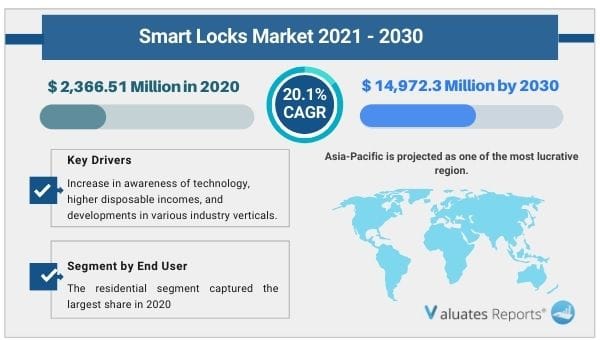

The global smart locks market size was valued at $ 2,366.51 million in 2020, and is projected to reach $14,972.3 million by 2030, growing at a CAGR of 20.1% from 2021 to 2030.

In the post COVID-19 situation, organizations are focusing on advanced technology such as artificial intelligence (AI), machine learning (ML), internet of things (IOT), and cloud computing across residential and commercial sectors to perform contactless operation. This factor is expected to create a demand for app-based smart lock system, which are predicted to drive the adoption of smart locks globally.

Smart locks are electronic keyless locks that use Wi-Fi or Bluetooth connectivity to interact with other electronic devices installed at home. The locks can be operated with a specific electric fob or by installing the smart lock app in the phone. The user can send temporary keys to people, giving them access in the home within a specific time frame. Moreover, smart lock technology is unique and easy-to-use as compared to conventional methods. The technologies before smart locks include the use of ID codes, passwords, mechanical locks, code words, and paper slips, which are tedious to maintain and have a high possibility of data theft or loss. Smart locks work on IoT connectivity, which synchronize with the user’s smartphone to access control. This characteristic of smart locks makes it unique, reliable, and user-friendly and strengthens its market presence.

The smart locks market is segmented on the basis of product type, technology, end user, and region. On the basis of product type, it is segmented into deadbolts, lever handles, padlocks, and others. Further, the others segment includes footplate locks, rim latches, and wall mounted locks. On the basis of technology, it is bifurcated into Wi-Fi and Bluetooth. On the basis of end user, it is segregated in to residential and commercial. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

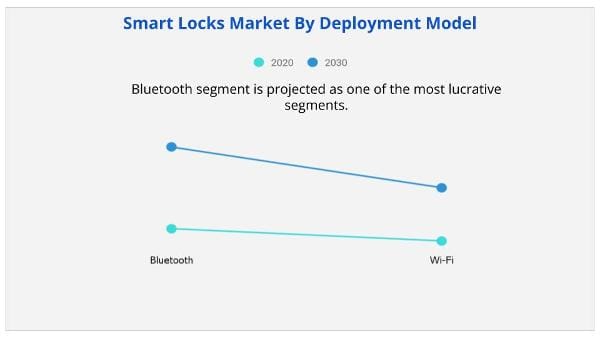

On the basis of technology, the Bluetooth segment dominated the overall smart locks industry in 2020, and is expected to continue this trend throughout the forecast period. The Bluetooth-enabled smart locks technology is the most convenient smart lock technology available in the market. Almost every smartphone available in the market is equipped with Bluetooth, so it is convenient for homeowners to integrate their smart locks with their smartphones, and into their other home automation systems. In addition, Bluetooth-enabled smart locks are safer as there is no need for the devices to be always connected to the internet; this reduces the risk of hacking. In addition, rise in awareness, reduction in costs of installing smart locks, low battery requirements, and device efficiency may also accelerate the adoption of Bluetooth-enabled smart locks, which are expected to drive the growth of this segment. However, the Wi-Fi segment is expected to grow the most, and this trend is expected to continue during the forecast period. The Wi-Fi-enabled smart locks can synchronize with other home devices connected to the network, to get daily updates. In addition, the Wi-Fi enabled system consists of solenoid lock and android application. The locking mechanism in the door can be activated and deactivated automatically by smartphone using Wi-Fi technology within specific range.. Such advanced and reliable features are expected to drive the growth of this segment.

