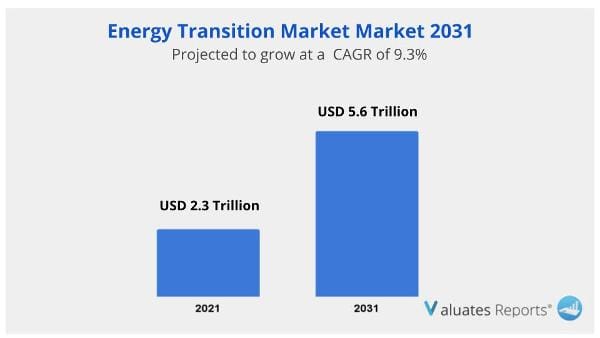

The global energy transition market size was valued at USD 2.3 trillion in 2021 and is projected to reach USD 5.6 trillion by 2031, with a CAGR of 9.3% from 2022 to 2031. The development of energy storage technologies, the rising usage of renewable energy sources, and the invention of electricity are all significant drivers anticipated to propel the growth of the energy transition market.

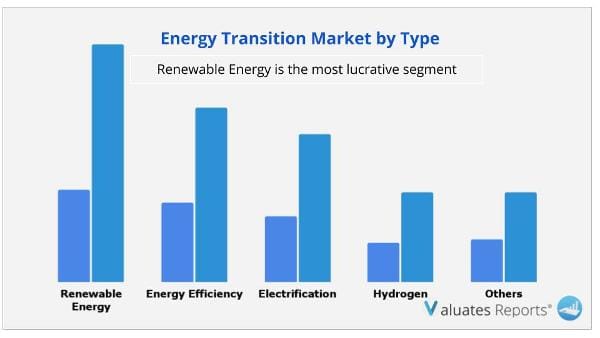

During the energy transition process, fossil fuels like oil, natural gas, and coal are converted into clean energy sources including wind and solar power as well as lithium-ion batteries. The energy transition can be divided into five primary categories: hydrogen, electrification, renewable energy, and energy efficiency. Due to their widespread use in the household and utility sectors, renewable energy sources hold the biggest market share in terms of income. Two major reasons driving the growth of the worldwide market for energy transition are innovations in energy storage.

A steady supply of energy, the emergence of prosumer business models, and a shift in people's attitudes towards renewable energy sources are all projected to create appealing potential for market growth during the forecast period. Due to the usage of transition technology in power generation and its capability to provide electricity for residential structures at an affordable price, the market for energy transition is also anticipated to grow. The energy transition market is anticipated to be driven by this factor.

Other factors promoting the growth of the global energy transition market during the course of the projected period include the development of grid infrastructure, an increase in energy-efficient building, the expansion of the transportation industry, and the focus on carbon emission reduction. It is also projected that as governments all over the world voice growing concern about the effects of global warming, the demand for energy transition would increase. To urge businesses to aid in ushering in the zero-carbon era, governments in several countries are implementing new incentives and rebate schemes. Such incentive schemes are expected to encourage utility and commercial end users to switch to clean energy, supporting the growth of the global market for energy transition.

Together with a serious international health crisis and wide-spread economic misery, the pandemic's enormous disruptions of trade, travel, and economic activity also caused a drop in global carbon emissions. To create a robust economic recovery without producing appreciable amounts of carbon emissions, the government is taking the lead in seeking structural reductions in emissions by offering or working with smart, sustained, and ambitious policies to boost growth. The market for energy transition is anticipated to increase as a result of this aspect.

The market for renewable energy, which brought in the most money in 2021, is anticipated to grow at a CAGR of 9.8% over the course of the projection year. The market is seeing an increase in demand for renewable energy, which has the advantage of emitting fewer emissions of carbon and other sorts of pollutants. The expansion of the energy transition and the storage of electricity generated by renewable sources will lead to an expanding market for renewable energy. As an illustration, China's Renewable Energy and Battery Storage Promotion Initiative aims to encourage the integration and use of renewable energy through creative applications of battery storage technologies.

Throughout the forecast period, the Asia-Pacific Energy Transition market size is anticipated to develop at the highest CAGR. In the Asia-Pacific region, countries like India, China, and Thailand have experienced rapid industrialization and urbanization, which has increased infrastructure development activities. These activities include building new residential complexes and highways, which is expected to increase demand for standalone systems. The need for an energy transition is also anticipated to be boosted by an increase in government expenditure in R&D and technological innovation.

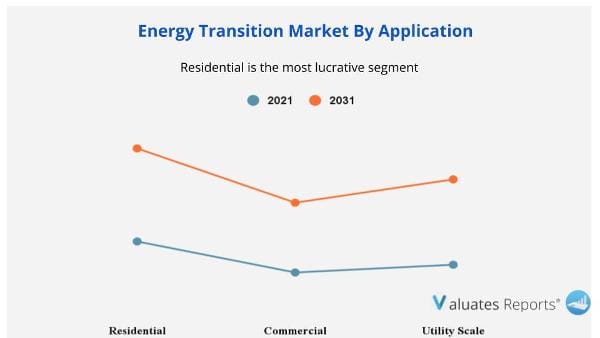

The residential market, which generated the most revenue in 2021, is expected to expand at a CAGR of 9.5% over the course of the projection year. The demand for electric water heaters from applications such as cooking, space heating, cleaning, bathing, and others is predicted to increase during the forecast period, which is one of several factors contributing to the market's rising residential demand.

The COVID-19 is an infectious disease that originated in Hubei province of the Wuhan city in China in late December 2019. The highly contagious disease, caused by a virus, severe acute respiratory syndrome coronavirus 2, is transmitted from humans to humans. Since the outbreak in December 2019, the disease has spread to almost 213 countries around the globe with the World Health Organization declaring it a public health emergency on March 11, 2020. During 2020-2021, the energy transition market was moderately impacted due to the spread of pandemic, however the presence of its beneficial features, the market has gained momentum through investments post lockdowns. Some factors which slowdown the demand for energy transitions market across the are smaller number of investments in 2020 and threatening to slow the expansion of key clean energy technologies.

| Report Metric | Details |

| Report Name | Energy Transition Market |

| The market size in 2021 | USD 2.3 Trillion |

| The revenue forecast in 2031 | USD 5.6 Trillion |

| Growth Rate | Compound Annual Growth Rate (CAGR) of 9.3% from 2022 to 2031 |

| Market size available for years | 2022-2031 |

| Forecast units | Value (USD) |

| Segments covered | By Service, Industry, Traveler, Regions |

| Report coverage | Revenue & volume forecast, company share, competitive landscape, growth factors, and trends |

| Geographic regions covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Ans. The global energy transition market size was valued at $2.3 trillion in 2021, and projected to reach $5.6 trillion by 2031, with a CAGR of 9.3% from 2022 to 2031.

Ans. The introduction of electricity, the increased use of renewable energy, and advancements in energy storage are all major factors expected to drive the growth of the Energy Transition Market.

Ans. The global energy transition market size is estimated to grow with a Compound Annual Growth Rate (CAGR) of 9.3% during the forecast period.

Ans. By Application, the residential segment was the largest revenue generator, and is anticipated to grow at a CAGR of 9.5% during the forecast period in 2021.

Ans. Europe would exhibit highest CAGR of 8.4% during 2022-2031.

Ans. The leading players operating in the global Energy Transition market include, Exelon Corporation, Duke Energy Corporation, Pacific Gas and Electric Company, Southern Company, American Electric Power, Inc, Edison International, Repsol, Brookfield Renewable Partners, Ørsted A/S, and NextEra Energy, Inc.

CHAPTER 1:INTRODUCTION

1.1.Report description

1.2.Key benefits for stakeholders

1.3.Key market segments

1.4.Research methodology

1.4.1.Secondary research

1.4.2.Primary research

1.5.Analyst tools and models

CHAPTER 2:EXECUTIVE SUMMARY

2.1.Key findings of the study

2.2.CXO perspective

CHAPTER 3:MARKET OVERVIEW

3.1.Market definition and scope

3.2.Key findings

3.2.1.Top investment pockets

3.3.Porter’s five forces analysis

3.4.Market dynamics

3.4.1.Drivers

3.4.1.1.The integration of digital innovation into the energy system

3.4.1.2.Regulatory Frameworks that Incentivize Companies to Change and Evolve into the Zero-Carbon Era

3.4.2.Restraint

3.4.2.1.Technological limitations and Geopolitical concerns

3.4.3.Opportunity

3.4.3.1.Increase in demand from commercial and utility-scale sectors for electricity

3.4.4.Challenge

3.4.4.1.Shortage in Supply of Energy Transition

3.4.5.Major Investment in Global Energy Transition Market

3.4.6.China- Overview of Renewable Projects

3.5.Value chain analysis

3.6.Patent Analysis

3.6.1.By region, 2014–2022

3.7.China Investment in Energy Transition, 2020 (US$ Billion)

3.8.Global Investment in Energy Transition by Sector, 2021 (US$ Billion)

3.9.Impact of COVID-19 on global energy transition market

CHAPTER 4:ENERGY TRANSITION MARKET, BY TYPE

4.1.Overview

4.1.1.Market size and forecast

4.2.Renewable Energy

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast, by region

4.2.3.Renewable Energy, by type

4.2.4.Comparative Share Analysis by Country

4.2.4.1.Wind Power

4.2.5.Comparative Share Analysis by Country

4.2.5.1.Solar Power

4.2.6.Comparative Share Analysis by Country

4.2.6.1.Bioenergy

4.2.7.Comparative Share Analysis by Country

4.2.7.1.Hydropower

4.2.8.Comparative Share Analysis by Country

4.3.Energy Efficiency

4.3.1.Key market trends, growth factors, and opportunities

4.3.2.Market size and forecast, by region

4.3.3.Comparative Share Analysis by Country

4.4.Electrification

4.4.1.Key market trends, growth factors, and opportunities

4.4.2.Market size and forecast, by region

4.4.3.Comparative Share Analysis by Country

4.5.Hydrogen

4.5.1.Key market trends, growth factors, and opportunities

4.5.2.Market size and forecast, by region

4.5.3.Comparative Share Analysis by Country

4.6.Others

4.6.1.Key market trends, growth factors, and opportunities

4.6.2.Market size and forecast, by region

4.6.3.Comparative Share Analysis by Country

CHAPTER 5:ENERGY TRANSITION MARKET, BY APPLICATION

5.1.Overview

5.1.1.Market size and forecast

5.2.Residential

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region

5.2.3.Comparative Share Analysis by Country

5.3.Commercial

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region

5.3.3.Comparative Share Analysis by Country

5.4.Utility-scale

5.4.1.Key market trends, growth factors, and opportunities

5.4.2.Market size and forecast, by region

5.4.3.Comparative Share Analysis by Country

CHAPTER 6:ENERGY TRANSITION MARKET, BY REGION

6.1.Overview

6.1.1.Market size and forecast, by region

6.2.North America

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by type

6.2.2.1.Renewable Energy, by type

6.2.3.Market size and forecast, By Application

6.2.4.Market analysis, by Country

6.2.4.1.U.S.

