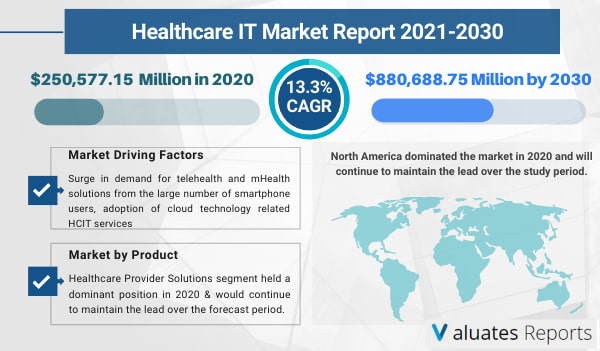

The global healthcare information technology (IT) market size was valued at $250,577.15 million in 2020 and is projected to reach $880,688.75 million by 2030, registering a CAGR of 13.3% from 2021 to 2030. Key drivers of the healthcare IT market include the growing acceptance of mhealth and telehealth solutions amongst smartphone users.

The gradual adoption of cloud-based technology for healthcare IT services will boost the growth of the healthcare IT market during the forecast period.

The rising demand for patient safety, care, and improved healthcare services necessitates the need for healthcare analytics thereby driving the market growth in the coming years.

The covid 19 accelerated adoption of IT systems in the medical industry fueling the expansion of the market in the subsequent years.

Rise of telemedicine

With the growing penetration of smartphones, the internet, and the rapid stride towards digitization mobile health and telemedicine services are spreading rapidly. Remote monitoring systems are being adopted by healthcare providers in order to stay competitive. Appointment scheduling, continuous alerts, and medication reminders are all done through smartphone apps. Timely medication and proper attention to health through wellness apps maintain a patient’s fitness levels thereby eliminating revisits. The extra paperwork, appointment follow up and data management is taken care of through automated processes in mobile applications. This reduces unnecessary costs, improves resource allocation, and decreases administrative burden. Caregiving efficiency improves as patients can connect with doctors through video solutions anytime anywhere cutting the hassles of physical visits and quality healthcare reaching even the remotest corners of the world. The claims process is optimized as the scope of manual error is decreased significantly with an easy billing process. Moreover, the patient data is available on an online platform for quick access, sharing, and modifying. These factors will propel the growth of the healthcare IT market during the forecast period.

Cloud computing

As the global healthcare burden is rising with multiple chronic diseases providing faster treatment procedures to patients is crucial. Cloud computing in healthcare IT is hugely beneficial. The exchange of medical records become safer, faster, and automated. The cloud servers are based on flexible subscription models thereby saving money on expensive systems. A dedicated server will come with pre-existing capability that automatically boosts resilience. Electronic health records, test results, and medical lists can be stored, and analyzed. It is interconnected with various access-right options. The automated analytics features will help solve problems of resource crunch through faster clinical decision making and shortening of treatment times. Collaboration and knowledge exchange becomes smooth with cloud-based messaging thereby improving the quality and diagnosis rate of healthcare. IT software can be updated as per the requirements to manage the overall load. Such factors will boost the growth of the healthcare IT market in the forthcoming period.

IT systems deploy analytics to improve the overall diagnosis rate. It reduces patient wait time and manual preparation of data. Smartphone apps with inbuilt analytics provide a near accurate view of key hospital metrics like bed availability, patient discharges, demand, quality, and safety. It helps with specific emergency response rates. Predictive analytics can monitor and provide exact details on which patient needs to be admitted and who can be sent home safely. This decreases costs and optimizes staff time. Limited ventilation and less time in Intensive Care Units help in resource-saving and careful deployment in far more critical cases. Training staff and addressing their workplace needs is the utmost priority for hospitals. Human resource data analysis helps in improving the business operations This will drive the growth prospects of the healthcare IT market during the forecast period.

Covid 19 impact

The pandemic has put pressure on the entire medical industry. Several hospitals have turned to IT systems for quick collaboration and instant sharing of information regarding bed capacity. This has helped them handle unexpected emergency situation and sudden surges in patient inflows. Ambulances are diverted accordingly in real-time and on-ground staff is better prepared. Emergency departments and patient safety teams are integrating successfully by using video camera analysis for enforcing stricter measurements on physical distancing in large compound areas. At-risk populations are kept safe. Telehealth went from being optional to mandatory as people remained in their homes because of social distancing. Doctors are now able to provide quality healthcare in real-time. Individual patient history data are captured and put in a centralized place for access across different departments, clinics, and pharmacies. The central data storage capability reduces data silos thereby making quality healthcare accessible to anyone in any part of the world without any hassles. Such factors will spur the growth of the healthcare IT market in the subsequent years.

Data privacy concerns

IT networks need to get robust as incidences of data theft, loss of confidential information, unauthorized access, hacking and improper disposal are getting sophisticated. Patient data related to billing and insurance are hacked by cyber thieves to gain considerable control. Medical identity theft is another loophole in the industry. These factors will deter the growth of the healthcare IT market during the forecast period.

