The global electric kick scooter market size was valued at $2.10 billion in 2020, and is projected to reach $4.52 billion by 2028, registering a CAGR of 12.2% from 2021 to 2028.

The electric kick scooter market is gaining popularity as an eco-friendly, efficient transportation solution for urban areas. Electric kick scooters are compact, easy to maneuver, and ideal for short-distance travel, making them suitable for congested cities. Growing concerns over air pollution and traffic congestion have led consumers and governments to favor electric kick scooters as part of the sustainable transportation shift. Additionally, the expansion of micro-mobility solutions through ride-sharing platforms has propelled market growth. Manufacturers are focusing on improving battery technology and durability to enhance user experience, catering to both personal and shared use.

The electric kick scooter market is witnessing a shift toward more robust battery systems to meet the demands of frequent use. Extended battery life and faster charging capabilities make electric kick scooters a viable alternative to cars for short-distance travel, appealing to both private owners and shared mobility services. Manufacturers are heavily investing in battery advancements to meet the increased demand.

Another trend is the expansion of electric kick scooter-sharing services in urban centers worldwide. These services provide convenient, low-cost transportation options for short distances, supported by cities looking to reduce carbon emissions and traffic congestion. Many cities across Europe, North America, and Asia-Pacific are partnering with companies to integrate shared electric kick scooters into public transportation systems.

The incorporation of advanced safety features is also trending. Many electric kick scooter models now include anti-theft technology, speed limiters, and brake sensors to enhance user safety. These features are especially valuable in high-traffic urban environments, where safety concerns are paramount. With continued growth, these scooters are likely to include more sophisticated safety mechanisms, further supporting widespread adoption.

The outbreak of COVID-19 caused huge impacts on the global economy, owing to total lockdown and temporary shutdown of industries across the world. Public transport tends to contain many people in one shared space, which boosts the spread of the coronavirus disease. As people reassess ground transportation options in the face of the COVID-19 pandemic, many are choosing isolated modes such as driving or biking over public transportation or ride-sharing. People are choosing electric kick scooter services to cover medium to short distances in view of health safety concerns during the outbreak.

In comparison with other types of electric vehicles used for shared mobility services, electric kick scooters can be more hyper-localized and can be leveraged to solve the problem of last-mile connectivity. In addition, as a means of shared mobility, these electric kick scooters are compact, easier to operate, and do not require any physical exertion. In addition, several leading companies have expanded their electric kick scooter sharing services to different locations and geographies. For instance, Bird and Lime, two American electrical scooter companies, launched dock-less eclectic kick scooters in 2017. Within a year, Bird reached 100 cities and a valuation of $2 billion. In the same year, Lime offered more than 11.5 million rides. Also, in 2018, Muving SL, a Spanish electric scooter sharing company, launched its service in Atlanta, the U.S. Moreover, several leading ride-hailing and automotive companies are focusing on acquiring electric two-wheeler sharing companies so as to increase their service offerings. In November 2018, Ford Motor Company acquired Spin, an electric kick scooter startup, for around $40 million. Furthermore, increase in focus on environment-friendliness and the need for effective, low-cost transportation have contributed to surge in demand for electric kick scooters in shared mobility services. Thus, the deployment of electric kick scooters in shared mobility services drives the market growth.

Governments of various countries are taking initiatives to reduce the carbon footprints by encouraging the use of electric vehicles including electric bikes, electric kick scooters, and electric bicycles, owing to increase in awareness toward the hazardous effects of using vehicles running on fossil fuels. Moreover, governments are allowing usage of kick scooter on public or defined streets, which are encouraging individuals to opt for e-kick scooter as a key mode of commute. For instance, as of February 2021, Irish Minister for Transport Eamon Ryan, legalized the use of electric kick scooters on public roads of Ireland without requiring tax, insurance or driving license. Furthermore, to encourage the use of these environment-friendly vehicles, governments around the world are supporting for the purchase of electric mobility, in terms of tax credits and incentives. For instance, in June 2019, the Indian Government announced a plan to lower the goods & service tax (GST) on e-vehicles from 12% to 5% for faster adoption of electric vehicles.

The cost of the battery and technology makes e-kick scooters costlier as compared to traditional bicycles, conventional scooters, or motorcycles. Hence, consumers find conventional scooters or motorcycles superior in performance with same or less price. Moreover, the use of drive mechanism of motor incurs maximum manufacturing cost, thereby restraining the growth of the market. Furthermore, high battery pack replacement cost, owing to the short life of the batteries and high electric component maintenance cost increases the overall maintenance cost of the electric kick scooters. Hence, upsurge in adoption of e-kick scooters in other than developed countries such as China and the U.S., are limited by high costs. Therefore, high maintenance as well as the manufacturing cost of e-kick scooters is a major factor that restrains the growth of the market.

Leading vendors in electric kick scooter industry are primarily focusing on enhancement of durability, performance, and range of e-kick scooter. In addition, manufacturers also focusing on implementing advanced technologies such as swappable battery technology, GPS, swappable battery technology, swappable battery technology, and others. Therefore, vendors are launching technologically-advanced vehicles taking into consideration design/style and range & speed specifications. For instance, in August 2020, a leading European e-scooter company TIER, has unveiled its most advanced scooter with user swappable batteries, a built-in helmet and indicator lights. This e-kick scooter enables users to extend range of scooter by swapping out batteries within 3-5 minute at TIER charging stations. Moreover, there has been a surge in trend among manufacturers to develop solar power and self-balancing electric scooter, which are expected to witness a positive growth opportunity during the forecast period.

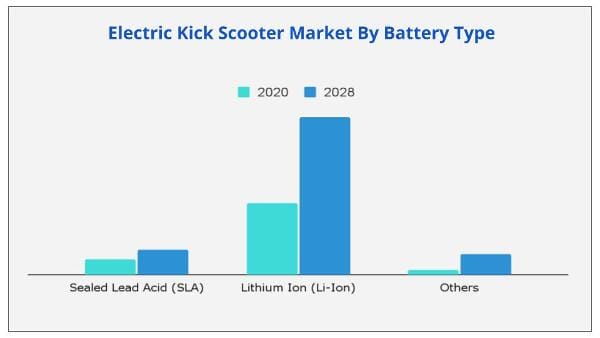

By Battery Type

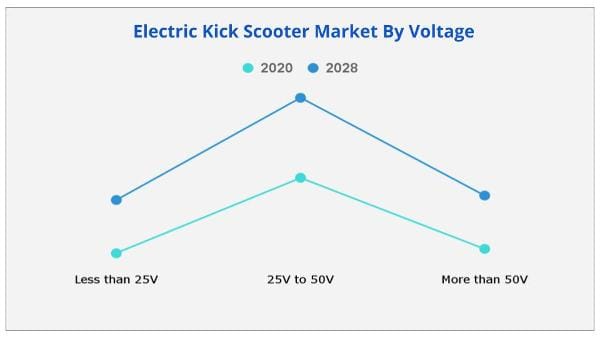

By Voltage

By Region

Key Players

|

Report Metric |

Details |

|

Report Name |

Electric Kick Scooter Market |

|

The market size in 2020 |

USD 2.10 Billion |

|

The revenue forecast in 2028 |

USD 4.52 Billion |

|

Growth Rate |

CAGR of 12.2% from 2021 to 2028 |

|

Market size available for years |

2021-2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Battery Type, Voltage, Offerings, and Region |

|

Report coverage |

Revenue & volume forecast, company share, competitive landscape, growth factors, and trends |

|

Geographic regions covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Ans. People reassess ground transportation options in the face of the COVID-19 pandemic, many are choosing isolated modes such as electric bikes and scooters over public transportation or ride-sharing. People are choosing electric kick scooter services to cover medium to short distances in view of health safety concerns during the outbreak.

Ans. The global electric kick scooter market was valued at $2.10 billion in 2020, and is projected to reach $4.52 billion by 2028, registering a CAGR of 12.2% from 2021 to 2028.

Ans. There are certain upcoming trands in electric kick scooter such as growing R&D investments for enhanced battery technologies and rapid technological advancements in e-kick scooters industry

Ans. By battery type, others segment is expacted to gain traction over the forecast period as well as domainate the market share in the global electric kick scooter market

Ans. Europe region is leading the market presently in terms of revenue. However, LAMEA region and Mexico is expected to provide more business opportunities for the key players operating in the global electric kick scooter market.

Table of Content

CHAPTER 1:INTRODUCTION

1.1.Report description

1.2.Key benefits for stakeholders

1.3.Key market segments

1.4.Research methodology

1.4.1.Primary research

1.4.2.Secondary research

1.4.3.Analyst tools and models

CHAPTER 2:EXECUTIVE SUMMARY

2.1.CXO perspective

CHAPTER 3:MARKET OVERVIEW

3.1.Market definition and scope

3.2.Key findings

3.2.1.Top impacting factors

3.2.2.Top investment pockets

3.2.3.Top winning strategies

3.3.Porter’s five forces analysis

3.4.Market share analysis (2020)

3.5.Market dynamics

3.5.1.Drivers

3.5.1.1.Deployment of kick scooters for shared mobility services

3.5.1.2.Growing popularity of electric vehicles and rising awareness regarding the environmental advantages of electric kick scooters

3.5.1.3.Positive government regulations to encourage the use of electric kick scooters

3.5.2.Restraints

3.5.2.1.High maintenance as well as the manufacturing cost

3.5.2.2.Ban on use of e-kick scooter in major cities across the world

3.5.3.Opportunity

3.5.3.1.Growing R&D investments for enhanced battery technologies

3.5.3.2.Rapid technological advancements in e-kick scooters industry

3.6.Impact of COVID-19 on global electric kick scooter market

3.6.1.Evolution of outbreaks

3.6.1.1.COVID-19

3.6.2.Microeconomic impact analysis

3.6.2.1.Consumer trends

3.6.2.2.Technology trends

3.6.2.3.Regulatory trends

3.6.3.Macroeconomic impact analysis

3.6.3.1.GDP

3.6.3.2.Import/export analysis

3.6.3.3.Employment index

3.6.4.Impact on electric kick scooter industry analysis

CHAPTER 4:ELECTRIC KICK SCOOTER MARKET, BY BATTERY TYPE

4.1.Overview

4.2.Sealed Lead Acid (SLA)

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast, by region

4.2.3.Market analysis by country

4.3.Lithium-ion (Li-ion)

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Market size and forecast, by region

4.3.3.Market analysis by country

4.4.Others

4.4.1.Key market trends, growth factors, and opportunities

4.4.2.Market size and forecast, by region

4.4.3.Market analysis by country

CHAPTER 5:ELECTRIC KICK SCOOTER MARKET, BY VOLTAGE

5.1.Overview

5.2.Less than 25V

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region

5.2.3.Market analysis by country

5.3.25V to 50V

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region

5.3.3.Market analysis by country

5.4.More than 50V

5.4.1.Key market trends, growth factors, and opportunities

5.4.2.Market size and forecast, by region

5.4.3.Market analysis by country

CHAPTER 6:ELECTRIC KICK SCOOTER MARKET, BY REGION

6.1.Overview

6.2.North America

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by battery type

6.2.3.Market size and forecast, by voltage

6.2.4.Market size and forecast, by country

6.2.4.1.U.S.

6.2.4.1.1.Market size and forecast, by battery type

6.2.4.1.2.Market size and forecast, by voltage

6.2.4.2.Canada

6.2.4.2.1.Market size and forecast, by battery type

6.2.4.2.2.Market size and forecast, by voltage

6.2.4.3.Mexico

6.2.4.3.1.Market size and forecast, by battery type

6.2.4.3.2.Market size and forecast, by voltage

6.3.Europe

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by battery type

6.3.3.Market size and forecast, by voltage

6.3.4.Market size and forecast, by country

6.3.4.2.Germany

6.3.4.2.1.Market size and forecast, by battery type

6.3.4.2.2.Market size and forecast, by voltage

6.3.4.3.France

6.3.4.3.1.Market size and forecast, by battery type

6.3.4.3.2.Market size and forecast, by voltage

6.3.4.4.Netherlands

6.3.4.4.1.Market size and forecast, by battery type

6.3.4.4.2.Market size and forecast, by voltage

6.3.4.5.Italy

6.3.4.5.1.Market size and forecast, by battery type

6.3.4.5.2.Market size and forecast, by voltage

6.3.4.6.Rest of Europe

6.3.4.6.1.Market size and forecast, by battery type

6.3.4.6.2.Market size and forecast, by voltage

6.4.Asia-Pacific

6.4.1.Key market trends, growth factors, and opportunities

6.4.2.Market size and forecast, by battery type

6.4.3.Market size and forecast, by voltage

6.4.4.Market size and forecast, by country

6.4.4.1.China

6.4.4.1.1.Market size and forecast, by battery type

6.4.4.1.2.Market size and forecast, by voltage

6.4.4.2.Japan

6.4.4.2.1.Market size and forecast, by battery type

6.4.4.2.2.Market size and forecast, by voltage

6.4.4.3.India

6.4.4.3.1.Market size and forecast, by battery type

6.4.4.3.2.Market size and forecast, by voltage

6.4.4.4.Australia

6.4.4.4.1.Market size and forecast, by battery type

6.4.4.4.2.Market size and forecast, by voltage

6.4.4.5.Rest of Asia-Pacific

6.4.4.5.1.Market size and forecast, by battery type

6.4.4.5.2.Market size and forecast, by voltage

6.5.LAMEA

6.5.1.Key market trends, growth factors, and opportunities

6.5.2.Market size and forecast, by battery type

6.5.3.Market size and forecast, by voltage

6.5.4.Market size and forecast, by country

6.5.4.1.Latin America

6.5.4.1.1.Market size and forecast, by battery type

6.5.4.1.2.Market size and forecast, by voltage

6.5.4.2.Middle East

6.5.4.2.1.Market size and forecast, by battery type

6.5.4.2.2.Market size and forecast, by voltage

6.5.4.3.Africa

6.5.4.3.1.Market size and forecast, by battery type

6.5.4.3.2.Market size and forecast, by voltage

CHAPTER 7:COMPANY PROFILES

7.1.GOVECS AG

7.1.1.Company overview

7.1.2.Company snapshot

7.1.3.Product portfolio

7.1.4.Key strategic moves and developments

7.2.IconBIT

7.2.1.Company overview

7.2.2.Company snapshot

7.2.3.Product portfolio

7.3.Jiangsu Xinri E-Vehicle Co., Ltd

7.3.1.Company overview

7.3.2.Company snapshot

7.3.3.Product portfolio

7.3.4.Business performance

7.3.5.Key strategic moves and developments

7.4.Ninebot (Segway Inc.)

7.4.1.Company overview

7.4.2.Company snapshot

7.4.3.Product portfolio

7.4.4.Business performance

7.4.5.Key strategic moves and developments

7.5.Ningbo MYWAY Intelligent Technology Co., Ltd (Inokim)

7.5.1.Company overview

7.5.2.Company snapshot

7.5.3.Product portfolio

7.5.4.Key strategic moves and developments

7.6.Niu International

7.6.1.Company overview

7.6.2.Company snapshot

7.6.3.Operating business segments

7.6.4.Product portfolio

7.6.5.Business performance

7.6.6.Key strategic moves and developments

7.7.Razor USA LLC

7.7.1.Company overview

7.7.2.Company snapshot

7.7.3.Product portfolio

7.7.4.Key strategic moves and developments

7.8.SWAGTRON

7.8.1.Company overview

7.8.2.Company snapshot

7.8.3.Product portfolio

7.8.4.Key strategic moves and developments

7.9.Xiaomi Inc.

7.9.1.Company overview

7.9.2.Company snapshot

7.9.3.Operating business segments

7.9.4.Product portfolio

7.9.5.Business performance

7.9.6.Key strategic moves and developments

7.10.YADEA Technology Group Co., Ltd.

7.10.1.Company overview

7.10.2.Company snapshot

7.10.3.Operating business segments

7.10.4.Product portfolio

7.10.5.Business performance

List of Tables & Figures

$5769

$9995

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS