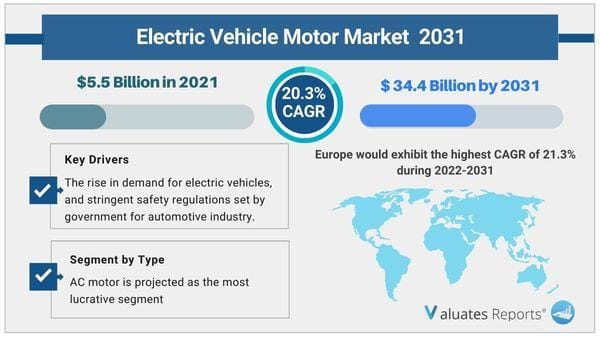

The global electric vehicle motor market was valued at USD 5.5 billion in 2021 and is projected to reach USD 34.4 billion by 2031, growing at a CAGR of 20.3% from 2022 to 2031.

The global electric vehicle (EV) motor market is expanding rapidly due to the increasing adoption of electric vehicles driven by environmental concerns, government incentives, and advancements in EV technology. Electric vehicle motors play a crucial role in determining the performance, efficiency, and range of EVs, which has led to a surge in demand for more powerful and efficient motors. The growing focus on reducing carbon emissions and the rising demand for sustainable transportation solutions are key drivers of this market. Additionally, the development of new materials and motor designs to enhance performance and energy efficiency further supports market growth.

One of the major trends in the electric vehicle motor market is the shift towards permanent magnet synchronous motors (PMSMs) due to their higher efficiency and power density compared to traditional induction motors. PMSMs offer better torque, faster acceleration, and enhanced energy efficiency, making them ideal for high-performance electric vehicles. As automakers seek to improve vehicle range and performance, the adoption of PMSMs is increasing, particularly in premium EV models.

Another key trend is the increasing integration of advanced motor control systems and power electronics. These systems allow for precise control of the motor's speed and torque, leading to improved vehicle performance and energy efficiency. The use of silicon carbide (SiC) in power electronics is also gaining traction, as SiC-based systems offer lower energy losses and higher thermal conductivity, making them ideal for electric vehicle applications.

The development of smaller, lighter, and more efficient motors is another trend shaping the market. Automakers are focusing on reducing the weight and size of electric vehicle motors without compromising performance, which helps improve overall vehicle efficiency and range. This trend is particularly important for compact and mid-sized EVs, where space and weight constraints are critical.

The growing adoption of integrated motor drive units (IDUs) is also influencing the market. IDUs combine the motor, inverter, and transmission into a single unit, reducing the overall size, weight, and cost of the powertrain. This trend is helping manufacturers streamline production processes and reduce the cost of EVs, making them more accessible to a broader range of consumers.

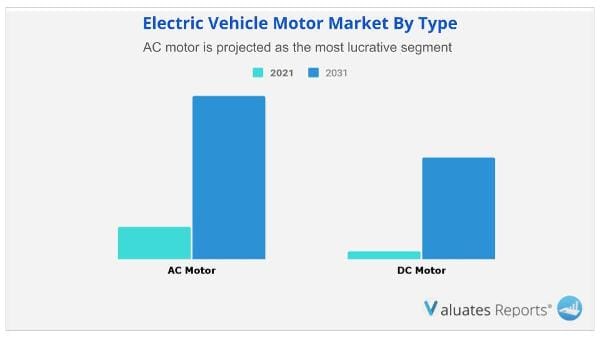

The global electric vehicle motor market was led by the AC motor segment in terms of revenue in 2021, and it is anticipated that this trend will hold throughout the forecast period.

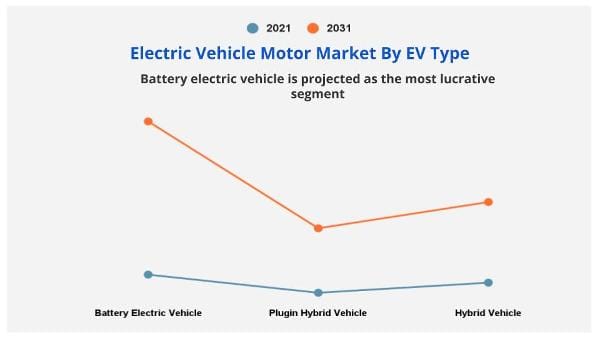

It is anticipated that the battery-electric car market would grow significantly in the near future.

It is anticipated that commercial vehicle use would grow significantly soon.

During the forecast period, Europe is expected to have the highest CAGR of any region.

Europe would have the highest CAGR of 21.3% between 2022 and 2031.

| Report Metric | Details |

| Report Name | Electric Vehicle Motor Market |

| Base Year | 2021 |

| Forecasted years | 2022-2031 |

| By Company |

|

| Segment by Type |

|

| Segment by Application |

|

| Segment by EV Type |

|

| Segment by Region |

|

| Forecast units | USD Billion in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Ans. The global electric vehicle motor market was valued at $5.5 billion in 2021, and is projected to reach $34.4 billion by 2031, growing at a CAGR of 20.3% from 2022 to 2031.

Ans. AC motor is projected as the most lucrative segment.

Ans. Europe would exhibit the highest CAGR of 21.3% during 2022-2031.

Ans. Battery electric vehicle is projected as the most lucrative segment.

Ans. Commercial vehicles is projected as the most lucrative segment

CHAPTER 1:INTRODUCTION

1.1.Report description

1.2.Key market segments

1.3.Key benefits to the stakeholders

1.4.Research Methodology

1.4.1.Secondary research

1.4.2.Primary research

1.4.3.Analyst tools and models

CHAPTER 2:EXECUTIVE SUMMARY

2.1.Key findings of the study

2.2.CXO Perspective

CHAPTER 3:MARKET OVERVIEW

3.1.Market definition and scope

3.2.Key findings

3.2.1.Top investment pockets

3.3.Porter’s five forces analysis

3.4.Top player positioning

3.5.Market dynamics

3.5.1.Drivers

3.5.2.Restraints

3.5.3.Opportunities

3.6.COVID-19 Impact Analysis on the market

CHAPTER 4: ELECTRIC VEHICLE MOTOR MARKET, BY TYPE

4.1 Overview

4.1.1 Market size and forecast

4.2 AC Motor

4.2.1 Key market trends, growth factors and opportunities

4.2.2 Market size and forecast, by region

4.2.3 Market analysis by country

4.3 DC Motor

4.3.1 Key market trends, growth factors and opportunities

4.3.2 Market size and forecast, by region

4.3.3 Market analysis by country

CHAPTER 5: ELECTRIC VEHICLE MOTOR MARKET, BY ELECTRIC VEHICLE TYPE

5.1 Overview

5.1.1 Market size and forecast

5.2 Battery Electric Vehicle

5.2.1 Key market trends, growth factors and opportunities

5.2.2 Market size and forecast, by region

5.2.3 Market analysis by country

5.3 Plugin Hybrid Vehicle

5.3.1 Key market trends, growth factors and opportunities

5.3.2 Market size and forecast, by region

5.3.3 Market analysis by country

5.4 Hybrid Vehicle

5.4.1 Key market trends, growth factors and opportunities

5.4.2 Market size and forecast, by region

5.4.3 Market analysis by country

CHAPTER 6: ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION

6.1 Overview

6.1.1 Market size and forecast

6.2 Passenger Cars

6.2.1 Key market trends, growth factors and opportunities

6.2.2 Market size and forecast, by region

6.2.3 Market analysis by country

6.3 Commercial Vehicles

6.3.1 Key market trends, growth factors and opportunities

6.3.2 Market size and forecast, by region

6.3.3 Market analysis by country

CHAPTER 7: ELECTRIC VEHICLE MOTOR MARKET, BY REGION

7.1 Overview

7.1.1 Market size and forecast

7.2 North America

7.2.1 Key trends and opportunities

7.2.2 North America Market size and forecast, by Type

7.2.3 North America Market size and forecast, by Electric Vehicle Type

7.2.4 North America Market size and forecast, by Application

7.2.5 North America Market size and forecast, by country

7.2.5.1 U.S.

7.2.5.1.1 Market size and forecast, by Type

7.2.5.1.2 Market size and forecast, by Electric Vehicle Type

7.2.5.1.3 Market size and forecast, by Application

7.2.5.2 Canada

7.2.5.2.1 Market size and forecast, by Type

7.2.5.2.2 Market size and forecast, by Electric Vehicle Type

7.2.5.2.3 Market size and forecast, by Application

7.2.5.3 Mexico

7.2.5.3.1 Market size and forecast, by Type

7.2.5.3.2 Market size and forecast, by Electric Vehicle Type

7.2.5.3.3 Market size and forecast, by Application

7.3 Europe

7.3.1 Key trends and opportunities

7.3.2 Europe Market size and forecast, by Type

7.3.3 Europe Market size and forecast, by Electric Vehicle Type

7.3.4 Europe Market size and forecast, by Application

7.3.5 Europe Market size and forecast, by country

7.3.5.1 UK

7.3.5.1.1 Market size and forecast, by Type

7.3.5.1.2 Market size and forecast, by Electric Vehicle Type

7.3.5.1.3 Market size and forecast, by Application

7.3.5.2 Germany

7.3.5.2.1 Market size and forecast, by Type

7.3.5.2.2 Market size and forecast, by Electric Vehicle Type

7.3.5.2.3 Market size and forecast, by Application

7.3.5.3 France

7.3.5.3.1 Market size and forecast, by Type

7.3.5.3.2 Market size and forecast, by Electric Vehicle Type

7.3.5.3.3 Market size and forecast, by Application

7.3.5.4 Italy

7.3.5.4.1 Market size and forecast, by Type

7.3.5.4.2 Market size and forecast, by Electric Vehicle Type

7.3.5.4.3 Market size and forecast, by Application

7.3.5.5 Rest of Europe

7.3.5.5.1 Market size and forecast, by Type

7.3.5.5.2 Market size and forecast, by Electric Vehicle Type

7.3.5.5.3 Market size and forecast, by Application

7.4 Asia-Pacific

7.4.1 Key trends and opportunities

7.4.2 Asia-Pacific Market size and forecast, by Type

7.4.3 Asia-Pacific Market size and forecast, by Electric Vehicle Type

7.4.4 Asia-Pacific Market size and forecast, by Application

7.4.5 Asia-Pacific Market size and forecast, by country

7.4.5.1 China

7.4.5.1.1 Market size and forecast, by Type

7.4.5.1.2 Market size and forecast, by Electric Vehicle Type

7.4.5.1.3 Market size and forecast, by Application

7.4.5.2 Japan

7.4.5.2.1 Market size and forecast, by Type

7.4.5.2.2 Market size and forecast, by Electric Vehicle Type

7.4.5.2.3 Market size and forecast, by Application

7.4.5.3 India

7.4.5.3.1 Market size and forecast, by Type

7.4.5.3.2 Market size and forecast, by Electric Vehicle Type

7.4.5.3.3 Market size and forecast, by Application

7.4.5.4 South Korea

7.4.5.4.1 Market size and forecast, by Type

7.4.5.4.2 Market size and forecast, by Electric Vehicle Type

7.4.5.4.3 Market size and forecast, by Application

7.4.5.5 Rest of Asia-Pacific

7.4.5.5.1 Market size and forecast, by Type

7.4.5.5.2 Market size and forecast, by Electric Vehicle Type

7.4.5.5.3 Market size and forecast, by Application

7.5 LAMEA

7.5.1 Key trends and opportunities

7.5.2 LAMEA Market size and forecast, by Type

7.5.3 LAMEA Market size and forecast, by Electric Vehicle Type

7.5.4 LAMEA Market size and forecast, by Application

7.5.5 LAMEA Market size and forecast, by country

7.5.5.1 Latin America

7.5.5.1.1 Market size and forecast, by Type

7.5.5.1.2 Market size and forecast, by Electric Vehicle Type

7.5.5.1.3 Market size and forecast, by Application

7.5.5.2 Middle East

7.5.5.2.1 Market size and forecast, by Type

7.5.5.2.2 Market size and forecast, by Electric Vehicle Type

7.5.5.2.3 Market size and forecast, by Application

7.5.5.3 Africa

7.5.5.3.1 Market size and forecast, by Type

7.5.5.3.2 Market size and forecast, by Electric Vehicle Type

7.5.5.3.3 Market size and forecast, by Application

CHAPTER 8: COMPANY LANDSCAPE

8.1. Introduction

8.2. Top winning strategies

8.3. Product Mapping of Top 10 Player

8.4. Competitive Dashboard

8.5. Competitive Heatmap

8.6. Key developments

CHAPTER 9: COMPANY PROFILES

9.1 Borgwarner Inc.

9.1.1 Company overview

9.1.2 Company snapshot

9.1.3 Operating business segments

9.1.4 Product portfolio

9.1.5 Business performance

9.1.6 Key strategic moves and developments

9.2 Buhler Motor GmbH

9.2.1 Company overview

9.2.2 Company snapshot

9.2.3 Operating business segments

9.2.4 Product portfolio

9.2.5 Business performance

9.2.6 Key strategic moves and developments

9.3 Continental AG

9.3.1 Company overview

9.3.2 Company snapshot

9.3.3 Operating business segments

9.3.4 Product portfolio

9.3.5 Business performance

9.3.6 Key strategic moves and developments

9.4 Denso Corporation

9.4.1 Company overview

9.4.2 Company snapshot

9.4.3 Operating business segments

9.4.4 Product portfolio

9.4.5 Business performance

9.4.6 Key strategic moves and developments

9.5 Inteva Products, LLC

9.5.1 Company overview

9.5.2 Company snapshot

9.5.3 Operating business segments

9.5.4 Product portfolio

9.5.5 Business performance

9.5.6 Key strategic moves and developments

9.6 Johnson Electric Holdings Limited

9.6.1 Company overview

9.6.2 Company snapshot

9.6.3 Operating business segments

9.6.4 Product portfolio

9.6.5 Business performance

9.6.6 Key strategic moves and developments

9.7 Mabuchi Motor Co., Ltd

9.7.1 Company overview

9.7.2 Company snapshot

9.7.3 Operating business segments

9.7.4 Product portfolio

9.7.5 Business performance

9.7.6 Key strategic moves and developments

9.8 Nidec Corporation

9.8.1 Company overview

9.8.2 Company snapshot

9.8.3 Operating business segments

9.8.4 Product portfolio

9.8.5 Business performance

9.8.6 Key strategic moves and developments

9.9 Magna International Inc.

9.9.1 Company overview

9.9.2 Company snapshot

9.9.3 Operating business segments

9.9.4 Product portfolio

9.9.5 Business performance

9.9.6 Key strategic moves and developments

9.10 Meritor, Inc.

9.10.1 Company overview

9.10.2 Company snapshot

9.10.3 Operating business segments

9.10.4 Product portfolio

9.10.5 Business performance

9.10.6 Key strategic moves and developments

9.11 Mitsuba Corporation

9.11.1 Company overview

9.11.2 Company snapshot

9.11.3 Operating business segments

9.11.4 Product portfolio

9.11.5 Business performance

9.11.6 Key strategic moves and developments

9.12 Robert Bosch GmbH

9.12.1 Company overview

9.12.2 Company snapshot

9.12.3 Operating business segments

9.12.4 Product portfolio

9.12.5 Business performance

9.12.6 Key strategic moves and developments

LIST OF TABLES

TABLE 1. GLOBAL ELECTRIC VEHICLE MOTOR MARKET, BY TYPE, 2021-2031 ($MILLION)

TABLE 2. ELECTRIC VEHICLE MOTOR MARKET, FOR AC MOTOR, BY REGION, 2021-2031 ($MILLION)

TABLE 3. ELECTRIC VEHICLE MOTOR MARKET FOR AC MOTOR, BY COUNTRY, 2021-2031 ($MILLION)

TABLE 4. ELECTRIC VEHICLE MOTOR MARKET, FOR DC MOTOR, BY REGION, 2021-2031 ($MILLION)

TABLE 5. ELECTRIC VEHICLE MOTOR MARKET FOR DC MOTOR, BY COUNTRY, 2021-2031 ($MILLION)

TABLE 6. GLOBAL ELECTRIC VEHICLE MOTOR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2031 ($MILLION)

TABLE 7. ELECTRIC VEHICLE MOTOR MARKET, FOR BATTERY ELECTRIC VEHICLE, BY REGION, 2021-2031 ($MILLION)

TABLE 8. ELECTRIC VEHICLE MOTOR MARKET FOR BATTERY ELECTRIC VEHICLE, BY COUNTRY, 2021-2031 ($MILLION)

TABLE 9. ELECTRIC VEHICLE MOTOR MARKET, FOR PLUGIN HYBRID VEHICLE, BY REGION, 2021-2031 ($MILLION)

TABLE 10. ELECTRIC VEHICLE MOTOR MARKET FOR PLUGIN HYBRID VEHICLE, BY COUNTRY, 2021-2031 ($MILLION)

TABLE 11. ELECTRIC VEHICLE MOTOR MARKET, FOR HYBRID VEHICLE, BY REGION, 2021-2031 ($MILLION)

TABLE 12. ELECTRIC VEHICLE MOTOR MARKET FOR HYBRID VEHICLE, BY COUNTRY, 2021-2031 ($MILLION)

TABLE 13. GLOBAL ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION, 2021-2031 ($MILLION)

TABLE 14. ELECTRIC VEHICLE MOTOR MARKET, FOR PASSENGER CARS, BY REGION, 2021-2031 ($MILLION)

TABLE 15. ELECTRIC VEHICLE MOTOR MARKET FOR PASSENGER CARS, BY COUNTRY, 2021-2031 ($MILLION)

TABLE 16. ELECTRIC VEHICLE MOTOR MARKET, FOR COMMERCIAL VEHICLES, BY REGION, 2021-2031 ($MILLION)

TABLE 17. ELECTRIC VEHICLE MOTOR MARKET FOR COMMERCIAL VEHICLES, BY COUNTRY, 2021-2031 ($MILLION)

TABLE 18. ELECTRIC VEHICLE MOTOR MARKET, BY REGION, 2021-2031 ($MILLION)

TABLE 19. NORTH AMERICA ELECTRIC VEHICLE MOTOR MARKET, BY TYPE, 2021-2031 ($MILLION)

TABLE 20. NORTH AMERICA ELECTRIC VEHICLE MOTOR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2031 ($MILLION)

TABLE 21. NORTH AMERICA ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION, 2021-2031 ($MILLION)

TABLE 22. NORTH AMERICA ELECTRIC VEHICLE MOTOR MARKET, BY COUNTRY, 2021-2031 ($MILLION)

TABLE 23. U.S. ELECTRIC VEHICLE MOTOR MARKET, BY TYPE, 2021-2031 ($MILLION)

TABLE 24. U.S. ELECTRIC VEHICLE MOTOR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2031 ($MILLION)

TABLE 25. U.S. ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION, 2021-2031 ($MILLION)

TABLE 26. CANADA ELECTRIC VEHICLE MOTOR MARKET, BY TYPE, 2021-2031 ($MILLION)

TABLE 27. CANADA ELECTRIC VEHICLE MOTOR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2031 ($MILLION)

TABLE 28. CANADA ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION, 2021-2031 ($MILLION)

TABLE 29. MEXICO ELECTRIC VEHICLE MOTOR MARKET, BY TYPE, 2021-2031 ($MILLION)

TABLE 30. MEXICO ELECTRIC VEHICLE MOTOR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2031 ($MILLION)

TABLE 31. MEXICO ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION, 2021-2031 ($MILLION)

TABLE 32. EUROPE ELECTRIC VEHICLE MOTOR MARKET, BY TYPE, 2021-2031 ($MILLION)

TABLE 33. EUROPE ELECTRIC VEHICLE MOTOR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2031 ($MILLION)

TABLE 34. EUROPE ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION, 2021-2031 ($MILLION)

TABLE 35. EUROPE ELECTRIC VEHICLE MOTOR MARKET, BY COUNTRY, 2021-2031 ($MILLION)

TABLE 36. UK ELECTRIC VEHICLE MOTOR MARKET, BY TYPE, 2021-2031 ($MILLION)

TABLE 37. UK ELECTRIC VEHICLE MOTOR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2031 ($MILLION)

TABLE 38. UK ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION, 2021-2031 ($MILLION)

TABLE 39. GERMANY ELECTRIC VEHICLE MOTOR MARKET, BY TYPE, 2021-2031 ($MILLION)

TABLE 40. GERMANY ELECTRIC VEHICLE MOTOR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2031 ($MILLION)

TABLE 41. GERMANY ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION, 2021-2031 ($MILLION)

TABLE 42. FRANCE ELECTRIC VEHICLE MOTOR MARKET, BY TYPE, 2021-2031 ($MILLION)

TABLE 43. FRANCE ELECTRIC VEHICLE MOTOR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2031 ($MILLION)

TABLE 44. FRANCE ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION, 2021-2031 ($MILLION)

TABLE 45. ITALY ELECTRIC VEHICLE MOTOR MARKET, BY TYPE, 2021-2031 ($MILLION)

TABLE 46. ITALY ELECTRIC VEHICLE MOTOR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2031 ($MILLION)

TABLE 47. ITALY ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION, 2021-2031 ($MILLION)

TABLE 48. REST OF EUROPE ELECTRIC VEHICLE MOTOR MARKET, BY TYPE, 2021-2031 ($MILLION)

TABLE 49. REST OF EUROPE ELECTRIC VEHICLE MOTOR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2031 ($MILLION)

TABLE 50. REST OF EUROPE ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION, 2021-2031 ($MILLION)

TABLE 51. ASIA-PACIFIC ELECTRIC VEHICLE MOTOR MARKET, BY TYPE, 2021-2031 ($MILLION)

TABLE 52. ASIA-PACIFIC ELECTRIC VEHICLE MOTOR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2031 ($MILLION)

TABLE 53. ASIA-PACIFIC ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION, 2021-2031 ($MILLION)

TABLE 54. ASIA-PACIFIC ELECTRIC VEHICLE MOTOR MARKET, BY COUNTRY, 2021-2031 ($MILLION)

TABLE 55. CHINA ELECTRIC VEHICLE MOTOR MARKET, BY TYPE, 2021-2031 ($MILLION)

TABLE 56. CHINA ELECTRIC VEHICLE MOTOR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2031 ($MILLION)

TABLE 57. CHINA ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION, 2021-2031 ($MILLION)

TABLE 58. JAPAN ELECTRIC VEHICLE MOTOR MARKET, BY TYPE, 2021-2031 ($MILLION)

TABLE 59. JAPAN ELECTRIC VEHICLE MOTOR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2031 ($MILLION)

TABLE 60. JAPAN ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION, 2021-2031 ($MILLION)

TABLE 61. INDIA ELECTRIC VEHICLE MOTOR MARKET, BY TYPE, 2021-2031 ($MILLION)

TABLE 62. INDIA ELECTRIC VEHICLE MOTOR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2031 ($MILLION)

TABLE 63. INDIA ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION, 2021-2031 ($MILLION)

TABLE 64. SOUTH KOREA ELECTRIC VEHICLE MOTOR MARKET, BY TYPE, 2021-2031 ($MILLION)

TABLE 65. SOUTH KOREA ELECTRIC VEHICLE MOTOR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2031 ($MILLION)

TABLE 66. SOUTH KOREA ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION, 2021-2031 ($MILLION)

TABLE 67. REST OF ASIA-PACIFIC ELECTRIC VEHICLE MOTOR MARKET, BY TYPE, 2021-2031 ($MILLION)

TABLE 68. REST OF ASIA-PACIFIC ELECTRIC VEHICLE MOTOR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2031 ($MILLION)

TABLE 69. REST OF ASIA-PACIFIC ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION, 2021-2031 ($MILLION)

TABLE 70. LAMEA ELECTRIC VEHICLE MOTOR MARKET, BY TYPE, 2021-2031 ($MILLION)

TABLE 71. LAMEA ELECTRIC VEHICLE MOTOR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2031 ($MILLION)

TABLE 72. LAMEA ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION, 2021-2031 ($MILLION)

TABLE 73. LAMEA ELECTRIC VEHICLE MOTOR MARKET, BY COUNTRY, 2021-2031 ($MILLION)

TABLE 74. LATIN AMERICA ELECTRIC VEHICLE MOTOR MARKET, BY TYPE, 2021-2031 ($MILLION)

TABLE 75. LATIN AMERICA ELECTRIC VEHICLE MOTOR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2031 ($MILLION)

TABLE 76. LATIN AMERICA ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION, 2021-2031 ($MILLION)

TABLE 77. MIDDLE EAST ELECTRIC VEHICLE MOTOR MARKET, BY TYPE, 2021-2031 ($MILLION)

TABLE 78. MIDDLE EAST ELECTRIC VEHICLE MOTOR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2031 ($MILLION)

TABLE 79. MIDDLE EAST ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION, 2021-2031 ($MILLION)

TABLE 80. AFRICA ELECTRIC VEHICLE MOTOR MARKET, BY TYPE, 2021-2031 ($MILLION)

TABLE 81. AFRICA ELECTRIC VEHICLE MOTOR MARKET, BY ELECTRIC VEHICLE TYPE, 2021-2031 ($MILLION)

TABLE 82. AFRICA ELECTRIC VEHICLE MOTOR MARKET, BY APPLICATION, 2021-2031 ($MILLION)

TABLE 83.BORGWARNER INC.: COMPANY SNAPSHOT

TABLE 84.BORGWARNER INC.: OPERATING SEGMENTS

TABLE 85.BORGWARNER INC.: PRODUCT PORTFOLIO

TABLE 86.BORGWARNER INC.: NET SALES,

TABLE 87.BORGWARNER INC.: KEY STRATERGIES

TABLE 88.BUHLER MOTOR GMBH: COMPANY SNAPSHOT

TABLE 89.BUHLER MOTOR GMBH: OPERATING SEGMENTS

TABLE 90.BUHLER MOTOR GMBH: PRODUCT PORTFOLIO

TABLE 91.BUHLER MOTOR GMBH: NET SALES,

TABLE 92.BUHLER MOTOR GMBH: KEY STRATERGIES

TABLE 93.CONTINENTAL AG: COMPANY SNAPSHOT

TABLE 94.CONTINENTAL AG: OPERATING SEGMENTS

TABLE 95.CONTINENTAL AG: PRODUCT PORTFOLIO

TABLE 96.CONTINENTAL AG: NET SALES,

TABLE 97.CONTINENTAL AG: KEY STRATERGIES

TABLE 98.DENSO CORPORATION: COMPANY SNAPSHOT

TABLE 99.DENSO CORPORATION: OPERATING SEGMENTS

TABLE 100.DENSO CORPORATION: PRODUCT PORTFOLIO

TABLE 101.DENSO CORPORATION: NET SALES,

TABLE 102.DENSO CORPORATION: KEY STRATERGIES

TABLE 103.INTEVA PRODUCTS, LLC: COMPANY SNAPSHOT

TABLE 104.INTEVA PRODUCTS, LLC: OPERATING SEGMENTS

TABLE 105.INTEVA PRODUCTS, LLC: PRODUCT PORTFOLIO

TABLE 106.INTEVA PRODUCTS, LLC: NET SALES,

TABLE 107.INTEVA PRODUCTS, LLC: KEY STRATERGIES

TABLE 108.JOHNSON ELECTRIC HOLDINGS LIMITED: COMPANY SNAPSHOT

TABLE 109.JOHNSON ELECTRIC HOLDINGS LIMITED: OPERATING SEGMENTS

TABLE 110.JOHNSON ELECTRIC HOLDINGS LIMITED: PRODUCT PORTFOLIO

TABLE 111.JOHNSON ELECTRIC HOLDINGS LIMITED: NET SALES,

TABLE 112.JOHNSON ELECTRIC HOLDINGS LIMITED: KEY STRATERGIES

TABLE 113.MABUCHI MOTOR CO., LTD: COMPANY SNAPSHOT

TABLE 114.MABUCHI MOTOR CO., LTD: OPERATING SEGMENTS

TABLE 115.MABUCHI MOTOR CO., LTD: PRODUCT PORTFOLIO

TABLE 116.MABUCHI MOTOR CO., LTD: NET SALES,

TABLE 117.MABUCHI MOTOR CO., LTD: KEY STRATERGIES

TABLE 118.NIDEC CORPORATION: COMPANY SNAPSHOT

TABLE 119.NIDEC CORPORATION: OPERATING SEGMENTS

TABLE 120.NIDEC CORPORATION: PRODUCT PORTFOLIO

TABLE 121.NIDEC CORPORATION: NET SALES,

TABLE 122.NIDEC CORPORATION: KEY STRATERGIES

TABLE 123.MAGNA INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 124.MAGNA INTERNATIONAL INC.: OPERATING SEGMENTS

TABLE 125.MAGNA INTERNATIONAL INC.: PRODUCT PORTFOLIO

TABLE 126.MAGNA INTERNATIONAL INC.: NET SALES,

TABLE 127.MAGNA INTERNATIONAL INC.: KEY STRATERGIES

TABLE 128.MERITOR, INC.: COMPANY SNAPSHOT

TABLE 129.MERITOR, INC.: OPERATING SEGMENTS

TABLE 130.MERITOR, INC.: PRODUCT PORTFOLIO

TABLE 131.MERITOR, INC.: NET SALES,

TABLE 132.MERITOR, INC.: KEY STRATERGIES

TABLE 133.MITSUBA CORPORATION: COMPANY SNAPSHOT

TABLE 134.MITSUBA CORPORATION: OPERATING SEGMENTS

TABLE 135.MITSUBA CORPORATION: PRODUCT PORTFOLIO

TABLE 136.MITSUBA CORPORATION: NET SALES,

TABLE 137.MITSUBA CORPORATION: KEY STRATERGIES

TABLE 138.ROBERT BOSCH GMBH: COMPANY SNAPSHOT

TABLE 139.ROBERT BOSCH GMBH: OPERATING SEGMENTS

TABLE 140.ROBERT BOSCH GMBH: PRODUCT PORTFOLIO

TABLE 141.ROBERT BOSCH GMBH: NET SALES,

TABLE 142.ROBERT BOSCH GMBH: KEY STRATERGIES

LIST OF FIGURES

FIGURE 1.ELECTRIC VEHICLE MOTOR MARKET SEGMENTATION

FIGURE 2.ELECTRIC VEHICLE MOTOR MARKET,2021-2031

FIGURE 3.ELECTRIC VEHICLE MOTOR MARKET,2021-2031

FIGURE 4. TOP INVESTMENT POCKETS, BY REGION

FIGURE 5.PORTER FIVE-1

FIGURE 6.PORTER FIVE-2

FIGURE 7.PORTER FIVE-3

FIGURE 8.PORTER FIVE-4

FIGURE 9.PORTER FIVE-5

FIGURE 10.TOP PLAYER POSITIONING

FIGURE 11.ELECTRIC VEHICLE MOTOR MARKET:DRIVERS, RESTRAINTS AND OPPORTUNITIES

FIGURE 12.ELECTRIC VEHICLE MOTOR MARKET,BY TYPE,2021(%)

FIGURE 13.COMPARATIVE SHARE ANALYSIS OF AC MOTOR ELECTRIC VEHICLE MOTOR MARKET,2021-2031(%)

FIGURE 14.COMPARATIVE SHARE ANALYSIS OF DC MOTOR ELECTRIC VEHICLE MOTOR MARKET,2021-2031(%)

FIGURE 15.ELECTRIC VEHICLE MOTOR MARKET,BY ELECTRIC VEHICLE TYPE,2021(%)

FIGURE 16.COMPARATIVE SHARE ANALYSIS OF BATTERY ELECTRIC VEHICLE ELECTRIC VEHICLE MOTOR MARKET,2021-2031(%)

FIGURE 17.COMPARATIVE SHARE ANALYSIS OF PLUGIN HYBRID VEHICLE ELECTRIC VEHICLE MOTOR MARKET,2021-2031(%)

FIGURE 18.COMPARATIVE SHARE ANALYSIS OF HYBRID VEHICLE ELECTRIC VEHICLE MOTOR MARKET,2021-2031(%)

FIGURE 19.ELECTRIC VEHICLE MOTOR MARKET,BY APPLICATION,2021(%)

FIGURE 20.COMPARATIVE SHARE ANALYSIS OF PASSENGER CARS ELECTRIC VEHICLE MOTOR MARKET,2021-2031(%)

FIGURE 21.COMPARATIVE SHARE ANALYSIS OF COMMERCIAL VEHICLES ELECTRIC VEHICLE MOTOR MARKET,2021-2031(%)

FIGURE 22.ELECTRIC VEHICLE MOTOR MARKET BY REGION,2021

FIGURE 23.U.S. ELECTRIC VEHICLE MOTOR MARKET,2021-2031($MILLION)

FIGURE 24.CANADA ELECTRIC VEHICLE MOTOR MARKET,2021-2031($MILLION)

FIGURE 25.MEXICO ELECTRIC VEHICLE MOTOR MARKET,2021-2031($MILLION)

FIGURE 26.UK ELECTRIC VEHICLE MOTOR MARKET,2021-2031($MILLION)

FIGURE 27.GERMANY ELECTRIC VEHICLE MOTOR MARKET,2021-2031($MILLION)

FIGURE 28.FRANCE ELECTRIC VEHICLE MOTOR MARKET,2021-2031($MILLION)

FIGURE 29.ITALY ELECTRIC VEHICLE MOTOR MARKET,2021-2031($MILLION)

FIGURE 30.REST OF EUROPE ELECTRIC VEHICLE MOTOR MARKET,2021-2031($MILLION)

FIGURE 31.CHINA ELECTRIC VEHICLE MOTOR MARKET,2021-2031($MILLION)

FIGURE 32.JAPAN ELECTRIC VEHICLE MOTOR MARKET,2021-2031($MILLION)

FIGURE 33.INDIA ELECTRIC VEHICLE MOTOR MARKET,2021-2031($MILLION)

FIGURE 34.SOUTH KOREA ELECTRIC VEHICLE MOTOR MARKET,2021-2031($MILLION)

FIGURE 35.REST OF ASIA-PACIFIC ELECTRIC VEHICLE MOTOR MARKET,2021-2031($MILLION)

FIGURE 36.LATIN AMERICA ELECTRIC VEHICLE MOTOR MARKET,2021-2031($MILLION)

FIGURE 37.MIDDLE EAST ELECTRIC VEHICLE MOTOR MARKET,2021-2031($MILLION)

FIGURE 38.AFRICA ELECTRIC VEHICLE MOTOR MARKET,2021-2031($MILLION)

FIGURE 39. TOP WINNING STRATEGIES, BY YEAR

FIGURE 40. TOP WINNING STRATEGIES, BY DEVELOPMENT

FIGURE 41. TOP WINNING STRATEGIES, BY COMPANY

FIGURE 42.PRODUCT MAPPING OF TOP 10 PLAYERS

FIGURE 43.COMPETITIVE DASHBOARD

FIGURE 44.COMPETITIVE HEATMAP OF TOP 10 KEY PLAYERS

FIGURE 45.BORGWARNER INC..: NET SALES ,($MILLION)

FIGURE 46.BUHLER MOTOR GMBH.: NET SALES ,($MILLION)

FIGURE 47.CONTINENTAL AG.: NET SALES ,($MILLION)

FIGURE 48.DENSO CORPORATION.: NET SALES ,($MILLION)

FIGURE 49.INTEVA PRODUCTS, LLC.: NET SALES ,($MILLION)

FIGURE 50.JOHNSON ELECTRIC HOLDINGS LIMITED.: NET SALES ,($MILLION)

FIGURE 51.MABUCHI MOTOR CO., LTD.: NET SALES ,($MILLION)

FIGURE 52.NIDEC CORPORATION.: NET SALES ,($MILLION)

FIGURE 53.MAGNA INTERNATIONAL INC..: NET SALES ,($MILLION)

FIGURE 54.MERITOR, INC..: NET SALES ,($MILLION)

FIGURE 55.MITSUBA CORPORATION.: NET SALES ,($MILLION)

FIGURE 56.ROBERT BOSCH GMBH.: NET SALES ,($MILLION)

$5540

$5656

$10280

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS

Add to Cart

Add to Cart

Add to Cart

Add to Cart