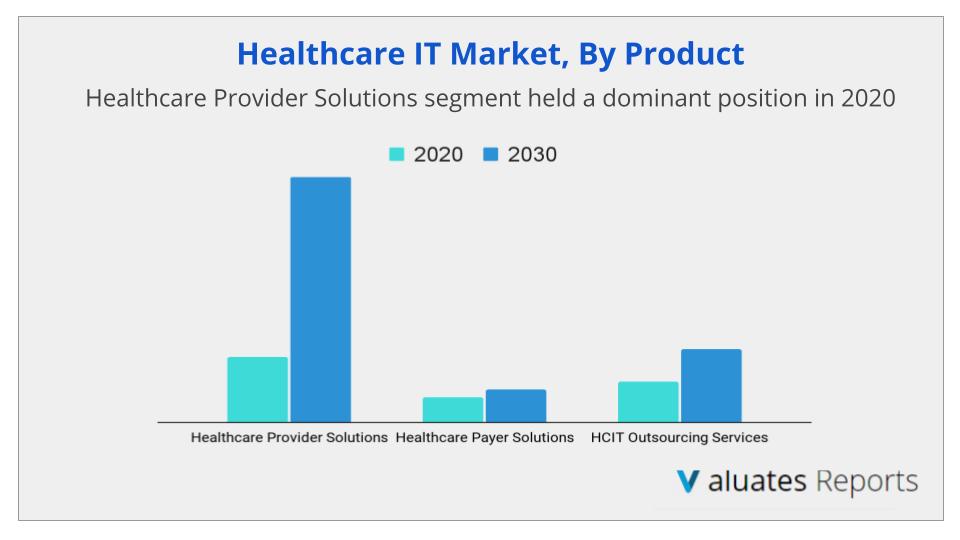

The healthcare provider solutions segment is predicted to be the fastest-growing category in the healthcare IT market throughout the forecast period due to the increased use of electronic health records (EHR) and other hospital information systems by healthcare providers.

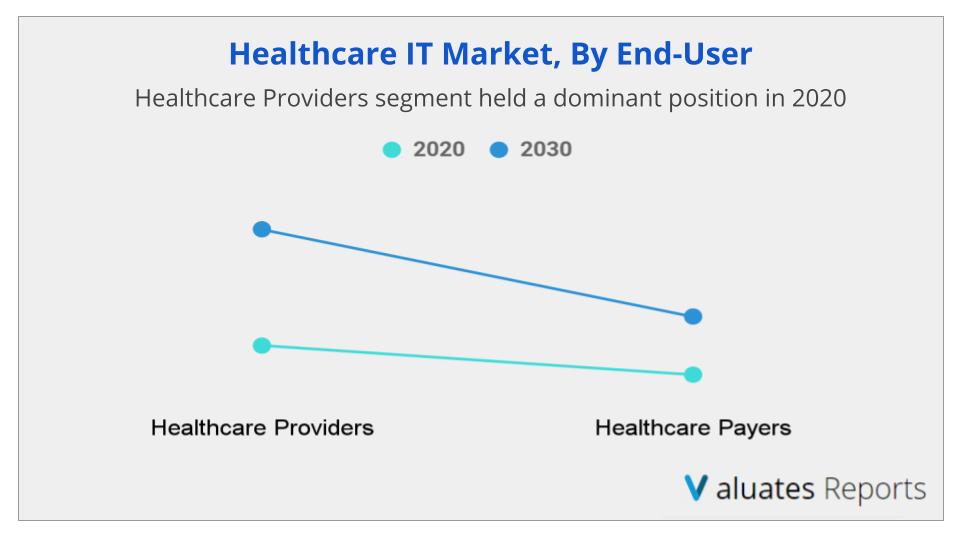

During the projected period, the healthcare providers category is expected to be the largest in the healthcare IT market. Hospitals make up the majority of healthcare providers. This is due to hospitals' increasing demand for a variety of HCIT solutions to help them manage the growing burden of patient data management.

From 2020 to 2030, North America is predicted to have the fastest growth rate. Asia-Pacific currently dominates the global healthcare IT market and is likely to continue to do so during the forecast period. Because of rising economies and government initiatives to digitalize and automate the operations of various healthcare institutions, such as hospitals, pharmacies, nursing homes, and other healthcare-related enterprises, this is the case.

Players are offering technology-enabled services to help improve patient care and boost efficiency, which has resulted in significant growth in the healthcare services and technology vertical. Nearly every component of the healthcare ecosystem is served by healthcare services and technology companies. Working with payers and providers to improve the relationship between actions and outcomes, engage with consumers, and give real-time and simple access to health information are all part of these initiatives.

Some of the top companies discuss in this healthcare IT market report include:

The top companies that hold the market share in global healthcare IT Market are McKesson Corporation, Allscripts Healthcare Solutions, Inc., Athenahealth, Inc., Epic System Corporation, General Electric Company, Cerner Corporation, Oracle Corporation, Koninklijke Philips N.V., UnitedHealth Group and Infor, Inc.

Key Benefits for Stakeholders

By Product

By End-User

Ans. North America dominated the market in 2020 and will continue to maintain the lead over the study period.

Ans. The top companies that hold the market share in the global healthcare IT market are McKesson Corporation, Allscripts Healthcare Solutions, Inc., Athenahealth, Inc., Epic System Corporation, General Electric Company, Cerner Corporation, Oracle Corporation, Koninklijke Philips N.V., UnitedHealth Group, and Infor, Inc.

Ans. The global healthcare information technology (IT) market size was valued at $250,577.15 million in 2020, and is projected to reach $880,688.75 million by 2030, registering a CAGR of 13.3% from 2021 to 2030.

Ans. The forecast period considered for the global healthcare IT market is 2021 to 2027.

Ans. Increase in demand for quality healthcare services and solutions, the surge in acceptance of mHealth and telehealth practices, rise in demand for improved patient safety and patient care, and increase in government initiatives to promote HCIT drive the growth of the global healthcare IT market.

Ans. By Product, Healthcare Provider Solutions segment held a dominant position in 2020 and would continue to maintain the lead over the forecast period.

Table of Content

CHAPTER 1:INTRODUCTION

1.1.Report description

1.2.Key benefits for stakeholders

1.3.Key market segments

1.4.Research methodology

1.4.1.Secondary research

1.4.2.Primary research

1.4.3.Analyst tools and models

CHAPTER 2:EXECUTIVE SUMMARY

2.1.Key findings of the study

2.2.CXO perspective

CHAPTER 3:MARKET LANDSCAPE

3.1.Market definition and scope

3.2.Key findings

3.2.1.Top investment pockets

3.2.2.Top winning strategies

3.3.Porter’s five force analysis

3.4.Top player positioning, 2020

3.5.Market dynamics

3.5.1.Drivers

3.5.1.1.Surge in Demand for Telehealth and mHealth solutions from the large number of smartphone users

3.5.1.2.Adoption of Cloud Technology related HCIT services

3.5.1.3.Implementation of various healthcare reforms such as Patient Protection and Affordable Care Act (PPACA)

3.5.1.4.Rapid increase in aging population and subsequent rise in the number of chronic diseases

3.5.2.Restraint

3.5.2.1.Increase in concerns regarding the patient data safety & security

3.5.3.Opportunity

3.5.3.1.Increasing investment in the Asia-Pacific region offers huge market potential

3.6.COVID-19 impact analysis on the healthcare IT market

CHAPTER 4:HEALTHCARE INFORMATION TECHNOLOGY MARKET, BY PRODUCT TYPE

4.1.Overview

4.1.1.Market size and forecast, by product type.

4.2.HEALTHCARE PROVIDER SOLUTIONS

4.2.1.Key market trends, growth factors, and opportunities

4.2.2.Market size and forecast, by product.

4.2.3.Market size and forecast, by region.

4.2.4.Market analysis, by country

4.2.5.Clinical Solutions

4.2.5.1.Key market trends, growth factors, and opportunities

4.2.5.2.Market size and forecast.

4.2.5.3.Electronic Health/Medical Records

4.2.5.3.1.Market analysis.

4.2.5.4.Vendor Neutral Archive (VNA)

4.2.5.4.1.Market analysis.

4.2.5.5.Computerized Physician Order Entry

4.2.5.5.1.Market analysis.

4.2.5.6.Clinical Decision Support Systems

4.2.5.6.1.Market analysis.

4.2.5.7.Radiology Information Systems

4.2.5.7.1.Market analysis.

4.2.5.8.Radiation Dose Management Solution

4.2.5.8.1.Market analysis.

4.2.5.9.Specialty Management Information Systems

4.2.5.9.1.Market analysis.

4.2.5.10.Medical Image Processing & Analysis Solution

4.2.5.10.1.Market analysis.

4.2.5.11.Healthcare Information Technology Integration Systems

4.2.5.11.1.Market analysis.

4.2.5.12.Practice Management Systems

4.2.5.12.1.Market analysis.

4.2.5.13.Laboratory Information Systems

4.2.5.13.1.Market analysis.

4.2.5.14.Digital Pathology Solutions

4.2.5.14.1.Market analysis.

4.2.5.15.Mobile Health (mHealth) Solutions

4.2.5.15.1.Market analysis.

4.2.5.16.Telehealth Solutions

4.2.5.16.1.Market analysis.

4.2.6.Non-Clinical Solutions

4.2.6.1.Key market trends, growth factors, and opportunities

4.2.6.2.Market size and forecast.

4.2.6.3.Pharmacy Information Systems

4.2.6.3.1.Market analysis.

4.2.6.4.Medication Management Systems

4.2.6.5.Market size and forecast.

4.2.6.5.1.Electronic Medication Administration Records (eMAR) Solution

4.2.6.5.2.Market analysis.

4.2.6.5.3.Barcode Medication Administration Solution

4.2.6.5.4.Market analysis.

4.2.6.5.5.Medication Inventory Management Systems

4.2.6.5.6.Market analysis.

4.2.6.5.7.Medication Assurance Systems

4.2.6.5.8.Market analysis.

4.2.6.6.Healthcare Asset Management

4.2.6.7.Market size and forecast.

4.2.6.7.1.Equipment Management Systems

4.2.6.7.2.Market analysis.

4.2.6.7.3.Patient Tracking and Management Solution

4.2.6.7.4.Market analysis.

4.2.6.7.5.Temperature and Humidity Monitoring Solution

4.2.6.7.6.Market analysis.

4.2.6.8.Workforce Management Systems

4.2.6.8.1.Market analysis.

4.2.6.9.Revenue Cycle Management Solution

4.2.6.10.Market size and forecast.

4.2.6.10.1.Admission Discharge Transfer/Registration

4.2.6.10.2.Market analysis.

4.2.6.10.3.Computer Assisted Coding Systems

4.2.6.10.4.Market analysis.

4.2.6.10.5.Patient Scheduling Solution

4.2.6.10.6.Market analysis.

4.2.6.10.7.Patient Billing and Claims Management Solutions

4.2.6.10.8.Market analysis.

4.2.6.10.9.Electronic Data Interchange Solution

4.2.6.10.10.Market analysis.

4.2.6.11.Financial Management Systems

4.2.6.11.1.Market analysis.

4.2.6.12.Medical Document Management Systems

4.2.6.12.1.Market analysis.

4.2.6.13.Healthcare Information Exchanges

4.2.6.13.1.Market analysis.

4.2.6.14.Population Health Management Solution

4.2.6.14.1.Market analysis.

4.2.6.15.Supply Chain Management Solution

4.2.6.16.Market size and forecast.

4.2.6.16.1.Procurement Management

4.2.6.16.1.1.Market analysis.

4.2.6.16.2.Inventory Management

4.2.6.16.2.1.Market analysis.

4.2.6.17.Healthcare Analytics

4.2.6.18.Market size and forecast.

4.2.6.18.1.Clinical Analytics

4.2.6.18.1.1.Market analysis.

4.2.6.18.2.Financial Analytics

4.2.6.18.2.1.Market analysis.

4.2.6.18.3.Operational and Administrative Analytics

4.2.6.18.3.1.Market analysis.

4.2.6.19.Customer Relationship Management Solution

4.2.6.20.Market analysis.

4.3.HEALTHCARE PAYER SOLUTIONS

4.3.1.Key market trends, growth factors, and opportunities

4.3.1.1.Market size and forecast, by product.

4.3.1.2.Market size and forecast, by region.

4.3.1.3.Market analysis, by country

4.3.2.Pharmacy Analysis and Audit Solution

4.3.2.1.Market analysis.

4.3.3.Claims Management Solution

4.3.3.1.Market analysis.

4.3.4.Fraud Management Solution

4.3.4.1.Market analysis.

4.3.5.Computer-assisted Coding Systems

4.3.5.1.Market analysis.

4.3.6.Payment Management

4.3.6.1.Market size and forecast, by type.

4.3.6.2.Patient Billing Management Solution

4.3.6.2.1.Market analysis.

4.3.6.3.Provider Billing Management Solution

4.3.6.3.1.Market analysis.

4.3.7.Provider Network Management Solution

4.3.7.1.Market analysis.

4.3.8.Member Eligibility Management Solution

4.3.8.1.Market analysis.

4.3.9.Customer Relationship Management Solution

4.3.9.1.Market analysis.

4.3.10.Medical Document Management Solution

4.3.10.1.Market analysis.

4.3.11.Others

4.3.11.1.Market analysis.

4.4.HCIT outsourcing services

4.4.1.Key market trends, growth factors, and opportunities

4.4.1.1.Market size and forecast, by product.

4.4.1.2.Market size and forecast, by region.

4.4.1.3.Market analysis, by country

4.4.2.Provider HCIT Outsourcing Services Market

4.4.2.1.Market size and forecast, by type.

4.4.2.2.Medical Document Management Services

4.4.2.2.1.Market analysis.

4.4.2.3.Pharmacy Information Management Services

4.4.2.3.1.Market analysis.

4.4.2.4.Laboratory Information Management Services

4.4.2.4.1.Market analysis.

4.4.2.5.Revenue Cycle Management Services

4.4.2.5.1.Market analysis.

4.4.2.6.Others

4.4.2.6.1.Market analysis.

4.4.3.Payer HCIT Outsourcing Services

4.4.3.1.Market size and forecast, by type.

4.4.3.2.Customer Relationship Management Services

4.4.3.2.1.Market analysis.

4.4.3.3.Claims Processing Services

4.4.3.3.1.Market analysis.

4.4.3.4.Billing Management Systems

4.4.3.4.1.Market analysis.

4.4.3.5.Fraud Detection Services

4.4.3.5.1.Market analysis.

4.4.3.6.Other Payer Outsourcing Services

4.4.3.6.1.Market analysis.

4.4.4.Operational HCIT Outsourcing Services

4.4.4.1.Market size and forecast, by type.

4.4.4.2.Supply Chain Management Services

4.4.4.2.1.Market analysis.

4.4.4.3.Business Process Management Services

4.4.4.3.1.Market analysis.

4.4.4.4.Others

4.4.4.4.1.Market analysis.

4.4.5.IT Infrastructure Management Services

4.4.5.1.Market analysis.

CHAPTER 5:HEALTHCARE IT MARKET, BY END USER

5.1.Overview

5.1.1.Market size and forecast

5.2.Healthcare Providers

5.2.1.Key market trends, growth factors, and opportunities

5.2.2.Market size and forecast, by region

5.2.3.Market analysis, by country

5.2.4.Hospitals

5.2.4.1.Market size and forecast

5.2.5.Ambulatory Care Centers

5.2.5.1.Market size and forecast

5.2.6.Diagnostic & Imaging Centers

5.2.6.1.Market size and forecast

5.2.7.Pharmacies

5.2.7.1.Market size and forecast

5.2.8.Others

5.2.8.1.Market size and forecast

5.3.Healthcare Payers

5.3.1.Key market trends, growth factors, and opportunities

5.3.2.Market size and forecast, by region

5.3.3.Market analysis, by country

5.3.4.Private Payers

5.3.4.1.Market size and forecast

5.3.5.Public Payers

5.3.5.1.Market size and forecast

CHAPTER 6:HEALTHCARE ITMARKET, BY REGION

6.1.Overview

6.1.1.Market size and forecast

6.2.North America

6.2.1.Key market trends, growth factors, and opportunities

6.2.2.Market size and forecast, by country

6.2.2.1.U.S.

6.2.2.1.1.U.S. Healthcare IT market, by product type

6.2.2.1.2.U.S. Healthcare IT market, by end user

6.2.2.2.Canada

6.2.2.2.1.Canada Healthcare IT market, by product type

6.2.2.2.2.Canada Healthcare IT market, by end user

6.2.2.3.Mexico

6.2.2.3.1.Mexico Healthcare IT market, by product type

6.2.2.3.2.Mexico Healthcare IT market, by end user

6.2.3.North America market size and forecast, by product type

6.2.4.North America market size and forecast, by end user

6.3.Europe

6.3.1.Key market trends, growth factors, and opportunities

6.3.2.Market size and forecast, by country

6.3.2.1.Germany

6.3.2.1.1.Germany Healthcare IT market, by product type

6.3.2.1.2.Germany Healthcare IT market, by end user

6.3.2.2.France

6.3.2.2.1.France Healthcare IT market, by product type

6.3.2.2.2.France Healthcare IT market, by end user

6.3.2.3.UK

6.3.2.3.1.UK Healthcare IT market, by product type

6.3.2.3.2.UK Healthcare IT market, by end user

6.3.2.4.Italy

6.3.2.4.1.Italy Healthcare IT market, by product type

6.3.2.4.2.Italy Healthcare IT market, by end user

6.3.2.5.Spain

6.3.2.5.1.Spain Healthcare IT market, by product type

6.3.2.5.2.Spain Healthcare IT market, by end user

6.3.2.6.Rest of Europe

6.3.2.6.1.Rest of Europe Healthcare IT market, by product type

6.3.2.6.2.Rest of Europe Healthcare IT market, by end user

6.3.3.Europe market size and forecast, by product type

6.3.4.Europe market size and forecast, by end user

6.4.Asia-Pacific

6.4.1.Key market trends, growth factors, and opportunities

6.4.2.Market size and forecast, by country

6.4.2.1.Japan

6.4.2.1.1.Japan Healthcare IT market, by product type

6.4.2.1.2.Japan Healthcare IT market, by end user

6.4.2.2.China

6.4.2.2.1.China Healthcare IT market, by product type

6.4.2.2.2.China Healthcare IT market, by end user

6.4.2.3.India

6.4.2.3.1.India Healthcare IT market, by product type

6.4.2.3.2.India Healthcare IT market, by end user

6.4.2.4.Rest of Asia-Pacific

6.4.2.4.1.Rest of Asia-Pacific Healthcare IT market, by product type

6.4.2.4.2.Rest of Asia-Pacific Healthcare IT market, by end user

6.4.3.Asia-Pacific market size and forecast, by product type

6.4.4.Asia-Pacific market size and forecast, by end user

6.5.LAMEA

6.5.1.Key market trends, growth factors, and opportunities

6.5.2.Market size and forecast, by country

6.5.2.1.Latin America

6.5.2.1.1.Latin America Healthcare IT market, by product type

6.5.2.1.2.Latin America Healthcare IT market, by end user

6.5.2.2.Middle East

6.5.2.2.1.Middle East Healthcare IT market, by product type

6.5.2.2.2.Middle East Healthcare IT market, by end user

6.5.2.3.Africa

6.5.2.3.1.Africa Healthcare IT market, by product type

6.5.2.3.2.Africa Healthcare IT market, by end user

6.5.3.LAMEA market size and forecast, by product type

6.5.4.LAMEA market size and forecast, by end user

CHAPTER 7:COMPANY PROFILES

7.1.ALLSCRIPTS HEALTHCARE SOLUTIONS INC.

7.1.1.Company overview

7.1.2.Company snapshot

7.1.3.Operating business segments

7.1.4.Product portfolio

7.1.5.Business performance

7.1.6.Key strategic moves and developments

7.2.ATHENAHEALTH INC.

7.2.1.Company overview

7.2.2.Company snapshot

7.2.3.Operating business segments

7.2.4.Product portfolio

7.2.5.Key strategic moves and developments

7.3.CERNER CORPORATION

7.3.1.Company overview

7.3.2.Company snapshot

7.3.3.Operating business segments

7.3.4.Product portfolio

7.3.5.Business performance

7.3.6.Key strategic moves and developments

7.4.EPIC SYSTEM CORPORATION

7.4.1.Company overview

7.4.2.Company snapshot

7.4.3.Operating business segments

7.4.4.Product portfolio

7.4.5.Key strategic moves and developments

7.5.GENERAL ELECTRIC COMPANY

7.5.1.Company overview

7.5.2.Company snapshot

7.5.3.Operating business segments

7.5.4.Product portfolio

7.5.5.Business performance

7.5.6.Key strategic moves and developments

7.6.INFOR, INC.

7.6.1.Company overview

7.6.2.Company snapshot

7.6.3.Operating business segments

7.6.4.Product portfolio

7.7.KONINKLIJKE PHILIPS N.V.

7.7.1.Company overview

7.7.2.Company snapshot

7.7.3.Operating business segments

7.7.4.Product portfolio

7.7.5.Business performance

7.7.6.Key strategic moves and developments

7.8.MCKESSON CORPORATION

7.8.1.Company overview

7.8.2.Company snapshot

7.8.3.Operating business segments

7.8.4.Product portfolio

7.8.5.Business performance

7.9.ORACLE CORPORATION

7.9.1.Company overview

7.9.2.Company snapshot

7.9.3.Operating business segments

7.9.4.Product portfolio

7.9.5.Business performance

7.9.6.Key strategic moves and developments

7.10.UNITEDHEALTH GROWP

7.10.1.Company overview

7.10.2.Company snapshot

7.10.3.Operating business segments

7.10.4.Product portfolio

7.10.5.Business performance

7.10.6.Key strategic moves and developments

Table 01.Healthcare It Market, By Product Type, 2020-2030 ($Million)

Table 02.Healthcare It Market, For Healthcare Provider Solution, 2020-2030 ($Million)

Table 03.Healthcare It Market, For Healthcare Provider Solution, By Region, 2020-2030 ($Million)

Table 04.Healthcare It Market, For Clinical Solutions By Type, 2020-2030 ($Million)

Table 05.Healthcare It Market, For Non-clinical Solutions By Type, 2020-2030 ($Million)

Table 06.Healthcare It Market, For Medication Management Systems, By Type, 2020-2030 ($Million)

Table 07.Healthcare It Market, For Healthcare Asset Management, By Type, 2020-2030 ($Million)

Table 08.Healthcare It Market, For Revenue Cycle Management Solution, By Type, 2020-2030 ($Million)

Table 09.Healthcare It Market, For Supply Chain Management Solution, By Type, 2020-2030 ($Million)

Table 10.Healthcare It Market, For Healthcare Analytics, By Type, 2020-2030 ($Million)

Table 11.Healthcare It Market, For Healthcare Payer Solutions, 2020-2030 ($Million)

Table 12.Healthcare It Market, For Healthcare Payer Solutions, By Region, 2020-2030 ($Million)

Table 13.Healthcare It Market, For Payment Management, 2020-2030 ($Million)

Table 14.Healthcare It Market, For Hcit Outsourcing Services, By Product, 2020-2030 ($Million)

Table 15.Healthcare It Market, For Hcit Outsourcing Services, By Region, 2020-2030 ($Million)

Table 16.Healthcare It Market, For Provider Hcit Outsourcing Services Market, 2020-2030 ($Million)

Table 17.Healthcare It Market, For Payer Hcit Outsourcing Services Market, 2020-2030 ($Million)

Table 18.Healthcare It Market, For Operational Hcit Outsourcing Services, By Type, 2020-2030 ($Million)

Table 19.Healthcare It Market, By End User, 2020-2030 ($Million)

Table 20.Healthcare It Market, For Healthcare Providers, By Region, 2020-2030 ($Million)

Table 21.Healthcare It Market, For Healthcare Payers, By Region, 2020-2030 ($Million)

Table 22.Healthcare It Market, By Region, 2020–2030 ($Million)

Table 23.North America Healthcare Itmarket, By Country, 2020–2030 ($Million)

Table 24.U.S. Healthcare Itmarket, By Product Type, 2020–2030 ($Million)

Table 25.U.S. Healthcare Itmarket, By End User, 2020–2030 ($Million)

Table 26.Canada Healthcare It Market, By Product Type, 2020–2030 ($Million)

Table 27.Canada Healthcare Itmarket, By End User, 2020–2030 ($Million)

Table 28.Mexico Healthcare Itmarket, By Product Type, 2020–2030 ($Million)

Table 29.Mexico Healthcare It Market, By End User, 2020–2030 ($Million)

Table 30.North America Healthcare Itmarket, By Product Type, 2020–2030 ($Million)

Table 31.North America Healthcare Itmarket, By End User, 2020–2030 ($Million)

Table 32.Europe Healthcare It Market, By Country, 2020–2030 ($Million)

Table 33.Germany Healthcare Itmarket, By Product Type, 2020–2030 ($Million)

Table 34.Germany Healthcare Itmarket, By End User, 2020–2030 ($Million)

Table 35.France Healthcare Itmarket, By Product Type, 2020–2030 ($Million)

Table 36.France Healthcare Itmarket, By End User, 2020–2030 ($Million)

Table 37.Uk Healthcare It Market, By Product Type, 2020–2030 ($Million)

Table 38.Uk Healthcare Itmarket, By End User, 2020–2030 ($Million)

Table 39.Italy Healthcare Itmarket, By Product Type, 2020–2030 ($Million)

Table 40.Italy Healthcare Itmarket, By End User, 2020–2030 ($Million)

Table 41.Spain Healthcare It Market, By Product Type, 2020–2030 ($Million)

Table 42.Spain Healthcare Itmarket, By End User, 2020–2030 ($Million)

Table 43.Rest Of Europe Healthcare It Market, By Product Type, 2020–2030 ($Million)

Table 44.Rest Of Europe Healthcare Itmarket, By End User, 2020–2030 ($Million)

Table 45.Europe Healthcare It Market, By Product Type, 2020–2030 ($Million)

Table 46.Europe Healthcare Itmarket, By End User, 2020–2030 ($Million)

Table 47.Asia-pacific Healthcare It Market, By Country, 2020–2030 ($Million)

Table 48.Japan Healthcare It Market, By Product Type, 2020–2030 ($Million)

Table 49.Japan Healthcare It Market, By End User, 2020–2030 ($Million)

Table 50.China Healthcare It Market, By Product Type, 2020–2030 ($Million)

Table 51.China Healthcare It Market, By End User, 2020–2030 ($Million)

Table 52.India Healthcare It Market, By Product Type, 2020–2030 ($Million)

Table 53.India Healthcare Itmarket, By End User, 2020–2030 ($Million)

Table 54.Rest Of Asia-pacific Healthcare It Market, By Product Type, 2020–2030 ($Million)

Table 55.Rest Of Asia-pacific Healthcare It Market, By End User, 2020–2030 ($Million)

Table 56.Asia-pacific Healthcare It Market, By Product Type, 2020–2030 ($Million)

Table 57.Asia-pacific Healthcare It Market, By End User, 2020–2030 ($Million)

Table 58.Lamea Healthcare It Market, By Country, 2020–2030 ($Million)

Table 59.Latin America Healthcare It Market, By Product Type, 2020–2030 ($Million)

Table 60.Latin America Healthcare Itmarket, By End User, 2020–2030 ($Million)

Table 61.Middle East Healthcare Itmarket, By Product Type, 2020–2030 ($Million)

Table 62.Middle East Healthcare It Market, By End User, 2020–2030 ($Million)

Table 63.Africa Healthcare Itmarket, By Product Type, 2020–2030 ($Million)

Table 64.Africa Healthcare Itmarket, By End User, 2020–2030 ($Million)

Table 65.Lamea Healthcare Itmarket, By Product Type, 2020–2030 ($Million)

Table 66.Lamea Healthcare Itmarket, By End User, 2020–2030 ($Million)

Table 67.Allscripts: Company Snapshot

Table 68.Allscripts: Operating Segments

Table 69.Allscripts: Product Portfolio

Table 70.Athenahealth: Company Snapshot

Table 71.Athenahealth: Operating Segments

Table 72.Athenahealth: Product Portfolio

Table 73.Cerner: Company Snapshot

Table 74.Cerner: Operating Segments

Table 75.Cerner: Product Portfolio

Table 76.Epic Systems: Company Snapshot

Table 77.Epic Systems: Operating Segments

Table 78.Epic Systems: Product Portfolio

Table 79.Ge: Company Snapshot

Table 80.Ge: Operating Segments

Table 81.Ge: Product Portfolio

Table 82.Infor: Company Snapshot

Table 83.Infor: Operating Segments

Table 84.Infor: Product Portfolio

Table 85.Philips: Company Snapshot

Table 86.Philips: Operating Segments

Table 87.Philips: Product Portfolio

Table 88.Mckesson: Company Snapshot

Table 89.Mckesson: Operating Segments

Table 90.Mckesson: Product Portfolio

Table 91.Oracle: Company Snapshot

Table 92.Oracle: Operating Segments

Table 93.Oracle: Product Portfolio

Table 94.Unitedhealth: Company Snapshot

Table 95.Unitedhealth: Operating Segments

Table 96.Unitedhealth: Product Portfolio

List Of Figures

Figure 01.Top Investment Pockets

Figure 02.Top Winning Strategies, By Year, 2018-2021

Figure 03.Top Winning Strategies, By Development, 2018-2021

Figure 04.Top Winning Strategies, By Company, 2018-2021

Figure 05.Low Bargaining Power Of Suppliers

Figure 06.Moderate Bargaining Power Of Buyers

Figure 07.Low Threat Of Substitutes

Figure 08.Moderate Threat Of New Entrants

Figure 09.High Intensity Of Rivalry

Figure 10.Top Player Positioning, 2020

Figure 11.Comparative Analysis Of Healthcare It Market, For Healthcare Provider Solution, By Country, 2020 & 2030 ($Million)

Figure 12.Comparative Analysis Of Healthcare It Market, For Electronic Health/Medical Records, 2020 & 2030 ($Million)

Figure 13.Comparative Analysis Of Healthcare It Market, For Vendor Neutral Archive, 2020 & 2030 ($Million)

Figure 14.Comparative Analysis Of Healthcare It Market, For Computerized Physician Order Entry, 2020 & 2030 ($Million)

Figure 15.Comparative Analysis Of Healthcare It Market, For Clinical Decision Support Systems, 2020 & 2030 ($Million)

Figure 16.Comparative Analysis Of Healthcare It Market, For Radiology Information Systems, 2020 & 2030 ($Million)

Figure 17.Comparative Analysis Of Healthcare It Market, For Radiation Dose Management Solution, 2020 & 2030 ($Million)

Figure 18.Comparative Analysis Of Healthcare It Market, For Specialty Management Information Systems, 2020 & 2030 ($Million)

Figure 19.Comparative Analysis Of Healthcare It Market, For Medical Image Processing &Analysis Solution, 2020 & 2030 ($Million)

Figure 20.Comparative Analysis Of Healthcare It Market, For Healthcare Information Technology Integration Systems, 2020 & 2030 ($Million)

Figure 21.Comparative Analysis Of Healthcare It Market, For Practice Management Systems, 2020 & 2030 ($Million)

Figure 22.Comparative Analysis Of Healthcare It Market, For Laboratory Information Systems, 2020 & 2030 ($Million)

Figure 23.Comparative Analysis Of Healthcare It Market, For Digital Pathology Solutions, 2020 & 2030 ($Million)

Figure 24.Comparative Analysis Of Healthcare It Market, For Mobile Health (Mhealth) Solutions, 2020 & 2030 ($Million)

Figure 25.Comparative Analysis Of Healthcare It Market, For Telehealth Solutions, 2020 & 2030 ($Million)

Figure 26.Comparative Analysis Of Healthcare It Market, For Pharmacy Information Systems, 2020 & 2030 ($Million)

Figure 27.Comparative Analysis Of Healthcare It Market, For Electronic Medication Administration Records (Emar) Solution, 2020 & 2030 ($Million)

Figure 28.Comparative Analysis Of Healthcare It Market, For Barcode Medication Administration Solution, 2020 & 2030 ($Million)

Figure 29.Comparative Analysis Of Healthcare It Market, For Medication Inventory Management Systems, 2020 & 2030 ($Million)

Figure 30.Comparative Analysis Of Healthcare It Market, For Medication Assurance Systems, 2020 & 2030 ($Million)

Figure 31.Comparative Analysis Of Healthcare It Market, For Equipment Management Systems, 2020 & 2030 ($Million)

Figure 32.Comparative Analysis Of Healthcare It Market, For Patient Tracking And Management Solution, 2020 & 2030 ($Million)

Figure 33.Comparative Analysis Of Healthcare It Market, For Temperature And Humidity Monitoring Solution, 2020 & 2030 ($Million)

Figure 34.Comparative Analysis Of Healthcare It Market, For Workforce Management Systems, 2020 & 2030 ($Million)

Figure 35.Comparative Analysis Of Healthcare It Market, For Admission Discharge Transfer/Registration, 2020 & 2030 ($Million)

Figure 36.Comparative Analysis Of Healthcare It Market, For Computer Assisted Coding Systems, 2020 & 2030 ($Million)

Figure 37.Comparative Analysis Of Healthcare It Market, For Patient Scheduling Solution, 2020 & 2030 ($Million)

Figure 38.Comparative Analysis Of Healthcare It Market, For Patient Billing And Claims Management Solutions, 2020 & 2030 ($Million)

Figure 39.Comparative Analysis Of Healthcare It Market, For Electronic Data Interchange Solution, 2020 & 2030 ($Million)

Figure 40.Comparative Analysis Of Healthcare It Market, For Financial Management Systems, 2020 & 2030 ($Million)

Figure 41.Comparative Analysis Of Healthcare It Market, For Medical Document Management Systems, 2020 & 2030 ($Million)

Figure 42.Comparative Analysis Of Healthcare It Market, For Healthcare Information Exchanges, 2020 & 2030 ($Million)

Figure 43.Comparative Analysis Of Healthcare It Market, For Population Health Management Solution, 2020 & 2030 ($Million)

Figure 44.Comparative Analysis Of Healthcare It Market, For Procurement Management, 2020 & 2030 ($Million)

Figure 45.Comparative Analysis Of Healthcare It Market, For Inventory Management, 2020 & 2030 ($Million)

Figure 46.Comparative Analysis Of Healthcare It Market, For Clinical Analytics, 2020 & 2030 ($Million)

Figure 47.Comparative Analysis Of Healthcare It Market, For Financial Analytics, 2020 & 2030 ($Million)

Figure 48.Comparative Analysis Of Healthcare It Market, For Operational And Administrative Analytics, 2020 & 2030 ($Million)

Figure 49.Comparative Analysis Of Healthcare It Market, For Customer Relationship Management Solution, 2020 & 2030 ($Million)

Figure 50.Comparative Analysis Of Healthcare It Market, For Healthcare Payer Solutions, By Country, 2020 & 2030 ($Million)

Figure 51.Comparative Analysis Of Healthcare It Market, For Pharmacy Analysis And Audit Solution, 2020 & 2030 ($Million)

Figure 52.Comparative Analysis Of Healthcare It Market, For Claims Management Solutions, 2020 & 2030 ($Million)

Figure 53.Comparative Analysis Of Healthcare It Market, For Fraud Management Solution, 2020 & 2030 ($Million)

Figure 54.Comparative Analysis Of Healthcare It Market, For Computer-assisted Coding Systems, 2020 & 2030 ($Million)

Figure 55.Comparative Analysis Of Healthcare It Market, For Patient Billing Management Solution, 2020 & 2030 ($Million)

Figure 56.Comparative Analysis Of Healthcare It Market, For Provider Billing Management Solution, 2020 & 2030 ($Million)

Figure 57.Comparative Analysis Of Healthcare It Market, For Provider Network Management Solution, 2020 & 2030 ($Million)

Figure 58.Comparative Analysis Of Healthcare It Market, For Member Eligibility Management Solution, 2020 & 2030 ($Million)

Figure 59.Comparative Analysis Of Healthcare It Market, For Customer Relationship Management Solution, 2020 & 2030 ($Million)

Figure 60.Comparative Analysis Of Healthcare It Market, For Medical Document Management Solution, 2020 & 2030 ($Million)

Figure 61.Comparative Analysis Of Healthcare It Market, For Others, 2020 & 2030 ($Million)

Figure 62.Comparative Analysis Of Healthcare It Market, For Hcit Outsourcing Services, By Country, 2020 & 2030 ($Million)

Figure 63.Comparative Analysis Of Healthcare It Market, For Medical Document Management Services, 2020 & 2030 ($Million)

Figure 64.Comparative Analysis Of Healthcare It Market, For Pharmacy Information Management Services, 2020 & 2030 ($Million)

Figure 65.Comparative Analysis Of Healthcare It Market, For Laboratory Information Management Services, 2020 & 2030 ($Million)

Figure 66.Comparative Analysis Of Healthcare It Market, For Revenue Cycle Management Services, 2020 & 2030 ($Million)

Figure 67.Comparative Analysis Of Healthcare It Market, For Others, 2020 & 2030 ($Million)

Figure 68.Comparative Analysis Of Healthcare It Market, For Customer Relationship Management Services, 2020 & 2030 ($Million)

Figure 69.Comparative Analysis Of Healthcare It Market, For Customer Relationship Management Services, 2020 & 2030 ($Million)

Figure 70.Comparative Analysis Of Healthcare It Market, For Billing Management Systems, 2020 & 2030 ($Million)

Figure 71.Comparative Analysis Of Healthcare It Market, For Fraud Detection Services, 2020 & 2030 ($Million)

Figure 72.Comparative Analysis Of Healthcare It Market, For Other Payer Outsourcing Services, 2020 & 2030 ($Million)

Figure 73.Comparative Analysis Of Healthcare It Market, For Supply Chain Management Services, 2020 & 2030 ($Million)

Figure 74.Comparative Analysis Of Healthcare It Market, For Business Process Management Services, 2020 & 2030 ($Million)

Figure 75.Comparative Analysis Of Healthcare It Market, For Others, 2020 & 2030 ($Million)

Figure 76.Comparative Analysis Of Healthcare It Market, For It Infrastructure Management Services, 2020 & 2030 ($Million)

Figure 77.Comparative Analysis Of Healthcare It Market For Healthcare Providers, By Country, 2020 & 2030 ($Million)

Figure 78.Comparative Analysis Of Healthcare It Market, For Hospitals, 2020 & 2030 ($Million)

Figure 79.Comparative Analysis Of Healthcare It Market, For Ambulatory Care Centers, 2020 & 2030 ($Million)

Figure 80.Comparative Analysis Of Healthcare It Market, For Diagnostic & Imaging Centers, 2020 & 2030 ($Million)

Figure 81.Comparative Analysis Of Healthcare It Market, For Pharmacies, 2020 & 2030 ($Million)

Figure 82.Comparative Analysis Of Healthcare It Market, For Others, 2020 & 2030 ($Million)

Figure 83.Comparative Analysis Of Healthcare It Market For Healthcare Payers, By Country, 2020 & 2030 ($Million)

Figure 84.Comparative Analysis Of Healthcare It Market, For Private Players, 2020 & 2030 ($Million)

Figure 85.Comparative Analysis Of Healthcare It Market, For Public Payers, 2020 & 2030 ($Million)

Figure 86.Allscripts: Net Sales, 2018–2020 ($Million)

Figure 87.Allscripts: Revenue Share By Segment, 2020 (%)

Figure 88.Allscripts: Revenue Share By Region, 2020 (%)

Figure 89.Cerner: Net Sales, 2018–2020 ($Million)

Figure 90.Cerner: Revenue Share By Segment, 2020 (%)

Figure 91.Ge Net Sales, 2018–2020, ($Million)

Figure 92.Ge: Revenue Share By Segments, 2020 (%)

Figure 93.Ge: Revenue Share, By Region, 2020 (%)

Figure 94.Philips: Net Sales, 2018-2020, ($Million)

Figure 95.Philips: Revenue Share By Segment, 2020 (%)

Figure 96.Philips: Revenue Share, By Region, 2020 (%)

Figure 97.Mckesson: Net Sales, 2018–2020, ($Million)

Figure 98.Mckesson: Revenue Share By Segment, 2020, ($Million)

Figure 99.Mckesson: Revenue Share By Region, 2020 (%)

Figure 100.Oracle: Net Sales, 2018–2020, ($Million)

Figure 101.Oracle: Revenue Share By Segment, 2020, ($Million)

Figure 102.Oracle: Revenue Share By Region, 2020 (%)

Figure 103.Unitedhealth: Revenue, 2018–2020 ($Million)

Figure 104.Unitedhealth: Revenue Share By Segment, 2020 (%)

$6168

$9663

HAVE A QUERY?

OUR CUSTOMER

SIMILAR REPORTS