6.2.4.1.1.Market size and forecast, by type

6.2.4.1.1.1.Renewable Energy, by type

6.2.4.1.2.Market size and forecast, By Application

6.2.4.2.Canada

6.2.4.2.1.Market size and forecast, by type

6.2.4.2.1.1.Renewable Energy, by type

6.2.4.2.2.Market size and forecast, By Application

6.2.4.3.Mexico

6.2.4.3.1.Market size and forecast, by type

6.2.4.3.1.1.Renewable Energy, by type

6.2.4.3.2.Market size and forecast, By Application

6.3.Europe

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by type

6.3.2.1.Renewable Energy, by type

6.3.3.Market size and forecast, By Application

6.3.4.Market analysis, by Country

6.3.4.1.Germany

6.3.4.1.1.Market size and forecast, by type

6.3.4.1.1.1.Renewable Energy, by type

6.3.4.1.2.Market size and forecast, By Application

6.3.4.2.France

6.3.4.2.1.Market size and forecast, by type

6.3.4.2.1.1.Renewable Energy, by type

6.3.4.2.2.Market size and forecast, By Application

6.3.4.3.UK

6.3.4.3.1.Market size and forecast, by type

6.3.4.3.1.1.Renewable Energy, by type

6.3.4.3.2.Market size and forecast, By Application

6.3.4.4.Italy

6.3.4.4.1.Market size and forecast, by type

6.3.4.4.1.1.Renewable Energy, by type

6.3.4.4.2.Market size and forecast, By Application

6.3.4.5.Spain

6.3.4.5.1.Market size and forecast, by type

6.3.4.5.1.1.Renewable Energy, by type

6.3.4.5.2.Market size and forecast, By Application

6.3.4.6.Rest of Europe

6.3.4.6.1.Market size and forecast, by type

6.3.4.6.1.1.Renewable Energy, by type

6.3.4.6.2.Market size and forecast, By Application

6.4.Asia-Pacific

6.4.1.Key market trends, growth factors, and opportunities

6.4.2.Market size and forecast, by type

6.4.2.1.Renewable Energy, by type

6.4.3.Market size and forecast, By Application

6.4.4.Market analysis, by Country

6.4.4.1.China

6.4.4.1.1.Market size and forecast, by type

6.4.4.1.1.1.Renewable Energy, by type

6.4.4.1.2.Market size and forecast, By Application

6.4.4.2.Japan

6.4.4.2.1.Market size and forecast, by type

6.4.4.2.1.1.Renewable Energy, by type

6.4.4.2.2.Market size and forecast, By Application

6.4.4.3.India

6.4.4.3.1.Market size and forecast, by type

6.4.4.3.1.1.Renewable Energy, by type

6.4.4.3.2.Market size and forecast, By Application

6.4.4.4.South Korea

6.4.4.4.1.Market size and forecast, by type

6.4.4.4.1.1.Renewable Energy, by type

6.4.4.4.2.Market size and forecast, By Application

6.4.4.5.Rest of Asia-Pacific

6.4.4.5.1.Market size and forecast, by type

6.4.4.5.1.1.Renewable Energy, by type

6.4.4.5.2.Market size and forecast, By Application

6.5.LAMEA

6.5.1.Key market trends, growth factors, and opportunities

6.5.2.Market size and forecast, by type

6.5.3.Market size and forecast, By Application

6.5.4.Market analysis, by Country

6.5.4.1.Brazil

6.5.4.1.1.Market size and forecast, by type

6.5.4.1.1.1.Renewable Energy, by type

6.5.4.1.2.Market size and forecast, By Application

6.5.4.2.South Africa

6.5.4.2.1.Market size and forecast, by type

6.5.4.2.1.1.Renewable Energy, by type

6.5.4.2.2.Market size and forecast, By Application

6.5.4.3.UAE

6.5.4.3.1.Market size and forecast, by type

6.5.4.3.1.1.Renewable Energy, by type

6.5.4.3.2.Market size and forecast, By Application

6.5.4.4.Rest of LAMEA

6.5.4.4.1.Market size and forecast, by type

6.5.4.4.1.1.Renewable Energy, by type

6.5.4.4.2.Market size and forecast, By Application

CHAPTER 7:COMPETITIVE LANDSCAPE

7.1.Introduction

7.1.1.Market player positioning, 2021

7.2.Top winning strategies

7.2.1.Top winning strategies, by year

7.2.2.Top winning strategies, by development

7.2.3.Top winning strategies, by company

7.3.Product mapping of top 10 players

7.4.Competitive heatmap

7.5.Key developments

7.5.1.Business Expansion

7.5.2.Acquisition

7.5.3.Partnership

CHAPTER 8:COMPANY PROFILES

8.1.EXELON

8.1.1.Company overview

8.1.2.Key executives

8.1.3.Company snapshot

8.1.4.Operating business segments

8.1.5.Product portfolio

8.1.6.Business performance

8.2.DUKE ENERGY CORPORATION

8.2.1.Company overview

8.2.1.Key executives

8.2.2.Company snapshot

8.2.3.Operating business segments

8.2.4.Product portfolio

8.2.5.Business performance

8.2.6.Key strategic moves and developments

8.3.PACIFIC GAS AND ELECTRIC COMPANY

8.3.1.Company overview

8.3.2.Key executive

8.3.3.Company snapshot

8.3.4.Operating business segments

8.3.5.Product portfolio

8.3.6.Business performance

8.3.7.Key strategic moves and developments

8.4.SOUTHERN COMPANY

8.4.1.Company overview

8.4.2.Key executives

8.4.3.Company snapshot

8.4.4.Operating business segments

8.4.5.Product portfolio

8.4.6.Business performance

8.5.AMERICAN ELECTRIC POWER, INC

8.5.1.Company overview

8.5.2.Key executives

8.5.3.Company snapshot

8.5.4.Operating business segments

8.5.5.Product portfolio

8.5.6.Business performance

8.6.EDISON INTERNATIONAL

8.6.1.Company overview

8.6.2.Key executives

8.6.3.Company snapshot

8.6.4.Operating business segments

8.6.5.Product portfolio

8.6.6.Business performance

8.7.REPSOL

8.7.1.Company overview

8.7.2.Key executives

8.7.3.Company snapshot

8.7.4.Operating business segments

8.7.5.Product portfolio

8.7.6.Business performance

8.7.7.Key strategic moves and developments

8.8.BROOKFIELD RENEWABLE PARTNERS

8.8.1.Company overview

8.8.2.Key executives

8.8.3.Company snapshot

8.8.4.Operating business segments

8.8.5.Product portfolio

8.8.6.Business performance

8.9.ØRSTED A/S

8.9.1.Company overview

8.9.2.Key executives

8.9.3.Company snapshot

8.9.4.Operating business segments

8.9.5.Product portfolio

8.9.6.Business performance

8.9.7.Key strategic moves and developments

8.10.NEXTERA ENERGY, INC.

8.10.1.Company overview

8.10.2.Key executives

8.10.3.Company snapshot

8.10.4.Product portfolio

8.10.5.Business performance

8.10.6.Key strategic moves and developments

LIST OF TABLES

TABLE 01.ENERGY TRANSITION MARKET, BY TYPE, 2021-2031 ($BILLION)

TABLE 02.ENERGY TRANSITION MARKET REVENUE, FOR RENEWABLE ENERGY, BY REGION, 2021-2031 ($BILLION)

TABLE 03.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY TYPE, 2021-2031 ($BILLION)

TABLE 04.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY WIND POWER, 2021-2031 ($BILLION)

TABLE 05.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY SOLAR POWER, 2021-2031 ($BILLION)

TABLE 06.ENERGY TRANSITION FOR RENEWABLE ENERGY, BY BIOENERGY, 2021-2031 ($BILLION)

TABLE 07.ENERGY TRANSITION FOR RENEWABLE ENERGY, BY HYDROPOWER, 2021-2031 ($BILLION)

TABLE 08.ENERGY TRANSITION MARKET REVENUE, FOR ENERGY EFFICIENCY, BY REGION, 2021-2031 ($BILLION)

TABLE 09.ENERGY TRANSITION MARKET REVENUE, FOR ELECTRIFICATION, BY REGION, 2021-2031 ($BILLION)

TABLE 10.ENERGY TRANSITION MARKET REVENUE, FOR HYDROGEN, BY REGION, 2021-2031 ($BILLION)

TABLE 11.ENERGY TRANSITION MARKET REVENUE, FOR OTHERS, BY REGION, 2021-2031 ($BILLION)

TABLE 12.GLOBAL ENERGY TRANSITION MARKET, BY APPLICATION, 2021-2031 ($BILLION)

TABLE 13.ENERGY TRANSITION MARKET REVENUE, FOR RESIDENTIAL, BY REGION, 2021-2031 ($BILLION)

TABLE 14.ENERGY TRANSITION MARKET REVENUE, FOR COMMERCIAL, BY REGION, 2021-2031 ($BILLION

TABLE 15.ENERGY TRANSITION MARKET REVENUE, FOR UTILITY-SCALE, BY REGION, 2021-2031 ($BILLION)

TABLE 16.ENERGY TRANSITION MARKET, BY REGION, 2021-2031 ($BILLION)

TABLE 17.NORTH AMERICA ENERGY TRANSITION MARKET, BY TYPE, 2021-2031 ($BILLION)

TABLE 18.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY TYPE, 2021-2031 ($BILLION)

TABLE 19.NORTH AMERICA ENERGY TRANSITION MARKET, BY APPLICATION, 2021-2031 ($BILLION)

TABLE 20.NORTH AMERICA ENERGY TRANSITION MARKET, BY COUNTRY, 2021-2031 ($BILLION)

TABLE 21.U.S. ENERGY TRANSITION MARKET, BY TYPE, 2021-2031 ($BILLION)

TABLE 22.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY TYPE, 2021-2031 ($BILLION)

TABLE 23.U.S. ENERGY TRANSITION MARKET, BY APPLICATION, 2021-2031 ($BILLION)

TABLE 24.CANADA ENERGY TRANSITION MARKET, BY TYPE, 2021-2031 ($BILLION)

TABLE 25.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY TYPE, 2021-2031 ($BILLION)

TABLE 26.CANADA ENERGY TRANSITION MARKET, BY APPLICATION, 2021-2031 ($BILLION)

TABLE 27.MEXICO ENERGY TRANSITION MARKET, BY TYPE, 2021-2031 ($BILLION)

TABLE 28.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY TYPE, 2021-2031 ($BILLION)

TABLE 29.MEXICO ENERGY TRANSITION MARKET, BY APPLICATION, 2021-2031 ($BILLION)

TABLE 30.EUROPE ENERGY TRANSITION MARKET, BY TYPE, 2021-2031 ($BILLION)

TABLE 31.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY TYPE, 2021-2031 ($BILLION)

TABLE 32.EUROPE ENERGY TRANSITION MARKET, BY APPLICATION, 2021-2031 ($BILLION)

TABLE 33.EUROPE ENERGY TRANSITION MARKET, BY COUNTRY, 2021-2031 ($BILLION)

TABLE 34.GERMANY ENERGY TRANSITION MARKET, BY TYPE, 2021-2031 ($BILLION)

TABLE 35.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY TYPE, 2021-2031 ($BILLION)

TABLE 36.GERMANY ENERGY TRANSITION MARKET, BY APPLICATION, 2021-2031 ($BILLION)

TABLE 37.FRANCE ENERGY TRANSITION MARKET, BY TYPE, 2021-2031 ($BILLION)

TABLE 38.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY TYPE, 2021-2031 ($BILLION)

TABLE 39.FRANCE ENERGY TRANSITION MARKET, BY APPLICATION, 2021-2031 ($BILLION)

TABLE 40.UK ENERGY TRANSITION MARKET, BY TYPE, 2021-2031 ($BILLION)

TABLE 41.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY TYPE, 2021-2031 ($BILLION)

TABLE 42.UK ENERGY TRANSITION MARKET, BY APPLICATION, 2021-2031 ($BILLION)

TABLE 43.ITALY ENERGY TRANSITION MARKET, BY TYPE, 2021-2031 ($BILLION)

TABLE 44.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY TYPE, 2021-2031 ($BILLION)

TABLE 45.ITALY ENERGY TRANSITION MARKET, BY APPLICATION, 2021-2031 ($BILLION)

TABLE 46.SPAIN ENERGY TRANSITION MARKET, BY TYPE, 2021-2031 ($BILLION)

TABLE 47.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY TYPE, 2021-2031 ($BILLION)

TABLE 48.SPAIN ENERGY TRANSITION MARKET, BY APPLICATION, 2021-2031 ($BILLION)

TABLE 49.REST OF EUROPE ENERGY TRANSITION MARKET, BY TYPE, 2021-2031 ($BILLION)

TABLE 50.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY TYPE, 2021-2031 ($BILLION)

TABLE 51.REST OF EUROPE ENERGY TRANSITION MARKET, BY APPLICATION, 2021-2031 ($BILLION)

TABLE 52.ASIA-PACIFIC ENERGY TRANSITION MARKET, BY TYPE, 2021-2031 ($BILLION)

TABLE 53.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY TYPE, 2021-2031 ($BILLION)

TABLE 54.ASIA-PACIFIC ENERGY TRANSITION MARKET, BY APPLICATION, 2021-2031 ($BILLION)

TABLE 55.ASIA-PACIFIC ENERGY TRANSITION MARKET, BY COUNTRY, 2021-2031 ($BILLION)

TABLE 56.CHINA ENERGY TRANSITION MARKET, BY TYPE, 2021-2031 ($BILLION)

TABLE 57.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY TYPE, 2021-2031 ($BILLION)

TABLE 58.CHINA ENERGY TRANSITION MARKET, BY APPLICATION, 2021-2031 ($BILLION)

TABLE 59.JAPAN ENERGY TRANSITION MARKET, BY TYPE, 2021-2031 ($BILLION)

TABLE 60.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY TYPE, 2021-2031 ($BILLION)

TABLE 61.JAPAN ENERGY TRANSITION MARKET, BY APPLICATION, 2021-2031 ($BILLION)

TABLE 62.INDIA ENERGY TRANSITION MARKET, BY TYPE, 2021-2031 ($BILLION)

TABLE 63.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY TYPE, 2021-2031 ($BILLION)

TABLE 64.INDIA ENERGY TRANSITION MARKET, BY APPLICATION, 2021-2031 ($BILLION)

TABLE 65.SOUTH KOREA ENERGY TRANSITION MARKET, BY TYPE, 2021-2031 ($BILLION)

TABLE 66.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY TYPE, 2021-2031 ($BILLION)

TABLE 67.SOUTH KOREA ENERGY TRANSITION MARKET, BY APPLICATION, 2021-2031 ($BILLION)

TABLE 68.REST OF ASIA-PACIFIC ENERGY TRANSITION MARKET, BY TYPE, 2021-2031 ($BILLION)

TABLE 69.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY TYPE, 2021-2031 ($BILLION)

TABLE 70.REST OF ASIA-PACIFIC ENERGY TRANSITION MARKET, BY APPLICATION, 2021-2031 ($BILLION)

TABLE 71.LAMEA ENERGY TRANSITION MARKET, BY TYPE, 2021-2031 ($BILLION)

TABLE 72.LAMEA ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY TYPE, 2021-2031 ($BILLION)

TABLE 73.LAMEA ENERGY TRANSITION MARKET, BY APPLICATION, 2021-2031 ($BILLION)

TABLE 74.LAMEA ENERGY TRANSITION MARKET, BY COUNTRY, 2021-2031 ($BILLION)

TABLE 75.BRAZIL ENERGY TRANSITION MARKET, BY TYPE, 2021-2031 ($BILLION)

TABLE 76.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY TYPE, 2021-2031 ($BILLION)

TABLE 77.BRAZIL ENERGY TRANSITION MARKET, BY APPLICATION, 2021-2031 ($BILLION)

TABLE 78.SOUTH AFRICA ENERGY TRANSITION MARKET, BY TYPE, 2021-2031 ($BILLION)

TABLE 79.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY TYPE, 2021-2031 ($BILLION)

TABLE 80.SOUTH AFRICA ENERGY TRANSITION MARKET, BY APPLICATION, 2021-2031 ($BILLION)

TABLE 81.UAE ENERGY TRANSITION MARKET, BY TYPE, 2021-2031 ($BILLION)

TABLE 82.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY TYPE, 2021-2031 ($BILLION)

TABLE 83.UAE ENERGY TRANSITION MARKET, BY APPLICATION, 2021-2031 ($BILLION)

TABLE 84.REST OF LAMEA ENERGY TRANSITION MARKET, BY TYPE, 2021-2031 ($BILLION)

TABLE 85.ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY, BY TYPE, 2021-2031 ($BILLION)

TABLE 86.REST OF LAMEA ENERGY TRANSITION MARKET, BY APPLICATION, 2021-2031 ($BILLION)

TABLE 87.KEY BUSINESS EXPANSION (2020-2022)

TABLE 88.KEY ACQUISITION (2020-2022)

TABLE 89.PARTNERSHIP (2020-2022)

TABLE 90.EXELON CORPORATION: KEY EXECUTIVES

TABLE 91.EXELON CORPORATION: COMPANY SNAPSHOT

TABLE 92.EXELON CORPORATION.: OPERATING SEGMENTS

TABLE 93.EXELON CORPORATION: PRODUCT PORTFOLIO

TABLE 94.EXELON CORPORATION.: NET SALES, 2019–2021 ($MILLION)

TABLE 95.DUKE ENERGY CORPORATION: KEY EXECUTIVES

TABLE 96.DUKE ENERGY CORPORATION: COMPANY SNAPSHOT

TABLE 97.DUKE ENERGY CORPORATION: OPERATING SEGMENTS

TABLE 98.DUKE ENERGY CORPORATION: PRODUCT PORTFOLIO

TABLE 99.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 100.DUKE ENERGY CORPORATION.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 101.PACIFIC GAS AND ELECTRIC COMPANY: KEY EXECUTIVES

TABLE 102.PACIFIC GAS AND ELECTRIC COMPANY: COMPANY SNAPSHOT

TABLE 103.PACIFIC GAS AND ELECTRIC COMPANY: OPERATING SEGMENTS

TABLE 104.PACIFIC GAS AND ELECTRIC COMPANY: PRODUCT PORTFOLIO

TABLE 105.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 106.PACIFIC GAS AND ELECTRIC COMPANY: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 107.SOUTHERN COMPANY: KEY EXECUTIVES

TABLE 108.SOUTHERN COMPANY: COMPANY SNAPSHOT

TABLE 109.SOUTHERN COMPANY: OPERATING SEGMENTS

TABLE 110.SOUTHERN COMPANY: PRODUCT PORTFOLIO

TABLE 111.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 112.AMERICAN ELECTRIC POWER, INC: KEY EXECUTIVES

TABLE 113.AMERICAN ELECTRIC POWER, INC: COMPANY SNAPSHOT

TABLE 114.AMERICAN ELECTRIC POWER, INC: OPERATING SEGMENTS

TABLE 115.AMERICAN ELECTRIC POWER, INC: PRODUCT PORTFOLIO

TABLE 116.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 117.EDISON INTERNATIONAL: KEY EXECUTIVES

TABLE 118.EDISON INTERNATIONAL: COMPANY SNAPSHOT

TABLE 119.EDISON INTERNATIONAL: OPERATING SEGMENTS

TABLE 120.EDISON INTERNATIONAL: PRODUCT PORTFOLIO

TABLE 121.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 122.REPSOL: KEY EXECUTIVES

TABLE 123.REPSOL: COMPANY SNAPSHOT

TABLE 124.REPSOL: OPERATING SEGMENTS

TABLE 125.REPSOL: PRODUCT PORTFOLIO

TABLE 126.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 127.REPSOL: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 128.BROOKFIELD RENEWABLE PARTNERS.: KEY EXECUTIVES

TABLE 129.BROOKFIELD RENEWABLE PARTNERS.: COMPANY SNAPSHOT

TABLE 130.BROOKFIELD RENEWABLE PARTNERS.: OPERATING SEGMENTS

TABLE 131.BROOKFIELD RENEWABLE PARTNERS.: PRODUCT PORTFOLIO

TABLE 132.BROOKFIELD RENEWABLE PARTNERS.: NET SALES, 2019–2021 ($MILLION)

TABLE 133.ØRSTED A/S: KEY EXECUTIVES

TABLE 134.ØRSTED A/S: COMPANY SNAPSHOT

TABLE 135.ØRSTED A/S: OPERATING SEGMENTS

TABLE 136.ØRSTED A/S: PRODUCT PORTFOLIO

TABLE 137.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 138.ØRSTED A/S: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 139.NEXTERA ENERGY, INC.: KEY EXECUTIVES

TABLE 140.NEXTERA ENERGY, INC.: COMPANY SNAPSHOT

TABLE 141.NEXTERA ENERGY, INC.: PRODUCT PORTFOLIO

TABLE 142.OVERALL FINANCIAL STATUS ($MILLION)

TABLE 143.NEXTERA ENERGY, INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 01.ENERGY TRANSITION MARKET SNAPSHOT, BY SEGMENTATION, 2021–2031

FIGURE 02.ENERGY TRANSITION MARKET SNAPSHOT, BY REGION, 2021–2031

FIGURE 03.ENERGY TRANSITION MARKET SEGMENTATION

FIGURE 04.TOP INVESTMENT POCKETS

FIGURE 05.HIGH BARGAINING POWER OF SUPPLIERS

FIGURE 06.MODERATE BARGAINING POWER OF BUYERS

FIGURE 07.MODERATE THREAT OF NEW ENTRANTS

FIGURE 08.MODERATE THREAT OF SUBSTITUTES

FIGURE 09.HIGHLY COMPETITIVE RIVALRY

FIGURE 10.ENERGY TRANSITION MARKET DYNAMICS

FIGURE 11.GLOBAL ENERGY TRANSITION INVESTMENT BY COUNTRY, 2021 ($ BILLION)

FIGURE 12.GLOBAL ENERGY TRANSITION INVESTMENT BY TECHNOLOGY, 2021 (%)

FIGURE 13.GLOBAL RENEWABLE ENERGY INVESTMENT BY TECHNOLOGY, 2017-2019 (%)

FIGURE 14.CHINA- OVERVIEW OF RENEWABLE PROJECTS

FIGURE 15.VALUE CHAIN ANALYSIS

FIGURE 16.PATENT ANALYSIS, BY REGION

FIGURE 17.CHINA INVESTMENT IN ENERGY TRANSITION, 2020 (US$ BILLION)

FIGURE 18.GLOBAL INVESTMENT IN ENERGY TRANSITION BY SECTOR, 2021 (US$ BILLION)

FIGURE 19.ENERGY TRANSITION MARKET, BY TYPE, 2021–2031 ($BILLION)

FIGURE 20.COMPARATIVE ANALYSIS OF ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY,

BY COUNTRY, 2021 & 2031 (%)

FIGURE 21.COMPARATIVE ANALYSIS OF ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY FOR WIND POWER, BY COUNTRY, 2021 & 2031 (%)

FIGURE 22.COMPARATIVE ANALYSIS OF ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY FOR SOLAR POWER, BY COUNTRY, 2021 & 2031 (%)

FIGURE 23.COMPARATIVE ANALYSIS OF ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY FOR BIOENERGY, BY COUNTRY, 2021 & 2031 (%)

FIGURE 24.COMPARATIVE ANALYSIS OF ENERGY TRANSITION MARKET FOR RENEWABLE ENERGY FOR HYDROPOWER, BY COUNTRY, 2021 & 2031 (%)

FIGURE 25.COMPARATIVE ANALYSIS OF ENERGY TRANSITION MARKET FOR ENERGY EFFICIENCY,

BY COUNTRY, 2021 & 2031 (%)

FIGURE 26.COMPARATIVE ANALYSIS OF ENERGY TRANSITION MARKET FOR ELECTRIFICATION, BY COUNTRY, 2021 & 2031 (%)

FIGURE 27.COMPARATIVE ANALYSIS OF ENERGY TRANSITION MARKET FOR HYDROGEN, BY COUNTRY,

2021 & 2031 (%)

FIGURE 28.COMPARATIVE ANALYSIS OF ENERGY TRANSITION MARKET FOR OTHERS, BY COUNTRY,

2021 & 2031 (%)

FIGURE 29.ENERGY TRANSITION MARKET, BY APPLICATION, 2021–2031 ($BILLION)

FIGURE 30.COMPARATIVE ANALYSIS OF ENERGY TRANSITION MARKET FOR RESIDENTIAL, BY COUNTRY,

2021 & 2031 (%)

FIGURE 31.COMPARATIVE ANALYSIS OF ENERGY TRANSITION MARKET FOR COMMERCIAL, BY COUNTRY,

2021 & 2031 (%)

FIGURE 32.COMPARATIVE ANALYSIS OF ENERGY TRANSITION MARKET FOR UTILITY-SCALE, BY COUNTRY, 2021 & 2031 (%)

FIGURE 33.ENERGY TRANSITION MARKET, BY REGION, 2021–2031 ($BILLION)

FIGURE 34.U.S. ENERGY TRANSITION MARKET REVENUE, 2021–2031 ($BILLION)

FIGURE 35.CANADA ENERGY TRANSITION MARKET REVENUE, 2021–2031 ($BILLION)

FIGURE 36.MEXICO ENERGY TRANSITION MARKET REVENUE, 2021–2031 ($BILLION)

FIGURE 37.GERMANY ENERGY TRANSITION MARKET REVENUE, 2021–2031 ($BILLION)

FIGURE 38.FRANCE ENERGY TRANSITION MARKET REVENUE, 2021–2031 ($BILLION)

FIGURE 39.UK ENERGY TRANSITION MARKET REVENUE, 2021–2031 ($BILLION)

FIGURE 40.ITALY ENERGY TRANSITION MARKET REVENUE, 2021–2031 ($BILLION)

FIGURE 41.SPAIN ENERGY TRANSITION MARKET REVENUE, 2021–2031 ($BILLION)

FIGURE 42.REST OF EUROPE ENERGY TRANSITION MARKET REVENUE, 2021–2031 ($BILLION)

FIGURE 43.CHINA ENERGY TRANSITION MARKET REVENUE, 2021–2031 ($BILLION)

FIGURE 44.JAPAN ENERGY TRANSITION MARKET REVENUE, 2021–2031 ($BILLION)

FIGURE 45.INDIA ENERGY TRANSITION MARKET REVENUE, 2021–2031 ($BILLION)

FIGURE 46.SOUTH KOREA ENERGY TRANSITION MARKET REVENUE, 2021–2031 ($BILLION)

FIGURE 47.REST OF ASIA-PACIFIC ENERGY TRANSITION MARKET REVENUE, 2021–2031 ($BILLION)

FIGURE 48.BRAZIL ENERGY TRANSITION MARKET REVENUE, 2021–2031 ($BILLION)

FIGURE 49.SOUTH AFRICA ENERGY TRANSITION MARKET REVENUE, 2021–2031 ($BILLION)

FIGURE 50.UAE ENERGY TRANSITION MARKET REVENUE, 2021–2031 ($BILLION)

FIGURE 51.REST OF LAMEA ENERGY TRANSITION MARKET REVENUE, 2021–2031 ($BILLION)

FIGURE 52.MARKET PLAYER POSITIONING, 2021

FIGURE 53.TOP WINNING STRATEGIES, BY YEAR, 2020-2022

FIGURE 54.TOP WINNING STRATEGIES, BY DEVELOPMENT, 2022

FIGURE 55.TOP WINNING STRATEGIES, BY COMPANY, 2020-2022

FIGURE 56.PRODUCT MAPPING OF TOP 10 PLAYERS

FIGURE 57.COMPETITIVE HEATMAP OF KEY PLAYERS

FIGURE 58.EXELON CORPORATION.: NET SALES, 2019–2021 ($MILLION)

FIGURE 59.EXELON CORPORATION. REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 60.EXELON CORPORATION. REVENUE SHARE BY REGION, 2021 (%)

FIGURE 61.DUKE ENERGY CORPORATION: REVENUE, 2019–2021 ($MILLION)

FIGURE 62.DUKE ENERGY CORPORATION: REVENUE SHARE BY SEGMENT, 2021(%)

FIGURE 63.DUKE ENERGY CORPORATION: REVENUE SHARE BY REGION, 2021 (%)

FIGURE 64.PACIFIC GAS AND ELECTRIC COMPANY: REVENUE, 2019–2021 ($MILLION)

FIGURE 65.PACIFIC GAS AND ELECTRIC COMPANY: REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 66.SOUTHERN COMPANY: REVENUE, 2019–2021 ($MILLION)

FIGURE 67.SOUTHERN COMPANY: REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 68.AMERICAN ELECTRIC POWER, INC: REVENUE, 2019–2021 ($MILLION)

FIGURE 69.AMERICAN ELECTRIC POWER, INC: REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 70.AMERICAN ELECTRIC POWER, INC: REVENUE SHARE BY SUBSIDIARIES, 2021 (%)

FIGURE 71.EDISON INTERNATIONAL: REVENUE, 2018–2020 ($MILLION)

FIGURE 72.EDISON INTERNATIONAL: REVENUE SHARE BY SEGMENT, 2020 (%)

FIGURE 73.REPSOL: REVENUE, 2019–2021 ($MILLION)

FIGURE 74.REPSOL: REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 75.REPSOL: REVENUE SHARE BY REGION, 2021 (%)

FIGURE 76.BROOKFIELD RENEWABLE PARTNERS.: NET SALES, 2019–2021 ($MILLION)

FIGURE 77.BROOKFIELD RENEWABLE PARTNERS REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 78.BROOKFIELD RENEWABLE PARTNERS.: REVENUE SHARE BY REGION, 2021 (%)

FIGURE 79.ØRSTED A/S: REVENUE, 2019–2021 ($MILLION)

FIGURE 80.ØRSTED A/S: REVENUE SHARE BY SEGMENT, 2021 (%)

FIGURE 81.ØRSTED A/S: REVENUE SHARE BY REGION, 2021 (%)

FIGURE 82.NEXTERA ENERGY, INC.: NET SALES, 2019–2021 ($MILLION)

FIGURE 83.NEXTERA ENERGY, INC.: REVENUE SHARE BY SEGMENT, 2021(%)

FIGURE 84.NEXTERA ENERGY, INC.: REVENUE SHARE BY REGION, 2021 (%)

$5769

$6929

$9663

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS

Add to Cart

Add to Cart

Add to Cart

Add to Cart