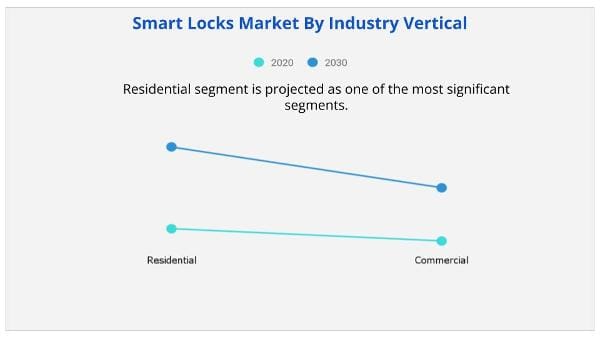

On the basis of end user, the residential segment captured the largest share in 2020 and is expected to continue this trend during the forecast period. The smart locks have contributed towards efficiency and security, thereby saving time and energy. In addition, it is very light-weight as it is small and tiny, thereby, adding to the convenience factor, which is expected to propel the growth of this segment during the forecast period. However, the commercial segment is expected to witness the highest growth in the upcoming years. The major factor that drives the growth of this segment is the increase in prevalence for data security at commercial spaces. Along with security, smart lock technology is used to make office access management simple and secure. In addition, these smart locks can be integrated with a range of various third-party apps, which ensures that all lights in office shut down automatically when the doors are locked, which is expected to drive the growth of this segment.

The report focuses on the growth prospects, restraints, and smart locks market analysis. The study uses Porter’s five forces analysis of the smart devices industry to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, the threat of substitutes, and bargaining power of buyers on the smart locks market trends.

The COVID-19 pandemic has drastically affected businesses globally. It has affected positively on the adoption of smart locks due to lockdown imposed by governments of different countries. In the post COVID-19 situation, organizations are focusing on advanced technology such as artificial intelligence (AI), machine learning (ML), internet of things (IOT), and cloud computing across residential and commercial sectors to perform contactless operation. This factor is expected to create a demand for app-based smart lock system, which are predicted to drive the adoption of smart locks globally. Furthermore, smart locks are used to provide security. The global smart lock market is expanding as a result of the increase in use of security-related products such as digital and cloud-based locks in commercial, residential, and industrial space. Moreover, the commercial and government sectors have started adopting smart locks to overcome concerns regarding safety and security of the public and enterprises. The use of smart locks is increasing globally to have a secure and viable economy. In the commercial sector, companies have started to deploy enhanced technology to promote lower liabilities, increase employee accountability, strengthen compliances, and increase efficiencies, which is expected to drive the smart locks market growth post COVID-19.

Top Impacting Factors

Factors such as the need for better security management has impacted both developed and developing economies to protect themselves from unknown entities such as cyber-attack, rivalry, or other disturbing activities. The need to adopt smart locks technology, which is a modernized locking platform, is anticipated to help regulate the security of residences or commercial spaces. Consumers in major countries have adopted the smart lock technology for protection from thefts, which is expected to drive the growth of the market. Moreover, increase in adoption of cloud-based mobile application boosts the growth of market globally. Furthermore, rapid changing business model and geographic expansion of businesses create lucrative opportunities for rapid growth of the smart locks market. However, high initial cost and fear of privacy intrusion can hamper the growth of the market.

Increase in Trend for Internet of Things (IoT)

IoT is the networking of smart electronic devices or things to transmit data signals between them in the absence of human intervention. Evolution in the convergence of wireless technologies, internet, and micro-electromechanical systems has made IoT communication possible. 51% of the population lives in metro cities at present, hence, the IoT-enabled smart locks market has numerous opportunities to grow. Internet of Things (IoT) simplifies the access of real-time data and remote-control monitoring, which is expected to drive the growth of the smart locks market during the forecast period.

|

Report Metric |

Details |

|

Report Name |

Smart Locks Market |

|

The Market size value in 2020 |

2,366.51 Million USD |

|

The Revenue forecast in 2030 |

14,972.3 Million USD |

|

Growth Rate |

CAGR of 20.1% from 2021 to 2030 |

|

Base year considered |

2020 |

|

Forecast period |

2021- 2030 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, End-User, Offerings, and Region |

|

Report coverage |

Revenue & volume forecast, company share, competitive landscape, growth factors, and trends |

|

Geographic regions covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Companies covered |

AUGUST HOME, HAVEN LOCK, INC., HONEYWELL INTERNATIONAL INC., PANASONIC CORPORATIONs, SALTO Systems, SAMSUNG SDS CO. LTD., SCHLAGE, SPECTRUM BRANDS, INC., UNIKEY TECHNOLOGIES INC., VIVINT, INC. |

Ans. The global smart locks market size was valued at $ 2,366.51 million in 2020, and is projected to reach $14,972.3 million by 2030.

Ans. The global osteoarthritis therapeutics market is expected to grow at a compound annual growth rate of 20.1% from 2021 to 2030.

Ans. The key players are AUGUST HOME, HAVEN LOCK, INC., HONEYWELL INTERNATIONAL INC., PANASONIC CORPORATIONs, SALTO Systems, SAMSUNG SDS CO. LTD., SCHLAGE, SPECTRUM BRANDS, INC., UNIKEY TECHNOLOGIES INC., VIVINT, INC.

CHAPTER 1: INTRODUCTION

1.1.Report Description

1.2.Key Market Segments

1.3.Key Benefits

1.4.Research Methodology

1.4.1.Primary Research

1.4.2.Secondary Research

1.4.3.Analyst Tools and Models

CHAPTER 2: EXECUTIVE SUMMARY

2.1.CXO Perspective

CHAPTER 3: MARKET LANDSCAPE

3.1.Market Definition and Scope

3.2.Key Findings

3.2.1.Top Investment Pockets

3.2.2.Top Winning Strategies

3.3.Porter's Five Forces Analysis

3.3.1.Bargaining Power of Suppliers

3.3.2.Threat of New Entrants

3.3.3.Threat of Substitutes

3.3.4.Competitive Rivalry

3.3.5.Bargaining Power among Buyers

3.4.Market Share Analysis/Top Player Positioning

3.4.1.Market Share Analysis/Top Player Positioning 2020

3.5.Market Dynamics

3.5.1.Drivers

3.5.2.Restraints

3.5.3.Opportunities

3.6. COVID-19 Impact Analysis

3.7.Patent landscape

3.8. Competitive Heatmap

3.9. Regulatory Guidelines

CHAPTER 4: SMART LOCKS MARKET, BY PRODUCT

4.1.Market Overview

4.1.1Market Size and Forecast, By Product

4.2.Deadbolts

4.2.1.Key Market Trends, Growth Factors and Opportunities

4.2.2.Market Size and Forecast, By Region

4.2.3.Market Share Analysis, By Country

4.3.Lever Handles

4.3.1.Key Market Trends, Growth Factors and Opportunities

4.3.2.Market Size and Forecast, By Region

4.3.3.Market Share Analysis, By Country

4.4.Padlocks

4.4.1.Key Market Trends, Growth Factors and Opportunities

4.4.2.Market Size and Forecast, By Region

4.4.3.Market Share Analysis, By Country

4.5.Others

4.5.1.Key Market Trends, Growth Factors and Opportunities

4.5.2.Market Size and Forecast, By Region

4.5.3.Market Share Analysis, By Country

CHAPTER 5: SMART LOCKS MARKET, BY TECHNOLOGY

5.1.Market Overview

5.1.1Market Size and Forecast, By Technology

5.2.Wi-Fi

5.2.1.Key Market Trends, Growth Factors and Opportunities

5.2.2.Market Size and Forecast, By Region

5.2.3.Market Share Analysis, By Country

5.3.Bluetooth

5.3.1.Key Market Trends, Growth Factors and Opportunities

5.3.2.Market Size and Forecast, By Region

5.3.3.Market Share Analysis, By Country

CHAPTER 6: SMART LOCKS MARKET, BY END USER

6.1.Market Overview

6.1.1Market Size and Forecast, By End User

6.2.Commercial

6.2.1.Key Market Trends, Growth Factors and Opportunities

6.2.2.Market Size and Forecast, By Region

6.2.3.Market Share Analysis, By Country

6.3.Residential

6.3.1.Key Market Trends, Growth Factors and Opportunities

6.3.2.Market Size and Forecast, By Region

6.3.3.Market Share Analysis, By Country

CHAPTER 7: SMART LOCKS MARKET, BY REGION

7.1.Market Overview

7.1.1Market Size and Forecast, By Region

7.2.North America

7.2.1.Key Market Trends and Opportunities

7.2.2.Market Size and Forecast, By Product

7.2.3.Market Size and Forecast, By Technology

7.2.4.Market Size and Forecast, By End User

7.2.5.Market Size and Forecast, By Country

7.2.6.United States Smart Locks Market

7.2.6.1.Market Size and Forecast, By Product

7.2.6.2.Market Size and Forecast, By Technology

7.2.6.3.Market Size and Forecast, By End User

7.2.7.Canada Smart Locks Market

7.2.7.1.Market Size and Forecast, By Product

7.2.7.2.Market Size and Forecast, By Technology

7.2.7.3.Market Size and Forecast, By End User

7.2.8.Mexico Smart Locks Market

7.2.8.1.Market Size and Forecast, By Product

7.2.8.2.Market Size and Forecast, By Technology

7.2.8.3.Market Size and Forecast, By End User

7.3.Europe

7.3.1.Key Market Trends and Opportunities

7.3.2.Market Size and Forecast, By Product

7.3.3.Market Size and Forecast, By Technology

7.3.4.Market Size and Forecast, By End User

7.3.5.Market Size and Forecast, By Country

7.3.6.U.K Smart Locks Market

7.3.6.1.Market Size and Forecast, By Product

7.3.6.2.Market Size and Forecast, By Technology

7.3.6.3.Market Size and Forecast, By End User

7.3.7.Germany Smart Locks Market

7.3.7.1.Market Size and Forecast, By Product

7.3.7.2.Market Size and Forecast, By Technology

7.3.7.3.Market Size and Forecast, By End User

7.3.8.France Smart Locks Market

7.3.8.1.Market Size and Forecast, By Product

7.3.8.2.Market Size and Forecast, By Technology

7.3.8.3.Market Size and Forecast, By End User

7.3.9.Spain Smart Locks Market

7.3.9.1.Market Size and Forecast, By Product

7.3.9.2.Market Size and Forecast, By Technology

7.3.9.3.Market Size and Forecast, By End User

7.3.10.Netherlands Smart Locks Market

7.3.10.1.Market Size and Forecast, By Product

7.3.10.2.Market Size and Forecast, By Technology

7.3.10.3.Market Size and Forecast, By End User

7.3.11.Italy Smart Locks Market

7.3.11.1.Market Size and Forecast, By Product

7.3.11.2.Market Size and Forecast, By Technology

7.3.11.3.Market Size and Forecast, By End User

7.3.12.Rest Of Europe Smart Locks Market

7.3.12.1.Market Size and Forecast, By Product

7.3.12.2.Market Size and Forecast, By Technology

7.3.12.3.Market Size and Forecast, By End User

7.4.Asia-Pacific

7.4.1.Key Market Trends and Opportunities

7.4.2.Market Size and Forecast, By Product

7.4.3.Market Size and Forecast, By Technology

7.4.4.Market Size and Forecast, By End User

7.4.5.Market Size and Forecast, By Country

7.4.6.China Smart Locks Market

7.4.6.1.Market Size and Forecast, By Product

7.4.6.2.Market Size and Forecast, By Technology

7.4.6.3.Market Size and Forecast, By End User

7.4.7.Japan Smart Locks Market

7.4.7.1.Market Size and Forecast, By Product

7.4.7.2.Market Size and Forecast, By Technology

7.4.7.3.Market Size and Forecast, By End User

7.4.8.India Smart Locks Market

7.4.8.1.Market Size and Forecast, By Product

7.4.8.2.Market Size and Forecast, By Technology

7.4.8.3.Market Size and Forecast, By End User

7.4.9.South Korea Smart Locks Market

7.4.9.1.Market Size and Forecast, By Product

7.4.9.2.Market Size and Forecast, By Technology

7.4.9.3.Market Size and Forecast, By End User

7.4.10.Australia Smart Locks Market

7.4.10.1.Market Size and Forecast, By Product

7.4.10.2.Market Size and Forecast, By Technology

7.4.10.3.Market Size and Forecast, By End User

7.4.11.Rest of Asia Pacific Smart Locks Market

7.4.11.1.Market Size and Forecast, By Product

7.4.11.2.Market Size and Forecast, By Technology

7.4.11.3.Market Size and Forecast, By End User

7.5.LAMEA

7.5.1.Key Market Trends and Opportunities

7.5.2.Market Size and Forecast, By Product

7.5.3.Market Size and Forecast, By Technology

7.5.4.Market Size and Forecast, By End User

7.5.5.Market Size and Forecast, By Country

7.5.6.Latin America Smart Locks Market

7.5.6.1.Market Size and Forecast, By Product

7.5.6.2.Market Size and Forecast, By Technology

7.5.6.3.Market Size and Forecast, By End User

7.5.7.Middle East Smart Locks Market

7.5.7.1.Market Size and Forecast, By Product

7.5.7.2.Market Size and Forecast, By Technology

7.5.7.3.Market Size and Forecast, By End User

7.5.8.Africa Smart Locks Market

7.5.8.1.Market Size and Forecast, By Product

7.5.8.2.Market Size and Forecast, By Technology

7.5.8.3.Market Size and Forecast, By End User

CHAPTER 8: COMPANY PROFILES

8.1.August Home

8.1.1.Company Overview

8.1.2.Key Executives

8.1.3.Company snapshot

8.1.4.Operating business segments

8.1.5.Product portfolio

8.1.6.Business Performance

8.1.7.Key Strategic Moves and Developments

8.2.SALTO Systems

8.2.1.Company Overview

8.2.2.Key Executives

8.2.3.Company snapshot

8.2.4.Operating business segments

8.2.5.Product portfolio

8.2.6.Business Performance

8.2.7.Key Strategic Moves and Developments

8.3.Haven Lock, Inc.

8.3.1.Company Overview

8.3.2.Key Executives

8.3.3.Company snapshot

8.3.4.Operating business segments

8.3.5.Product portfolio

8.3.6.Business Performance

8.3.7.Key Strategic Moves and Developments

8.4.Honeywell International Inc.

8.4.1.Company Overview

8.4.2.Key Executives

8.4.3.Company snapshot

8.4.4.Operating business segments

8.4.5.Product portfolio

8.4.6.Business Performance

8.4.7.Key Strategic Moves and Developments

8.5.Panasonic Corporation

8.5.1.Company Overview

8.5.2.Key Executives

8.5.3.Company snapshot

8.5.4.Operating business segments

8.5.5.Product portfolio

8.5.6.Business Performance

8.5.7.Key Strategic Moves and Developments

8.6.Samsung SDS Co. Ltd.

8.6.1.Company Overview

8.6.2.Key Executives

8.6.3.Company snapshot

8.6.4.Operating business segments

8.6.5.Product portfolio

8.6.6.Business Performance

8.6.7.Key Strategic Moves and Developments

8.7.Schlage

8.7.1.Company Overview

8.7.2.Key Executives

8.7.3.Company snapshot

8.7.4.Operating business segments

8.7.5.Product portfolio

8.7.6.Business Performance

8.7.7.Key Strategic Moves and Developments

8.8.Spectrum Brands, Inc.

8.8.1.Company Overview

8.8.2.Key Executives

8.8.3.Company snapshot

8.8.4.Operating business segments

8.8.5.Product portfolio

8.8.6.Business Performance

8.8.7.Key Strategic Moves and Developments

8.9.UniKey Technologies Inc.

8.9.1.Company Overview

8.9.2.Key Executives

8.9.3.Company snapshot

8.9.4.Operating business segments

8.9.5.Product portfolio

8.9.6.Business Performance

8.9.7.Key Strategic Moves and Developments

8.10.Vivint, Inc.

8.10.1.Company Overview

8.10.2.Key Executives

8.10.3.Company snapshot

8.10.4.Operating business segments

8.10.5.Product portfolio

8.10.6.Business Performance

8.10.7.Key Strategic Moves and Developments

LIST OF TABLES

TABLE 1.GLOBAL SMART LOCKS MARKET, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 2.GLOBAL SMART LOCKS MARKET FOR DEADBOLTS, BY REGION, 2020-2030 ($MILLION)

TABLE 3.GLOBAL SMART LOCKS MARKET FOR LEVER HANDLES, BY REGION, 2020-2030 ($MILLION)

TABLE 4.GLOBAL SMART LOCKS MARKET FOR PADLOCKS, BY REGION, 2020-2030 ($MILLION)

TABLE 5.GLOBAL SMART LOCKS MARKET FOR OTHERS, BY REGION, 2020-2030 ($MILLION)

TABLE 6.GLOBAL SMART LOCKS MARKET, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 7.GLOBAL SMART LOCKS MARKET FOR WI-FI, BY REGION, 2020-2030 ($MILLION)

TABLE 8.GLOBAL SMART LOCKS MARKET FOR BLUETOOTH, BY REGION, 2020-2030 ($MILLION)

TABLE 9.GLOBAL SMART LOCKS MARKET, BY END USER, 2020-2030 ($MILLION)

TABLE 10.GLOBAL SMART LOCKS MARKET FOR COMMERCIAL, BY REGION, 2020-2030 ($MILLION)

TABLE 11.GLOBAL SMART LOCKS MARKET FOR RESIDENTIAL, BY REGION, 2020-2030 ($MILLION)

TABLE 12.GLOBAL SMART LOCKS MARKET, BY REGION, 2020-2030 ($MILLION)

TABLE 13.NORTH AMERICA SMART LOCKS, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 14.NORTH AMERICA SMART LOCKS, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 15.NORTH AMERICA SMART LOCKS, BY END USER, 2020-2030 ($MILLION)

TABLE 16.UNITED STATES SMART LOCKS, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 17.UNITED STATES SMART LOCKS, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 18.UNITED STATES SMART LOCKS, BY END USER, 2020-2030 ($MILLION)

TABLE 19.CANADA SMART LOCKS, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 20.CANADA SMART LOCKS, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 21.CANADA SMART LOCKS, BY END USER, 2020-2030 ($MILLION)

TABLE 22.MEXICO SMART LOCKS, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 23.MEXICO SMART LOCKS, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 24.MEXICO SMART LOCKS, BY END USER, 2020-2030 ($MILLION)

TABLE 25.EUROPE SMART LOCKS, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 26.EUROPE SMART LOCKS, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 27.EUROPE SMART LOCKS, BY END USER, 2020-2030 ($MILLION)

TABLE 28.UNITED KINGDOM SMART LOCKS, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 29.UNITED KINGDOM SMART LOCKS, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 30.UNITED KINGDOM SMART LOCKS, BY END USER, 2020-2030 ($MILLION)

TABLE 31.GERMANY SMART LOCKS, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 32.GERMANY SMART LOCKS, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 33.GERMANY SMART LOCKS, BY END USER, 2020-2030 ($MILLION)

TABLE 34.FRANCE SMART LOCKS, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 35.FRANCE SMART LOCKS, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 36.FRANCE SMART LOCKS, BY END USER, 2020-2030 ($MILLION)

TABLE 37.SPAIN SMART LOCKS, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 38.SPAIN SMART LOCKS, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 39.SPAIN SMART LOCKS, BY END USER, 2020-2030 ($MILLION)

TABLE 40.NETHERLANDS SMART LOCKS, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 41.NETHERLANDS SMART LOCKS, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 42.NETHERLANDS SMART LOCKS, BY END USER, 2020-2030 ($MILLION)

TABLE 43.ITALY SMART LOCKS, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 44.ITALY SMART LOCKS, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 45.ITALY SMART LOCKS, BY END USER, 2020-2030 ($MILLION)

TABLE 46.REST OF EUROPE SMART LOCKS, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 47.REST OF EUROPE SMART LOCKS, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 48.REST OF EUROPE SMART LOCKS, BY END USER, 2020-2030 ($MILLION)

TABLE 49.ASIA-PACIFIC SMART LOCKS, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 50.ASIA-PACIFIC SMART LOCKS, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 51.ASIA-PACIFIC SMART LOCKS, BY END USER, 2020-2030 ($MILLION)

TABLE 52.CHINA SMART LOCKS, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 53.CHINA SMART LOCKS, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 54.CHINA SMART LOCKS, BY END USER, 2020-2030 ($MILLION)

TABLE 55.JAPAN SMART LOCKS, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 56.JAPAN SMART LOCKS, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 57.JAPAN SMART LOCKS, BY END USER, 2020-2030 ($MILLION)

TABLE 58.INDIA SMART LOCKS, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 59.INDIA SMART LOCKS, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 60.INDIA SMART LOCKS, BY END USER, 2020-2030 ($MILLION)

TABLE 61.SOUTH KOREA SMART LOCKS, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 62.SOUTH KOREA SMART LOCKS, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 63.SOUTH KOREA SMART LOCKS, BY END USER, 2020-2030 ($MILLION)

TABLE 64.AUSTRALIA SMART LOCKS, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 65.AUSTRALIA SMART LOCKS, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 66.AUSTRALIA SMART LOCKS, BY END USER, 2020-2030 ($MILLION)

TABLE 67.REST OF ASIA PACIFIC SMART LOCKS, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 68.REST OF ASIA PACIFIC SMART LOCKS, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 69.REST OF ASIA PACIFIC SMART LOCKS, BY END USER, 2020-2030 ($MILLION)

TABLE 70.LAMEA SMART LOCKS, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 71.LAMEA SMART LOCKS, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 72.LAMEA SMART LOCKS, BY END USER, 2020-2030 ($MILLION)

TABLE 73.LATIN AMERICA SMART LOCKS, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 74.LATIN AMERICA SMART LOCKS, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 75.LATIN AMERICA SMART LOCKS, BY END USER, 2020-2030 ($MILLION)

TABLE 76.MIDDLE EAST SMART LOCKS, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 77.MIDDLE EAST SMART LOCKS, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 78.MIDDLE EAST SMART LOCKS, BY END USER, 2020-2030 ($MILLION)

TABLE 79.AFRICA SMART LOCKS, BY PRODUCT, 2020-2030 ($MILLION)

TABLE 80.AFRICA SMART LOCKS, BY TECHNOLOGY, 2020-2030 ($MILLION)

TABLE 81.AFRICA SMART LOCKS, BY END USER, 2020-2030 ($MILLION)

TABLE 82.AUGUST HOME: KEY EXECUTIVES

TABLE 83.AUGUST HOME: COMPANY SNAPSHOT

TABLE 84.AUGUST HOME: OPERATING SEGMENTS

TABLE 85.AUGUST HOME: PRODUCT PORTFOLIO

TABLE 86.AUGUST HOME: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 87.SALTO SYSTEMS: KEY EXECUTIVES

TABLE 88.SALTO SYSTEMS: COMPANY SNAPSHOT

TABLE 89.SALTO SYSTEMS: OPERATING SEGMENTS

TABLE 90.SALTO SYSTEMS: PRODUCT PORTFOLIO

TABLE 91.SALTO SYSTEMS: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 92.HAVEN LOCK, INC.: KEY EXECUTIVES

TABLE 93.HAVEN LOCK, INC.: COMPANY SNAPSHOT

TABLE 94.HAVEN LOCK, INC.: OPERATING SEGMENTS

TABLE 95.HAVEN LOCK, INC.: PRODUCT PORTFOLIO

TABLE 96.HAVEN LOCK, INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 97.HONEYWELL INTERNATIONAL INC.: KEY EXECUTIVES

TABLE 98.HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 99.HONEYWELL INTERNATIONAL INC.: OPERATING SEGMENTS

TABLE 100.HONEYWELL INTERNATIONAL INC.: PRODUCT PORTFOLIO

TABLE 101.HONEYWELL INTERNATIONAL INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 102.PANASONIC CORPORATION: KEY EXECUTIVES

TABLE 103.PANASONIC CORPORATION: COMPANY SNAPSHOT

TABLE 104.PANASONIC CORPORATION: OPERATING SEGMENTS

TABLE 105.PANASONIC CORPORATION: PRODUCT PORTFOLIO

TABLE 106.PANASONIC CORPORATION: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 107.SAMSUNG SDS CO. LTD.: KEY EXECUTIVES

TABLE 108.SAMSUNG SDS CO. LTD.: COMPANY SNAPSHOT

TABLE 109.SAMSUNG SDS CO. LTD.: OPERATING SEGMENTS

TABLE 110.SAMSUNG SDS CO. LTD.: PRODUCT PORTFOLIO

TABLE 111.SAMSUNG SDS CO. LTD.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 112.SCHLAGE: KEY EXECUTIVES

TABLE 113.SCHLAGE: COMPANY SNAPSHOT

TABLE 114.SCHLAGE: OPERATING SEGMENTS

TABLE 115.SCHLAGE: PRODUCT PORTFOLIO

TABLE 116.SCHLAGE: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 117.SPECTRUM BRANDS, INC.: KEY EXECUTIVES

TABLE 118.SPECTRUM BRANDS, INC.: COMPANY SNAPSHOT

TABLE 119.SPECTRUM BRANDS, INC.: OPERATING SEGMENTS

TABLE 120.SPECTRUM BRANDS, INC.: PRODUCT PORTFOLIO

TABLE 121.SPECTRUM BRANDS, INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 122.UNIKEY TECHNOLOGIES INC.: KEY EXECUTIVES

TABLE 123.UNIKEY TECHNOLOGIES INC.: COMPANY SNAPSHOT

TABLE 124.UNIKEY TECHNOLOGIES INC.: OPERATING SEGMENTS

TABLE 125.UNIKEY TECHNOLOGIES INC.: PRODUCT PORTFOLIO

TABLE 126.UNIKEY TECHNOLOGIES INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

TABLE 127.VIVINT, INC.: KEY EXECUTIVES

TABLE 128.VIVINT, INC.: COMPANY SNAPSHOT

TABLE 129.VIVINT, INC.: OPERATING SEGMENTS

TABLE 130.VIVINT, INC.: PRODUCT PORTFOLIO

TABLE 131.VIVINT, INC.: KEY STRATEGIC MOVES AND DEVELOPMENTS

LIST OF FIGURES

FIGURE 1.GLOBAL SMART LOCKS MARKET SEGMENTATION

FIGURE 2.GLOBAL SMART LOCKS MARKET

FIGURE 3.SEGMENTATION SMART LOCKS MARKET

FIGURE 4.TOP INVESTMENT POCKET IN SMART LOCKS MARKET

FIGURE 5.TOP WINNING STRATEGIES, 2019-2021*

FIGURE 6.TOP WINNING STRATEGIES, BY DEVELOPMENT, 2019-2021(%)

FIGURE 7.TOP WINNING STRATEGIES, BY COMPANY, 2019-2021*

FIGURE 8.MODERATE BARGAINING POWER OF BUYERS

FIGURE 9.MODERATE BARGAINING POWER OF SUPPLIERS

FIGURE 10.MODERATE THREAT OF NEW ENTRANTS

FIGURE 11.LOW THREAT OF SUBSTITUTION

FIGURE 12.HIGH COMPETITIVE RIVALRY

FIGURE 13.TOP PLAYER POSITIONING, 2020

FIGURE 14.MARKET SHARE ANALYSIS, 2020

FIGURE 15.RESTRAINTS AND DRIVERS: SMART LOCKS MARKET

FIGURE 16.SMART LOCKS MARKET SEGMENTATION, BY PRODUCT

FIGURE 17.SMART LOCKS MARKET FOR DEADBOLTS, BY COUNTRY, 2020-2030 ($MILLION)

FIGURE 18.SMART LOCKS MARKET FOR LEVER HANDLES, BY COUNTRY, 2020-2030 ($MILLION)

FIGURE 19.SMART LOCKS MARKET FOR PADLOCKS, BY COUNTRY, 2020-2030 ($MILLION)

FIGURE 20.SMART LOCKS MARKET FOR OTHERS, BY COUNTRY, 2020-2030 ($MILLION)

FIGURE 21.SMART LOCKS MARKET SEGMENTATION, BY TECHNOLOGY

FIGURE 22.SMART LOCKS MARKET FOR WI-FI, BY COUNTRY, 2020-2030 ($MILLION)

FIGURE 23.SMART LOCKS MARKET FOR BLUETOOTH, BY COUNTRY, 2020-2030 ($MILLION)

FIGURE 24.SMART LOCKS MARKET SEGMENTATION, BY END USER

FIGURE 25.SMART LOCKS MARKET FOR COMMERCIAL, BY COUNTRY, 2020-2030 ($MILLION)

FIGURE 26.SMART LOCKS MARKET FOR RESIDENTIAL, BY COUNTRY, 2020-2030 ($MILLION)

FIGURE 27.AUGUST HOME: NET SALES, 2018-2020 ($MILLION)

FIGURE 28.AUGUST HOME: REVENUE SHARE, BY SEGMENT, 2020 (%)

FIGURE 29.AUGUST HOME: REVENUE SHARE, BY REGION, 2020 (%)

FIGURE 30.SALTO SYSTEMS: NET SALES, 2018-2020 ($MILLION)

FIGURE 31.SALTO SYSTEMS: REVENUE SHARE, BY SEGMENT, 2020 (%)

FIGURE 32.SALTO SYSTEMS: REVENUE SHARE, BY REGION, 2020 (%)

FIGURE 33.HAVEN LOCK, INC.: NET SALES, 2018-2020 ($MILLION)

FIGURE 34.HAVEN LOCK, INC.: REVENUE SHARE, BY SEGMENT, 2020 (%)

FIGURE 35.HAVEN LOCK, INC.: REVENUE SHARE, BY REGION, 2020 (%)

FIGURE 36.HONEYWELL INTERNATIONAL INC.: NET SALES, 2018-2020 ($MILLION)

FIGURE 37.HONEYWELL INTERNATIONAL INC.: REVENUE SHARE, BY SEGMENT, 2020 (%)

FIGURE 38.HONEYWELL INTERNATIONAL INC.: REVENUE SHARE, BY REGION, 2020 (%)

FIGURE 39.PANASONIC CORPORATION: NET SALES, 2018-2020 ($MILLION)

FIGURE 40.PANASONIC CORPORATION: REVENUE SHARE, BY SEGMENT, 2020 (%)

FIGURE 41.PANASONIC CORPORATION: REVENUE SHARE, BY REGION, 2020 (%)

FIGURE 42.SAMSUNG SDS CO. LTD.: NET SALES, 2018-2020 ($MILLION)

FIGURE 43.SAMSUNG SDS CO. LTD.: REVENUE SHARE, BY SEGMENT, 2020 (%)

FIGURE 44.SAMSUNG SDS CO. LTD.: REVENUE SHARE, BY REGION, 2020 (%)

FIGURE 45.SCHLAGE: NET SALES, 2018-2020 ($MILLION)

FIGURE 46.SCHLAGE: REVENUE SHARE, BY SEGMENT, 2020 (%)

FIGURE 47.SCHLAGE: REVENUE SHARE, BY REGION, 2020 (%)

FIGURE 48.SPECTRUM BRANDS, INC.: NET SALES, 2018-2020 ($MILLION)

FIGURE 49.SPECTRUM BRANDS, INC.: REVENUE SHARE, BY SEGMENT, 2020 (%)

FIGURE 50.SPECTRUM BRANDS, INC.: REVENUE SHARE, BY REGION, 2020 (%)

FIGURE 51.UNIKEY TECHNOLOGIES INC.: NET SALES, 2018-2020 ($MILLION)

FIGURE 52.UNIKEY TECHNOLOGIES INC.: REVENUE SHARE, BY SEGMENT, 2020 (%)

FIGURE 53.UNIKEY TECHNOLOGIES INC.: REVENUE SHARE, BY REGION, 2020 (%)

FIGURE 54.VIVINT, INC.: NET SALES, 2018-2020 ($MILLION)

FIGURE 55.VIVINT, INC.: REVENUE SHARE, BY SEGMENT, 2020 (%)

FIGURE 56.VIVINT, INC.: REVENUE SHARE, BY REGION, 2020 (%)

$6169

$6930

$10665

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS