2018 (%)

FIGURE 69. ZF FRIEDRICHSHAFEN AG: REVENUE, 2016–2018 ($MILLION)

FIGURE 70. ZF FRIEDRICHSHAFEN AG: REVENUE SHARE BY SEGMENT, 2018 (%)

FIGURE 71. ZF FRIEDRICHSHAFEN AG: REVENUE SHARE BY GEOGRAPHY, 2017 (%)

$6369

$10000

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS